7.1. Introduction 7.2. Business Strategy –ideas and concept

advertisement

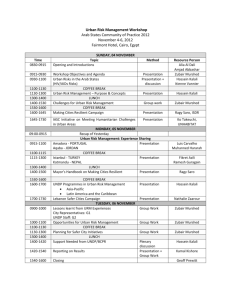

International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.1. Introduction This chapter covers one major components of learning objectives/outcomes that are likely to examine via coursework or examination. This chapter will enable students to build their knowledge on strategic issues faced by international business, such as the strategic analysis, evaluating strategic options, and operations management etc. This chapter will cover the following topics: Business strategy – ideas and concepts Choice of strategy Corporate strategy in a global economy International business and the value chain International business strategies International business strategies and political perspectives Institutional strategies and international business Techniques for strategic analysis International operations management and logistical strategies 7.2. Business Strategy –ideas and concept Some of the techniques used in strategic analysis include SWOT, PESTLE and industry analysis. 7.2.1. SWOT and PESTLE analysis It is believed that organisation must achieve ‘fit’ between internal and external environment by formulating an appropriate strategy. This means organisational much achieves “fit” between its capabilities, competences and resources (strengths/weakness) and external situation (opportunities/threats) (Wall et al, 2010). Identifying strengths/weakness and opportunities/threats is known as SWOT analysis. In order to use SWOT analysis, firms must analyse the internal and external environment. External environment can be analysed using PESTLE framework (covered in chapter 4-6) External analysis involves identifying the influences that might come from political, economical, social, technological, legal and ecological environment of business. This analysis will enable the organisation to identify opportunities and threats from external environment. Similarly, Porter (1980s) proposed an alternative framework that can be used for further analysis of the external environment to identify opportunities and threats from industry itself. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 1 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.2.2. Porter’s five forces/Industry Analysis Porter’s five forces framework includes bargaining power of customer/purchasers, suppliers, threats of substitutes, threats of new entrants, and threats from existing competitors (rivalry). Nortan and Hughes (2009, p. 73-76) provides a useful discussion of Porter’s five forces. New Entrants 1. Through the impact of actual entry. A new entrant will reduce profits in the industry by: (a)Reducing prices either as an entry strategy or as a consequence of increased industry capacity. There is also the danger that a price war may break out as rivals try to recover share or push out the new rival. (b) Increasing costs of participation of incumbents through forcing product quality improvements, greater promotion or enhanced distribution. (c) Reducing economies of scale available to incumbents by forcing them to produce at lower volumes due to loss of market share. 2. By forcing firms to follow pre-emptive strategies to stop them from entering. In view of the above danger, firms may take action to forestall entry of new rivals by: (a)Charging an entry-deterring price which is so low as to make the market unattractive to new, and possibly higher cost, rivals. (b) Maintenance of high capital barriers through deliberate investment in product or production technologies or in continuous promotion of research and development. New rivals would be unlikely to gain sufficient scale to recover these investments. Porter suggests that the strength of the threat of market entry depends on the availability of barriers to entry against the entrant. These are: 1. Economies of scale. Incumbent firms will enjoy lower unit costs due to spreading their fixed costs across a larger output and through the ability to drive better bargains with their suppliers. This gives them the ability to charge prices below the unit costs of new entrants and hence render them unprofitable. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 2 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 2. Product differentiation. If established firms have strong brands, unique product features or established good relations with customers, it will be hard for an entrant to rival these by a price reduction, and expensive and time consuming to emulate them. 3. Capital requirements. If large financial resources will be needed by a rival to enter, the effect will be to exclude many potential entrants. Porter argues this will be particularly effective if the investment is needed in dedicated capital assets with no alternative use or in promotion. Few would-be entrants will want to take the risk. 4. Switching costs. These are one-off costs for a customer to switch to the new rival. If they are high enough, they will eliminate any price advantage the new rival may have. Examples include connection charges, termination costs, special service equipment and operator training costs. 5. Access to distribution channels. If the established firms are vertically integrated, this leaves the entrant needing either to bear the costs of setting up its own distribution or depending on its rivals for its sales. Both will reduce potential profits. 6. Cost advantages independent of scale. These make the established fi rm to have lower costs. Examples are unique low-cost technologies, cheap resources, or experience effects (a fall in cost gained from having longer experience in the industry, usually influenced by cumulative production volume). 7. Government policy. Some national governments jealously guard their domestic industries by forbidding imports or using legal and bureaucratic techniques to stall import competition. Also, some governments prefer to allow existing firms to grow large to give them the economies of scale that they will need to compete in a global market. Pressure from substitute products Substitute products are ones that satisfy the same need despite being technically dissimilar. Examples include aeroplanes and trains, e-mail and postal services, and soft drinks and ice cream. Substitutes affect industry profitability in several ways: 1. They put an upper limit on the prices the industry can charge without experiencing large-scale loss of sales to the substitute. 2. They can force expensive product or service improvements on the industry. 3. Ultimately, they can render the industry technologically obsolete. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 3 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business The power of substitutes depends on: 1. Relative price/performance. A coach journey is cheaper than a rail journey which is in turn cheaper than a flight. However, a coach is slower than a train. The trade-off is far less clear between e-mail and postal services for simple messages, since e-mail is both quicker and cheaper! 2. The extent of switching costs Bargaining Power of buyer Buyers use their power to trade around the industry participants to gain lower prices and/ or improvements to product or service quality. This will impact on profitability. Their power will be greater if: 1. Buyer power is concentrated in a few hands. This denies the industry any alternative markets to sell to if the prices offered by buyers are low. 2. Products are undifferentiated. This enables the buyer to focus on price as the important buying criterion. 3. The buyer earns low profits. In this situation, they will try to extract low prices for their inputs. This effect is enhanced if the industry’s supplies constitute a large proportion of the buyer’s costs. 4. Buyers are aware of alternative producer prices. This enables them to trade around the market. Improvements in information technology have significantly increased this, by enabling a reduction in ‘search costs’. 5. Low switching costs. In this case, the switching costs might include the need to change the final product specification to accept a different input or the adoption of a new ordering and payments system. Bargaining Power of Suppliers The main power of suppliers is to raise their prices to the industry and hence take over some of its profits for themselves. Power will be increased by: 1. Supply industry dominated by a few firms. Provided that the buying industry does not have similar monopolistic firms, the supplier will be able to raise prices. For example, the ‘Wintel’ domination in personal computers developed because IBM did not insist on exclusive access to Microsoft’s operating systems or Intel’s processors. 2. The suppliers have proprietary product differences. These unique features of images make it impossible for the industry to buy elsewhere. For example, branded food suppliers rely on this to offset the buyer power of the large grocery chains. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 4 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Rivalry among existing competitors Some industries feature cut-throat competition, while others are more relaxed. The latter have the higher profitability. Porter suggests that the factors determining competition are: 1. Numerous rivals, such that any individual firm may suddenly reduce price and trigger a price war. If there are fewer firms of similar size, they will tend to, formally or informally, recognise that it is not in their interest to cut prices. 2. Low industry growth rate. Where growth is slow, the participants will be forced to compete against one another to increase their sales volumes. 3. High fixed or storage costs. The former, sometimes called operating gearing, put pressure on firms to increase volumes to take up capacity. Because variable costs are low, this is usually accomplished by cutting prices. This is common in transportation and telecommunications. Similarly, high storage costs are often the cause of a sudden dumping of stocks on to the market. 4. Low differentiation or switching costs mean that price competition will gain customers and so be commonplace. 5. High strategic stakes. This is where a lot depends on being successful in the market. Often this is because the firms are using the market as a springboard into other lines of business. For example, banks may fight for a share of the current (chequing) account or mortgage markets in order to provide a customer base for their insurance and investment products. 6. High exit barriers. These are economic or strategic factors making exit from unprofitable industries expensive. They can include the costs of redundancies and cancelled leases and contracts, the existence of dedicated assets with no other value or the stigma of failure. 7.2.3. Portfolio analysis The portfolio matrix analyses the range of products possessed by an organisation (its portfolio) against two criteria: relative market share and market growth. It is sometimes called the growth–share matrix Boston Consultancy Group’s portfolio matrix provides a useful framework for examining an organisation’s own competitive position. The organisation’s portfolio of products is subjected to a detail analysis according to market share, growth rate and cash follow. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 5 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business The diagram below shows the BCG matrix that is being used by many organisations to make decision which product to invest or not Figure 7.1: BCG matrix Source: Perry (2009, p.172). Lynch (2008, p.132) defined the following elements as follows Stars: The upper-left quadrant contains the stars: products with high relative market shares operating in high-growth markets. The growth rate will mean that they will need heavy investment and will therefore be cash users. However, because they have high market shares, it is assumed that they will have economies of scale and be able to generate large amounts of cash. Overall, it is therefore asserted that they will be cash neutral an assumption not necessarily supported in practice and not yet fully tested. Cash cows: The lower-left quadrant shows the cash cows: product areas that have high relative market shares but exist in low-growth markets. The business is mature and it is assumed that lower levels of investment will be required. On this basis, it is therefore likely that they will be able to generate both cash and profits. Such profits could then be transferred to support the stars. However, there is a real strategic danger here that cash cows become under-supported and begin to lose their market share Problem children: The upper-right quadrant contains the problem children: products with low relative market shares in high-growth markets. Such products have not yet obtained dominant positions in rapidly growing markets or, possibly, their market shares have become less dominant as competition has become more aggressive. The market growth means that it is likely that considerable investment will still be required and the low market share will mean that such products will have difficulty generating substantial cash. Hence, on this basis, these products are likely to be cash users. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 6 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Dogs: The lower-right quadrant contains the dogs: products that have low relative market shares in low-growth businesses. It is assumed that the products will need low investment but that they are unlikely to be major profit earners. Hence, these two elements should balance each other and they should be cash neutral overall. In practice, they may actually absorb cash because of the investment required to hold their position. They are often regarded as unattractive for the long term and recommended for disposal. 7.3. Choice of Strategy There have been several theoretical models of strategic choice, each of which seeks to identify the main strategic options to the business in pursuit of its objectives. There are mainly three approaches to strategic choices (options): Product –market strategies-which determine where the organisation competes and the direction of growth Competitive strategies-which influence the organisation will pursue for competitive advantage actions/reactions patterns an Institutional strategies- which involve a variety of formal and informal relationships with other firms usually directed towards the method of growth (acquisition vs organic) 7.3.1. Product-Market strategies Figure 7.2: Ansoff Matrix Source: Botten (2009, p.283) As shown in the figure 7.2, product-market approach provides four strategic choices that firms can adopt. These strategies are discussed below as illustrated by Botten (2009, p.282-284) Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 7 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Market penetration strategy: Firm increases its sales in its present line of business. This can be accomplished by: ● Price reductions; ● Increases in promotional and distribution support; ● Acquisition of a rival in the same market; ● Modest product refinements. Product development strategy: This involves extending the product range available to the firm’s existing markets. These products may be obtained by: ● Investment in the research and development of additional products; ● Acquisition of rights to produce someone else’s product; ● Buying-in the product and ‘ badging ’ it; ● Joint development with owners of another product who need access to the firm’s distribution channels or brands. Market development strategy: Here the firm develops through finding another group of buyers for its products. Examples include: ● Different customer segments, for example, introducing younger people to goods previously purchased mainly by adults; ● Industrial buyers for a good that was previously sold only to households; ● New areas or regions of the country; ● Foreign markets. Diversification strategy: Here the firm is becoming involved in an entirely new industry, or a different stage in the value chain of its present industry. Ansoff distinguishes several forms of diversification: 1. Related diversification. Here there is some relationship, and therefore potential synergy, between the fi rm’s existing business and the new product/market space: (a) Concentric diversification means that there is a technological similarity between the industries which means that the firm is able to leverage its technical know-how to gain some advantage. For example, a company that manufactures industrial adhesives might decide to diversify into adhesives to be sold via retailers. The technology would be the same but the marketing effort would need to change. (b) Vertical integration means that the firm is moving along the value system of its existing industry towards its customers (forward vertical integration) or towards its suppliers (backward vertical integration). The benefits of this are assumed to be: ● taking over the profit margin presently enjoyed by suppliers or distributors; ● Securing a demand for the product or a supply of Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 8 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business ● ● key inputs; Better synchronisation of the value system; Reduction in buyer or supplier power. However, it also means increasing the firm’s investment in the industry and hence its fixed cost base. It should also be noted that Vertical integration may well take the company into industries where the operating characteristics are significantly different. For instance, the oil industry can be considered, simplistically, to have three stages in the industry value chain. Those stages can be described as exploration and production, refining and, finally, marketing of petroleum and other products. The business model and the critical success factors for each of these industries are quite different and will require different types of management to be successful. They are sufficiently different to be described as unrelated diversification. Shell is a typical vertically integrated company 2. Unrelated diversification. This is otherwise termed conglomerate growth because the resulting corporation is a conglomerate, that is, a collection of businesses without any relationship to one another. The strategic justifications advanced for this strategy are to: ● take advantage of poorly managed companies which can then be turned around and either run at a gain to the shareholders or sold on at a profit; ● spread the risks of the firm across a wide range of industries; ● escape a mature or declining industry by using the positive cash flows from it to develop into new and more profitable areas of business. A typical conglomerate company would be Yamaha who manufacture amongst other products pianos, musical organs and motorcycles. 7.3.2. Competitive strategies Porter (1980) introduced three generic strategies that whereby that relies on three host potential factors Architecture: ( a more effective set of contractual relationships with suppliers/customers) Incumbency advantages (reputation, branding, scale of economies, etc.) Innovation (product or process, protected by patents, licences etc.) Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 9 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Operational efficiencies (quality circles, JIT techniques, re-engineering etc). The three generic strategies are given the figure 7.3 below These three strategies were: Overall cost strategies Differentiation strategies Focus strategies Cost Strategy Achieving the industry’s ‘ lowest delivered cost to customer ’ provides a number of competitive advantages to the firm: reduces the impact of competitive rivalry by allowing the firm to make superior profit margins at the prevailing level of industry prices – the firm can also become the price leader because no other firm is able to undercut it; reduces the impact of buyer and supplier power by giving the firm a unique cushion of profits against cost increases and price cuts – indeed, buyer and supplier power will be the forces which drive rivals from the industry; low costs provide a barrier to entry against potential new entrants and hence safeguard long-term profits. Porter recognises that cost reduction strategies are widespread due to management’s adherence to the experience curve concept. He criticises this Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 10 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business by pointing out that it only considers production costs, and recommends analysis of the entire value chain to achieve substantial cost savings. Differentiation strategy This is a premium perceived value in the eyes of the buyer. This will normally result in a number of competitive advantages: premium prices can be charged for the product to give better margins in the short run, while in the long run exempting the fi rm from the price wars of the mature stage; differentiation is a barrier to entry; buyer power from retailers and manufacturers may be reduced if the differentiation of the product makes it an essential element in attracting their customers; the cushion of better profits reduces the impact of buyer and supplier power. Focus Strategy This strategy involves selecting a particular buyer group, segment of the product line, or geographic market’ as the basis for competition rather than the whole industry. This strategy is ‘built around serving a particular target very well’ in order to achieve better results. Within the targeted segement the business may attempt to compete on a low cost or differentiation basis (Wall, et al, 2010, p.245). Figure 7.4: Example of Competitive Strategies Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 11 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.3.3. Institutional Strategies The focus here is on possible relationships with other firms and organisations. An initial decision for firm seeking growth is whether to do so using its own endeavours (e.g. organic growth) or to short-cut the growth process by some kind of institutional tie-up with other firms. This can take many forms, including the franchising, joint venture, alliances, and mergers & acquisitions. There are also many other conventional techniques of business analysis such as product life cycle, strategic clock, value chain analysis, barriers to entry, and constable market theory and so on. 7.4. Corporate Strategy in a global economy Prahalad (2002, p.2) paints a vivid picture of ‘discontinuous competitive landscape’ as characterising much of the 1990s and early years of the millennium. Industries are no longer stable entities they once are for the following reasons: 1. Privatisation and deregulations become global trends within industrial sectors (e.g. telecommunication, power , water, healthcare, financial services) and even within nations themselves (e.g. transition economies such as China). 2. Rapid technology changes and convergence of technologies are constantly redefining industrial ‘boundaries’ so that the ‘old’ industrial structure become barely recognisable. 3. Internet related technologies are beginning to have major impacts on business to business and business to consumer relationship 4. Pressure groups based around environmental and ecological sensitivities are progressively well organised and influential 5. New forms of institutional arrangements and liaisons are exerting greater influences on organisational structures than hitherto (strategic alliances, franchising). 7.4.1. Strategy in the new competitive environment According to Prahalad (2002, p. 2-3) suggested four key ‘transformations’ which must now be registered: 1. Recognising changes in strategic space. Consider for example, the highly regulated power industry. All utilities once looked alike and their scope of operations were constrained by public utility commissions and government regulators. Due to deregulation, utilities can now determine their own strategic space. Today utilities have a choice regarding the level of vertical integration. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 12 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business The forces of change - deregulation, the emergence of large developing countries such as India, China and Brazil as major business Opportunities - provide a new playing field. Simultaneously, forces of digitalisation, the emergence of the internet and the convergence of technologies, provide untold new opportunities for strategists. The canvas available to the strategist is large and new. One can paint the picture one wants. 2. Recognising globalisation impact. Increasingly, the distinction between local and global business will be narrowed. All businesses will have to be locally responsive and all businesses will be subject to the influences and standards of global players. Consider for example, McDonald's and Coca-Cola - held up as examples of a truly global players unconstrained by local customers and national differences. In India, McDonald's had to change its recipe to serve lamb (instead of beef) and vegetarian patties (a radical departure from its normal western fare). Coke had to recognise the power of "Thums Up", a local cola (which Coke purchased) and promote that product. The need for local responsiveness, especially when global companies want to penetrate markets with different levels of consumer purchasing power are very clear. On the other hand, Nirula's, a local fast food chain in India, was, in its own restaurants, forced to respond to the cleanliness and ambience of McDonald's. This is a case of global standards being imposed on a local player. Global and local distinctions will remain in products and services. Globalisation may have as much to do with standards - quality, service levels, safety, environmental concerns, protection of intellectual property, and talent management. Needless to say, globalisation will force strategists to come to terms with multiple geographical locations, new standards, capacity for adaptation to local needs, multiple cultures and collaboration across national and regional boundaries in everything from manufacturing, product development, global account management, and logistics 3. Recognizing the importance of timely responses. Given the nature of competitive changes, speed of reaction will be a critical element of strategy. At a minimum, it will challenge the yearly planning cycle. For example, consider the traditional strategic planning process in a large company. The process of strategy discussion and commitments typically starts in October. It identifies the strategic issues for the next calendar year and three to four years hence. Speed is also an element in how fast a company learns new technologies and integrates them with the old. As all traditional companies are confronted with disruptive changes, the capacity to learn and act fast is increasingly a major source of competitive advantage. 4. Recognising the importance of innovation. Innovation was always a source of competitive advantage. However, the concept of innovation was tied to product and process innovations. In many large companies, Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 13 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business the innovation process is still called the "product creation process". Reducing cycle time, increasing modularity, tracking sales from new products introduced during the last two years as a percentage of total sales, and global product launches were the hallmarks of an innovative company. Increasingly the focus of innovation has to shift towards innovation in business models. 7.5. International Business and the value chain International production is dominated by MNE that are increasingly transnational in operations , including horizontally and vertically integrated activities more widely dispersed on geographical basis. This dispersion of activities across the world can be explained in detail using Value Chain activities developed by Porter. These activities are divided into two categories of primary activities and secondary activities (Wall et al, 2010, p. 254). Primary activities: are those required to create the product (goods or services, including inbound raw materials, components and other inputs), sell the product and distribute it to the market place Secondary/support activities: includes a variety of functions such as human resources management, technological development, management information systems, finance for procurement, etc. These secondary activities are required to support the primary activities. Source: Cullen. and Parboteeah (2010, p. 38). Figure 7.5: Value Chain Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 14 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business These activities are combined to experience the synergy effect. Synergy refers to the so called ‘2+2=5 or greater than this, whereby the whole become greater than the sum of the individual parts. A number of sources can be identified as contributing to these global synergies. 1. Localisation on global scale where only international business can dispersed individual value creating activities around the world to locations where they can be undertaken most efficiently and effectively. 2. Economies of scale where it only by becoming an international business that the firm can operate at such size that all available economies of scale technical (technical, non technical) are achieved for a particular activity within the value chain. This is especially important when the ‘minimum efficient size’ for an activity within the firms value chain exceeds the maximum level of output achievable within domestic economy. 3. Economies of scope and experience where only international business can configure most appropriate mix of activities (economies of scope) within value chain consistent with efficient and effective production. Or where only by becoming an international business can the firm secure the economies of experience to minimise the cost. 4. Non-organic growth on international scale where the international business recognises that organic growth is ‘insufficient’ to meet its key objectives and where some form institutional arrangement with one or more overseas firms is seen as the way ahead. 5. Increase in geographical reach of core competencies where the international business seeks to earn a ‘still higher return from distinctive core competencies by applying those competencies to new geographic markets. 7.6. International Business Strategy Choosing a multinational strategy, be it transnational, multidomestic, international, regional, or some combination of these options, depends to a large degree on the balance of pressures for local adaptation and potential advantages of cost and quality from global integration. Figure 7.6 shows where the basic multinational strategies fall in meeting these often conflicting demands. One of the best ways to determine whether local adaptation pressures or global integration pressures are more important is to understand the degreeof globalization of the industry in which your company competes. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 15 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Global Figure 7.6: International strategies 7.6.1. International strategy International strategies selling global products and using similar marketing techniques worldwide. The international strategy is a partial global integration strategy. That is, companies pursuing international strategies, such as Toys “R” Us, Boeing, Apple, and IBM, take a middle ground regarding the global–local dilemma. Like the transnational strategist, the international strategist prefers, to the degree possible, to use global products and similar marketing techniques everywhere. To the degree that local customs, culture, and laws allow, they limit adaptations to minor adjustments in product offerings and marketing strategies. However, international-strategist MNCs differ from transnational companies in that they keep as many value-chain activities as possible located at home. In particular, the international strategist concentrates its R&D and manufacturing units at home to gain economies of scale and quality than are more difficult to achieve with the dispersed activities of the transnational. For example, Boeing keeps most of its R&D and production in the United States while selling its planes worldwide with a similar marketing approach focusing on price and technology. However, for its most recent plane, the Dreamliner, Boeing become a little more transnational, outsourcing production and design of some components to Japan and other countries but leaving final assembly in the US. Unfortunately for Boeing, coordination problems resulted in costly delays to the final delivery of the plane. When necessary for economic or political reasons, companies with international strategies frequently do set up sales and production units in major countries of operation. However, home-country headquarters retains control of local strategies, marketing, R&D, finances, and production. Local facilities become only “mini-replicas” of production and sales facilities at home Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 16 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.6.2. Multidomestic strategy Multidomestic strategies emphasizing local responsiveness issues at the country level. One important problem for a locally responsive strategist is the question of how fine-grained one should focus. The extreme approach is called the multidomestic strategy, which means each country where you do business is treated differently. The key distinguishing feature of multi-domestic firm is that they extensively customize both their product offering and their marketing strategy to match different national conditions. Consistent with this, they also tend to establish a complete set of value creation activities, including production, marketing, and R& D in each major national market in which they do business. 7.6.3. Global strategy Firms that pursue a global strategy focus on increasing profitability by reaping the cost reduction that come from experience curve effects and location economies. That is they are pursuing a low cost strategy. The production, marketing, and research and development activities of the firm pursuing a global strategy are concentrated in a few favourable locations. Global firms tend not to customised their product offerings and marketing strategy to local conditions because customisation raises cost (it involves shorter production runs and duplications of functions). Instead, global firm prefer to market standardised product offerings worldwide so that they can reap the benefit from economies of scale that underlie the experience curve. They may also use their cost advantage to support aggressive pricing in world market. This strategy makes more sense where there are strong pressures for cost reduction and where demands for local responsiveness are minimal. According to Hills (2003), Texas Instruments, Motorola and Intel are pursuing a global strategy. However this strategy is not appropriate when there is a strong demand for local responsiveness. 7.6.4. Transnational strategy This strategy pursues two goals get top priority: seeking location advantages and gaining economic efficiencies from operating worldwide. The more inclusive version of global integration is known as the transnational strategy. Its top priorities are seeking location advantages and gaining economic efficiencies from operating worldwide. Location advantages mean that the transnational company disperses or locates its value-chain activities (e.g. manufacturing, R&D, and sales) anywhere in the world where the company can “do it best or cheapest” as the situation Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 17 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business requires. For example, Intel has manufacturing and testing facilities located in five countries outside of the US, its headquarters. These production facilities offer cheaper but also high-quality labor. Michael Porter argues that, for global competition, firms must look at countries not only as potential markets but also as “global platforms.” A global platform is a country location where a firm can outperform competitors in some, but not necessarily all, of its value-chain activities. The transnational views any country as a global platform where it can perform any value-chain activity. Thus, the absolute advantage of a nation is no longer just for locals. Examples of such transnational strategic activities include: Locate upstream supply units near cheap sources of high-quality raw material—approximately 18 multinational oil companies are in Nigeria Locate research and development centers near centers of research and innovation—in 2005 Motorola opened its new R&D center in Bangalore, a growing center of IT development in India. Locate manufacturing subunits near sources of high-quality or lowcost labor—Intel has five sites where labor is relatively cheap and well educated. Share discoveries and innovations made in any unit regardless of location with operations in other parts of the world—Ford’s Taiwanbased design center, named Ford Lio, is working on the nextgeneration Tierra medium sized sedan, which shares a chassis platform with the Mazda 323, for the Asia-Pacific market. Locate supporting value-chain activities such as accounting in lowcost countries—GE Capital uses Indian employees to do support activities such as checking eligibility of payments on health plans. Operate close to key customers—BWM produces a sport utility vehicle in the US, which is the major market for this type of vehicle. Offshore aftermarket support such as call centers to low-cost countries— if you call American Express, Sprint, Citibank, or IBM it is likely your call will be answered in India Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 18 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Table 7.1: The Content of Multinational Strategies: From Local Adaptation to Global Integration Source: Cullen and Parboteeah (2010, p. 46) 7.6.5. Advantages and disadvantages of international business strategies strategy Advantages Standardised products become highly cost competitive Disadvantages Less responsive to local conditions Economies of scale Loss of market share if consumer behaviour becomes more responsive to localised characteristic Economies of experience Few opportunities for global learning Global Emphasis home country core competences Economies of locations via a geographically dispersed value chain Complex coordination to implement strategy Economies of experience Possible conflicts between cost competitiveness and local responsiveness. Global learning stemming from the sharing of core Difficult to implement due organisational problems Transnational Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 19 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business competences Product differentiation with production and marketing responsive to local conditions Highly customised production and marketing, emphasising local responsiveness Most appropriate where the minimum efficient size (MES) is relatively low for key elements of the value chain and strong Multidomestic local/cultural preferences exist Loss of location economies (which require a geographically dispersed value chain) Loss of experience economies Little global learning where core competencies are not transferred between foreign companies Lack of corporate group cohesions International Core competencies transferred to foreign markets Less responsive to local condition Economies of scale for centralised markets in ‘core architecture ‘ (e.g. product development) Less location economies available via retention of core competencies Less global learning as few core competencies transferred Less experience economies available Source: Wall et al (2010, p. 258) Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 20 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.7. International business strategies and political perspectives MNE also makes strategic decision based on political decision of economic integrations. 7.7.1. Economic Integration-national responsiveness framework 1. National responsiveness refers to the pressure on MNE to respond to different national or regional (e.g. EU) standards imposed by governments and agencies and to different consumers tastes in segmented national (or regional) markets. 2. Economic integration refers to the pressure on MNE to develop economies of scale to develop location economies (via global specialisation for appropriate activities within the value chain), to develop experience economies and to seek to benefit from other efficiency advantages from increased coordination and control of geographically dispersed activities. Strategies appropriate to the MNE will then depend on the quadrant they inhibit or seek to inhibit. High Economic Integration Pressure Quadrant 1 Quadrant 2 Quadrant 4 Quadrant 3 Low Low National Responsiveness Pressure High 7.7.2. Strategies appropriate to the MNE 1. Quadrant 1: high economic integration, low national responsiveness. Here the MNE operates in a market characterised by high economic integration pressures and its strategy must therefore incorporate a drive for cost and price competitiveness. Typically MNE in this quadrant will be centralised in structure, often using mergers and acquisitions to achieve economies of scale, scope and experience. However, this MNE in this quadrant need not by unduly concerned with responding to host Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 21 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business country national (political, regulatory, and cultural) concerns as these are deemed to have low impact on its operations. 2. Quadrant 2: High economic integration, High national responsiveness. Here MNE operates in a market characterised by strong international cost and price competitiveness pressure but it must see such challenges while paying due regard to the high political sensitivities of host nationals/regional governments and agencies. MNE in this quadrant will face a variety of policy options which seeks compromise between these two , somewhat opposing tendencies. The coordination of variety of flexible responses maybe challenging for the MNE 3. Quadrant 3: Low economic integration, low national responsiveness. Here economic integration is less important to the MNE than national responsiveness. Production practices in product specification and support activities (e.g. marketing) must be carefully adapted to the consumer characteristics, standards and regulation of the national/regional grouping. Economic integration is much less important (less cost and price competitive pressures) than a decentralised strategy responsive to national (regional) characteristics. 4. Quadrant 4: Low economic integration, low national responsiveness. Few scale economies or location economies via a more geographically dispersed value chain are likely in this quadrant so price competition will tend to be less fierce. Nor are there are many benefits from seeking close alignment with national (regional) regulations, standards and consumer characteristics. A broadly standardised product can be sold by MNE in this quadrant and there may be benefits from a centralised transfer of core competencies to overseas national (regional) subsidiaries. 7.8. Institutional Strategies international business There are two broad institutional strategies used by MNE such as 1. Mergers and Acquisition 2. Knowledge management 7.8.1. Mergers and Acquisitions Merger takes place with mutual agreement of the management of both companies, usually through exchange of shares of the merging firms with shares of merging firms with shares of the legal entity. Acquisition (or takeover) occurs when management of the firm A makes a direct offer to the shareholders of firm B and acquires controlling interest. Acquisition normally requires additional funds to takeover the firm. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 22 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Figure 7. 7. Driving forces for Mergers and Acquisition Mergers and Acquisition (M&A) are encouraged for many reasons. 1. Cost based synergies. Horizontal acquisitions have traditionally been considered an effective means of achieving economies of scale in production, in R&D and in administrative, logistical and sales functions. Cost based synergies can be achieved through cost efficiencies. This means that growth in firms can provide economies of scale , i.e. a fall in long run average costs. These can be of a technical or non technical variety. Technical economies of scale. These are related to an increase in size of the plant or production unit and are most common in horizontal M & As. Reasons include: Specialisation of labour or capital, which becomes more possible as output increases. Specialisation raises productivity per unit of labour/capital input, so that average variable costs fall as falls as output increases. The engineer rules whereby material costs increase as the square but volume (capacity) increases as the cube, so that materials costs per unit of capacity fall as output increases. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 23 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Dovetailing of process, which may only be feasible at high levels of output. Dovetail will allow to avoid incurring the unnecessary cost of spare (unused) capacity. Non-technical (enterprises) economies. These are related to an increase in size as a whole and are valid for both horizontal and vertical Merger and Acquisition (M&A). Financial economies. Large organisations can raise financial capital more cheaply, lower interest rates, access to share and rights issues via Stock Exchange listings etc). Administrative, marketing and other functional economies- existing departments can often increase throughput without a pro-rata increase in their establishment Distributive economies. More efficient distributional and supply chain operations become feasible with great size (lorries, ships, and other containers can be dispatched with loads nearer to capacity etc). Purchasing economies. bulk buying discounts are available for larger enterprises. Also, vertical integration (e.g. backwards) means that components can be purchased at cost from the now internal supplier rather than at cost plus profit. Economies of scope is about more appropriate mix of products or activities in the company’s portfolio can help reduce average costs. Cost based synergy or cost efficiency can be also achieved through economies of scope via M& A. Risk reduction. This applies particularly to conglomerate M&As, which involves diversifying the firm’s existing portfolio of products or activities. Such diversification helps cushion the firm against any damaging movements which are restricted particular products groups or particular countries. Market Power. The enlarged firms can use its high market share or capitalised value to exert greater influence on price or on any competitor actions/reactions in ‘game’ playing situations. Enhanced market power can be deployed to raise corporate profit or to achieve other corporate objectives. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 24 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business However Robert Gertner (2000) suggested three possible reasons for the failure of mergers and acquisition. Unpredictability: For acquisitions where the stock market reacts negatively to the merger announcements, the subsequent break-ups (divestments) of the new entity was more likely to occur. This suggested that stock market does in fact have some ability to identify those mergers and acquisitions that are more likely to fail in the future. Agency problem: Where the principle-agent problem occurs, there may well be a separation of interests between those of the shareholders (principals) and managers (agents). It may then follow that a merger/acquisition viewed as favourable by one may actually be unfavourable to the other. Some research indicated that only 17% M&A produce any value for shareholders while 53% of M&A destroyed shareholders value. Managerial errors. Lack of knowledge, errors of judgement and managerial hubris (overconfidence) can manifest themselves in all three phases of M& A activities such as planning, implementation, and operational phases. 7.8.2. Knowledge management Knowledge is about information that comes laden with experience, judgement, intuitions and values (Empson, 1999, cited at Wall et al, 2010). Four types of knowledge 1. Explicit knowledge: codified knowledge reports, online etc available in books, 2. Tacit Knowledge: knowledge embodied in human experience and practice 3. Collective knowledge: the outcomes of corporate structure and process for converting tacit knowledge into explicit knowledge available for corporate use in process or products innovation. Nonaka and Takeuchi (1995) identified the process of knowledge conversions and how different forms of knowledge in the organisations were form. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 25 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Figure 7.8: Knowledge creating process Socialization The process that transfers tacit knowledge in one person to tacit knowledge in another person is socialization. It is experiential, active and a “living thing,” involving capturing knowledge by walking around and through direct interaction with customers and suppliers outside the organization and people inside the organization. This depends on having shared experience, and results in acquired skills and common mental models. Socialization is primarily a process between individuals. Externalization The process for making tacit knowledge explicit is externalization. One case is the articulation of one’s own tacit knowledge, ideas or images in words, metaphors, analogies. A second case is eliciting and translating the tacit knowledge of others - customer, experts for example - into a readily understandable form, e.g., explicit knowledge. Dialogue is an important means for both. During such face-to-face communication people share beliefs and learn how to better articulate their thinking, though instantaneous feedback and the simultaneous exchange of ideas. Externalization is a process among individuals within a group. Combination. Once knowledge is explicit, it can be transferred as explicit knowledge through a process is called combination. This is the area where information technology is most helpful, because explicit knowledge can be conveyed in Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 26 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business documents, email, data bases, as well as through meetings and briefings. The key steps collecting relevant internal and external knowledge, dissemination, and editing/processing to make it more usable. Combination allows knowledge transfer among groups across organizations. Internalization Internalization is the process of understanding and absorbing explicit knowledge in to tacit knowledge held by the individual. Knowledge in the tacit form is actionable by the owner. Internalization is largely experiential, in order to actualize concepts and methods, either through the actual doing or through simulations. The internalisation process transfers organization and group explicit knowledge to the individual. Nonaka and Takuchi suggest five key mechanisms by which knowledge creation can e encouraged 1. Intentions. Senior management must be committed to accumulating, exploiting and renewing the knowledge base within their organisation and to creating management systems compatible with this intention. 2. Autonomy. Individual are the major source of new knowledge and they must be given organisational support to explore and develop new ideas. 3. Creative chaos. An internal ‘culture’ must be established which is willing to use new knowledge to challenge existing orthodoxies. 4. Redundancy. Knowledge should not be allowed to become ‘redundant’ via it being rationed to selected individuals only within the organisation. 5. Requisite variety. The internal diversity within the organisation must at least match that of the external environment within which it operates. 7.9. Techniques for Strategic analysis Some of the widely used techniques include Game based techniques Strategic Scenario analysis 7.9.1. Game-based Techniques This approach has been widely used in highly concentrated industries and markets dominated by a few large firms. The idea is to estimate for each proposed strategy the firm might adopt, the likely counter –strategies of teh rival (or rivals). The decision rules are built on the assumption of two of which are widely adopted: Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 27 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 1. Maxi-min decision rule-assumes that rivals reacts in the worst way possible for each strategy of the firm. Then the firm can selects the best (maxi) of the worst (mini) possible outcome. 2. Mini-max decision rule- assumes that the rival (firm B) reacts in the best (for firm A) way possible for each A strategy. Firm A then selects the worst (mini) of these best (maxi) possible outcomes. A number of other ideas are widely presented in game theory approaches. Dominant strategy: In this approach the firm seeks to do the best it can (in terms of the objectives set) irrespective of the possible actions/reactions of any rivals. Nash equilibrium. This occurs when each firm is doing the best that it can in terms of its own objectives, given the strategies chosen by the other firms in the market. Prisoner dilemma. This is an outcome where the equilibrium for the game involves both firms doing worse than they would have done had they colluded, and sometimes called a ‘cartel game’ because the obvious implication is that the firm would be better off by colluding. There are different types of games to which these ideas might be applied include one-shot game, repeated game, sequential game, and finally first mover advantage. 7.9.2. Strategic Scenario Analysis A scenario cab be defined as an internally consistent view of the future, which often reflects a situation in which large number of variables are seen as moving in particular direction. Scenario analysis is an approach that is widely used to evaluate possible future outcomes of different courses of actions (e.g. high, medium, low profitability scenarios). Arguably scenario analysis takes a broader perspective in terms of strategic direction than does game theory, the latter confirming itself to competitors actions/reactions. Scenario analysis is more useful in macroeconomics or industry wide factors, whereas game theory is more useful in dealing with the strategic uncertainties related to rivals. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 28 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.10. International operations management and logistical strategies Both international operations management and international logistics involve the coordination of set of interrelated activities directed towards the efficient production and supply of goods and services. 7.10.1. International operation management International management of operations and production may be very similar to the management of operations and production in a home country. Common to both are considerations regarding the efficient use of all the factors of production, productivity improvements, R & D, and the extent of horizontal or vertical integration, or both. The international environment, however, includes other considerations. Before making production decisions, an MNC must consider such additional factors as different wage rates, industrial relations, sources of financing, foreign exchange risk, international tax laws, control, the appropriate mix of capital and labor, access to suppliers, and the production-experience curve in each country. While many MNCs attempt to standardize their production systems on a worldwide basis by transferring production processes and procedures unchanged from the parent corporation, these environmental influences often make such standardization unsuccessful or at best difficult. 7.10.2. Operation management: a manufacturing perspective Operation management is concerned with managing the transformation process whereby input resources are converted into outputs. Five general approaches can be used for managing transformation process and continuous process. 1. Project process. These are traditionally sued to produce highly customised, one off items such as the construction of new building, production of cinema film or the installation of computer system (Low volume, high variety products). 2. Jobbing process. These involve the manufacture of a unique item from beginning to end as a result of an individual order. Products are subjected to jobbing processes are usually of a small stature than those subjected to project processes and may include handmade shoes, restored furniture and individualised computer system. 3. Batch process. These involve the manufacture of a number of similar items whereby a batch of products is processed through a given stage before the entire batch is moved on to the next stage in well defined sequences. Example clothing, (High volume) 4. Mass production. These involves the use of a mass production line whereby the product moves continuously from one operation to another Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 29 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business without stopping. Mass process typically produce goods in large volumes but less varied in terms of design characteristics. Example include motor vehicles, food preparations etc. 5. Continuous process. These can be considered as variation of mass processes in that goods are produced in even larger volumes and are often highly standardised in their design, such as beer, paper and electricity production. 7.10.3. Operation management: a non manufacturing perspective Also operation management is concern about service provisions. In service provision entities such as hospitals, educations, airlines, hotels provides services. Nigel Slack identified five performance objectives for operation management for service provision organisation such as cost, quality, speed, dependability and flexibility. 7.10.4. Current operations management issues Some of the issues relating operations management include 1. 2. 3. 4. 5. 6. 7. 8. Design. Manufacture Distribution Capacity Stock Purchasing Scheduling Employees 7.10.5. Flexible specialisation Flexible specialisation is a term that is often applied to new methods of manufacturing that attempt to produce ‘an expandable range of highly specialised products’. Flexible specialisation emerged as a result of the globalised and information intensive environment within which firms operate and increase in demand for products that are custom-made and more varied in nature. Implication of flexible specialisation 1. To render less useful the idea of the learning or experience curve in contributing to productive efficiency, whether for the provision of service or goods. 2. Shifts the focus away from various internal economies of scale as a major competitive advantage. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 30 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business 7.10.6. Integration versus modularity A modular product has been defined as a ‘complex product whose individual elements has been designed independently and yet functions together as seamless whole’. Enterprises Resource Planning: This terms refers to wide variety of company-wide information system that are increasingly replacing the more fragmented, stand-alone IT system in many companies. Modular strategies Globalisation has been a driving force for modular strategies. Modular strategies can embrace production, design, and or use 1. Modularity in production. (MIP). 2. Modularity in design 3. Modularity in use 7.10.7. International logistics Logistics is a term that has long been associated with military activities, and particular with coordinating the movements of troops and other supplies to specific locations in the most efficient ways technically feasible. Logistical principles 1. Square root law- the amount of safety stock required will decline by fractions who denominator is the square root of the reduction in number of stock holding points in logistical system. 2. Logistical cost control. It will often be the case that logistical changes will reduce certain specified costs but only at the expenses of raising other costs. Such changes will only be applied where the net outcome is positive, i.e. the logistical cost trade off is ‘favourable’. 3. Time compressions. This refers to the various attempts to accelerate the flow of materials and information in logistical systems. It is sometimes extended to cover a variety of techniques and approaches, such as just-in time, quick responses, lead-time management, lean logistics, process mapping techniques and so on. 4. Postponements principles. The company will benefit by postponing decisions as to precise configuration of customised products until as late a stage as possible within the precise configuration of customised product until as late a stage as possible within the supply chain. This Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 31 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business implies that companies should hold stock in generic form for as long as possible before deciding how to extend the product range by reconfiguring the stock into the separate ‘stock-keeping units’(SKU) which correspond to customised products. Application of this ‘postponement principle’ reduces the volume of inventory in the global supply chain and the costs associated with under –supplying (stock-out costs) or over supplying (stock handling costs) a particular market with customised products. 7.10.8. International distribution system There are many types of distribution system, These include 1. Direct 2. Transit 3. Classical 4. Multicounty Choice of distribution channels include: 1. Foreign customer base 2. Export volumes 3. Value density of products Transport issues are also important issues in international logistics. Centralisation and decentralisation of distribution system can significantly influence the cost of transpiration. Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 32 International Business (MOD001055) Chapter 7: International Strategic Issues Zubair Hassan (2013) International Strategic Issues. International Business Reference list Ajami, R.A., Cool, K., Goddard, G.J., Khambata, D and Sharpe, M.E. (2006). International Business: Theory and Practice, (2nd Edition). pp. 3-19. M.E. Sharpe, Inc. Brett, J, Behfar, K, Kern, M C (2006). Managing multi-cultural teams. Harvard business review, 84(11), pp. Cullen, J.B., and Parboteeah, K.P. (2010). International Business: Strategy and Multinational Company, pp. 3-33. Routledge, 270 Madison Ave, New York, NY 10016 Fedor, Kenneth J., Werther Jr., William B (1996). The Fourth Dimension: Creating Culturally Responsive International Alliances. Organizational Dynamics, 25( 2), pp.39-53 Katsioloudes, M.I. and Hadjidakis, S. (2007). International Business: A global perspective. Butterworth-Heinemann /Elsevier Wall, S., Minocha, S., and Rees, B. (2010). International Business, (3rd Edition), pp.1-36. Prentice Hall, Financial Times. (RECOMMENDED READING) Yeung, Irene Y. M.; Tung, Rosalie L. (1996). Achieving business success in Confucian societies: The importance of Guanxi (Connections). Organizational Dynamics, 25(2), pp. 54-65 Notes compiled by Zubair zubair@ftms.edu.my or Zubai7@gmail.com 33