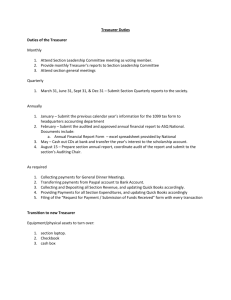

branch finances handbook

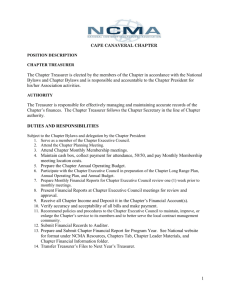

advertisement