Ansoff Matrix & Portfolio Analysis: Marketing Strategies

advertisement

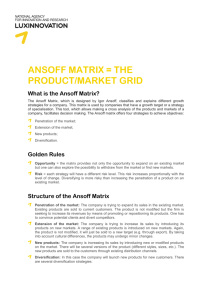

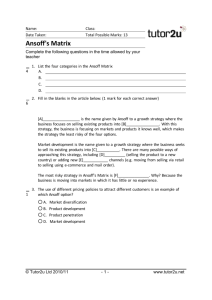

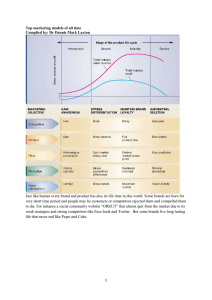

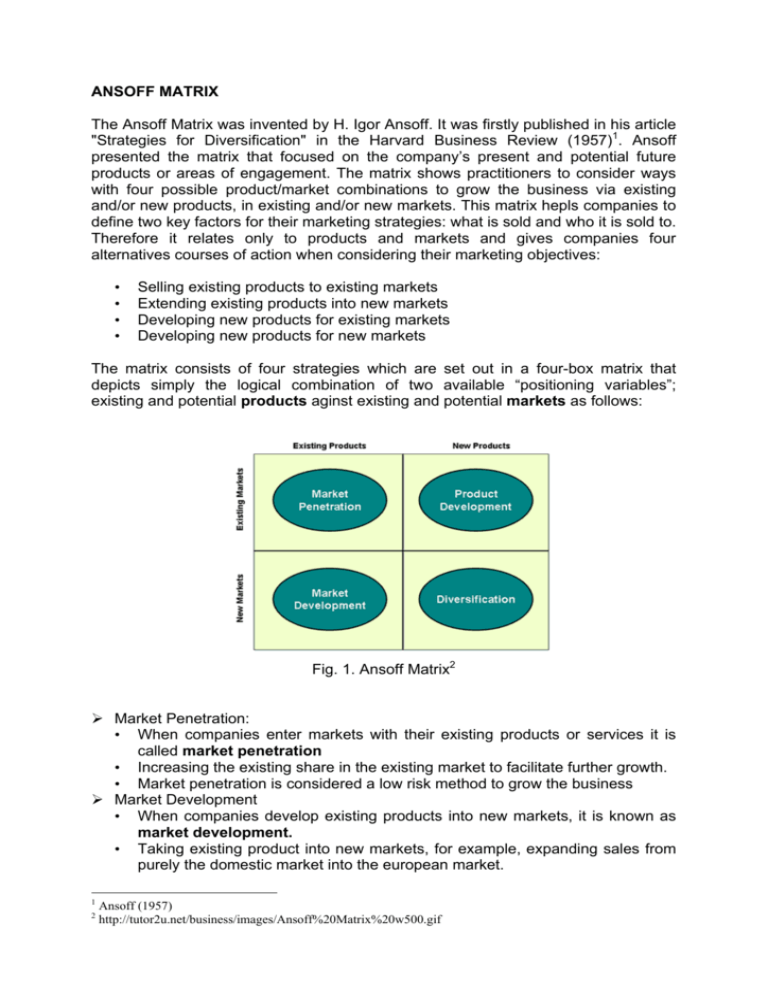

ANSOFF MATRIX The Ansoff Matrix was invented by H. Igor Ansoff. It was firstly published in his article "Strategies for Diversification" in the Harvard Business Review (1957)1. Ansoff presented the matrix that focused on the company’s present and potential future products or areas of engagement. The matrix shows practitioners to consider ways with four possible product/market combinations to grow the business via existing and/or new products, in existing and/or new markets. This matrix hepls companies to define two key factors for their marketing strategies: what is sold and who it is sold to. Therefore it relates only to products and markets and gives companies four alternatives courses of action when considering their marketing objectives: • • • • Selling existing products to existing markets Extending existing products into new markets Developing new products for existing markets Developing new products for new markets The matrix consists of four strategies which are set out in a four-box matrix that depicts simply the logical combination of two available “positioning variables”; existing and potential products aginst existing and potential markets as follows: Fig. 1. Ansoff Matrix2 ¾ Market Penetration: • When companies enter markets with their existing products or services it is called market penetration • Increasing the existing share in the existing market to facilitate further growth. • Market penetration is considered a low risk method to grow the business ¾ Market Development • When companies develop existing products into new markets, it is known as market development. • Taking existing product into new markets, for example, expanding sales from purely the domestic market into the european market. 1 2 Ansoff (1957) http://tutor2u.net/business/images/Ansoff%20Matrix%20w500.gif The product can also be targeted to anther customer segment. Either way, both strategies can lead to additional earnings for the business ¾ Product Development • Companies develop new products in existing markets. This is called product development. • Offering new products or modifying existing products into the existing markets. ¾ Diversification • An organization that introduces new products into new markets has chosen a strategy of diversification. • Either with related products and markets or unreleated products that are totally unconnected with the existing products and markets. • Related diversification describes how companies stay in a market with which they have some familiarity. • Brand new products may also be created in an attempt to leverage the company's brand name • Portfolio Analysis3 The portfolio analysis is a tool that helps to analyze the current business portfolio and its future possibilities in the market environment. A good portfolio reflects the strengths of the company. The tools help to decide which products should receive further investment and which products should be eliminated from our portfolio. Usually, there are two dimensions to describe the portfolios. On the one axis, there is the attractiveness of the market and on the other one the ability of products to compete on the target market. Today, two different models are present in the scientific society. One model was developed by the Boston Consulting Group (BCG) while the other one was developed by McKinsey. Figure 2: : Portfolio-matrix of the Boston Consulting Group4 3 4 by analogy with:Tutor2u (2010) and Haberfellner (2009) Bartscher, Bomke, p. 276 The BCG portfolio matrix distinguishes between 4 different fields – dogs, cash cows, babies, and stars. Dogs refer to products with low market share and low growth, so this products should only be kept in the portfolio if they still produce profit. Cash Cows are not attractive on the market so we should not invest in these products. But companies are going to keep them in there portfolio as long as some profit is possible. Babies are attractive on the market so further investment can lead to future earnings. But there might be some risk addicted to these products. The stars should be the main business of a company and earn the highest profit. It is advisable to invest in these products. Figure 3: Different fields of action in the portfolio matrix5 The portfolio matrix of McKinsey is seperated into nine fields. The recommended strategies are quite similar to the strategies recommended by the BCG. The main strategies are draw back, extension and milking. Draw back and extension are self describing. The extension with the questionmark simply says that an extension involves both risk and chance of success and has to be questioned seperately. The term milking stands for capitalizing products of low attractivity and high market share as long as profitable. 5 Haberfellner (2009) REFERENCES Ansoff, I.: Strategies for Diversification, Harvard Business Review, Vol. 35 Issue 5, Sep-Oct 1957, pp. 113-124. Stone, P.: Make marketing work for you: boost your profits with proven marketing techniques, How to Books Ltd, UK, 2001. Mercer, D.: Marketing, Blackwell Publishers Inc, 2001. Bartscher, S. / Bomke, P.: Einführung in die Unternehmenspolitik; Schäffer Poeschel, 1993 Tutor2u, strategy - portfolio analysis - ge matrix, URL: http://tutor2u.net/business/strategy/ge_matrix.htm, visited March 22, 2010 Haberfellner, R.: General Management and Organization Lecture Notes, Institute for General Management and Organization, Graz University of Technology, 2009