Branch Annual accounts – Notes to aid preparation and worked

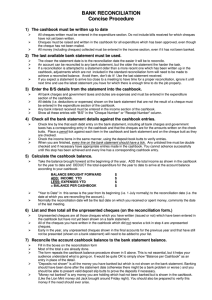

advertisement

Branch Annual accounts – Notes to aid preparation and worked examples for accounting adjustments This document is designed to help you prepare your Branch Annual Accounts. It gives some more detailed guidance around the stages that we recommended you go through to prepare the accounts and gives worked examples for accounting adjustments which may be necessary. Annual Branch Accounts – basic principles Annual Branch Accounts primarily consist of an income and expenditure summary and a balance sheet. The income and expenditure summary is split up into standard categories. There are other detailed schedules that support the total numbers on the balance sheet (fixed assets reconciliation, bank reconciliations and lists of assets and liabilities). A Balance sheet is a list of assets and liabilities that the branch has as at the financial year end (31st December) and a summary of its reserves (the total historical surplus or deficit that exists at the end of the year). The total assets minus the total liabilities should be equal to the end of year reserves of the branch. The assets and liabilities appear on the left of the balance sheet, the reserves appear on the right of the balance sheet. The total of each side should be equal. The reserves are the total of the branch’s yearly profits and losses from when the branch started. So each year the next profit or loss is added on the previous total to calculate the end of year surplus or deficit. The reason why this surplus or deficit should equal the total assets and liabilities is because everything the branch has earnt or lost since it started should be represented in an asset or a liability. For example, if in year 1 of its existence the branch makes a profit of a £1000 so it will have a £1000 cash in the bank at the end of the year, this goes in the left hand side of the balance sheet. On the right hand side goes the £1,000 profit in the “Income less expenditure this year” line and this is the carried forward end of year surplus (the reserves). So each year the profit or loss will get added on and the assets and liabilities will change accordingly. Obviously it might not always be cash, as cash might be spent on items such as stock or fixed assets and so these would appear on the left hand side of the balance sheet instead. Likewise he branch might, at points, owe people money (liabilities/ creditors) and so these would appear on the left hand side as negative figures, which will reduce the total of the left hand side of the balance sheet. So last year’s reserves plus the profit or loss from this year is the end of year reserves. This should equal the total assets minus the total liabilities at the yearend date. Each change you make to the right hand side of the balance sheet (the surplus or deficit) by altering the income and expenditure summary for the year (as this affects the profit or loss for the year which is added into the surplus or deficit at the end of the year) needs to be mirrored by a change on the left hand side of the balance sheet. Normally this change on the left hand side of the balance sheet is by cash increasing or reducing but it could also be for other items such as stock, debtors, creditors and fixed assets. If the two sides of a balance sheet don’t equal each other then something has been missed on one side or perhaps included twice. The most common items which cause differences are missed or double counted income or expenditure in the bank account, unpresented cheques, stock adjustments, fixed assets, debtors and creditors The Annual Branch Accounts are in a standard format to allow everything to be compiled centrally. Hopefully, most activities a branch has run in the year should fit into one of the categories for income and expenditure but if not there is “Other” for both income and expenditure for you to put any unusual items under It is best to start with the figures from your cashbook for the year (which should normally agree to the bank account statements for the year) and check everything adds up and the bank “reconciles”. Then you can use those figures as your starting points for the accounts Once you are happy with your starting point you can make double entry accounting adjustments necessary to account for items such as unpresented cheques, fixed assets, stock, yearend debtors and creditors Starting from the cashbook and reconciling your bank You will have recorded during the year all your income and expenditure that has gone through the bank and analysed it to the different categories, now you can use that information to check that you have actually recorded everything that has gone in and out of the bank Take the bank balance at the start of the year and the bank balance at the end of the year and work out the difference between the two. This should agree to the difference between your income and expenditure for the year in your cashbook. This is a bank reconciliation for the year. A worked example of this would be as follows; Cash balance per the accounts at the start of the year - £10,123 Cash balance per initial accounts at the end of the year - £9,997 (this could be your exact bank statement value before any unpresented cheques are removed but you may take away unpresented cheques if you know they exist and you have included them in your cashbook figure ) 9997 – 10123 = 126 As the cash balance is lower at the end of the year than at the start it would seem the branch has made a small loss for the year This can be confirmed by checking the income and expenditure in the cashbook Income for the year - £12,134 Expenditure - £12,260 12,134 – 12,260 = 126 The two numbers agree and your cash reconciles, i.e. you can explain the movement in it during the year If these don’t agree then you have possibly missed out or double counted some income and expenditure in the cashbook. The other option is regarding unpresented cheques which we will deal with now Dealing with Unpresented Cheques Unpresented cheques are cheques that you have written out by the end of the year but the person you gave it to hasn’t actually cashed it by the end of the year. You are then supposed to adjust your accounts accordingly and recognise the expense in your annual branch accounts to reflect the fact that you have written the cheque and so removed your debt. This means your cash balance in the branch accounts will be different from the actual bank balance as you record the expenditure and reduce the bank balance by the same amount. This is an example of double entry accounting and by making both changes your accounts will remain in balance as one affects each side of the balance sheet. However, the person then cashes the cheque the following year and you then also could potentially record them in your cash book as an expense in the following year as it has gone through your bank. You can’t have the expense in two years so what you have to do is remove this expense from your branch accounts in the year where it has gone through the bank. An unpresented cheque being recorded twice will sometimes also explain a difference on your bank reconciliation. Worked examples of these would be as follows 2013: Your bank balance per the year end bank statement is £10,140 You record items in your cashbook when they go through the bank so everything in your cash book has gone through the bank However, you know you wrote a cheque for £150 to an instructor and they haven’t cashed it. You want to reflect this cost in 2013 as that is when the person provided their instruction services and you have recognised the corresponding income from the members in 2013. So what you do is add £150 to the expenditure for the year (under rallies & instructions) and also reduce the bank balance in your branch accounts by £150. This is double entry. You can’t do one entry without the other entry, if you do your branch accounts balance sheet will not balance. This is because, as noted above, your profit/ loss figure for the year affects the right hand side of your balance sheet (the surplus/ deficit) so changing that without changing something on the left hand side of the balance sheet (assets and liabilities) will unbalance it. So your yearend bank balance per the branch accounts is £9,990. It doesn’t affect the value per the bank statement but it does affect your branch accounts 2014: The instructor cashes the cheque and you record it off the bank statement as normal in your cashbook under rallies and instruction. At the end of the year you try and reconcile your cash The closing cash balance per the bank is £11,500. There are no unpresented cheques outstanding at the end of 2014 so your branch accounts should have exactly the same balance The closing cash balance per your accounts in 2013 was £9,990. 11500 – 9990 = 1510 The income for the year in your cashbook was £14,250 and the expenditure was £12,890 14250 – 12890 = 1360 If you add the profit from your cashbook of £1,360 on the starting cash balance (per the branch accounts) of £9,990 the end expected cash balance is £11,350. This is £150 lower than the actual bank balance per the bank statement The difference is your unpresented cheque from 2013, you included it in 2013 so you can’t include it again now in 2014 and including it twice has caused your cash balance to not reconcile. So you add £150 to the cash to make it agree and then take away £150 from the expenditure on rallies and instructions in 2014 (as that is where you analysed the cashbook expenditure in 2014). So unpresented cheques from the previous year are a possible reason for your bank reconciliation not agreeing. Further accounting adjustments using double entry There are certain items which are non cash movements in accounts which should be taken into account after you are happy that your cashbook and your bank reconcile These are items such as fixed assets (additions, disposals and depreciation), stock, debtors and creditors It is probably simplest to make these adjustments using columns on a spreadsheet. Column one will be the starting figures from your cash book for the income and expenditure summary and the starting positions for your balance sheet. Starting position for most of your balance sheet items will be last year’s balance sheet. The starting point for the bank accounts is the value per the year end bank statements. In each column you would write one adjustment. Write both sides of the adjustment (normally one will be to the balance sheet and one to the income and expenditure summary) and the total of each column should be zero There are two versions of such a spreadsheet on the website, one with these notes and one in the Template spreadsheets section. One version contains some of the worked examples which are discussed below, another is completely blank for your own use. We would suggest downloading the worked example version with these notes and looking at it as you go through the examples below. Annual Branch Accounts – Debtors and Creditors The easiest adjustments to start with are debtors and creditors These are normally if someone owes you money at year end or you owe someone money at year end. The trick is always to remember that you must make two adjustments to your accounts for each entry For example if someone owes you money, they are a debtor. The debtor goes on the balance sheet and the income associated with that debt has to be recognised in the income and expenditure summary With creditors you owe someone money, the creditor will go on the balance sheet to show you owe someone money and the expenditure has to go in the income and expenditure summary, otherwise the balance sheet won’t balance. Worked example of these would be as follows: Debtors At the yearend a member owes you £150 in unpaid rally fees. You should put £150 pounds on the balance sheet under debtors AND increase rally income by £150. If you don’t do both then your accounts won’t balance as only by increasing your income will you increase your profit for the year and so increase your yearend reserves (the right hand side of the balance sheet) in line with how you increase the left hand side of the balance sheet by adding in the debtor. Creditors (This example is not included on the example of the accounting adjustments spreadsheet as adding too many columns makes it very small to print out) You owe several instructors for their services at year end. The total is for £300. You also owe a sound company for equipment hire for your Christmas show. You owe them £200 The instructors were all just instructors at general rallies but the sound system was for a competition so the expenditure needs to go to difference places. However, the total creditors are £500 so you can add that to creditors in your balance sheet Then you have to add £300 to rallies and instruction expenditure and £200 to competitions expenditure in your income and expenditure summary. This way you reduce your profit and reduce your reserves on the right hand of your balance sheet and your increased creditors will reduce the total assets minus total liabilities on the left hand side of your balance sheet. A note for the next year... Whatever you do at the end of one year you will have to do the opposite at the end of the next year, unless the debtor or creditor is still in existence (i.e. hasn’t been paid or received). So if you add a debtor one year you will have to take it away at the end of the next year and cancel out the relevant income in the next year’s income and expenditure summary, otherwise you will have counted the income twice (once when you put the debtor in and once when it appears in your cashbook the next year) and also you will still have the debtor in existence when it has actually been received. The same is true for creditors. When you pay the amount the next year you will record it from your bank into your cash book. Therefore, at the end of the year you will have to remove that expense from your accounts and remove the creditor, otherwise you will again have included the expenditure twice in two different years. Annual Branch Accounts –Advance Receipts One specific area that often turns up in branch accounts is Advance receipts (also known as deferred income) This is normally because people will pay their membership before the end of the year and it will be in the bank account at year end Advance receipts are a type of creditor because we owe the members something for their money, specifically we owe them next year’s membership and membership opportunities So we should actually not recognise those receipts as income until the next year, we should “defer the income” We do this is the same way as dealing with any other creditors, by creating a balance sheet liability and reducing the income and expenditure summary A worked example would be as follows Jimmy Henderson’s mother pays for his next year’s membership early. It is £64. It is in the bank by the 15th of December and so makes up part of the bank balance at year end and you have correctly analysed it in your cashbook to Subscriptions, as that is what it is. However, it is subscription for next year so we shouldn’t recognise the income till then as we owe the family something in return (a year of membership). You should create an Advanced Receipts balance on the balance sheet (this is within liabilities) for £64 AND reduce Subscriptions income in the Income and expenditure summary by £64. Doing both will keep your balance sheet balanced. At the end of the next year you will have to do the opposite to recognise Jimmy’s subscription income in the correct year, so increase subscriptions income by £64 and reduce the advanced receipts balance on the balance sheet by the same amount. There is also a worked example for reversing last years’ advanced receipts balance on the example accounting adjustments spreadsheet. In this example, the previous year’s advanced receipts balance was £122 and it has been recorded in the initial branch accounts as a balance from the prior year accounts. Recording it like this to start with will make sure you don’t forget to reverse it. Then in a dedicated column the £122 is removed from the advanced receipts balance and the corresponding entry is recorded against subscriptions in the income and expenditure summary to increase the income. By increasing the income and removing the balance from the balance sheet you are recognising the income in the correct year, the year you were actually entitled to it as you gave the member their membership. Annual Branch Accounts – Stock Stock adjustments are very similar to debtors and creditors but if you have stock you will often have it every year and so you will have to deal with a starting balance in the balance sheet as well. There are two ways of doing it. You could simply record the stock movement or you could take away the opening stock (last year’s year end stock value) and add on this year’s closing stock value. Both methods will give you the same answer The important thing is to try and get your stock value as accurate as possible by doing a stock count and checking what the items cost you – stock should be recorded at cost and not the price you are going to sell it for A worked example of both methods is as follows You had £2,000 of stock at the end of 2013. This was on your balance sheet under stock At the end of 2014 you count up your stock and you now have £1,500 The movement in stock is a decrease of £500 (2000 – 1500) During the year you actually purchased and paid for merchandise worth £3,000 so in your income and expenditure summary the box for “Purchase of merchandise for resale” initially reads £3,000. However, you haven’t sold all of this, some of it is in stock and in the branch accounts you should recognise income and expenditure in the same year (so when you sell the stock and get the income you recognise the cost of that stock, this is called the “matching principle”). What you haven’t sold goes as stock on your balance sheet. In order to do this you adjust your initial figure for “Purchase of merchandise for resale” for the stock movements in the year So you could say that you had £2,000 of stock at the start of the year, you bought a further £3,000 and you have £1,500 of that stock left at year end. So the actual stock you have sold in the year and received income for is the starting stock of 2000 + the stock you bought for 3000 – what you didn’t actually sell, the 1500 = £3,500 is your final “Purchase of merchandise for resale” figure in the income and expenditure summary and you have stock value in the balance sheet of £1500 as that is what you counted on your stock take. So you can see your balance sheet value drops £500 and your income and expenditure value increases £500 so the balance sheet will still balance. Or you can say that your balance sheet value of stock has decreased by £500 in the year (2000 – 1500). If this has decreased it means you have sold more than you actually purchased so you take the £3,000 you purchased and add on the 500 stock movement = £3,500. Again your closing stock balance will be £1,500 as that is what you have counted in your stock take. If the stock value had increased year on year then you have sold less than you purchased so in that instance you would take away the stock movement to work out the final “Purchase of merchandise for resale” figure so if stock was up £500 you would say 3000 – 500 = 2500. Annual Branch Accounts – Fixed Assets Fixed Assets are assets that the branch will have for a number of years. For that reason it would be incorrect to recognise all the cost of these assets in one year as you will recognise the benefits of them for a number of years. Most fixed assets will bring you in income either directly or indirectly for a number of years and so by spreading the cost over a number of years you are matching it with the income. Fixed Assets are instead “capitalised” – this means they are put onto the Balance sheet as an asset and then the cost is recognised over the estimated life of the asset. This process of releasing the cost gradually is called “Depreciation” It’s important to note that the life is only an estimate, if you end up owning the asset for longer than that it doesn’t really matter and you don’t have to amend your branch accounts for this Depreciation is charged every year until the asset’s cost is completely gone (an asset can never have negative value so when it hits zero stop depreciating it) If you dispose of it you have to record the sale proceeds and then write off the remaining value of the asset as depreciation. A worked example would be as follows Your branch buys some show jumps for £2,000 Initially you simply record them in your cash book as normal and analyse them to the ”Purchase of small equipment” column (or perhaps a specific “Fixed asset” column so you can keep track of them easily) to show the cash movement However, when you are preparing the annual accounts you know that the whole cost shouldn’t be recognised in the year. As always you must make two entries. In this case you have to decrease the expenditure in your income and expenditure summary by the £2,000 you have initially included and then add the £2,000 to the Fixed asset section on the Balance sheet. Doing both sides will keep your balance sheet balanced You have decided that the show jumps will probably last about 5 years, this is their useful life. So you will recognise their cost over 5 years at 2000/ 5 = £400 a year. This £400 a year is your yearly depreciation charge for the show jumps. So each year you reduce the value on the balance sheet by £400 AND put £400 in the “Depreciation this year” box on the income and expenditure summary. Again doing both will keep your balance sheet balanced. If after two years you sell the show jumps you have to write off the remaining cost in one go through the depreciation charge and recognise any sale proceeds in the “Sale of equipment” box in the income and expenditure summary For example, after two years the value will be 2000 – 400 – 400 = £1200. You sell them for £600. You remove the remaining £1,200 from the fixed assets in the balance sheet and the depreciation charge for the year is the whole £1,200 In the “Sale of equipment” box you should already have the £600 as you will have included in your cashbook and analysed to here when it has gone in your bank account.