The ICFAI University

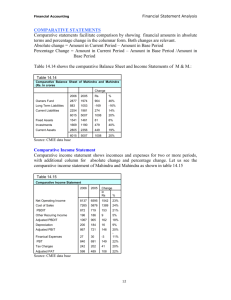

advertisement