RnD-Tax-prepayment-loan-service

advertisement

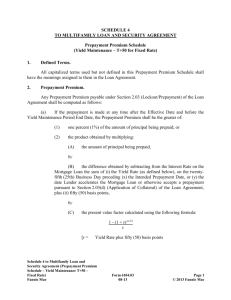

R&D TAX INCENTIVE PREPAYMENT FUNDING SERVICE Australian R&D companies with less than $20 million in annual turnover that are eligible to receive a 45% refundable tax offset, may wish to use their prospective ATO refund as security - to drawdown a prepayment for the purpose of assisting their cash flow needs. 3 FUNDING OPTIONS ARE AVAILABLE: 1 2 FUNDING OPTIONS FUNDING EXAMPLES Short term – prepayment of 80% of the calculated tax refund, against a current claim lodgement relative to the prior year’s R&D expenses. Short term against a current claim lodgement: Mid-term – a quarterly or half-yearly drawdown of up to 80% of the expected tax refund after incurring current year expenses. Mid-term – against the quarterly or half yearly incurring of R&D expenses. R&D expenditure $200,000 In Tax Loss x 45% $90,000 Prepayment @ 80% $72,000 1st drawdown in October covers July to Sept R&D expenses = $200,000 x 45% x 80% = $72,000 2nd drawdown in January covers Oct to Dec R&D expenses = $ 500,000 x 45% x 80% = $180,000 3rd drawdown in April covers Jan to March R&D expenses = $200,000 x 45% x 80% = $72,000 4th drawdown in July covers April to June R&D expenses = $ 500,000 x 45% x 80% = $180,000 Repaid from lodgement of tax return by following October = $1.4m x 45% = $630,000 which repays the $504,000 principal loan, any applicable interest and the 3 claim preparation fees – any remaining balance is refunded to the R&D company. Longer term – against a partially funded R&D plan and budget, backed by a positive Advanced finding whereby the prepayment loan will be provided at the commencement of a project or financial year (capped to 60% of the R&D capital on hand). Long term – prepayment at the commencement of a financial year, based upon a budgeted R&D plan and positive Advanced finding. • June/July each year – A R&D company’s R&D plan/budget requires $512,000 to fund its current year R&D activities. • The R&D company has $320,000 in existing funds allocated to its R&D Plan, but requires an additional 60% ($192,000) to complete the project. • TCF provides $192,000 which allows the R&D company to claim back $512.000 x 45% = $230,400 • The $230,400 R&D tax benefit is claimed and refunded by the ATO in the following year which repays the principal loan, any applicable interest and the claim preparation fees – any remaining balance is then refunded back to the R&D company Fee Structure: Establishment fee 5% of initial prepayment amount (capped at $10,000) Annual service fee $1,000 - $2,500 – to cover ongoing due diligence work Interest Rate 1.25% - 1.5% per month – dependent on the size of loan www.tcf.net.au FUNDING CRITERIA: • Eligible R&D activities OR positive Advanced Finding • No bank facilities • No ATO debt • Good record keeping practices allowing for up-to-date accounting reports being readily available • Professional management team in place - with no prior history of insolvency, bankruptcy or criminal record • TCF Services engaged to undertake all R&D Tax Incentive claim preparation, lodgement and compliance work FUNDING PAYMENT AND REPAYMENT: Once all due diligence requirements are met and the R&D Tax Prepayment loan agreement is executed, a first payment can be processed within 48 hours. Further drawdowns may take place as agreed against milestones and budgets being met. Ongoing due diligence is required to confirm that the company is trading within the requirements of the loan agreement. The principal loan amount, establishment fees, annual service fees, applicable interest and any fees for claim preparation and lodgement services are all netted-off the resultant ATO refund payment, which is irrevocably directed into TCF’s nominated Trust clearing account. Any remaining balance is then refunded to the client. CLIENT APPLICATION CHECK LIST: • Signed Confidentiality & Service Agreement and Letter of Engagement (to perform claim preparation and lodgement work) • Signed and completed Prepayment Application form • Directors Statement of Financial Position • Monthly Management Accounts/Previous Year Tax return and Statutory Accounts • Aged Debtors & Creditors report • ATO Reports o Income Tax Statement – Statement of Account o Integrated Client Account – Activity Statement List (BAS report) o Integrated Client Account – Itemised Account o Client Account List • R&D Tax Prepayment Loan Agreement • TCF trust clearing Bank Account (established to sweep funds required) - to be entered as the recipient of the ATO refund payment. SECURITY REQUIRED: • PPSR Registration • Director(s) Personal Guarantee(s) – may be required TCF Services Pty Ltd • Irrevocable direction to external accountant, to insert Phone +61 2 8219 4900 Fax +61 2 8219 4999 TCF’s Trust Bank clearing account into clients tax return. Gerry Frittmann: David Tonkin: gerry@tcf.net.au david@tcf.net.au www.tcf.net.au www.tcf.net.au