Time Series Analysis Spring 2015 Assignment 2 Solutions Kaiji

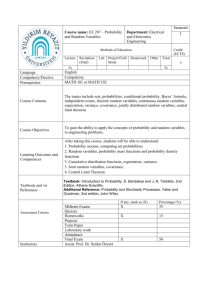

advertisement

Time Series Analysis

Spring 2015

Assignment 2

Solutions

Kaiji Motegi

Waseda University

Reading: Chapter 5 of Enders (2010) Applied Econometric Time Series.

Problem-1: In the midterm exam, we learned that a martingale difference sequence {yt }

is always a white noise. The converse is not true, however. This problem constructs an

example of white noise that is not a martingale difference sequence.

Consider a bilinear process:

i.i.d.

ϵt ∼ (0, σ 2 ).

yt = bϵt−1 yt−2 + ϵt ,

(a) Show that yt = b2 ϵt−1 ϵt−3 yt−4 + bϵt−1 ϵt−2 + ϵt .

(b) Show that yt = b3 ϵt−1 ϵt−3 ϵt−5 yt−6 + b2 ϵt−1 ϵt−3 ϵt−4 + bϵt−1 ϵt−2 + ϵt .

(c) Assume |b| < 1. Keep iterating to show that

yt =

∞

∑

bi ϵt−2i

i=0

where

∏n

j=1 zj

≡ z1 × z2 × · · · × zn .

i

∏

ϵt−(2j−1) ,

(1)

j=1

∏0

j=1 ϵt−(2j−1)

(d) Show that Et−1 [yt ] ≡ E[ yt | ϵt−1 , ϵt−2 , . . . ] =

∑∞

i=1

is understood as 1.

bi ϵt−2i

∏i

j=1 ϵt−(2j−1) .

(Remark: This

result indicates that {yt } is not a martingale difference sequence since Et−1 [yt ] ̸= 0.)

(e) Using Eq. (1), show that E[yt ] = 0.

(f) Assume that b2 σ 2 < 1. Show that E[yt2 ] = σ 2 /(1 − b2 σ 2 ). (Hint: Since {ϵt } is i.i.d.,

E[f (ϵt )g(ϵs )] = E[f (ϵt )]E[g(ϵs )] for any functions f (·) and g(·) whenever t ̸= s. For

example, E[ϵ2t ϵs ] = E[ϵ2t ]E[ϵs ] = σ 2 × 0 = 0 whenever t ̸= s.)

(g) Show that E[yt yt−j ] = 0 for all j ≥ 1. (Hint: Use the i.i.d. property of {ϵt } again.)

(Remark: Parts (e), (f), and (g) indicate that {yt } is a white noise.)

1

Time Series Analysis

Spring 2015

Assignment 2

Solutions

Kaiji Motegi

Waseda University

Solution-1: (a) We have that yt = bϵt−1 (bϵt−3 yt−4 +ϵt−2 )+ϵt = b2 ϵt−1 ϵt−3 yt−4 +bϵt−1 ϵt−2 +ϵt .

(b) Iterating back once more, we have that yt = b2 ϵt−1 ϵt−3 (bϵt−5 yt−6 + ϵt−4 )+bϵt−1 ϵt−2 +ϵt

= b3 ϵt−1 ϵt−3 ϵt−5 yt−6 + b2 ϵt−1 ϵt−3 ϵt−4 + bϵt−1 ϵt−2 + ϵt .

(c) Keep iterating to realize that yt = b0 ϵt−2×0 + b1 ϵt−2×1 (ϵt−1 ) + b2 ϵt−2×2 (ϵt−1 ϵt−3 ) +

b3 ϵt−2×3 (ϵt−1 ϵt−3 ϵt−5 ) + . . . . Using the summation and product operators, this can be rewritten compactly as (1).

(d) The first term of the right-hand side of Eq. (1), i.e. b0 ϵt−2×0 , contains ϵt . All other

terms of the right-hand side contain past values of ϵ only (e.g. ϵt−1 ϵt−2 in the second term).

Since Et−1 [ϵt ] = 0 and ϵt−1 , ϵt−2 , . . . are all known given the information set up to time t − 1,

∑

∏i

i

we have that Et−1 [yt ] = ∞

i=1 b ϵt−2i

j=1 ϵt−(2j−1) .

(e) The unconditional expectation of each term of the right-hand side of Eq. (1) is zero

due to the i.i.d. property of {ϵt }. Hence, E[yt ] = 0.

(f) Consider E[yt2 ] = E[(ϵt + bϵt−1 ϵt−2 + b2 ϵt−1 ϵt−3 ϵt−4 + . . . )2 ]. The expectations of cross

terms are all zeros due to the i.i.d. property of {ϵt }. Focusing on squared terms, we have

that E[yt2 ] = σ 2 + b2 (σ 2 )2 + b4 (σ 2 )3 + · · · = σ 2 [1 + b2 σ 2 + b4 (σ 2 )2 + . . . ] = σ 2 /(1 − b2 σ 2 ).

(g) Consider j = 1 first. We have that E[yt yt−1 ] = E[ (ϵt + bϵt−1 ϵt−2 + b2 ϵt−1 ϵt−3 ϵt−4 + . . . )

(ϵt−1 + bϵt−2 ϵt−3 + b2 ϵt−2 ϵt−4 ϵt−5 + . . . )]. The expectation of each term equals zero due to the

i.i.d. property of {ϵt } (e.g. E[bϵt−1 ϵt−2 × ϵt−1 ] = E[bϵ2t−1 ϵt−2 ] = b × σ 2 × E[ϵt−2 ] = 0). The

same argument holds for any j ≥ 2 as well.

Problem-2: Consider bivariate time series {xt } with xt = [x1,t , x2,t ]′ . This problem has

two similar goals. First, we construct an example where both {x1,t } and {x2,t } are covariance

stationary but {xt } is not jointly covariance stationary. Second, keeping the same example,

we show that a linear combination of individually covariance stationary series may not be

covariance stationary.

(a) Suppose that {bt } is independently and identically distributed mean-centered Bernoulli

2

Time Series Analysis

Spring 2015

Assignment 2

Solutions

random variables:

bt =

Kaiji Motegi

Waseda University

−1 with probability 0.5,

1 with probability 0.5.

Show that E[bt ] = 0, E[b2t ] = 1, and E[bt bt−j ] = 0 for any j ≥ 1.

(b) Assume that x1,2t = b3t and x1,2t+1 = b3t+1 for each t. Also assume that x2,2t = b3t and

x2,2t+1 = b3t+2 for each t. These patterns can be summarized in the following table:

t

1

2

3

4

5

6

7

...

x1,t

b1

b3

b4

b6

b7

b9

b10

...

x2,t

b2

b3

b5

b6

b8

b9

b11

...

Show that both {x1,t } and {x2,t } are covariance stationary.

(c) Show that {xt } is not jointly covariance stationary. (Hint: Joint covariance stationarity

requires that variance E[(xt − E[xt ])(xt − E[xt ])′ ] does not depend on t.) (Remark

1: As shown here, joint covariance stationarity is stronger than individual covariance

stationarity.)

(d) Consider a linear combination yt = β1 x1,t + β2 x2,t with β1 ̸= 0 and β2 ̸= 0. Show that

{yt } is not covariance stationary. (Remark 2: We learned in class that any linear

combination of jointly covariance stationary {xt } is covariance stationary. Problem-2

has shown that individual covariance stationarity does not guarantee the covariance

stationarity of linear combination.)

Solution-2: (a) E[bt ] = (−1) × 0.5 + 1 × 0.5 = 0. E[bt ] = (−1)2 × 0.5 + 12 × 0.5 = 1.

E[bt bt−j ] = E[bt ]E[bt−j ] = 0 for any j ≥ 1 in view of the independence.

(b) E[x1,t ] = 0, E[x21,t ] = 1, and E[x1,t x1,t−j ] = 0 for any j ≥ 1. {x1t } is therefore

covariance stationary. Similarly, E[x2,t ] = 0, E[x22,t ] = 1, and E[x2,t x2,t−j ] = 0 for any j ≥ 1.

{x2t } is therefore covariance stationary.

3

Time Series Analysis

Spring 2015

Assignment 2

Solutions

Kaiji Motegi

Waseda University

(c) E[(xt − E[xt ])(xt − E[xt ])′ ] is equal to I 2 if t is odd, while it is equal to a 2 × 2 matrix

whose elements are all 1 if t is even. Thus, E[(xt − E[xt ])(xt − E[xt ])′ ] depends on time t.

(d) We have that E[yt ] = 0 and E[(yt − E[yt ])2 ] = E[yt2 ] = β12 x21,t + 2β1 β2 x1,t x2,t + β22 x22,t .

Hence, E[yt2 ] = β12 + β22 if t is odd, while E[yt2 ] = β12 + 2β1 β2 + β22 if t is even. Since β1 ̸= 0

and β2 ̸= 0, E[yt2 ] takes a different value for odd t and even t. Thus, {yt } is not covariance

stationary.

Problem-3: Consider a bivariate VAR(1) process:

x1t 0.7 0.6 x1t−1 ϵ1t

=

+ ,

x2t

0 0.8

x2t−1

ϵ2t

| {z } | {z } | {z } | {z }

≡X t

≡A

(2)

≡ϵt

=X t−1

where {ϵt } is a joint white noise with

1 0.5 1

E[ϵt ϵ′t ] =

=

0.5 1.25

0.5

|

{z

} | {z

≡Ω

≡L

′

0 1 0

.

1

0.5 1

} | {z }

=L′

(a) Show that the VAR(1) process appearing in Eq. (2) is covariance stationary.

(b) Calculate VMA coefficients Θ0 , Θ1 , Θ2 , Θ3 , Θ4 , and Θ30 . (Recall xt =

∑∞

j=0

Θj η t−j ,

where {η(τL )} is a joint white noise with E[η(τL )η(τL )′ ] = I 2 .)

(c) Implement the forecast error variance decomposition of {x1t } for horizons h = 1, 2, 3, 4, 30.

(d) Implement the forecast error variance decomposition of {x2t } for horizons h = 1, 2, 3, 4, 30.

Solution-3: (a) The eigenvalues of A are 0.6 and 0.7. Hence Eq. (2) is a covariance

stationary VAR process.

4

Time Series Analysis

Spring 2015

Assignment 2

Solutions

Kaiji Motegi

Waseda University

(b) We have that Θj = Aj L for any j ≥ 0. Hence,

1 0

1 0.6

0.94 0.9

Θ0 =

, Θ1 =

, Θ2 =

,

0.5 1

0.4 0.8

0.32 0.64

0.85 1.014

0.749 1.107

0.004 0.007

Θ3 =

, Θ4 =

, Θ30 =

.

0.256 0.512

0.205 0.410

0.001 0.001

(c) See Table 1.

Table 1: Forecast Error Variance Decomposition of {x1t }

Share of η1

Share of η2

h=1

1

0

h=2

0.848

0.153

h=3

0.711

0.289

h=4

0.621

0.379

...

...

...

h = 30

0.445

0.555

(d) See Table 2.

Table 2: Forecast Error Variance Decomposition of {x2t }

Share of η1

Share of η2

h=1

0.2

0.8

h=2

0.2

0.8

h=3

0.2

0.8

5

h=4

0.2

0.8

...

...

...

h = 30

0.2

0.8