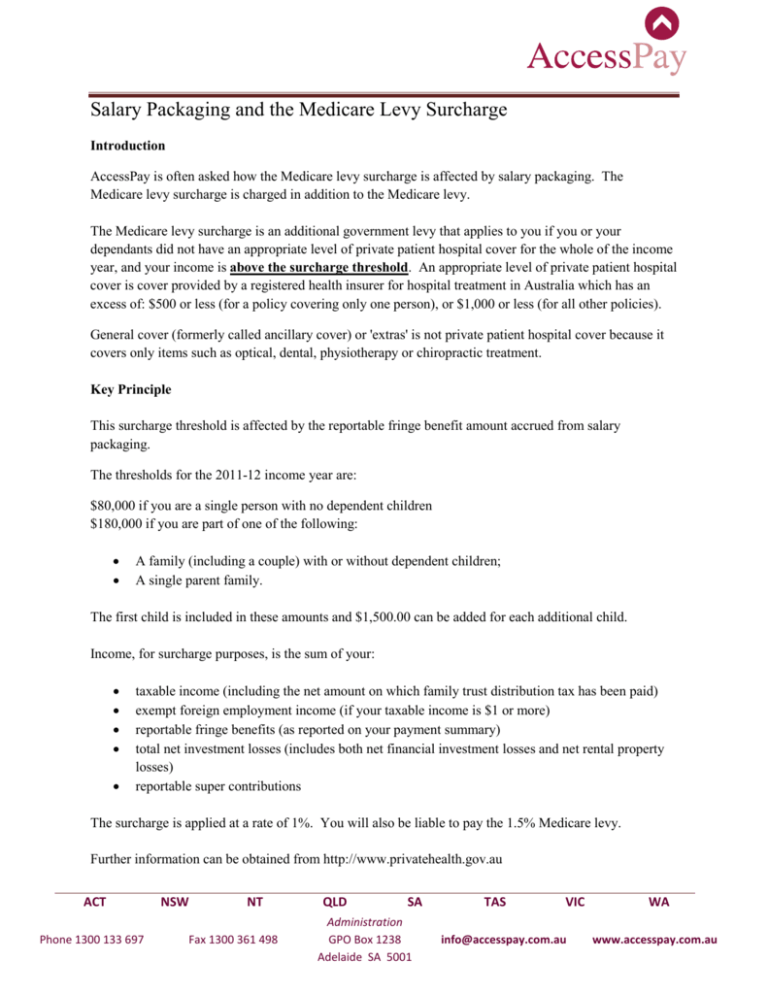

Salary Packaging and the Medicare Levy Surcharge

advertisement

Salary Packaging and the Medicare Levy Surcharge Introduction AccessPay is often asked how the Medicare levy surcharge is affected by salary packaging. The Medicare levy surcharge is charged in addition to the Medicare levy. The Medicare levy surcharge is an additional government levy that applies to you if you or your dependants did not have an appropriate level of private patient hospital cover for the whole of the income year, and your income is above the surcharge threshold. An appropriate level of private patient hospital cover is cover provided by a registered health insurer for hospital treatment in Australia which has an excess of: $500 or less (for a policy covering only one person), or $1,000 or less (for all other policies). General cover (formerly called ancillary cover) or 'extras' is not private patient hospital cover because it covers only items such as optical, dental, physiotherapy or chiropractic treatment. Key Principle This surcharge threshold is affected by the reportable fringe benefit amount accrued from salary packaging. The thresholds for the 2011-12 income year are: $80,000 if you are a single person with no dependent children $180,000 if you are part of one of the following: • • A family (including a couple) with or without dependent children; A single parent family. The first child is included in these amounts and $1,500.00 can be added for each additional child. Income, for surcharge purposes, is the sum of your: • • • • • taxable income (including the net amount on which family trust distribution tax has been paid) exempt foreign employment income (if your taxable income is $1 or more) reportable fringe benefits (as reported on your payment summary) total net investment losses (includes both net financial investment losses and net rental property losses) reportable super contributions The surcharge is applied at a rate of 1%. You will also be liable to pay the 1.5% Medicare levy. Further information can be obtained from http://www.privatehealth.gov.au ACT Phone 1300 133 697 NSW NT Fax 1300 361 498 QLD SA Administration GPO Box 1238 Adelaide SA 5001 TAS VIC info@accesspay.com.au WA www.accesspay.com.au Salary Packaging and the Medicare Levy Surcharge Example For the 2011-12 income year, Jo has a taxable income of $90,000 and reportable fringe benefits amount of $30,000. Lee, Jo's spouse, has a taxable income of $55,000 and reportable employer super contributions of $15,000. As income for surcharge purposes includes reportable fringe benefits and reportable super contributions, their total family income for surcharge purposes is $190,000. Neither Jo nor Lee has private patient hospital insurance. The couple's family threshold for the surcharge is $180,000. If Jo's reportable fringe benefits had not been taken into account, their combined income for surcharge purposes would have been $160,000 and they would not have had to pay the Medicare levy surcharge. If Lee's reportable employer super contributions had not been taken into account, their combined income for surcharge purposes would have been $175,000 and they would not have had to pay the Medicare levy surcharge. However, with the reportable fringe benefits and the reportable employer super contributions, their family income exceeds the surcharge threshold and they are both liable to pay the Medicare levy surcharge. This means: • • Jo has to pay a surcharge of $1,200 - that is, 1% of $120,000 Lee has to pay a surcharge of $700 - that is, 1% of $70,000. Although reportable employer super contributions are included in calculating the Medicare levy surcharge threshold, the actual surcharge is only applied to taxable income, any applicable reportable fringe benefits and any amount on which family trust distribution tax has been paid. ACT Phone 1300 133 697 NSW NT Fax 1300 361 498 QLD SA Administration GPO Box 1238 Adelaide SA 5001 TAS VIC info@accesspay.com.au WA www.accesspay.com.au