SENATE MAJORITY PAC – “Bqhatevwr” AD FACTS Senate

advertisement

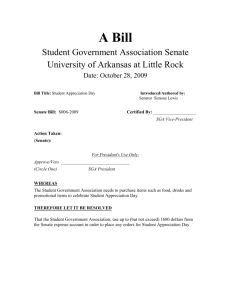

SENATE MAJORITY PAC – “Bqhatevwr” AD FACTS Senate President: “The Senator from Massachusetts” BROWN “DELIVERED FOR WALL STREET” BY SAVING BIG BANKS $19 BILLION IN TAXES Title: Senator Scott Brown “Brown delivered for Wall Street” Boston Globe, 5/2/12 Narrator: When Scott Brown was the Senator from Massachusetts, the Boston Globe reports, he “delivered” for Wall Street, saving big banks $19 billion in taxes. Brown “Delivered For Wall Street” By Eliminating A $19 Billion Tax On Banks From Wall Street Reform Legislation. “Brown delivered for Wall Street in the battle over Dodd-Frank when he extracted a pro-industry concession from the Democratic majority: the elimination from the bill of a proposed $19 billion tax on banks, money which would have been used for part of the regulatory overhaul.” [Boston Globe, 5/2/12] Brown And His Staff Worked “Both Publicly And Behind The Scenes To Scuttle $19 Billion In Fees” On Wall Street. “As the money poured in, Brown and his Senate staff were working both publicly and behind the scenes to scuttle $19 billion in fees on the financial industry that would have paid for part of the regulatory overhaul, and to weaken a provision intended to curb certain types of investment activities by banks and insurance companies.” [Boston Globe, 12/12/10] As He Became A Favorite Of Wall Street Firms, Brown “In Turn” Was “An Important Ally At Critical Moments,” Including Striping Out A Proposed $19 Billion Bank Tax. “Of the 20 companies that accounted for the most campaign donations to Mr. Brown, about half were prominent investment or securities firms like Morgan Stanley, Fidelity Investments and Bain Capital. His donors include such blue-chip names as Gary Cohn, the president of Goldman Sachs, and the hedge fund kings John Paulson and Kenneth Griffin. Mr. Brown, in turn, has been an important ally at critical moments, using his swing vote in the Senate to wring significant concessions out of Democrats on last year’s financial regulation bill, including helping strip out a proposed $19 billion bank tax and weakening a proposal to stop commercial banks from holding large interests in hedge funds and private equity funds.” [New York Times, 11/18/11] During Wall Street Reform Negotiations, Wall Street Poured Campaign Contributions To Brown While He Used Leverage To Win Key Concessions Sought By Wall Street. “Campaign contributions to Senator Scott Brown from the financial industry spiked sharply during a critical three-week period last summer as the fate of the Wall Street regulatory overhaul hung in the balance and Brown used the leverage of his swing vote to win key concessions sought by firms.” [Boston Globe, 12/12/10] Around A Critical Period In Wall Street Reform Negotiations, Brown Received 400% More In Contributions Than What Was Received On Average By All Republican Senators During The Same Three Week Period. “From mid-June until the Fourth of July, according to a Globe analysis of his campaign finance reports, the Massachusetts senator took in $140,000 from banks and investment firms and their executives, including companies based in the state, such as MassMutual and State Street Corp. That is 400 percent more than the $28,000 received on average by all Republican senators during the same three weeks. As the money poured in, Brown and his Senate staff were working both publicly and behind the scenes to scuttle $19 billion in fees on the financial industry that would have paid for part of the regulatory overhaul, and to weaken a provision intended to curb certain types of investment activities by banks and insurance companies.” [Boston Globe, 12/12/10] Senate President: “The Senator from Massachusetts” “THANKS” TO BROWN, BANKS CAN MAKE RISKY INVESTMENTS IN PRIVATE EQUITY AND HEDGE FUNDS Headline: “Scott Brown Winning Fight For Loophole In Volcker Rule” [Talking Points Memo, 6/23/10] Title: Senator Scott Brown Title: Eased Restrictions on risky investments Citation: Bloomberg, 6/26/10 Narrator: And Brown wrote legislation helping big banks make risky investments. During Negotiations Over Wall Street Reform Legislation, Brown Wanted A “Hedge Fund Loophole” In The Volcker Rule. From a Talking Points Memo article on negotiations over the Volcker Rule and Wall Street reform: “Senate staffers tonight are hammering out the shape of the so-called Volcker rule, which would limit insured financial firms' ability to take speculative bets with their capital, or prohibit it altogether. Brown for weeks has been seeking a carveout in the legislation--originally authored by Sens. Carl Levin (D-MI) and Jeff Merkley (D-OR)--that would allow banks to invest a portion of their profits in hedge and private equity funds. And as the 60th vote for financial reform, his demands carry a lot of weight. Enter Feingold, who opposed financial reform from the left. After discussions with, and public pressure from, pro-reform groups, Feingold has toyed with the idea of changing his vote from 'no' to 'yes', becoming the new 60th vote and robbing Brown of his leverage--if the Volcker rule survived loophole free. Multiple sources tonight say that in all likelihood the hedge fund loophole (known as a 'de minimis exemption') will be included in the offer that the conference committee considers this week.” [Talking Points Memo, 6/23/10] “Thanks To Brown’s Efforts” Financial Institutions Were Allowed To Wager Up to 3% Of Their Own Money In Certain Investments, Instead Of Being Prohibited From Making Those Investments. In reference to Wall Street reform legislation, Boston Globe reported: “And instead of being prohibited from investing their own reserves in stocks and other securities, financial institutions will be allowed to wager up to 3 percent of their own money in hedge funds and other investments, thanks to Brown’s efforts.” [Boston Globe, 12/12/10] “To Appease Senator Scott Brown” Wall Street Reform Negotiators Altered Volcker Rule Language. “The Obama administration’s proposal to ban banks from proprietary trading, nicknamed the Volcker rule after former Federal Reserve Chairman Paul Volcker, was softened by Senate negotiators. Banks will be allowed to invest in private-equity and hedge funds, though they will be limited to providing no more than 3 percent of the fund’s capital. Banks also can’t invest more than 3 percent of their Tier 1 capital. The change alters language in a bill the Senate approved in May, which would have barred banks from sponsoring or investing in private-equity and hedge funds. Lawmakers offered the modification to appease Senator Scott Brown, a Massachusetts Republican who was concerned the ban would harm Boston-based State Street Corp.” [Bloomberg News, 6/26/10] Brown Watered Down The Volcker Rule, Which Was Aimed At Preventing Banks From “Making Risky Trades” With Money Backed By The Government. “After his upset election in January 2010, he became the key vote on the bill and leveraged that position to extract big concessions favored by banks, who had given generously to his campaign. First, Brown forced Democrats to strip from the bill a $19 billion bank tax. He also successfully pushed to water down a key reform — the so-called ‘Volcker rule’ — that was aimed at preventing banks from making risky trades with dollars backed by the government.” [Think Progress, 9/13/11] Brown And His Staff Worked “Both Publicly And Behind The Scenes” To Weaken The Volcker Rule. “As the money poured in, Brown and his Senate staff were working both publicly and behind the scenes to scuttle $19 billion in fees on the financial industry that would have paid for part of the regulatory overhaul, and to weaken a provision intended to curb certain types of investment activities by banks and insurance companies.” [Boston Globe, 12/12/10] “Scott Brown Flirts With New Hampshire Run” US News & World Report, 12/13/13 Narrator: Now he’s shopping for a senate seat in New Hampshire. Really. Narrator: That's good for Wall Street and great for Scott Brown. Narrator: But it doesn’t make sense for New Hampshire. Title: Doesn’t Make Sense For New Hampshire FORMER MASSACHUSETTS SENATOR BROWN “FLIRTS” AND TOYS WITH NH SENATE RUN Headline And Sub-Headline: “The Flirt. Is Scott Brown Really Running, Or Just Leading New Hampshire On?” [Politico Magazine, 12/17/13] Union Leader Editorial Headline: “Hey, Scott Brown Stop Flirting With NH” [Editorial, New Hampshire Union Leader, 10/1/13] Headline: “Scott Brown Flirts With New Hampshire Run” [The Ballot 2014 blog, US News & World Report, 12/13/13] Headline: “Scott Brown Flirts With New Hampshire, But The Feeling Might Not Be Mutual” [The Fix, Washington Post, 10/2/13] Headline: “Scott Brown Continues To Toy With New Hampshire Run” [Politico, 12/3/13] Disclaimer: Paid for by Senate Majority PAC, www.senatemajority.com, not authorized by any candidate or candidate’s committee. Senate Majority PAC is responsible for the content of this advertising. Headline: “Republicans To Scott Brown: Oh, You're Serious?” [National Journal, 12/10/13] ANNCR: Senate Majority PAC is responsible for the content of this advertising. Headline: “Scott Brown Not Taking Presidential Run Off The Table” [ABC News, 12/9/13] Headline: “Scott Brown Stirs Speculation Over U.S. Senate Run At Nashua Fundraiser” [Concord Monitor, 12/19/13] … AND FLIRTED WITH RUNNING IN OTHER RACES IN OTHER STATES TOO In NH And Iowa, Brown Flirted With The Idea Of Running For President In 2016. “Former Massachusetts Sen. Scott Brown has been spending quite a bit of time in New Hampshire testing the waters for a possible U.S. Senate run there next year, but the Granite State is also a place where presidential contenders frequent and Brown is again not ruling out a 2016 run. ‘I don’t think I ever said I was thinking about running for president,’ Brown told reporters at a stop in Londonderry, N.H., according to the Stoneham Patch. He then added ‘I don’t think anything’s off the table at this point.’ Brown first floated the idea of a possible 2016 presidential bid in August, even stopping at the Iowa State Fair, a rite of passage for any presidential contender.” [ABC News, 12/9/13] Headline: “Scott Brown Considering 2016 Presidential Bid” [CBS News, 8/19/13] Headline: “Scott Brown Is Thinking Really Hard About Being Governor of Massachusetts” [The Atlantic’s The Wire, 2/19/13] Headline: “Scott Brown On Massachusetts Gubernatorial Bid: ‘Stay Tuned’” [Politico, 8/8/13] BROWN’S BEEN REALLY GOOD FOR WALL STREET… As He Became A Favorite Of Wall Street Firms, Brown “In Turn” Was “An Important Ally At Critical Moments.” “Of the 20 companies that accounted for the most campaign donations to Mr. Brown, about half were prominent investment or securities firms like Morgan Stanley, Fidelity Investments and Bain Capital. His donors include such blue-chip names as Gary Cohn, the president of Goldman Sachs, and the hedge fund kings John Paulson and Kenneth Griffin. Mr. Brown, in turn, has been an important ally at critical moments, using his swing vote in the Senate to wring significant concessions out of Democrats on last year’s financial regulation bill, including helping strip out a proposed $19 billion bank tax and weakening a proposal to stop commercial banks from holding large interests in hedge funds and private equity funds.” [New York Times, 11/18/11] …AND MAKING MONEY OFF HIS WALL STREET RELATIONSHIPS Brown Joined Boston Law Firm, Nixon Peabody, Where He Would Focus On “Matters Relating To The Financial Services Industry.” “Former senator Scott Brown said today he is joining the Boston law firm of Nixon Peabody, where he will focus on matters relating to the financial services industry and commercial real estate.” [Boston Globe, Political Intelligence, 3/11/13] Brown’s Job At Nixon Peabody Allowed Him “To Begin Cashing In On His Contacts With The Financial Services Industry” He Oversaw In The Senate. “The job allows Brown to begin cashing in on his contacts with the financial services industry, which he helped oversee in the Senate. He received hefty donations from the industry during his race last year against Warren.” [Boston Globe, Political Intelligence, 3/11/13] …BUT BROWN’S BAD AT KEEPING NEW HAMPSHIRE AND MASSACHUSETTS STRAIGHT VIDEO: Brown Forgot He Was In New Hampshire, Not Massachusetts. Brown: “What I've heard from the Republicans up here is they're thankful that I've been around for a year, helping them raise money, helping them raise awareness as to the issues that are effecting not only people here in Massachesett--uh, in New Hampshire, but also in Massachusetts, obviously, in Maine. I've been to Maine, Rhode Island, New Hampshire, Connecticut, I've been all over the New England area, certainly, talking and helping people raise money.” [Brown Press Availability, Londonderry, NH, 12/5/13] Headline: “Just Where Is Scott Brown? New Hampshire? Massachusetts?” [McClatchy, 12/6/13] Headline: “Scott Brown: Where Am I?” [Politico, 12/6/13] Headline: “Scott Brown Forgets He’s In New Hampshire” [The Hill, 12/6/13] Headline: “Scott Brown Spaces On Which State He’s In” [MSNBC, 12/6/13] Headline: “Scott Brown Flubs His Location During N.H. Visit” [USA Today, 12/6/13] BUT HEY, #BQHATEVWR