Accounting with QuickBooks - National Association of Certified

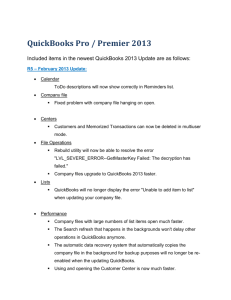

advertisement