Mergers and Acquisitions and Managerial Commitment to

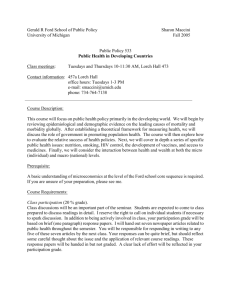

advertisement