Nuclear Energy Profits

Special Report

Power-Packed Nuclear Energy Profits with Beryllium Technology

One of the rarest metals in the world is gaining attention for its potential to change the face of nuclear

energy.

It’s called beryllium, and just fifty or so years after it became commercially available, one company that

produces the material is ready to reap massive profits from the nuclear energy renaissance that's upon

us.

I'll tell you about that company in just a moment…

But first, you have to understand that this isn't some random idea in a lab somewhere.

Beryllium is actively being tested right now in next-generation nuclear reactors like the Advanced Test

Reactor in Idaho and the High Flux Isotope Reactor at Oak Ridge, Tennessee.

And internationally, beryllium is being used in test reactors in Poland and Belgium; it is one of the atomic

energy components the international community is trying to keep out of Iran’s hands.

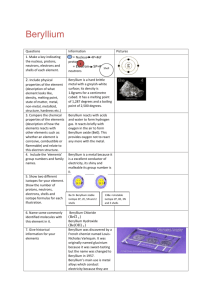

So why beryllium?

Smaller, Cooler, Lighter

Beryllium isn’t only used in nuclear power.

It’s also part of NASA’s Space Shuttles, where its status as one of the lightest metals on earth gives it

great value beyond the stratosphere.

And in the types of nuclear test reactors where we’re talking about beryllium being used, size and weight

matter a great deal, too.

Now I'll try to make sure this doesn't read like some over-the-top science lesson… But it's important for us

as investors to fully understand the basics of the beryllium advantage.

You see, beryllium is much lighter than its main rival in reactor construction, graphite…

It's also great for keeping neutrons from bouncing around too much inside reactors.

How does keeping those tiny particles calm help nuclear power plants operate?

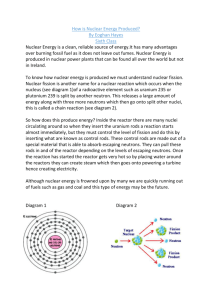

Well, to keep up the fission that makes a nuclear power plant more than just hunks of glowing material

and cooling towers, fast neutrons need to be slowed down.

As those fast neutrons settle with the help of beryllium, they become part of the chain reactions that make

nuclear power happen.

Beryllium competes with graphite and water, but industrially-processed beryllium has the added

advantage of also being able to reflect neutrons.

As a reflector, beryllium has the effect of maximizing the energy in reactor cores. Just as computer

microchips have gotten smaller through efficiency improvements, beryllium could shrink the size of the

average nuclear reactor core.

Smaller reactor cores mean fewer resources will be needed to churn out more energy.

Add those benefits to the fact that nuclear is a carbon-free energy technology, and beryllium is clearly a

critical component in reducing the environmental footprint of countries with major electrical power needs.

That’s why nuclear power plant developers like France’s Areva are looking to beryllium to boost efficiency

by up to 10% -- and replacing uranium with such a kick to energy output is worth paying for.

This is revolutionary stuff, my friend. And in order to get a piece of this action, you need to buy into the

companies producing beryllium.

IBC Advanced Alloys Corp. (TSX-V: IB)

IBC Advanced Alloys Corp. is a Vancouver-based public company that specializes in mining and

production of rare metals and related materials. The company’s shares trade on the TSX Venture

exchange under the ticker symbol IB.

With properties in Colorado and Utah in the United States and in Brazil, IBC mines beryllium for

production of copper-beryllium alloys that can be used in nuclear power applications, automotive parts,

aeronautics, and telecommunications.

Beryllium copper is strong, easy to form into different shapes, and it conducts electricity and heat better

than copper alone.

IBC has integrated its mining operations in with two wholly-owned market-oriented manufacturing

divisions based in the U.S.:

Freedom Alloys, Inc.

Nonferrous Products, Inc.

IBC’s ability to quickly crank out custom-made alloys that can be used in power plants, cars, phones, and

satellites gives it a major leg up on competitors that may be locked into just a few primary beryllium alloy

products.

For more updates and new developments on other alternative energy innovations and opportunities, stay

tuned to Green Chip Stocks .

You can view the HTML version here: Nuclear Energy Profits

Green Chip Review , Copyright © Angel Publishing LLC . All rights reserved. The content of this site may not be redistributed

without the express written consent of Angel Publishing. Individual editorials, articles and essays appearing on this site may be

republished, but only with full attribution of both the author and Green Chip Review as well as a link to

www.greenchipstocks.com. Your privacy is important to us -- we will never rent or sell your e-mail or personal information. No

statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to

buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no

way represent or guarantee the accuracy of the statements made herein. Green Chip Review does not provide individual

investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or

investment. The publisher, editors and consultants of Angel Publishing may actively trade in the investments discussed in this

publication. They may have substantial positions in the securities recommended and may increase or decrease such positions

without notice. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this

publication as offering personalized legal or investment counseling. Investments recommended in this publication should be

made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the

company in question.