SESSION 15: BANK RECONCILIATION / INTERNAL CONTROLS

advertisement

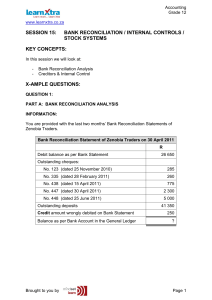

Accounting Grade 12 www.learnxtra.co.za SESSION 15: BANK RECONCILIATION / INTERNAL CONTROLS / STOCK SYSTEMS KEY CONCEPTS: In this session we will look at: - Bank Reconciliation Analysis Creditors & Internal Control X-AMPLE QUESTIONS: QUESTION 1: PART A: BANK RECONCILIATION ANALYSIS INFORMATION: You are provided with the last two months’ Bank Reconciliation Statements of Zenobia Traders. Bank Reconciliation Statement of Zenobia Traders on 30 April 2011 R Debit balance as per Bank Statement 26 650 Outstanding cheques: No. 123 (dated 25 November 2010) 285 No. 335 (dated 28 February 2011) 260 No. 438 (dated 15 April 2011) 775 No. 447 (dated 30 April 2011) 2 300 No. 448 (dated 25 June 2011) 5 000 Outstanding deposits Credit amount wrongly debited on Bank Statement Balance as per Bank Account in the General Ledger Brought to you by 41 350 250 ? Page 1 Accounting Grade 12 www.learnxtra.co.za Bank Reconciliation Statement of Zenobia Traders on 31 May 2011 Unfavourable balance as per Bank Statement 23 270 Outstanding cheques: No. 335 (dated 28 February 2011) 260 No. 448 (dated 25 June 2011) 5 000 No. 473 (dated 22 May 2011) 3 300 Outstanding deposits Credit balance as per Bank Account in the General Ledger 31 600 230 REQUIRED: Refer to the Bank Reconciliation Statements of April and May 2011 and answer the following questions: 1.1 According to the April 2011 Bank Statement, does Zenobia Traders have a favourable bank balance or an overdraft? Give a reason for your answer. (2) 1.2 Calculate the missing bank balance in the General Ledger of Zenobia Traders on 30 April 2011. State whether this is a favourable or unfavourable balance. (7) 1.3 Cheque No. 123 does not appear on the May 2011 Bank Reconciliation Statement. The payee, C.Cheese, did not deposit this cheque for commission. 1.3.1 Briefly explain what the problem is with cheque No. 123. (2) 1.3.2 What entries would the bookkeeper have to make during May 2011 to deal with cheque No. 123? (2) 1.4 Which of the cheques shown as outstanding on the April 2011 Bank Reconciliation Statement was reflected on the May 2011 Bank Statement? (write down only the cheque numbers). (2) 1.5 The Bank Reconciliation on 30 April 2011 shows an item “Credit amount wrongly debited on Bank Statement, R250”. 1.5.1 Was this error corrected by the bank during May 2011? Give a reason for your answer. (3) 1.5.2 Give an example of the type of error that the bank could have made. 1.6 (2) Explain why cheques 335 and 448 appear on both the April and May 2011 Bank Reconciliation Statements. Give a different reason for each cheque. (4) Brought to you by Page 2 Accounting Grade 12 www.learnxtra.co.za PROBLEM SOLVING: 1.7 As the internal auditor of Zenobia Traders you have noticed that there has been an increase in the number of debtors who have complained that their payments have not been reflected on their statements from us, even though they have receipts for their payments. On investigation you find that the cashier has been hand writing receipts, where Zenobia Trades have a programme that automatically prints receipts when recording the receipt of the money on the computer. 1.7.1 What do you suspect is happening in the above scenario? (2) 1.7.2 If, after an investigation, the cashier is suspected of doing something illegal, give TWO steps that you can be take. (4) 1.7.3 Give ONE internal control measure that could be implemented in the accounting department to avoid any further problems of this type occurring. (2) PART B: CREDITORS & INTERNAL CONTROL 1.8 How do creditors assist with the cash flow in your business? 1.9 A business needs to have strict internal control procedures in place for its creditors. Give TWO procedures that a business could use to ensure good control of its creditors. 1.10 Suggest TWO ways in which the bookkeeper could be defrauding the business using the creditor's system. 1.11 Give the formula to calculate the 'Creditors Payment Period' in days. Brought to you by Page 3 Accounting Grade 12 www.learnxtra.co.za QUESTION 2: PART A: BANK RECONCILIATION ANALYSIS The following information was extracted from the accounting records of Sujee Shoes. INFORMATION Sujee Shoes buys and sells one type of shoes. The business uses the periodic inventory system and the weighted average method of valuing inventory. Inventory: 145 pairs were on hand at R180 per share on 1 August 2011. 125 pairs were purchased at R210 per pair on 7 August 2011. One of the suppliers was having a sale. Purchased 100 pairs of shoes for R11 000 on 20 August 2011. 110 pairs of shoes were imported at R230 per pair on 26 August 2011. Import duties paid was R3 610. 140 pairs of shoes were on hand on 31 August 2011. Shoes are sold at R400 per pair. REQUIRED 2.1 Calculate the weighted average value per unit on 31 August 2011. (10) 2.2 Calculate the value of the inventory on hand on 31 August 2011 (round off to the nearest rand). (4) 2.3 Draw up the Trading Account to determine the gross profit for the month ended 31 August 2011. (12) 2.4 The owner, Nadia, wants to sell her business. She approached you as the accountant of Sujee Shoes and requested that you change their inventory valuation method to the FIFO method to create a higher profit and a higher closing inventory for the business to enable her to sell the business at a much higher price. 2.4.1 Calculate the value of the inventory on hand on 31 August 2011 by using the FIFO inventory valuation method. (6) 2.4.2 Will it be ethical for Nadia to change the inventory valuation method? Provide TWO reasons to support your answer. (5) 2.5 Which of the two inventory valuation systems provides better internal control for your inventory and why? (5) 2.6 What does GAAP suggest in respect of stock valuation? Brought to you by (3) Page 4