UPL Limited Annual Report 2014-15

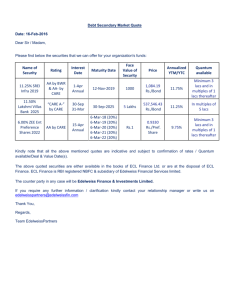

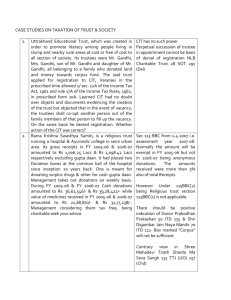

advertisement