Chapter 7—Risk, Return, and the Capital Asset Pricing

advertisement

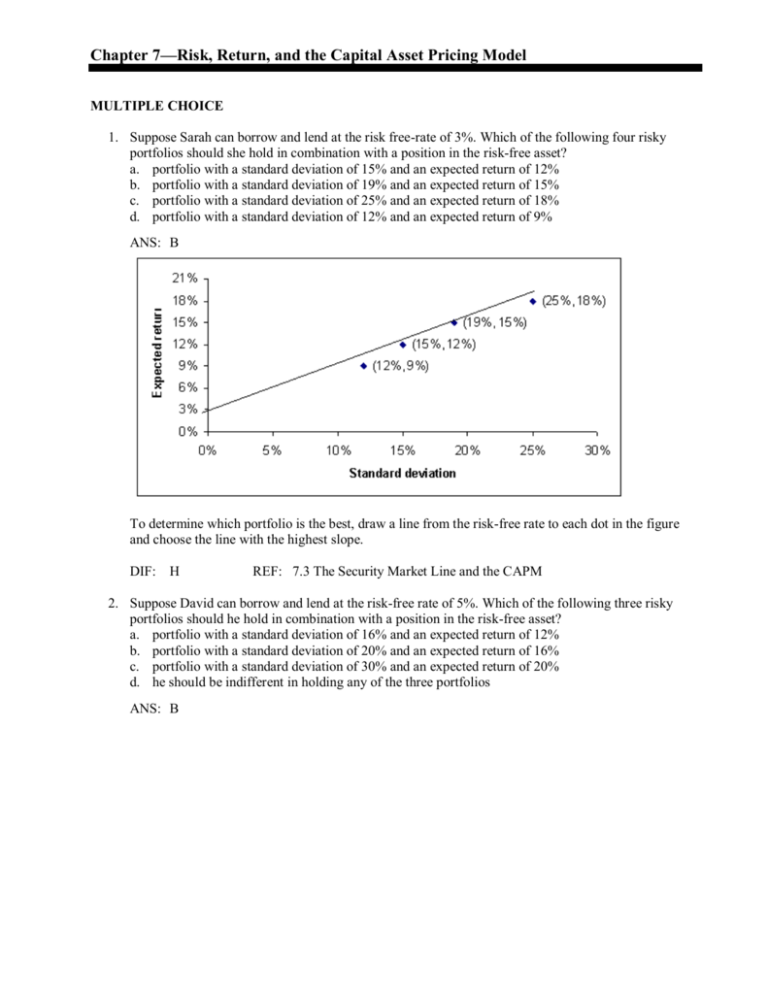

Chapter 7—Risk, Return, and the Capital Asset Pricing Model MULTIPLE CHOICE 1. Suppose Sarah can borrow and lend at the risk free-rate of 3%. Which of the following four risky portfolios should she hold in combination with a position in the risk-free asset? a. portfolio with a standard deviation of 15% and an expected return of 12% b. portfolio with a standard deviation of 19% and an expected return of 15% c. portfolio with a standard deviation of 25% and an expected return of 18% d. portfolio with a standard deviation of 12% and an expected return of 9% ANS: B To determine which portfolio is the best, draw a line from the risk-free rate to each dot in the figure and choose the line with the highest slope. DIF: H REF: 7.3 The Security Market Line and the CAPM 2. Suppose David can borrow and lend at the risk-free rate of 5%. Which of the following three risky portfolios should he hold in combination with a position in the risk-free asset? a. portfolio with a standard deviation of 16% and an expected return of 12% b. portfolio with a standard deviation of 20% and an expected return of 16% c. portfolio with a standard deviation of 30% and an expected return of 20% d. he should be indifferent in holding any of the three portfolios ANS: B To determine which portfolio is the best, draw a line from the risk-free rate to each dot in the figure and choose the line with the highest slope. DIF: H REF: 7.3 The Security Market Line and the CAPM 3. The risk-free rate is 5% and the expected return on the market portfolio is 13%. A stock has a beta of 1.5, what is its expected return? a. 17% b. 12% c. 19.5% d. 24.5% ANS: A E(R) = 5% + 1.5(13%-5%) = 17% DIF: E REF: 7.3 The Security Market Line and the CAPM 4. The risk-free rate is 5% and the expected return on the market portfolio is 13%. A stock has a beta of 1.0, what is its expected return? a. 8% b. 13% c. 5% d. none of the above ANS: B E(R) = 5% + 1.0(13%-5%) = 13% DIF: E REF: 7.3 The Security Market Line and the CAPM 5. The risk-free rate is 5% and the expected return on the market portfolio is 13%. A stock has a beta of 0, what is its expected return? a. 0% b. 5% c. 13% d. none of the above ANS: B E(R) = 5% + 0(13%-5%) = 5% DIF: E REF: 7.3 The Security Market Line and the CAPM 6. According to the CAPM (capital asset pricing model), the security market line is a straight line. The intercept of this line should be equal to a. zero b. the expected risk premium on the market portfolio c. the risk-free rate d. the expected return on the market portfolio ANS: C DIF: M REF: 7.3 The Security Market Line and the CAPM 7. According to the CAPM (capital asset pricing model), the security market line is a straight line. The slope of this line should be equal to a. zero b. the expected risk premium on the market portfolio c. the risk-free rate d. the expected return on the market portfolio ANS: B DIF: M REF: 7.3 The Security Market Line and the CAPM 8. According to the CAPM (capital asset pricing model), what is the single factor that explains differences in returns across securities? a. the risk-free rate b. the expected risk premium on the market portfolio c. the beta of a security d. the expected return on the market portfolio e. the volatility of a security ANS: C DIF: E REF: 7.3 The Security Market Line and the CAPM 9. If the market portfolio has an expected return of 0.12 and a standard deviation of 0.40, and the risk-free rate is 0.04, what is the slope of the security market line? a. 0.08 b. 0.20 c. 0.04 d. 0.12 ANS: A Slope = 0.12 - 0.04 = 0.08 DIF: M REF: 7.3 The Security Market Line and the CAPM 10. A particular asset has a beta of 1.2 and an expected return of 10%. The expected return on the market portfolio is 13% and the risk-free is 5%. Which of the following statement is correct? a. This asset lies on the security market line. b. This asset lies above the security market line. c. This asset lies below the security market line. d. Cannot tell from the given information. ANS: C Equilibrium return = 5% + 1.2 (13%-5%) = 14.6% DIF: M REF: 7.3 The Security Market Line and the CAPM 11. A particular asset has a beta of 1.2 and an expected return of 10%. The expected return on the market portfolio is 13% and the risk-free is 5%. The stock is a. overpriced b. underpriced c. appropriately priced d. Cannot tell from the given information ANS: A Equilibrium return = 5% + 1.2 (13%-5%) = 14.6% DIF: M REF: 7.3 The Security Market Line and the CAPM 12. An asset has a beta of 2.0 and an expected return of 20%. The expected risk premium on the market portfolio is 5% and the risk-free is 7%. The stock is a. overpriced b. underpriced c. appropriately priced d. Cannot tell from the given information ANS: B Equilibrium return = 7% + 2.0 (5%) = 17% DIF: M REF: 7.3 The Security Market Line and the CAPM 13. A stock that pays no dividends is currently priced at $40 and is expected to increase in price to $45 by year end. The expected risk premium on the market portfolio is 6% and the risk-free is 5%. If the stock has a beta of 0.6, the stock is a. overpriced b. underpriced c. appropriately priced d. Cannot tell from the given information ANS: B Equilibrium return = 5% + 0.6 (6%) = 8.6% Stock expected return = (45-40)/40 = 12.5% DIF: M REF: 7.3 The Security Market Line and the CAPM 14. A particular stock has a beta of 1.4 and an expected return of 13%. If the expected risk premium on the market portfolio is 6%, what’s the expected return on the market portfolio? a. 10.6% b. 4.6% c. 8.4% d. 9.3% ANS: A 13% = Rf + 1.4 (6%) Rf = 4.6% Expected market return = 4.6% + 6% = 10.6% DIF: M REF: 7.3 The Security Market Line and the CAPM 15. A particular stock has an expected return of 18%. If the expected return on the market portfolio is 13%, and the risk-free rate is 5%, what’s the stock’s CAPM beta? a. 1.000 b. 1.625 c. 2.250 d. 1.385 ANS: B 18% = 5% + (8%) = 1.625 DIF: M REF: 7.3 The Security Market Line and the CAPM 16. A particular stock has an expected return of 11%. If the expected risk premium on the market portfolio is 8%, and the risk-free rate is 5%, what’s the stock’s CAPM beta? a. 1.375 b. 0.750 c. 0.846 d. 0.462 ANS: B 11% = 5% + (8%) = 0.75 DIF: M REF: 7.3 The Security Market Line and the CAPM 17. The stock of Alpha Company has an expected return of 15.5% and a beta of 1.5, and Gamma Company stock has an expected return of 13.4% and a beta of 1.2. Assume the CAPM holds. What’s the expected return on the market? a. 12% b. 7% c. 10.3% d. 11.2% ANS: A Suppose the risk free rate is Rf, and the expected market return is Rm. 15.5% = Rf +1.5(Rm-Rf) 13.4% = Rf +1.2(Rm-Rf) Rf = 5% Rm = 12% DIF: M REF: 7.3 The Security Market Line and the CAPM 18. The stock of Alpha Company has an expected return of 18% and a beta of 1.5, and Gamma Company stock has an expected return of 15.6% and a beta of 1.2. Assume the CAPM holds. What’s the risk-free rate? a. 8.0% b. 6.0% c. 0% d. 4.7% ANS: B Suppose the risk free rate is Rf, and the expected market return is Rm. 18% = Rf +1.5(Rm-Rf) 15.6% = Rf +1.2(Rm-Rf) Rf = 6% Rm = 14% DIF: M REF: 7.3 The Security Market Line and the CAPM 19. The CAPM (capital asset pricing model) assumes that: a. all assets can be traded b. investors are risk-averse c. investors have homogeneous expectations d. all of the above ANS: D DIF: H REF: 7.3 The Security Market Line and the CAPM 20. A portfolio has 40% invested in Asset 1 and 60% invested in Asset 2. If Asset 1 has a beta of 1.2 and Asset 2 has a beta of 1.8, what’s the beta of the portfolio? a. 1.50 b. 1.56 c. 1.20 d. 1.80 e. cannot tell from the given information ANS: B Suppose the expected return of Asset 1 is R1, the expected return of Asset 2 is R2, the risk free rate is Rf, and the market return is Rm. Portfolio expected return = 0.4R1 + 0.6R2 = 0.4[Rf +1.2(Rm-Rf)]+ 0.6[Rf +1.8(Rm-Rf)]= Rf +1.56(Rm-Rf)] DIF: H REF: 7.2 Risk and Return for Portfolios 21. A portfolio has 40% invested in Asset 1, 50% invested in Asset 2 and 10% invested in Asset 3. Asset 1 has a beta of 1.2, Asset 2 has a beta of 0.8 and Asset 3 has a beta of 1.8, what’s the beta of the portfolio? a. 1.27 b. 0.80 c. 1.06 d. 1.20 e. Cannot tell from given information ANS: C Suppose the expected return of Asset 1 is R1, the expected return of Asset 2 is R2, the expected return of Asset 3 is R3, the risk free rate is Rf, and the market return is Rm. Portfolio expected return = 0.4R1 + 0.5R2 + 0.1R3 = 0.4[Rf +1.2(Rm-Rf)]+ 0.5[Rf +0.8(Rm-Rf)]+ 0.1[Rf +1.8(Rm-Rf)] = Rf +1.06(Rm-Rf)] DIF: H REF: 7.2 Risk and Return for Portfolios 22. A portfolio consists 20% of a risk-free asset and 80% of a stock. The risk-free return is 4%. The stock has an expected return of 15% and a standard deviation of 30%. What’s the expected return a. 12.8% b. 9.5% c. 15.0% d. 4.0% ANS: A Portfolio expected return = 20%(4%) + 80%(15%) = 12.8% DIF: M REF: 7.2 Risk and Return for Portfolios 23. The stock of Alpha Company has an expected return of 0.10 and a standard deviation of 0.25. The stock of Gamma Company has an expected return of 0.16 and a standard deviation of 0.40. The correlation coefficient between the two stock’s return is 0.2. If a portfolio consists of 40% of Alpha Company and 60% of Gamma Company, what’s the expected return of the portfolio? a. 0.126 b. 0.136 c. 0.160 d. 0.130 ANS: B Portfolio expected return = .4(0.10) + .6(0.16) = 0.136 DIF: M REF: 7.2 Risk and Return for Portfolios 24. Asset 1 has a beta of 1.2 and Asset 2 has a beta of 0.6. Which of the following statements is correct? a. Asset 1 is more volatile than Asset 2. b. Asset 1 has a higher expected return than Asset 2. c. In a regression with individual asset’s return as the dependent variable and the market’s return as the independent variable, the R-squared value is higher for Asset 1 than it is for Asset 2. d. All of the above statements are correct. ANS: B DIF: M REF: 7.3 The Security Market Line and the CAPM 25. An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%, what’s the investor’s expected return? a. 22.28% b. 14.80% c. 15.08% d. 21.80% ANS: C Expected return (stock A) = 5% + 1.2(12%-5%) = 13.4% Expected return (stock B) = 5% + 1.6(12%-5%) = 16.2% Portfolio expected return = .4(13.4%) + .6(16.2%) = 15.08% DIF: M REF: 7.2 Risk and Return for Portfolios 26. You have the following data on the securities of three firms: Firm A Firm B Firm C Return last year 10% 11% 12% Beta 0.8 1.0 1.2 If the risk-free rate last year was 3%, and the return on the market was 11%, which firm had the best performance on a risk-adjusted basis? a. Firm A b. Firm B c. Firm C d. There is no difference in performance on a risk-adjusted basis ANS: A Expected return (firm A) = 3% + 0.8(8%) = 9.4% < actual firm A return Expected return (firm B) = 3% + 1.0(8%) = 11% = actual firm B return Expected return (firm C) = 3% + 1.2(8%) = 12.6% > actual firm C return Only firm A beats the market on a risk-adjusted basis. DIF: M REF: 7.3 The Security Market Line and the CAPM 27. Expected returns are: a. always positive. b. always greater than the risk-free rate. c. inherently unobservable. d. usually equal to actual returns. ANS: C DIF: E REF: 7.1 Expected Returns 28. Which of the following is not a method used by analysts to estimate an asset’s expected return? a. historical approach b. probabilistic approach c. risk-based approach d. estimation approach ANS: D DIF: E REF: 7.1 Expected Returns 29. A drawback to the historical approach of estimating an asset’s expected return is: a. the risk of the firm may have changed over time. b. history always repeats itself. c. that the range of potential outcomes is often very broad. d. all of the above are drawbacks to the historical approach. ANS: A DIF: E REF: 7.1 Expected Returns 30. An advantage of the probabilistic approach to estimating an asset’s returns is: a. history always repeats itself. b. it does not require one to assume that the future will look like the past. c. recent history is more important than future risk. d. exact probabilities are easy to estimate. ANS: B DIF: E REF: 7.1 Expected Returns 31. A disadvantage of the probabilistic approach to estimating an asset’s returns is: a. history always repeats itself. b. it does not require one to assume that the future will look like the past. c. recent history is more important than future risk. d. that the range of possible outcomes is often broader than the scenarios used. ANS: D DIF: M REF: 7.1 Expected Returns 32. Suppose that over the last 20 years, company XYZ has averaged a return of 13%. Over the same period, the Treasury bond rate has averaged 4%. The current estimate of the Treasury bond rate is 6.5%. Using the historical approach, what is the estimate of XYZ’s expected return. a. 13.0% b. 16.5% c. 15.5% d. 19.5% ANS: C Historical Risk Premium = 13% - 4% = 9% Expected Return = 9% + 6.5% = 15.5% DIF: E REF: 7.1 Expected Returns 33. Suppose that over the last 30 years, company ABC has averaged a return of 10%. Over the same period, the Treasury bond rate has averaged 3%. The current estimate of the Treasury bond rate is 5%. Using the historical approach, what is the estimate of ABC’s expected return. a. 13.0% b. 12.5% c. 12.0% d. 11.0% ANS: C Historical Risk Premium = 10% - 3% = 7% Expected Return = 7% + 5% = 12% DIF: E REF: 7.1 Expected Returns 34. Suppose that over the last 25 years, company DEF has averaged a return of 7.5%. Over the same period, the Treasury bond rate has averaged 1.5%. The current estimate of the Treasury bond rate is 4%. Using the historical approach, what is the estimate of DEF’s expected return. a. 13.0% b. 12.5% c. 12.0% d. 10.0% ANS: D Historical Risk Premium = 7.5% - 1.5% = 6% Expected Return = 6% + 4% = 10% DIF: E REF: 7.1 Expected Returns NARRBEGIN: Exhibit 7-1 Exhibit 7-1 Outcome Recession Expansion Boom Probability 25% 40% 35% Return -30% 15% 55% NARREND 35. Given Exhibit 7-1, what is the expected return? a. 13.00% b. 15.96% c. 16.00% d. 17.75% ANS: D 0.25*-0.3 + 0.4*0.15 + 0.35*0.55 = 0.1775 DIF: E REF: 7.1 Expected Returns NAR: Exhibit 7-1 36. Given Exhibit 7-1, what is the expected variance? a. 957.38% b. 1058.69% c. 49.27% d. 32.54% ANS: B Outcome Recession Expansion Boom DIF: M Probability 25% 40% 35% 100% Return -30% 15% 55% Return - E(r) -47.75% -2.75% 37.25% Variance REF: 7.1 Expected Returns (Return - (E(r))2 2280.06% 7.56% 1387.56% 1058.69% NAR: Exhibit 7-1 37. Given Exhibit 7-1, what is the expected standard deviation? a. 957.38% b. 1058.69% c. 49.27% d. 32.54% ANS: D Outcome Recession Expansion Boom DIF: M Probability 25% 40% 35% 100% Return -30% 15% 55% REF: 7.1 Expected Returns NARRBEGIN: Exhibit 7-2 Exhibit 7-2 Outcome Recession Expansion Boom Return - E(r) -47.75% -2.75% 37.25% Variance Std Dev Probability 40% 25% 35% Return -25% 20% 45% NARREND 38. Given Exhibit 7-2, what is the expected return? a. 10.75% b. 13.00% (Return - (E(r))2 2280.06% 7.56% 1387.56% 1058.69% 32.54% NAR: Exhibit 7-1 c. 16.00% d. 17.75% ANS: A 0.4*-0.25 + 0.25*0.2 + 0.35*0.45 = 0.1075 DIF: E REF: 7.1 Expected Returns NAR: Exhibit 7-2 39. Given Exhibit 7-2, what is the expected variance? a. 943.19% b. 1058.69% c. 49.27% d. 32.54% ANS: A Outcome Recession Expansion Boom DIF: M Probability 40% 25% 35% 100% Return -25% 20% 45% Return - E(r) -35.75% 9.25% 34.25% Variance REF: 7.1 Expected Returns (Return - (E(r))2 1278.06% 85.56% 1173.06% 943.19% NAR: Exhibit 7-2 40. Given Exhibit 7-2, what is the expected standard deviation? a. 957.38% b. 1058.69% c. 30.71% d. 32.54% ANS: C Outcome Recession Expansion Boom DIF: M Probability 40% 25% 35% 100% Return -25% 20% 45% Return - E(r) -35.75% 9.25% 34.25% Variance Std Dev REF: 7.1 Expected Returns (Return - (E(r))2 1278.06% 85.56% 1173.06% 943.19% 30.71% NAR: Exhibit 7-2 41. The first step in the risk-based approach to estimating a security’s expected return is to: a. define what is meant by “risk” and to measure it. b. quantify how much return we should expect on an asset with a given amount of risk. c. estimate the risk-free rate. d. define what is meant by return. ANS: A DIF: E REF: 7.1 Expected Returns 42. Standard deviation measures: a. systematic risk. b. unsystematic risk. c. total risk. d. beta risk. ANS: C DIF: E REF: 7.1 Expected Returns 43. Investors can eliminate what type of risk by diversifying? a. systematic risk b. unsystematic risk c. beta risk d. total risk ANS: B DIF: E REF: 7.1 Expected Returns 44. Which type of risk affects many different securities? a. return risk b. variance risk c. unsystematic risk d. systematic risk ANS: D DIF: E REF: 7.1 Expected Returns 45. Which type of risk affects just a few securities at a time? a. return risk b. variance risk c. unsystematic risk d. systematic risk ANS: C DIF: E REF: 7.1 Expected Returns 46. A standardized measure of risk is: a. alpha b. beta c. gamma d. omega ANS: B DIF: E REF: 7.1 Expected Returns 47. Which type of firm would most likely have the greatest systematic risk? a. A grocery store chain b. A electric company c. A telephone company d. A vibrating chair manufacturer ANS: D DIF: M REF: 7.1 Expected Returns 48. The beta of the risk-free asset is: a. -1.0 b. 0.0 c. 0.5 d. 1.0 ANS: B DIF: E REF: 7.1 Expected Returns NARRBEGIN: Exhibit 7-3 Exhibit 7-3 Security 1 2 3 Weight 30% 10% Expected Return 10% 15% 21% NARREND 49. Given Exhibit 7-3, what is the weight of Security 2? a. 20% b. 40% c. 60% d. 80% ANS: C 100 - 30 - 10 = 60 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-3 50. Given Exhibit 7-3, what is the expected return on the portfolio? a. 14.1% b. 15.0% c. 16.3% d. 17.9% ANS: A 0.3*0.1 + 0.6*0.15 + 0.1*0.21 = 0.141 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-3 NARRBEGIN: Exhibit 7-4 Exhibit 7-4 Security 1 2 3 Weight 35% 40% Expected Return 7% 9% NARREND 51. Given Exhibit 7-4, what is the weight of Security 1? a. 25% b. 35% c. 45% d. 55% ANS: A 100 - 35 - 40 = 25 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-4 52. Given Exhibit 7-4, if the expected return on the portfolio is 9.7%, what is the expected return for Security 3? a. 10% b. 11% c. 12% d. 13% ANS: C 0.25*0.07 + 0.35*0.09 + 0.4*X = 0.097 X = .12 DIF: M REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-4 NARRBEGIN: Exhibit 7-5 Exhibit 7-5 Security 1 2 3 $ Invested $5,000 $7,000 $9,000 Expected Return 7% 9% 12% NARREND 53. Given Exhibit 7-5, what is the weight of Security 1? a. 42.9% b. 33.3% c. 23.8% d. Cannot be determined with the data given ANS: C $5,000/$21,000 = .238 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-5 54. Given Exhibit 7-5, what is the weight of Security 2? a. 42.9% b. 33.3% c. 23.8% d. Cannot be determined with the data given ANS: B $7,000/$21,000 = .333 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-5 55. Given Exhibit 7-5, what is the weight of Security 3? a. 42.9% b. 33.3% c. 23.8% d. Cannot be determined with the data given ANS: A $9,000/$21,000 = .429 DIF: E REF: 7.2 Risk and Return for Portfolios 56. Given Exhibit 7-5, what is the expected return on the portfolio? a. 9.81% b. 9.00% c. 17.31% d. Cannot be determined with the data given ANS: A NAR: Exhibit 7-5 5000/21000*0.07 + 7000/21000*0.09 + 9000/21000*0.12 = 0.0981 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-5 57. If you believed a stock was going to fall in price, a strategy to profit from the stock decline is known as: a. buying long. b. buying short. c. selling long. d. selling short. ANS: D DIF: E REF: 7.2 Risk and Return for Portfolios NARRBEGIN: Exhibit 7-6 Exhibit 7-6 Security 1 2 3 $ Invested $9,000 $5,000 $8,000 Beta 0.7 0.9 1.2 NARREND 58. Given Exhibit 7-6, what is the portfolio beta? a. 0.4987 b. 0.9273 c. 0.3791 d. 1.2367 ANS: B 9000/22000*0.7 + 5000/22000*0.9 + 8000/22000*1.2 = 0.9273 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-6 NARRBEGIN: Exhibit 7-7 Exhibit 7-7 Security 1 2 3 $ Invested $3,000 $7,000 $2,000 Beta 1.2 1.4 0.9 NARREND 59. Given Exhibit 7-7, what is the portfolio beta? a. 0.4987 b. 0.9273 c. 0.3791 d. 1.2667 ANS: B 3000/12000*1.2 + 7000/12000*1.4 + 2000/12000*0.9 = 1.2667 DIF: E REF: 7.2 Risk and Return for Portfolios NAR: Exhibit 7-7 60. The country with the highest level of systematic risk is: a. Russia b. Poland c. Taiwan d. USA ANS: A DIF: H REF: 7.2 Risk and Return for Portfolios 61. The difference between the return on the market portfolio and the risk-free rate is known as the: a. total return. b. systematic premium. c. unsystematic return. d. market risk premium. ANS: D DIF: E REF: 7.3 The Security Market Line and the CAPM 62. An investor has $10,000 invested in Treasury securities and $15,000 invested in stock UVW. UVW has a beta of 1.2. What is the beta of the portfolio? a. 0.00 b. 0.72 c. 1.20 d. 1.60 ANS: B ($10,000/$25,000 * 0) = ($15,000/$25,000 * 1.2) = 0.72 DIF: M REF: 7.3 The Security Market Line and the CAPM 63. The slope of the security market line is: a. E(Rm) - Rf b. 1/(E(Rm) - Rf) c. Rf - E(Rm) d. Rf ANS: A DIF: M REF: 7.3 The Security Market Line and the CAPM 64. The intercept of the security market line is: a. E(Rm) - Rf b. 1/(E(Rm) - Rf) c. Rf - E(Rm) d. Rf ANS: D DIF: M REF: 7.3 The Security Market Line and the CAPM 65. The slope of the security market line is: a. the return on the market. b. beta. c. the market risk premium. d. the risk-free rate. ANS: C DIF: M REF: 7.3 The Security Market Line and the CAPM 66. The formula for the Capital Asset Pricing Model is: a. E(Ri) = Rf + i(E(Rm) - Rf) b. E(Ri) = Rf + iE(Rm) c. E(Ri) = i(E(Rm) - Rf) d. E(Ri) + Rf = i(E(Rm) - Rf) ANS: A DIF: E REF: 7.3 The Security Market Line and the CAPM 67. Security I has a beta of 1.3, the risk-free rate is 4%, and the expected return on the market is 11%. What is the expected return for Security I? a. 15.0% b. 18.3% c. 14.6% d. 13.1% ANS: D 4% + (11% - 4%)1.3 = 13.1% DIF: E REF: 7.3 The Security Market Line and the CAPM 68. Security I has a beta of 1.3, the risk-free rate is 4%, and the expected market risk premium is 11%. What is the expected return for Security I? a. 15.0% b. 18.3% c. 14.6% d. 13.1% ANS: B 4% + (11%)1.3 = 18.3% DIF: E REF: 7.3 The Security Market Line and the CAPM 69. The idea that asset prices fully reflect all available information is known as the: a. fair price hypothesis. b. efficient market hypothesis. c. full information hypothesis. d. full price hypothesis. ANS: B DIF: E REF: 7.4 Are Stock Returns Predictable? 70. The hypothesis that states that it is nearly impossible to predict exactly when stocks will do well relative to bonds is known as the: a. fair price hypothesis. b. efficient market hypothesis. c. full information hypothesis. d. full price hypothesis. ANS: B DIF: E REF: 7.4 Are Stock Returns Predictable? 71. A mutual fund that adopts a passive management style is called: a. an index fund. b. a research fund. c. an active fund. d. a technology fund. ANS: A DIF: E REF: 7.4 Are Stock Returns Predictable? 72. What type of mutual fund managers do extensive analysis to identify mispriced stocks? a. passive b. index c. active d. short ANS: C DIF: E REF: 7.4 Are Stock Returns Predictable? 73. A buy-and-hold strategy: a. typically earns higher returns, after expenses, than an active stock picking strategy. b. always earns the lowest returns. c. always have the lowest risk. d. typically outperforms most market indexes. ANS: A DIF: E REF: 7.4 Are Stock Returns Predictable? 74. Active managers: a. generate lower expenses for their shareholders than passive managers. b. trade more frequently than passive managers c. always use trading rules to decide when to buy and sell stocks. d. all of the above. ANS: B DIF: M REF: 7.4 Are Stock Returns Predictable? 75. Modern financial markets are: a. competitive. b. transparent. c. efficient. d. all of the above. ANS: D DIF: M REF: 7.4 Are Stock Returns Predictable?