Beyond borders

Global biotechnology report 2009

“It is different this time because this crisis

is deep-rooted, systemic and persistent.

But, in spite of that, the industry has been

here before, in that biotech companies

have overcome seemingly insurmountable

challenges in the past, bucking trends and

defying odds.“

Glen T. Giovannetti and Gautam Jaggi, Ernst & Young Global Biotechnology Center

To our clients and friends

As the shockwaves from the global financial crisis rippled across the

world economy in late 2008 and 2009, they left little untouched.

The reverberations leveled long-standing institutions, triggered

unprecedented policy responses and revealed new risks. For the

biotechnology industry, the impact of these turbulent times has

deepened the divide between the sector’s haves and have-nots.

Many small-cap companies are scrambling to raise capital and

contain spending, while a select few continue to attract favorable

valuations from investors and strategic partners.

A number of this year’s articles focus on the acute challenges

created by the funding crisis. When we interviewed John Martin

of Gilead Sciences seven years ago, in the midst of a different

funding crisis, he was confident that his company could make the

long journey to sustainability. He was vindicated, of course, and

his guest article in this year’s report offers advice to companies

facing similar challenges today. Meanwhile, a roundtable of CEOs

from four next-generation companies discusses the outlook for

their enterprises and for the industry as a whole.

Challenging times have always inspired biotech’s creativity. So

it’s not surprising that the search for creative models — both

to overcome immediate operational challenges in the

current environment and to foster the sector’s long-term

sustainability — is a core theme in this year’s Beyond borders.

James Cornelius of Bristol-Myers Squibb discusses his company’s

model for reinventing itself by focusing on R&D and partnering

with biotechs. Adelene Perkins of Infinity Pharmaceuticals

emphasizes the need for partnering models that allow companies

the flexibility to evolve, while Samantha Du of Hutchison

MediPharma discusses how China can offer firms advantages that

address weaknesses in the Western business model.

But turbulent times can make the unimaginable possible, and

sweeping disruptions have often redrawn maps, changed playing

fields and altered rules and regimes. In “Beyond business as

usual?” — our Global introduction article — we present four

paradigm-shifting trends that have the potential to reshape the

healthcare landscape and create new opportunities: high-quality

generics, fundamental healthcare reform, personalized medicine

and globalization. To create a more sustainable biotechnology

industry, companies will need to understand these trends, prepare

for them and help shape them.

As biotech faces the future, it’s worth considering the responses

of our venture capital panel. We asked a number of leading VCs

to tell us whether biotech has “been here before” or whether it’s

“different this time.” It turns out that both interpretations are

correct. It is different this time because this crisis is deep-rooted,

systemic and persistent. But, in spite of that, the industry has

been here before, in that biotech companies have overcome

seemingly insurmountable challenges in the past, bucking trends

and defying odds.

Ernst & Young’s global organization stands ready to help you as

the business of biotech goes beyond business as usual.

Glen T. Giovannetti

Gautam Jaggi

Global Biotechnology Leader

Global Biotechnology Center

Ernst & Young

Managing Editor, Beyond borders

Global Biotechnology Center

Ernst & Young

Contents

Global section

Beyond business as usual? The global perspective

2

Global introduction

Beyond business as usual?

4

The interconnectedness of all things

How the housing markets sneezed and biotech caught a cold

p. 2

9

A closer look

10

Necessity is the mother of all models

18

Survival of the focused

19

Innovation from a string of pearls

Enlightened competition

How unprecedented changes are driving new approaches

John Martin, Gilead Sciences, Inc.

James M. Cornelius, Bristol-Myers Squibb

20

Venture capitalists speak out

The more things change, the more they stay the same?

22

Valuing innovation: new approaches for new products and

changing expectations

24

Global year in review

Andrew Dillon and Sarah Garner, NICE

Turbulent times

Americas section

A Darwinian moment? The Americas perspective

30

Americas introduction

A Darwinian moment?

37

A closer look

Compensation and benefits in turbulent times

38

CEO roundtable

Only the innovative survive: perspectives from biotech’s next generation

• Jean-Jacques Bienaimé, BioMarin Pharmaceutical Inc.

• Jean-Paul Clozel, Actelion Pharmaceuticals, Ltd

• Colin Goddard, OSI

• Louis Lange, CV Therapeutics

p. 30

45

The Darwinian challenge: why evolution is vital for

building biotech

Adelene Q. Perkins, Infinity Pharmaceuticals, Inc.

47

Connecting the dots: the impact of the global financial crisis

on biotechnology

48

US financing

Peter Wirth, Genzyme Corporation

Collateral damage

52

A closer look

State capital: incentive programs

53

US deals

Buying biotech, being biotech

56

A closer look

New rules for the M&A road

59

US public policy

Will biotech get the change it needs?

60

A closer look

63

US products and technologies

66

Canada year in review

The FDA: transforming an agency in crisis

Monitoring progress

A time of reckoning

ii

European section

Staying afloat? The European perspective

74

European introduction

Staying afloat?

77

Roundtable on deals

New deal structures for challenging times

• Naseem Amin, Biogen Idec

• Jeffrey Elton, Novartis Institutes for BioMedical Research

• John Goddard, AstraZeneca PLC

• Mervyn Turner, Merck & Co., Inc.

p. 74

84

European financing

Down, but not out

90

European deals

Dealing by dealing

94

A closer look

Up-fronts and bottom lines: accounting for up-front payments under IFRS

95

European products and pipeline

A surging pipeline and a trickle of products

98

A closer look

Growing pains in the European biosimilars market

101

Roundtable on industrial biotechnology

Evolution, progress and sustainability

• Karl-Heinz Maurer, Henkel AG & Co. KGaA

• Marcel Wubbolts, DSM Innovation Center

• Holger Zinke, BRAIN AG

Asia-Pacific section

Seeds of change? The Asia-Pacific perspective

106

Asia-Pacific introduction

Seeds of change?

107

The dream of the sea turtles: can China offer a new model for

Western biotech companies?

108

Changing realities

110

Australia year in review

Samantha Du, Hutchison MediPharma Limited

p. 106

A conversation with M.K. Bhan

Haves and have-nots

114

India year in review

Nurturing growth

115

A closer look

If you build it, will they come?

117

China year in review

On the road to innovation

120

Japan year in review

Seeking investors, seeking innovation

122

New Zealand year in review

122

A closer look

124

Singapore year in review

Strong research and creative approaches

Attracting new investment: New Zealand’s new LP structure

Looking beyond borders

Resources

125

Acknowledgements

126

Data exhibit index

128

Global biotechnology contacts

iii

Beyond business

as usual?

The global perspective

1

Global introduction

Beyond business as usual?

biotech funding has ebbed and flowed

as IPO windows opened wide and then

slammed shut with seeming inevitability.

Ernst & Young has been tracking the

biotech industry since its early days,

and by our count the current crisis is

at least the sector’s fifth major funding

drought. And while it is far from over,

it is not the longest — not yet, anyway.

Interestingly, when biotech veterans

are asked to compare the current

situation to prior downturns, most point

to the “nuclear winter” of the early

1990s that was precipitated by the

Clinton administration’s proposals for

sector and the viability of its business

and financing model. Even by the

standards of an industry where “business

as usual” is a gauntlet of unpredictable

initial public offering (IPO) windows,

shifting investor sentiment, daunting

product-development odds and tightening

regulatory pressure, this feels different.

In late 2008, the biotechnology industry,

like the rest of the global economy, was

blindsided by the tsunami that is the

global financial crisis. Biotech companies

now face a host of challenges as they

attempt to navigate through a systemic

financial meltdown and deep-rooted

uncertainty. In market after market,

valuations of precommercial biotechs

have plummeted, capital has dried up and

the landscape is littered with companies

struggling to survive. While the crisis will

almost certainly wipe out many of these

firms, it could also, at the extreme, have

implications for the sustainability of the

The question, of course, is whether it

truly is different. Certainly, biotechnology

companies are no strangers to financing

challenges. There have been biotech

funding droughts for almost as long

as there has been a biotech industry.

Through much of the sector’s history,

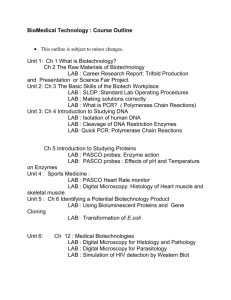

This is neither the industry’s first IPO drought, nor (so far) its longest

2.5

25

Capital raised in US IPOs

Number of US IPOs

Q2 01–Q3 01

2 quarters

2.0

20

Q3 02–Q3 03

5 quarters

Q4 88–Q3 89

4 quarters

Q2 08–present

4 quarters and ongoing

1.5

15

1.0

10

0.5

5

0.0

0

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

Source: Ernst & Young

2

Beyond borders Global biotechnology report 2009

00

01

02

03

04

05

06

07

08

Number of US IPOs

Capital raised in US IPOs (US$b)

Q2 84–Q3 85

6 quarters

fundamental healthcare reform. But even

in the depths of that period’s uncertainty,

IPOs and follow-on offerings made it to

market with some regularity.

In the past, biotech companies survived

funding crises through a combination of

creativity and nimbleness. As investor

sentiment shifted, firms reinvented their

research focus and market orientation,

transforming themselves in short order

from vaccine companies to biodefense

firms or from bioinformatics providers to

drug developers. They opportunistically

formed strategic alliances, pared back

their already-lean operations and found

creative ways to go after untapped

sources of capital. In extreme periods,

they closed highly dilutive financings

that included warrants and other deal

“sweeteners” to bring investors on board.

But over the industry’s history, very few

companies actually ended up filing for

bankruptcy or being liquidated.

Several characteristics of the current

crisis make it unlike any previous funding

challenge faced by the biotech industry.

Each of these distinguishing features, as

we discuss in this article, has implications

for biotech companies trying to weather

the storm as well as for the industry’s

sustainability, approaches and models.

Pervasive uncertainty

There is much about the current crisis

that has taken practically everyone

by surprise: the speed with which it

unfolded, the sheer size of the financial

institutions it has leveled, and the extent

and nature of public policy responses it

has unleashed. There is now a consensus

that this, whatever this is (it has been

variously labeled a credit crunch, a

liquidity crisis, a recession and even

sometimes a depression), is huge. But just

Even by the standards of an

industry where “business

as usual” is a gauntlet of

unpredictable initial public

offering (IPO) windows, shifting

investor sentiment, daunting

product-development odds and

tightening regulatory pressure,

this feels different.

how huge, no one really knows. We don’t

know how deep the crisis will run, how far

it will extend, or when it will all end.

This uncertainty is one thing we’re all sure

of — and as a result, cash has become

king. Companies and consumers are

cutting spending. Investors and bankers

have become increasingly conservative,

making it even more difficult for firms to

raise capital. While funding crises in the

past have typically lasted about 12–18

months, it is quite likely the current

downturn will run considerably longer.

The interconnectedness

of all things

In the past, biotech funding droughts

have largely been driven by investor

sentiment toward the biotech industry.

When investors were bullish about the

sector’s prospects — buoyed, for instance,

by product approvals in the industry’s

formative years or by media excitement

over the sequencing of the human genome

around the turn of the millennium — money

rushed into the sector, and companies

rushed out to conduct IPOs. Unfortunately,

the boom was inevitably followed by a bust

a few years later, when investors realized

that the path to commercialization was

considerably longer than they had initially

assumed or when business models failed to

live up to their promises. Funds withdrew,

bubbles burst, windows slammed shut.

The current funding crisis is different.

The bubble that burst was not in biotech,

but fueled by real estate, financial

instruments and an environment of easy

credit. This time, irrationally exuberant

investors were seduced by loose lending

practices, high-leverage models and

the assurances of complex financial

derivatives that promised to hedge and

reduce risk. And so, while biotech’s past

financing droughts were localized and

industry-specific, the present downturn

crosses national boundaries and impacts

industries across the economy. It is, in a

word, systemic.

As the impact of the crisis spreads

wide — infecting everything from investment

portfolios in remote Norwegian fishing

hamlets to the financial aid packages

of undergraduates at leading US

universities — it can produce unexpected

ripple effects. We have listed some

examples of these effects below, though

the list is by no means exhaustive. (For

a simplified graphical representation

of these connections, refer to “The

interconnectedness of all things” on page 4.)

• Investment banks and hedge funds.

The financial crisis has taken a

significant toll on investment banks,

as some of the most venerable names

on Wall Street have been humbled by

investments in subprime mortgages.

But these investment banks also

often acted as prime brokers to

hedge funds, and hedge funds have

in recent years served as a major

source of capital for publicly traded

biotech companies. Consequently,

while much has been made of those

now-infamous links between distressed

continued on page 6

3

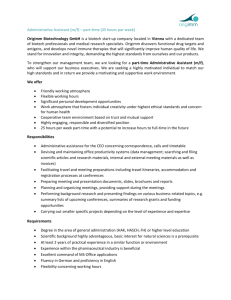

The interconnectedness of all things

How the housing markets sneezed and biotech caught a cold

Current crisis

US property

values fall

Subprime

mortgage

default rates

increase

Foreclosures

climb

Public capital

for biotech

constrained

Biotech IPOs

disappear

Mortgage-backed

securities become

“toxic”

Risk

aversion

Biotech

stocks fall

Credit

crunch

Less debt

for biotech

Less capital

for hedge

funds

Lower

valuations

in M&A and

alliances

Challenging

exits for

biotech

investors

Less capital

for venture

funds

Biotech venture

funding could

fall

Less capital

New risks

Source: Ernst & Young

4

Beyond borders Global biotechnology report 2009

Lower valuations

All prior crises

Investors’ enthusiasm

for biotech stocks

declines

Banks

distressed,

fail

Less lending

to households

Less lending

to businesses

Layoffs

Corporate

earnings

decline

Stocks

plummet

Household

wealth shrinks

Institutional

investors’

portfolios

diminish

University

endowments

down

Nonprofit and

foundation

endowments

down

Sector-specific

withdrawal from

biotech

Household

spending

declines

Household

income

declines

Tax revenues

drop

Drug usage

could fall

Ranks of

uninsured

swell

Pricing

pressure

could

increase

Increased

counterparty

risk from suppliers

and partners

Research

funding could

fall

Increasing pricing pressure?

Lower drug usage?

5

mortgages in Las Vegas, Nevada,

and the investments of taxpayers in

Narvik, Norway, considerably less has

been written about the fact that those

same distressed mortgages are linked,

through the fortunes of highly leveraged

investment banks and hedge funds, to

the capital invested in scores of biotech

companies. A significant portion of the

capital available to the industry has been

decimated, not because of changes

in investors’ attitudes toward biotech

companies, but simply because of the

way the dominoes line up in the modern

financial system. (See Peter Wirth’s

article, “Connecting the dots,” for a more

detailed discussion.)

In addition, many of the investment

banks that have traditionally backed

the biotech industry are now focused

elsewhere, including on shoring up

their own balance sheets. It is unlikely

that the biotech industry will provide

enough fee potential in the near term

to grab significant mindshare at these

institutions. As a result, the industry

may see the return to prominence

of the boutique, early-stage-focused

investment bank.

• Venture capital. As the stock market has

tumbled, we have all become collectively

poorer. The separation between the real

economy and the financial economy

has become ever more blurred in recent

decades, as an increasing portion of

6

financial assets in the economy has come

to be invested in the stock market. So,

as plunging share prices dragged down

everything from the endowments of

large universities to the investments of

public pension plans, the portfolios of

many major institutional investors have

been diminished. Many of these investors

are, in turn, limited partners (LPs) in

the venture funds that invest in biotech

companies. Since these funds make

portfolio allocations by asset class, they

have less money to invest in the sector

simply because their overall portfolios

have shrunk — the pie is smaller, and

everyone gets a smaller slice.

This “denominator effect” raises the

risk that venture capitalists (VCs) may

not have as much “dry powder” in

their funds as they assume they do,

and that some LPs may not be able

to fulfill the capital calls when the

funds come knocking. So far, there is

no indication that this has happened

to any large degree, and anecdotal

evidence suggests that at least the

most substantial life sciences VCs will

have access to the funds they need to

continue investing. But the risk is out

there, and it is possible that there could

be a somewhat slower deployment

of capital in the future because of

these linkages. VCs needing to raise

new funds will likely find a much more

challenging environment. So the

Beyond borders Global biotechnology report 2009

bar for new company formation has

been raised and venture investors are

becoming very selective about the firms

they back.

• Convertible debt. The simultaneous

implosion of credit markets and stock

markets in the current crisis may create

a ticking time bomb in an industry where

convertible debt has been a significant

source of capital. Convertible debt

first became popular in a significant

way around the time of the genomics

bubble, when a combination of factors

made it an attractive way to raise

money. For many public companies that

expected their stock prices to rise over

time with the achievement of clinical

milestones, convertible debt offered

a way to raise capital in a less dilutive

manner. Meanwhile, it offered investors

relatively more security and a hedging

strategy — certain funds invested in

biotech companies by buying convertible

debt while simultaneously shorting

the companies’ stocks. The large debt

overhang became a potential problem

for many companies after the genomics

bubble burst in the early 2000s, but

the crisis was averted because markets

recovered and companies were able to

refinance the debt.

Today, a similar crisis looms, but

this time several factors are in play.

The plunging stock prices of biotech

companies have meant that converting

debt to equity is improbable, while the

prospects for refinancing are bleak

because of the credit crisis. Meanwhile,

hedge funds, which provide much of the

capital for convertible debt, have seen

their portfolios diminished by the stock

market downturn and by a reduction in

their own borrowing power, and are also

constrained by new rules on shorting

stock. Already we are seeing companies

trying to negotiate new terms with debt

holders to forestall bankruptcy.

• Patient behavior. Between December

2007, when the slowing US economy

officially entered a recession, and March

2009, the number of unemployed in the

US increased by 5.1 million — pushing

the official unemployment rate to a

26-year high of 8.5%. The US economy

is now shedding over 600,000 jobs

a month, and layoffs are becoming

increasingly visible in other countries

as the recession spreads globally. While

the uptick in European unemployment

has not been as sharp (in part

because many European countries had

higher unemployment rates to begin

with), China is concerned about the

potential fallout as large numbers of

manufacturing jobs are lost and migrant

workers return to their villages.

While health-related industries such

as biotech are generally regarded as

being fairly recession-resistant (people

fall sick and need healthcare regardless

of the state of the business cycle), the

conventional wisdom may not hold true

in a recession of this magnitude. In the

US economy, where health benefits are

largely provided through employers,

a significant swelling in the ranks of

the unemployed could bring the loss

of health insurance for large portions

of the population. Consequently,

we could see changes in patient

behavior such as reduced compliance

with drug regimens, lower levels of

preventive care, and selective seeking

of healthcare for non-life-threatening

conditions. Meanwhile, in many

emerging economies, where health

insurance is not as prevalent to start

with, job losses could leave significant

swaths of the nascent middle class

less able to afford drugs — which

could present a temporary setback for

Western companies that are counting

on emerging markets for future growth.

• Government spending and

reimbursement. The economic

slowdown has diminished tax revenues

and strained government budgets — a

situation that will only be heightened

in the months ahead, either because of

stimulus spending (such as in the US)

or because of increased spending on

social safety-net programs as citizens

lose jobs (as in many Western European

countries). In the US, where healthcare

reform is a top priority of the new

Obama administration, budgetary

pressures could be further exacerbated

by the high cost of expanding

healthcare access. As governments face

increasing pressure to rein in healthcare

costs, it seems almost inevitable that

the scrutiny of drug prices will grow.

Meanwhile, more people could become

dependent on governments for health

coverage, increasing the purchasing

power of the public sector and

strengthening its ability to drive down

prices in negotiations with industry.

The bottom line is that biotech

companies — in both pre- and

post-commercial stages — face a far more

complex environment than in previous

funding crises. This time, it’s not about

biotech, but about everything. And when

it seems that everything is impacted,

the impacts may not be everything they

seem. More than ever, companies may

find many unexpected sources of risk

beneath the surface.

The fact that the current crisis is driven

by larger economic forces rather than

a change in investor sentiment toward

biotech companies also has implications for

the length of the drought and the path to

recovery. In the past, conditions improved

when investor sentiment recovered, but

this time the global economy is undergoing

a significant deleveraging which could

As funding options have dried

up, many companies with little

cash may also have little in the

way of options. For many at the

low end of the survival index,

survival may truly be at stake.

constrain the flow of money into equity

markets for an extended period. Things will

only get better when the overall pie — the

global economy — grows. And that, by all

accounts, will take time.

Against the backdrop of an industry

where it can take well over a decade

to successfully take a product from

early research to regulatory approval,

a crisis that lasts several years may

appear short-lived. But, of course, for

companies with dwindling cash reserves

and few funding options, it could be an

insurmountably long period.

Contraction ahead

For most of the 23 years that Ernst & Young

has produced an annual biotechnology

report, we have included a “survival index”

comparing the rate at which companies

were spending to the amount of cash

on their balance sheets. And in each of

those years, there has always been a

sizeable cohort of firms — typically around

25% — with less than one year’s worth of

cash on hand. But even though about a

fourth of publicly traded biotech companies

have perennially been a few months

away from going out of business, the

survival index was never followed by the

mass extinctions its name appeared to

portend. Our chart, it would seem, had

been misnamed. It’s not a survival index if

everyone survives.

What was missing in those annual

charts — and the answer to the apparent

paradox — is that there was relatively little

overlap between the “at risk” companies

in any two consecutive years. Instead

of closing shop, most companies simply

7

Large companies will not

start buying assets en masse

that do not fit their strategic

objectives simply because

they are relatively cheaper.

Misallocated resources and

distracted energies are no

bargain at any price.

replenished their dwindling cash balances

by raising more capital.

In the current environment, of course, all

of that has changed. As funding options

have dried up, many companies with little

cash may also have little in the way of

options. For many at the low end of the

survival index, survival may truly be at

stake. While many firms are restructuring

their operations to stay alive, we are likely

to see a sizeable number of firms declare

bankruptcy or cease operations.

We are also likely to see increased merger

activity in this environment, as some

financially distressed biotechs combine

operations with similarly sized firms to

improve their odds. And while depressed

biotech valuations might seem to predict

increased pharma-biotech mergers, we

are unlikely to see a dramatic uptick.

Large companies will not start buying

assets en masse that do not fit their

strategic objectives simply because

they are relatively cheaper. Misallocated

resources and distracted energies are no

bargain at any price.

However, pharma companies are likely to

remain actively interested in more mature

firms. Over the last year or so, several of

the biotech sector’s bigger names have

attracted the eye of pharma buyers,

including Genentech, MedImmune,

Millennium and ImClone. In early 2009,

two big pharmas merged with each other,

and there is speculation that more could

follow. But here, too, the outlook could

become cloudy because of the financial

crisis. Large acquisitions will inevitably

need some degree of debt financing,

particularly as prospective buyers see

revenue-generating blockbusters go off

patent in the years ahead. And getting

credit has become more difficult, even for

entities with significant cash flows. While

huge sums have been raised to finance

the Pfizer, Merck and Roche transactions,

there is a limit to how much debt will be

available, and at a minimum, buyers will

confront a higher cost of capital from

borrowing than they faced in the past.

In spite of these difficulties, we can expect

considerable industry consolidation in the

months and years ahead, driven by big

pharma’s growing need to fill the pipeline

and achieve cost efficiencies and the

existential funding crisis faced by many

small biotech companies. Whether by

merger and acquisition (M&A), bankruptcy

or liquidation, the number of companies

in the industry will contract over the

remainder of 2009 and into 2010.

New models for new necessities

Some of the most sweeping implications

of today’s unprecedented challenges,

however, may be for the industry’s

long-standing models. Over the 33-year

history of the biotech industry, companies

have gravitated toward some enduring

operational models — approaches for

financing, partnering, conducting

research and development (R&D) and

bringing products to market. These

operational models, in turn, collectively

drive the overall business model — helping

determine, for instance, how vertically

integrated companies become and the

degree to which they specialize in specific

aspects of the value chain.

The world’s longest relay race

To understand why certain models have

evolved in this industry — and why we

think approaches that have largely

withstood the tests of time will become

increasingly unsustainable in the months

and years ahead — we need to start by

presenting an axiom: necessity is the

mother of all models. The models that

companies and investors adopt are, in

other words, not developed in a vacuum.

They are instead compromises shaped

by a number of constraints — resources,

funding options, bargaining power and

the inescapable reality that it takes

US$1–2 billion and upwards of a decade

for a biotech company to become a

mature, financially sustainable enterprise.

Few investors have the means and

patience to endure such a journey — after

all, they face constraints of their own on

investment horizons and rates of return.

Consequently, the business model that

has evolved in the biotech industry is akin

to a marathon relay race, in which biotech

companies work with a series of investors

and partners to raise capital and share

risk. From venture capitalists through

strategic-alliance partners and public and

other investors, each set of buyers carries

the baton for a few years.

Not surprisingly, these necessities move

biotech companies to behave in certain

ways. Their overwhelming objective is

often to survive long enough to reach

the next value-creating milestone,

where existing investors can pass the

baton and companies can raise more

The business model that has

evolved in the biotech industry

is akin to a marathon relay race,

in which biotech companies

work with a series of investors

and partners to raise capital and

share risk.

capital. Consequently, firms often

keep R&D spending very lean and are

forced to choose short-term priorities

over long-term ones — focusing on the

most advanced pipeline candidate, for

instance, instead of a later-generation

one with more scientific and commercial

potential. And given the industry’s

sequential, pass-the-baton funding

continued on page 12

8

Beyond borders Global biotechnology report 2009

A closer look

Enlightened competition

Perhaps more than any other sector, the biopharmaceutical

industry depends on innovation for its very survival. While

the term “innovation” is usually applied to scientific or

technological advancement, financial and organizational

innovation has also played a critical role in shaping the industry,

especially during periods of constrained capital investment.

At such times, companies have sought to access capital,

reduce burn rates and share risk through a variety of creative

transactions and deal structures. In 2008, when pharmaceutical

companies represented the primary buyers of technology

assets and companies, the concept of “precompetitive”

collaborations surfaced at companies and venture firms.

The idea is that, as pharmaceutical companies face growing

pressures to find new ways to innovate, they could benefit

from arrangements where several firms collaborate on the

development of early-stage platforms or enabling technologies.

Enlight Biosciences, launched in 2008 by Boston-based

PureTech Ventures, has translated this vision into a reality,

in the process developing a novel collaboration and financial

structure. PureTech has assembled a number of big pharma

backers so far: Eli Lilly, Johnson & Johnson, Merck & Co.

and Pfizer. With venture investors seeking to mitigate risk by

investing in later-stage companies with clinical compounds,

Enlight’s founders and pharma members saw a risk of

underinvestment in platforms and enabling technologies. Yet

developing new platforms is critical — they could, for instance,

significantly enhance the drug discovery and development

Enlight corporate structure

Enlight

Biosciences, LLC

Endra

Holdings, LLC

Endra, Inc.

Holding company 2

Holding company 3

(LLC structure)

(LLC structure)

Operating

company 2

Operating

company 3

process in areas such as molecular imaging, drug delivery,

personalized medicine and early prediction of safety.

The pharmas work closely with Enlight to identify the most

pressing needs in the industry and to help guide Enlight’s

search for, and development of, novel technologies that address

those needs. The goal is to form start-ups that will develop

and commercialize the most promising technologies. Via an

approach that the PureTech team applies across its portfolio,

Enlight adds an entrepreneurial component to the pharma

collaborative model: the company serves as an institutional

entrepreneur, pulling together transformational intellectual

property (often from multiple sources), assembling preeminent

scientific thought leaders and providing interim management

to its new companies. The pharma partners provide the initial

funding (they have committed to provide financing of up to a

combined US$65 million) with additional investment coming

from the partners, venture investors or other third parties.

Enlight’s model addresses a critical structural impediment

to funding innovation in the biopharma industry, namely the

fundamental tension between entrepreneurs and investors

around how to apportion financial returns. Enlight’s pharma

partners are focused primarily on the impact Enlight-supported

innovations make within their organizations. As such, they are

looking for not just financial returns but strategic returns, and

turning what was once a zero-sum game (dividing up financial

returns) into a symbiotic relationship where each party can

derive benefit in a different way.

Key activities/purpose

Ownership

• Identifying new technologies

• Enlight leadership

• Forming new companies

• PureTech

• Investment vehicle for

• Pharma partners

new companies

• Enlight

• Holding companies

• Operations

• Management

• Venture capitalists

Source: Enlight Biosciences

9

Necessity is the mother of all models

How unprecedented changes are driving new approaches

New necessities

More flexibility to retain rights, upside and independence

Exploit

choices

Top

innovators

Unprecedented changes

Bargaining power shifts from big pharma to top innovators

Patent expirations

and big pharma’s

reinvention

Boost R&D productivity

Foster innovative cultures

Capture external breakthroughs

Change

Big pharma

(see Beyond borders 2008)

Cut costs, maintain earnings

Leverage globalization

Sustain ecosystem

(see “The interconnectedness

of all things”)

Raise capital

Retain some upside

Survive

Global

financial

crisis

Small-cap companies

Small caps see further erosion of bargaining power

Greater focus to contain costs and reduce burn

VCs

Seek novel ways to enhance returns

Source: Ernst & Young

10

Beyond borders Global biotechnology report 2009

Sustain

returns

Find path to exits

New models

Buy and leave alone

Nonexclusive

licensing

Takeda/Millennium

Roche/Alnylam

License and leave alone

Purdue/Infinity

Option and

leave alone

Amgen/Cytokinetics

Cephalon/Ception

Larger up-fronts

for sustainability

Acquisitions with

earn-outs

Genzyme/PTC

Viropharma/Lev

Precompetitive cooperation

Early IP lockups

Enlight Biosciences

Pfizer/UCSF

CRO/PE “at risk”

transactions

TPG-Axon/Lilly

More options

around

geographic rights

Rifle shots

(lean companies)

VCs investing in

public companies

(VIPEs)

Consolidate to survive

(roll-ups)

Monetize

noncore assets

The Medicines Company/

Targanta Therapeutics

Paul Capital,

Royalty Pharma,

others

Later-stage

specialty

pharma

approaches

Build it to slot it?

(medtech model)

Creative project

financing

Symphony Capital

VCs with

extended

fund lives?

11

model and the inherent uncertainty

of investor sentiment over time, firms

attempt to strike a balance between

taking money when it’s available and not

raising capital in ways that overly dilute

existing investors or give away too much

potential upside.

Among the key constraints that biotech

companies have traditionally faced are

their limited resources and bargaining

power. As a result, the conventional

wisdom has been that biotech companies

“sell their first born” — licensing their

initial product candidate to big pharma

out of necessity — in order to sustain

operations with the hope of controlling,

or at least materially participating in,

the commercialization of subsequent

products themselves. In other words,

most biotechs aspire ultimately to

become fully integrated pharmaceutical

companies (FIPCOs) because of one

simple reason — that’s where the money

is. Companies with top-line revenue earn

higher returns than what is generally

possible by outlicensing to another

company and settling for a royalty.

Of course, not all companies can go the

distance, and successful biotech enterprises

often choose the ultimate baton pass — to

a strategic acquirer — after concluding

that such a move is in the best interest of

shareholders and other stakeholders.

Unprecedented challenges

If models are functions of necessity,

it follows that unprecedented

challenges — and the new necessities

they create — should be fertile ground for

seeding new models. This is, of course,

precisely the situation in which the

industry now finds itself. Companies of

all sizes are operating in a landscape that

is profoundly different from anything

they have seen before, because of some

historic shifts.

12

These trends create new necessities

with potential implications for the

biotech industry’s existing business and

operational models. (For a simplified

representation of some of these new

necessities, see “Necessity is the mother

of all models” on page 10.) The most

immediate changes will stem from the

issues that are confronting companies in

the near future: big pharma’s reinvention

and the global financial crisis.

New necessities:

big pharma’s reinvention

Biotech companies have already started

seeing the impact of big pharma’s

pipeline problems on biotech operational

models, since pharmaceutical firms

have been taking serious measures to

boost R&D productivity for some time

now. Not surprisingly, some of the initial

consequences have been for partnering

models. As pharma’s pipeline problems

became more acute, bargaining power

shifted toward biotech firms with highly

promising products and platforms. Big

pharma companies, many of which had

initially steered clear of the biologics

revolution, were determined not to

miss the “next big thing.” As a result,

competition for technologies such as RNAi

became heated in recent years. Biotech

companies developing these desirable

technologies benefited, commanding high

premiums in acquisitions and structuring

deals that gave them greater flexibility

while allowing them to retain more rights.

Beyond borders Global biotechnology report 2009

Yet the benefits of this power shift accrued

to a relatively small group of companies

developing assets that are widely regarded

as having tremendous commercial

potential. For these “top innovators,” even

the arrival of the global financial crisis did

not alter their power equation with big

pharma. Indeed, while other companies

were buffeted by roiling capital markets,

plummeting valuations and wary investors,

these firms have continued to structure

deals and access capital at favorable

terms. Examples include Alnylam’s

nonexclusive licensing deal with Takeda

and Infinity Pharmaceuticals’ innovative

alliance with Purdue Pharmaceuticals.

(These transactions, and other creative

deals involving top innovators, are

discussed in the US deals article, “Buying

biotech, being biotech.”)

Big pharma’s challenges are also

motivating it to cut costs and maintain

earnings. Once again, this is driving

creative approaches through deal-making.

In at least one prominent example, the

creation of Enlight Biosciences, we have

seen several big pharmas collaborate in

a precompetitive space. (See “A closer

look” on page 9 for details.) We’re likely

to see more structures along these

lines. The concept — bringing together

many big companies to jointly develop

a platform or address a scientific

quandary — could certainly be applied

more broadly at a time when big pharma

needs both scientific breakthroughs and

cost containment.

New necessities:

the global financial crisis

While the global financial crisis may not

have had much impact on big pharma and

the top innovators, it has certainly taken a

toll on small-cap biotechs. This has always

been an industry of haves and have-nots,

but the disparity between those two

camps has probably never been greater.

As described above, small companies

are now struggling to survive, and these

firms have fewer funding options and

considerably less bargaining power than

they did even a few months ago.

The immediate response of many

small-cap companies has been to suspend

development of secondary products in

the pipeline, seek to sell noncore assets,

cut costs and focus resources on the

most promising pipeline candidate. While

this response is understandable, it is

also, ironically, more of the same. The

existing model — building “rifle shot”

companies around lean R&D operations

in order to reach the next value-creating

milestone — is now in overdrive as

companies pare back even further in

bare-bones approaches that can risk

everything on the fortunes of a single

clinical candidate.

Here, too, many companies are looking

at creative deal-making approaches

to address their challenges. We could

see deals where two or more small

single-product biotech firms “roll up”

their enterprises into a single franchise

to lower burn rate, take advantage of

scale efficiencies and attract investment.

To close the valuation gap between

sellers’ expectations and market realities,

acquisitions with earn-outs have become

increasingly regular even in purchases

of public companies — an unprecedented

development. Companies that choose

not to sell out will likely be pushed to

partner assets earlier than they would

have otherwise. To still retain rights and

flexibility for an attractive exit down the

road, these firms will seek deals with an

increased use of options or creative ways

to divide geographic rights.

Seeking sustainability

Clearly, big pharma’s reinvention and

the global financial crisis are driving

companies of all sizes to seek new

solutions to the quandaries confronting

them. Much of what we’ve discussed so

far has involved relatively minor changes

to long-standing transaction models.

This is not entirely surprising — after

all, deal-making has been an integral

part of the biotech business model

since the industry’s earliest days, and

the sweeping changes currently under

way are fundamentally realigning the

balance of power between different

groups of companies.

But there is also a much deeper question

at play in this crisis, and it strikes at the

very heart of the industry’s business

model. As we articulated earlier,

operational models can help companies

address challenges of funding, partnering,

developing and commercializing products,

but these approaches ultimately feed

into a larger business model. Is the

business model that biotech has always

known — built, as it is, on a lengthy

relay race — still sustainable? Will

various runners — investors, partners,

buyers — still enter their legs of the race if

they don’t know whether the next runner

will be there to take the baton? Will the

race be run by different sets of runners?

Will it be run at all?

What we’re talking about, in short, is

sustainability. At a time when many firms

are struggling to remain in business, the

real question is not whether individual

Is the business model

that biotech has always

known — built, as it is, on

a lengthy relay race — still

sustainable? Will various

runners — investors, partners,

buyers — still enter their legs

of the race if they don’t know

whether the next runner will be

there to take the baton? Will the

race be run by different sets of

runners? Will it be run at all?

13

companies will survive (many won’t) but

whether biotech’s basic business model

is itself sustainable. As we articulate

below, several major trends in the current

market suggest that the biotech business

model will not be sustainable in the same

form as it has existed in the past. For the

model to survive, it needs to sustain both

its inputs and its outputs. In other words,

it needs steady supplies of the fuel that

keeps it going: funding. And it needs to

continue to deliver the results that justify

its existence: innovation.

Relay runners wanted

Sustaining funding:

relay runners wanted

To sustain an adequate supply of funding

for the industry’s relay-race business

model, we need a constant supply of

willing runners. Over the next few years,

however, the runners that biotech

companies have come to rely on — venture

capitalists, public investors and big

pharma — will face constraints that could

limit their participation.

For VCs, the existing venture funding

model — which was already facing

considerable pressure in recent years

because of longer paths to exits,

increased regulatory uncertainty and

lower returns from IPOs — has come under

unprecedented pressure due to the global

financial crisis. Exits have become even

more difficult, thanks to an extended

IPO famine, depressed public-company

valuations and big pharma buyers that

may be distracted by their own internal

challenges and less able to use debt

for acquisitions. Bargaining power in

acquisitions has shifted toward buyers,

to the detriment of smaller companies

and their VC backers. Raising capital from

LPs is becoming more challenging as

LPs see their portfolios shrink — meaning

that there is now more competition for a

smaller pool of money and that LPs are

more likely to demand better performance

from their investments.

Meanwhile, public investors — who account

for the majority of the recent decline in

biotech funding — are not expected to

14

New investors?

Better valuations?

More effective

drug development?

return in force any time soon. The era of

easy money and high leverage has come

to an end, and public biotech companies,

which had attracted significant funding

from highly leveraged hedge funds in

recent years, will simply have less capital.

Lastly, many pharma firms will likely find

their ability to invest in biotech increasingly

Beyond borders Global biotechnology report 2009

Quicker

exits?

constrained, both because of the need to

focus on integrating mega-mergers and

because the pharma industry will spend

less on R&D (and, likely, R&D alliances with

biotechs) as its revenues decline.

Creative partnering models — including

deals with larger up-fronts or deals that

give VCs partial exits now in exchange

for a sale at a prenegotiated price if the

product succeeds — could find ways around

some of these constraints. Such solutions

could help overcome immediate hurdles

and allow individual runners to remain in

the race. But they cannot entirely address

the larger sustainability issue: with the

industry’s existing business model, it

costs US$1–2 billion to build a sustainable

enterprise, and there will simply not be

enough capital to sustain a large number

of today’s companies at that level.

Sustaining innovation:

watch what you cut

This lack of funding will inevitably lead

to reduced R&D spending and slow

innovation. In addition, ultra-lean business

models are likely to put innovation at

risk. The use of these approaches is not

surprising, given the paucity of financing

alternatives. It is also not entirely

without precedent. Indeed, in dire times,

this industry is used to reverting to

cheerleader mode. Biotech companies

are exhorted to focus on innovation and

only pursue the targets that are most

likely to deliver true advancements in

meeting patients’ needs. While that’s an

understandable response, the unfortunate

reality — as we noted in our discussion

of the “drug development lottery” in last

year’s Beyond borders, and as Merv Turner

of Merck argues in this year’s Roundtable

on deals article — is that even the smartest

minds and best technologies are unable

to separate the winners and losers early

on. If drug development is still dependent

on a good deal of serendipity, the culling

of large numbers of “less promising” R&D

programs raises the very real prospect that

we might be killing the next big thing. It’s a

sobering thought.

What’s at stake?

Let’s take a minute to remind

ourselves about what’s at stake, and

what we stand to lose if innovation

slows down.

While we’ve made impressive progress

in treating scores of diseases in recent

decades, we still have a ways to go in

addressing unmet or underserved medical

needs. There is absolutely no doubt,

however, that the answers to those

needs — from curing cancers to fighting

new strains of treatment-resistant

infections and tackling neurodegenerative

diseases — will principally be found

through biotechnology.

As a society, we urgently need to

contain our rapidly growing healthcare

costs — a problem that will only get worse

in the decades ahead as populations age,

setting off demographic time bombs in

the West, China and Japan. Again, the

innovative power of biotechnology has

the potential to provide an important

part of the answer — through the promise

of more efficient drug development and

interventions that are safer, more timely

and more effective.

If we are to have any hope of improving

the quality of millions of lives through

better treatments and interventions — and

do so while containing healthcare

costs — then we need not just to sustain

biotech innovation, but to unleash its full

transformative potential.

Paradigm shifts

So how do we jump-start innovation?

If biotech’s existing business model is

becoming unsustainable, how do we

accelerate the transition to sustainability?

In last year’s Beyond borders, we talked

about big pharma’s “existential moment,”

referring to the fact that many large

pharmaceutical companies need to either

fundamentally reinvent themselves

or risk disappearing, at least in their

current form. This year, on the 100th

anniversary of Charles Darwin’s birth,

another analogy seems more fitting: the

“Darwinian moment.” At a time when the

biotech industry faces the prospect of

significant contraction and consolidation,

the question is whether this will be a

destructive process or an evolutionary

The process of evolution has

been neither linear nor smooth.

Every now and then it has been

shaped by cataclysmic events …

one. Clearly it’s an issue on the minds of

industry executives, since the metaphor

is used repeatedly by this year’s guest

contributors. From the titles of guest

articles (“Survival of the focused,” “The

Darwinian challenge”) to our roundtable

with four next-generation CEOs, much of

the discussion in this year’s book revolves

around a central question — how do we

create a Darwinian opportunity out of an

existential threat? How do we ensure that

this is not the start of a mass extinction

but rather a process of advancement in

which biotech’s best and fittest survive?

If we’re going to use the Darwinian

metaphor, then it’s worth remembering

that the process of evolution has been

neither linear nor smooth. Every now and

then it has been shaped by cataclysmic

events — a helpful meteor or two, a

mega-volcanic eruption — that completely

altered the environment and created

opportunities for new species to evolve.

And that is where we are today — on the

cusp of a world of change that could quite

possibly change the world.

Over the next few years, several trends

currently in play have the potential to

shift existing paradigms and, in doing

so, to create new, sustainable business

models. We highlight a few of these here:

• Generics, generics, generics. We have

written extensively, in this article as

well as in last year’s Beyond borders,

about the financial implications of big

pharma’s patent cliff. Pharma’s revenues

face a precipitous drop. The products

themselves, however, are not in peril.

To the contrary, they will probably serve

more patients than ever before, as

generic equivalents reach the market.

These are, it should be remembered,

some of the most successful blockbuster

15

drugs in the world — meaning that

patients will have access to some of

the best generics the industry has

ever seen. Even as this creates new

competitive pressures — companies will

need truly innovative products to secure

reimbursement from payors — it could

remove some of the pricing demands

that the industry has faced in recent

years, as payors’ budgetary constraints

are loosened by lower-priced generics.

This, in turn, could allow for better

margins for innovative products and help

make the numbers work for sustainable

business models.

• Healthcare reform. The United States

may finally be on the verge of making

its much-delayed, long-anticipated,

often-feared transition to universal

healthcare coverage. Like the coming

wave of generics, this change would

be nothing short of momentous — a

dramatic expansion in the world’s

largest (and most laissez-faire)

drug market. Indeed, recognizing

healthcare’s paradigm-shifting

power, the Obama administration

is positioning healthcare reform

as one of three investments in the

future (energy and education are the

others) that will lay the foundation

for a more competitive 21st-century

economy. For drug companies,

expanded coverage will likely bring

new pricing regimes where buyers

have concentrated bargaining power.

Meanwhile, the push for electronic

medical records to increase efficiency

could produce vast volumes of data for

companies to mine in developing better

treatments — creating new winners

and losers, including perhaps from

competitors and collaborators that

emerge from outside the traditional

healthcare sector. Once again, there

are opportunities to build sustainable

business models in this uncertainty.

Healthcare reform will likely include

the adoption of pay-for-performance

metrics. The challenge for the drug

industry will be to make sure that these

metrics maintain the right incentives

16

Sweeping changes that are

on the horizon — a wave

of high-quality generics,

fundamental healthcare

reform, personalized medicine

and globalization — could

dramatically shift existing

paradigms and generate

opportunities to build

sustainable business models.

for innovation rather than simply

aim to lower costs. The movement

to a system that measures and truly

rewards companies based on the

value their products deliver could give

investors the returns they need and

create the basis for a more sustainable

business model.

• Personalized medicine. Some of the

paradigm-shifting trends discussed

above, such as competition from a

new wave of generics and the move to

pay-for-performance under healthcare

reform, could also accelerate the

adoption of personalized medicine.

We discussed personalized medicine

in considerable detail in last year’s

Beyond borders and won’t cover the

same ground here, but this is another

development that promises to be truly

transformative, with implications for

the entire business model from early

research through commercialization

and marketing. Among other effects,

more targeted and efficient ways of

developing drugs should lower R&D

costs, reducing the length of biotech’s

marathon relay race. With the use

of biomarkers to identify promising

targets up front, personalized medicine

will also make early stages of the

value chain — research and early

development — more valuable. Since

these are precisely the activities that

have traditionally been biotech’s

strengths, the move to personalized

Beyond borders Global biotechnology report 2009

medicine should bring more bargaining

power to biotech companies, creating

opportunities for deals and business

models where biotech firms can make

the numbers work by capturing more of

the upside.

• Globalization. Last, but not least, is

globalization, another trend discussed

in some detail in last year’s Beyond

borders. Much of what we discussed

last year remains unchanged in the

current environment. The global

financial crisis has not fundamentally

altered the outlook for the burgeoning

biotech industries in many Asian

economies, where cost-cutting drives

by Western firms could lead to more

business for local companies. As overall

growth in emerging markets slows,

however, some Western companies

may start reconsidering the timing of

their strategies, which are based on

the assumption that rapidly growing

middle classes will give them access to

previously untapped markets. Beyond

these short-term impacts, however,

globalization promises to bring

sweeping changes to the drug industry,

with implications for the business

models of Western firms. As ex-US

and ex-European geographic rights

become more valuable, for instance, it

will become increasingly possible for

partners to divide up worldwide rights

in ways that provide value to each

participant. As companies in these

markets develop, they are partnering

with and acquiring assets from Western

companies — creating new sources of

capital and the potential for new ways

of collaborating that could become

increasingly significant with time.

More broadly, it is worth noting that

the biotech business model we have

discussed in this article is really the

Western biotech business model. In the

emerging biotechnology industries of

Asia, many of the factors that Western

companies have relied on — strong

university research, technology transfer

laws that support commercialization,

experienced venture capitalists — have

not been as readily available, and

companies have evolved different

models in response. As Western

companies look for alternatives in the

current climate, there may be Asian

examples to learn from.

The path ahead: beyond business

models as usual

Biotech’s existing business model has

never been under more strain, with

funding dramatically reduced and

considerable innovation at risk. The

question is whether the industry will find

new ways to reach a sustainable model. To

keep runners in the race (or attract entirely

new runners), companies will need ways to

improve returns on investment — through

better prices and valuations, quicker exits

or more efficient R&D. Alternatively, if they

can find ways to shorten the race itself, the

model could work with fewer runners.

Yes, this crisis is truly different. It’s

deep-rooted and systemic, and the

problems it has prompted are unlikely to

be mitigated any time soon. But times

of tremendous change — whether set off

by global recessions or meteors — can

reshape landscapes and create new

opportunities. There is good news in

that realization, because the sweeping

changes that are on the horizon — a wave

of high-quality generics, fundamental

healthcare reform, personalized

medicine and globalization — could

dramatically shift existing paradigms

and generate opportunities to build

sustainable business models.

For that to happen, biotech executives

will need to understand the potential

impact of these changes, prepare for

them, and wherever possible, help shape

them. The industry’s representatives will

need to be actively involved in the policy

debate on healthcare reform, to ensure

that the pay-for-performance metrics

developed align incentives with the needs

of innovation. And its scientists will need

to focus their R&D efforts to embrace

personalized medicine, since its adoption

offers some of the best hope for quicker

R&D and better returns on investment.

Necessity is the mother of all models,

and if history is any guide, today’s

tremendous challenges will unleash

tremendous creativity. So far, we’ve

seen that creativity applied in relatively

small ways to adjust partnering models

and navigate around immediate

roadblocks. As the industry’s creativity

is applied to the larger issue of

sustaining the entire relay race, and as

several paradigm-shifting trends unfold,

we could see the emergence of more

durable models that will carry biotech

through the next 30 years. The sooner

we can get there, the better.

17

John Martin, Ph.D.

Gilead Sciences, Inc.

Chairman and

Chief Executive Officer

The question of how we sustain growth in

our industry is, ultimately, one of how we

sustain innovation in treatment advances

and ensure greater patient access to

those advances. The global financial crisis

has had a direct and immediate impact on

the biotechnology industry, most visibly

in the consolidation and downsizing of

many organizations. Without continued

investment, we face the real danger

that an entire generation of biotech

companies will be cut down.

This danger is not unprecedented. We

have been threatened by economic, legal

and policy changes over the history of

the industry. At Gilead Sciences, we have

endured challenging times, and faced the

question of whether it made more sense

for us to be acquired rather than remain

independent. We persevered and went on

to become one of the industry’s largest

and most successful fully integrated

companies. Our experience may offer

insights for companies that are similarly

challenged today.

Risks

Risk is inherent in both the financial

and research components of our industry.

Bringing novel therapeutics to market

is a lengthy, difficult and expensive

endeavor, particularly compared to

product development in other industries.

Only a small percentage of compounds

in development ever make it to

commercialization.

With investors already facing significant

R&D risk from biotech investments,

anything that substantially worsens

the odds can lead to precipitous

declines in funding. In the early 1990s,

proposed healthcare reforms were

initially undertaken without sufficient

18

Survival of the focused

transparency for investors to understand

and evaluate risk, which dampened

investment. In the current crisis, the

perceived risk is mostly systemic rather

than sector-specific, and biotech is one

of many sectors that public investors

have abandoned.

Responses

At Gilead, we survived past

periods of uncertainty through a

concerted emphasis on what is most

important — developing innovative

drugs. To this day, our approach is to

apply critical decision-making to advance

only those compounds that we believe

have the potential to truly address

unmet medical needs. In an environment

in which regulators and payors are

demanding more, it is more important

than ever that we all have this focus.

Drugs that offer significant advances in

treating patients are the ones that will

gain market acceptance — and deliver

the returns that investors require.

We have always believed in being

deeply connected with the healthcare

ecosystem. Our conversations and

collaborations with governments,

companies, physicians and patients

help us understand the needs of the

communities we serve. Through these

conversations, we have, for instance,

developed access and care programs for

patients who cannot otherwise obtain

our medications in the developing

world and industrialized nations. But

being connected also gives a company

valuable feedback to make its operations

more effective, allowing it to adapt

clinical development programs, make

manufacturing processes leaner or

simplify the logistics of a patient

Beyond borders Global biotechnology report 2009

assistance program. For companies

and their investors, this means more

predictability, fewer surprises — and

less risk.

We also recognize that our research

efforts represent a small percentage

of the overall R&D landscape. Our

expertise, however, allows us to

evaluate and identify opportunities

outside our organization, and affords

us the credibility to be a valued partner

for other companies and academic

collaborators. In areas where we do not

have an inherent efficiency advantage

or strategic rationale for conducting

certain activities, we rely on the

experience and capacity of partners.

For example, we have outsourced much

of our manufacturing to partners with

substantial knowledge in this area.

Rewards

Tough times, as the adage goes, don’t

last. The question is what the industry

will look like after this crisis is over. Will

a new generation of fully integrated

companies emerge? I hope so. It won’t

be easy, and many firms will perish, but

I am confident that many will make it

through — and be the tougher for it.

In summary: focus on what matters.

Innovation matters, because that’s what

drives value in this industry. Collaboration

matters for efficiency and strategic

advantage. Connectivity matters, because

success depends on understanding the

needs of the communities we serve.

And that, in the final reckoning, is

the real reward — the opportunity to

make a difference in curing diseases

and helping patients. I can think of no

greater motivation.

James M.

Cornelius

Bristol-Myers Squibb

Chairman and

Chief Executive Officer

Innovation from a string of pearls

A raft of challenges

A string of pearls

Over the next few years, escalating

pressures will transform the

pharmaceutical industry as we know it.

The industry will face a host of patent

expirations on many of its most important

products, making innovation and R&D

productivity paramount. Meanwhile, access

to physicians is fleeting, and governments

and payors are bearing down on prices,

access and prescribing patterns.

To achieve these goals, we have

restructured in two significant ways.

First, we are divesting assets to focus

intently on innovative medicines. We

have moved away from our non-pharma

assets — selling our wound care and

imaging businesses, for instance,

and completing a partial IPO for our

nutritionals group.

These challenges are being compounded

by the global economic downturn,

which could reduce the uptake of novel

medicines as customers balance medical

care with other basic needs. For biotech

companies, access to capital has dried

up — with potentially dire consequences

for many innovators.

These measures have given us a

strong cash balance, allowing us to

pursue the second critical component

of our model: our “string of pearls,”

a series of interrelated acquisitions,

licensing agreements and partnerships

with biotech companies. We intend to

become the partner of choice for the

biotech industry.

In the face of these challenges, old business

models are unsustainable, and companies

must reinvent themselves — or fail. While

it is clear that new models are needed,

there is no consensus around what shape

those models should take. So, while all

pharma companies are responding, they

are taking somewhat different approaches

to the problem. Some are betting that

large-scale consolidation will provide a

path forward. Others have cast their lot

with diversification, turning to generics or

non-pharma products.

We don’t have a one-size-fits-all approach

to these alliances. Instead, we aim for

transaction structures that can generate

the greatest innovation and value.

In some cases, we may engage in a

licensing agreement for a single asset

or a particular group of compounds. In