- Mentor Education

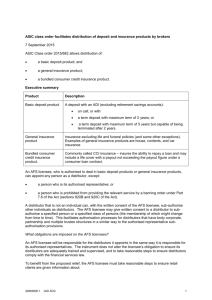

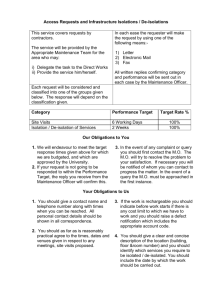

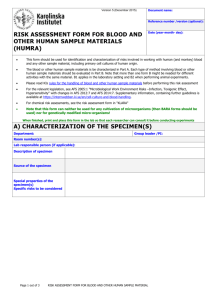

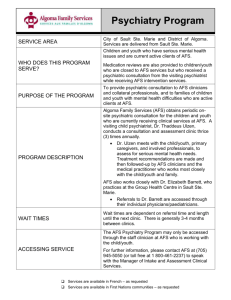

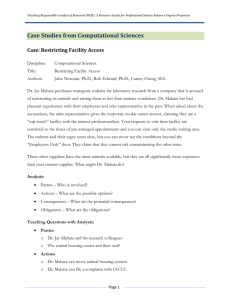

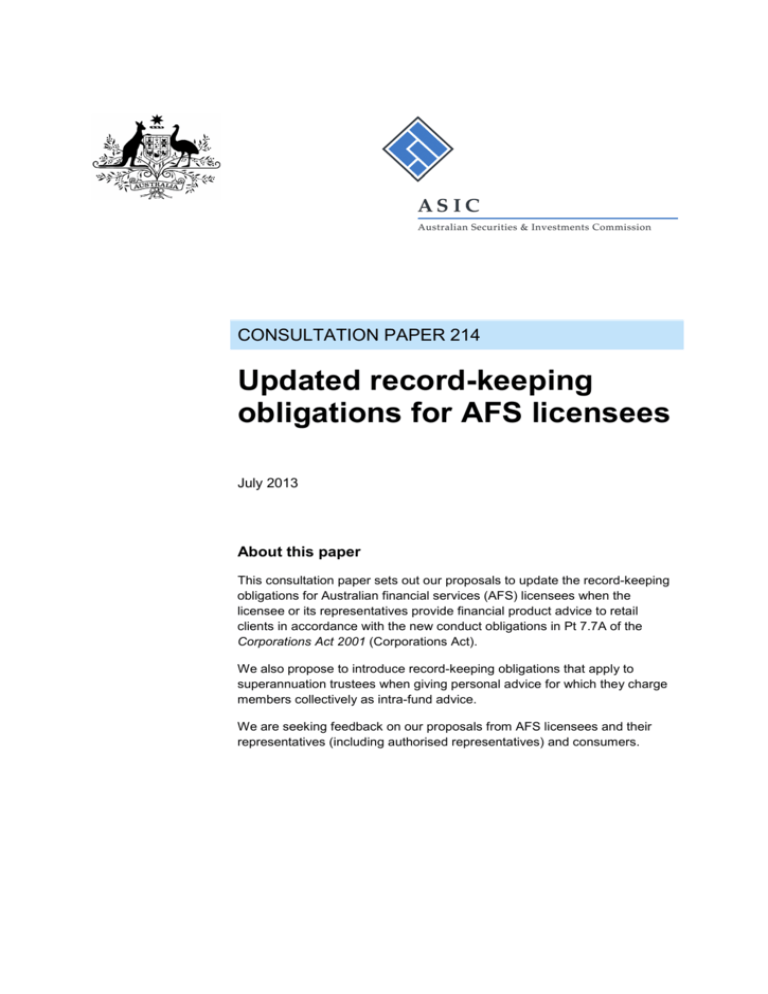

advertisement