Wooldridge, Jeffrey. 2003. Introductory Econometrics

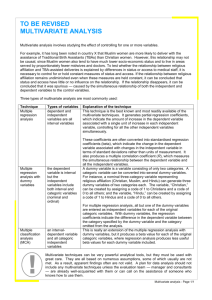

advertisement