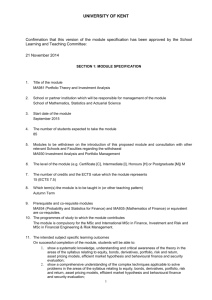

Asset-Liability Management: An Overview

advertisement