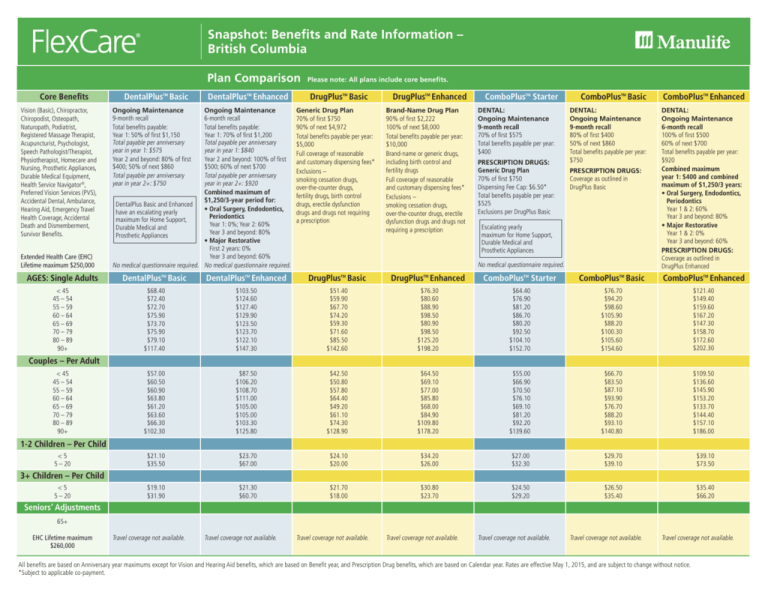

Snapshot: Benefits and Rate Information –

British Columbia

Plan Comparison

Core Benefits

Vision (Basic), Chiropractor,

Chiropodist, Osteopath,

Naturopath, Podiatrist,

Registered Massage Therapist,

Acupuncturist, Psychologist,

Speech Pathologist/Therapist,

Physiotherapist, Homecare and

Nursing, Prosthetic Appliances,

Durable Medical Equipment,

Health Service Navigator®,

Preferred Vision Services (PVS),

Accidental Dental, Ambulance,

Hearing Aid, Emergency Travel

Health Coverage, Accidental

Death and Dismemberment,

Survivor Benefits.

Extended Health Care (EHC)

Lifetime maximum $250,000

DentalPlus Basic

TM

DentalPlus Enhanced

TM

Ongoing Maintenance

9-month recall

Total benefits payable:

Year 1: 50% of first $1,150

Total payable per anniversary

year in year 1: $575

Year 2 and beyond: 80% of first

$400; 50% of next $860

Total payable per anniversary

year in year 2+: $750

Ongoing Maintenance

6-month recall

Total benefits payable:

Year 1: 70% of first $1,200

Total payable per anniversary

year in year 1: $840

Year 2 and beyond: 100% of first

$500; 60% of next $700

Total payable per anniversary

year in year 2+: $920

Combined maximum of

$1,250/3-year period for:

DentalPlus Basic and Enhanced

• Oral Surgery, Endodontics,

have an escalating yearly

Periodontics

maximum for Home Support,

Year 1: 0%; Year 2: 60%

Durable Medical and

Year 3 and beyond: 80%

Prosthetic Appliances

• Major Restorative

First 2 years: 0%

Year 3 and beyond: 60%

No medical questionnaire required. No medical questionnaire required.

Please note: All plans include core benefits.

DrugPlusTM Basic

Generic Drug Plan

70% of first $750

90% of next $4,972

Total benefits payable per year:

$5,000

Full coverage of reasonable

and customary dispensing fees*

Exclusions –

smoking cessation drugs,

over-the-counter drugs,

fertility drugs, birth control

drugs, erectile dysfunction

drugs and drugs not requiring

a prescription

DrugPlusTM Enhanced

Brand-Name Drug Plan

90% of first $2,222

100% of next $8,000

Total benefits payable per year:

$10,000

Brand-name or generic drugs,

including birth control and

fertility drugs

Full coverage of reasonable

and customary dispensing fees*

Exclusions –

smoking cessation drugs,

over-the-counter drugs, erectile

dysfunction drugs and drugs not

requiring a prescription

ComboPlusTM Starter

DENTAL:

Ongoing Maintenance

9-month recall

70% of first $575

Total benefits payable per year:

$400

PRESCRIPTION DRUGS:

Generic Drug Plan

70% of first $750

Dispensing Fee Cap: $6.50*

Total benefits payable per year:

$525

Exclusions per DrugPlus Basic

ComboPlusTM Basic

DENTAL:

Ongoing Maintenance

9-month recall

80% of first $400

50% of next $860

Total benefits payable per year:

$750

PRESCRIPTION DRUGS:

Coverage as outlined in

DrugPlus Basic

Escalating yearly

maximum for Home Support,

Durable Medical and

Prosthetic Appliances

No medical questionnaire required.

ComboPlusTM Enhanced

DENTAL:

Ongoing Maintenance

6-month recall

100% of first $500

60% of next $700

Total benefits payable per year:

$920

Combined maximum

year 1: $400 and combined

maximum of $1,250/3 years:

• Oral Surgery, Endodontics,

Periodontics

Year 1 & 2: 60%

Year 3 and beyond: 80%

• Major Restorative

Year 1 & 2: 0%

Year 3 and beyond: 60%

PRESCRIPTION DRUGS:

Coverage as outlined in

DrugPlus Enhanced

AGES: Single Adults

DentalPlus Basic

DentalPlus Enhanced

DrugPlus Basic

DrugPlus Enhanced

ComboPlusTM Starter

ComboPlusTM Basic

ComboPlusTM Enhanced

< 45

45 – 54

55 – 59

60 – 64

65 – 69

70 – 79

80 – 89

90+

$68.40

$72.40

$72.70

$75.90

$73.70

$75.90

$79.10

$117.40

$103.50

$124.60

$127.40

$129.90

$123.50

$123.70

$122.10

$147.30

$51.40

$59.90

$67.70

$74.20

$59.30

$71.60

$85.50

$142.60

$76.30

$80.60

$88.90

$98.50

$80.90

$98.50

$125.20

$198.20

$64.40

$76.90

$81.20

$86.70

$80.20

$92.50

$104.10

$152.70

$76.70

$94.20

$98.60

$105.90

$88.20

$100.30

$105.60

$154.60

$121.40

$149.40

$159.60

$167.20

$147.30

$158.70

$172.60

$202.30

$57.00

$60.50

$60.90

$63.80

$61.20

$63.60

$66.30

$102.30

$87.50

$106.20

$108.70

$111.00

$105.00

$105.00

$103.30

$125.80

$42.50

$50.80

$57.80

$64.40

$49.20

$61.10

$74.30

$128.90

$64.50

$69.10

$77.00

$85.80

$68.00

$84.90

$109.80

$178.20

$55.00

$66.90

$70.50

$76.10

$69.10

$81.20

$92.20

$139.60

$66.70

$83.50

$87.10

$93.90

$76.70

$88.20

$93.10

$140.80

$109.50

$136.60

$145.90

$153.20

$133.70

$144.40

$157.10

$186.00

$21.10

$35.50

$23.70

$67.00

$24.10

$20.00

$34.20

$26.00

$27.00

$32.30

$29.70

$39.10

$39.10

$73.50

$19.10

$31.90

$21.30

$60.70

$21.70

$18.00

$30.80

$23.70

$24.50

$29.20

$26.50

$35.40

$35.40

$66.20

TM

TM

TM

TM

Couples – Per Adult

< 45

45 – 54

55 – 59

60 – 64

65 – 69

70 – 79

80 – 89

90+

1-2 Children – Per Child

<5

5 – 20

3+ Children – Per Child

<5

5 – 20

Seniors’ Adjustments

65+

EHC Lifetime maximum

$260,000

Travel coverage not available.

Travel coverage not available.

Travel coverage not available.

Travel coverage not available.

Travel coverage not available.

Travel coverage not available.

Travel coverage not available.

All benefits are based on Anniversary year maximums except for Vision and Hearing Aid benefits, which are based on Benefit year, and Prescription Drug benefits, which are based on Calendar year. Rates are effective May 1, 2015, and are subject to change without notice.

*Subject to applicable co-payment.

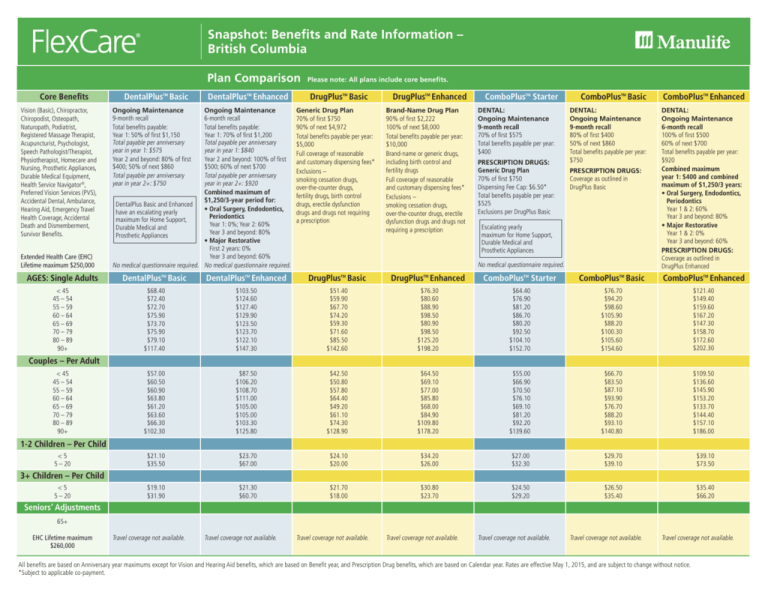

Add-On Coverages

Catastrophic Coverage

($4,500 deductible)

Catastrophic Coverage

($10,200 deductible)

Unlimited 100% coverage for Unlimited 100% coverage

drugs after $4,500 deductible. for drugs after $10,200

deductible.

Up to $25,000 coverage

for Homecare and Nursing,

Durable Medical Equipment

& Prosthetic Appliances after

$7,500 deductible.

Unlimited Chiropractor and

Physiotherapist for 1 year

following accident requiring

hospitalization.

Up to $25,000 coverage

for Homecare and Nursing,

Durable Medical Equipment

& Prosthetic Appliances after

$7,500 deductible.

Hospital Basic

Hospital Enhanced

Semi-private room, 100% first 100% of private and semi30 days, 50% next 100 days; private room coverage, up to

up to maximum $150 per day. maximum $200 per day.

Cash Benefit in lieu of room:

$25/day beginning on the 4th

day. Maximum of 30 days.

Cash Benefit in lieu of room:

$50/day beginning on the 4th

day. Maximum of 60 days.

Vision Enhanced

Travel +8 Days

$100 towards laser

eye surgery.

Trips of up to 17 days are

covered (i.e. 9 days + 8 days)

$500 maximum per

3 consecutive benefit years.

$5,000,000 per covered

person per trip.

$100 deductible per claim.

Optometrists to maximum of

$50/2 years.

Not available with ComboPlus

Starter.

Unlimited Chiropractor and

Physiotherapist for 1 year

following accident requiring

hospitalization.

Travel +21 Days

AD&D Enhanced

Trips of up to 30 days are

$50,000 for adults and

covered (i.e. 9 days + 21 days) $20,000 for children

($25,000 Core coverage &

$5,000,000 per covered

$25,000 Add-On coverage

person per trip.

for adults; $10,000 Core

$100 deductible per claim.

coverage & $10,000 Add-On

coverage for children.)

No medical questionnaire required.

No medical questionnaire required.

No medical questionnaire required.

No medical questionnaire required.

Hospital Enhanced

Vision Enhanced

Travel +8 Days

Travel +21 Days

AD&D Enhanced

$7.30

$6.70

$7.40

$10.70

$14.20

$20.50

$29.80

$39.00

$9.70

$9.30

$10.60

$14.70

$18.20

$26.50

$38.50

$50.60

$16.10

$17.30

$17.70

$17.90

$15.50

$13.60

$12.10

$11.60

$4.40

$4.40

$5.20

$6.90

n/a

n/a

n/a

n/a

$7.30

$7.30

$8.30

$11.80

n/a

n/a

n/a

n/a

$3.30

$3.40

$3.50

$3.50

$3.20

$4.00

$7.00

$10.90

$12.20

$13.50

$14.90

$16.40

$20.00

$22.50

$26.30

$28.80

$6.90

$6.60

$7.20

$10.10

$13.60

$19.60

$27.80

$36.00

$9.30

$8.70

$10.10

$12.50

$17.00

$24.70

$35.80

$46.80

$13.60

$14.20

$14.70

$14.90

$12.90

$11.50

$10.50

$9.70

$4.40

$4.40

$5.20

$6.90

n/a

n/a

n/a

n/a

$7.30

$7.30

$8.30

$11.80

n/a

n/a

n/a

n/a

$3.30

$3.40

$3.50

$3.50

$3.20

$4.00

$7.00

$10.90

$11.90

$11.90

$10.80

$10.80

$5.60

$4.40

$6.70

$5.40

$4.40

$13.30

$4.30

$4.30

$6.80

$6.80

$3.00

$2.90

$11.90

$11.90

$10.80

$10.80

$5.00

$4.10

$6.00

$4.60

$4.10

$12.00

$4.00

$4.00

$6.20

$6.20

$2.80

$2.60

Available as renewal only.

Available as renewal only.

No change.

No change.

No change.

Coverage not available.

Coverage not available.

$10,000 core coverage and

$10,000 add-on coverage.

AGES

Single Adults

Catastrophic Coverage

($4,500 deductible)

Catastrophic Coverage

($10,200 deductible)

Hospital Basic

< 45

45 – 54

55 – 59

60 – 64

65 – 69

70 – 79

80 – 89

90+

$13.40

$14.90

$16.40

$18.00

$24.70

$27.30

$31.70

$38.60

$12.20

$13.50

$14.90

$16.40

$22.50

$24.80

$28.80

$35.10

$13.40

$14.90

$16.40

$18.00

$22.00

$24.70

$28.90

$31.70

Couples – Per Adult

< 45

45 – 54

55 – 59

60 – 64

65 – 69

70 – 79

80 – 89

90+

1-2 Children – Per Child

<5

5 – 20

3+ Children – Per Child

<5

5 – 20

Seniors’ Adjustments

65+

Anniversary year means the 12 consecutive months following the effective date of the Agreement, and each 12-month period thereafter. Benefit year means the 12 consecutive months following the incurred date of the claim. Calendar year means each successive 12-month period commencing January 1 and ending December 31.

All references to “year” refer to anniversary year. When it relates to Hearing Aids and Vision Care benefits, year refers to benefit year. When it relates to Prescription Drug benefits, year refers to calendar year.

Flexcare® Health and Dental Plans are offered through The Manufacturers Life Insurance Company (Manulife).

Plans underwritten by The Manufacturers Life Insurance Company. Manulife, the Block Design, the Four Cubes Design, and Strong Reliable Trustworthy Forward-thinking are trademarks of The Manufacturers Life Insurance Company and are used by it, and

by its affiliates under license. Health Service Navigator® and Preferred Vision Services (PVS) are offered through The Manufacturers Life Insurance Company. ™/®Trademarks held by The Manufacturers Life Insurance Company. ©2015 The Manufacturers Life

Insurance Company. All rights reserved. This is not a contract. Actual terms and conditions are detailed in the policy issued by Manulife upon application approval. It contains important information concerning details, terms, conditions and limitations.

Please read it carefully.

Manulife, P.O. Box 4213, Stn A, Toronto, ON M5W 5M3.

FC-SS-BC-E.04/2015

15.5021