Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 70

Chapter 5: Adjustments and the Worksheet

Chapter Opener: Thinking Critically

Students should suggest that accountants estimate the amount of wear and tear on the equipment. This

expense should be charged against the income earned during that same period. The concept of adjustments

and depreciation can be introduced at this time.

Fast Facts

• William Boeing founded Pacific Aero Products Company in 1916; the name was changed to Boeing in

1917.

• In 1917 the company employed 28 people. In 2004 Boeing employed more than 159,000 people in

48 U.S. states and 67 foreign countries.

• Boeing is the largest contractor working for NASA.

• Along with the ISS, the Boeing Company manufactures and services commercial airplanes, military

aircraft, helicopters, a variety of electronic defense systems, and advanced communication systems.

• Boeing’s newest division, Connexion, equips aircraft with a broadband connection that provides highspeed access to the Internet, entertainment and television—all in real-time.

• Boeing’s 2004 sales were $52.5 billion from customers in 145 countries. International sales accounted for

nearly 30 percent of total sales.

Computers in Accounting: Thinking Critically

Answers will vary, but students should demonstrate an understanding of the word “integrated” as it applies to

computerized accounting systems. Each accounting module (accounts payable, accounts receivable,

general ledger, fixed asset, etc.) communicates with the others, transferring data, keeping the entire system

in balance.

Computers in Accounting: Internet Application

Students can find information at www.accubooks.com. Reports will vary. The Accu-Books general ledger

module provides the following features: produces financial reports, offers customizable chart of accounts,

and provides easy-to-use forms for journal entries.

Managerial Implications: Thinking Critically

Adjustments ensure that the financial statements reflect the true condition and performance of the business.

Discussion Questions

These questions are designed to check students’ understanding of new terms, concepts, and procedures

presented in the chapter.

1. Debit Depreciation Expense – Machine, $125; Credit Accum. Depr. – Machine, $125

2. Debit Insurance Expense; credit Prepaid Insurance.

3. Expense items that are acquired and paid for in advance of their use. Supplies, prepaid rent, prepaid

insurance, and advertising.

4. Update supplies accounts at the end of a period to reflect amounts used.

5. b, d, f, g, and i are depreciated.

6. a. none b. none c. none d. decrease

7. a. decrease b. none c. none d. decrease

8. To create a permanent record of any changes in account balances that are shown on the worksheet.

9. Asset cost, accumulated depreciation, book value.

10. Contra asset accounts have a credit balance. Asset accounts have a debit balance.

11. Cost of asset less accumulated depreciation.

12. To keep a record of total depreciation taken; to reduce the book value of asset.

13. Charges off an equal amount of cost of asset during each accounting period in asset’s useful life.

14. Equipment, buildings, and automobiles.

70 䡲 Chapter 5

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 71

Exercises

Exercise 5.1

1. Rent Expense, $1,500 Dr.

Prepaid Rent, $1,500 Cr.

($9,000 ⫼ 6 months = $1,500 per month)

2. Supplies Expense, $1,475 Dr.

Supplies, $1,475 Cr.

($2,375 – $900 = $1,475)

3. Depreciation Expense—Equipment, $225 Dr.

Accumulated Depreciation—Equipment, $225 Cr.

($27,000 ⫼ 120 months = $225)

Exercise 5.2

1. Insurance Expense, $250 Dr.

Prepaid Insurance, $250 Cr.

($6,000 ⫼ 24 months = $250 month)

2. Advertising Expense, $450 Dr.

Prepaid Advertising, $450 Cr.

($5,400 ⫼ 12 months = $450)

Exercise 5.3

Mason Company

Worksheet (Partial)

Month Ended January 31, 2007

Trial Balance

Account Name

Debit

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accumulated Depr.—Equipment

Accounts Payable

Jerry Mason, Capital

Fees Income

Rent Expense

Salaries Expense

Supplies Expense

Insurance Expense

Depreciation Expense—Equipment

62,000

21,500

8,000

7,200

90,500

Totals

Credit

Adjustments

Debit

Credit

(a) 5,200

(b) 1,800

Adjusted

Trial Balance

Debit

62,000

21,500

2,800

5,400

90,500

(c) 1,575

1,575

15,700

80,950

112,000

15,700

80,950

112,000

9,600

9,850

9,600

9,850

5,200

1,800

1,575

(a) 5,200

(b) 1,800

(c) 1,575

208,650

208,650

8,575

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Credit

8,575

210,225

210,225

Chapter 5 䡲 71

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 72

Exercise 5.4

Net Income Before Adjustments . . . . . . . . . .

Less Adjustments:

Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . $3,000

Depreciation Expense . . . . . . . . . . . . . . . . . . 3,600

Supplies Expense . . . . . . . . . . . . . . . . . . . . . 1,300

$40,000

Total Adjustments for Expenses Not Made . .

7,900

Corrected Net Income . . . . . . . . . . . . . . . . . .

$32,100

If the adjusting entries are not made, total expenses will be understated by $7,900 and net income will be

overstated by $7,900.

Exercise 5.5

GENERAL JOURNAL

PAGE 3

Description

Post.

Ref.

Supplies Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation Expense—Equipment . . . . . . . . . . . . . . . .

Accumulated Depreciation—Equipment . . . . . . . . . . .

523

121

521

131

517

142

Date

Debit

Credit

Adjusting Entries

2007

Dec. 31

31

31

72 䡲 Chapter 5

2,500

2,500

1,800

1,800

1,200

1,200

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 73

GENERAL LEDGER

ACCOUNT

Date

2007

Dec. 1

31

Description

Adjusting

ACCOUNT

Date

2007

Dec. 1

31

Adjusting

Date

Adjusting

Date

2007

Dec. 31

Adjusting

Date

2007

Dec. 31

Date

2007

Dec. 31

J1

J3

4,000

2,500

Adjusting

Debit

J1

J3

Post.

Ref.

10,800

1,800

J3

Post.

Ref.

J3

Adjusting

10,800

9,000

ACCOUNT NO.

Debit

1,200

ACCOUNT NO.

Credit

1,200

J3

Debit

1,200

Credit

1,800

J3

Debit

521

Balance

Debit

Credit

1,800

ACCOUNT NO.

Post.

Ref.

517

Balance

Debit

Credit

ACCOUNT NO.

Post.

Ref.

142

Balance

Debit

Credit

Credit

1,200

Debit

131

Balance

Debit

Credit

Credit

Supplies Expense

Description

4,000

1,500

ACCOUNT NO.

Post.

Ref.

121

Balance

Debit

Credit

Credit

Insurance Expense

Description

ACCOUNT

Debit

Depreciation Expense—Equipment

Description

ACCOUNT

Post.

Ref.

Accumulated Depreciation—Equipment

Description

ACCOUNT

ACCOUNT NO.

Prepaid Insurance

Description

ACCOUNT

2007

Dec. 31

Supplies

Credit

2,500

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

523

Balance

Debit

Credit

2,500

Chapter 5 䡲 73

74 䡲 Chapter 5

95,000

95,000

25,800

6,200

63,000

11,050

(a) 8,000

(c) 550

(b) 2,500

Debit

550

11,050

(c)

(a) 8,000

(b) 2,500

Credit

Analyze: The adjustment to Prepaid Insurance decreased the account balance.

Totals

Net Income

800

7,800

3,600

26,000

5,200

9,600

15,000

27,000

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accumulated Dep.—Equipment

Accounts Payable

Julie Denton, Capital

Julie Denton, Drawing

Fees Income

Depreciation Expense—Equipment

Insurance Expense

Salaries Expense

Supplies Expense

Utilities Expense

Credit

Adjustments

95,550

550

2,500

7,800

8,000

800

3,600

26,000

5,200

1,600

12,500

27,000

Debit

95,550

25,800

550

6,200

63,000

Credit

Adjusted

Trial Balance

25,800

25,800

25,800

25,800

Credit

19,650

6,150

550

2,500

7,800

8,000

800

Debit

Income

Statement

75,900

75,900

3,600

26,000

5,200

1,600

12,500

27,000

Debit

75,900

69,750

6,150

550

6,200

63,000

Credit

Balance Sheet

2:40 PM

Debit

Trial Balance

DENTON COMPANY

Worksheet

Month Ended January 31,2007

10/26/05

Account Name

Problem 5.1A

Problems

Price_SM_ch05.qxd

Page 74

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

90,837

450

7,500

90,837

42,000

8,000

40,837

Credit

6,100

(a) 2,400

(c) 700

(b) 3,000

Debit

6,100

(c) 700

(a) 2,400

(b) 3,000

Credit

91,537

700

3,000

7,500

2,400

450

3,000

22,575

3,312

3,600

18,000

27,000

Debit

91,537

42,000

700

8,000

40,837

Credit

Adjusted

Trial Balance

Credit

Income

Statement

Debit

Analyze: The balance of the Prepaid Rent account prior to the adjusting entry for expired rent is $21,000.

Totals

22,575

3,312

6,000

21,000

27,000

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Accumulated Depreciation—Equip.

Accounts Payable

Chuck Keen, Capital

Chuck Keen, Capital, Drawing

Fees Income

Depreciation Expense—Equip.

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

3,000

Debit

Adjustments

Debit

Credit

Balance Sheet

2:40 PM

Trial Balance

CAMPUS BOOK STORE

Worksheet

Month Ended November 30, 2007

10/26/05

Account Name

Problem 5.2A

Price_SM_ch05.qxd

Page 75

Chapter 5 䡲 75

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 76

Problem 5.3A

OXNARD CORPORATION

Income Statement

Month Ended December 31, 2007

Revenue

Fees Income . . . . . . . . . . . . . . . . . . . . . .

Expenses

Salaries Expense . . . . . . . . . . . . . . . . . .

Utilities Expense . . . . . . . . . . . . . . . . . . .

Supplies Expense . . . . . . . . . . . . . . . . . .

Advertising Expense . . . . . . . . . . . . . . . .

Depreciation Expense—Equipment . . . .

39,750

8,400

900

3,000

1,200

600

Total Expenses . . . . . . . . . . . . . . . . . .

14,100

Net Income . . . . . . . . . . . . . . . . . . . . . . . . .

25,650

OXNARD CORPORATION

Statement of Owner’s Equity

Month Ended December 31, 2007

Derrick Wells, Capital, December 1, 2007 .

Net Income for December . . . . . . . . . . . . .

Less Withdrawals for December . . . . . . . . .

54,000

25,650

3,600

Increase in Capital . . . . . . . . . . . . . . . . . . .

22,050

Derrick Wells, Capital, December 31, 2007

76,050

OXNARD CORPORATION

Balance Sheet

December 31, 2007

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accounts Receivable . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . .

Equipment . . . . . . . . . . . . . . . . . . . . . . . . .

Less Accumulated Depreciation . . . . . . . . .

38,600

6,000

2,050

6,000

30,000

600

Total Assets . . . . . . . . . . . . . . . . . . . . . . . .

29,400

82,050

Liabilities & Owner’s Equity

Liabilities

Accounts Payable . . . . . . . . . . . . . . . . . .

Owner’s Equity

Derrick Wells, Capital . . . . . . . . . . . . . . .

76,050

Total Liabilities & Owner’s Equity . . . . . . . .

82,050

6,000

Analyze: Net income would be $24,450.

76 䡲 Chapter 5

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Net Income

Totals

61,575

700

4,850

3,500

17,750

6,300

3,875

4,200

9,600

10,800

Cash

Accounts Receivable

Supplies

Prepaid Advertising

Prepaid Rent

Equipment

Accumulated Depreciation—Equip.

Accounts Payable

Carlos Ramon, Capital

Carlos Ramon, Drawing

Fees Income

Advertising Expense

Depreciation Expense—Equipment

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

61,575

23,800

7,775

30,000

Credit

5,265

(a) 3,325

(b) 1,050

(d)

90

(c) 800

Debit

(d)

5,265

90

(a) 3,325

(b) 1,050

(c) 800

Credit

Adjustments

61,665

1,050

90

800

4,850

3,325

700

3,500

17,750

6,300

550

3,150

8,800

10,800

Debit

61,665

23,800

90

7,775

30,000

Credit

Adjusted

Trial Balance

50,850

50,850

23,800

37,865

90

7,775

30,000

Credit

23,800

50,850

3,500

17,750

6,300

550

3,150

8,800

10,800

Debit

12,985

23,800

23,800

Credit

Balance Sheet

12,985

10,815

1,050

90

800

4,850

3,325

700

Debit

Income

Statement

2:40 PM

Debit

Trial Balance

RAMON CREATIVE DESIGNS

Worksheet

Month Ended January 31, 2007

10/26/05

Account Name

Problem 5.4A

Price_SM_ch05.qxd

Page 77

Chapter 5 䡲 77

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 78

RAMON CREATIVE DESIGNS

Income Statement

Month Ended January 31, 2007

Revenue

Fees Income . . . . . . . . . . . . . . . . . . . . . .

Expenses

Salaries Expense . . . . . . . . . . . . . . . . . .

Utilities Expense . . . . . . . . . . . . . . . . . . .

Supplies Expense . . . . . . . . . . . . . . . . . .

Advertising Expense . . . . . . . . . . . . . . . .

Rent Expense . . . . . . . . . . . . . . . . . . . . .

Depreciation Expense—Equipment . . . .

23,800

4,850

700

3,325

1,050

800

90

Total Expenses . . . . . . . . . . . . . . . . . .

10,815

Net Income . . . . . . . . . . . . . . . . . . . . . . . . .

12,985

RAMON CREATIVE DESIGNS

Statement of Owner’s Equity

Month Ended January 31, 2007

Carlos Ramon, Capital, January 1, 2007 . .

Net Income for January . . . . . . . . . . . . . . .

Less Withdrawals for January . . . . . . . . . .

30,000

12,985

3,500

Increase in Capital . . . . . . . . . . . . . . . . . . .

9,485

Carlos Ramon, Capital, January 31, 2007 .

39,485

RAMON CREATIVE DESIGNS

Balance Sheet

January 31, 2007

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less Accumulated Depreciation—Equipment . . . . .

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17,750

6,300

550

3,150

8,800

10,800

90

10,710

47,260

Liabilities and Owner’s Equity

Liabilities

Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . .

Owner’s Equity

Carlos Ramon, Capital . . . . . . . . . . . . . . . . . . . . .

39,485

Total Liabilities and Owner’s Equity . . . . . . . . . . . . .

47,260

78 䡲 Chapter 5

7,775

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 79

GENERAL JOURNAL

Date

PAGE 3

Post.

Ref.

Description

Adjusting Entries

2007

Jan. 31 Supplies Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31 Advertising Expense . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . . . . . . . . .

31 Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31 Depreciation Expense—Equipment . . . . . . . . . . . . . . . .

Accumulated Depreciation—Equipment . . . . . . . . . . .

517

121

519

130

520

131

523

142

Debit

Credit

3,325

3,325

1,050

1,050

800

800

90

90

GENERAL LEDGER

ACCOUNT

Date

2007

Jan. 1

31

Description

Adjusting

ACCOUNT

Date

2007

Jan. 1

31

Adjusting

Date

Date

2007

Jan. 31

Post.

Ref.

Debit

J1

J3

3,875

3,325

Adjusting

Debit

J1

J3

4,200

1,050

Adjusting

4,200

3,150

ACCOUNT NO.

Post.

Ref.

Debit

J1

J3

Post.

Ref.

800

9,600

8,800

ACCOUNT NO.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

142

Balance

Debit

Credit

Credit

J3

131

Balance

Debit

Credit

Credit

9,600

Debit

130

Balance

Debit

Credit

Credit

Accumulated Depreciation—Equipment

Description

3,875

550

ACCOUNT NO.

Post.

Ref.

121

Balance

Debit

Credit

Credit

Prepaid Rent

Description

ACCOUNT

ACCOUNT NO.

Prepaid Advertising

Description

ACCOUNT

2007

Jan. 1

31

Supplies

90

90

Chapter 5 䡲 79

Price_SM_ch05.qxd

ACCOUNT

10/26/05

Description

Adjusting

ACCOUNT

Description

Adjusting

ACCOUNT

Description

Adjusting

ACCOUNT

J3

Debit

Credit

3,325

Description

Adjusting

Balance

Debit

Credit

ACCOUNT NO.

Post.

Ref.

J3

Debit

Credit

1,050

J3

Debit

Post.

Ref.

1,050

Credit

J3

520

Balance

Debit

Credit

800

800

ACCOUNT NO.

Debit

519

Balance

Debit

Credit

ACCOUNT NO.

Post.

Ref.

517

3,325

Depreciation Expense—Equipment

Date

2007

Jan. 31

Post.

Ref.

Rent Expense

Date

2007

Jan. 31

ACCOUNT NO.

Advertising Expense

Date

2007

Jan. 31

Page 80

Supplies Expense

Date

2007

Jan. 31

2:40 PM

Credit

523

Balance

Debit

Credit

90

90

Analyze: If adjusting entries had not been made, net income would be overstated.

80 䡲 Chapter 5

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

164,500

164,500

54,000

12,000

98,500

5,000

(a) 2,000

(b) 2,000

(c) 1,000

Debit

5,000

(c) 1,000

(a) 2,000

(b) 2,000

Credit

165,500

6,300

1,600

2,000

2,000

1,000

3,000

73,000

6,400

2,200

22,000

46,000

Debit

165,500

54,000

1,000

12,000

98,500

Credit

Adjusted

Trial Balance

Analyze: No depreciation has been recorded for the fiscal period, or any previous fiscal period.

Net Income

Totals

6,300

1,600

3,000

73,000

6,400

4,200

24,000

46,000

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Accumulated Depreciation—Equip.

Accounts Payable

Deloros Argo, Capital

Deloros Argo, Drawing

Fees Income

Salaries Expense

Utilities Expense

Supplies Expense

Rent Expense

Depreciation Expense—Equip.

Credit

Adjustments

152,600

152,600

54,000

111,500

1,000

12,000

98,500

Credit

54,000

152,600

3,000

73,000

6,400

2,200

22,000

46,000

Debit

41,100

54,000

54,000

Credit

Balance Sheet

41,100

12,900

6,300

1,600

2,000

2,000

1,000

Debit

Income

Statement

2:40 PM

Debit

Trial Balance

ARGO COMPANY

Worksheet

Month Ended February 28, 2007

10/26/05

Account Name

Problem 5.1B

Price_SM_ch05.qxd

Page 81

Chapter 5 䡲 81

82 䡲 Chapter 5

91,350

5,400

875

Analyze: Accumulated Depreciation—Equipment

Totals

17,525

4,250

5,200

22,100

33,000

Cash

Accounts Receivable

Supplies

Prepaid Rent

Equipment

Accum. Deprec.—Equip

Accounts Payable

Denise De La Rosa, Capital

Denise De La Rosa, Drawing

Fees Income

Salaries Expense

Utilities Expense

Supplies Expense

Rent Expense

Deprec. Exp.—Equip.

3,000

Debit

91,350

42,850

8,500

40,000

Credit

3,775

(a) 1,800

(b) 1,700

(c) 275

Debit

(c)

3,775

275

(a) 1,800

(b) 1,700

Credit

Adjustments

91,625

5,400

875

1,800

1,700

275

3,000

17,525

4,250

3,400

20,400

33,000

Debit

91,625

42,850

275

8,500

40,000

Credit

Adjusted

Trial Balance

Debit

Credit

Income

Statement

Debit

Credit

Balance Sheet

2:40 PM

Trial Balance

DENISE DE LA ROSA, ATTORNEY-AT-LAW

Worksheet (Partial)

Month Ended November 30, 2007

10/26/05

Account Name

Problem 5.2B

Price_SM_ch05.qxd

Page 82

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 83

Problem 5.3B

ARROW ACCOUNTING SERVICES

Income Statement

Month Ended December 31, 2007

Revenue

Fees Income . . . . . . . . . . . . . . . . . . . . . .

Expenses

Salaries Expense . . . . . . . . . . . . . . . . . .

18,600

Supplies Expense . . . . . . . . . . . . . . . . . .

600

Utilities Expense . . . . . . . . . . . . . . . . . . .

1,080

Rent Expense . . . . . . . . . . . . . . . . . . . . .

3,500

Advertising Expense . . . . . . . . . . . . . . . .

800

Depreciation Expense—Fixtures . . . . . .

300

31,330

Total Expenses . . . . . . . . . . . . . . . . . .

24,880

Net Income . . . . . . . . . . . . . . . . . . . . . . . . .

6,450

ARROW ACCOUNTING SERVICES

Statement of Owner’s Equity

Month Ended December 31, 2007

John Arrow, Capital, December 1, 2007 . . .

Net Income for Year . . . . . . . . . . . . . . . . . .

Less Withdrawals for Year . . . . . . . . . . . . .

30,000

6,450

3,000

Increase in Capital . . . . . . . . . . . . . . . . . . .

3,450

John Arrow, Capital, December 31, 2007 . .

33,450

ARROW ACCOUNTING SERVICES

Balance Sheet

December 31, 2007

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accounts Receivable . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . .

Fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less Accumulated Depreciation . . . . . . . . .

16,950

2,200

900

3,200

18,000

300

Total Assets . . . . . . . . . . . . . . . . . . . . . . . .

17,700

40,950

Liabilities & Owner’s Equity

Liabilities

Accounts Payable . . . . . . . . . . . . . . . . . .

Owner’s Equity

John Arrow, Capital . . . . . . . . . . . . . . . . .

33,450

Total Liabilities & Owner’s Equity . . . . . . . .

40,950

7,500

Analyze: Adjusting entries decreased the assets of the company by $1,700.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 5 䡲 83

84 䡲 Chapter 5

Net Income

Totals

Cash

Accounts Receivable

Supplies

Prepaid Advertising

Prepaid Rent

Equipment

Accumulated Depreciation—Equip.

Accounts Payable

Paul Torres, Capital

Paul Torres, Drawing

Fees Income

Advertising Expense

Depreciation Expense—Equipment

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

72,350

650

3,800

2,000

9,850

3,050

3,800

7,200

18,000

24,000

72,350

36,900

5,400

30,050

Credit

6,000

(a) 2,300

(b) 1,800

(d) 400

(c) 1,500

Debit

(d)

6,000

400

(a) 2,300

(b) 1,800

(c) 1,500

Credit

Adjustments

72,750

1,800

400

1,500

3,800

2,300

650

2,000

9,850

3,050

1,500

5,400

16,500

24,000

Debit

72,750

36,900

400

5,400

30,050

Credit

Adjusted

Trial Balance

62,300

62,300

36,900

35,850

400

5,400

30,050

Credit

36,900

62,300

2,000

9,850

3,050

1,500

5,400

16,500

24,000

Debit

26,450

36,900

36,900

Credit

Balance Sheet

26,450

10,450

1,800

400

1,500

3,800

2,300

650

Debit

Income

Statement

2:40 PM

Debit

Trial Balance

TORRES ESTATE PLANNING AND INVESTMENTS

Worksheet

Month Ended June 30, 2007

10/26/05

Account Name

Problem 5.4B

Price_SM_ch05.qxd

Page 84

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 85

TORRES ESTATE PLANNING AND INVESTMENTS

Income Statement

Month Ended June 30, 2007

Revenue

Fees Income . . . . . . . . . . . . . . . . . . . . . .

36,900

Expenses

Salaries Expense . . . . . . . . . . . . . . . . . .

3,800

Utilities Expense . . . . . . . . . . . . . . . . . . .

650

Supplies Expense . . . . . . . . . . . . . . . . . .

2,300

Advertising Expense . . . . . . . . . . . . . . . .

1,800

Rent Expense . . . . . . . . . . . . . . . . . . . . .

1,500

Depreciation Expense—Equipment . . . .

400

Total Expenses . . . . . . . . . . . . . . . . . .

10,450

Net Income . . . . . . . . . . . . . . . . . . . . . . . . .

26,450

TORRES ESTATE PLANNING AND INVESTMENTS

Statement of Owner’s Equity

Month Ended June 30, 2007

Paul Torres, Capital, June 1, 2007 . . . . . . .

Net Income for June . . . . . . . . . . . . . . . . . .

Less Withdrawals for June . . . . . . . . . . . . .

30,050

26,450

2,000

Increase in Capital . . . . . . . . . . . . . . . . . . .

24,450

Paul Torres, Capital, June 30, 2007 . . . . . .

54,500

TORRES ESTATE PLANNING AND INVESTMENTS

Balance Sheet

June 30, 2007

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accounts Receivable . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . . . . .

Prepaid Rent . . . . . . . . . . . . . . . . . . . . . . . . . . .

Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less Accumulated Depreciation—Equipment . .

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9,850

3,050

1,500

5,400

16,500

24,000

400

23,600

59,900

Liabilities & Owners Equity

Liabilities

Accounts Payable . . . . . . . . . . . . . . . . . . . . .

Owner’s Equity

Paul Torres, Capital . . . . . . . . . . . . . . . . . . . .

54,500

Total Liabilities & Owner’s Equity . . . . . . . . . . .

59,900

5,400

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 5 䡲 85

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 86

GENERAL JOURNAL

PAGE 3

Description

Post.

Ref.

Supplies Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Advertising Expense . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Advertising . . . . . . . . . . . . . . . . . . . . . . . . . .

Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation Expense—Equipment . . . . . . . . . . . . . . . .

Accumulated Depreciation—Equipment . . . . . . . . . . .

517

121

519

130

520

131

523

142

Date

Debit

Credit

Adjusting Entries

2007

Jun. 30

30

30

30

2,300

2,300

1,800

1,800

1,500

1,500

400

400

GENERAL LEDGER

ACCOUNT

Supplies

Date

2007

Jun. 1

30

Description

Adjusting

ACCOUNT

Description

Adjusting

ACCOUNT

Description

Adjusting

ACCOUNT

J1

J3

3,800

2,300

Description

Adjusting

86 䡲 Chapter 5

3,800

1,500

ACCOUNT NO.

Post.

Ref.

Debit

J1

J3

7,200

1,800

Debit

J1

J3

Post.

Ref.

7,200

5,400

J3

131

Balance

Debit

Credit

Credit

18,000

1,500

Debit

130

Balance

Debit

Credit

Credit

ACCOUNT NO.

Post.

Ref.

121

Balance

Debit

Credit

Credit

Accumulated Depreciation—Equipment

Date

2007

Jun. 30

Debit

Prepaid Rent

Date

2007

Jun. 1

30

Post.

Ref.

Prepaid Advertising

Date

2007

Jun. 1

30

ACCOUNT NO.

18,000

16,500

ACCOUNT NO.

Credit

400

142

Balance

Debit

Credit

400

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

ACCOUNT

Date

2007

Jun. 30

Adjusting

Date

Adjusting

Date

Date

2007

Jun. 30

Post.

Ref.

J3

Debit

Credit

2,300

Adjusting

J3

Debit

Credit

1,800

Adjusting

Balance

Debit

Credit

ACCOUNT NO.

Post.

Ref.

J3

Debit

Post.

Ref.

Credit

1,500

J3

520

Balance

Debit

Credit

1,500

ACCOUNT NO.

Debit

519

1,800

Depreciation Expense—Equipment

Description

Balance

Debit

Credit

ACCOUNT NO.

Post.

Ref.

517

2,300

Rent Expense

Description

ACCOUNT

ACCOUNT NO.

Advertising Expense

Description

ACCOUNT

2007

Jun. 30

Supplies Expense

Description

ACCOUNT

2007

Jun. 30

Page 87

Credit

400

523

Balance

Debit

Credit

400

Analyze: Generally accepted accounting principles require that the original cost of the asset appear in the

asset account until the asset has been used up or disposed. A contra asset account is used to record

depreciation costs.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 5 䡲 87

88 䡲 Chapter 5

Net Income

Totals

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accumulated Depreciation—

Equipment

Accounts Payable

Wilson Mandela, Capital

Wilson Mandela, Drawing

Fees Income

Advertising Expense

Rent Expense

Salaries Expense

Supplies Expense

Insurance Expense

Telephone Expense

Utilities Expense

Depreciation Expense

76,925

350

850

1,500

2,500

6,700

2,000

18,475

3,400

2,150

15,000

24,000

76,925

30,925

6,000

40,000

Credit

(c)

3,750

200

(a) 1,050

(b) 2,500

Debit

(c)

3,750

200

(a) 1,050

(b) 2,500

Credit

Adjustments

77,125

1,500

2,500

6,700

1,050

2,500

350

850

200

2,000

18,475

3,400

1,100

12,500

24,000

Debit

77,125

30,925

200

6,000

40,000

Credit

Adjusted

Trial Balance

61,475

61,475

30,925

46,200

200

6,000

40,000

Credit

30,925

61,475

2,000

18,475

3,400

1,100

12,500

24,000

Debit

15 275

30,925

30,925

Credit

Balance Sheet

15 275

15,650

1,500

2,500

6,700

1,050

2,500

350

850

200

Debit

Income

Statement

2:40 PM

Debit

Trial Balance

MANDELA INTERNATIONAL COMPANY

Worksheet

Month Ended January 31, 2007

10/26/05

Account Name

Challenge Problem

Price_SM_ch05.qxd

Page 88

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 89

MANDELA INTERNATIONAL COMPANY

Income Statement

Month Ended January 31, 2007

Revenue

Fees Income . . . . . . . . . . . . . . . . . . . . . .

Expenses

Advertising Expense . . . . . . . . . . . . . . . .

Rent Expense . . . . . . . . . . . . . . . . . . . . .

Salaries Expense . . . . . . . . . . . . . . . . . .

Supplies Expense . . . . . . . . . . . . . . . . . .

Insurance Expense . . . . . . . . . . . . . . . . .

Telephone Expense . . . . . . . . . . . . . . . .

Utilities Expense . . . . . . . . . . . . . . . . . . .

Depreciation Expense . . . . . . . . . . . . . . .

30,925

1,500

2,500

6,700

1,050

2,500

350

850

200

Total Expenses . . . . . . . . . . . . . . . . . .

15,650

Net Income . . . . . . . . . . . . . . . . . . . . . . . . .

15,275

MANDELA INTERNATIONAL COMPANY

Statement of Owner’s Equity

Month Ended January 31, 2007

Wilson Mandela, Capital, January 1, 2007 .

Net Income for January . . . . . . . . . . . . . . .

Less Withdrawals for January . . . . . . . . . .

40,000

15,275

2,000

Increase in Capital . . . . . . . . . . . . . . . . . . .

13,275

Wilson Mandela, Capital, January 31, 2007

53,275

MANDELA INTERNATIONAL COMPANY

Balance Sheet

January 31, 2007

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accounts Receivable . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . .

Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less Accumulated Depreciation—Equipment . .

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18,475

3,400

1,100

12,500

24,000

200

23,800

59,275

Liabilities and Owner’s Equity

Liabilities

Accounts Payable . . . . . . . . . . . . . . . . . . . . .

Owner’s Equity

Wilson Mandela, Capital . . . . . . . . . . . . . . . .

53,275

Total Liabilities and Owners Equity . . . . . . . . . .

59,275

6,000

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 5 䡲 89

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 90

GENERAL JOURNAL

PAGE 3

Description

Post.

Ref.

Supplies Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation Expense—Equipment . . . . . . . . . . . . . . . .

Accumulated Depreciation—Equipment . . . . . . . . . . .

518

121

519

131

524

142

Date

Debit

Credit

Adjusting Entries

2007

Jan. 31

31

31

1,050

1,050

2,500

2,500

200

200

GENERAL LEDGER

ACCOUNT

Supplies

Date

2007

Jan. 1

31

Description

Balance

Adjusting

ACCOUNT

Description

Balance

Adjusting

ACCOUNT

Description

Adjusting

ACCOUNT

✓

J3

2,150

1,050

Description

Adjusting

90 䡲 Chapter 5

2,150

1,100

ACCOUNT NO.

Post.

Ref.

Debit

✓

J3

Post.

Ref.

2,500

15,000

12,500

ACCOUNT NO.

J3

200

J3

Debit

1,050

Credit

142

Balance

Debit

Credit

Credit

200

ACCOUNT NO.

Post.

Ref.

131

Balance

Debit

Credit

Credit

15,000

Debit

121

Balance

Debit

Credit

Credit

Supplies Expense

Date

2007

Jan. 31

Debit

Accumulated Depreciation—Equipment

Date

2007

Jan. 31

Post.

Ref.

Prepaid Insurance

Date

2007

Jan. 1

31

ACCOUNT NO.

518

Balance

Debit

Credit

1,050

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Price_SM_ch05.qxd

10/26/05

2:40 PM

ACCOUNT

Date

2007

Jan. 31

2007

Jan. 31

Insurance Expense

Description

Adjusting

ACCOUNT

Date

Page 91

ACCOUNT NO.

Post.

Ref.

J3

Debit

Credit

2,500

Adjusting

Post.

Ref.

J3

Balance

Debit

Credit

2,500

Depreciation Expense-Equipment

Description

ACCOUNT NO.

Debit

519

Credit

200

524

Balance

Debit

Credit

200

Analyze: If the useful life of the equipment had been 12 years instead of 10 years, depreciation would have

been $167 rather than $200. Net income would have been $33 greater.

Critical Thinking Problem

TO:

FROM:

DATE:

SUBJECT:

Ellis Coppell, President

Student’s Name

Current Date

Effect on Financial Statements of Omitting Adjusting Entries

Adjusting entries are recorded to update the accounts at the end of the accounting period for previously

unrecorded items that belong to that period. If these entries are omitted, the net income will not be an

accurate measure of the operation of the company for the year and certain accounts on the balance sheet

will not report correct end-of-year balances.

In particular, Coppell Enterprise’s net income for the year will be overstated by $52,300; net income should

be $112,700 instead of $165,000. This amount represents a 32% decrease in net income over the amount

that would be reported if the adjusting entries were not made. ($52,300 ⫼ $165,000 = 0.32).

This decrease in net income results from not making adjusting entries for the following unrecorded

expenses:

1. Expense of rent for the year

($42,000 x 6/12 = $21,000 for 6 months)

2. Expense of supplies used during the year

(Total supplies of $18,000 – Ending Inventory of $3,500 = $14,500 supplies used)

3. Depreciation expense for the year

($420,000 ⫼ 25 = $16,800 depreciation per year)

Total increase in expenses

$21,000

14,500

16,800

$52,300

In addition to overstating the net income, the balances of Prepaid Rent and Supplies on the Balance Sheet

would be overstated and the book value of the Building would also be overstated.

Preparation of the adjusting entries would permit the financial statements to present a more accurate

measure of the company’s operations for the year and its financial condition at the end of the year.

Therefore, it is important and the time is well spent to prepare adjusting entries so that the financial

statements are up to date and present an accurate picture of the business.

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 5 䡲 91

Price_SM_ch05.qxd

10/26/05

2:40 PM

Page 92

Business Connections

Managerial Focus

1. Accounting records generally reflect an asset’s historical or original cost, less accumulated depreciation

(not market value).

2. Depreciation Expense will offset income. Accumulated Depreciation will decrease the value of the asset.

3. Are necessary to present an accurate financial position of the firm.

4. Provides end-of-period adjusting entries and contains income statement and balance sheet accounts.

Ethical Dilemma

If the company wanted to donate to a nonprofit organization they would write a check and get a tax

deduction. It is unethical to record higher costs than are actually incurred.

Streetwise

1. Answers will vary. Accruals for interest expense, interest income, adjustments for depreciation, salaries,

deferral of income taxes, and accrual of sales tax payable.

2. $1,180 million. Current year depreciation expense increases the accumulated depreciation account.

Financial Statement Analysis

1. 4.7% ($1,124 ⫼ $23,978)

2. 57.4% ($13,754 ⫼ $23,978)

3. 9.1 years ($10,224 ⫼ $1,124)

Extending the Thought

Students’ responses will vary. This situation extends the topic of adjusting entries to potentially uncollectible

accounts. Students may believe that the customer’s account receivable should be reduced to zero since the

likelihood of payment is low. Other students may suggest that the account be left intact until a determination

is made that the customer will not make the payment.

Business Communication

Answers will vary, but students’ notes should reflect a diplomatic introduction of the topic when phoning the

owner. The accountant should recommend more frequent depreciation adjustments in order to provide upto-date records of the assets and expenses of the company.

Team Work

Mr. Mincks has expenses that will appear on the income statement. He needs to match these expenses with

revenue. He can record the revenue as a receivable, other than accounts receivable, for the amount that he

has completed. In this case he can record $15,000 or 15% of the price of the job.

Internet Connection

Professional liability, surety bonds, umbrella policies, errors and omissions, product liability, fire, auto, dental,

workmen’s compensation, sexual harassment.

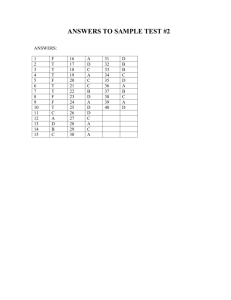

Practice Test Answer Key

Part A True-False

1. T

2. F

3. T

4. T

5. T

6. T

7. T

8. T

9. F

10. T

92 䡲 Chapter 5

Part B Matching

1. a

2. e

3. f

4. c

5. b

6. d

Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.