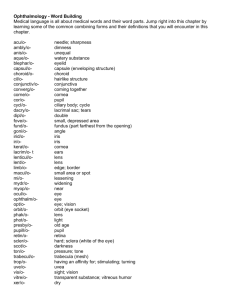

IRIS International Railway

Industry Standard

The Global Quality Standard for the

Railway Industry

IRIS Conference – May 21

IRIS Conference May 2008

Presentation by Pierre Pelouzet – Purchasing Director

Direction de

High Level Certification: a necessity for rail

The SNCF purchasing in brief:

6 large purchasing segments

In 2007 :

General Supply

More than 9 billions euros of

purchase (excluded RFF tolls)

Railway and civil works

About 25 000 orders per year

Energy

Services

Intellectual services

Rolling Stock

Purchasing is the 2nd element of spend for SNCF :

A crucial tool to control the costs and the quality of its own services

Direction des Achats

3

High Level Certification: A necessity for rail

Purchasingat

atSNCF

SNCF::

Purchasing

Moreand

andmore

moreworldwide

worldwidesourcing

sourcingwhich

whichmodifies

modifiesstrongly

strongly

99More

therelationship

relationshipbetween

betweenSNCF

SNCFand

andits

itssuppliers,

suppliers,ininparticular

particular

the

concerningthe

theproduct

productquality

qualitycontrol.

control.

concerning

9SNCF’swill

willincrease

increaseits

itsambitions

ambitionsand

andexpectations

expectationsfor

forits

its

9SNCF’s

suppliers,concerning

concerningtheir

theirresponsibilities

responsibilitiesand

andthe

thecontinuous

continuous

suppliers,

improvementof

oftheir

theirperformance.

performance.

improvement

EvenififSNCF

SNCFdoesn’t

doesn’trequire

requireimperatively

imperativelyaacertification

certificationfor

forall

all

99Even

itssuppliers,

suppliers,aareliable

reliablecertification

certificationisisessential

essentialfor

forthe

thetrust

trust

its

SNCFneeds

needsto

tohave

haveininits

itssuppliers.

suppliers.

SNCF

Direction des Achats

4

High Level Certification: A necessity for rail

TheEuropean

Europeancontext

context::

The

TheEuropean

Europeanrailway

railwaymarket

marketisisalso

alsoan

anopen

openmarket

marketfor

for

99The

railwaysoperators

operatorsas

asSNCF.

SNCF.We

Weare

areand

andwe

wewill

willbe

bemore

moreand

and

railways

moreinincompetition

competitionwith

withother

otherEuropean

Europeanoperators.

operators.

more

9Costcontrol

controland

andquality

qualitycontrol

controlof

ofthe

thepurchased

purchasedproducts

productsare

are

9Cost

essentialfor

forthe

theSNCF

SNCFto

tobe

bepresent

presenton

onthe

theEuropean

Europeanrailway

railway

essential

market.

market.

Direction des Achats

5

High Level Certification A necessity for rail

Thequality

qualitymanagement

managementcontext

context::

The

Theworldwide

worldwidesuccess

successof

ofthe

theISO

ISO9000

9000standards

standardscertification

certification

99The

andits

itsextension

extensionto

toall

allkinds

kindsof

ofactivities

activitiesputs

putsforward

forwardthe

the

and

“processquality”

quality”certification

certificationbut

buttoo

toooften

oftenforgets

forgetsthe

the“product

“product

“process

quality”aspects.

aspects.

quality”

9Ourexperience

experienceand

andparticipation

participationininthe

theactivities

activitiesof

ofcertification

certification

9Our

bodiesshows

showsus

usthe

thenecessity

necessityto

tohave

havespecific

specificrequirements

requirements

bodies

andauditors

auditorswith

withhigh

highlevel

levelcompetency

competencyininthe

therailway

railwayfield.

field.

and

Direction des Achats

6

High Level Certification A necessity for rail

TheSNCF

SNCFexpectations:

expectations:that

thatthe

thehigh

highlevel

levelcertification

certificationsought

sought

The

byIRIS

IRISbe

beconfirmed

confirmedand

andmaintained

maintained

by

9Toassociate

associatemore

moreclosely

closelyoperators

operatorsto

tothe

theIRIS

IRISactivities

activitiesand

and

9To

functionsto

tostrengthen

strengthenits

itsdimension

dimensionand

andits

itscredibility.

credibility.

functions

9Tobenefit

benefitfrom

fromthe

theoperators’

operators’knowledge

knowledgeof

ofsuppliers,

suppliers,to

to

9To

implementand

andmaintain

maintainaareal

reallink

linkbetween

betweencertification

certificationand

and

implement

qualityrecorded

recordedby

bythe

theclients,

clients,on

onthe

thesuppliers’

suppliers’performance

performance

quality

andon

onthe

theproducts

productssupplied.

supplied.

and

9Tobe

berigorous

rigorousconcerning

concerningthe

theissuing

issuingand

andthe

thewithdrawal

withdrawalof

of

9To

theIRIS

IRIScertificates.

certificates.

the

9Toreinforce

reinforcethe

theoperators’

operators’confidence

confidenceininthe

themanagement

managementand

and

9To

operationof

ofthe

theIRIS

IRIScertification

certificationsystem.

system.

operation

Direction des Achats

7

Direction des Achats

8

IRIS - International Railway Industry Standard

The Quality Standard for the Railway Industry

High level certification: A necessity for Rail

First IRIS Conference

Brussels, May 21st, 2008

Pierre Attendu

Chief Procurement Officer

Bombardier Transportation has its global headquarters in Berlin, Germany with a

presence in over 60 countries. It has an installed base of over 100,000 vehicles

worldwide. The Group offers the broadest product portfolio and is recognized as

the leader in the global rail sector.

Workforce*

31,485

Countries with

Production Presence

21

Production Sites

43

Revenues**

Order Backlog*

$ 7.8 billion US

$ 30.9 billion US

* as at 31 January, 2008

** year ending 31 January, 2008

© Bombardier Inc. or its subsidiaries. All rights reserved.

Bombardier Transportation

IRIS - The Quality Standard for the Railway Industry

– Sector specific requirements on the top of ISO 9001.

– An evaluation process to be performed by independent and

approved certification bodies.

– A web-based information tool including information about audit

results.

IRIS is not competing against any other Certification Scheme.

© Bombardier Inc. or its subsidiaries. All rights reserved.

We welcome,

A common global system for the evaluation of Business

Management Systems specific to the railway industry, that includes

Our Expectations towards the IRIS certification scheme

Stable process and improved interfaces by standardized requirements.

Less auditing by recognition of IRIS certificates.

Reliable Information about suppliers of the railway industry.

To build confidence and partnerships

© Bombardier Inc. or its subsidiaries. All rights reserved.

Reduction of cost of poor quality in the whole supply chain.

IRIS Commitment of System Integrators

–

–

–

–

Bombardier Transportation

Alstom Transport

AnsaldoBreda

Siemens Transportation Systems

Committed (2006-05-18) to

recognized IRIS certificates and

therefore to not initiate business

management system audits at

companies having a valid IRIS

certificate.

project and/or product audits have

different purposes and so they are not

part of this commitment.

© Bombardier Inc. or its subsidiaries. All rights reserved.

The four System Integrators:

Bombardier approach

– 8 BT sites are already IRIS certified with a score > 80%

(Spain, Germany, Sweden, China)

– Further sites will follow in accordance with our global certification plan.

In terms of our suppliers:

– Preferred suppliers are expected to be IRIS certified by May 2009 and to

grant access to their IRIS results.

– In this case: BT’s supplier evaluation and approval process will be reduced to

topics that are not covered by IRIS, such as supplier performance, financial

health, capabilities and capacities issues.

– Targeted suppliers not meeting the deadline will be considered as

“NOT preferred supplier” in new contracts.

© Bombardier Inc. or its subsidiaries. All rights reserved.

BT fully support IRIS and is committed to obtain IRIS certification for its

own sites

Tel:

+49 30 98607 1400

Fax:

+49 30 98607 2400

Mail:

pierre.attendu@de.transport.bombardier.com

Web:

www.bombardier.com

www.theclimateisrightfortrains.com

© Bombardier Inc. or its subsidiaries. All rights reserved.

Pierre Attendu

© Bombardier Inc. or its subsidiaries. All rights reserved.

A benefit for

the railway

industry!

Knorr-Bremse,

Dr. Albrecht Köhler

Brussels, 21st May 2008

Knorr-Bremse Group

Knorr-Bremse Rail Group – Product Overview Brake Systems (Extract)

Brake Systems for Rail Vehicles - Product Overview

(Extract)

Brake- and System Control

Air Supply

EP Compact

Screw/

Piston

Compressor

EP

2002

MBS (Locomotives)

Under floor

assembly

Hydraulics

Bogie Equipment

Eddy Current Brake

Magnetic Track Brake

Knorr-Bremse Group

Oil free

Compressor

Brake Caliper

Brake Disc

Hydraulic Unit

Brake Caliper

Knorr-Bremse Rail Group – Product Overview On-Board Systems (Extract)

On-Board Systems for Rail Vehicles - Product Overview

(Extract)

Door Systems

HVAC

Power Supply

Disconnector

Braking Resistor

Platform Door Systems

Toilets / Electronics

Signaling / Power Supply

Electronic

Voltage

Converter

Knorr-Bremse Group

IRIS supports Zero Defect Approach of Knorr-Bremse

Remaining major improvement areas for achieving Zero Defect:

- Product Engineering

- System Engineering

- Project Management

Various factors which influence

our systems and growing complexity

of supply chain result in increasing

challenge on these key elements

IRIS defines requirements

for engineering and project

management processes

A successful management

system is absolutely necessary

to ensure that well defined

processes are in place and

regularly improved

Result

End User /

Customer

Requirements

Interface

of Products to

Customer Systems

Main Influence

on Product and

System Quality

Equipment

Manufacturer

Requirements

Environmental

Influence

Track

Environmental

Influence

Car

Improved process and product quality leads to reduced quality costs

Knorr-Bremse Group

IRIS – Railway standard for business processes

IRIS sets the standard for processes in the railway industry

IRIS defines the requirements of the

General requirements

rail industry and fills the gaps

Improvement

Documentation requirements

Analysis of data

Knowledge management

of ISO 9001:2000

Control of nonconforming processes

Management of Multisite projects

100

90

Control of nonconforming products

Monitoring and measurement

Measurement, analysis

and improvement

Biggest gaps of ISO 9001

in product realization

(e.g. project management,

first article inspection,

RAMS/LCC)

Obsolescence Management

IRIS is driving topics which were

neglected in the past (e.g.

configuration management,

obsolescence management)

RAMS / LCC

80

Management commitment

70

Customer focus

60

50

Quality policy

40

Planning

30

Responsibility, authority

and communication

20

10

Commissioning /

customer service

0

Management review

First article inspection

Provision of resources

Configuration management

Project management

Control of monitoring

and measuring devices

Production scheduling

production and service

provisions Purchasing

Design and development

max IRIS Rev01

Human resources

Infrastructure

Contingency plan

Work environment

Planning of production realization

Customer

related processes

Tender

Management

min IRIS rev01

Detailed questionnaire shows potentials for process improvements

Knorr-Bremse Group

ISO

IRIS – Certification and Audit Standard

IRIS provides a high level certification and audit standard

One unique and high level international rail standard leads to upgrade of

management system and improved processes

IRIS audit tool supports internal pre-assessments

Fair and objective evaluation by accredited certification bodies with

experienced auditors familiar with the Railway Industry

Standardized and detailed audit report with maturity score is available

Elimination of comprehensive system audits by major system integrators

Areas of Improvement:

¾ IRIS shall be accepted by all system integrators and operators

¾ IRIS shall be joined quickly by all major suppliers in the rail industry

¾ International presence of Certified Bodies is necessary

¾ IRIS standard must not be weakened by ‘generous’ auditors

Result

IRIS builds mutual trust with customers and supports preferred partnerships

Knorr-Bremse Group

IRIS in Knorr-Bremse Rail Group

IRIS Certification in Knorr-Bremse Rail Group

Knorr-Bremse is

absolutely

convinced about

the benefit of IRIS

IRIS will be an

important

prerequisite for

railway market

access, specially

for preferred

suppliers

IRIS certification 2007

IRIS certification 2008

IRIS certification 2009

Commitment

Knorr-Bremse Group

All relevant 23 Knorr-Bremse locations will be IRIS certified until mid of 2009

Knorr-Bremse Group

IRIS Conference

Brussels, May 20/21 2008

German Railway Industry Association

Axel Schuppe, General Manager

The German Railway Industry Association

The current business situation

The value of IRIS

Conclusion and outlook

Mai 2008

IRIS

VDB ...

was founded in 1877

represents the interests of manufacturers of railway technology

includes more than 110 member companies with about 40.000 employees in all fields of railway

technology (rail vehicles and accessory, mechanical and electrical components, railway infrastructure

and electrification, information and communication systems, magnetic levitation systems, train control,

signaling and safety systems)

works within 18 spezialised sections and working groups

represents its members interests towards the public, politics, customers, national and international

authorities, institutions and organisations for the sustainable promotion of railway traffic

active participation in shaping the industries economical, technical, political and legal conditions

Mai 2008

IRIS

27

Organization of the VDB

Mai 2008

IRIS

SHW

Weichenbau

GmbH

Mai 2008

IRIS

The German Railway Industry Association

The current business situation

The value of IRIS

Conclusion and outlook

Mai 2008

IRIS

Turnover in the German Railway Industry (VDB-Members).

12

+5,5%

10

9,1

Gesamt in Mrd. €

9,6

Inland in Mrd. €

Ausland in Mrd. €

8

6

4,5

4,6

4,5

4

2

0

2006

Mai 2008

2007

IRIS

5,1

Order intake in the German Railway Industry (VDB-Members).

+1,0%

12

10,7

10,6

Gesamt in Mrd. €

Inland in Mrd. €

10

Ausland in Mrd. €

8

6,2

5,8

6

4,9

4,4

4

2

0

2006

Mai 2008

2007

IRIS

Turnover and Order intake in the Railway Industry

in chronological Order (VDB Members)

12

10,6

9,3

10

9,3

9,9

8,9

8,1

8

7,3

6,8

6,4

6

6,0

5,9

9,9

10,7

10,0

9,0

9,1

9,6

8,4

7,2

7,7

6,7

6,2

Umsatz in Mrd. €

4

Auftragseingang in Mrd. €

2

0

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Mai 2008

IRIS

Available Global Market for Railway

Technology incl. Tracking & incl. Services in 2005*, Growth Rate till 2012.

NAFTA

WESTERN EUROPE

EASTERN EUROPE

2005: 14,3 – 19,0 bn €

~ + 1,7% - 2,5% p.a.

2005: 22,3 – 25,8 bn €

~ + 1,0% - 2,1% p.a.

2005: ~ 3,7 bn €

~ + 3,5% p.a.

The Impulses of Growth:

CIS

TOTAL

2005: ca. 63,2 – 72,7 bn €

+ 2% - 2,5% p.a.

p.a.

• Environment and climate issues

• Economical globalisation

• Increasing fuel prices

• Worldwide conurbations

• Liberalisation and deregulation

• Interoperability

2005: ~ 4,5 bn €

~ + 3,3% p.a.

CENTRAL & SOUTH AMERICA

AFRICA & MIDDLE EAST

ASIA & PACIFIC

2005: ~ 2,2 bn €

~ + 2,0% – 3,3% p.a.

2005: ~ 1,5 bn €

~ + 3,5% - 3,7% p.a.

2005: 14,7 – 16,0 bn €

~ + 3,0% - 5,0% p.a.

References: F & S 2006, SCI 2006, Unife 2007, own calculations

Mai 2008

* average of the years 2003-2005

IRIS

The German Railway Industry Association

The current business situation

The value of IRIS

Conclusion and outlook

Mai 2008

IRIS

Value of IRIS – some questions

How to keep this growth sustainable?

How to gain the best share for the Eureopean rail supply industry in the growing market?

Could IRIS be one part of the answer even for SME‘s?

Mai 2008

IRIS

Conclusion and outlook

IRIS encourages process innovation

IRIS contributes to an improvement of product quality

IRIS helps to save cost

IRIS (the IRIS approach) has the potential to become more than a rail supply industry

standard while becoming mutually recognized

by rail supply industry customers and operators

within EU certification procedures by NoBo‘s

for certification of maintenance workshops

Mai 2008

IRIS

The German Railway Industry Association

The current business situation

The value of IRIS

Conclusion and outlook

Mai 2008

IRIS

The Rail Supply Indystry: A „Hidden Champion“ of the Economy

Mai 2008

IRIS

Verband der Bahnindustrie in

Deutschland (VDB) e.V.

With excellent and efficiant railway system solutions for more

sustainable traffic on rail.

www.bahnindustrie.info

Knorr-Bremse Group

IRIS International Railway

Industry Standard

The Global Quality Standard for the

Railway Industry

IRIS Conference – May 21

IRIS International Railway

Industry Standard

The Global Quality Standard for the

Railway Industry

Friedrich Smaxwil

Member of the Executive Management Board of Siemens TS

GDP-growth of China and India (optional slide)

China

GDP

(in bn. USD)

USA

30,000

India

20,000

10,000

Japan

Germany

0

2000

2005

2010

Source: GoldmanSachs

2015

2020

2025

2030

2035

2035

2040

2040

2045

2045

2050

Rotem – from local low-end player

to international player

Germany

Offer

Ireland

Spain

2005

Offer

150 DMU

Canada

Hungary

2005 40 EMU

Offer

Turkey

2001

2005

2006

2000

2001

Monopoly in

domestic market

Hong Kong

120 DMU

1998 104 Metro

Greece

2004

2002

USA

2004

2006

2007

2008

Korea

2003 50 DMU

2004

2003

2006

Syria

Iran

2002

2005

92 EMU

34 LRV

24 DMU

96 EMU

2008

2004 32 Metro

126 Metro

Taiwan

1999

32 DMU (TTA pending)

104 EMU (SEPTA)

131 Double deck - PC

75 Double deck - PC

Saudi Arabia

2003

17 PC

Philippines

New Zealand

2000

2007

2007

72 EMU

Bangladesh

PC: Passenger Coaches

DMU: Diesel Multiple Unit

EMU: Electrical Multiple Unit

LRV: Light Rail Vehicle

Figures indicate quantity of cars

2003

2003

2004

11 Locomotives

India / Delhi

Brazil

24 EMU

80 Metro

56 Metro

2001 240 Metro

2007 90 Metro

156 Metro

70 EMU

35 EMU

European manufacturers still outpace

Asian companies...

System integrators with highest sales volume in railway sector by regions

(sales in billion EUR)

European

Alstom + Ansaldo Transport + Bombardier + Siemens

suppliers

US

GE + Trinity

suppliers

Asian

suppliers

CSR + CNR + Kawasaki

Russian

suppliers

Transmash

4.6

4.2

1.2

Source: SCI Verkehr, VDB, Wettbewerbsbericht Deutsche Bahn

16.3

Secure market advantages with IRIS

European manufacturers can maintain their lead with

Stabile, efficient processes

Optimal meshing of processes between suppliers and

system integrators

Î IRIS plays an important part in this process

In short: IRIS increases the chance of getting

a good product at a competitive price

Asian rail technology in the world market

Ireland

Germany

Turkey

2005 150 DMU

Offer

Great Britain

Spain

2005 28 EMU

Offer

2001 92 EMU

2005 34 LRV

24 DMU

2006 96 EMU

Hungary

Korea

Monopoly in

domestic market

China

Offer

Syria

Canada

2003 50 DMU

2005 Track Rehab

2005 40 EMU

1998 80 locos

480 EMU

300 metro

Iran

2004 120 DMU

Japan

Greece

Key player in

domestic market

2002 126 Metro

USA

1997

1998

2002

2004

2004

400

212

680

32

104

131

2008 75

metro

metro

metro

DMU (TTA pending)

EMU (SEPTA)

Double deck - PC

Double deck - PC

2007 LR Trinidad

Saudi Arabia

2003 17 PC

2006 North-South

2003

2004

Thailand

Dubai

2005

40 DE Locos

2005 Monorail

Bangladesh

Nigeria

Singapore

2003 11 Locomotives

2006 Lagos Rail

1998 66 metro

India / Delhi

Philippines

2001 240 Metro

2007 90 Metro

156 Metro

2006 LRT Colombo

Brazil

Subsystem suppliers

Taiwan

Caribbean

24 EMU

80 Metro

2000

72 EMU

Indonesia

2005 Java Turnkey

1999

2000

2003

2005

56Metro

High-Speed

321 metro

High-Speed

Hong Kong

1998 104 Metro

2004 32 Metro

New Zealand

2007 70 EMU

35 EMU

Î Growing global involvement of Asian system integrators

Î Growing interest of Asian railway subsystem suppliers in IRIS

Î An opportunity to show a company’s areas of competence

IRIS opens up global sourcing in Asia

IRIS reduces the risks of global sourcing

IRIS simplifies the process and makes it less expensive

Asian providers with IRIS certification become much more

likely potential business partners

来自亚洲的竞争 :

对欧洲制造商的挑战 ?

(Asian Competition : a challenge for european manufacturers?)

Pierre Sainfort – COO Faiveley

File: IRIS

Asia:

before being a challenge with competition, is a

huge opportunity

• Domestic market (China , India)

• Overseas Strategy & Ambition of local Car Builders (China, Korea)

Beijing

Datong

QingDao

Shijiazhuang

Seoul

Shanghai

Baddir

Delhi

Hong Kong

Bangalore

X

X

X

X

X

File: IRIS

Faiveley

Faiveley

Faiveley

Faiveley

Faiveley

Air Conditioning since 1994

Brake Systems since 1995

Platform Screen Doors since 1999

Passenger Access Doors since 2002

Couplers since 2007

Asia: a cultural challenge

File: IRIS

Asia: a stability challenge (China, India)

X

Extreme contrasts

X

Human Ressources

y for urban citizens, english speaking, educated: salary increase

+10/20%/year – loosing people @ +30% (purchasing, quality, SQA…)

X

Finance

y exchange rate evolution vs €,$

y volume management > profit management > cash management

X

File: IRIS

Quality

(base=FT domestic suppliers)

y poor results local supplier quality audit

y poor ppm level , high NCR, multiple FAI,

y mandatory 100% Incoming Inspection before use/shipment

Asian Competition: a true challenge

X

X

Cultural Challenges

Stability Challenges

BUT

X

X

X

File: IRIS

Very Fast Learning,

High Skills and Competencies,

Future Very Active Players,

File: IRIS

IRIS - Seminar

Foucauld de LAUZON

AFAQ AFNOR Asia

foucauld.delauzon@afnor.org

NORMALISATION

Standardization

process

Standards &

Books sales

Training

European (CEN)

and International (ISO)

standards

Information & Intelligence

Sector schemes and

Trades approach

International Relations

AFNOR on-line shop

QHSE

Services

Products

Metrology

Audit

27 500 experts

124 000 items

10 000 trainees

Assessment

& Certification

QSE Management Systems

Services

Products

Competences

Labels

65 000 certified sites

The railway industry in China

¾ Railway development in China

¾ Increasing of outsourcing

in China

59

IRIS awareness in China

¾ From “ IRIS … what is IRIS ? ”

¾ Commitment of major purchasers

¾ Market open and curious about new initiatives

¾ Companies looking for recognition from outside China

¾ To “ How do I get IRIS certificate ? ”

IRIS …. a large range of questions

¾

¾

¾

¾

¾

¾

¾

¾

¾

QMS Quality Management System

IRIS

Auditing

RAMS

LCC

Project Management

Product testing

Product certification

…

May 2008 …

middle of a 3 keys steps for IRIS

¾ 2007 .. .. awareness

¾ 2008 .. .. implementation

¾ 2009 .. .. certification ?

File: IRIS

Asian Competition,

a challenge for European

manufacturers

José Taborda

21st May 2008

TRANSPORT

The world we know…

- - P 65

The world… railway oriented !

- - P 66

ALSTOM Transport in China

Subsidiaries and joint ventures

QINGDAO:

Dampers

Employees

31

ALSTOM

China Ltd. Holding

Employees

Employees

Holding

CASCO:

Signalling

YONGJI:

Motors

Employees

271

112

Transport

New JV

SATCO

Rolling Stock

Employees

313

21

In M Euros

Hong-Kong:

Signalling

Employees

47

SATEE:

Traction

ATSL

Services

Employees

- - P 67

270

Employees

70

Boost purchases in Emerging markets

Alstom Transport Purchases

2006/2007

96.8%

2009/2010

2.9

%

0.4

%

Western Countries

70%

15

%

15

%

East Europe Countries

ASIA

915 Asian suppliers to be part of LP150 program

- - P 68

IRIS is at the heart of Suppliers Development

SQA

Sourcing

- - P 69

Technical

Support

IPOs in Asia

SQA

India

IndiaSourcing

Sourcing

Office

Office

Jan

Jan2008

2008

Sourcing

- - P 70

Technical

Support

China

ChinaSourcing

Sourcing

reinforcement

reinforcement

since

sinceMay

May2007

2007

Alstom Transport Approach

Communication to Suppliers Panel

− Standard letter sent on 28/08/2006 to Alstom Transport

Panel Suppliers requiring certification by end of 2008

− Strong follow up on Key Suppliers by Commodities

From January 1st 2009, IRIS Certification will be a

discriminatory factor

All suppliers (including Asian) will follow the same

program

- - P 71

Benefits of IRIS in Asia

Benefits will be the same as in Europe

– Quality will increase across the entire supply chain

– Evaluation and approval of equipment manufacturers will

become more efficient

– Cost for manufacturers and suppliers will decrease

– Comprehensive data and its accessibility will improve

Moreover

– Clear Iris requirements will enable Asian supplier to be

compliant sooner

– A certified Asian supplier base will push to industrial

excellence the global base

– Asian supplier quality systems will become legitimate

- - P 72

Improvement for IRIS deployment in Asia

Issues

– Little knowledge of the IRIS standard in Asia by our

Suppliers (except for European subsidiaries)

– Little Certification bodies competent resources available

in Asia. That does not allow the right speed in the

deployment of this new standard

Suggestions

– UNIFE/IRIS event in Asia: China and India

– Certification Bodies in Asia posted on IRIS Website

- - P 73

- - P 74