Year 2008 - Foundation Center

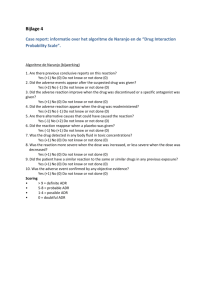

advertisement

Return of Private Foundation

Form 990-PF

OMB No. 1 54 5-0052

or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

Department of the Treasury

Internal Revenue Service

2008

Note. The foundation may be able to use a copy of this return to satisfy state reporting requirements.

For calendar year 2008 , or tax year beginning

, and ending

G Check all that aDDIv:

Use the IRS

label.

n Initial return

n Final return

n Amended return

Addrass channo

Name of foundation

Otherwise , THRIVE FOUNDATION FOR YOUTH

print

94-3382864

Number and street (or P 0 box number If mail Is not delivered to street address)

ortype .

Roomrsulte

800 MENLO AVENUE

See Specific

or town, state, and ZIP code

Seer Specit . City

ENLO PARK ,

B Telephone number

650-323-0430

1 200

C If exemption application Is pending , check here _

CA

94025

Analysis of Revenue and Expenses

(rho toted of amounts In columns (b), (c), and (d) may not

necessarily equal the amounts In column (a))

1

Contributions , gifts, grants , etc., received

2

Check ^ Q If tM foundation Is not required to attach Sch B

(a) Revenue and

ex p enses p er books

^O

D 1- Foreign organizations , check here

^0

n

2.

the 85% test, .

check h ereandatttahcopu9ta tion

H Check type of organization :

Q Section 501( c)(3) exempt private foundation

Section 4947 (a )( 1 ) nonexem pt chantable trust = Other taxable p rivate foundation

I Fair market value of all assets at end of year J Accounting method : E1 Cash

Accrual

(from Part ll, col. (c), line 16)

= Other (specify )

^$

21 , 922 , 222 . (Part 1, column (0) must be on cash basis)

E If pr i vate f oundation status was terminated

under section 507(b)(1)(A), check here

^

F If the foundation is in a 60-month termination

under section 507 ( b )( 1 ) B), check h ere

^0

(b) Net investment

income

(c) Adjusted net

income

( d) Disbursements

for charitable purposes

(cash basis only)

N .,

3 1a^v^tsavint and. temporary

4

n Warne rhsnno

A Employer Identification number

32

792

Dividends and interest from securities

, 156.

, 258.

^ ,

'LATENT 2

32 , 156.

792 , 258.

5a Gross rents

b Net rental Income or (loss)

2 , 296 , 8 87 .

6a Net gain or (loss) from sale of assets not on line 10

b Gross sales price for ell

,

,

assets on line 6a

8 787 136.

0

7

Capital gain net Income (from Part IV, line 2)

8

9

Net short-term capital gain

Income modifications

..

.

2

296 1 887.

Gross sales less returns

10a and allowances

b Less Cost of goods sold

0

LL9

c Gross profit or (loss)

21 , 566 .

3 , 142 , 867 .

11 Other income

Total. Add lines 1 throu g h 11

12

13

Compensation of officers , directors , trustees , etc

14

15

Other employee salaries and wages

Pension plans , employee benefits

1 a

ea

Acc

fW41BEIVED

her pro es Dnat-fees

b

W

.'-.

1

.

Ig nter goOV

8 Taxes

2 5 209

0 .

0 .

241 .

541 .

258.

100.

947.

0.

0.

0.

0.

69 , 165.

12 , 088.

0.

395 , 857.

205 , 881.

1 , 079 , 032.

275 , 046.

322 ,

56

35

32

224

STMT 4

MT 5

STMT 6

21 , 566 .

3 142 867 .

,

,

,

,

TAT MMNT 3

0

265,424 .

56 , 541

29 969.

27 , 285.

132 , 415.

q

9 De e ation-and dteplettpn

DEN, UT

21

22

Travel, conferences, a

Printing and publications

23 Other expenses

STMT 7

1 68,373.

24 Total operating and administrative

expenses . Add lines 13 through 23

26 Total expenses and disbursements.

Add lines 24 and 25

27 Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements

b Net Investment income of negative, enter -0-)

1 , 725 , 476.

2 , 804 , 508.

.

338

275 046.

2- r 4-0-5- , 483.

1 359.

2

c Ad l usted net Income (if

enter-0

LHA For Privacy Act and Paperwork Reduction Act Notice , see the instructions.

823501

01-02-09

680 , 007.

1 , 725 , 476.

0 25 Contributions , gifts, grants paid

867 , 821. i

N/A

Form 990-PF (2008)

94-3382864

Form 990-PF (2008)

THRIVE FOUNDATION FOR Y

andamount "thedescription

Balance Sheets column

At edschedules

should be for endat W amounts only.

p

1

nning of year

Book Value

Book Value

Fair Market Value

Cash - non - interest - bearing

36.

2 Savings and temporary cash investments

4 , 783.

3 Accounts receivable ^

Less* allowance for doubtful accounts ^

4 Pledges receivable ^

Less : allowance for doubtful accounts ^

5 Grants receivable

6 Receivables due from officers , directors, trustees , and other

disqualified persons

.

7

Page2

End of

Other notes and loans Ixehiable

203 329.

6,203,329.

4,783.

4,783.

5,038.

45, 038.

^

Less : allowance for doubtful accounts ^

r

8

Inventories for sale or use

9

10a

b

c

Prepaid expenses and deferred charges .

Investments - U S and state government obligations

Investments - corporate stock

Investments - corporate bonds -

..

11

Imesbran >s - Iandbulldnps , andequipmentbasis

,-

.

.

STMT

STMT

.

17 Accounts payable and accrued expenses

18 Grants payable

in 19 Deferred revenue

20,197,667.

15,520, 611.

10, 161.

3, 125.

14,766.

3,125.

14, 766.

3, 125.

26,423, 732.

8,486.

26,583,088.

16,460.

21,922,222.

8.486.

16,460.

0.

0.

26,415,246.

26,415,246.

0.

0.

26,566,628.

26,566,628.

26,423,732.

26,583,088.

134 , 085.

119 , 319.

.

9

20

Loans from officers , directors , trustees , and other disqualified persons

3

21

Mortgages and other notes payable

J

22

Other liabilities (describe ^

p

22,985, 070.

^

Land , buildings , and equipment, basis ^

Less a mumuwfad depreciation . STMT 1011,15 Other assets (describe ^ DEPOSITS

27

28

29

30

9

Foundations that follow SFAS 117, check here

^ U

and complete lines 24 through 26 and lines 30 and 31.

Unrestricted

.

Temporarily restricted

..

..

. - ,

Permanently restricted

Foundations that do not follow SFAS 117, check here

^ E

and complete lines 27 through 31.

Capital stock, trust principal, or current funds

Paid-in or capital surplus, or land, bldg , and equipment fund

Retained earnings, accumulated Income, endowment, or other funds

Total net assets or fund balances

H

Analysis of Changes in Net Assets or Fund Balances

2

3

4

5

Total net assets or fund balances at beginning of year - Part II, column (a), line 30

(must agree with end-of-year figure reported on prior year ' s return)

Enter amount from Part I, line 27a

Other increases not included in line 2 (itemize) ^

Add lines 1, 2, and 3

Decreases not included in line 2 (itemize ) ^ BOOK/TAX DIFFERENCE

R

Tnfal not accafc or frinu haiant ne of and of vnar ( lino d mince line r% . Dirt II nnlumn Ih1 Ii

1

823511

01-02-09

130, 570.

^

14

24

114,380.

Investments - mortgage loans

13 Investments - other

j 25

m 26

8

.

Less aocumulalad depreciation

12

.

137,060.

26,415,246.

338,359.

0.

26,753,605.

186,977.

Form 990-PF (2008)

Form 990-PF 2008

THRIVE FOUNDATION FOR YOUTH

Capital

Gains

and Losses for Tax on Investment Income

Part

IV

1

94-3382864

( b How acquired

- Purchase

D - Donation

(a) List and describe the kind ( s) of property sold (e .g , real estate ,

2-story brick warehouse ; or common stock , 200 shs . MLC Co.)

( c) Date acquired

( mo , day . yr)

Pa g e 3

( d) Date sold

(mo., day, yr.)

a

b

SEE ATTACHED STATEMENT

C

d

e

(e) Gross sales price

( f) Depreciation allowed

(or allowable)

( h) Gain or (loss)

(e) plus (f) minus (g)

( g) Cost or other basis

plus expense of sale

a

b

c

d

e

8 , 787 , 136.

2 , 296 , 887.

6 , 490 , 249.

Complete only for assets showing gain in column ( h) and owned by the foundation on 12/31 /69

(I) F.M.V. as of 12/31/69

( 1) Adjusted basis

as of 12/31/69

(I) Gains (Col (h) gain minus

col

but

le ss th an -0-) or

(k), s (from col.

( k) Excess of col. (i)

over col . (1), if any

a

b

c

d

e

2 , 296 , 887.

2 Capital gain net income or (net capital loss )

If gain, also enter In Part I, line 7

If (loss), enter -0- in Part I, line 7

2 , 296

2

3 Net short-term capital gain or (loss ) as defined in sections 1222(5 ) and (6):

If gain, also enter in Part I, line 8, column (c).

If toss enter -0- in Part I line 8

, 887.

N/A

3

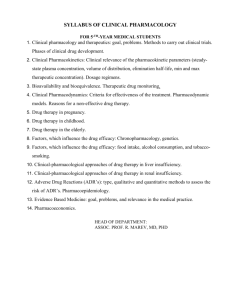

[ Part V .. j Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period?

If Yes, the foundation does not qualify under section 4940 ( e) Do not complete this part.

1 Enter the appropriate amount in each column for each year; see instructions before making any entries

years

Base priod

e

Calendar year ( or tax year beg innin g

( b)

Adjusted qualifying distributions

2007

2006

2005

2004

2003

2 , 557

2 , 117

214

151

59

, 590.

, 935.

636.

866.

325.

O Yes X No

Distribution

on ratio

(cal ( b) divided by cal. (c))

(C)

Net value of nonchantable -use assets

25 230 088.

13 890 979.

618 829.

407 186.

127 243.

.101371

.152468

.346842

.372965

.466234

..

..

2 Total of line 1, column (d)

. . ..

3 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the number of years

. .

the foundation has been in existence if less than 5 years

2

1 .439880

3

. 287976

4 Enter the net value of nonchantable -use assets for 2008 from Part X, line 5

4

5 Multiply line 4 by line 3

5

B Enter 1% of net investment income (1% of Part I, line 27b )

6

28 , 678.

7 Add lines 5 and 6

7

6 , 774 , 649.

8 Enter qualifying distributions from Part XII, line 4

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1 b, and complete that part using a 1 % tax rate.

See the Part VI instructions.

8

2 , 405 , 483.

823521 01-02-09

23

,

425

, 464

6 , 745 ,

.

971.

Form 990-PF (2008)

Form 990-PF 1 2008)

THRIVE FOUNDATION FOR YOUTH

94-3382864

Paae4

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions)

Part Vt

1 a Exempt operating foundations described in section 4940(d)(2), check here ^ 0 and enter 'N/A' on line 1.

Date of ruling letter:

( attach copy of ruling letter If necessary-see Instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check here ^ 0 and enter 1 %

of Part I, line 27b

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col. (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-)

. . . . . .

1

2

0.

3 Add lines 1 and 2

3

57 , 356.

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-)

5 Tax based on Investment Income . Subtract line 4 from line 3. If zero or less, enter -0- ....

4

6 Credits/Payments:

a 2008 estimated tax payments and 2007 overpayment credited to 2008

Part Vt A

7

^

8

9

^

7 7 8 . Refunded ^

10

11

3

4a

b

5

6

7

102 , 134.

44 , 778.

0.

Stateme nts Regarding Activities

1 a During the tax year, did the foundation attempt to influence any national , state, or local legislation or did it participate or intervene in

any political campaign?

b Did it spend more than $ 100 during the year (either directly or indirectly ) for political purposes ( see instructions for definition)?

If the answer is "Yes" to 1 a or 1 b, attach a detailed description of the activities and copies of any materials published o r

distributed by the foundation in connection with the activities.

c Did the foundation file Form 1120 - POL for this year?

..

.

d Enter the amount (if any) of tax on political expenditures (section 4955 ) imposed during the year:

(1) On the foundation . 0- $

0. (2) On foundation managers Do- $

0.

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on foundation

0.

managers. 0- $

2

0.

356

57

5

102 , 134.

6a

b Exempt foreign organizations - tax withheld at source .

..

. .

6b

c Tax paid with application for extension of time to file (Form 8868)

6c

d Backup withholding erroneously withheld

6d

7 Total credits and payments. Add lines 6a through 6d

8 Enter any penalty for underpayment of estimated tax. Check here OX if Form 2220 is attached

9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed

10 Overpayment . If line 7 is more than the total of lines 5 and 8 , enter the amount overpaid

11 Enter the amount of line 10 to be: Credited to 2009 estimated tax ^

44

57 , 356.

Has the foundation engaged in any activities that have not previously been reported to the IRS?

If "Yes," attach a detailed description of the activities.

Has the foundation made any changes , not previously reported to the IRS , in its governing instrument , articles of incorporation, or

bylaws , or other similar instruments ? If "Yes," attach a conformed copy of the changes

Did the foundation have unrelated business gross income of $1,000 or more during the year?

If 'Yes ,' has it filed a tax return on Form 990 -T for this year? .

.

N/A

Was there a liquidation , termination , dissolution , or substantial contraction dunng the year?

If "Yes, " attach the statement required by General Instruction T.

Are the requirements of section 508 (e) (relating to sections 4941 through 4945 ) satisfied either.

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing instrument?

.

Did the foundation have at least $5 ,000 In assets at any time during the year?

If "Yes, " complete Part ll, col. (c), and Part XV.

la

Yes No

X

lb

X

1c

X

2

X

3

X

4a

X

4b

5

X

6

7

X

X

8b

X

Be Enter the states to which the foundation reports or with which it is registered (see instructions) ^

CA

b If the answer is'Yes'to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General (or designate)

of each state as required by General Instruction G? If "No," attach explanation

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(j)(5) for calendar

0

year 2008 or the taxable year beginning in 2008 (see instructions for Part XIV)' If "Yes," complete Part XIV

9

X

Did any persons become substantial contnbutors during the tax year') if 'Yes.' attach a schedule Ilstlna their names an d addresses

10

X

Form 990-PF (2008)

823531

01-02-09

orni990•PF(2008 )

THRIVE FOUNDATION FOR YOUTH

Part witA Statements Regarding Activities (continued)

Pages

94-3382864

At any time during the year , did the foundation , directly or indirectly, own a controlled entity within the meaning of

section 512 (b)(13)? If 'Yes,* attach schedule (see instructions)

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract before

.

.

August 17, 2008?

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application ?

11

Website address ^ WWW. THRIVEFOUNDAT ION. ORG

14 The books are in care of ^ ROBERT E. KING

I_ocatedat ^ 800 MENLO AVENUE, SUITE 200, MENLO PARK,

CA

pat V7111a

b

c

2

a

X

12

13

. .

X

X

Telephone no ^ (6 5 0) 323-0430

ZIP+4 ^94025

Section 4947(a)(1) nonexempt chantable trusts filing Form 990-PF in lieu of Form 1041 - Check here

and enter the amount of tax-exem pt interest received or accrued durin the year

15

11

^

^

N/A

15

Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column , unless an exception applies.

During the year did the foundation (either directly or indirectly):

(1) Engage in the sale or exchange , or leasing of property with a disqualified person?

Yes

(2) Borrow money from, lend money to , or otherwise extend credit to (or accept it from)

a disqualified person?

Yes

(3) Furnish goods, services , or facilities to (or accept them from ) a disqualified person?

Yes

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person?

. .

E1 Yes

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person )? .

..

. ...

. .

0 Yes

(6) Agree to pay money or property to a government official? ( Exception . Check 'No'

if the foundation agreed to make a grant to or to employ the official for a penod after

termination of government service , if terminating within 90 days )

_

LI Yes

It any answer is'Yes'to la ( 1)-(6), did any of the acts fail to quality under the exceptions described in Regulations

section 53 .4941(d)- 3 or In a current notice regarding disaster assistance (see page 20 of the instructions )? .

Organizations relying on a current notice regarding disaster assistance check here

Did the foundation engage in a prior year in any of the acts described in 1 a, other than excepted acts, that were not corrected

before the first day of the tax year beginning in 2008 ?. .

Taxes on failure to distribute income ( section 4942 ) (does not apply for years the foundation was a private operating foundation

defined in section 4942 (1)(3) or 4942 (1)(5)).

At the end of tax year 2008 , did the foundation have any undistributed income ( fines 6d and 6e, Part XIII) for tax year(s) beginning

before 2008 ?

. .

.

.

. .

LI Yes

If 'Yes,' list the years ^

b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2) (relating to incorrect

valuation of assets ) to the year' s undistributed income ? ( If applying section 4942 (a)(2) to all years listed , answer 'No' and attach

.. .

statement - see instructions )

c If the provisions of section 4942 (a)(2) are being applied to any of the years listed in 2a, list the years here.

Yes

No

0 No

0 No

0 No

© No

0 No

0 No

N /A

lb

^ LI

1c

X

No

_ N/A

3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any time

during the year?

OX Yes 0 No

b If "Yes ; did it have excess business holdings in 2008 as a result of (1) any purchase by the foundation or disqualified persons after

May 26 , 1969, (2 ) the lapse of the 5-year penod ( or longer period approved by the Commissioner under section 4943 (c)(7)) to dispose

of holdings acquired by gift or bequest , or (3) the lapse of the 10- , 15-, or 20-year first phase holding period ? (Use Schedule C,

Form 4720, to determine if the foundation had excess business holdings in 2008)

4a Did the foundation invest during the year any amount in a manner that would jeopardize its chantable purposes?

b Did the foundation make any investment in a prior year ( but after December 31, 1969 ) that could jeopardize its charitable purpose that

2b

3b

4a

X

X

X

Form 990-PF (2008)

823541

01-02-09

18)

THRIVE FOUNDATION FOR YOUTH

Statements Regarding Activities for Which Form 4

94-338286

Be Required

5a During the year did the foundation pay or incur any amount to:

(1) Carry on propaganda , or otherwise attempt to influence legislation (section 4945 (e))?. . .

EJ

(2) Influence the outcome of any specific public election (see section 4955 ); or to carry on , directly or indirectly,

any voter registration dove?

....

.. .

0

.

(3) Provide a grant to an individual for travel , study , or other similar purposes ?

. 0

(4) Provide a grant to an organization other than a charitable , etc., organization described in section

509(a )( 1), (2), or (3 ), or section 4940 (d)(2)?

Q

(5) Provide for any purpose other than religious , chartable , scientific , literary , or educational purposes, or for

the prevention of cruelty to children or animals? ..

Q

b If any answer Is'Yes'to 5a ( 1)-(5), did any of the transactions fail to quality under the exceptions described in Regulations

section 53 .4945 or in a current notice regarding disaster assistance ( see instructions )?

Organizations relying on a current notice regarding disaster assistance check here

I

^i^

Yes

No

Yes 0 No

Yes

..

No

Yes [X No

.

_

. . _

c If the answer is "Yes ' to question 5a (4), does the foundation claim exemption from the tax because it maintained

expenditure responsibility for the grant ?

N/A.

If "Yes," attach the statement required by Regulations section 53 .4945-5(d).

6a Did the foundation, during the year, receive any funds , directly or indirectly , to pay premiums on

a personal benefit contract ?

b Did the foundation , during the year, pay premiums , directly or indirectly , on a personal benefit contract?

If you answered " Yes" to 6b, also file Foram 8870.

7a At any time during the tax year , was the foundation a party to a prohibited tax shelter transaction ?

P

Yes 0 No

.

. N/A

^0

5b

LI Yes 0 No

Q Yes OX No

X

6b

Yes 0 No

..... ....... .

7b

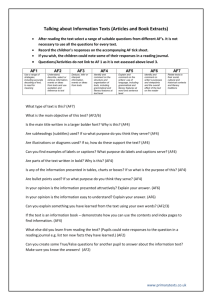

Directors, Trustees, Foundation Managers, Highly

PaidErrtion Abo, andContractors

List all officers , directors, trustees , foundation managers and their compensation.

(b) Title, and average

hours per week devoted

to osdion

(a) Name and address

SEE STATEMENT 11

(c) Compensation

(If not paid ,

enter -0-)

0.

2 Compensation of five highest-paid employees (other than those included on line 1). If none, enter "NONE."

(b) Title, and average

(a) Name and address of each employee paid more than $50 ,000

hours p er week

(c) Compensation

devoted to p osition

JULIE WARREN

800 MENLO AVENUE ,

LAUREN JOHNSON

800 MENLO AVENUE ,

CAROL GRAY

(d)cocmbuoonsto

" deb ttp

c «naa,

0.

0.

(d)Contdbueonsto

°f» a^,^^l" ^

co ensaton

( e) Expense

account, other

allowances

SUITE 200 ,

MENLO P

40.00

90 , 000.

18 1 000.

SUITE 200 ,

MENLO P

40.00

70,000.

14 , 000.

800 MENLO AVENUE , SUITE 200 , MENLO P

40.00

Total number of other employees paid over $50,000

823551

01-02-09

( e) Expense

account, other

allowances

100 000. 20 , 000.

^ 1

0

Form 990-PF (2008)

Forrp 990-PF (2008)

94-3382864

THRIVE FOUNDATION FOR YOUTH

Information About Officers , Directors , Trustees, Foundation Managers, Highly

0 Paid Employees , and Contractors (continued)

3 Five highest - paid independent contractors for professional services. If none, enter " NONE."

(a) Name and address of each person paid more than $50,000

(b) Type of service

Page 7

(c) Compensation

NONE

Total number of others receivin g over $50 ,000 for p rofessional services

Pod #xC-A

0

^

Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as the

number of organizations and other beneficiaries served, conferences convened, research papers produced, etc.

Expenses

1

12

400,235.

SEE STATEMENT 13

250,000.

SEE STATEMENT 14

250,000.

SEE STATEMENT 15

200,000.

SEE

STATEMENT

2

3

4

cart IX B Summary of Proaram - Related Investments

Describe the two largest program - related investments made by the foundation during the tax year on lines 1 and 2.

Amount

N/A

1

2

All other program - related investments . See instructions.

3

Total . Add lines 1 throu g h 3

^

0.

Form 990-PF (2008)

823561

01-02-09

Form 990-PF ( 2008 )

Part

1

THRIVE

FOUNDATION FOR YOUTH

94-3382864_

Page 8

Minimum Investment Return (All domestic foundations must complete this part . Foreign foundations , see instructions.)

2

Fair market value of assets not used ( or held for use ) directly in carrying out charitable, etc , purposes:

Average monthly fair market value of securities . .

. ,

Average of monthly cash balances

Fair market value of all other assets

Total (add lines 1 a , b, and c)

Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation ) . . . .

....

le

Acquisition indebtedness applicable to line I assets

_

2

0 .

3

Subtract line 2 from line t d .

3

23 , 782 , 197 .

4

Cash deemed held for charitable activities . Enter 1 1/2% of line 3 (for greater amount , see instructions )

Net value of noncharitable -use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4

Minimum Investment return . Enter 5% of line 5

4

5

6

23 , 425 , 464 .

1 ,

1.273.

a

b

c

d

e

5

6

..

la

lb

1c

1d

19 , 954 , 958.

3 , 827 , 239.

23

, 782 ,

197 .

0.

356 , 733 .

Distributable Amount (see instructions) (Section 4942(1)(3) and (j)(5) private operating foundations and certain

foreign organizations check here ^ Q and do not complete this part )

1

2a

b

c

3

4

5

6

7

Minimum investment return from Part X, line 6

Tax on investment income for 2008 from Part VI, line 5

2a

Income tax for 2008. (This does not include the tax from Part VI)

2b

Add lines 2a and 2b

Distributable amount before adjustments Subtract line 2c from line 1

Recoveries of amounts treated as qualifying distributions.

Addlines3and4

Deduction from distributable amount (see instructions)

Distributable amount as adjusted Subtract line 6 from line 5 Enter here and on Part XIII line 1

1

1 , 171 , 273.

57 , 356.

57 , 356 .

2c

3

4

5

1 , 113 , 917 .

6

7

1 , 113 , 917 .

1 , 113 , 917 .

0 .

0 .

Pitt XIS Qualifying Distributions (see instructions)

1

Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes.

a Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26

.

. ,

2,

1a

b Program-related investments - total from Part IX-6

..

1b

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes

2

3 Amounts set aside for specific charitable projects that satisfy the.

a Suitability test (prior IRS approval required)

3a

b Cash distribution test (attach the required schedule) ..

..

. .

3b

4 Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4

4

2,

5 Foundations that quality under section 4940(e) for the reduced rate of tax on net investment

income. Enter 1% of Part I, line 27b

5

6 Adjusted qualifying distributions . Subtract line 5 from line 4 .

. .

. .

6

2,

Note. The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section

4940(e) reduction of tax in those years

405 , 483.

0.

405,483.

0.

405 , 483.

Form 990-PF (2008)

823571

01-02-09

Forro 990- PF (2008 )

THRIVE FOUNDATION FOR YOUTH

94-3382864

Page g

Undistributed Income (see instructions)

Part XI

(a)

Corpus

1

Distributable amount for 2008 from Part XI,

line 7

2

Undistributed Income, if any, as of the and of 2007

(b)

Years prior to 2007

(d)

(c)

2007

2008

1 113 917.

0.

a Enter amount for 2007 only

b Total for prior years

0.

3 Excess distributions carryover, If any, to 2008:

a From 2003

bFrom2004

c From 2005

1

dFrom2006

1,

e From 2007

f Total of lines 3a through e

55

134

214

895

345

, 818.

575.

, 636.

, 883.

, 617.

4 Qualifying distributions for 2008 from

2,405,483.

Part Xll, line 4.0, $

a Applied to 2007, but not more than line 2a

b Applied to undistributed income of prior

years (Election required - see instructions)

c Treated as distributions out of corpus

(Election required - see instructions)

d Applied to 2008 distributable amount

e Remaining amount distributed out of corpus

5

Excess distributions carryover applied to 2008

3,646,529.

0.

0.

0.

1 , 113 , 917.

1 , 291 , 566.

0.

0.

Of an amount appears In column (d), the same amount

must be shown In column (a) )

6 Enter the not total of each column as

Indicated below:

a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5

4 938 095.

b Prior years' undistributed income. Subtract

line 4b from line 2b

c Enter the amount of prior years'

undistributed income for which a notice of

deficiency has been issued, or on which

the section 4942(a) tax has been previously

assessed

7

8

9

10

d Subtract line 6c from line 6b Taxable

amount - see instructions

e Undistributed income for 2007. Subtract line

4a from line 2a. Taxable amount - see instr.

f Undistributed income for 2008. Subtract

lines 4d and 5 from line 1. This amount must

be distributed in 2009

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or 4942(8)(3)

Excess distributions carryover from 2003

not applied on line 5 or line 7

Excess distributions carryover to 2009.

Subtract lines 7 and 8 from line 6a

Analysis of line 9

a Excess

b Excess

c Excess

d Excess

a Excess

823581

01-02-09

from

from

from

from

from

2004

2005

2006

2007

2008

0.

0.

0.

0.

0.

0.

55 , 818.

4 , 882 , 277.

134 , 575.

214 , 636.

1 895 , 883.

1 345 , 617.

1,291,566.

Form 990-PF (2008)

Form 990-PF 2008

THR IVE FOUNDATION FOR YOUTH

Pad'E XIH Private Operating Foundations (see instructions and Part VII-A, question 9)

94-338286 4

Page 10

N/A

1 a If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2008 , enter the date of the ruling .

. ,

lo. 1

b Check box to indicate whether the foundation is a P rivate o eratm foundation described in section

.

--14942 (1)( 3 ) or Q 4942(j)(5)

2 a Enter the lesser of the adjusted net

Tax year

Prior 3 years

(b) 2007

( a) 2008

( c) 2006

( d) 2005

(e) Total

income from Part I or the minimum

investment return from Part X for

each year listed

b 85% of line 2a

c Qualifying distributions from Part XII,

line 4 for each year listed

d Amounts included in line 2c not

used directly for active conduct of

exempt activities .. .

.. . .

e Qualifying distributions made directly

for active conduct of exempt activities.

Subtract line 2d from line 2c

3 Complete 3a, b, or c for the

alternative test relied upon.

a 'Assets' alternative test - enter:

(1) Value of all assets

(2) Value of assets qualifying

under section 4942 (j)(3)(B)(i)

b 'Endowment' alternative test - enter

2/3 of minimum investment return

shown In Part X, line 6 for each year

listed

c 'Support' alternative test - enter,

(1) Total support other than gross

investment income ( interest,

dividends , rents, payments on

securities loans (section

512(a)(5 )), or royalties)

(2) Support from general public

and 5 or more exempt

organizations as provided in

section 4942 (I)(3)(8)(m)

(3) Largest amount of support from

an exempt organization

Part XV

I

Supplementary Information (Complete this part only if the foundation had $5, 000 or more in assets

at any time during the year- see the instructions.)

Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax

year (but only if they have contributed more than $5,000) (See section 507(d)(2) )

SEE STATEMENT 16

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 10% or greater interest.

NONE

2

Information Regarding Contribution, Grant , Gift, Loan , Scholarship , etc., Programs:

Check here ^ IX if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If

the foundation makes gifts, grants, etc. (see instruct io n s) to ind ividua ls or organizations under other conditions, comp lete items 2a, b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, chantable fields, kinds of institutions, or other factors-

823601 01 -02-09

Form 990-PF (2008)

Forrp 990- PF (2008)

THRIVE FOUNDATION FOR YOUTH

94-3382864

Page 11

Information

9

Grants and Gontrlbutions Paid Ounri cal the Year or A pp roved for Future Pa

Recipient

Name and address (home or business)

If recipient is an individual,

show any relationship to

any foundation manager

or substantial contributor

ent

Foundation

status of

recipient

Purpose of grant or

contribution

Amount

a Paid dung the year

FROM K-1:LEGACY VENTURE

IV, LLC

4,633.

SEE STATEMENT A-1

Total

1720843.

t 3a

1725476.

b Approved for future payment

NONE

Total

823611 01-02-09

0.

3b 1

Form 990-PF (2008)

Form990-PF (2008)

t XVtA

THRIVE FOUNDATION FOR YOUTH

94-338286 4

Page 12

Analysis of Income - Producing Activities

UIIItlWdrtl U UUJI11US5 11IGU1IIB

Enter g ross amounts unless otherwise indicated .

(a)

Business

code

1 Program service revenue :

txC1 Cod b

(b)

Amount

E.9us ione

cod

section 512 513 or 519

(d)

Amount

(e)

Related or exempt

function income

a

b

C

d

0

f

g Fees and contracts from government agencies

2 Membership dues and assessments

.

3 Interest on savings and temporary cash

investments

4 Dividends and interest from securities

5 Net rental income or (loss) from real estate.

a Debt-financed property

b Not debt-financed property .

6 Net rental income or (loss ) from personal

property .

.

32 , 156.

792 , 258.

14

21 , 566.

18

2 , 296 , 887.

...

7 Other investment income

8 Gain or ( loss) from sales of assets other

than inventory .

14

14

..

9 Net income or (loss ) from special events

10 Gross profit or (loss ) from sales of inventory

11 Other revenue,

a

b

C

d

a

12 Subtotal . Add columns ( b), (d), and (e)

13 Total . Add line 12, columns ( b), (d), and (e)

(See worksheet in line 13 instructions to verdy calculations.)

P" XVf-B

0. 1

3 , 142 , 867.

Relationship of Activities to the Accomplishment of Exempt Purposes

_ 13

0.

3,142,867.

94-3382864

THRIVE FOUNDATION FOR YOUTH

Forrp990- PF(2008 )

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

XVII

Exempt Organizations

a

b

c

d

Pa ge 13

Yes No

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of

the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political organizations

Transfers from the reporting foundation to a nonchardable exempt organization of:

1 a0 )

„ ..

X

(1) Cash

2

X

11

(2) Other assets

..

..

...

.

Other transactions:

1 b (l )

X

. .

(1) Sales of assets to a noncharitable exempt organization . ..

1 b(2)

X

(2) Purchases of assets from a nonchantable exempt organization. .

1 b ( 3)

X

(3) Rental of facilities, equipment, or other assets

..

. .

X

(4) Reimbursement arrangements

1b (4)

. .

..

X

(5) Loans or loan guarantees

1 b (5 )

....

..

X

1 b ( 6)

(6) Performance of services or membership or fundraising solicitations

. .

X

Sharing of facilities, equipment, mailing lists, other assets, or paid employees

1C

If the answer to any of the above is 'Yes,' complete the following schedule. Column (b) should always show the fair market value of the goods, other assets,

or services given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing arrangement, show in

2a is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described

in section 501(c) of the Code (other than section 501 (c)(3)) or in section 527? .

h

Q Yes

if'Yes ' cmmniete the follnwinn schedule.

(a) Name of organization

(b) Type of organization

(c) Description of relationship

N/A

edam

Under penalties of a ury

n of prep r o

and complete 0

Signature of

d

X

n

am ed this return , Including accompanying schedules and statements , and to the best of my knowledge and belief, it Is true, correct,

aver flducliiiy) Is based on all Information 01which ore oarer has any knowledge

cer or trustee

Preparer's

E signature

a am nrm ' sname (of yours

a ^ Itsel}employod),

addrs andZIPcode

823622

01-02-09

S

LLC

, 100 FIRST STREETJSUITE

SAN FRANCISCO

CA 94105

® No

CMB No 1545-0172

Far, 4562

Depreciation and Amortization

990-PF

2008

(Including Information on Listed Property)

Department of the Treasury

Internal Revenue Service (99)

^ See separate instructions .

Attachment

Sequence No 67

^ Attach to your tax return.

Name(s) shown on return

Business or activity to which this form relates

identifying number

4-3382864

THRIVE FOUNDATION FOR YOUTH

ORM 990-PF PAGE 1

IPA f Election To Exp ense Certain Pro p e rty Under Section 179 Note : If you have any listed roe , complete Part l/ before

1 Maximum amount. See the instructions for a higher limit for certain businesses

. . .

1

2 Total cost of section 179 property placed in service (see instructions) .

2

3 Threshold cost of section 179 property before reduction in limitation

. .

3

4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -04

(a) Description of

(b) Cost (business use only)

nplete Part I.

250,000.

(c) Elected cost

I

7 Listed property. Enter the amount from line 29

1 7 1

8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 .

.

9 Tentative deduction. Enter the smaller of line 5 or line 8 .. . _

10 Carryover of disallowed deduction from line 13 of your 2007 Form 4562 .

11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5

12 Section 179 expense deduction. Add lines 9 and 10, but do not enter more than line 11

13 Carryover of disallowed deduction to 2009. Add lines 9 and 10, less line 12

. ^ 13

Note: Do not use Part ll or Part 111 below for listed property. Instead, use Part V.

Part It I

Special Depreciation Allowance and Other Depreciation (Do not include listed orooertv.)

14 Special depreciation for qualified property (other than listed property) placed in service dunng the tax year

15 Property subject to section 168(f)(1) election

8 , 348.

14

15

18

MACRS Depreciation (Do not include listed

Section A

17

17 MACRS deductions for assets placed in service in tax years beginning before 2008

18

2,903.

If you are electina to arouo any assets olaeed In service durino the tax year Into one or more general asset arm

Section B - Assets Placed in Service Durina 2008 Tax Year Using the General Depreciation System

(a) Classification of property

19a

3 -year property

5-year property

c

7 -year property

d

e

f

1 0ear

15 ear

20 ear

25 ear

(b) Month and

year placed

in service

(c) Basis for depreciation

(business /Investment use

only - see Instructions)

229. 5 YRS.

116. 7 YRS.

ro ert

property

property

property

h

Residential rental property

i

Nonresidential real property

(d) Recovery

period

/

/

/

/

25 yrs.

27.5 yrs.

27.5 y rs.

39 y rs.

(e) Convention

(Q Method

MQ

MQ

200DB

200DB

MM

IVIM

MM

MM

S/L

S/L

S/L

S/L

S/L

(g) Depreciation deduction

762.

75.

Section G - Assets Placed in Service During 2008 Tax Year Using the Alternative Deoreciation System

20a

b

c

Class life

12 ear

40 ear

Summary (See instructions.)

I Part IV

/

12 yrs.

40 y rs.

21 Listed property. Enter amount from line 28

22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21.

Enter here and on the appropriate lines of your return. Partnerships and S corporations - see instr.

23 For assets shown above and placed in service during the current year, enter the

e ie^ os

1

LHA For Paperwork Reduction Act Notice , see separate instructions .

MM

S/L

S/L

S/L

21

22

12 , 088.

Form 4562 (2008)

Form 4562 (2008)

THRI VE FOUNDATION FOR YO UTH

94- 3382864

Page 2

Listed Property (Include automobiles, certain other vehicles, cellular telephones, certain computers, and property used for entertainment,

recreation, or amusement.)

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a)

through (c) of Section A. all of Section B. and Section C if applicable.

Section A - Depreciation and Other Information (Caution : See the instnictions for limits for passenger automobiles.)

pad ,V

24a Do you have evidence to su pp ort the buslnesslnvestment use claimed ?

(a)

(b)

Type of prope rty

(list vehicles first )

(c)

(d)

Date

placed in

Business/

investment

service

use percentage

Cost or

other basis

0 Yes

0 No 24b If 'Yes ' is the evidence written ? 0 Yes

(e)

(f)

(9)

(h)

use only)

Recovery

penod

Method/

Convention

Depreciation

deduction

B asis for depredation

(b usinesenn vestment

25 Special depreciation allowance for qualified listed property placed in service during the tax year and

used more than 50% Ina q ualified business use

No

Elected

section 179

cost

25

Section B - Information on Use of Vehicles

Complete this section for vehicles used by a sole proprietor, partner, or other 'more than 5% owner,' or related person.

If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for

those vehicles.

(a)

(b)

(c)

(d)

(e)

(f)

Vehicle

Vehicle

30 Total business/investment miles driven during the

Vehicle

Vehicle

Vehicle

Vehicle

year (do not include commuting miles) .

31 Total commuting miles driven during the year

32 Total other personal (noncommuting) miles

driven

33 Total miles driven during the year.

Add lines 30 through 32

Yes

No

Yes

No

Yes

No

Yes

34 Was the vehicle available for personal use

No

Yes

No

Yes

No

.. . .

during off-duty hours?

35 Was the vehicle used primarily by a more

than 5% owner or related person?

38 Is another vehicle available for personal

use?

Section C - Questions for Employers Who Provide Vehicles for Use by Their Employees

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who are not more than 5%

37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by your

employees?. .

38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your

employees? See the instructions for vehicles used by corporate officers, directors, or 1 % or more owners

39 Do you treat all use of vehicles by employees as personal use?

40 Do you provide more than five vehicles to your employees, obtain information from your employees about

_

the use of the vehicles, and retain the information received?

41 Do you meet the requirements concerning qualified automobile demonstration use?

(a)

Description of costs

I

(b)

I

Damamortlnbon

tiepins

(c)

Amortizable

amount

I

(d)

Code

section

I

(e)

Amortization

period or percentage

I

(f)

Amortization

for this year

costs that begins du

43 Amortization of costs that began before your 2008 tax year

816252 11-08-08

Form 4562 (2008)

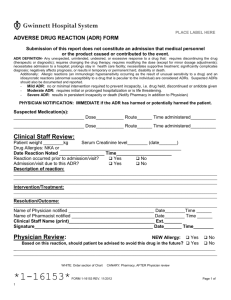

2008 DEPRECIATION AND AMORTIZATION REPORT

990-PF

FORK 990-PF PAGE 1

Asset

No

Description

Date

Acquired

Method

1 ORGANIZATION COSTS

12/15 / 00

2 OP 'lCH F,£XTMO

04124/0

200

3 COMPUTER EQUIPMENT

10/17 / 0

Life

Bus

%

Excl

Section 179

Expense

Reduction In

Basis

Basis For

Depreciation

Beginning

Accumulated

Depreciation

Current

Sec 179

Expense

Current Year

Deduction

Ending

Accumulated

Depreciation

HN 4 3

11,116 .

11,116 .

11,116.

0.

11,116.

7.00

7

6,779.

4,779 .

2"62s ,

1,186.

3,814.

200D

5.00

H1 1 7

33,314 .

06 /05/0

Sig

3,00

>d

6

a, 9^.

5 FURNITURE & FIXTURES

09/01 / 0

200D

10.0

H1 1 7

56 , 775.

6

'SxC^tJHES

!!,£/03./0

200

7_00

7

4,831 .

4,!831.

690.

£,£83.

1,873_

7 FURNITURE & FIXTURES

02/01 / 0

200D

7 . 00

H1 1 7

2,180 .

2,180.

311.

534.

845.

*6/11/0

8#fit

5.01E

$

1,256.

578.

578,

78 .

x .

20 COMPUTER EQUIPMENT

07/17 / 0

200D

5.00

Ml

9

3,227.

1 , 614.

1,613 .

1,856.

242.

21 C0MPUTZ9 30013mam

08118/4

2*0

$ . 04

.

19 8

2 , 415.

x,208 .

£,207.

,389.

X82.

22 COMPUTER EQUIPMENT

08/18 / 0

200D

5.00

Ml

9

1,038.

519.

519 .

597.

78.

23

10108/0

8#ttt

^.tt#f

9

2,ft7;.

1<, 87.

£x 87 ,

i, ^#!.

53.

10/20 / 0

200D

5.00

9

4,625.

2,313.

2,312.

2,429.

116.

12/15/0

ntto

7,00

9

1,258.

629.

829 .

553..

82.

10,745.

33 , 251.

12,088.

18,485.

4 C

UTZR S©P 'WARZ

qt8 £

&

8QG£>'t

3 C^1

URN £9

& t 7C^f7CrJk;<t4

24 COMPUTER EQUIPMENT

25 PURN £

!

&

t^t9ei1#{^S

60M

C Line Unadjusted

v No Cost Or Basis

M

33,314.

0.

2,33w.

#t.

56 , 775.

0.

* TOTAL 990-PP PG 1 DEPR &

AMORT

828111

04-25-08

134 , 085.

(D) - Asset disposed

90,089 .

14,745.

• ITC, Salvage, Bonus , Commercial Revitalization Deduction, GO Zone

THRIVE FOUNDATION FOR YOUTH

94-3382864

FOUNDATION STATUS

ADDRESS

NAME

Stanford University School of Education 505 Lausen Mall, Stanford,

John Gardner Center for Youth and Their Communities CA 94305

Search Institute

Stanford Center on Adolescence

Friends of the Children, National

OF RECIPIENT

501(c)(3)

615 First Ave. NE, Suite 125, Minneapolis, MN 55413

Stanford University School of Education, 326 Galvez St., Stanford,

CA 94305

One Penn Center, 1617 JFK Boulevard, Suite 900, Philadelphia, PA

501(c)(3)

19103

501(c)(3)

501(c)(3)

PURPOSE OF

GRANT

AMOUNT

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

250,000

of Youth

200,000

150,000

250,000

Transforming lives

Positive Coaching Aliance

3430 W. Bayshore Rd, Suite 104 Palo Alto, CA 94303

Fuller Center for Research in Child and Adolescent

Development

Fuller Theological Seminary, 135 North Oakland Ave., Pasadena, CA

91182

501(c)(3)

501(c)(3)

of Youth

400,235

Transforming lives

of Youth

96,883

Transforming lives

Grassroot Soccer

2456 Christian St., White River Junction, VT 05001

ImagineNations Group (YouthGive)

221 Bay Front Road, Pasadena, MD 21122

501(c)(3)

501(c)(3) 509(a)(1)

170(b)(1)(A)(vi)

Eastside College Pre paratory School

1041 Myrtle St., East Palo Alto, CA 94303

501(c)(3)

Fuller Youth & Families

135 North Oakland Ave., Pasedena, CA 91182

501(c)(3)

to

D

m

9

m

z

D

11

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

50,000

50,000

34,000

31,600

Transforming lives

Il

Harambee

1581 Navarro Ave., Pasadena, CA 91103

501(c)(3)

Boys and Girls Club

401 Pierce Rd., Menlo Park, CA 94025

501(c)(3)

Friends, SF

800 Ines Ave. #12, San Francisco, CA 94124

501(c)(3)

Knox Pres. Church

225 S. Hill Ave., Pasadena, CA 91106

501(c)(3)

Friends of the Children, Portland

44 NE Morris St., Portland, OR 97212

501(c)(3)

218 W 13th St., New York, NY 10026

501(c)(3)

It Friends of the Children, NY

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

15,000

10,000

40,000

25,000

67,500

10,625

Transforming lives

City Church

PO Bix 641049, San Francisco, CA 94109

501(c)(3)

If Reikes Center

3455 Edison Way, Menlo Park, CA 94025

501(c)(3)

1S World Vision

PO Box 9716, Federal Way, WA 98063

501(c)(3)

2a

751 Laurel St. PMB #222, San Carlos, CA 94070

501(c)(3)

Village Enterprise Fund

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

Transforming lives

of Youth

10,000

10,000

15,000

5,000

1,/LU,S4S

From Legacy Venture K-I

4,633

TOTAL

1,725,476

THRIVE FOUNDATION FOR YOUTH

94-3382864

Short Term

m

Quantity

Cost Basis

Net Proceeds

G ain/Loss

Description

Symbol/CUSIP

CHUNGHWA TELECOM CO LTD

ROSNEFT OIL CO OAO REGS

SEVERSTAL JT STK CO-USD

17133Q304001

67812M207001

818150302001

1.000

765.000

556.000

$22.10

7,045.96

13,348.82

$22.53

7,145.64

15,075.99

$0.43

99.68

1,727.17

TMK OAO

URALKALI JSC SPONSORED

ALCOA INC

APPLE INC

ANGLO AMERICAN PLC ADR

87260R201001

91688E206001

AA

AAPL

AAUK

503.000

228.000

100.000

288.000

753.000

17,996.20

9,892.59

3,684.80

38,135.49

24,189.09

20,955.41

5,549.35

3,819.35

37,086.65

24,036.56

2,959.21

(4,343.24)

134.55

(1,048.84)

(152.53)

ABBOTT LABORATORIES

COMPANHIA DE BEBIDAS DAS

BARRICK GOLD CORP CAD

ACE LTD ORD SHS

ABT

ABV

ABX

ACE

623.000

49.000

840.000

212.000

32,544.77

2,041.73

25,246.37

12,617.84

32,443.60

2,380.47

40,878.93

11,439.39

(101.17)

338.74

15,632.56

(1,178.45)

ALUMINUM CORP OF CHINA ADR

AETNA INC NEW

ACH

AET

479.000

345.000

9,633.66

20,155.78

4,879.64

16,038.88

(4,754.02)

(4,116.90)

AMGEN INC

ARCELORMITTAL SOUTH AFRICA

AMGN

AMSOY

435.000

424.000

20,429.87

12,806.68

21,025.15

10,972.84

595.28

(1,833.84)

AMERICAN TOWER CORP-CLASS A

AMT

324.000

12,756.69

11,898.89

APACHE CORP

APA

176.000

15,264.09

17,520.73

2,256.64

ARACRUZ CELULOSE SA SP ADR

AU OPTRONICS CORP

ARA

AUO

34.000

327.000

1,203.58

5,085.87

544.06

5,921.68

(659.52)

835.81

ALUMINA LTD SPONSORED ADR

AXA S.A.SPONS ADR

ASTRAZENECA PLC SPON ADR

AWC

AXA

AZN

2,590.000

734.000

790.000

0.01

32,333.36

38,525.27

1,502.87

23,341.09

37,861.15

1,502.86

(8,992.27)

(664.12)

BOEING CO

BANK OF AMERICA CORP

BASF SE COMMON STOCK

BA

BAC

BASFY

604.000

939.000

628.000

57,283.67

31,510.27

42,165.49

43,898.47

23,571.63

39,936.48

(13,385.20)

(7,938.64)

(2,229.01)

BANCO BRADESCO SPONS ADR

BBD

1,014.000

15,048.61

11,916.25

(3,132.36)

(857.80)

THRIVE FOUNDATION FOR YOUTH

94-3382864

m

m

Z

Description

Symbol/CUSIP

FRANKLIN RESOURCES INC

BENCHMARK ELECTRONICS INC

BEN

BHE

Quantity

Cost Basis

Net Proceeds

Gain/Logs

55.000

775.000

$5,622.61

17,901.24

$5,387.85

13,768.03

($234.76)

(4,133.21)

30.000

8,658.64

10,566.40

1,907.76

25.000

1,487.000

1,756.48

47,285.01

2,407.13

27,906.57

650.65

(19,378.44)

380.000

547.000

57.000

12,138.83

35,362.38

8,734.91

14,001.32

30,858.91

8,443.21

1,862.49

(4,503.47)

(291.70)

1,325.000

340.000

560.000

185.000

2,023.000

1,299.000

146.000

29,251.76

25,115.80

11,545.39

4,859.19

38,596.64

37,241.63

7,402.46

7,177.68

24,443.95

11,994.84

3,342.77

39,268.33

28,591.13

9,793.52

(22,074.08)

(671.85)

449.45

(1,516.42)

671.69

(8,650.50)

2,391.06

543.000

40.000

19.945.96

2,370.83

20,974.58

3,170.70

1,028.62

799.87

BAIDU.COM SPONSORED ADR

BIDU

BRASIL TELECOM PARTICIPACO

CITIGROUP INC

BRP

C

CAMECO CORP

CELGENE CORP

CNOOC LTD SPONS ADR

CCJ

CELG

CEO

COUNTRYWIDE FINANCIAL CORP

LOEWS CORP CAROLINA GROUP

CHUNGHWA TELECOM CO LTD

CATHAY FINANCIAL GDR REGS

COMPANHIA ENERGETICA DE

CISCO SYS INC

CTRIP.COM INTERNATIONAL

CFC

CG

CHT

CHYFF

CIG

CSCO

CTRP

CVS CAREMARK CORP

CHEVRON CORP

CVS

CVX

CEMEX S.A.B DE C.V SPONS

CX

189.000

6,832.35

4,896.66

(1,935.69)

COMMUNITY HEALTH SYS INC NEW

DELTA AIR LINES INC

CYH

DAL

590.000

993.000

23,131.78

18,076.40

18,724.62

9,408.92

(4,407.16)

(8,667.48)

DEUTSCHE BANK-EUR

DBS GROUP HLDG LTD SP ADR

DEERE & CO

WALT DISNEY CO

DIAMOND OFFSHORE DRILLING INC

DEVON ENERGY CORP NEW

DISTRIBUCION Y SERVICIO

DB

DBSDY

DE

DIS

DO

DVN

DYS

230.000

282.000

184.000

618.000

28.000

51.000

107.000

31,121.30

17,343.36

12,691.95

19,934.89

4,027.91

6,087.17

3,842.13

26,040.80

14,417.31

16,448.02

19,054.84

2,986.45

5,474.63

2,722.79

(5,080.50)

(2,926.05)

3,756.07

(880.05)

(1,041.46)

(612.54)

(1,119.34)

ENI SPA SPONSORED ADR

E

370.000

23,805.80

23,822.81

17.01

THRIVE FOUNDATION FOR YOUTH

94-3382864

Descnption

Symbol/CUSIP

Quantity

Co s t B asis

BRINKER INTL INC

ERSTE GROUP BANK AG SPON

EAT

EBKDY

EMPRESA NATIONALE DE

ERICSSON L M TEL CO CL B

EOC

ERIC

EMBRAER-EMPRESA BRASILERIA

ERJ

271.000

8,053.66

8,333.49

279.83

EVRAZ GROUP S A-USD

EVGPF

409.000

34,869.85

22,077.03

(12,792.82)

ISHARES MSCI MALAYSIA FREE

EWM

830.000

10,081.75

8,766.03

(1.315.72)

ISHARES MSCI SINGAPORE INDEX

EWS

2,672.000

34,366.57

27,886.59

(6,479.98)

(n

ISHARES INC MSCI TAIWAN

EWT

768.000

12,037.26

10,319.25

(1,718.01)

D

ISHARES MSCI SOUTH KOREA

EWY

692.000

36,017.76

21,431.25

(14,586.51)

m

Z

I

EXXARO RES LTD

ISHARES INC MSCI SOUTH AFRICA

FREEPORT MCMORAN COPPER & GOL

FIATS P A SPONSORED ADR

FOCUS MEDIA HOLDING ADR

FOMENTO ECONOMICO MEXICANO

GENERAL DYNAMICS CORP

GROUPE DANONE SPONS ADR

EXXAY

EZA

FCX

FIATY

FMCN

FMX

GD

GDNNY

911.000

377.000

234.000

1,469.000

142.000

343.000

350.000

676.000

13,143.70

25,817.75

23,944.98

47,271.82

7,463.12

12,589.70

31,586.43

9,707.36

7,531.64

20,885.43

24,127.77

34,687.99

6,701.87

11,865.57

29,752.23

11,866.84

(5,612.06)

(4,932.32)

182.79

(12,583.83)

(761.25)

(724.13)

(1,834.20)

2,159.48

GAFISA S A SPON ADR-USD

GOLD FIELDS LTD SPONS ADR

GFA

GFI

671.000

1,209.000

21,483.12

21,199.72

23,402.13

21,280.49

1,919.01

80.77

GILEAD SCIENCES INC

CORNING INC

GOOGLE INC

GOODRICH CORP

GILD

GLW

GOOG

GR

677.000

625.000

111.000

501.000

25,115.01

14,982.44

55,991.24

31,250.93

32,103.53

14,438.38

49,467.23

28,740.14

6,988.52

(544.06)

(6,524.01)

(2,510.79)

GOLDMAN SACHS GROUP INC

HERCULES OFFSHORE INC

GS

HERO

266.000

580.000

57,587.50

17,286.12

39,952.67

14,217.84

(17,634.83)

(3,068.28)

HON HAI PRECISION

HUANENG POWER INTL SP ADR

HNHPF

HNP

354.000

3.22

12,707.30

1.28

11,558.86

(1.94)

(1,148.44)

Net Proceeds

730.000

1,979.000

$16,871.10

63,885.41

$12,439.13

33,864.32

486.000

430.000

19,288.08

10,896.03

22,479.02

11,625.54

Gain/ Loss

($4,431.97)

(30,021.09)

3,190.94

729.51

THRIVE FOUNDATION FOR YOUTH

94-3382864

Description

Symbol/CUSIP

HEWLETT PACKARD CO

DESARROLLADORA HOMEX

INTL BUSINESS MACHINES CORP

ICICI BANK LTD-SPONS ADRINDIA FUND INC

MORGAN STANLEY INDIA INVT FUND

IMPALA PLATINUM HOLDINGS

IPATH MSCI INDIA ETN

HPQ

HXM

IBM

IBN

IFN

IIF

IMPUY

INP

INTEL CORP

IPC HOLDINGS LTD -USD

BANCO ITAU HOLDING

JANUS CAPITAL GROUP INC

JPMORGAN CHASE & CO

KB FINANCIAL GROUP INC ADR

KOHLS CORP

KSS

256.000

12,095.44

10,440.92

(1,654.52)

LEHMAN BROTHERS HOLDINGS INC

LEH

412.000

24,353.10

15,367.14

(8,985.96)

Quantity

Cost Basis

Net Proceeds

Gain/Loss

594.000

54.000

288.000

462.000

494.000

292.000

419.000

157.000

$28,505.35

2,491.42

29,361.67

21,354.90

28,481.29

15,556.72

14,968.36

10,276.85

$27,111.88

1,197.33

32,392.58

18,657.69

18,435.14

11,983.81

15,953.90

7,042.83

($1,393.47)

(1,294.09)

3,030.91

(2,697.21)

(10,046.15)

(3,572.91)

985.54

(3,234.02)

INTC

1,264.000

31,906.85

29,678.44

(2,228.41)

IPCR

ITU

JNS

JPM

KB

1,140.000

325.000

132.000

275.000

391.000

33,265.20

6,189.02

3,790.18

11,101.45

28,844.98

30,637.26

7,084.84

3,255.09

9,141.03

14,250.16

(2,627.94)

895.82

(535.09)

(1,960.42)

(14,594.82)

CHINA LIFE INSURANCE CO

LFC

566.000

32,974.58

31,046.67

(1,927.91)

LG DISPLAY CO LTD SPON ADR

LOEWS CORP

LPL

LTR

273.000

401.000

5,800.65

19,235.78

4,003.35

17,055.06

(1,797.30)

(2,180.72)

LUKOIL OIL SPONS ADR

LAS VEGAS SANDS CORP

LUKOY

LVS

799.000

338.000

62,792.81

28,838.45

59,773.00

29,624.10

(3,019.81)

785.65

(34,490.78)

LLOYDS TSB GRP PLC SP ADR

LYG

2,209.000

83,609.85

49,119.07

MACYS INC

M

635.000

19,226.60

14,593.02

(4,633.58)

MARKS & SPENCER GROUP PLC

MAKSY

765.000

59,872.21

35,399.83

(24,472.38)

MOBILE TELESYSTEMS OJSC

MBT

260.000

16,198.26

20,704.48

4,506.22

MCDONALDS CORP

MEDTRONIC INC

MCD

MDT

378.000

394.000

18,937.80

19,641.13

20,571.55

18,802.01

1,633.75

(839.12)

MERRILL LYNCH & CO INC

MER

1,232.000

72,733.01

56,196.04

(16,536.97)

THRIVE FOUNDATION FOR YOUTH

94-3382864

Descnption

Symbol/CUSIP

MEDCO HEALTH SOLUTIONS INC

MHS

537.000

$22,876.20

$23,801.44

ALTRIA GROUP INC

MO

445.000

22,980.73

23,466.22

MOSAIC COMPANY

MACQUARIE GROUP SPONS ADR

MERCK & CO INC

MARATHON OIL CORP

MOS

MQBKY

MRK

MRO

105.000

558.000

615.000

189.000

12,121.98

25,578.82

31,272.75

9,191.72

10,736.32

7,688.48

26,413.31

9,891.17

(1,385.66)

(17,890.34)

(4,859.44)

699.45

MICROSOFT CORP

MECHELOAO

MSFT

MTL

1,145.000

176.000

32,735.55

12,138.70

32,420.03

13,344.43

(315.52)

1,205.73

MTN GROUP LTD

NATIONAL BK GREECE S A

NET SERVICOS DE COMUNICACA

JSC MINING & SMELTING SP

NOKIA CORP SPONSORED ADR

NESTLE S A SPONSORED ADR

NEW YORK & CO INC

NEXEN INC

NYSE EURONEXT

OMNICARE INC

MTNOY

NBG

NETC

NILSY

NOK

NSRGY

NWY

NXY

NYX

OCR

1,007.000

1,239.000

665.000

1,277.000

221.000

1,115.000

410.000

415.000

380.000

19,432.83

0.49

15,563.88

19,243.32

44,390.00

22,018.92

16,721.99

12,445.22

32.822.77

12,761.84

19,656.96

0.38

14,203.41

19,043.29

40,187.15

28,134.99

4,815.62

16,086.95

26,207.72

6,293.79

224.13

(0.11)

(1,360.47)

(200.03)

(4,202.85)

6,116.07

(11,906.37)

3,641.73

(6,615.05)

(6,468.05)

OEST ELEKTRIZATS SPON ADR

GAZPROM OAO SPONS ADR

ORACLE CORP

OCCIDENTAL PETROLEUM CORP-DEL

SOUTHERN COPPER CORP DEL

OEZVY

OGZPY

ORCL

OXY

PCU

1,235.000

224.000

980.000

514.000

106.000

18,074.10

9,197.31

19,110.60

39,889.32

6,819.70

19,211.84

13,063.94

18,665.57

38,850.21

6,017.38

1,137.74

3,866.63

(445.03)

(1,039.11)

(802.32)

(1,637.94)

quantity

Cost Basis

Net Proceeds

Gain/Loss

$925.24

485.49

PERDIGAO SA SPONS ADR

PDA

134.000

7,316.14

5,678.20

PEPSICO INC

PEP

49.000

2,798.33

2,737.77

(60.56)

PROCTER & GAMBLE CO

PHILLIPPINE LONG DISTANCE

PROMISE CO LTD-UNSPON ADR

PG

PHI

PMSEY

94.000

156.000

1,030.000

6,692.14

8,318.33

17,901.81

5,954.42

10,776.04

14,647.61

(737.72)

2,457.71

(3,254.20)

THRIVE FOUNDATION FOR YOUTH

94-3382864

C/,

Z

Description

Symbol/CUSIP

POTASH CORP SASK INCPILGRIMS PRIDE CORP

POT

PPC

PETROCHINA CO LTD ADR

QUALCOMM INC

TRANSOCEAN INC

RESEARCH IN MOTION LTD-CAD

COMPANHIA VALE DI RIO ADR

PTR

QCOM

RIG

RIMM

RIO

Quantity

Cost Basis

Net Proceeds

Gain/Loss

177.000

760.000

$19,683.52

18.971.25

$27,329.37

17,629.29

$7,645.85

(1,341.96)

190.000

181.000

325.000

170.000

2.479.000

26,529.51

8,726.24

44,269.79

16,807.16

78,349.53

25,884.06

6,716.11

38,887.28

14,831.11

73,117.36

(645.45)

(2,010.13)

(5,382.51)

(1,976.05)

(5,232.17)

RELIANCE INDS LTD GLOBAL

RLNIY

11.000

1,121.21

1,154.45

33.24

BANCO SANTANDER-CHILE-CLP

SAN

85.000

3,366.92

2,975.12

(391.80)

STATE BANK OF INDIA-INR

SBKFF

141.000

16,332.35

15,840.33

(492.02)

SOCIETE GENERALE SPON ADR

SCGLY

1,530.000

25,140.98

30,174.16

5,033.18

SHINHAN FINANCIAL GRP CO

SK TELECOM LTD SPON ADR

SCHLUMBERGER LTD

STERLITE INDUSTRIES INDIA

CHINA PETROLEUM&CHEM ADR

SHG

SKM

SLB

SLT

SNP

180.000

718.000

1,036.000

106.000

287.000

19,378.80

15,615.90

95,861.70

1,948.36

28,932.42

7,200.32

15,343.12

78,116.61

2,758.14

26,475.63

(12,178.48)

(272.78)

(17,745.09)

809.78

(2,456.79)

SOHU.COM INC

SOHU

168.000

7,817.89

11,738.24

SILICONWARE PRECISION INDS

SPIL

0.80

0.62

(0.18)

SASOL LTD SPONS ADR

SSL

236.000

12,763.25

12,843.72

80.47

SUNTRUST BANKS INC

STATOILHYDRO ASA SPONS

SUN HUNG KAI PPTYS LTD

STRYKER CORP

STI

STO

SUHJY

SYK

85.000

1,310.000

1,461.000

272.000

3,259.83

35,722.85

27,675.17

19,602.74

3,764.30

45,084.65

25,733.64

16,858.89

504.47

9,361.80

(1,941.53)

(2,743.85)

AT&T INC

TARGET CORP

TURKCELL ILETISM HIZMET

T

TGT

TKC

1,010.000

74.000

3,070.000

41,634.55

4,058.76

59,236.38

34,618.58

3,246.80

65,108.20

(7,015.97)

(811.96)

5,871.82

PTTELEKOMUNAKASI

TRAVELERS COMPANIES INC

TLK

TRV

1,004.000

635.000

45,229.16

33,260.47

39,746.05

32,049.60

(5,483.11)

(1,210.87)

-

3,920.35

THRIVE FOUNDATION FOR YOUTH

94-3382864

co

I

m

K

m

z

v

Description

Symbol/CUSIP

TENARIS S A

TAIWAN SEMICONDUCTOR MFG

TS

TSM

Quantity

469.000

604.000

Cost Basis

Net Proceeds

Gain/Loss

$19,771.55

6,247.36

$17,365.85

6,072.61

($2,405.70)

(174.75)

TIM PARTICIPACOES S A-BRL

TSU

142.000

4,123.91

2,396.40

(1,727.51)

TATA MOTORS LTD

ISHARES MSCI TURKEY

TIM

TUR

691.000

210.000

12,171.97

8,995.81

6,752.14

5,096.11

(5,419.83)

(3,899.70)

GRUPO TELEVISA SA DE CV

UBS AG (NEW)

TV

UBS

1,086.000

608.000

27,371.19

32,083.20

24,168.61

18,708.52

(3,202.58)

(13,374.68)

UNITEDHEALTH GROUP INC

UNION PACIFIC CORP

UPM KYMMENE CORP SPN ADR

UNH

UNP

UPMKY

504.000

189.000

1,300.000

24,907.68

18,428.01

26,286.35

24,148.18

20,149.51

20,392.99

(759.50)

1,721.50

(5,893.36)

UNITED PARCEL SERVICE CL B

UPS

331.000

23,912.31

23,006.65

(905.66)

URALKALI JSC SPONSORED

UNITED TECHNOLOGIES CORP

UNITED UTILS GROUP PLC-GBP

VIVO PARTICIPACOES SA ADR

WACHOVIA CORP 2ND NEW

WIMM-BILL-DANN FOODS OJSC

WESCO INTERNATIONAL INC

WEATHERFORD INTL LTD NEW

WELLPOINT INC

WAL-MART STORES INC

URALL

UTX

UUGRY

VIV

WB

WBD

WCC

WFT

WLP

WMT

618.000

441.000

749.000

465.000

70.000

380.000

307.000

290.000

720.000

11,241.09

33,892.62

3.02

3,680.79

7,883.28

7,346.18