Assessing Interest-Rate Risk from the Rate's Constituent

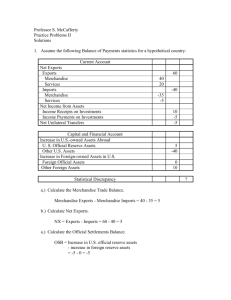

advertisement

Assessing Interest-Rate Risk from the Rate’s Constituent Components by Frank Browne and Mary Everett1 ABSTRACT Any increase in interest rates will have implications for the Irish economy, and more specifically for the stability and soundness of the Irish financial system. The overall impact of an interest-rate rise will depend on the factors behind the increase. This paper examines some of the likely causes and consequences of an interest-rate hike. In order to understand how the nominal interest rate might evolve over the short and medium term, we decompose the nominal interest rate into its constituent components, the most important of these being the equilibrium real rate of interest. Analysis of various models of the equilibrium real rate of interest for the euro area shows that in the short-run, there does not appear to be a likelihood of a substantial increase in the nominal interest rate stemming from a significant shift in the underlying equilibrium real rate of interest, or from the other components of the nominal interest rate. Over the medium-term horizon (chronologically approximately three to seven years), however it is likely that the euro area economy will revive and will see a much higher equilibrium real rate of interest. A steady state growth rate of 3 per cent, combined with an inflation rate of about 2 per cent (consistent with the ECB’s inflation objective) and a risk premium of 1 per cent would add up to an equilibrium mortgage rate of approximately 6 per cent. With the typical variable mortgage rate of interest being around 3 per cent now (October 2005), an increase in interest rates to this putative equilibrium level would double the repayments burden. For highly indebted borrowers, this would be an intolerable burden and would almost certainly mean a sharp increase in the ratio of non-performing loans. 1. Introduction This paper looks at the issue of interest-rate risk now facing the Irish economy and how its realisation might impact on financial stability in Ireland. It starts from the proposition that all increases in the headline nominal rate are not the same in their impact on financial stability. The effect depends on the factors behind the increase. At the moment, short-term rates in the euro area are at an all-time low as is the whole term structure of nominal interest rates. It would appear, therefore, that the risk is all on the upside. The issue, therefore, is not whether interest rates will rise but rather by how much. The aim of the article is to examine the range of possible causes for a hike in interest rates. The variety of driving forces for an increase in rates have to be scrutinised because the effect on the economy and financial stability, via its effects on households, non-financial firms and banks, depends on which driving force(s) are behind the increase in rates. Our treatment of interest-rate risk in our previous Financial Stability Reports was partial and did not examine some of the likely causes and implications of an interest-rate rise. The central message of this background paper is that the implications of an interest-rate rise for the Irish economy generally, but more specifically for the stability and soundness of the Irish financial system, depends on the reason for the rise. 2. Disentangling the Components of the Nominal Interest Rate In last year’s Financial Stability Report, the Irish equilibrium nominal mortgage rate of interest was put at approximately 6 per cent2. The equilibrium interest rate, which is defined in Box 1 and elaborated on within Section 3, is the rate to which the economy tends to in the medium to long run. It was concluded that an increase in the standard variable mortgage rate to this level would be a cause for concern for financial stability given the very large proportion of mortgage borrowers who are partaking in variable-rate contracts. However, such an increase in the rate was not in itself considered to be systemically threatening. Nevertheless, it was concluded that it might be a realistic threat if accompanied by what was deemed to be the other major potential shock to the economy in the form of a substantial increase in the rate of unemployment. The financial stability implications arising from an increase in the mortgage rate must be qualified further. First, it has to be acknowledged that, for the most part, 1 The authors are respectively, Head of Monetary Policy & Financial Stability and an economist in the Statistics Department. The views expressed in this article are the personal responsibility of the authors and are not necessarily those held by the CBFSAI or the ESCB. The authors would like to thank Anne-Marie McKiernan for helpful comments. 2 An estimate of 6 per cent for the Irish equilibrium mortgage rate is comprised of an ECB estimated equilibrium real rate of 3 per cent , an inflation target of 2 per cent, plus a 1 per cent risk premium (i.e., an estimate of banks’ margin). For further detail see Box 6, Financial Stability Report 2004, September, CBFSAI. Financial Stability Report 2005 123 Box 1: Definitions of Equilibrium, Nominal and Real Interest Rates Equilibrium Interest Rate This rate is variously known as the natural rate or the neutral rate or the Wicksellian rate after Wicksell (1936)1, who first identified it as an important economic concept. Wicksell described the natural rate as ‘a certain rate of interest on loans which is neutral in respect to commodity prices and tends neither to raise nor to lower them’. It is defined as the rate that would be obtained when all prices are fully flexible. It is the rate that would prevail in general equilibrium and according, in Wicksellian terminology, the rate that equates the ex-ante supply of savings (by households) with the ex-ante demand for investment (by firms). Nominal Interest Rate The short-term nominal interest rate is the de facto instrument of monetary policy. It is the cost of using money over a period of time, which does not take the effects of inflation into consideration. Real Interest Rate The real interest rate is the nominal interest rate adjusted for inflation effects. It is the difference between the nominal interest rate and the inflation rate. —————— 1 Wicksell, K., (1936), ‘‘Interest and Prices’’ (translation of the 1898 edition by R.F. Kahn), London: Macmillian. if the mortgage rate does rise significantly in the coming years, it will most likely do so on account of factors which are predominantly exogenous to the Irish economy. Secondly, and the main point we want to make in this background paper, is that the effects on the Irish economy, but more especially on the Irish mortgage and housing markets, depends on which of these reasons might be driving any increase in the mortgage rate. The danger posed for financial stability in Ireland depends on how any such exogenously driven increase in interest rates would also be likely to precipitate a simultaneous and substantial increase in Irish unemployment. This is really the type of double effect to which the Irish economy is currently vulnerable because of the combination of the rapid rate of increase of household indebtedness over the past decade and the very high proportion of adjustable-rate mortgages in the total outstanding stock of mortgages. The likelihood that an increase in the interest rate would also precipitate an increase in unemployment depends on the reason for the increase in the interest rate. If, for example, an increase in the exogenouslydetermined headline nominal mortgage rate were to occur because of upward pressure on the equilibrium real interest rate, i.e., the natural or real equilibrium rate, which is a component of the headline nominal rate, then the consequences for the stability of the financial system would be different in significant ways than it would be in the case of an increase arising from, say, an increase in expected inflation. This is because, in the former case, the increase in the equilibrium rate would be likely to have its origin in an increase in the trend growth rate of the euro area economy. While this would, of course, 124 Financial Stability Report 2005 drive up nominal interest rates in general and consequently the nominal mortgage rate in Ireland, which could possibly lead to an increase in loan arrears and defaults, the improved performance of the euro area economy would undoubtedly also be good for the overall performance of the Irish economy. The increase in the mortgage rate, due to the rise in the equilibrium real interest rate, would, therefore, be unlikely to be accompanied by a simultaneous increase in the unemployment rate. Indeed, given the weight of the euro area in Irish exports, it is not inconceivable that unemployment might even fall on balance. Although the burden of servicing mortgages for Irish households would of course increase and could be accompanied by an increase in loan arrears and defaults, this would by itself be very unlikely to pose any systemic threat to the financial system in a situation in which there is no simultaneous deterioration in overall economic performance or in unemployment. However, in the latter instance of an inflation scare, the increase in nominal rates would be unequivocally deleterious to the economy and to its financial stability. It would drive up nominal interest rates without this being accompanied by any benign countervailing force coming from an enduring improvement in the overall performance in the euro area economy, in the form of an increase in the potential growth rate. Instead, the overall performance of the euro area economy would almost certainly deteriorate. Maintaining the ECB’s price stability objective would require a tightening of monetary policy, putting further upward pressure on both real and nominal interest rates, and slowing the euro area economy in the process. Chart 1 illustrates in a simplified format the potential consequences of an increase in the nominal interest rate in these two cases. Diagram 1: Causes and Consequences of a Mortgage Interest Rate Change Mortgage loan debt servicing Loan arrears Loan defaults On balance, little threat to financial stability in Ireland Nominal interest rate Equilibrium rate component of the nominal rate arising from an increase in potential growth of the euro area economy Mortgage loan debt servicing Improved performance of the Irish economy Loan arrears No adverse implications for Irish unemployment Loan defaults Combination could be a threat to financial stability in Ireland Nominal interest rate Inflation expectations component of nominal interest rate in the euro area Tightening of monetary conditions via the bond market or monetary policy resulting in a deterioration of the euro area economy Adverse implications for Irish unemployment Financial Stability Report 2005 125 These considerations suggest that an increase in the headline nominal rate of interest should not necessarily be seen as a negative for the economy because it may be driven by an increase in the natural rate which is itself, in turn, driven by an acceleration in the underlying growth rate of the euro area economy. Nor can a fall in the nominal rate necessarily be seen as a positive for the economy since it might merely be symptomatic of deterioration in the long-run potential of the euro area economy to produce goods and services. It is clear, therefore, that it is important to know the factors driving the nominal rate so as to be able to make an assessment of the likely implications for financial stability. Since the late 1960s or early 1970s, until the mid 1980s, Chart 1 reveals that the bulk of the variation in the nominal rate of interest was attributable to factors of the less benign type such as inflation premia and inflation risk premia for most of the industrialised countries. The variation in the natural rate tended to be overwhelmed by the explosion of nominal values driven by inflation (see Chart 1). Chart 1: Nominal Rates of Interest for a Sample of Industrialised Countries per cent US Australia UK Japan 25 Canada Euro area 20 15 10 5 0 1960 Q1 64 68 72 76 80 84 88 92 96 00 05 Q2 The low inflation environment prevailing in industrialised economies since the early 1990s should mean that variation in the equilibrium or natural rate should now play a proportionately larger role in variation in the nominal rate. This effect should also be reinforced by the improved allocation of resources promoted by price stability which should, other things being equal, have helped to improve the potential growth rates of these 126 Financial Stability Report 2005 economies. In order to clarify the issues involved, the headline nominal interest rate, therefore, has to be decomposed into its theoretical sub-components. We do not know what the reaction of an economy will be to a change in the headline rate unless we know to which of these components, or subset of these components, the change is due. These sub-components are not directly observed and, therefore, have to be estimated. The deconstruction into separate components depends on the model used to explain movements in the headline rate of interest. This type of decomposition for the euro area allows us to look at the separate influences of cyclical factors and longer-term structural factors bearing on the nominal rate of interest. This more detailed analysis allows us, in turn, to make a more thorough assessment of the likelihood of an interest-rate increase and to infer whether such an increase will be more or less deleterious for the stability of the financial system in Ireland. In order to effect this decomposition of the nominal rate of interest we look at a number of different models of the equilibrium real rate of interest in this background paper. 3. Micro Foundations of the Equilibrium Real Rate of Interest A key sub-component of the nominal rate of interest is the real equilibrium interest rate, as defined in Box 1. In a world devoid of risk or uncertainty, any change in the nominal rate of interest has to come from one of two sources, i.e., a change in the real rate of interest or a change in expected inflation. If the rate of return on a debt security is known with certainty over the time horizon to the maturity of the security then this nominal rate of return can be written as the sum of the real rate of return and the inflation rate that is expected to prevail over this period. Since bond holders can only be persuaded to hold the bond if the nominal rate of return compensates for the loss of purchasing power, nominal bond yields are often used as indicators of future inflation. The ex-ante real interest rate is the difference between the nominal interest rate and the expected inflation rate. The expected inflation rate is not observed but it can be estimated and also allows for the estimation of ex-ante real rate. When there is no inflation and output is growing at its potential rate in the steady state then this ex-ante real interest rate becomes the natural or equilibrium real rate of interest. This natural interest rate can best be understood at a micro level by being placed in the context of the behaviour of the individual representative consumer and producer. Figure 1: The Production Opportunity Set C1 consumption tomorrow. It is the marginal rate of transformation (MRT) available with the existing production infrastructure. At the point of equilibrium in the figure (A), the MRS is equal to the MRT. This is a Robinson Crusoe economy without capital markets and therefore lacking a capability of transferring consumption across time [implying that consumption (C) and income (Y) have to be the same in both periods, i.e., Y0 = C0 and Y1 = C1]. A Y 1 =C 1 C0 Y 0 =C 0 In steady state equilibrium, the rate at which consumers substitute consumption over time at the margin (the socalled marginal rate of intertemporal substitution, MRS), should be equal to the rate at which resources not consumed today are transformed into future output at the margin (known as the rate of technical transformation in production, MRT). And both of these should equal the equilibrium or natural real rate of In such a Robinson Crusoe economy with only one individual there is opportunity to exchange consumption between individuals across time. Figure 2 shows that two individuals (as consumers cum investors) can both enjoy higher levels of utility by being able to move along the capital market line (i.e., w1ABw0 in the figure) than they could in the complete absence of financial markets. For our purposes here, the main thing to note is that the slope of the capital market line is the equilibrium real rate of interest. In equilibrium, this capital market line is tangent to both the production opportunity set of the economy and the indifference curves of all (but, in the diagram, only two) investors. This means that, in equilibrium, the MRS for all investors between current and future consumption, is equal to the equilibrium real rate of interest, which, in turn, is equal to the MRT according to which firms transform current output into (higher) future output. In symbols, we have that: interest. This can be understood better in the context of the accompanying Figure 1. The two axes represent consumption now (C0) and consumption tomorrow MRSi = MRSj = −(1+R*) = MRT (C1).3 The curved convex line represents an indifference curve in the sense that the consumer is indifferent Figure 2: The Investment Decision between the consumption bundles at any point along the curve. The slope of the tangent at any point on the C1 curve indicates the rate at which the consumer is willing to trade off consumption today for consumption tomorrow, i.e., it reveals the consumer’s subjective rate w1 of time preference. The subjective rate of time A preference can be conceived as being the rate of interest Investor 2 a consumer must receive in order to transfer present consumption to the future and maintain total utility. The P1 B concave curve represents productive opportunities that allow any given value of resources to be converted into Investor 1 a higher level of future consumption. The slope of the tangent to the curve indicates the rate at which a euro’s C0 P0 w0 worth of consumption foregone today is transformed by the productive process into more than a euro’s worth of 3 See Copeland, T. and J. Weston, (1988), ‘‘Financial Theory and Corporate Policy’’, Massachusetts: Addison Wesley for a more complete discussion. Financial Stability Report 2005 127 To approximate the equilibrium rate, R*, it is clear from this that we can tackle it either from the side of the producer via the production-based-capital asset pricing model (PCAPM), or from the side of the consumer which we do by employing the consumption-based-capital asset pricing model (CCAPM). The most important breakdown of the components of the headline nominal rate for the purposes of the present exercise is the twoway breakdown between the equilibrium real rate and all the remaining components of the nominal rate. This is because, as mentioned previously, an increase in the nominal mortgage rate in Ireland, which is driven by an increase in the equilibrium real rate in the euro area, would be much less damaging to financial stability in Ireland than would a corresponding increase in the nominal rate coming from any of the latter’s many other components. Indeed, it could be on balance beneficial to overall financial stability in the long run. This is why in the following a lot of attention is devoted to isolating the equilibrium real rate. 4. Empirical Models of the Equilibrium Real Rate of Interest A number of ways have been proposed in the literature for approximating the equilibrium real interest rate. They can usefully be seen as falling into the following categories: ● simple averages of the actual real rate over long periods of time; ● long-dated yields on inflation indexed bonds; ● ‘‘Golden rule of growth’’ model; ● ‘‘Taylor rule’’ methodology; and ● capital asset pricing (CAPM) models, whether consumption-based or production-based. We briefly examine each of these in turn below. However, we give most attention to the method in the last bullet point, which we consider to be the most comprehensive. This is because it permits the headline rate to be decomposed into a number of separate components of which the equilibrium rate is just one. 4.1 Simple Averages of the Actual Real Rate for Periods of Low Inflation This simple method approximates the equilibrium rate by taking averages of the actual real rate (i.e., the difference between the actual nominal rate and the actual inflation rate) over long time periods. This approach relies on the logic that an average over a long enough time period would wash out short-run deviations between the actual real rate and the natural real rate, thereby yielding an estimate of the natural rate. Table 1 reports a number of estimations of the natural rate of interest for various countries using this simple average approach. The variations in the natural rates of interest across the countries and sub-periods listed in the table could be explained by a number of factors. The type of monetary policy regime in operation, the stability of inflation, fiscal conditions and various historical experiences all contribute to explaining the differences in the natural interest rates. In general, it would be expected that the natural rates would vary across nations, as interest rates are country specific and are subject to economic conditions relevant to that country. This is particularly true for the full period for which the calculations are made. However, as financial markets become more liberalised and integrated, the natural rates across countries should converge more. The estimates for the most recent sub-period (1999Q1-2005Q1) from Table 1 are, with the possible exception of that for the UK, implausibly low. Table 1: Simple Averages of the Short-Term Real Interest Rate, 1981Q1-2005Q1 Short-term real interest rate Euro area United States United Kingdom Japan Australia Canada Average inflation 1981Q12005Q1 19811989 19901998 19992005Q1 1981Q12005Q1 19811989 19901998 19992005Q1 3.85 2.21 3.94 2.08 4.15 3.78 4.82 3.86 4.92 3.62 4.94 5.12 4.72 1.78 4.09 1.63 4.84 4.14 1.20 0.44 2.30 0.51 2.02 1.32 3.72 3.53 4.40 1.11 4.81 3.70 5.76 4.67 6.27 1.95 8.22 6.11 2.89 3.10 3.95 1.38 2.61 2.25 1.98 2.51 2.34 −0.48 3.05 2.30 Sources: ECB, US Federal Reserve and IMF International Financial Statistics. Note: Albeit, the breakdown of the simple averages of the short-term real interest rate and inflation into sub-periods undermines the principles of long-run averages, these breakdowns are none-the-less informative. 128 Financial Stability Report 2005 Although a worthwhile approach as a way of conveying the broad benchmark for the natural rate, these averaging methods suffer from the disadvantage that the estimated equilibrium rate is a single number and, therefore, constant over the period for which it is calculated. Although one would expect the equilibrium rate not to be too erratic since it is anchored in the steady state characteristics of the real economy, and, therefore, less variable than the actual real rate, it is nevertheless unlikely to be a constant over time. It is related to a number of factors that are likely to experience some volatility in the short run and to change with the passage of time even if only slowly, arising, for example, from structural change in both the real economy and in financial markets. 4.2 Long-dated Yields on Inflation Indexed Bonds An intuitively appealing approach that does not involve the specification and estimation of a model is to approximate the equilibrium rate using long-dated inflation-index-linked bonds. The rationale for this approach is, first, that the difference between yields on indexed and non-indexed government bonds of identical maturity can be used as a measure of expected inflation and, secondly, that the long-dated yield reflects expectations at long horizons providing, in principle, a closer measure of the steady state. Chart 2: Real Bond Yields in the Euro Area and France Derived from French Inflation-Linked Bonds per cent per annum Chart 2 displays real bond yields in the euro area (since early 2002) and in France (since early 1999)4. The most salient feature of the graph is the downward trend in the estimate of the equilibrium rate from almost 4 per cent in March 2000 to less than 1.5 per cent in March 2004. However, this seems like too big a movement over such a short space of time to be a plausible estimate of an equilibrium rate. There are a number of shortcomings to using this method. The yields on inflation-indexed bonds may suffer from distortions arising from thin markets, tax arrangements and time varying risk premia. A more practical shortcoming is that long time series on indexlinked bonds are not in general available. 4.3 ‘‘Golden Rule of Growth’’ Model The above methods are fairly ad hoc in that they do not invoke any theory to motivate the approach used in the estimation of the equilibrium rate. Given the discussion above on the definition of the equilibrium real interest rate, one would expect the rate to be related to a number of deep parameters in the economy relating to the long-run potential growth rate of the economy, the preference of households for consumption now relative to consumption in the future, and demographic developments. The precise nature of the relationship between these variables and the equilibrium rate is crystallised in the neo-classical growth model (i.e., the Golden rule growth model) as described, for example, by Laubach and Williams (2001) in the following equation: 5 r* = 1 q + + n, 4 where: r* is the equilibrium real rate of interest, 3 q is the rate of technological progress, is the coefficient of relative risk aversion, France Euro area 2 n is the population growth rate, and is the discount rate. 1 0 May-99 00 01 02 03 04 05 Aug Source: French Treasury, Reuters and the ECB Note: French index-linked bond linked to the French CPI is maturing in 2009. The French index-linked bond linked to the euro area HICP is maturing in 2012. Monthly averages. 4 An acceleration in the rate of technological progress (q) increases total factor productivity and the return to investment. The ensuing increased demand for investment funds drives up the equilibrium real rate of interest for a given level of savings. An increase in the population growth rate (n) enhances the labour endowment in the economy and leads to an increase in the potential growth rate whose funding requirements These are derived respectively from French government bonds linked to the French CPI and from French government bonds linked to the euro area HICP. Financial Stability Report 2005 129 drives up the equilibrium real rate of interest for a given supply of loanable funds. An increase in the discount rate (), or a fall in the rate of time preference, would see a proportion of consumption being brought forward from the future to the present. This reduces the level of current savings and drives up the equilibrium rate of interest. The equilibrium real rate also varies inversely with the consumer’s attitude to risk (where denotes the coefficient of relative risk aversion), with an increase (decrease) in the degree of relative risk aversion causing the consumer to save (dissave) more leading to a fall (increase) in the equilibrium rate. Recall again that the equilibrium rate is the rate that would prevail in general equilibrium and accordingly also the rate that equates the ex-ante supply of savings (by households) with the ex-ante demand for investment funding (by firms). An advantage of this approach is that it allows the equilibrium rate to vary over time and can also offer an explanation as to why it changed by relating it back to fundamental driving forces. Employing the Golden rule growth model to calculate the equilibrium real interest rate for the period 1971 to 2003 yields an average equilibrium rate of 2.48 per cent5. Estimations from this model in various sub-decades move around the overall average rate, there was an average rate of 3.16 per cent in the 1970s, 2.45 per cent in the 1980s, 2.34 per cent in the 1990s, and an average rate of 1.56 per cent in the period since the start of EMU until 2003. It is notable that, as with the method outlined in Section 4.2, the estimate of the equilibrium rate that emerges for the last sub-period seems to be on the small side. 4.4 ‘Taylor Rule’ Methodology This approach is based on the belief that monetary authorities’ interest-rate decisions are based on the observed behaviour of the economy, i.e., the behaviour of inflation and the output gap. It proposes that the central bank adjusts the nominal rate of interest according to the following rule: r(t) = r* + ((t) − *) + (x(t) − x*) where r and r* are the actual and equilibrium real rates of interest, and * are the actual rate of inflation and the rate of inflation being targeted by the central bank respectively, x and x* symbolise actual and potential output growth rates, and their difference, the output gap. It is clear from this specification of central bank behaviour that if inflation is equal to its target, and output is growing at potential then the actual real rate of interest 5 is equal to the equilibrium rate. Whenever inflation is in excess of target or the output gap is non-zero, the central bank will maintain the actual real rate above or below the equilibrium rate as appropriate in order to correct these deviations from the central bank’s objectives. Given the central bank’s inflation target (*) and an estimate of the economy’s potential output growth rate (x*) along with the corresponding actual values of these variables ((t) and x(t)), and the actual rate of interest r(t) as well as estimates of and , an estimate of the natural rate r* can be derived from the last equation. Using this approach for the US economy, when (*) is taken to be 2 per cent, Reifschneider and Williams (2000) report a value of about 2.5 per cent for the equilibrium rate of interest. They also state that lower inflation targets yield higher equilibrium real interest rates. They report an equilibrium real rate of 3.5 per cent for an inflation target in the region of 0 per cent to 1 per cent. Estimates of r* for the euro area, synthetic pre-1999 and actual post-1999, from 1985 to 2002, produced by Gerdesmeier and Roffia (2003), place estimates of the natural rate in the region of 2.1 per cent to 3.2 per cent. However, in the shorter sample period starting in 1995, Gerdesmeier and Roffia (2003) estimate lower rates for r* in the region of 2.22 per cent, and 1.78 per cent for the period 1999 to 2002. This suggests that the equilibrium real rate for the euro area may have fallen over time. A fairly persuasive set of rationales has been put forward as to why the equilibrium real rate fell in the group of countries that currently comprise the euro area. Section 4.6 provides a summary of the factors, which may conceivably have contributed to this fall. 4.5 Consumption-Based Capital (CCAPM) Model Approach Financial Stability Report 2005 Pricing Another way of looking at the natural rate of interest is as the rate that would prevail if the economy behaved as in the classical model, i.e., free of nominal frictions and informational asymmetries. In such a world, households would be able to exchange consumption across time as desired (in accordance with the behaviour depicted in Figure 2 above), with the only constraint being the cost (to the borrower) or benefit (to the lender) of doing so, which is the natural rate of interest. The consumption-based capital asset pricing model (CCAPM), which we use here to decompose the headline nominal rate, is founded on this observation. In this approach, therefore, the natural rate is being inferred from the intertemporal portfolio behaviour of the private The values imputed into the ‘‘Golden rule of growth’’ equation for q, n, σ and θ are explained respectively in the Annex. 130 Asset sector of the economy. The CCAPM places intertemporal consumption and saving behaviour in a stochastic setting, and in doing so, provides additional risk-based determinants of the headline nominal rate of interest. to save will, other things being equal, drive down the risk-free real rate of interest and hence the headline nominal rate also. Uncertainty about future consumption is measured by the variance of the one period ahead forecast for consumption. The theoretical components of the nominal interest rate are dictated by the elements that enter into the theoretical CCAPM pricing model. If the data suggest that the model is a good representation of household consumption and saving behaviour then the relative magnitudes of the various components of the nominal interest rate, and how they have changed over time, can be inferred from the estimated model. The theoretical model is the following: The fourth component listed (E(Δp)) is expected inflation. This is the standard variable used to test for the validity of the Fisher hypothesis as to whether nominal interest rates contain a full inflation premium. However, what bondholders are concerned about is the expected change in the purchasing power of money (i.e., E(Pt/Pt+1)) over the holding period of the bond and not the expected inflation rate over this period (i.e., E(Pt+1/Pt))6. In a world of uncertainty, according to Jensen’s inequality, the expected value of one is not the inverse of the expected value of the other. According to Jensen’s inequality, a mean-preserving spread in the inflation rate (Var(Δp)) results in an increase in the expected purchasing power of money. Other things being equal, this results in an increase in the demand for bonds driving up bond prices and depressing bond yields. The relationship between the expected inflation and expected future purchasing power in a world of uncertainty can be written as follows: i = + E(Δc) − (1/2)Var(Δc) + E(Δp) − (1/2)Var(Δp) − Cov(Δc,Δp) (i) The first component of the headline nominal rate of interest (i) is the discount rate (). It reflects the fact that the more heavily individuals discount the future (i.e., the higher is the discount rate), the greater is current consumption and the lower is current savings. This reduces the supply of loanable funds and, other things being equal, drives up the real, and accordingly the nominal, rate of interest. The second component is expected aggregate real consumption ((E(Δc)). For a given discount rate, the higher the expected growth rate of consumption, the higher is future consumption relative to current consumption and the higher the interest rate has to be to prevent people transferring future consumption to the present, where consumption goods are in fixed supply. There is a natural corollary of this — when there is an incipient excess supply of current consumption goods, the higher current consumption needs to be relative to future consumption to encourage people to consume more now and less in the future and, therefore, the lower the interest rate needs to be. Expected consumption is captured by the one-period (one period is equal to a quarter) ahead forecast of consumption. The third component captures uncertainty about future consumption (Var(Δc)). The more uncertain risk-averse individuals are about future consumption the more they will want to save now to insure themselves against the realisation of this uncertainty. Their increased preference 6 7 E(Pt/Pt+1) = exp[−Et(ΔPt+1) + 1/2Vart(ΔPt+1)] (ii) The first term on the right hand side reflects the fact that bondholding households7 expect to be compensated for any inflation, which they expect to occur over the holding period of the bond. If the current yield does not reward them for the inflation they expect to occur over the holding period of the bond, then they will sell off their bond holdings. This will have the effect of driving down the price of bonds and boosting the yield. Therefore, either an increase in expected inflation or a fall in the variance of future prices implies a decline in expected future purchasing power. This spills over into a reduction in demand for bonds, which inflates bond yields, which accounts for the positive and negative signs on these respective variables in equation (ii) above8. The final component (Cov(Δc,Δp)) is less familiar. It is another risk term, called the covariance risk. It captures the risk to portfolios arising from the correlation between the business cycle and interest rates. It is assumed that households would prefer to hold assets that would enable them to smooth consumption over time. They This is a key distinction made by Evans and Wachtel (1992) whose model provides the core theoretical framework for this paper. The introduction of collective investment schemes, in particular money market, bond and equity mutual funds, enabled retail investors to gain effective access to the securities’ markets. Financial Stability Report 2005 131 would accordingly want to hold assets that would yield a high return when income (and, therefore, consumption) is subject to cyclical downturn. This implies that they would want to hold assets that would co-vary negatively with consumption, i.e., Cov(Δc,Δr) < 0. Since the expected real rate varies negatively with the price level, households would want to hold assets such that Cov(Δc,Δp) > 0. If, in fact, the asset is such that the first of these covariances is positive and the second negative, then households would expect to be compensated for this and, to be persuaded to hold the asset, would have to be rewarded with a risk premium (i.e., a covariance risk premium). This would then be build into the observed nominal rate of interest. Detailed empirical results for the euro area are reported in Browne and Everett (2004). If financial markets are relatively liquid, following a loosening of the stance of monetary policy, then the nominal rate of interest will be low relative to its fundamental determinants as represented by the CCAPM. The model must, therefore, be adjusted to capture this well-known Keynesian liquidity effect of monetary policy. The background to this adjustment follows the work of Fuerst (1992) and is explained in more detail in Browne and Everett (2003). This model suggests that it is expected money growth that impacts on the nominal interest rate. However, it could be argued that changes in money, whether anticipated or not, will, by relaxing the liquidity constraints noted already, have a dampening effect on the nominal and, other things being equal, the real interest rate. The sign of the effect is unambiguously negative. Chart 3 depicts our estimate of the equilibrium rate of interest along with the actual real rate for the euro area. Chart 3: Actual and Equilibrium Real Interest Rates for the Euro Area per cent Equilibrium real rate of interest 8 7 Actual real rate of interest 6 5 4 3 2 1 0 1982 Q2 85 90 95 00 05 Q1 Note: Data are moving averages (window = 6 quarters). As can be seen from Table 2, evaluations of the equilibrium real rate of interest vary across the different methods of estimation. Variations in the estimations may be the result of a number of factors. Most obviously, the models employed are comprised of different components, and the periods of estimation also differ. 4.6 Factors Contributing to the Trend Decline in the Equilibrium Rate All the time-varying estimated equilibrium rates for the euro area seem to display a common feature: a downward trend. Chart 4a shows our estimate of the equilibrium rate for the euro area from the early 1980s Table 2: Summary of Equilibrium Real Interest Rate Estimates for the Euro Area Model Rate - % Period of estimation 4.1 Simple averages of the actual rate 3.85 1981-2005 4.2 Long dated yields on inflation indexed bonds 4 1.5 March 2000 March 2004 4.3 Golden rule of growth model 2.48 1971-2003 4.4 Taylor rule 2.1-3.2 2.22 1.78 1985-2002 1995-2002 1999-2002 4.5 CCAPM CCAPM including liquidity constraints 2.17 2.51 1981Q1-2005Q1 1981Q1-2005Q1 8 There have been other interpretations of the Var(ΔPt+1) term. Friedman for example argued that inflation uncertainty erodes the efficiency of the market mechanism in allocating resources decreasing real output and shifting the aggregates supply curve to the left necessitating an increase in the real interest rate. This would suggest a positive sign on this variable. Others have argued that uncertainty about inflation reduces demand for investment and puts downward pressure on the real interest rate. 132 Financial Stability Report 2005 to the first quarter of 2005. The rate fell from a peak of about 4 per cent in 1988 to about 2 per cent in 2004. A leading candidate to account for this trend decline is productivity. Chart 4a: Equilibrium Real Interest Rate for the Euro Area per cent 5 Total factor productivity growth, displayed in Chart 4b, demonstrates a fairly strong declining trend since the late 1980s. Changes in expected total factor productivity growth tend to affect the equilibrium rate via households’ current and future consumption and saving preferences. If a dampening of expectations in total factor productivity growth occurs, households’ expectations of their future income will decline and, therefore, they will choose to save more in the current period. The equilibrium rate of interest must decrease in order to encourage households to save less today and to stimulate current consumption. Demographic developments can also have an effect on savings patterns. As Chart 4c demonstrates, the overall trend of total population growth is downward9. This downward trend in population growth feeds into the equilibrium interest-rate calculations, which can be seen most directly via the ‘‘Golden rule of growth’’ model, discussed in Section 4.3. The declining working-age population and the corresponding drop in the available workforce, means that less capital will be required to equip workers. Therefore, a fall in the equilibrium rate of interest will be necessary to encourage investment in capital. This implies that reduced population growth since the 1960s may have contributed to the fall in the equilibrium interest rate during this time. Other structural changes and fundamental components of the economy may also have been instrumental in the decline of the equilibrium rate. The introduction of the euro in January 1999, has led to the elimination of intra euro area exchange-rate risk premia leading to a permanent fall in the real cost of borrowing. Current inflation rates in the euro area are more predictable than those in previous decades due to the ECB’s increasingly credible commitment to price stability10. This has resulted in a reduction of inflation risk premia in the euro area. The constraints of the requirements imposed on euro area Member States by the Maastricht Treaty has created lower national government deficits, which, in turn, has led to increased investor confidence and reduced national inflationary pressures. All of these factors were likely to have been influential in the trend decline of the equilibrium real interest rate over the last number of years. 4 3 2 1 0 1982 85 88 91 94 97 00 03 05 Q1 Note: Data are moving averages (window = 6 quarters). Chart 4b: Trend Total-factor Productivity Growth per cent per annum (based on quarterly data) 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 1981 84 87 90 93 96 99 02 03 9 The slight upward trend in the total population growth rate since 1999 is due to euro area immigration however, the euro area’s natural population growth rate continues to decline. 10 Price stability is defined as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2 per cent. Financial Stability Report 2005 133 ongoing downward trend in the volatility of consumption growth over at least the last 25 years11. So this also seems highly unlikely. Chart 4c: Rate of Increase of the Total Population (Crude Rate) per cent 1.2 Chart 5: Volatility of Consumption Growth 1.0 per cent 2.0 1.8 0.8 1.6 0.6 1.4 1.2 0.4 1.0 0.8 0.2 0.6 0.0 1960 65 70 75 80 85 90 95 00 0.4 03 0.2 0.0 5. Assessment of the likely Sources of Upward Pressure on the Nominal (Mortgage) Rate of Interest Any increase in the headline nominal mortgage rate of interest will put some pressure on heavily indebted households. But some increases may be less threatening to their financial health than others. A situation in which an increase in the headline nominal rate of interest is driven by an increase in the equilibrium real rate is probably the least unfavourable development for the vulnerable household sector in Ireland. An examination of some of the models of the equilibrium rate discussed above, and the factors they suggest are behind movements in the equilibrium rate, may help to infer what are the chances of a sharp increase in the nominal mortgage rate arising from a similarly sharp increase in the equilibrium rate. In this respect, the decomposition suggested by the consumption-based capital asset pricing model, i.e., the model discussed in Section 4.5, is probably the most instructive. Assuming that the rate at which agents discount the future does not change, a sharp increase in the equilibrium rate would only occur if there was an expectation that consumption would increase substantially or if the variance of consumption growth were to rise significantly. Mainstream forecasts do not envisage any such acceleration in consumption growth. For the variance of consumption growth to suddenly start increasing would mean the reversal of an 11 1982 Q2 85 88 Financial Stability Report 2005 94 97 00 03 05 Q2 Looked at from the production side of the economy, the strong correlation between the equilibrium real interest rate (as estimated from the CCAPM model) and trend total factor productivity growth (see Chart 4b) would suggest that the equilibrium rate would only rebound if the downward trend in total factor productivity growth since about the early 1990s were to be reversed which seems unlikely at least over the near-term horizon of the next few years. If anything, recent discussion on the low potential output growth rate for the euro area tended to be focused on a downward revision of the growth potential. The positive correlation between population growth and the equilibrium rate is more obvious over longer periods than that shown in Charts 4a and 4c, where, over this shorter time period, there is no notable relationship. So it would look as if the least unfavourable event, an increase in the equilibrium real interest rate, has quite a low probability of happening over the next few years. Of course, the lower the equilibrium rate the less upside potential there is to any particular value for the headline nominal rate of interest. One of the reasons why the current structure of nominal interest rates is so low in the euro area by historical comparisons is because the A steeper downward trend has existed in the volatility of consumption growth since the mid-1990s. 134 91 equilibrium rate has been subject to a downward trend noted since at least the early 1980s. So what about a sharp increase in the nominal mortgage rate arising from much more unfavourable events stemming from developments that would affect the ‘‘nominal’’ component (i.e., an expected loss of purchasing power by bondholders) and/or the risk component (i.e., consumption covariance risk) of the nominal rate? With respect to the former, there is nothing to doubt the ECB’s determination to keep inflation at its target of close to, but below, 2 per cent. For more recent time periods, consumption covariance risk does not feature as a significant phenomenon. There was a drop in the estimated covariance in 2002Q1, after which it remained at this low level close to zero. This may be largely attributable to an increasing capability of households to smooth consumption across time. Any increase in this covariance from this low level is highly improbable since the developments most likely responsible for consumption smoothing (i.e., financial market deregulation and financial innovation) are most unlikely to experience any reversal of the recent trend towards more liberalisation. Therefore, the upside risk to the nominal mortgage rate from either of these two factors seems fairly small from the current perspective. Despite this, a short-term burst of inflation stemming, say, from strong cost-push factors such as oil prices could become embedded via second round effects unless countered by the central bank. Such an inflation scare could lead to substantially higher interest rates, which would no doubt spill over into mortgage rates in Ireland, the bulk of which are variable rates. This would pose problems for mortgage holders particularly those who are already highly geared. A sudden bunching of nonperforming loans could, in turn, erode the quality of mortgage lenders’ loan books. Over the medium-term horizon (chronologically approximately three to seven years), it is likely that the euro area economy will revive and will see a much higher equilibrium real rate of interest. As noted already in footnote 1 above, a steady state growth rate of 3 per cent, combined with an inflation rate of about 2 per cent (consistent with the ECB’s inflation objective) and a risk premium of 1 per cent would add up to an equilibrium mortgage rate of approximately 6 per cent. With the typical variable mortgage rate of interest being around 3 per cent now (October 2005), an increase in interest rates to this putative equilibrium level would double the repayments burden. For highly indebted borrowers, this would be an intolerable burden and would almost certainly mean a sharp increase in the ratio of nonperforming loans. There is, however, a silver lining in this medium-term scenario. This arises from the fact that the event most likely to drive the mortgage rate to this level is a corresponding increase in the equilibrium rate, which would only happen if the potential growth rate (and the consumption growth rate) in the euro area economy were to accelerate from the current low rate in the region of 1.5 per cent to 3 per cent, provided peoples’ time preferences do not shift and provided there is no increase in the volatility of overall growth (or consumption growth) which seems reasonable. Such acceleration in the growth rate of Ireland’s main trading region would undoubtedly be beneficial to the conjunctural performance of the economy. It would probably mean that any depressing effect on the economy coming from the housing and bank loan markets would tend to be offset by an improved international trade position. The less favourable events impacting on the actual mortgage rate (i.e., the probability that any increase in the headline nominal mortgage rate being driven by events that are unfavourable to the overall euro area economy, namely, an increase in expected inflation or an increase in consumption covariance risk) are deemed to be less long lasting in their effects than those affecting the equilibrium rate. Not only is the first of these unfavourable, it would almost certainly evoke a tightening of monetary policy which would, in turn, almost certainly slow the euro area economy with adverse implications for the Irish economy and financial stability in Ireland. 6. Conclusions The overall impact of any interest-rate increase on the financial stability of the Irish banking system is likely to depend on the reasons why the rate increased. There are a number of important long-term developments currently influencing the euro area economy, which are probably now having a determining effect on the level of nominal and real interest rates. Decomposing the headline nominal interest rate into its constituent components (where the number and nature of these components depend on the model of the interest rate used) can be helpful in endeavouring to understand how the nominal interest rate might evolve over the near- and mediumterm future. Financial Stability Report 2005 135 None of the components in the two more comprehensive models examined12 would suggest that there is currently much danger of a substantial increase in the nominal interest rate stemming from a significant shift in the underlying equilibrium real rate of interest. The likelihood of either a turnaround in the recent trend in total factor productivity, or population growth (the Golden rule of growth model), or a burst on household consumption expenditure or a reversal of the downward trend in the variance of consumption growth (the consumption-based capital asset pricing model) seem remote, especially given the prospects for the euro area conjuncture. Inflation also seems set to remain in the region of the ECB’s target, while upward pressure on the nominal rate coming from risk factors seems low, the scope for nominal interest rates to rise substantially seems limited. There are a number of longer-term institutional and structural factors moulding this picture for the nominal interest rate. First, there appears to be little dispute about the fact that structural rigidities are constraining total factor productivity in the euro area. Although there has been some structural reform, it is moving at a very slow pace. It is unlikely then to have the effect of relaxing the binding constraint on productivity growth in the short to medium term. Sluggish consumption growth is also tied up with the poor performance of the euro area economy reinforced by an aging population and probably also precautionary saving arising from the reforms that have been announced. The low volatility of consumption growth following a long trend decline over the last 30 years or so is probably attributable to financial market reforms and financial innovation and is, therefore, almost certainly here to stay. Another important institutional reform has come in the shape of an independent central bank (the ECB) mandated to achieve price stability in the euro area, a task in which it has so far largely succeeded, a performance set to persist into the future. There are, therefore, many factors, which would suggest that the current low interest rate regime could endure for some time. An event, which could upset this scene in the near term, is a sudden burst in inflation probably driven by some combination of a supply shock and cost push such as a (further) substantial oil price hike. To prevent this from becoming embedded in overall inflation and in inflation expectations, the ECB might have to raise interest rates quite sharply. 12 These are the ‘‘Golden rule of growth’’ and the capital asset pricing models. 136 Financial Stability Report 2005 Focusing on the longer-term horizon a quite different picture could emerge. The structural reforms that are currently being undertaken could be intensified. The new technologies that have raised productivity growth permanently in the US may come to be embraced more enthusiastically by European firms resulting in a similar increase in overall potential growth rate for the euro area. If this were to happen, then the equilibrium interest rate and the nominal mortgage rate would also increase towards the 6 per cent benchmark rate we have identified or maybe even higher. The danger posed for financial stability in Ireland by an increase in the nominal rate of this size would depend on whether any such increase would also be accompanied by a simultaneous and substantial increase in Irish unemployment. This is really the type of double effect to which the Irish economy is currently vulnerable because of the combination of the rapid rate of increase of household indebtedness over the past decade and the very high proportion of adjustable rate mortgages in the total outstanding stock of mortgages. The likelihood that an increase in the interest rate would also precipitate an increase in unemployment depends on the reason for the increase in the interest rate. Unfavourable increases in the nominal mortgage rate are more likely in the short to medium term (arising from an inflation scare for example). However, given the credibility of the ECB’s commitment to price stability, any such increase would hardly be long lasting. The less unfavourable type of increase (coming from an increase in the equilibrium rate) is more likely to be something that would happen over a longer time frame (probably 3 to 7 years from now). Although it would probably see nominal variable-rate mortgages double in size, it would be accompanied by an improvement in the potential growth rate of the euro area economy which would benefit the Irish economy. Any damage done to the systemic health of the Irish financial system would tend to be contained by the fact that unemployment would be unlikely to rise at the same time as the increase in interest rates. References Browne, F. and M. Everett, (2003), ‘‘The Real Interest Rate Spread as a Monetary Policy Indicator’’, Monetary Policy Discussion Paper, No. 3., Monetary Policy and Financial Stability Department, CBFSAI. Browne, F. and M. Everett, (2004), ‘‘The Real Interest Rate Spread for the Euro Area’’, mimeo. Central Bank & Financial Services Authority of Ireland, (2004), ‘‘Financial Stability Report’’, Central Bank & Financial Services Authority of Ireland. Copeland, T. and J. Weston, (1988), Financial Theory and Corporate Policy, Massachusetts: Addison Wesley. European Central Bank, (2004), Monthly Bulletin, European Central Bank, May. Evans, M. and P. Wachtel, (1992), ‘‘Interpreting the Movements in Short-Term Interest Rates’’, Journal of Business, Vol. 65, No. 3. Fagan, G., J. Henry and R. Mestre, (2001), ‘‘An AreaWide Model (AWM) for the Euro Area’’, ECB Working Paper, No. 42, ECB. Fuerst, T.S., (1992), ‘‘Liquidity, Loanable Funds and Real Activity’’, Journal of Monetary Economics, Vol. 29, pp3-24 Gerdesmeir, D. and B. Roffia, (2003), ‘‘Empirical Estimates of Reaction Functions for the Euro Area’’, ECB Working Paper, No. 206, ECB. Laubach, T. and J. Williams, (2001), ‘‘Measuring the Natural Rate of Interest’’, Finance and Economics Discussion Series 2001-56, Board of Governors of the Federal Reserve System (U.S.) Lucas, R. E., (1990), ‘‘Liquidity and Interest Rates’’, Journal of Economic Theory, Vol. 50, pp237-264. Reifschneider, D. and J. Williams, (2000), ‘‘Three Lessons for Monetary Policy in a Low-Inflation Era’’, Journal of Money, Credit and Banking, Vol. 32, No. 4. Wicksell, K., (1936), ‘‘Interest and Prices’’ (translation of the 1898 edition by R.F. Kahn), London: Macmillian. Annex: Data Sources and Methods Data used to calculate simple averages of the actual real interest rate are sourced from the ECB, US Federal Reserve and the IFS, August 2004. The long-dated yields 13 on inflation-indexed bonds in the euro area and France are extracted from the ECB’s Monthly Bulletin, May 2004. Trend total factor productivity growth is used as a proxy for the rate of technological progress, a component of the neo-classical growth model, and is sourced from the Area Wide Model13 database. The population growth rate is sourced from Eurostat’s New Cronos database. The coefficient associated with expected consumption calculated via the CCAPM approach, is used as a measure of the constant relative risk aversion coefficient. The rate of time preference is assumed to be the inverse of the discount rate variable in the CCAPM framework, outlined in Section 4.5. Estimates of the equilibrium real rate of interest calculated via the Taylor rule are sourced from Reifschneider and Williams (2000), and Gerdesmeier and Roffia (2003). The performance of the CCAPM approach is assessed using quarterly data for the period 1980 to 2004. All data are sourced from the Area Wide Model database, ECB monthly bulletins and the IFS. ECB data post-1999 is linked with AWM data prior to this date, in order to ensure consistency across all data sequences. A similar method is employed (by the ECB) for the re-scaling of the AWM database to ECB monthly bulletin data. The chosen measure of the nominal interest rate is the short-term interest rate and the three-month money market rate sourced from the AWM and ECB, respectively. The consumption data are the AWM databases’ and ECB’s nominal private sector consumption data deflated to constant prices. The measure of inflation is derived from the Harmonised Index of Consumer Prices (HICP) based in the year, 1996. The data series for real money stock, i.e., the liquidity variable, is compiled from German total reserves minus gold, sourced from the IFS, August 2004 and the ECB. Fagan. G, Henry. J and Mestre. R (2001). ‘An Area-Wide Model (AWM) for the euro area’. ECB Working Paper No. 42. Financial Stability Report 2005 137