Asia • Philippines

Smart Communications: Low-cost

Money Transfers for Overseas

Filipino Workers

Prepared by • Elvie Grace Ganchero (Philippines)

Sector • ICT

Enterprise Class • Large national

Summary

Smart Communications, Inc. (Smart) is a leading wireless telephone services provider in the

Philippines and a subsidiary of the largest and most diversified telecommunications company,

the Philippine Long Distance and Telephone Company (PLDT). Smart has been widely cited

for its innovations in product development targeting the “base of the pyramid” (BOP) market.

This case looks at the latest innovations of the company’s business model, particularly the

products and services that directly respond to the needs of the Overseas Filipino Workers

(OFW). OFW have been instrumental in helping to buoy the Philippine economy through

remittances, totaling US$10.7 billion through formal channels in 2005, an amount estimated

1

to be at least matched by money sent through informal channels. Smart pioneered a cheaper,

faster (in real time) and more convenient way of sending remittances using the short

messaging system (SMS) technology. This, and other product innovations described in this

case, allowed Smart to serve OFW, including the poor segments of the OFW community and

their families. For OFW, low-cost communication and remittance services enable them to

maximize the impact of their hard-earned income.

The Philippine mobile phone market

The Philippines is home to more than 81.4 million people 2 in an archipelago composed of

7,100 islands. Forty percent of the population in 2001 was estimated to live below the poverty

threshold. 3 The archipelagic topography of the country, and the closely-knit family ties that

characterize Filipinos, means that access to communication is very important. Filipinos have

not been able to connect as much as they wish, especially when family members live in

distant places with poor or non-existent telecommunications service. Smart has led

innovations in wireless technology, offering a wide array of cellular products and services in

the Philippines.

Established in 1991 when it acquired its congressional franchise, Smart started commercial

operations in 1993 and since then, has contributed to the growth of the PLDT 4 group. By end

of 2006, the company employed more than 5,000 people. Over the past 14 years, the company

has grown to dominate its industry with an impressive market share of 58 percent (as of yearend 2006). 5 The company has the most extensive and modern digital communications Global

System for Mobile communications (GSM) network and infrastructure in the country,

covering over 99 percent of the population. Smart contributed US$1.542 billion in PLDT

revenue in 2006 6 (see Appendix A and B for more on Smart and PLDT’s Financial Report).

The key success factors have been the following: the technological innovations developed and

1

BSP (2006), Available at http://www.bsp.gov.ph/statistics/spei/tab11.htm

2

CIA World Factbook, July 2006 estimates.

3

The Economist, Pocket World in Figures (2007 Edition), Profile Books Ltd., London.

PLDT is a publicly listed corporation in both Philippine Stock Exchange and the New York Stock

Exchange.

5

PLDT corporate website, investor relations section. Available at www.smart.com.ph

6

2005 PLDT Annual Report.

4

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

2

successfully applied; and a focus on the needs of the lower-income population as the primary

target market. Smart has transformed the cellular phone industry in the Philippines and

changed the way Filipinos connect to each other, from the countryside communities in the farflung barangays 7 to the Overseas Filipino Workers (OFW) living in nearly every country

around the world.

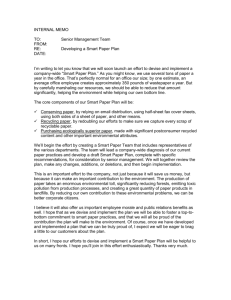

The impact of Smart’s focus on the low-income market to its bottom line is apparent through

its dramatic growth: from 191,000 subscribers in 1999, to over 2.6 million in 2000, to about

24.2 million by the end of 2006. 8 This impressive growth can be attributed to its aggressive

marketing and distribution effort coupled with an unprecedented expansion of Smart’s GSM

network in the country and abroad, and, most importantly, its ability to continuously

introduce innovations to wireless services in response to the needs of a robust but untapped

low-income market. Figure 1 illustrates the growth of the company in relation to the total

growth of wireless industry in the Philippines.

Figure 1: Smart Subscribers Growth versus Competitors (1999-2006)

45,000

18%

Number of subscribers (000)

40,000

4% Sun

6%

Smart

Smart takes

takes

GSM

GSMMarket

Market

leadership

leadership

35,000

30,000

5%

4%

48%

TNT

TNT

launched

launched

14%

22.5M

51%

44%

12%

10,000

46%

9%

7%

6%

1%

42%

1.3M

12% Touch

5%

45%

44%

5.4M

44%

13%

15.2M

121% 11.9M 13%

41% Smart

44%

20,000

15,000

17% Piltel

34.7M

33.0M

14%

25,000

5,000

41.8M

33%

38%

26% Globe

27%

33%

0

1999

2000

2001

2002

2003

2004

2005

2006

Source: Smart Communications

FINDING A UNIQUE MARKET POSITION

Smart offered GSM in 1999, five years after its main competitor, Globe Telecommunications

(Globe). Before 1999, Smart offered an analog service. “In a way, coming a bit late in the

marketplace allowed us to study and understand the dynamics of the market better,” said

Smart’s President and CEO, Mr. Napoleon Nazareno. One of the key challenges that the

company wanted to address early on was the serious lack of access to telecommunications in

7

Barangay is the second smallest political unit for local governance in the Philippines, sitio being the

smallest.

8

Source: PLDT MD&A

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

3

the country. The advent of mobile phone technology presented an opportunity to address the

problem; however, in 1993 the high cost of mobile handsets and subscription rates meant

cellular was unaffordable to the majority of the population. Globe products and services

centered on the needs of higher-income population segments, mainly business executives and

professionals, until Smart challenged that business model.

Smart developed its business model around the corporate mantra “to make mobile phones as

affordable and accessible to as many Filipinos as possible”. Looking back, “the mantra

provided us direction, inspiration, and an incredible amount of creativity,” said Mon Isberto,

PLDT and Smart’s Public Affairs Group Head. “Our drive to broaden the market for cellular

phones defined our ‘bottom of the pyramid’ orientation. We changed the old mindset that

mobile phones were only for affluent people on the go. We defined the market as everyone

looking for affordable telephone service, including the large number of people who had been

waiting for years for a landline phone,” Mr. Isberto added.

The leadership of the company had the foresight to see the significant business opportunity in

targeting the untapped potential of the low-income populations as its primary market segment.

In the Philippine context, where access to telecommunication was a perennial problem, this

business model served as a subtle form of social inclusion of the poor. Smart’s strategy was

then an uncharted approach in the Philippine business environment. See Appendix C for

Awards and Recognition received by the company for its innovative products and services.

REACHING THE MARKET OF THE MAJORITY

One of the key factors of success of the company was its ability to understand the needs of its

target market. The primary barriers in reaching the low-income market included affordability

of wireless products and services, as well as the ability of the poor to comply with the

requirements needed to own a mobile phone, for example credit-worthiness. In 1996, the

company launched Smart BillCrusher, the first pre-paid wireless service in the country that

enabled users to access wireless service without any documentation. Until BillCrusher,

applicants were required to produce documents to establish their financial status, such as a

credit card, utility bills, proof of employment, a three-month pay slip, or income tax

certification. In October 1999, the company introduced Smart Buddy, its prepaid GSM

service that enabled subscribers to purchase airtime cards at an affordable cost, in

denominations of 6, 10, and US$20. By May 2003, Smart further increased affordability with

Smart Load, a revolutionary over-the-air, micro, prepaid, top-up service that offered units as

low as US$0.60.

Napoleon Nazareno, President and CEO of Smart Communication, described the birth of

Smart Load in the following way, “The idea for that revolutionary product was born when I

had lunch with some of our employees at the company canteen; as I was having chicken soup,

one of our field salesmen asked what turned out to be the right question: Why can’t we sell

phone credits in very small amounts - like sachets for soap or shampoo? Our lowest-priced

phone card at that time was 300 pesos, roughly US$6. Affordable, yes. But it was too high for

many Filipinos”.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

4

The economies of scale in the low-income market allowed the company to lower the price of

subscription rates and handsets, thereby making their services more accessible to a larger

number of people. Handsets first priced at over US$100 became available at less than US$50,

as used units became available in the market. The success of Smart Buddy, Smart Pasa Load

(and its predecessor Smart Load), as well as Smart Money gave the company the confidence

to further explore the needs of the low-income market (see Appendix D List of Smart

Products and Services). Most recently, Smart looked at OFW and their families as an

opportunity for further growth in an underserved market.

Box 1: Key Innovative Products from Smart

Smart Load: Connecting people in massive proportions

Since the launch of Smart Buddy, the company continuously developed a series of

cutting-edge innovations directed towards low-income customers. In May 2003, Smart

Load was launched. It was an over-the-air prepaid reloading service offered in units priced

for as little as US$0.60 (versus the conventional US$2 to $10 prepaid card). Smart Load

allowed millions of poor Filipinos to gain access to cellular phone services (as of

December 2006, almost 50% of the Philippine population had wireless phones, and over

50% were Smart subscribers). In 2006, about 99% of Smart's subscribers used the

company’s prepaid service. Smart’s distribution system for Smart Load (using short

messaging system [SMS] technology) was a departure from the traditional system of

producing cards to sell airtime. By cultivating small and micro-entrepreneurs to re-sell

airtime, Smart spawned a distribution network of over 800,000 entrepreneurs nationwide

(as of September 2006). These small-scale distributors generate a 15% commission

directly from the company for airtime sales.

Smart Pasa Load: Miniaturizing pre-paid airtime

Capitalizing on the unique Filipino culture of sharing, the company further revolutionized

access to airtime by launching a new product in December 2003, called Smart Pasa Load

(pasa translates to “pass on”). With this service, one person could buy airtime and share it

with friends and family in units as low as US$0.10. More important for the entrepreneurial

poor was the opportunity to resell airtime to their friends through SMS. This spread the

company’s distribution system to the household level. As cited in a New York Times

article, this was a way of miniaturizing prepaid cellular packages. “This is

telecommunications in sachets,” said Mr Isberto.1

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

5

Smart Money: Cutting edge e-solutions

In December of 2000, in partnership with MasterCard, Smart launched the world’s first

electronic cash card linked to a mobile phone - called Smart Money. It allowed users to

transfer money from a bank account to a Smart Money account or from a Smart Money

account to another Smart Money account. Once loaded with cash, the Smart Money

subscriber could perform the following:

▪ Mobile Banking. Subscribers with enabled mobile banking accounts can enroll their

mobile phone and Smart Money wallets. Once linked, they can do PIN-based (personal

identification number) bank transactions such as fund transfer, balance inquiries and

loading Smart Money cards.

▪ Wallet-to-wallet transfers. The subscriber could transfer funds from one e-wallet to

another.

▪ Reloading of prepaid airtime. Subscribers could use Smart Money to reload pre-paid

phone credits.

▪ Terminal purchases/Debit card. As an option, the subscriber could get a Smart Money

MasterCard Electronic card and use it as debit card in MasterCard Electronic

establishments in the Philippines and abroad.

▪ Automated Teller Machine (ATM) withdrawals. Subscribers can use the physical Smart

Money MasterCard electronic card to withdraw cash from an ATM.

▪ Debit card. Smart Money MasterCard could be used as a debit card, acceptable in all

establishments that accept MasterCard.

Profile of Overseas Filipino Workers

Overseas Filipino Worker, or OFW, was coined in reference to a Filipino who lived and

worked abroad. Diaspora of Filipino labor and large remittance flows have been prominent

features of the Philippine economy for decades. Over the last 30 years, remittances have

helped to stabilize the economy by strengthening the currency and keeping balance of

payments even with the magnitude of its inflows. The data varies from one source to another,

but it is safe to say that at least eight million Filipinos work and live abroad. This represents

about one-tenth of the country's citizens, equivalent to almost one quarter of the domestic

labor force. 9 The Philippines is the second-largest migrant exporters, from the oil fields of

Africa and the Middle East, to the cargo ships in the Atlantic and Pacific oceans or luxury

ships in Europe, private homes in Singapore, Hong Kong and Canada, or the villas of Italy

and Spain, all the way to the deep jungles of Kalimantan and the thick forest of Sumatra;

Filipinos are there working, apart from their families, to provide a decent and comfortable

future for their children (see Appendix E for the Top Ten OFW Destinations in the World).

The Philippines was the third largest recipient of remittances, behind India and Mexico at a

record high of US$10.7 billion in 2005. This was about 12.5 percent of the GDP, five times

9

Burgess, Robert and Haksar, V. 2005. Migration and Foreign Remittances in the Philippines – IMF

Working Paper. IMF.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

6

bigger than the country’s Foreign Direct Investment (US$2.1 billion). 10 Banko Sentral ng

Pilipinas (BSP or the Central Bank of the Philippines) reported that 2006 OFW remittances

hit an all-time high of US$12.8 billion 11 (breakdown for 2006 figures in Table 1 was based

on the mid-year data from BSP).

Table 1: Five Year OFW Remittances by Region of Origin

(in thousands of US$) 12

REGION

2002

2003

2004

2005

ASIA

AMERICAS

OCEANIA

EUROPE

MIDDLE EAST

AFRICA

OTHERS

TOTAL

1,116,336

3,537,768

34,793

889,094

1,242,809

3,959

61,397

6,886,156

894,310

4,370,705

44,470

1,040,562

1,166,376

11,371

50,664

6,684,148

918,329

5,023,803

42,600

1,286,130

1,232,069

3,439

44,001

8,550,371

1,172,373

6,605,231

54,573

1,433,904

1,417,491

4,546

887

10,689,005

2006

(as of

August)

954,401

4,652,894

50,858

1,284,323

1,149,246

5,968

478

8,316,140

Source: Bangko Sentral ng Pilipinas (2006)

The main reason for the exodus of Filipinos abroad is poverty. There is a lack of opportunity,

evident by the high unemployment rate (8.9 percent 13 ) and the poor economic situation in the

country. As a result, many Filipinos seek employment abroad in the hope that they are able

afford a good education for their children, which, for most Filipino parents, is seen as the best

passport to a better future. Being extremely family-oriented, Filipinos face hardships by being

away from their families, but do so to be able to remit earnings to their families that they left

behind. The advent of mobile technology and the innovations of Smart have become an

intrinsic part of the Filipino life in keeping families separated by geographic distances

connected.

10

National Statistics Coordination Board (NCSB). Available at http://www.nscb.gov.ph/fiis/2006/3q06/Default.asp

11

International Herald Tribune. Published: February 15, 2007.

Available at http://www.iht.com/articles/ap/2007/02/15/business/AS-FIN-Philippines-Remittances.php

12

Data is based on bank reports submitted to BSP as contained in FED Form 1 prior to April 1999 and

FX Form 1 from May 1999 onwards. Beginning 2001, transactions reported by thrift banks, OBUs and

FOREX companies are likewise included. The data is not truly reflective of the actual country of

deployment of OFW due to the common practice of remittance centers in various cities abroad to course

remittances through correspondent banks mostly located in the U.S. Since banks attribute the origin of

funds to the most immediate source, the U.S. therefore appears to be the main source of OFW

remittances.

13

Data

from

the

National

Statistics

Coordination

Board

(NCSO).

Available

at

http://www.nscb.gov.ph/secstat/d_labor.asp, accessed on January 5, 2007.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

7

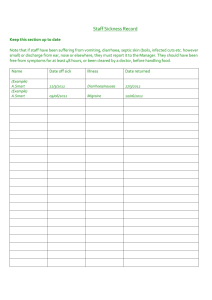

OFW include all socio-economic

classes, but the majority are from

households earning less than US$600

per month. A study conducted by

ADB in 2004, showed that 44 percent

of OFW were from low-income

families (household monthly incomes

of less than US$160) and 39% were

from lower middle class families

(household monthly incomes between

US$160 and $600) (see Appendix F

Women from poor provinces are recruited as domestic

for Profile of OFW Socioeconomic

helpers. While waiting for their work documents, four to

Class). The low-income profile was

five women stay in a small room shown here (photo

courtesy of Greg Fanslow)

also matched by a low education

level. Data from National Statistics

Office from 2000 showed that only 30 percent of OFW had either attended or finished high

schools, and only 20 percent completed elementary school. The distribution between males

and females varied from year to year, but at least half were women. Most women work as

domestic helpers, service providers, and entertainers, and most men work as seafarers, skilled

and unskilled laborers. 14

THE NEED FOR BETTER MONEY TRANSFER SYSTEMS FOR OVERSEAS

FILIPINO WORKERS

For OFW, communication with families left behind in the Philippines and sending

remittances was difficult. Thousands of OFW were disenfranchised by the remittance service

system. The formal channels 15 were often regarded as expensive and slow. As much as 45

percent of their hard-earned wages went to wire transfer fees and charges. A host of issues

forced disenfranchised OFW to use unregulated channels with long delivery times and no

banking access for the beneficiaries.

In spite of the government’s rhetoric to give due recognition to the OFW as “the modern day

heroes” of the country, the fact remained that hundreds of thousands, perhaps even millions

of OFW, needed reliable, affordable, speedy and convenient remittance system. Marilyn

Dabo, a professional midwife from Composela Valley in Mindanao, served as the guardian of

her niece’s (a single parent) three year old daughter; her experiences were illustrative of the

problems faced by many: “it took three months for the bank to clear the check, and when I

was supposed to get the money, I was told that the check has to be sent back to Kuwait

because of some problems. It was very frustrating.”

14

Ericta, Carmelita (2003). Profile of Filipino Overseas Workers.

Available at http://www.ancsdaap.org/cencon2003/Papers/Philippines.pdf.

15

ADB refers formal channels to banks and informal channels are non-bank money transfer agencies,

which are registered or regulated by authorities to engage in money transfers. Unregulated channels are

those outside the regulatory environment -- usually made through unlicensed money transfer agencies,

or occur when money or goods are sent through friends or brought home personally by the migrant.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

8

Smart response to Overseas Filipino Workers

needs

Smart Pinoy Center in Hong Kong

Recognizing the importance of OFW in the

country’s economy and the unmet needs of

that market, the company launched Smart

Pinoy 16 in 2004. It was the umbrella brand

of the company’s programme designed

solely to address the unique needs of the

OFW. “Smart Pinoy is our way of

recognizing the sacrifices made by our

OFW in working abroad,” said Smart’s

CEO. Under Smart Pinoy, Smart created

various products and services to address the

communication and remittance needs of the

OFW including Smart Padala and 1528

Smart Service.

SMART PADALA

Smart Padala 17 was launched in 2004. It was the first international remittance service in the

world using SMS technology. 18 It was developed using the Smart Money mobile commerce

platform technology (refer to Box 1 for background on Smart Money). Smart Padala allowed

OFW to send cash via SMS to the Smart Money account of the beneficiary from Smart

Padala Remittance Centers in over 20 countries (see Appendix G for list of International

Smart Padala Partner Remittance Centers).

The beneficiary exchanged the electronic money into cash from any Smart Padala Center.

They could also go to any other sending and encashment centers, which Smart had partnered

with, for increased customer convenience. By 2007, there were about 10,000 locations,

including 7-11 convenience stores, Smart Wireless Centers, Banco de Oro (the company’s

partner bank) and all Megalink and Express Net ATMs 19 . In rural provinces, beneficiaries did

not have access to major banks. To overcome this challenge, Smart forged partnerships with

local pawnshops, pharmacies, rural banks and gasoline stations: “Mabilis at Maaasahan”

(meaning fast and reliable), the branding tagline of Smart Padala, guarantees fast, efficient

and reliable service. Box 2 describes the remittance process.

16

Pinoy is a Tagalog term commonly used in the Philippines to refer to Filipino nationals.

Padala means “to send” in Tagalog. But over the years, padala popularly refers to remittance.

18

PLDT 2005 Annual Report

19

Smart is the only telecommunications company member of an ATM consortium.

17

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

9

Box 2: Remittance sending and receiving process

For Sender

Step 1. The sender goes to any Smart Padala Remittance Partner to fill out an information

sheet about the beneficiary.

Step 2. The remittance center transfers the remittance to the Smart Money number of the

beneficiary. For a first time user, the beneficiary will be assigned a Smart Money number.

For those with existing Smart Money cards, the sender simply indicates the beneficiary

number when sending the remittance.

Step 3. After a few seconds, the Remittance Center confirms that the transaction has been

completed.

For Beneficiary

Step 1. When the remittance transaction is completed, the beneficiary will receive another

SMS confirming that the money has been received through the Smart Money number.

There are two ways to cash in remittances:

Step 2. The beneficiary (without a Smart Money card) can go to any of the 10,000

encashment centers nationwide and present the Smart Money number to exchange the

electronic money for cash with a percent of the worth, in pesos, of the transaction value.

Step 3. For a beneficiary with a Smart Money MasterCard Electronic card (this comes with

post-paid subscription package; or for pre-paid subscribers, the card can be purchased from

any Smart Wireless Centers at US$4) he or she can use it as an ATM card to withdraw cash

remittance in any Banco de Oro branches with charge fee of US$0.06 per withdrawal) or

Megalink member ATM nationwide with a charge fee of US$0.21 per withdrawal.

Source: Smart Communications

Smart Padala has made sending money back

home much easier for OFW. It also lowered

the cost of sending remittances; through this

service, the company offered low-cost

remittances for as low as 1.2 percent (US$12

charge for US$1,000) of the total amount

received to as high as eight percent (US$8

charge for US$100). A comparison to other

remittance services is provided later, in

Table 2.

Smart Padala’s success encouraged the company to replicate the Smart Padala product for

domestic use, following exactly the same mechanics in June 2005. See Appendix A for

revenue growth of Smart Money.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

10

1528 SMART SERVICE

In August 2004, in partnership with Hong Kong CSL Ltd and PLDT (HK) Ltd/PLDT Global,

Smart launched 1528 Smart (read as “fifteen-twenty-eight”), a pre-paid GSM wireless service

designed for the OFW community in Hong Kong. 1528 Smart encompasses many of the

existing Smart products, including those previously exclusive to Philippine residents such as

Smart Money, e-load and Pasa Load.

The unique value added by 1528 Smart, aside from the regular Smart Money capability, is

that its Mobile Remittance Service allows the subscribers to send remittances directly from

their 1528 Smart Money e-wallet to their beneficiaries in the Philippines. The sender simply

loads up funds, in pesos, to their e-wallet at the remittance center. Once loaded, the sender

can program his or her preferred fund transmittal frequency, for example, once a week. On

the preset dates, the beneficiary will receive an SMS about the receipt of fund and can present

his or her Smart Money number to any Smart Padala partner encashment centers and

exchange it for cash. This product was designed to address the desire of female OFW in Hong

Kong to have more control over their money. Eighty percent of roughly 140,000 OFW in

Hong Kong are women (i.e. 112,000 potential customers). Stories abound that beneficiaries

find it difficult to manage large sums of money. With 1528 services, women have more

control over the timing and amount of money sent, so that the money can be spent according

to their wishes.

Like Smart Load, 1528 Smart has an e-load service feature that offers airtime in sachet-like

packages in US$3.90 (valid for 30 days), $2.60 (valid for 15 days) and $1.30 (valid for seven

days). 1528 Smart not only enables mothers to frequently communicate with their children

and loved ones in the Philippines and manage the family budget virtually out of Hong Kong,

but it also opens up business opportunities and additional income for OFW in Hong Kong by

reselling airtime to other OFW. About 1,000 OFW resell Smart airtime in Hong Kong.

Impact on the Money-Transfer Industry

ADB’s 2004 study, Enhancing the Efficiency of Overseas Filipino Workers Remittance,

provided insightful recommendations to the government for improving conditions for

remittances. It also encouraged the banking sector and non-traditional remittance channels

(e.g. internet and mobile phone technology) to improve the remittance system by closing the

gaps that prevented OFW from using the formal channels. Since 2004, actors in the regulated

remittance channels have slowly addressed the key barriers to encourage OFW to use the

formal channels.

Smart Padala’s entry in the marketplace introduced new competition to the banking services

industry, with cheaper, more efficient and more accessible money transfer services to OFW

customers. After the launch of Smart Padala, telecommunications and banking institutions

raced to compete by offering low-rate money transfer services. The company’s archrival,

Globe Telecom planned to establish a similar system in the United States’ marketplace in

2007. However, no competitor has been able to compete with Smart Padala’s pricing.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

11

Another advantage of Smart Padala, compared to other competitors, is that the beneficiary

did not need a bank account. It was also faster, since it was real time, as opposed to the twoday turnaround time that most other service providers offered. The company has a

competitive edge having been the first telecommunications company to explore the OFW

market and, so far, building a good market base remitting at least US$50 million per month

on average. Table 2 shows the comparative remittance costs using different remittance

channels.

Table 2: Comparison of Money Transfer Mechanism

Type of transfer

Cost to

remit ($)

Delivery

Period

Bank Account

Required

Remitter/

Beneficiary

Credit to account–same bank $ to peso

6-8

Minutes to 48

hours

No/Yes

6-15

2-3 days

No/Yes

Pick up at bank counters $ to peso

6-12

1-3 days

No/No

Door-to-door cash $ to peso (City)

10-14

1-3days

Door-to-door cash $ to peso (Province)

12-14

3-5 days

Prepaid, reloadable credit/debit cards

8

Credit to account–same bank $ to peso

7-12

Minutes to 24

hours

10-15

12 hours to 3

days

Door-to-door cash $ to peso (City)

11-12

2-3 days

Door-to-door cash $ to peso (Province)

12-14

3-5 days

Int’l money

transfer (e.g.

Western Union)

Pick up at MTO agents $ to peso

14-400

minutes

No/No

Host Country

Banks

Credit to account–same bank $ to peso

35-45

3-5 days

Yes/Yes

Credit to account–different bank $ to

peso

35-45

3-5 days

Yes/Yes

Text remittance through Smart

Money

1-8

minutes

No/No

Remittance

Channel

Credit to account – different banks

$ to peso

Philippine Banks

Philippine Money

Transfer Offices

Smart Padala*

Credit to account – different banks

$ to peso

No/No

No/Yes

Source: Asian Development Bank (2004) and Smart Communications

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

12

Development Impacts from Smart Padala

OFW AND THEIR FAMILIES

Over the past few decades, it became apparent that remittances contribute significantly to

economic development in the Philippines. They are also central to poverty alleviation. By

lowering the cost of money transfers, Smart Padala enabled OFW to increase their net

income and, potentially, the net remittance. A US$10 savings may look small, but for an

average domestic helper in Singapore or a construction worker in Angola, with six children

left at home, every dollar counts.

Box 3: Some commentary from Smart’s OFW customers

“I worked in Saudi Arabia for over 20 years and our contract before allowed us to see our

family only once a year. It was tough not being able to communicate with my family. But

today, communication technology provides us the opportunity to be in touch with our

families almost on a daily basis as it is very affordable to call or send message back

home. Lower cost of communication makes a whole world of difference for the OFW

community.” Says Hermie Punzalan, Assistant Plant Director of Equatorial Guinea Liquid

Natural Gas Company, a Smart subscriber.

Terri Alibarbar, an electrician from Quezon province working in Equatorial Guinea, West

Africa, keeps in touch with his wife and four young children through text messaging. All he

needs is to maintain a balance of airtime or “load” of US$2 to continuously use his

international roaming service. Once he is close to the limit, he sends SMS to his wife or to

one of his brothers to send him electronic load and allowing him to stay connected with

them. “It can really get lonely sometimes, being in touch with my family through SMS

gives me a lot of peace of mind,” says Terri. “It is very important for me to know how my

family is doing especially when one of my children gets sick. It is also a way of giving

emotional support to my wife as it is tough to be a single parent,” Terri added. “A mobile

phone is a must for OFW.”

IMPACT ON THE ECONOMY

The high propensity of Filipinos to use mobile phones and the wide reach of Smart

subscription helped the government advance its agenda to popularize the use of formal money

transfer channels. The entry of money transfer mechanisms, such as Smart Padala, provided

convenience, affordability, security and timely service both to remitters and their beneficiaries

and encouraged more OFW to use the formal channels. ADB 20 pointed out that the formal

remittance channel has several development, economic and security impacts. This was

particularly important in relation to the macroeconomic landscape of the country. The use of

unregulated money transfer channels undermined the integrity of the remittance system and

made it vulnerable to money laundering, terrorist financing and capital flight. It also had

20

Asian Development Bank (2004)

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

13

indirect effects on exchange rates and monetary policy. Moreover, remittances through

unregulated channels can cost a government and the private sector potential income, not to

mention the human development value of the remittance. Finally, there was the difficulty, if

not impossibility, of obtaining reliable estimates of the volumes of unregulated remittances,

which distorted the balance of payment figures for a sending country and precluded the

formulation of sound monetary policies.

Future Prospects for Smart

MONEY TRANSFER SERVICES

For Smart, the BOP will continue to be the company’s primary market, including the OFW

with newfound disposable income. Focusing on the OFW as a unique market segment opened

enormous opportunities to develop new solutions to serve these customers. The success of

Smart Padala and Smart 1528 provided the company with a foundation upon which to pursue

more innovations.

One of the traditional problems faced by OFW is determining how to direct and control the

money sent to beneficiaries in the Philippines. A classic complaint is that beneficiaries spend

the remittance on consumables, instead of on intended uses, such as paying children’s school

tuition fees. Once remittances start flowing, most of the OFW beneficiaries find it difficult to

manage the income. This was particularly true when the OFW was the mother of the

household. It was mostly female OFW that complained that they need to have more control

over their remittances.

To address this concern, the Smart President and CEO announced 21 at the 2007 3GSM World

Congress in Barcelona that the company will widen the coverage of its mobile-phone-based

remittances service for OFW in 2007 in more countries in the Middle East and Europe. This

global remittance service will be marketed by partner telecommunications companies and

banks and powered by Smart’s existing Smart Padala platform.

For the purposes of branding with other telecommunication companies

abroad, the expansion will be dubbed the Smart Service Hub. This

financial and telecommunications hub model is also based on an

upgraded Smart Money Mobile Commerce platform. In effect, Smart

will be a global financial service applications provider for

telecommunications companies in other countries. “The Smart Service

Hub is designed to help telecommunication companies and banks to

work together to serve the remittance needs of migrant populations in

their respective countries,” said Mr. Nazareno. As far as its marketing

21

Press Release: Smart Services Hub to help banks and telecommunications companies work together

to serve migrant workers worldwide. February 13, 2007/ Barcelona, Spain. Smart Communications, Inc.

Corporate Affairs Group.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

14

strategy amongst OFW and their beneficiaries, all products and services that address the

needs of OFW will continue to fall under the Smart Pinoy platform. These new partnerships,

with global reach, will enable Smart to serve not only OFW, but to eventually serve other

migrant workers from other nationalities, as well.

Smart is also currently working on a pilot programme in the Philippines to use SMS

technology for OFW to directly pay specific expenses, such as school tuition, insurance

premiums, utility and hospital bills and mortgages. With an enhanced remittance system and

technology, the company envisaged that OFW will be able to remit money during any time of

the day, wherever they may be. There would no longer be any need to spend time and money

traveling to and from the bank or remittance offices. Like Smart 1528, Smart hopes that future

remittance services will give Filipinos, particularly women, greater control over how their

monies are spent. Because the fees are lower and remittances can be done by phone, they now

have the option of sending smaller amounts at the time the funds are needed very much like

just-in-time delivery.

The 2006 launch of the domestic version of Smart Padala is also an opportunity to generate

economic activity in rural areas to help alleviate socio-economic conditions through

remittances from family members working in the urban centers. In early 2007, Smart also

announced that it partnered with two more Philippine banks, Rizal Commercial Banking

Corporation and Development Bank of the Philippines, for the development and expansion of

Smart Money-powered cards and remittance services.

FORGING PARTNERSHIPS WITH LOCAL ENTREPRENEURS AND

FINANCIAL INSTITUTIONS AS CASH REDEMPTION CENTERS

Considering that majority of the OFW were from rural areas, Smart saw the need to partner

with local enterprises such as local stores, pawnshops, local development and rural banks,

non-governmental organizations and micro-finance institutions to play a pivotal role in the

delivery of remittance and financial products and services to beneficiary families. The

company hopes to replicate its success in working with women-owned micro and small

enterprises as a distribution network to re-sell airtime as they multiply the number of cash

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

15

redemption centers nationwide. Smart foresees this as an opportunity to further spread the

economic impact of Smart Padala to local enterprises and institutions.

Conclusion

Smart’s innovative strategies to marry the social objective of providing better services at a

lower cost to the poor with the business objective of increasing revenues and growing the

company have been overwhelmingly successful. The introduction of products specifically for

OFW has positively impacted the lives of Filipinos and the Philippine economy. The Smart

Padala programme is an example of how a technology like the mobile phone can be used to

reduce the cost of money transfer transactions of OFW, thereby enabling them to retain a

greater proportion of their income. As Smart Padala gained momentum, it forced the banking

community to improve and reduce the cost of their services. As a result, all OFW, not just

those that use the Smart Padala service, benefit from this competition. As the service is

further improved, we are likely to see continued innovation aimed at serving the OFW

community. Among the innovations will be improved ways to enable OFW to direct and

better manage how remittances will be used.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

16

References

Asian Development Bank. 2004. “Enhancing the Efficiency of Overseas Filipino

Workers Remittance Manila, Philippines.”

Available at www.adb.org/Documents/TARs/PHI/tar-phi-4185.pdf.

Associated Press. 2007. “Philippine overseas workers sent home US$12.8 billion in

2006, up 20 percent from 2005.” 15 February 2007. International Herald Tribune.

Available at www.iht.com/articles/ap/2007/02/15/business/AS-FIN-PhilippinesRemittances.php

Bangko Sentral ng Pilipinas. “Overseas Filipino Workers Remittance (2002-2006).”

Available at www.bsp.gov.ph/statistics/spei/tab11.htm

Burgess, Robert and Haksar, V. 2005. “Migration and Foreign Remittances in the

Philippines – IMF Working Paper.” IMF.

Ericta, Carmen. 2003. “Profile of Filipino Overseas Workers.”

Available at www.ancsdaap.org/cencon2003/Papers/Philippines.pdf.

National Statistics Coordination Board (NCSB).

Available at www.nscb.gov.ph/fiis/2006/3q-06/Default.asp

Opiniano, Jeremiah. 2006. “Using text message to send cash—new technology

transfers money cheaply and easily.” 18 December 2006. The Mercury News.

Available at http://mercurynews.com/mld/mercurynews.16270491.htm

Philippine Overseas Employment Administration (POEA).

Available at www.poea.gov.ph/docs/STOCK%20ESTIMATE%202004.xls

Smart. Connect (Corporate Magazine). Vols. 1, 2, & 3.

Available at www.smart.com.ph/smart/About+Us/ Corporate+Mag/

Smart. PLDT Annual Report 2004 and 2005

Smart. Smart Communications corporate website. Corporate Profile. Available at

www.smart.com.ph

Smith, Sharon. 2003. “What works: Smart Communications – Expanding Networks,

Expanding Profits.” World Resources Institute.

Available at www.digitaldividend.org/pdf_communications_case.pdf

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

17

Social Weather Stations. 2004. “Household Amenities/Facilities Survey. Manila,

Philippines.”

The CIA World Factbook, Philippine Country Profile.

Available at https://www.cia.gov/cia/publications/factbook/geos/rp.html#top

Vera de, Roberto. 2006. “Tapping OFW Markets.” Urban Strategies Group, School of

Economics, University of Asia and the Pacific.

Available at http://ofnews.blogspot.com/2006/03/tapping-ofw-markets.html

Interviews

Aldaba, Sally F., Senior Manager for Corporate Communications, Public Affairs Group,

Smart, Makati, Philippines, 9 November 2006.

Alibarbar, Terri, OFW working for Bechtel in Equatorial Guinea, West Africa, 22 November

2006.

Dabo, Marilyn, OFW remittance beneficiary, Compostela Valley, Philippines, 20 November

2006.

Flores, Darwin F., Senior Manager for Community Partnerships, Public Affairs Group, Smart

Communications, Inc., Makati, Philippines, 9 November 2006.

Isberto, Ramon, Public Affairs Group Head, PLDT and Smart, Makati, Philippines,

November 2006.

Photo Acknowledgments

Smart pictures, courtesy of Smart Public Affairs Group

Greg Fanslow, “Woman by the window”.

Available at http://www.flickr.com/photos/framefive/234894969

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

18

Appendix A: Comparative Cellular Data Revenues Performance

from Smart 2004-2005

Sources of Revenue

2004

2005

% Change

Text Message (or SMS)

Related

570.62

643.48

13%

65.94

72.94

11%

Smart Money

1.22

2.04

67%

TOTAL

637.78

718.46

Value added services

22

Source: Smart Communications

Notes:

Text messaging related services accounted for the majority (about 90%) of Smart’s total

revenue for 2004 and 2005.

Smart Money covers revenues from Smart Padala transactions.

22

This includes sales from logo and ring tone download activities, info-on-demand such as news

updates, entertainment news, etc.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

19

Appendix B: Financial Statements for PLDT 2004 - 2006

2005- 2006 (Note 2006 up to 3Q only)

2004-2005

Note: In this report, wireless refers to Smart Communications, Inc.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

20

Appendix C: Awards and Recognition

2005

•

•

Most Outstanding M2M Implementation, Gold Prize Winner citation, M2M Value Chain Awards,

Chicago, Illinois, USA

Mobile Operator of the Year, Asian Mobile News Awards, Singapore

2004

•

•

•

•

•

•

•

Best Mobile Application or Service for the Consumer Market, (Smart Load), GSM Association,

Cannes, France

Grand Anvil Award and Excellence Award (for PPCRV electoral campaign), Excellence Award (for

Smart Entrepreneurial Program)

Merit Award (for Smart Padala), 40th Anvil Awards, Manila

Finalist (for Smart Padala), Asian Innovation Awards 2004, Far Eastern Economic Review,

Singapore

Business of the Year, Innovator of the Year (for Smart Load), 1st Raul Locsin Award for Business

Excellence

Best Managed Company in the Philippines, (PLDT and Smart) Finance Asia

Asia Pacific Wireless Service Provider of the Year, Most Innovative Application of the Year (Smart

Load) Frost and Sullivan Asia Pacific Technology Awards 2004, Singapore

2003

•

•

•

Winner (for the Smart Mobile Commerce Platform), 4th Annual Intelligent 20 Awards, Singapore

Philippines' Best Employer, Cited in an Asian-wide study conducted by The Asian Wall Street

Journal and Far Eastern Economic Review, Management Association of the Philippines and

Business World; Hewitt Associates

Top 10 Philippine Companies in terms of Corporate Leadership (Far Eastern Economic Review)

2002

•

•

Top 10 Philippine Companies in terms of Corporate Leadership (Far Eastern Economic Review)

Second Best Employer in the Philippines (Far Eastern Economic Review)

2001

•

•

•

Top 10 Philippine Companies in terms of Corporate Leadership (Far Eastern Economic Review)

Most Innovative Service (Smart Money), Asia-Pacific marketing awards; MasterCard International,

Sydney, Australia

Top 10 Best Employers in the Philippines, Hewitt /Dow Jones

2000

•

•

Top 10 Philippine Companies in terms of Corporate Leadership (Far Eastern Economic Review)

Most Innovative GSM Wireless Service for Customers (Smart Money), GSM Association, Cannes,

France

1998

•

Top 10 Philippine Companies in terms of Corporate Leadership (Far Eastern Economic Review)

1997

•

Marketing Company of the Year, Philippine Marketing Association, 18th Agora Awards

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

21

Appendix D: List of Smart Products and Services

Products

Description

Smart Gold

The company’s original, most broad-based postpaid brand introduced in 1999

Smart

Buddy

Introduced in 1999, shortly after Smart Gold, it is a popular prepaid wireless services

brand of the company comprising 98% of the total subscribers.

Smart Link

Smart’s prepaid satellite telephony service. It utilizes the AceS satellite technology, which

covers the entire Asia-Pacific region in three gateways in Indonesia, Thailand and the

Philippines. This satellite system has a footprint covering 11 million square miles in the

Asia-Pacific region with the capacity of providing telecommunication service for those

without access to landline or without cell coverage in remote and isolated areas. This is a

very important infrastructure for the company as it provides the platform to develop

products to reach far-flung barangays in the country. Smart offers its satellite phone

services in more than 10 countries in Asia.

Smart Talk

Launched in October 2000, Smart Talk is a pre-paid pay phone service that can send

SMS service to GSM mobile phones in addition to voice calls.

Talk N Text

Pre-paid Piltel GSM cell phone subscriber service

Smart

Infinity

Introduced in January 2004, is a premium postpaid plan that offers round-the-clock

dedicated personal concierge service, international assistance service, premium handset

packages and exclusive lifestyle content.

1528 Smart

Launched in Hong Kong in August 2004, 1528 is a prepaid GSM mobile phone services

designed and packaged to cater to the Filipino OFW in Hong Kong.

Smart 25/8

Unlimited

Call and

Text

Launched on March 11, 2005, a one month promotion which gives Smart and Talk N Text

pre-paid subscribers the option to avail of unlimited on-network voice calls or unlimited onnetwork texts, is Smart’s test for the apparent market demand for fixed rate or “bucket”

plans for voice and SMS services.

Smart Load

A revolutionary over the air (OTA) prepaid reloading service offering airtime sachet-like

packages. The service makes available four types of retail packages: Economy worth

US$0.60, Regular worth US$1.20, Extra which sells for US$2.30 and a US$4.00 package

Pasa Load

It is s a service that allows Smart Buddy and Talk ‘N Text subscribers to pass on to each

other airtime with the following denomination: US$0.30, $0.20, $0.10 and $0.04.

Smart

Padala

It is the first international cash remittance services through SMS. Smart Padala Domestic

was launched in June 2006.

Smart 3G

On February 14, 2006, Smart 3G was made available to customers on a free trial basis.

On May 1 2006 enhanced and enriched Smart 3G services were made commercially

available to customers. More than local and international video calling, Smart 3G also

offers content that includes real time video streaming of TV shows and downloads of

movie trailers, music videos. Anime and vacation spots. Other content includes real time

traffic videos in major thoroughfares in key cities.

Smart Click

Internet

Cage & More

On April 5, 2006, Smart launched Smart Click which serves as a neighborhood one-stop

digital shop in places with limited or no provisions for high-speed Internet and other related

computer and desktop publishing services. Smart will use a dedicated wireless broadband

connection providing speeds of up to 1 MBps. Smart aims to make Internet services

accessible in towns in provinces nationwide, even in so-called ‘uncharted territories’.

Smart Bro

On April 23, 2006, Smart Bro was unveiled, the new brand for Smart’s wireless broadband

offering, marking a move from its earlier Smart WiFi brand. Parent firm the PLDT is also

reselling Smart Bro. The launch of Smart Bro underscores the strategy of the PLDT group

to provide its customers with the widest range of broadband connectivity solutions and

establish its leadership in the broadband market in the country.

Smart Amazing Phone

Other post

paid

products

Blackberry email service

Smart Infinity: multiple cell phone lines in one handset

Smart Kid: SMS service designed for children aged 5-12 years old to keep them in touch

with family members anytime, anywhere.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

22

Services

Features

Text: post and prepaid

includes

Basic SMS services and Value-added Services

Voice post and prepaid

includes

Call blocking

Call waiting, forwarding and holding

MMS

International Multi-Media Messaging Services

Data post and pre paid

service

Includes, WAP or wireless application protocol, GPRS general packet ratio

services and mobile data fax (for post paid only)

Post and prepaid services in partnership with MasterCard. Transfers

money from bank account to a Smart Money Card in order to:

Use card in nationwide shops and restaurants

Smart Money

Re-load airtime for Smart Buddy over the air

Transfer from one Smart Money card to another

Pay utility bills (for Smart Gold subscriber only)

Use like an ATM card

Get reward points with every transactions

Use of the click and browse menu in Smart 64K super SIM

Online banking transaction including reloading of Smart Load over air

Mobile Banking

Pay bills through cell phone: water, electricity, post paid subscription,

insurance, credit card, etc.

Re-load Smart Money

9 Banks including CitiBank, Banco de Oro, East West Bank and Equitable

PCI Bank, and others.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

23

Appendix E: Top 10 Countries of OFW Destination

Deployment

TOP TEN DESTINATIONS

2004

2005

1. Saudi Arabia

188,107

193,991

2. Hong Kong

87,254

94,553

3. United Arab Emirates

68,386

81,707

4. Taiwan

45,059

46,714

5. Japan

74,480

42,586

6. Kuwait

36,591

40,248

7. Qatar

21,360

31,418

8. Singapore

22,198

27,599

9. Italy

23,329

21,261

10. United Kingdom

18,347

16,799

TOTAL

585,111

596,876

Source: Philippine Overseas Employment Administration (POEA).

Available at http://www.poea.gov.ph/html/statistics.html

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

24

Appendix F: Profile of OFW Socioeconomic Class

Socioeconomic Class

Indicators

AB

C1

C2

D&E

% of OFW 23

2

15

39

44

House or

dwelling

appearance,

location of

home

Durable materials,

fine workmanship,

well-maintained, has

lawn and garage,

expensive

furnishings

Durable materials,

maintained, may

have

lawn/garage, less

expensive

furnishings

Less durable

materials, no

lawn/ garage

likely, not too well

maintained

College graduate or

master’s

College graduate

or master’s

High school or

some high school,

some college

Some high school,

elementary or some

elementary, or none

Household

monthly

income

$1,000 and up

$600 to $1,000

$160 to $600

$160 and below

House

ownership

Own house

Own house/renting

Renting, staying

with relatives

Renting, staying

with relatives,

squatting

Several items

owned in the

Philippines and in

country of work

Several items

owned in the

Philippines and

some in country of

work

Few items owned

in Philippines,

and very few or

none in

country of work

Very few in the

Philippines, and

very few or none in

country of work

Education of

respondent

and

spouse

Ownership of

items, i.e.,

house,

vehicle,

computers,

cell phones,

refrigerator,

etc.

Number of

household

members

Materials not long

lasting (i.e., nipa),

furnishings meager.

Relatively rundown,

poor neighborhood

Relative to household income, position as household head, and ages of household

members

Source: Asian Development Bank (2004)

23

Figures are percentages of OFW sample respondents in the ADB study.

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

25

Appendix G: International Padala Centers and Partners

COUNTRY

REMITTANCE PARTNER

Australia

Pera Padala PTY Ltd., Chartered Forex,

Austria

Pinoy Express

Brunei

GP Express, Pinoy Express

Belfast

CBN Holdings

Dubai

Ventaja International Corporation

Dublin

CBN Holdings

Canada

Global Peso Express, Maharlika Services Inc., Philippine Tropical

Express, Quick as a Flash, Reliable Peso Remit, Philsend Inc., Philsend

Inc.,

Greece

CBN Holdings

Hawaii

Remit Plus International Inc

Hong Kong

1528 Pinoy Center, Amazing Communications, Banco De Oro, Far East

Remittance, Gen Ex, IREmit Global Remittance, Ideal Pinoy Shop, Pinoy

Express, Rainbow, Travelex/Asia Fx, Carlson’s Remittance, PLDT Global

Ireland

CBN

Japan

CBN Holdings

London/UK

CBN Holdings, Direct Money Tansfer, Far East Remittance, Twilight

Express Ltd., Swift Cash Inc., IREmit Global Remittance, Philsend Inc.,

New Zealand

Cybertalk Limited, Tres Marias Trading Ltd., TLC Remittance,

Palau

Pinoy Express

Qatar

Al Jazeera Exchange, Arabian Exchange, City Exchange, Future

Exchange, Gulf Exchange Mian, Lari Exchange

Saipan

Pinoy Express

Saudi Arabia

Pinoy Express

Singapore

GP Express, Pinoy Express, Travelex/Asia FX

Spain

CBN Holdings

Taiwan

Iremit Global Remittance

United Arab Emirates

Al Ahalia Financial Brokerage (formerly Buset Investment Co.), Al Ansari,

Sajmani, UAExchange

United States of America

Dollar American Exchange (DAX), New York Bay Remittance (New York),

Grammercy, Chartered Forex, Philsend Inc.,

Source: Smart website

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

26

September 2007

The information presented in this case study has been reviewed and signed-off by the company to

ensure its accuracy. The views expressed in the case study are the ones of the author and do not

necessarily reflect those of the UN, UNDP or their Member States.

Copyright @ 2007

United Nations Development Programme

All rights reserved. No part of this document may be reproduced, stored in a retrieval system or

transmitted, in any form by any means, electronic, mechanical, photocopying or otherwise, without

prior permission of UNDP.

Design: Suazion, Inc. (N, USA)

For more information on Growing Inclusive Markets:

www.growinginclusivemarkets.org or gim@undp.org

United Nations Development Programme

Private Sector Division, Partnerships Bureau

One United Nations Plaza, 23rd floor

New York, NY 10017, USA

Case Study • Smart Communications: Low-cost Money Transfers for Overseas Workers

27