The Greening Grocery Scene

advertisement

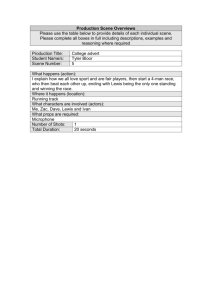

The Greening Grocery Scene Prepared by Natalie Berg, Grocery Research Manager Planet Retail Ltd | May 2008 www.planetretail.net part of emap communications Sustainability – why now? Increased media attention Heightened consumer awareness Regulatory pressure The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net The environment affects retailing from production to consumption Distribution Store Product Consumer The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Financial incentives to go green Technology – electronic shelf labelling (ESL), double-sided receipt printers. Carrier bags – reusable, recyclable, employee training to add more items per bag. Reduction in packaging. General utility costs – lighting, electricity. Cheaper distribution methods – rail/ship. Labour costs/inventory management. ROI on eco-stores. Retailers are going green to stay out of the red! “We have found that there is a great marriage between environmental sustainability and business sustainability.” - Mario Pilozzi, CEO of Wal-Mart Canada The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Product The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Commoditizing the niche In some developed markets, up to 80% of organic products are sold through supermarkets. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Main deterrents to buying organic food Price – 75% Availability – 46% Loyalty to non-organic brands – 37% Source: Whole Foods Market survey This has created a massive opportunity for both national brand and private label manufacturers! The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Top 10 European grocery retailers going green with private label Home Market Organic/Natural PL Eco-friendly PL Fairtrade PL France Carrefour Bio Carrefour Eco Planète Carrefour Solidaire UK Tesco Organic, bnatural, Fresh & Easy Organic, Whole Foods Tesco Naturally Fresh & Easy Germany Grünes Land - - Germany Bioness - Fairglobe Germany Rewe Bio, Naturgut - - France Auchan Bio Auchan Auchan Germany Bio/Prima Bio - Germany Bio Wertkost - - France Marque Repère Marque Repère Entr’Aide UK So Organic, Organic You, Active Naturals, Whole Foods Active Naturals Sainsbury The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Private label : organic food Organic food & drink sector = EUR30 bn Mainstream retailers have capitalised on the green trend by offering their own organic ranges. Happening in the most developed markets where there is strong consumer demand (NA/WE). PL makes such products accessible to more consumers – lower prices, more shelf space, increased availability. From a retailer’s perspective – higher margins! The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Rewarding shoppers for going green One of the first UK grocers to introduce organic PL food including fruit & vegetables, dairy products, bakery products and eggs. Currently the country's largest organic products retailer. Sales of organic products grew by 39% in 2007. Organics promoted to over 1 million shoppers through Clubcard mailings. Clubcard points are incentive for customers to purchase organics, fairtrade & eco-friendly products. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Private label : eco friendly Eco-friendly household products are also on the rise. Like other ‘green’ products, ecofriendly items generally cost more than the conventional product. But the benefits can sometimes pay for the product itself (ie. energy-savings light bulbs) Legislative changes and retailer decisions may result in certain categories being phased out altogether. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Private label : fairtrade Ethical consumerism on the rise. Consumers around the globe spend in excess of EUR2 bn on fairtrade products. USA largest market for fairtrade goods but that is down to the size of the American retail sector. On a per capita basis, Western Europeans are the biggest fairtrade spenders (UK tops the list). Retailers dedicating more shelf space to these products and converting entire categories to fairtrade. Major manufacturers also making the switch (ie. Tate & Lyle, Ritter Sport) The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Green products – challenges Demand outstripping supply – leading to out-of-stocks, etc. Population growth will make organic land more difficult to come by. Consumers are reigning in spending due to rising food prices and the economic downturn. Confusion around which is better – fairtrade or local? Organic or fairtrade? The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Packaging The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Packaging – key points This is one of the areas likely to be most affected by green concerns. Around 30% of all household waste is supermarket packaging. Solutions? Refills in cleaning agents, concentrated detergents, reduced/compostable packaging, local sourcing… Financial incentives – for every USD100 spent on food by the average household, USD16 goes to packaging costs. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Retailers are embracing green packaging Each year, Sainsbury’s plans to replace 150 million plastic trays and bags on Sainsbury’s ready meals and organic food with new compostable packaging. All Delhaize supermarkets in Belgium use biopackaging from NatureWorks PLA for prepared salads and breads. Tesco now uses compostable packaging on organic PL ranges. Aim to reduce packaging on both branded & PL products by 25% by 2010. Albert Heijn uses biodegradable packaging for all fresh organic fruit and vegetables. The Greening Grocery Scene © Planet Retail Ltd 2008 Costco replaced plastic clamshells with paperboardbased packaging. www.planetretail.net Measuring suppliers on packaging – Wal-Mart Packaging scorecards launched in Feb 2007 to measure suppliers on the sustainability of their packaging. Preliminary results show strong interest from suppliers to make their packaging more sustainable. Step towards achieving a 5% reduction in packaging by 2012. About half of 2,000+ registered suppliers have completed the scorecard for at least one item. All & Mighty concentrate – out-of-stocks reduced by half & a USD91.4 million reduction in Wal-Mart labour dollars. Going global! "If we throw it away, we had to buy it first. So we pay twice - once to get it, once to have it taken away. What if we reverse that? What if our suppliers send us less and everything they send us has value as a recycled product?“ – Wal-Mart CEO, Lee Scott The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Innovative packaging by manufacturers The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Distribution The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net The food miles debate has led to increased demand for local foods In 1970, there were 340 farmers’ markets in the US. Today, there are more than 4,500. In 1997, there was one farmer’s market in the UK. Today, there are over 500. A clear majority of consumers would prefer to buy a local non-organic option rather than an imported organic one. – Soil Association “Local foods are the new organic.” – Whole Foods Market CEO, John Mackey The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Local versus fairtrade Rise in local foods has augmented consumer awareness about product origins. But what effect will this have on fairtrade producers from developing countries that rely on exports? "I don't think retailers will make a conscious decision at a point in time to stop listing products (with a high carbon footprint). What will happen is consumers will make a choice that they don't want to buy it and ultimately it will disappear off the shelves.” –Wal-Mart UK CEO, Andy Bond The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net A threat to air freighted foods? The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Carbon labelling In the UK, Tesco is developing a “universally accepted and commonly understood” measure of the carbon footprint of all products sold at Tesco. Others testing a similar scheme with the Carbon Trust – M&S, Boots, Walkers (right), Innocent, Cadbury, Coca-Cola, Kimberly-Clark. Coop in Switzerland – Climatop (right). Product’s complete lifecycle will be measured (eg, energy used in manufacturing, distribution, etc). More informed decisions for the consumer. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Store The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Store level – key points Mainstream grocers are launching specialty formats or eco-friendly stores in response to the growing green trend. Specialists such as Whole Foods Market (USA) and ThreeSixty (Hong Kong) have been influencers. Primarily happening in NA/WE where demand is strongest. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net New format development Japan Belgium The Greening Grocery Scene © Planet Retail Ltd 2008 USA Germany France USA www.planetretail.net Eco-friendly stores are cropping up across the US & Europe Ahold USA Meijer USA Boots UK Migros Switzerland Carrefour China Monoprix France Colruyt Belgium Safeway USA Coop UK Sainsbury UK Coop Switzerland Schwarz (Lidl) UK Costco USA Staples USA BI-LO USA Tesco Czech Republic, Malaysia, Thailand, UK Delhaize Belgium, USA Giant Eagle USA Harris Teeter USA M&S UK The Greening Grocery Scene © Planet Retail Ltd 2008 "Four years ago, 50% of customers said it mattered to them that M&S was a responsible business. By last year that proportion had grown to 97%.” – Mike Barry, M&S Waitrose UK Wal-Mart, USA, Canada, UK Whole Foods Market, USA, UK www.planetretail.net Consumer The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Consumer barriers to purchasing green Price. Inconvenience. Lack of knowledge. Sense that individual actions will not make a difference. Too much time to make an informed decision. The right information is not on the pack. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net How are consumers voicing their opinion? Reusable carrier bags Plastic bags are used for an average of 30 minutes but they can take 1,000 years to decompose. But plastic bags are the cheapest to produce (1 cent/bag). Drastic reduction in usage where consumers are charged for plastic bags (Ireland, Bangladesh, Taiwan). Recycling initiatives. Become more selective in the products purchased! The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Conclusions Green is not a fad. Financial motivations ring true. Retailers and suppliers need to define the value proposition of buying green products. Private label poses a threat to manufacturers but an opportunity for consumers. However, opportunities for FMCG manufacturers in new product development and brand extensions. Retailer/supplier collaboration will be key going forward. The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net Contact details United Kingdom: Greater London House, Hampstead Road, London NW1 7EJ, United Kingdom T: +44 (0)207 728 5000 F: +44 (0)207 728 4999 Natalie Berg Grocery Research Manager Germany: Planet Retail Ltd Dreieichstrasse 59, D-60594 Frankfurt am Main, Germany T: +49 (0) 69 96 21 75-0 F: +49 (0) 69 96 21 75-40 T: +44 (0)207 728 5000 F: +44 (0)207 728 4999 natalie.berg@planetretail.net Japan: Minami-Magome 5-42-3-508, Ohta-ku, Tokyo 143-0025, Japan T: +81 (0) 3 3775 4158 F: +81 (0) 3 3775 4162 The Greening Grocery Scene © Planet Retail Ltd 2008 www.planetretail.net www.planetretail.net part of emap communications 34 ‘’The role of the paperboard carton in a sustainable packaging policy’’ M.A. Clark Chairman, Pro Carton, Europe “The single most important thing that my customers want to talk to me about is sustainability. It’s more important than price at the moment (sic)” M-real Cartonboard Sales Director, France. Why does our industry need to respond to sustainability driven innovation? Environmental Issues are FRONT PAGE What does the Consumer Understand? • That there is a problem • That someone ought to do something about it • That they would like to help, providing . . . • In summary, virtually nothing! Retailers, publishers and brand owners are taking responsibility to give the lead The strength of their promise lies in the strength of their supply chain. Sustainability: Perceptions in Paper As a business driver, the environment has been a growing force over 30 years. Issue follows issue, but with a residual accumulating impact. The collective direction is one of ‘sustainability’ – of life, quality, aspiration. The Tree of Sustainablility Thank you Meeting Consumer Needs – Paperboard Packaging Work in Progress The Top 6 Current Perceptions: 1. “Greenhouse gases, Climate Change, Carbon”. 2. “Packaging Waste” 3. “Nuclear Power” 4. “GMO – Forest Certification” 5. “EU REACH Chemical Regulations” 6. “Forest Certification” Carbon Cycle of Forest Industry Products A Good Story for Cartons Atmosphere Sustainable carbon store of forests Energy recovery Natural degradation Sustainable forestry retains or increases the carbon stores of forests Carbon store of products in use Mill Illustrative Carbon Balance for printed folding Cartons Carbon captured and Stored in the forests Fossil CO2 emissions, kg CO2/t Total emission 1004 CO2 from atmosphere stored in the product, kg CO2/t Wood-based carbon stored in the product (as CO2) 1,474kg The Hidden Harvest The Cartonboard Industry has progressively invested in new technology to deliver equal performance at lower board weights. On average, Cartonboard weights reduce by 1%p.a = Less raw material, less energy, low transport emissions. The Carton Industry constantly reduces board consumption by design innovation. It is estimated that, over the same long term period, this has yielded another 1% volume reduction. Est. Carton Production 000 tra. The Hidden Harvest 2500 2400 2300 2200 2100 2000 1900 1800 1700 1600 1500 451,000 tonnes “saved” 2018 1565 1987 902,000 tonnes “saved” 2007 Time (1987-2007) Basis: W. Europe – “EU11”. Sources: Pro Carton Research CDC European Cartonboard Review Business Prospects in W Europe to 1993 The Hidden Harvest: What we all achieved before the spotlight focused on us; 902,000 tonnes of Cartons @ 1004 kgs CO2 905,608 tonnes of CO2 saved p.a ! What can’t we do in the next 20 years – if we all work together? 47 From niche to mainstream – coffee as best practice for sustainability Nicola Oppermann Corporate & Government Affairs Kraft Foods Deutschland GmbH Annemieke Wijn Member of the Board Rainforest Alliance Rainforest Alliance Certified Coffee at Kraft Foods Sustainability is not new to Kraft Foods Over 15 years fostering sustainability in coffee business Since 2003 cooperation with Rainforest Alliance (RA) Further co-operations with United States Agency for International Development (USAID) as well as German Technical Cooperation Agency (GTZ) 49 Rainforest Alliance Certified Coffee at Kraft Foods What is the Rainforest Alliance? The Rainforest Alliance is an international, non-profit environmental and sustainable development organization Our mission is to protect ecosystems and the people and wildlife that depend on them by transforming … Land use practices Consumer behavior Business practices 50 Rainforest Alliance Certified Coffee at Kraft Foods What is Rainforest Alliance Certification? As an independent, third party we award a seal of approval to farm and forestry operations that meet our guidelines Rainforest Alliance guidelines are comprehensive and balance ecological, economic and social considerations Our seal is a guarantee to consumers that the products meet our set of criteria for sustainability Certification is a strictly voluntary, non-governmental process 51 Rainforest Alliance Certified Coffee at Kraft Foods Sustainable Agriculture at the Rainforest Alliance Developed first global sustainable agriculture standard with a network of NGOs in the south (Sustainable Agriculture Network) Certified as sustainable more than 556,000 acres in the production of bananas, oranges, coffee and cacao and tea 15% of all bananas in international trade come from our certified farms 1.3% of the coffee in the world comes from our certified farms Our sustainable agriculture program currently benefits more than one million people in 14 countries Global retail value of Rainforest Alliance Certified coffee, cocoa and bananas is one billion dollars P ti l li t f i K ft F d Chi it L 52 Rainforest Alliance Certified Coffee at Kraft Foods What are certification criteria? Conservation of biodiversity and ecosystems Soil and water conservation measures Forest conservation, tree cover, wildlife protection Worker rights, housing, health and safety Education of workers and their children Community relations 53 Rainforest Alliance Certified Coffee at Kraft Foods Certification builds Sustainability Increased number of butterfly and migratory bird species on Rainforest Alliance certified farms Social security and good housing for workers Producers increase productivity up to 20% Premium up to 8-14 cts /lb received 54 Rainforest Alliance Certified Coffee at Kraft Foods Certification builds Sustainability Water treatment technology installed Producers see themselves as creating a sustainable future for their children and their country 55 Rainforest Alliance Certified Coffee at Kraft Foods From niche to mainstream Kraft Foods is largest partner of RA in the coffee sector Buys nearly half of RA-certified beans available Every year: increased volume of certified coffee 20000 16000 12000 Tons 8000 4000 0 2004 2005 2006 2007 56 Rainforest Alliance Certified Coffee at Kraft Foods Two roads to sustainable coffee for consumers Small percentage of certified coffee blended in all brands 100% Rainforest Alliance certified 8 coffee brands worldwide 57 Rainforest Alliance Certified Coffee at Kraft Foods Jacobs Krönung – 100% sustainable? T F A R D Y L ON 58 Rainforest Alliance Certified Coffee at Kraft Foods Jacobs Milea in the German retail business 59 Rainforest Alliance Certified Coffee at Kraft Foods Jacobs Coffee for Away from Home (AFH) Continuously growing product portfolio 60 Rainforest Alliance Certified Coffee at Kraft Foods Cooperation with McDonald's Since 2007 coffee from certified farms at 500 McCafés in Germany (integrated McDonald’s coffeeshop) Since 2008 sustainable coffee in 1.300 German McDonald's Restaurants Allover Europe guests in 6.400 McDonald‘s Restaurants enjoy sustainable coffee from Kraft Foods 61 Rainforest Alliance Certified Coffee at Kraft Foods Kenco in the UK Going towards 100% sustainable coffee in the whole range 62 Rainforest Alliance Certified Coffee at Kraft Foods Kraft Coffee Vision: - BY 2010 All Kenco coffee will be sourced from Rainforest Alliance Certified™ farms Making a REAL DIFFERENCE to coffee growing communities SUSTAINABILITY + QUALITY: NO COMPROMISE 63 Rainforest Alliance Certified Coffee at Kraft Foods Achievements towards a sustainable world 205.000 farmers work and live under better conditions 41.000 hectare land were under certification in 2007 64 Rainforest Alliance Certified Coffee at Kraft Foods Thank you very much! Questions? 65 ECR Berlin 66 Unilever in Brazil Top ten companie s in FMGC * rank 2nd biggest advertiser d -Mind brrasnin f o p o T a n a ee OMO has bCategories* for 17 ye a row * in all FMGC (440 million E uros spent in advertising in 2007) “companies fo r which people want to work in ” Global Ranking Top five 3 Unilev er brand s among the mos t reliabl e brand s in Brazi l ** Reached 1 00% of all Brazilian h omes in on e year Nº 2004 2005 2006 2007 1 USA USA USA USA 2 United Kingdom United Kingdom United Kingdom United Kingdom 3 Germany Germany Brazil Brazil 4 France Brazil 5 Italy 6 India 7 Brazil 67 Some numbers: Unilever in Brazil lR a ob Gl an g kin • 12.500 empl oyees • 50 brands • 12 factories • Almost 2000 dire ct (in 4 states – SP , MG, PE and G O) customers 68 GPA – Grupo Pão de Açúcar in Brazil € 6,76 14% Billion in gross income in 2007 Market share (ABRAS 2007 rating ) 575 15 Stores 1.3 million States 2 sq. mt. for sales 69 GPA – Grupo Pão de Açúcar in Brazil Pão de so Aphçisútic caa terd superma n o i t a i t n Differe rket cha in target: m en and w omen belongin g t o A an dB groups, with a cosmop olitan lif estyle stores that o ffer a variety of high quali ty products and custom ized service s 70 GPA – Grupo Pão de Açúcar in Brazil ization m i t p o l a n Operatio nd C consumers Ba • target: A,t/benefit ratio s • good co Category extensio n (non-foo d) • target: sm all-sized and end retailers consume rs • shoppe r extensio n nience) e v n o c ( rence e f e r ome and g h n e i h n t o e i t id Posi ing outs rk omen wo w : t e g r a •t budget od d e it im l ighborho e with n d n a ience • conven 71 Limitations of Developing & Emerging countries 1. They are always impacted by big figures Brazil • Population: 191.908.598 inhabitants. • PIB: € 862 billi on s • Area: 8.511.96 5 k m2 China • Population: 1.330.044.605 inhabitants. • PIB: € 2.207 billions • Area: 9.596.960 km2 India • Popula tion 1.147.99 : 5.898 inhabita n ts • PIB: € 740 billi o ns • Area:3 .287.590 Km2 Source: https://www.cia.gov/library/publications/the-world-factbook/ 72 Limitations of Developing & Emerging countries 2.Complexity involved in managing different scenarios at the same time Different behaviours Growth rate Infra-structure Social & Educational level 73 Limitations of Developing & Emerging countries 3. Too Large Geographical areas / distances From São Paulo to Manaus 2692 Km = From Berlin to Damascus 2795 Km From São Paulo to Recife 2127 Km = From Berlin to Ankara 2039 Km From São Paulo to Porto Alegre 854 Km = From Berlin to Milan 842 Km 74 Restrictions of Developing & Emerging countries 4.Importance of Low and Medium Income Consumers 75 Limitations of Developing & Emerging countries 5. Fragmented retailer concentration - from big players, to small points of sales Concentration index 5 biggest retailers x total sales per country - 2006 Brasil 25,4 76 Video: The impact of recycling in a country like Brazil 77 Project Challenges Social To reach D&E social classes ntal Environmecia l classes B so To impact A/ Economic ach Capillarity re 78 Collaboration made It Feasible 79 Project Conception Collaboration made it feasible 25 In 2001, Unilever had sustainability projects It was necessary to find a partner that shared this same view ores that can GPA has several st nsumers reach different co GPA stores share the same view The project took place at Pão de Açúcar, GPA Top Label Core objectives of the project: - To obtain substantial social benefits for D/E classes - Create environmental concern for A/B social classes - Improve GPA & Unilever image 80 The Project A Virtuous cycle Shoppers Income Increas e clers y c e R Environmental Education e Cooperatives Wag up to € 460 /month t Transpor ation t S g n i l Recyc 81 Project Results Triple benefit achievement Social To reach D/E social classe s al Environment sses B social cla / A t c a p Im o T Economic tained Capillarity at 82 Project Results Triple benefit achievement Social l To reach D/E socia classes • Thousands of direct and indirect Jobs • Social and occupational inclusion • 21 cooperatives “recyclable materials collectors” • Improving the environment (cleaning “lixões” i.e., garbage dumps) A cooperative employee gets an amount up to € 460,00 per month (Brazil minimu m wage is € 1 53,7 0) 83 Project Results Triple benefit achievement Environmental Accumulated percentage of recycled material al classes To impact A/B soci “More than 20.000 tons of recycled material” 6000 21% 0,01% 51% 5000 23% 4000 1% 4% 3000 2000 1000 0 2001 2002 2003 2004 2005 2006 2007 2008* Paper Glass Cooking oil* Plastic Metal Aluminum Total tons Q1* 84 Project Results Triple benefit achievement Economic Capillarity attained • • • • • Shared Responsibility: government, industry, retail and society. Partnership with 7 local government in Brazil Reduce counterfeit products 100 supermarkets 24 cities in 8 Estates Fortaleza João Pessoa Recife Brasíli Goiâni a a São Paulo Curitiba Rio de Janeiro 85 Project Results Triple benefit achievement Economic Capillarity attained • • • • • Shared Responsibility: government, industry, retail and society. Partnership with 7 local government in Brazil Reduce counterfeit products 100 supermarkets 24 cities in 8 Estates plus 50 cities and 7 states 86 Raising the bar though joint beliefs: managing the post consumption and shared system 87 Raising the bar though joint beliefs: managing the post consumption and shared system 88 Raising the bar though joint beliefs: managing the post consumption and shared system 89 Adriana Muratore – Unilever Hugo Bethlem – GPA 90