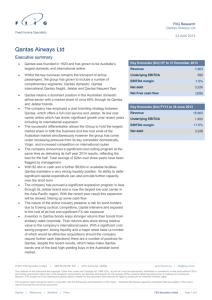

Qantas investor day presentation

advertisement