Fact Sheet - Advantage Salary Packaging

advertisement

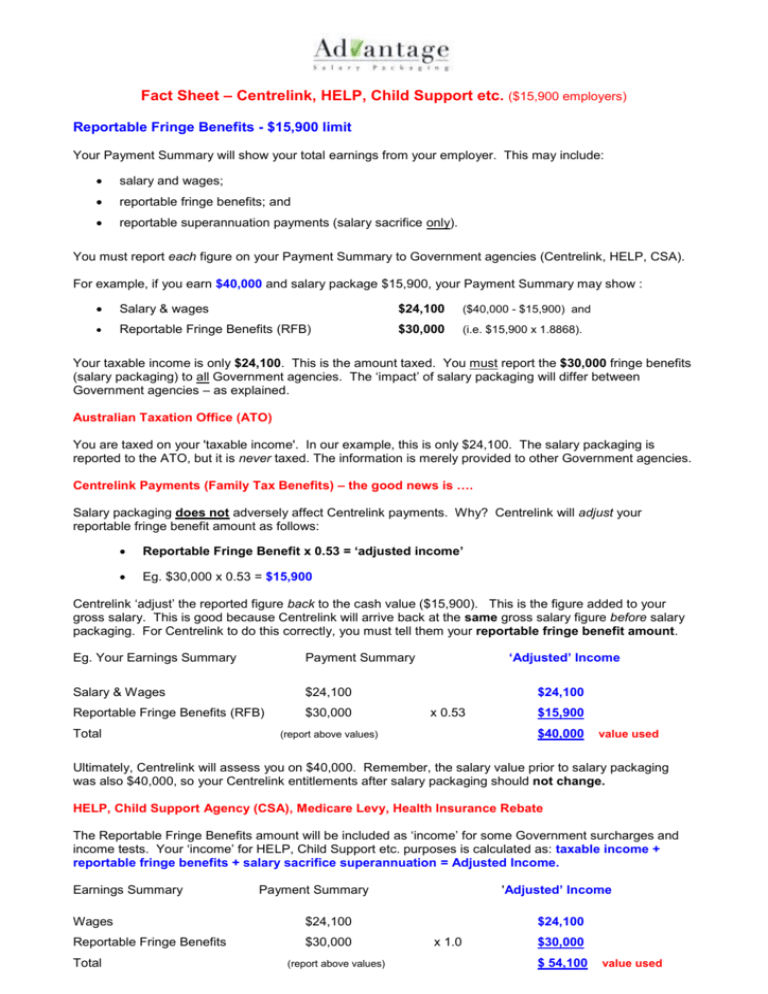

Fact Sheet – Centrelink, HELP, Child Support etc. ($15,900 employers)

Reportable Fringe Benefits - $15,900 limit

Your Payment Summary will show your total earnings from your employer. This may include:

salary and wages;

reportable fringe benefits; and

reportable superannuation payments (salary sacrifice only).

You must report each figure on your Payment Summary to Government agencies (Centrelink, HELP, CSA).

For example, if you earn $40,000 and salary package $15,900, your Payment Summary may show :

Salary & wages

$24,100

($40,000 - $15,900) and

Reportable Fringe Benefits (RFB)

$30,000

(i.e. $15,900 x 1.8868).

Your taxable income is only $24,100. This is the amount taxed. You must report the $30,000 fringe benefits

(salary packaging) to all Government agencies. The ‘impact’ of salary packaging will differ between

Government agencies – as explained.

Australian Taxation Office (ATO)

You are taxed on your 'taxable income'. In our example, this is only $24,100. The salary packaging is

reported to the ATO, but it is never taxed. The information is merely provided to other Government agencies.

Centrelink Payments (Family Tax Benefits) – the good news is ….

Salary packaging does not adversely affect Centrelink payments. Why? Centrelink will adjust your

reportable fringe benefit amount as follows:

Reportable Fringe Benefit x 0.53 = ‘adjusted income’

Eg. $30,000 x 0.53 = $15,900

Centrelink ‘adjust’ the reported figure back to the cash value ($15,900). This is the figure added to your

gross salary. This is good because Centrelink will arrive back at the same gross salary figure before salary

packaging. For Centrelink to do this correctly, you must tell them your reportable fringe benefit amount.

Eg. Your Earnings Summary

Payment Summary

Salary & Wages

$24,100

Reportable Fringe Benefits (RFB)

$30,000

Total

‘Adjusted’ Income

$24,100

x 0.53

$15,900

$40,000

(report above values)

value used

Ultimately, Centrelink will assess you on $40,000. Remember, the salary value prior to salary packaging

was also $40,000, so your Centrelink entitlements after salary packaging should not change.

HELP, Child Support Agency (CSA), Medicare Levy, Health Insurance Rebate

The Reportable Fringe Benefits amount will be included as ‘income’ for some Government surcharges and

income tests. Your ‘income’ for HELP, Child Support etc. purposes is calculated as: taxable income +

reportable fringe benefits + salary sacrifice superannuation = Adjusted Income.

Earnings Summary

Wages

$24,100

Reportable Fringe Benefits

$30,000

Total

'Adjusted’ Income

Payment Summary

(report above values)

$24,100

x 1.0

$30,000

$ 54,100

value used

As a result of salary packaging, HELP payments will increase slightly. In our example, HELP is payable on

$54,100. This amount is higher than the original salary figure ($40,000). However, the net take-home pay

amount should increase. This is because the income tax savings outweigh the extra HELP payments, so

there is a net gain by salary packaging.

If you have a HELP debt, we strongly recommend Advantage calculate your HELP payments.

If you have Child Support, your support payments are likely to increase. They will be calculated on your

adjusted income, $54,100 in our example. The income tax saved from salary packaging may be offset by

additional child support payments. You may elect not to salary package your expenses. However, you can

still salary package non reportable benefits – dining (meal entertainment) and ‘venue hire’ (or remote area

housing if you qualify). Your taxable income will be reduced and child support payments do not increase.

Your ‘income’ for the Private Health Insurance Rebate and the Medicare Levy Surcharge purposes is

salary + reportable fringe benefits + reportable super = adjusted income. In our example, the ‘adjusted

income’ is $54,100. The Medicare Levy Surcharge (an extra 1.0% to 1.5% tax) only applies if you do not

have private hospital health care cover and your ‘adjusted income’ exceeds $90,000 for an individual

($180,000 for a family) - from 1 July 2014.

The 30% Private Health Insurance Rebate also decreases when an employee’s income exceeds the same

thresholds. In our example, the income is below the threshold – salary packaging has no impact.

It is the employee’s responsibility to address the taxation and other implications of salary packaging.

Advantage can assist.

Need Assistance?

If you need help, please contact us.

Please contact us by

Email: info@salary.com.au

Phone: (03) 9822 3455 or 1800 555 582

Fax:

(03) 9822 7455

Post

PO Box 8480 Armadale VIC 3143

Manage Your Salary Package from Work or Home

www.salary.com.au or download our App ('Advantage Salary Packaging' at the App Store)

To access your information:

1.

Visit www.salary.com.au and click on Employee Log-in (RHS)

2.

Enter your Package Number (provided on our Report. Eg. 106432 )

3.

Password. Temporary password is your Date of Birth. For example,

enter 05/06/1978 for 5 June 1978. Format is DD/MM/YYYY.

4.

Follow the prompts to set up a new password.

© Advantage Salary Packaging PO Box 8480 Armadale VIC 3143 Ph (03) 9822 7455 Fax (03) 9822 7455 Email info@salary.com.au