1 Strategic management accounting in business-to

Strategic management accounting in business-to-business networks

Martin Carlsson-Wall, Kalle Kraus and Johnny Lind

Stockholm School of Economics

Department of Accounting

Box 6501

SE-113 83 Stockholm, Sweden.

Abstract

This paper draws on literature from marketing and inter-organisational accounting to develop a framework for Strategic Management Accounting (SMA) in business-to-business networks.

Through an intensive single case study of a global robot manufacturer, the paper extends previous conceptions of what SMA may consist of, who the actors implicated in SMA practices are and when SMA is performed.

In a context of complex interdependencies in business-to-business networks, our study demonstrates that network SMA primarily concerns information on the unique connections to close customers and suppliers, and third party effects. Cross-functional teams, comprised of middle managers concerned with engineering, sales and quality, as well as selected personnel from close customers and suppliers, are important actors for SMA. It is also seen that when

SMA is performed it is often because financial and non-financial information is required to solve unexpected problems and to exploit unexpected opportunities arising in conjunction with close relationships.

However, even though the case study supports and enriches the theoretical framework of network SMA, we also find evidence of mainstream SMA practices in the case company‟s arm‟s-length relationships. Thus, our findings indicate that network SMA is complementary to, rather than a substitute for, mainstream SMA.

Keywords: Strategic management accounting, inter-organisational relationships, business-tobusiness networks

Acknowledgements

The authors gratefully acknowledge helpful comments from Lars Frimansson, Trevor Hopper and Bob Scapens. Financial assistance was provided from the Swedish Agency for Innovation

Systems, and the Jan Wallander and Tom Hedelius Foundation

1

1. Introduction

Strategic management accounting (SMA) entered the accounting literature almost thirty years ago (Simmonds, 1981) and, since then, a growing number of papers have been published on the topic (Langfield-Smith, 2008) on subjects ranging from conceptual to empirical investigations through to case studies and surveys (e.g. Bromwich, 1990; Dixon,

1998; Guilding et al ., 2000; Tillmann and Goddard, 2008). A special issue was dedicated to

SMA in the mid 1990s ( Management Accounting Research , 1996), and, in recent years, it has been incorporated as an ordinary subject in accounting text-books (Drury, 2005; Hopper et al ., 2007; Horngren et al ., 2002). SMA is often defined as the use of financial and nonfinancial accounting information to support strategic decision-making (Tillmann and

Goddard, 2008) and, compared to conventional management accounting, SMA has an externally oriented perspective (Bromwich, 1990; Cadez and Guilding, 2008; Roslender and

Hart, 2003; Tomkins and Carr, 1996b).

Inter-organisational relationships have also gained an increased amount of attention from accounting researchers during the last decade (Caglio and Ditillo, 2008; Håkansson and

Lind, 2007). These relationships are often intense and long-term, and have the characteristic of blurring the boundaries between a company and its environment (Dekker, 2004; Van der

Meer-Kooistra and Vosselman, 2000). A common issue in the inter-organisational accounting literature is information exchange and control in the supply chain (Lind and Thrane, 2010).

Thus, this literature also considers accounting outside the company. Despite the external orientation of SMA, few accounting scholars have set out to identify the connections between

SMA and inter-organisational relationships (Anderson et al ., 2000; Dekker, 2003; Håkansson and Lind, 2007). For example, prior research on SMA has largely been descriptive and brings a clear competitive aspect to the relationships under examination (Bromwich, 1990; Cadez and Guilding, 2008; Shank and Govindarajan, 1993). Companies are assumed to operate mainly in business-to-consumer settings, and it is considered to be strategically important to strive for independence and power over buyers and suppliers (Roslender and Hart, 2003).

Winning in the mainstream SMA zero-sum contest means that someone else has to lose, and the competition between conflicting and rival relationships becomes the strategic goal. The

SMA literature advocates the consideration of arm‟s-length relationships that are analysed as isolated dyadic relations.

However, recent inter-organisational accounting research has questioned this conventional strategic approach (Agndal and Nilsson, 2009; Carlsson-Wall et al ., 2009;

Håkansson and Lind, 2004; Håkansson et al ., 2010; Lind and Strömsten, 2006; Tomkins,

2

2001). These studies show that companies in business-to-business settings are embedded in complex networks of interconnected relationships. Embeddedness implies that each interorganisational relationship is connected to the other relationships of two companies and, through these relationships, the companies are linked to numerous other companies in a wider network (Håkansson and Lind, 2004). This has implications for the way on which one needs to consider the effectiveness of a company in the context, its strategy and the process by which it can be managed. For example, customer relationships are seen as an important source of competitive advantage and, therefore, a core part of the strategy of companies in businessto-business networks is to build and maintain the requisite close relationships with other companies (Agndal and Nilsson, 2009; Håkansson et al ., 2010). The scope of strategy is, therefore, shifted away from the deliberate pursuance of victory over others to a more cooperative approach towards „making it together‟. In this endeavour, it becomes important to include the network level of analysis in strategic decision-making and thereby emphasize interdependencies between the company and its customers and suppliers (Carlsson Wall et al .,

2009). Thus, inter-organisational accounting studies point to the necessity of complementing previous accounts of the conceptions of what SMA may consist of, and of examining who is implicated in SMA practices and when SMA is performed.

This study has two main objectives. The first is to develop a framework of SMA in business-to-business networks. The framework describes how financial and non-financial accounting information is used to support strategic decisions in a setting characterised by embeddedness and by the interdependencies between inter-organisational relationships. The study‟s second objective is to obtain empirical detail of the practices of SMA and explore the framework in an intensive case study of ABB Robotics, a global manufacturer of industrial robots that are mainly sold to large automotive companies. Sales to these customers are highly order-driven, customised, and often include a broad range of products and services. Our empirical study answers to Cadez and Guildings‟ (2008) call for more empirically based research on SMA. These authors noted that (p. 837), “Despite this attention, it is notable that

SMA suffers from a relative dearth of empirically based research.”

The remainder of this paper is organised as follows. In the next section, mainstream

SMA is reviewed and a theoretical framework for SMA in business-to-business networks is developed. Following this, the research methods are described. Thereafter, the case study of

ABB Robotics is described and analysed, and immediately followed by a discussion of the findings of the case study. Finally the conclusions are presented and the issues remaining to be addressed by further research are outlined.

3

2. Strategic management accounting in business-to-business networks

2.1 Previous literature

Despite the fact that Simmonds (1981) introduced SMA already in the early 1980s, there is little agreement on what SMA is (Roslender and Hart, 2003; Tomkins and Carr,

1996 a ). Nyamori et al . (2001, p.77) concluded in their literature review: “the bulk of the SMA literature has taken strategy as unproblematic, without questioning what various organisations or groups within these organisations understand by it or how it is formed”. It is assumed that strategic change is initiated by the top management, a planning perspective is applied to strategy formation and top management can dramatically change the company‟s position in the customer market (Shank and Govindarajan, 1993; Slagmulder, 1996). Thus, change is portrayed as a discontinuous phenomenon, with periods of change being combined with periods of stability. Competition is more important than cooperation for the long term success within the mainstream SMA literature, and collaboration is viewed as a temporary arrangement based on power and calculation (Bromwich, 1990). Because of this, the importance of obtaining information about competitors and competitive forces in the market is a frequent theme (Bromwich, 1990; Guilding, 1999; Scapens, 1998) and it is assumed that companies should adapt their operations to the environment (Bromwich, 1990; Dixon 1998;

Guilding et al.

, 2000; Shank and Govindarajan, 1993; Simmonds, 1981; Slagmulder, 1996).

The company is seen as an atomistic unit that is free to choose the best alternative without considering interdependencies with close customers and suppliers. This view of strategy in the mainstream SMA literature has implications for what SMA may consist of, who is implicated in SMA practices and when SMA is performed.

In the mainstream SMA literature, the purpose of SMA is to provide financial and nonfinancial information to create and sustain competitive advantage within a highly competitive and hostile environment (Bromwich, 1990; Bromwich and Bhimani, 1994; Dixon, 1998;

Guilding, 1999; Guilding et al ., 2000; Lord, 1996; Shank and Govindarajan, 1993;

Simmonds, 1981). Competitor analysis (see Simmonds 1981; 1986), provides information about the company‟s position in the competitive environment and enables “decisions to be evaluated in the light of possible competitor reactions” (Lord, 1996, p. 349). This information may include cost projections made for input products, competitors‟ cost structures, and fluctuations in market prices (Bromwich, 1990; Guilding, 1999; Guilding et al ., 2000).

Customer and supplier analyses provide information about the company‟s position vis-à-vis its customers or suppliers (Bromwich and Bhimani, 1994). Value chain analysis is a well-

4

known example of how customer and supplier analysis can be used to create and sustain competitive advantage (Dekker, 2003; Guilding et al , 2000; Hergert and Morris, 1989; Lord,

1996; Shank and Govindarajan, 1993). The basic idea behind value chain analysis is that the company can exploit links to its customers or suppliers by adapting or eliminating costcausing activities that do not create value. The information collected about competitors, customers and suppliers is often in an aggregated form where information concerning the position of a company in the market or value chain is concerned (Bromwich and Bhimani,

1994; Shank and Govindarajan, 1993). Value-chain analysis is not about the company‟s unique linkages to a specific customer or supplier, nor is it about a specific competitor and its unique linkages to specific customers or suppliers.

When it comes to who is implicated in SMA practices, a common argument in mainstream SMA is that accounting information should provide the requisite information for the top management‟s strategic decisions (Bromwich, 1990; Dixon 1998; Shank and

Govindarajan, 1993; Slagmulder, 1996; Van Cauwenbergh et al ., 1996), and that the role of

SMA is that of accounting for strategic positioning in the final customer market and assessing how a company should compete (Carr and Tomkins, 1996; Roslender and Hart, 2003;

Simmonds, 1981). Mainstream SMA typically depicts the top managers as those who identify radical improvements; and they are presumed to be assisted by management accountants who collect, process, and analyse information (Bromwich, 1990; Shank and Govindarajan, 1993;

Simmonds, 1981; Tomkins and Carr, 1996 a ). It is the company under consideration that, sometimes with support from the suppliers or customers, collects and uses the accounting information to improve its competitive advantage (Dekker, 2003; Shank and Govindarajan,

1993). Furthermore, it is mainly the top management in the company that seems to be knowledgeable and active when it comes to the identification of new business opportunities and to bringing about radical improvement in the operations. Thus, the direction of information flow within mainstream SMA is perceived to be unilateral: Top management and management accountants within the company collect information from the external environment in order to make more informed decisions.

Regarding when SMA is performed, the mainstream SMA literature tends to advocate a plan-and-execute logic which implies that the use of accounting information to support strategic decisions is made on a non-routine basis (Roslender and Hart 2003; Tomkins and

Carr, 1996a). Shank and Govindarajan‟s (1993) framework for strategic cost management and

Tomkins and Carr‟s (1996 a ) strategic investment decision-model are good examples. A common feature of these models is the emphasis placed upon planning and that accounting

5

information is used to compare customers, suppliers, competitors and the company‟s own operations in various features such as prices, cost structures, cost drivers, consumer benefits, and product attributes. After this review of mainstream SMA, it is time to develop a SMA framework for business-to-business networks. Table 1 summarises the view taken of strategy in mainstream SMA, and clarifies what this implies for the what, who and when questions and makes comparisons with SMA in business-to-business networks (the column labelled network

SMA).

INSERT TABLE 1 ABOUT HERE

2.2 Towards a framework for SMA in business-to-business networks

Recent literature within inter-organisational accounting has demonstrated that companies operating in business-to-business markets tend to have a few highly significant customers and suppliers that are critical for the companies‟ development and survival, and with which they have close and long term relationships (Agndal and Nilsson, 2009; Carlsson

Wall et al ., 2009; Håkansson and Lind, 2004; Håkansson et al , 2010). These companies are also embedded in complex networks where each inter-organisational relationship is connected to other relationships and, through these relationships, the companies are linked to numerous other firms in a wider network (Lind and Thrane, 2005). Drawing on literature from businessto-business marketing (Anderson et al ., 1994; Gadde et al, . 2003; Håkansson and Snehota,

1989; 1995; Holmen and Pedersen, 2003), these studies challenge the view of strategy adopted in mainstream SMA. The differences, compared to the picture assumed in mainstream SMA, are summarised in Table 1.

Companies operating in industrial markets invest significant physical, financial, managerial and developmental resources in establishing the basis for close relationships with customers and suppliers (Anderson et al ., 1994; Gadde et al ., 2003; Håkansson and Snehota

1989). These investments lead to significant interdependencies between the companies. From a strategic viewpoint, these relationships affect the nature and the outcome of the companies‟ actions and are potential sources of efficiency and effectiveness (Håkansson and Snehota

1995; Holmen and Pedersen, 2003). A company‟s close relationships with customers and suppliers constitute valuable resources in themselves. Through these relationships, resources and activities are made available and can be mobilised and exploited by the company in order to enhance its own performance. Thus, cooperation becomes more important than competition for building and sustaining long-term success, and competitive advantage derives from

6

interaction and coordination with close customers and suppliers (Håkansson and Snehota,

1995; Gadde et al., 2003).

Company effectiveness is largely determined by how successful these close partners are, and a company can shape parts of its environment by negotiating adjustments within its close relationships (Gadde et al., 2003; Holmen and Pedersen, 2003). A company‟s interdependence with close partners is, therefore, not only a restriction on its operations, but instead, the relationships can be considered to be a resource on which the company can build.

For example, close relationships with customers are important to gain inside and privileged access to information about the emerging needs of established customers (Anderson et al .,

1994; Håkansson and Lind 2004). New ideas for products can be picked up through more or less direct requests from customers, in addition to independently derived insights into emerging needs. However, because of interdependences, the company has to accept that some of the aspects of its environment are given (Carlsson-Wall et al . 2009; Håkansson and

Snehota, 1995; Gadde et al ., 2003). Furthermore, a solitary decision-maker within the company cannot intentionally plan strategic changes because the company is deeply rooted in a set of connected relationships. The outcome of the company‟s actions will be dependent on the actions of other companies within the network. Thus, strategy largely involves dealing with the actions of others and achieving the organisation‟s goals by working with close relationships. Reacting to other actors‟ actions is important, and this reactive behaviour cannot be planned, therefore strategic change is initiated by people at all organisational levels within the company, and by customers and suppliers, and through connected relationships.

Because of embeddedness, strategic decision-making needs to take into account the impact of third party effects and, thereby, extend the perspective to include parties other than the pair involved in the dyadic relationship (Anderson et al.

, 1994; Holmen and Pedersen,

2003). The inter-organisational relationship between, for example, a customer and a supplier will be affected by the customer‟s relationships with its own customers and with their other customers and suppliers (Anderson et al ., 1994). The relationship will also be affected by the relationships between each of those suppliers and customers and their other customers and suppliers. This means that strategic analysis should not only be trying to understand the relationships as such, but also their connections to other relationships. Often managers underestimate interconnectedness and try to manage single relationships in isolation (Gadde et al., 2003; Håkansson and Snehota, 1995; Holmen and Pedersen, 2003).

When adopting a network view on strategy, previous conceptions of what SMA may consist of, who is implicated in SMA practices and when SMA is performed need to be

7

refined. Table 1 details the differences between network SMA and mainstream SMA.

Compared to mainstream SMA, less emphasis is placed on obtaining information about competitors. Competition is not absent within networks, so the analysis of competition is still important, but the emphasis is placed on the competitive forces acting upon the company‟s network rather than just on the company itself (Tomkins, 2001). Analysing competition in networks is about understanding actual and potential competitors to the company‟s central customer and supplier relationships, and also how other parties influence these central customer and supplier relationships (Håkansson et al . 2010; Tomkins, 2001). However, the main focus in network SMA is information concerning the company‟s unique connections to close customers and suppliers because of the interdependence created by adaptations of resources and activities. The quality of the interaction processes within close relationships will be dependent on the information available; therefore aggregated information about products and markets is often not a relevant object of analysis because a company‟s products or services are seldom given in business-to-business markets (Carlsson-Wall et al ., 2009).

Instead, certain features of the products or services are the outcome of actions and reactions between the company and its customers and suppliers.

Embeddedness means that network SMA will not be limited to a consideration of the information relating to specific close relationships, it should also provide information about interdependencies with other connected companies that have an impact on the close relationships (Tomkins, 2001). In studying the large telecommunications company, Ericsson,

Lind and Strömsten (2006) demonstrated the value of providing information about both direct and third party effects in inter-organisational relationships. Some of Ericsson‟s close customer relationships were characterised by a high level of adaptation of products and considerable investments in terms of time and resources, but they were not associated with large revenue streams. However, these relationships contributed by introducing indirect benefits, such as channelling important knowledge that could be leveraged in other relationships or by acting as a bridge to other important connected relationships. Because the outcome of investments in one relationship often appear as decreased costs or increased revenues in other relationships, network SMA needs to be able to capture the direct effects of a company‟s decisions on the company itself and on its relationships, as well as the indirect effects on third parties (; Lind and Strömsten, 2006; Tomkins, 2001). Thus, the conceptualisation of a company‟s interorganisational context through a value chain analysis centred on the focal company becomes too simple and homogeneous a description. Instead, a company will be part of a large number

8

of value chains at the same time. These different value chains can even compete with each other.

Regarding who is implicated in network SMA practices, accounting information supports the interactions between the company and its close partners, and it has a central role in identifying improvements, initiating change and focusing on the interaction that take place within certain areas of a relationship (Håkansson and Lind, 2004). It is individuals within the company, and also selected personnel within external organisations, such as customers and suppliers, who use detailed financial and non-financial accounting information about both their own company and the other company‟s operations to support them in identifying improvements, making adaptations and initiating change. This means a focus not only on top management and management accountants, but also on middle and lower level managers and key specialists. In close relationships, it is those people within the company who are most deeply involved in interactions that identify improvements, and these people are often lower and middle level managers and specialists from the operational units.

Individuals working for the close partners can also identify improvements that benefit the focal company. It is important for the company to exploit its context through close relationships to partners, but it is equally important that partners can exploit the company through the same relationships. It is therefore not enough to collect information; it is equally necessary to diffuse information to close customers and suppliers (Håkansson and Lind,

2004). Hence, the information flow between the company and its close relationships is bilateral (Agndal and Nilsson, 2009). However, it is not enough for a company to collect and diffuse financial and non-financial information to all of its customers and suppliers, thereby increasing transparency (Håkansson and Lind, 2004). No two close partners to a company are identical, and each close partner provides a unique strategic advantage for the company

(Håkansson and Lind, 2004). Each close partner needs a unique set of information to identify improvements and possible adaptations to the company.

When it comes to when network SMA is performed, network SMA practices are sometimes planned, but often the collection and diffusion of the financial and non-financial information is unexpected (Carlsson-Wall et al.

, 2009; Håkansson and Lind, 2004). Since strategy in business-to-business networks largely involves reacting to close customers‟ and suppliers‟ actions, strategic change is not always planned. People in the collaborating companies often need to exchange information to handle unexpected problems and opportunities that arise in close relationships. These unexpected events often have potentially large financial effects and the information needs to provide details relating to specific

9

activities and resources since interdependence between companies often includes technical details of the development and production of products (Håkansson and Lind, 2004). The handling of these unexpected problems and opportunities will gradually shape how the company relates to its close partners (Carlsson-Wall et al ., 2009).

10

3. Methodology: studying SMA practices in business-to-business networks

3.1 Research design – a single-case study at ABB Robotics

This paper presents a longitudinal case study of ABB Robotics (Robotics), a business unit of ABB, a large multinational company. Robotics manufactures, develops and sells robots and is one of the world‟s largest robot manufacturers. The annual turnover of Robotics is about 250 million Euros and the company employs 600 people. All of the major functions of Robotics, such as the product development, marketing, purchasing and production are located in Västerås, Sweden. The annual sales volume varies between 8 000-10 000 robots.

The most important customers are car manufactures and their tier-1 suppliers, together accounting for more than 65% of the total volume.

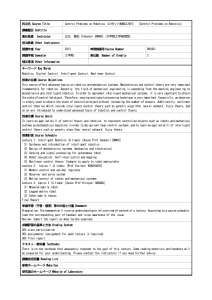

INSERT FIGURE 1 ABOUT HERE

As illustrated in Figure 1, an industrial robot consists of two main parts, a mechanical arm and an industrial control system (ICS). The arm is usually mounted on a support-stand and, at the end, the effector, the device which performs the actual function, is fastened. The ICS then steers and controls the robot‟s actions. The term „naked robot‟ refers to the combined robotic arm and the ICS. Like a human brain, the ICS calculates how the robot can move its arm to a certain position and then controls how this is carried out. The grey area in the figure highlights the driveline, consisting of the drive, the motor and the gear. The motor and the gear are the most expensive and technically advanced parts in the robot, whereas the drive is the most expensive part of the ICS. In analogy with the human body, the drive is the heart, sending the current to the motor, enabling it to move. There are several different sizes of robots and they are suitable for a variety of applications: spot and arc welding, material handling, machine tending, painting and coating. But, while basically every naked robot can be used for different applications, a robot is usually installed to perform only one kind of activity. So, when it is supplied, the robot is fitted with some special effectors or more complicated additional process equipment to make it suitable for its application; for example a full welding or gluing set.

To understand the benefits of taking a network perspective (Anderson et al ., 1994;

Håkansson and Snehota, 1995; Gadde et al ., 2003), it is important to note that Figure 1 highlights the key interdependencies between Robotics, and its customers and suppliers.

There are strong interdependencies between the motors, gears and drives because the driveline determines the „customer functionality‟. For example, if General Motors, a customer, wants a

11

new feature, Robotics needs to coordinate the product development with three different suppliers, one for each of the motors, gears and drives. As a consequence, long-term decisions concerning future revenue and cost streams are largely dependent on involving both customers and suppliers. From a research design perspective, this was important in selecting

Robotics as the subject of the case study. Relying on theoretical sampling (Eisenhardt, 1989),

Robotics offered two compelling reasons for making the study. First, it operates in a businessto-business setting with strong technical and financial interdependencies. As illustrated in our framework, we wanted to study SMA in a setting where interdependencies are managed both internally across departments (Håkansson and Lind, 2004) and externally with customers and suppliers (Anderson et al ., 1994). Second, Robotics offered a good opportunity to study the interplay between planned and improvisational strategic action on multiple levels. We requested and were granted access to the top management as well as the middle and lower level managers involved in product development projects.

Choosing between single and multiple cases is another research design issue

(Eisenhardt, 1989; 1991; Dyer and Wilkins, 1991). Individual cases can provide an in-depth description and understanding (Dyker and Wilkins, 1991; Dubois and Gadde, 2002), while multiple cases have the advantage of making comparisons possible, i.e., cases from different settings can be compared and contrasted to strengthen the theory developing process

(Eisenhardt, 1989; 1991). As Halinen and Törnroos (2005, p.1291) concluded, in a review of network studies, the complexities of business networks favour single-case studies:

A single case study is an appropriate design for network research in many situations. The objective of providing holistic descriptions of contemporary business networks to learn about their nature, management and evolution is such a demanding task that a single-case study is often the only option.

3.2 Data collection

Moving on to the data collection, our analysis draws primarily on semi-structured interviews conducted between 2002 and 2009. The interviews were typically conducted in company offices and were then transcribed and coded, the majority were also tape-recorded.

55 persons were interviewed, many of them several times, with the average duration being about one hour. In total 99 interviews were made at all levels in the company, including the top management and people working within different parts of Robotics, such as, purchasing, development, quality, logistics, production, accounting and sales, with the intention of

12

ensuring that different perspectives would be represented. Consequently, this study takes the perspective of the focal company (Halinen and Törnroos, 2005).

Each interview began with an introduction by the informant in which he/she clarified his or her current role and explained what he/she had been doing previously. Then followed more specific questions related to the role of accounting information in strategic decisionmaking and the nature of the cooperation with close and arm‟s-length relationships with customers and suppliers. Finally, the informants were asked to recount other experiences which they deemed relevant to issues raised during the interview. As Table 2 illustrates, the data collection was comprised of three phases.

INSERT TABLE 2 ABOUT HERE

Pilot interviews began in the fall of 2002 with the main purpose being to broadly investigate ABB Robotics‟ use of accounting for strategic decision-making and its cooperation with customers and suppliers. It became clear that product development played a crucial role in Robotics and many of the interviewees explained the complex technical issues involved in developing industrial robots. In the second phase, therefore, interviews became focused on the use of accounting in inter-organisational product development in close customer and supplier relationships. Project members of ongoing development projects were interviewed as cost levels were decided in the development projects and several critical episodes occurred at this point. It also became evident that product development projects were linked to a major re-orientation in the late 1980s and interviews were conducted with key individuals involved in this re-orientation, complemented with various documents about the re-orientation. Finally, the interviews in the third phase complemented the main themes identified in phases one and two; some of them also focused on the role of accounting in dealing with arm‟s-length customers. The interviews were complemented with direct observation, and internal and external documents to ensure that there was some triangulation

(Scapens, 1990; Dubois and Gadde, 2002). With the intention of obtaining a feel for how the site operated, one of the researchers was given a desk in the product development department, in an office landscape, and was granted access to all internal documents available on the intranet. Thus he was able to interact with engineers, purchasers, and quality and production personal and had access to strategic product development plans, the minutes from present and past development projects, lessons learned from earlier projects and the development routines used in supplier relationships. He was also given financial information concerning the content

13

of contracts, and overall sales and profits. In total, 22 days were spent at Robotics. In addition to this, one of the researchers participated in a two-day course called “Robotics Supplier

University”. During the course, he was introduced to about 15 suppliers and was able to ascertain their view of Robotics. The researcher also participated in formal product development meetings. These meetings included the project manager, engineers from different sub-projects and line managers. The main function was to discuss technical problemsolving, often involving the consequences in terms of the costs.

3.3 Data analysis

The next step was to use the material gathered to start writing the case study. Each interview transcript, the notes from the direct observation and the internal and external documents were read carefully by the researchers and the contents were manually coded and analysed in the context of the research questions and the theoretical framework of the study.

Theory was used as a skeletal framework to sensitise the research to particular issues and provide a way of illuminating the relevant aspects of the case (Laughlin, 1995; 2004). For example, the material on strategy was related to the concepts from the theoretical framework on building and sustaining success, to the perspective on the firm‟s environment interface and to strategy development. Information on the role of accounting in strategic decision-making was analysed by posing the what, who and when questions from the theoretical framework.

However, the empirical situation cannot be fully captured in and through theoretical terms and concepts (Laughlin, 1995). The empirical detail is, therefore, vital to the research; it complements, completes, and often extends the theoretical skeleton thereby enriching the results (Laughlin, 2004). One key purpose of empirical engagement is to put some flesh on the skeleton, however theory can be an immediate output of the research as the patterns observed in the empirical case can themselves lead to the development of theory (Laughlin,

1995; 2004). For example, even though the theoretical framework depicted network SMA as a substitute for mainstream SMA, the case analysis showed that they were complementary; hence the iterative process involved in moving between data and theory resulted in an unanticipated discovery.

14

4. Case study at ABB Robotics

During the early 1980s, expectations were high within the robotics industry. The robot was described as the answer to increased productivity and was expected to result in a healthier working environment. Sales grew rapidly and Robotics became one of the largest robot producers in Europe. However, in the late 1980s Robotics ran into financial problems.

Product development required substantial resources and, owing to intense competition from

German (Kuka) and Japanese competitors (Fanuc, Nachi, Kawasaki), the price of robots decreased rapidly. For example, a robot that costed $100,000 in the early 1980s had dropped to just $60,000 a decade later. Despite the problematic situation, however, there were also interesting opportunities to be taken up. Management accountants collected statistics about robot usage, and Robotics‟ top management realised that robot penetration was relatively low in the United States compared to Japan and Europe, as a result of which, geographical expansion into North America was identified as an important avenue for future growth. A second opportunity was discovered in the analysis of customer segments. Management accountants mapped growth trends in these segments relative to Robotics‟ market share, and it became evident for top management that there was considerable potential to be gained from building stronger relationships with large automotive customers. For example, even though

Robotics was the largest European robot manufacturer, this primarily arose from their success in relationships with non-automotive customers. Therefore, the top management of Robotics decided to invest in close customer relationships with the intention of increasing sales volumes and conducting joint product development. One sales manager described the change by saying: “ We decided to start to listen to the automotive customers... We said „Let‟s do what they ask us to do.‟ It was a major change.”

4.1 Focusing on automotive customers and expanding to North America

The starting point in attempting to understand the implications of the strategic redirection initiated by Robotics is the need to develop a product that would enable it to win large automotive customers. As Figure 2 shows, in contrast to arm‟s length customers, who buy one or two robots at a time and have little technical knowledge, automotive customers are experienced buyers that require customised solutions involving different products and services. A normal size automotive factory has hundreds of large, medium and small robots which are combined into different production cells. Owing to the complexity of integrating the robots with one another and also with the customer‟s other production equipment, the organisational set-up is complex. Thus, cross-functional teams are needed to work with the

15

automotive customers in contrast to arm‟s length customers where a salesman brings company brochures. Initially, the focus is on negotiating a framework contract which is then followed by joint product development. However, despite an increased focus on automotive customers, Robotics still needs arm‟s length customers because they complement close customers, financially, technically and in terms of the delivery time .

INSERT FIGURE 2 ABOUT HERE

Financially, large automotive customers represent large volumes of sales, but with low margins. The prices specified in the framework contracts are close to the costs of making the robots, meaning that the mark-up or profit is slight, while arm‟s length customers can pay

200-300% more than the production costs. Thus, even though the volume associated with each arm‟s-length customer is small, in combination, they give Robotics decent volumes of sales, but more importantly, they provide good profit margins. Arm‟s length customers also help Robotics to reduce its risks because a sudden cancellation or delay of a large automotive contract could hurt Robotics‟ growth and profitability severely. The mix of close and arm‟s length relationships is, therefore, important to manage sales growth, profitability and risk.

From a technical point of view, the close automotive customers have the resources to act as lead users in joint product development, while arm‟s length customers seek simplicity and reliability. For example, General Motors is an ideal partner with which to engage in product development because the staff working directly with robots in Detroit includes several hundred technical, quality and production engineers. In contrast, for arm‟s length customers, the approach taken to the purchase of a new robot is similar to that of buying a new car for an average consumer. These customers lack the specific knowledge required to make qualitative judgments regarding production processes and determining the price for a particular robot often fulfils their information needs. They contact Robotics‟ local sales office and the salesman visits the customer to ensure that the order is appropriate and made correctly. As a starting point, arm‟s length customers are offered standard products, but where technical modifications or adaptations are required, there is a list of different standard customer modifications.

As mentioned above, close and arm‟s length customers are also complementary in terms of timing. Since large automotive orders are difficult to predict, arm‟s length customers are important for flexibility. For example, to improve productivity, Robotics uses arm‟s-length customers for “fill in” production, making delivery times inexact. Thus, the reason delivery

16

times to arm‟s-length customers is not exact (although they are normally 6-10 weeks) is to maintain flexibility making it possible to handle unscheduled deliveries to important close customers in the interim period. Describing the difference between automotive customers and arm‟s-length customers, a sales manager says:

Automotive customers are much more demanding than other customers. For a small customer, you normally just go there and show them brochures and ask them: „Which one do you want?‟ For automotive customers, the sales process can take one or two years. It‟s a hell of a journey, talking with purchasing and other departments. There‟s a big difference.

Recognising the challenges that automotive customers represent, the top management within Robotics implemented a strategy involving three major initiatives. First, product development investments were re-directed to suit the needs of automotive customers. More specifically, to win framework contracts it was considered to be crucial to have a robot for spot welding that offered a variety of applications at an attractive price. Robotics invested resources in the development of a large automotive robot which it named IRB 6000. To further improve the products being offered, the top management also reorganized the sales force and created so-called “dedicated cross-functional sales teams” for the large automotive customers GM, Ford, Chrysler, BMW and Volvo. The teams consisted of 6-7 people and included middle managers with experience from sales, engineering and quality. This was deemed necessary as it was difficult for a single salesperson to discuss complex engineering solutions with automotive companies.

The second strategic initiative was an acquisition in North America. General Motors,

Ford and Chrysler already had strong supplier relationships with Japanese robot manufacturers, so it was argued that a new partnership was needed. Therefore Robotics purchased Cincinnati Milacron, a large America robot company that was specialised in spot welding. Milacron had previously been a dominant actor, but had not been able to keep up with the Japanese robot manufacturers which had both reduced prices and invested heavily in product development. By partnering with Robotics, the goal was to challenge the Japanese robot manufacturers in North America.

Despite new products and the partnership with Milacron, Robotics still had a problem with its costs. Having focused on smaller customers who paid higher prices, product costs were too high to generate profits from large automotive deals. Thus, the third strategic

17

initiative introduced by top management was P25, a cost-cutting program with the explicit goal of reducing product costs by 25%. Describing how P25 was motivated, a technical manager recalls how Stelio Demark, the CEO of Robotics, walked around and showed slides from management accountants revealing different price trends:

Yes, that‟s when the big cost-hunt started, the P25 program… and… the background was that Stelio saw the market development… I remember he had a favorite picture showing the price developments in different parts of the world… he concluded that prices would be harmonized and that we had to cut costs by 25% to stay competitive.

However, P25 was initially met with scepticism. In a culture characterized by technical innovation, cost-awareness had rarely been emphasised. Nevertheless, with the need to win large automotive contracts engineers began to re-think their initial hesitation. As one technical project manager said: “I guess we changed our mentality a little bit after the initial success with P25. Cost savings were so large, sometimes cost were reduced by 40-50%.”

Furthermore, outsourcing also improved the ability to re-negotiate new cost savings. One technical manager exemplified the different attitudes internal ABB companies and external suppliers had towards P25:

The treatment we received from DriveSys [an external supplier] was very different.

Nothing was impossible. The customer-supplier relationship became much clearer compared to that with ABB Drives [the internal supplier]. I remember once in P25 when we needed additional cost reductions; the ABB Drives engineer just looked at us and said

“Guys, get real! We made your first cost goal, now you‟ll have to settle for this.”

4.2 Winning the GM order: unexpected changes in direction

Even though Robotics invested in product development, made acquisitions and introduced cost-cutting programs, the expansion to North America proved to be more challenging than expected. The main reason for this was that GM, Ford and Chrysler already had close relationships with Japanese robot manufacturers. The competitor Fanuc had a joint venture established with GM and was its main supplier, so Robotics‟ initial ambition was to approach Ford and Chrysler. It managed to secure some orders from the latter companies, but

18

with limited experience of the complexity of large automotive contracts, quality problems proved to be challenging. As one sales manager described it:

In the US, we had sold to Chrysler, to Ford…There is a big difference between a single robot and placing 500 robots in a row. That‟s when quality problems start to be noticed].

One robot can break down every second year and you think it is ok. But if you place them in a row and one breaks down every day, then you start to think “What the hell is this?”

However, against all expectations, GM became the largest customer in North America.

The background for this was that the managers within GM wanted to bring about cost reductions. Since suppliers made up 60-70% of costs, the purchasing department wanted to challenge Fanuc by taking in a second-source supplier. Robotics was, therefore, given a small test order of 50 robots. However, just before delivery, General Motor‟s factory management refused to accept the robots. With a strong engineering culture, they wanted to continue with

Fanuc. Tensions between GM‟s engineering and purchasing departments built up, and, to resolve these tensions, the robots from Robotics were placed in different divisions. This turned out to be a lucky co-incidence because it meant that Robotics‟ dedicated crossfunctional sales team gained a number of personal contacts in GM. Robotics started to position itself as a key player for the upcoming framework contracts for GM‟s large robot investment program. Describing the importance of personal contacts for winning large frame contracts, a member of the dedicated sales team said:

You‟ve got to have local people out there who work on their [GM‟s] top management. If you don‟t have the right individuals it‟s damned difficult to sell. If the individuals have the right connections, they get a lot of information. They know what to include, the right price levels and what‟s going to win you the deal. These are the kind of things you need to know, otherwise, you spend your energy on the wrong things.

Top management in Robotics together with management accountants and the dedicated sales team analysed technical and financial data and submitted a bid for the framework contract and chose to offer its existing product, the Industrial Control System S3, because previous quality problems had demonstrated the high cost of not living up to automotive customers‟ expectations. At this point, Robotics‟ new Industrial Control System, called S4, was still under testing. S4 consisted of two development projects: one involved the software

19

of the industrial control system, and the other, the hardware. The new software was already developed but had not yet been fully tested and the new hardware was under development and did not even have a prototype. However, just days before General Motors was to decide, the dedicated sales team at Robotics was informed that S3 was considered to be technically outdated. This was a surprise, and the team had to act quickly. Together with the top management, they decided to show GM the new software. As one of the engineers involved described it:

I was called to a meeting with one of their [GM‟s] superintendents. He said, let‟s go down and have a look. We went down and I tried to explain the advantages of our [new software] system. Nothing touched him! It was not until I said that we have more computer power in the programmable interface than we had in the entire S3 generation that he was triggered. “Does that mean you can run parallel execution?” he said, “Yes,” I replied. Good, book the entire day tomorrow and I will have my best technicians ready to go through the system, he said.

By quickly improvising and changing the product being offered, the Robotics‟ sales team thereby managed to convince GM‟s technical engineers and, in combination, with a low price, Robotics won the framework contract with GM. The initial volumes were estimated to be 1073 robots, which was more than twice the size of any previous order. One top manager expressed how valuable the relationship with GM has been as follows: “GM is number one.

There is no question about it. They buy 10 % of our robots… I mean, what a customer!”

However, after signing the framework contract, GM did not want the first robot delivery until two years later. Armed with this knowledge, the sales team and top management began to persuade GM to take an interest in the new hardware system and thereby become involved in joint product development. Furthermore, the price agreed upon in the frame contract was so low that Robotics would not otherwise make a profit. One sales manager recounted: “In a car deal like that with General Motors, it works like this: this is our price, that‟s how much we are willing to pay. Are you interested in the deal?”.

GM agreed to be involved in joint development partly because, as GM would use the robots for 7-10 years (the approximate life-time of a model of a car), they wanted to avoid large product changes because this might bring about substantial re-training and service costs.

For example, if GM purchased 300 robots in the first year, large additional costs for training and service would occur if Robotics decided to add or take away crucial functionality on the

20

robots offered in year three. By getting involved in joint development, GM therefore tried to influence Robotics in a direction that reduced their long-term cost structure. One product manager at Robotics described GM‟s interest in joint development in the following way:

GM came back and said; OK, we know we have a technical specification that turns your arm around and we know this means you are making customised adaptations for us. We realise this lowers our quality compared to the quality we could have if we bought a standard system because you would put more resources into ensuring the quality if the volume were to be 10,000 than if it were 1000. What do you want to deliver to us?

In addition, GM wanted all robot suppliers to follow the same technical specification to improve its utilization of its assets. The long-term ambition was that robots from ABB or

Fanuc would be compatible, so that GM could close down a factory with ABB robots and then combine their use with that of Fanuc‟s robots elsewhere. However, at this point, the project had not been completed, which meant that the joint development with Robotics could be used to further improve the technical specification.

4.3 Joint product development with General Motors

When GM agreed to become involved in joint product development with Robotics, this gave them considerable say over Robotics‟ product development, but it also involved an expectation that GM would commit considerable resources to joint development. Robotics engineers stressed that the advantage of cooperating with GM in the development of new robots is that, if GM is satisfied with the robotics technology, all other customers are likely to be satisfied. By targeting product development towards the requirements of GM, the amount of knowledge involved in the development process increases as both parties are at the forefront of technology. The robots can then easily be used for customers in other industries with less advanced requirements. Thereby, the technologies that are developed in close cooperation with GM would become the standard solution for the arm‟s-length customers.

Thus, the close relationship with GM not only improves the robot quality for GM, but also has benefits for other customers. GM invests time and effort in Robotics‟ technological development, thus contributing to Robotics possibilities of attaining revenue gains from its relationships with other customers.

21

GM and Robotics have joint projects involving key specialists such as project coordinators, engineers, purchasers and sales representatives. In GM‟s factories, robots are integrated with equipment from other suppliers. GM‟s complex usage of robots and its importance as a customer has resulted in Robotics staff being physically based at GM‟s factories. They handle smaller robot problems and the knowledge Robotics gains from having people observing and handling problems in GM‟s factories is used also in Robotics‟ other customer relationships. Robotics describes the GM staff as being extremely knowledgeable, with useful ideas about how to improve robots. One example was the development of an advanced version of programming language for robots, which was done in close cooperation with GM. It was important for Robotics to have a means of programming that is advanced enough to enable it to handle the diversity inherent in using robots for work in foundry, packaging and car production. One engineer described it like this:

How do you express in computer programs that you should: clean fish, pick chocolate or build cars. You know, the same computer language must be used for all customers. We send one system, irrespective of the user…. This [development of the advanced computer language] was done in close cooperation with General Motors.

In addition to being actively involved in improving Robotics‟ robot functionality, GM is actively involved in reducing the cost of the robots and discussing trade-offs between costs and functionality. The project manager and the other engineers and purchasers from GM cooperate with the Robotics development team on a daily basis. There is a constant exchange of information relating to the cost and functionality passing between the purchasers and engineers from GM and Robotics. The discussions often concern trade-offs between costs and robot functionality. Lower-level sales managers and engineering managers from Robotics, often assisted by management accountants, give financial and non-financial information to

GM, which makes it possible for GM to suggest cost-efficient changes during the product development processes. As one engineer at Robotics explained:

Yes, we have had many tough discussions [with GM representatives]. These discussions ended up in trading lists…if you let go of this demand and use this component or feature instead, then we can deduct X dollars per robot and so on. It was quite successful.

22

The engineers at Robotics emphasised that these negotiations and interactions with GM staff are crucial for developing industrial robots with top-edge functionality at a low price.

Naturally, Robotics constantly wants to lower its production costs and the engineers have used GM‟s knowledge to achieve this. As one engineer at Robotics put it:

We [technical engineers from Robotics and GM] sat for six months and ended up with a very thick [technical] specification. OK, this costs a lot of money, you bought a standard system. The result was that we invested 5 years of man time... This was a unique situation.

GM often receives detailed financial information showing the various costs listed in detail, with the various activities adding up to the total cost of the robot. Robotics calls this interaction „work-arounds‟ and the financial data is prepared by Robotics‟ management accountants. In Table 3 it is shown that GM sees the different cost savings or cost increases broken down into individually significant items/functionalities. There are several different components and cost reductions that require many different types of knowledge. Engineers and sales managers from Robotics and engineers and purchasing managers from GM jointly discuss different types of solution that give a reasonable trade-off between costs and functionality. In the example, it is seen that by replacing push buttons with a cheaper brand, 4300 dollars is saved and by using less expensive connectors, an additional 127000 dollars can be gained.

INSERT TABLE 3 ABOUT HERE

Robotics also obtains input from GM on important trends of relevance to the future development of industrial robots and, hence, to future product development projects. One

Robotics engineer described this as follows:

Of course you talk to GM to get their technical knowledge. They have a large technical department. We try to get them to talk about the future use of robots, and then we draw conclusions… Then you get into the questions: If you take a tool that looks like this today, how will it look in the future? Then we find out that there is a trend that everyone is building in more flexibility in the tools. The tools are very expensive, often more expensive than the robot.

23

4.4 A technological breakthrough requiring product development with both customers and suppliers

Even though GM was the most important customer, joint product development was conducted with other close customers, such as BMW and Volvo. In this section, how new discoveries that unexpectedly emerged in product development were handled in cooperation with close customers and suppliers is discussed, illustrating interdependencies on a network level.

Robotics had almost terminated the development for its important S4 hardware development project. However, despite working closely with GM, there was still a considerable amount of uncertainty about how customers would perceive the new Industrial

Control System. Thus, with the intention of receiving more feedback, the S4 hardware steering committee, which included several top managers, decided to involve two additional lead users, BMW and Volvo. Similar to GM, BMW was a customer with a strong relationship with another robot supplier (in this instance, Kuka from Germany). However, with the ambition of becoming BMW‟s preferred supplier, Robotics offered the S4 hardware to BMW.

As far as Volvo was concerned, being a Swedish company, over the years, Volvo had bought large volumes from Robotics and there were strong personal contacts on numerous levels.

Thus, to get early feedback, the three customers could be said to complement each other: in terms of both geographical location (USA, Europe and Sweden) and previous history

(old/new customer). Describing the need for additional customers, the project manager for the

S4 hardware project said:

We were in on GM. Of course, there was still a lot of uncertainty… Would the customers like this product?... If you had a customer in every part of the world, you couldn‟t be going too far wrong.

Involving the three customers gave Robotics their feedback and resulted in some early sales of an important product, but it also created challenges. One particular problem had to do with meeting customers‟ deadlines. When large customers such as GM and BMW chose

Robotics, they also placed their future in Robotics‟ hands because quality problems or late deliveries could result in the postponement of a new model of car. Describing the increased

24

time pressure, and how S4 hardware became a prioritised project within Robotics, the project manager continued:

It became a very important project because they are three very important customers.

Imagine if something were to go wrong. At GM, it [the S4 hardware] was going to GM

Trucks which, at that time, made up 80% of GM‟s profit, and for BMW, it was to be included in their new 3-series. Think about that. How much do you think they wanted to postpone that launch? … It was just a fact: not delivering on time was not an option. … I had complete freedom to get anything I needed.

Working towards tough customer deadlines at a time when the S4 hardware was not entirely finished provided a challenge. Setting up joint cross-functional teams with GM,

BMW and Volvo, trade-offs were discussed on a daily basis and involved discussions of which functionality was absolutely necessary at the launch and which functionality could be developed for later deliveries. Still, even though the ambition was to meet deadlines, new

„discoveries‟ unexpectedly emerged when robots were integrated in the customers‟ production lines. One example occurred in the relationship with BMW, where it was discovered that the robots needed to be connected to an external railroad track to solve a production problem.

More specifically, the robot would do one operation and then it would move a few meters along the railroad track to conduct a second operation.

At first, this seemed like a local problem and, since BMW was buying so many robots,

Robotics just added a second Industrial Control System (ICS) to quickly satisfy the production engineers at BMW. However, it was soon discovered that this improvised solution was very expensive since the second ICS was only used to perform a portion of its entire repertoire. As one technical manager described it:

The first system supplied to BMW needed a robot plus a railway track. To solve this problem, we gave them two ICS… so, effectively, we gave them a lot of spare parts.

Then we realised we needed a cost efficient alternative for large robots.

Robotics faced the dilemma of meeting the short-term demands from BMW or attaining its own long-term goal of achieving a cost-efficient solution. Management accountants assisted engineers and sales managers in Robotics to investigate the general demand from customers. Did customers other than BMW have a need to use the robot with an external

25

application such as the railroad track? If so, who were these customers and how would they affect the future profitability of Robotics. The main reason for making this analysis was that close automotive customers have very detailed technical specifications that need to be met to win a framework contract. This means that seemingly minor customer features can play an important role if they turn into what several interviewees referred to as “customer hang-ups”.

The investigation indicated that the technical solution involving two industrial control systems would negatively affect growth opportunities with small arc-welding customers. These arm‟s length customers provided stable volumes and, since arc welding is one of the most common applications, a loss of such customers could potentially harm Robotics‟ profitability. Thus, describing how a local problem at BMW turned into a long-term issue involving both close and arm‟s length customers, a senior manager said:

Then it became apparent that the step of including an additional cabinet only for this railroad track became a huge step that made the arc welding application rather unprofitable.

As illustrated in Figure 3, since the drive system is the central component for running an external application such as the railroad track, the supplier, DriveSys, was contacted for the initial brainstorming.

INSERT FIGURE 3 ABOUT HERE

Before deciding on the technical solution, it was, therefore, important to ensure that there would be minimal third party effects on other suppliers‟ components, and that the redesign required from DriveSys would not be too expensive. Describing the joint process of identifying a solution that would be both commercially and technically viable, one of the project managers said:

I guess one identifies a problem and starts grappling with it. First, one needs to make it clear that there is a problem. Then one starts sniffing around… Is there any possibility of doing anything at all? Well, kind of like that… I mean, initially I did not know much.

Then they [DriveSys] came back, … we had an idea that might work… and then it rolled on. It all starts with, „We have seen a possibility,… Might it be interesting?‟

26

The idea that DriveSys came back with was to re-design the architecture so that the additional drive for running the railroad track could be fitted into the existing drive system, which had been developed and tested in S4 hardware. However, although an interesting solution, since this extension has not been included in the framework contract between

Robotics and DriveSys, there was also a need to include purchasers and sales staff in the discussions to identify a joint solution. These commercial and technical negotiations necessarily included timing issues relating to customers‟ requirements. Even though BMW might understand and be able to factor in a delay, GM and Volvo would certainly not.

Dealing with multiple issues involving customers and suppliers, a compromise was therefore reached where DriveSys was given an additional development contract that would be delivered as soon as the deliveries to GM, BMW and Volvo had been secured.

Furthermore, it was agreed that customers who wanted more than one external application would have to buy a new ICS. The process of managing this unexpected discovery was, therefore, characterised by the negotiation of mutual adjustments between Robotics and its customers and suppliers. Owing to the complex interdependencies, the strategic importance of solving the problem with the railroad track had not been identified initially as, in the first instance, it had been perceived to be a local problem, and it had only been elevated to the level of a strategically important issue involving key customers and suppliers once the third party effects were fully understood.

27

5. Analysis: Strategic Management Accounting in Robotics

It is evident from the case description that building and maintaining close relationships with large customers, such as GM, Volvo and BMW, and suppliers, such as DriveSys, are a core part of Robotics‟ strategy and an important source of competitive advantage (Agndal and

Nilsson, 2009; Håkansson et al ., 2010). Through these close relationships, resources and activities are made available to Robotics that can be mobilised and exploited. Robotics‟ interdependence with close partners can, therefore, be considered a resource on which it can build, a point stressed by Håkansson and Lind (2004). The close customers and suppliers are knowledgeable in robot technology and influence Robotics' technological development. For example, it is stressed that the automotive companies push Robotics to improve on as many fronts as possible, but especially in terms of cost reduction and quality. The case study shows that Robotics‟ strategic development is intimately related to the close customer and supplier relationships and that Robotics includes the network level of analysis in its strategic decisionmaking and thereby emphasises interdependencies between, for example, General Motors,

BMW and DriveSys (Tomkins, 2001). Customers from other industries, such as plastic fabrication, packaging and foundry are not prioritised in the same way and Robotics has arm‟s-length relationships with them. These customers are discussed on an aggregate level within Robotics in terms of the different customer segments and they are not involved in product development. Robotics‟ mix of close and arm‟s-length customer relationships has implications for its use of strategic management accounting.

5.1 Network SMA in close relationships

Strategic management accounting practices in Robotics‟ close relationships corroborate the propositions on network SMA in the theoretical framework put forward in this paper.

Regarding the “What?” question, the framework proposes that most of the information is about unique connections to close customers and suppliers and about third party effects

(Carlsson-Wall et al ., 2009; Tomkins, 2001). Robotics primarily creates value through its interaction with close partners such as GM, BMW, Volvo and DriveSys. The accounting information on the unique connections to these close customers and suppliers is important as it influences Robotics‟ strategic development. One example is the winning of the large GM order. Unique information on GM‟s ambition to decrease costs by challenging Fanuc as well as information on S3 being technically outdated was vital when Robotics won the GM contract, which meant that, from a strategic point of view, GM became the most important customer for Robotics. BMW‟s demand for a short piece of railroad track to be installed,

28

requiring the technical adaptations to enable the robot to utilise this additional degree of movement, and the costs associated with this demand, are other examples of accounting information pertaining to unique close relationships. For its close relationships, Robotics had little use for the aggregated accounting information about products and markets put forward in the mainstream literature on SMA (Bromwich, 1990; Guilding, 1999) because most of the features of the robots were the outcome of actions and reactions between Robotics and its close partners. Even though the mainstream SMA literature has not focused on accounting information associated with unique connections in close relationships, some interorganisational accounting studies exist that have considered this matter (Agndal & Nilsson

2009; Håkansson and Lind, 2004; Mouritsen, 1999). For example, studying BusinessPrint, a

Danish machine manufacturer, Mouritsen (1999) revealed the strategic importance of a close relationship to a single customer. Making up 95% of all revenues, BusinessPrint‟s strategic direction is influenced by accounting information on its unique connections to this customer.

In their examination of close supplier relationships, Agndal and Nilsson (2009) demonstrated how, in joint product development, accounting information influenced the long-term strategic direction of an automotive company and its tier-1 supplier.

Furthermore, SMA at Robotics included third party effects. For example, Robotics did not evaluate the benefits of working closely with GM solely on the basis of the profit margin on the sales; the fact that GM invested time and effort in Robotics‟ technological development, thereby contributing to Robotics‟ possibilities to attain revenue gains in relationship with other customers was of overriding importance. Joint product development was conducted with GM, BMW and Volvo and, in the S4 hardware project, it was strategically important for Robotics to use information about third party effects. Working with tight customer deadlines, Robotics needed information about which functionality was absolutely necessary for the launch, the individual costs entailed for each piece of functionality, and which of these could await later deliveries. When BMW wanted an external application for the railroad track, Robotics used information on the cost entailed in providing this application as well information on whether it would be of importance for other customers before deciding on how to respond to BMW‟s request. Eventually the supplier DriveSys got involved, and by diffusing accounting information to and receiving other such information from DriveSys, Robotics could find a cost-efficient solution. On the whole the mainstream

SMA literature has neglected the importance of information on third party effects in value chain analyses and the relationships studied have been considered to be isolated dyads (Lord,

1996; Tomkins and Carr, 1996b). For Robotics, the receipt of accounting information from a

29

value chain analysis was not of primary interest since it has a number of value chains, the impact of all of which would have to be considered in conjunction with each modification and therefore needs to obtain information on third party effects. Value chains draw attention to the firm‟s own products vis-à-vis the firm‟s position in the value chain, whereas in business networks it is close relationships that are the relevant subject of analysis (Lind and Strömsten,

2006; Tomkins, 2001). In the inter-organisational accounting literature, the study by

Håkansson and Lind (2004) has highlighted the importance of accounting for third party effects. By studying Ericsson, a Swedish telecommunications company, they show how accounting was used to balance conflicting demands in close customer relationships. For example, similar to the tensions described between Robotics, GM, BMW and Volvo,

Håkansson and Lind illustrate how investments made for a close customer, Telia, required simultaneous co-ordination with other close customers, such as Mannesman.

As far as who is implicated in SMA practices is concerned, the framework on network

SMA proposes that not only the top management and management accountants are involved in SMA; lower and middle level managers, key specialists within the company, and selected personnel working for close customers and suppliers influence strategic change because they are often most deeply involved in the value creation from the close relationships (Håkansson and Lind, 2004). The information flow is bilateral as the company not only collects and unexpectedly receives information, but also diffuses information to customers and suppliers

(Agndal and Nilsson, 2009). The case description reveals that the interaction in the close relationship with GM mainly involves middle and lower level managers and key specialists.

These are important actors in Robotics‟ network SMA because they identify improvements and possible cost reductions. The dedicated cross-functional sales teams, comprised of middle managers from sales, engineering and quality, managed to win the GM framework contract which changed Robotics‟ strategy in North America. GM became the most important customer and joint product development began. The top management got involved only when the final decision to offer the S4 was to be made. In other important network SMA activities, the top management was not involved at all. This is relevant to the joint product development, where the top management only became involved when a major problem was encountered that needed to be resolved with haste. Instead, lower-level managers and key specialists became highly involved in strategic change because GM and Robotics embarked upon joint development projects involving project coordinators, engineers, purchasers and sales representatives.

30

Thus, on both empirical and theoretical grounds, this study challenges the prevailing view in the mainstream SMA literature that the actors involved are only the top management and management accountants (Shank and Govindarajan, 1993; Simmonds, 1981). Our findings can be compared to the results in Lord (1996); Lord studied the company

Cyclemakers and its close relationships to its suppliers and found that middle managers and key specialists were important. She then concluded that SMA is but a figment of the imagination of academics without trying to elaborate on the findings in a theoretical way.

Through the theoretical lens of network SMA, the middle managers and key specialists and their use of accounting information can be seen to be important for SMA practices.

Challenging the conclusion in Lord, our findings rather render support to Langfield-Smith‟s

(2008, p. 224) reasoning: “Given the spread of management accounting work to other functions of the organization future research should not just be focused on the output of accounting departments. Understanding how management accounting practices come to the attention of organizational actors and how they are implemented and developed will continue to be a source of interesting research.”

The case study also shows that the information flow in Robotics‟ network SMA was bilateral; Robotics collected information from GM, but it also diffused information to GM. In addition to being involved in improving Robotics‟ robot functionality, GM was actively involved in reducing the cost of the robots and discussing trade-offs between costs and functionality. A constant exchange of information relating to the cost and functionality took place between the purchasers and engineers from General Motors and the sales people and engineers from Robotics. Thus, work-arounds provide an important means of attaining a bilateral information exchange. Accounting information supported the interaction between

Robotics and GM as GM received detailed financial information setting out various costs in detail. Robotics and GM then jointly discussed alternative solutions in an attempt to identify a reasonable trade-off between costs and functionality. In this manner, GM staff became actively involved in identifying improvements and initiating change. The engineers at