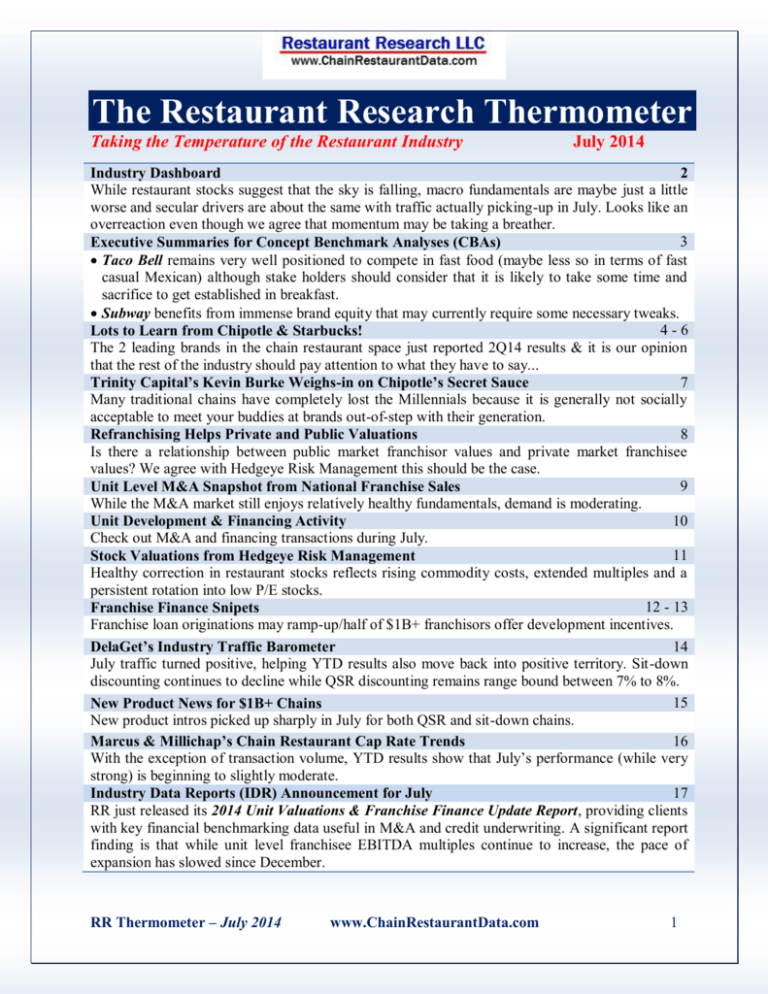

The Restaurant Research Thermometer

Taking the Temperature of the Restaurant Industry

July 2014

Industry Dashboard

2

While restaurant stocks suggest that the sky is falling, macro fundamentals are maybe just a little

worse and secular drivers are about the same with traffic actually picking-up in July. Looks like an

overreaction even though we agree that momentum may be taking a breather.

3

Executive Summaries for Concept Benchmark Analyses (CBAs)

Taco Bell remains very well positioned to compete in fast food (maybe less so in terms of fast

casual Mexican) although stake holders should consider that it is likely to take some time and

sacrifice to get established in breakfast.

Subway benefits from immense brand equity that may currently require some necessary tweaks.

4-6

Lots to Learn from Chipotle & Starbucks!

The 2 leading brands in the chain restaurant space just reported 2Q14 results & it is our opinion

that the rest of the industry should pay attention to what they have to say...

7

Trinity Capital’s Kevin Burke Weighs-in on Chipotle’s Secret Sauce

Many traditional chains have completely lost the Millennials because it is generally not socially

acceptable to meet your buddies at brands out-of-step with their generation.

8

Refranchising Helps Private and Public Valuations

Is there a relationship between public market franchisor values and private market franchisee

values? We agree with Hedgeye Risk Management this should be the case.

9

Unit Level M&A Snapshot from National Franchise Sales

While the M&A market still enjoys relatively healthy fundamentals, demand is moderating.

10

Unit Development & Financing Activity

Check out M&A and financing transactions during July.

11

Stock Valuations from Hedgeye Risk Management

Healthy correction in restaurant stocks reflects rising commodity costs, extended multiples and a

persistent rotation into low P/E stocks.

12 - 13

Franchise Finance Snipets

Franchise loan originations may ramp-up/half of $1B+ franchisors offer development incentives.

14

DelaGet’s Industry Traffic Barometer

July traffic turned positive, helping YTD results also move back into positive territory. Sit-down

discounting continues to decline while QSR discounting remains range bound between 7% to 8%.

15

New Product News for $1B+ Chains

New product intros picked up sharply in July for both QSR and sit-down chains.

16

Marcus & Millichap’s Chain Restaurant Cap Rate Trends

With the exception of transaction volume, YTD results show that July’s performance (while very

strong) is beginning to slightly moderate.

17

Industry Data Reports (IDR) Announcement for July

RR just released its 2014 Unit Valuations & Franchise Finance Update Report, providing clients

with key financial benchmarking data useful in M&A and credit underwriting. A significant report

finding is that while unit level franchisee EBITDA multiples continue to increase, the pace of

expansion has slowed since December.

RR Thermometer – July 2014

www.ChainRestaurantData.com

1

Industry Dashboard – July Overview

While restaurant stocks suggest that the sky is falling, macro fundamentals are maybe just a little worse

and secular drivers are about the same with traffic actually picking-up in July. Looks like an

overreaction even though we agree that momentum may be taking a breather.

Stock Performance

RR Thermometer – July 2014

www.ChainRestaurantData.com

2

Taco Bell

2013 US System Sales: $7.8B

2013 Growth: +4.0%

Taco Bell continues to build upon its solid positioning as the largest QSR Mexican chain, providing

a compelling and unique fast food alternative that resonates well not just with young males, but also

increasingly to a wider demographic addressed by the brand's thoughtful menu extensions. The

brand enjoys a great business model with a Mexican food platform that easily allows the mixing and

matching of simple ingredients and proteins to drive a seemingly endless pipeline of new product

news through its powerful and effective marketing juggernaut which should further benefit from an

increase in digital communication and a coming mobile platform. Breakfast represents the brand's

latest foray into ways to extend dayparts (complimenting its Happier Hour promotion) and we note

that the brand is heavily invested in its newest platform in terms of marketing, which while maybe

necessary at first, is certainly unsustainable over the long-term (reflecting the need to eventually

balance marketing support in relationship to the ratio of daypart sales). We note that breakfast is a

very tricky, long-term business given the difficulty of retraining consumers around a very ritualistic

daypart. In any case, the system's unit economics remain strong and a new remodel cycle should

help make facilities more relevant. In conclusion, it is our opinion that Taco Bell remains very well

positioned to compete in fast food (maybe less so in terms of fast casual Mexican) although stake

holders should consider that it is likely to take some time and sacrifice to get established in

breakfast.

Subway

2013 US System Sales: $12.25B

2013 Growth: +1.0%

Subway developed into an iconic brand by being first to the market with health and customization,

creating a huge base of very loyal fans. Further, the brand's industry changing $5 Footlong offer

provided even greater momentum which helped propel the system past the recession. However,

Subway's business model began to lose steam in 2013 against a backdrop of increased competition

(success has attracted a lot of attention) and rising costs which rendered the immensely important $5

Footlong platform less than optimal. Today's relevant question seems to center around how Subway

can gain wallet share from its existing customer base more so than how to attract new value seekers

with a compelling price point. To put it another way, the right question now is: how can Subway

improve its perceived value sufficiently to charge more money and to grow sales with a higher

average check? A move more towards fast casual may be required, but this will not be quick or easy

when dealing with a domestic system of almost 25,000 stores (many of which are in lower income

markets and/or not well suited to dine-in because of their small size). We like the idea of its new

Cafe format, but this vision remains in its infancy and may not be well received by operators.

Rather, we suggest that a menu fix could be more timely/appropriate and perhaps Subway should

consider upgrading its proteins for its core sandwiches (higher quality/larger portions) to better

compete at fast casual price points. Ultimately, the brand must decide whether to fight competition

from above (fast casual) or from below (QSR sandwich) or both (seems most difficult to us). In any

case, this brand can rely on its best-in-class marketing along with its ever present option to rollout

value based LTOs to buy it time while the chain considers its best long-term approach to address its

current economic/competitive backdrop. In conclusion, it is our opinion that Subway benefits from

immense brand equity that may currently require some necessary tweaks.

RR Thermometer – July 2014

www.ChainRestaurantData.com

3

Lots to Learn from Chipotle & Starbucks!

The 2 leading brands in the chain restaurant space just reported 2Q14 results & it is our opinion that

the rest of the industry should pay attention to what they have to say... Read the details of their 2Q

performance on the following 2 pages and Kevin Burke’s insight into Chipotle’s results on the page

after that.

Lessons from Chipotle

Did Chipotle really generate a +17% comp during 2Q14? Did it really put through

a +6% price increase? Is it really the most popular restaurant brand with male

teens?

This brand is most certainly doing something right! Further, it is most definitely

taking share from a host of competitors.

The entire industry should take note that Chipotle's growth is attributed to people

skills and a "unique food culture" as opposed to traditional advertising, discounting

and/or LTOs.

Lessons from Starbucks

Chipotle generated a +17% comp during 2Q14 while Starbucks took 2 years to

generate +16% comps (+9% during 2Q13 and +7% during 2Q14). Either way,

pretty impressive results...

Key Points for National Restaurant Chains to Consider:

Starbucks attributes comp growth to food sales.

The brand plans to transform tea the same way it did coffee. Now is the time for

restaurant chains to address the tea category.

Integration of mobile loyalty & payment and in-store digital experiences is creating

game-changing customer experiences which may translate into new business lines.

Drive-thrus continue to drive double digit sales growth and enhanced drive-thru

experience will include opportunity for face-to-face conversations, improvements

in ordering and payment and ability to keep-out rain in drive-thru lanes.

Company is very careful to maintain a strict 2:1 sales-to-investment ratio for new

builds.

Source: RR's Quarterly Concept Dashboard

RR Thermometer – July 2014

www.ChainRestaurantData.com

4

Chipotle 2Q14 Analysis

Qtr ended: 6/30/14

US Comps: +17.3%

Company Sales: +29%

Costs: Stabilizing

Sales

2Q14 comps grew +17.3% at nearly 1,700 stores which generate $2.3MM in AUV. Strong sales growth

is credited to restaurant managers and crews providing an exceptional dining experience which, in turn,

drives frequency and loyalty. Comp strength also reflects a unique food culture which stresses sourcing

the best ingredients (with an eye to sustainability and great taste) prepared with classic cooking

techniques.

Comps were primarily driven by traffic along with a +5% increase in check - including a +2.5% price

increase rolled-out during the quarter and +2.5% growth from: an increase in its high ticket catering

business, an increase in the group size per transaction, and sales of additional sides (Chips & Guac).

Traffic growth reflects an expanded customer base more so than a significant increase in frequency from

the brand’s core audience.

Full year 2014 comp guidance: mid-teen growth.

Menu

Sofritas are driving a 3.5% mix with an appeal beyond vegans and vegetarian customers to also include

guests who normally eat meat. This is consistent with the brand’s L-T goal of promoting vegetable diets.

Costs

The brand actually raised average prices by +6.25% to +6.5% but only measured a partial +2.5% price

increase for the quarter because the hike was implemented in late April before finishing in late June.

Based upon significant recent inflation in beef and an expectation that beef prices will remain elevated

for the foreseeable future, steak prices were raised by +9% on average while chicken prices were raised

by +5% - the brand expects that some customers will trade down from steak to chicken. Despite the price

increase, food cost were 150 bps higher than 2Q13 due to higher costs for beef, avocados and dairy.

At this time, the brand does not anticipate much more food inflation. Further, price increases are not

expected to drive much more in trade down or lost transactions. Given moderating food inflation and

sustained price increases, it is possible COGs will eventually fall to 30% from 34.6% during 2Q14.

Marketing

Purpose of marketing program is designed to encourage people to be more serious about their food and

where it comes from.

Marketing expenditures are expected to equal 1.6% of sales during 2014 and will remain elevated during

3Q as the brand continues its better ingredients ad campaign in 34 markets (1,000 stores) which will

wind-down by October. The brand uses billboards and radio ads augmented by local marketing programs

(fund raisers, etc.) to build top of mind awareness while connecting with people on an emotional level.

The company reports that it is the most popular brand with male teens.

Operations

Despite long lines at lunch and dinner, the brand drove +9.4% traffic during its peak lunch hour and

+13.3% at its peak dinner hour because of better throughput driven by: more top performing managers

and teams; the use of a linebacker during peak hours; and by better oversight and more input from field

leaders which are leveraging the system’s restaurateur diagnostic tool.

Facilities

Plans to open 180 to 195 new stores during 2014 and 70% of new stores will be in proven markets, 15%

in developing or established markets and another 15% in new markets (including Duluth, Texarkana,

Mobile and Charleston, West Virginia). New store AUV has increased +$100k to $1.7MM to $1.8MM.

Development plans call for potential sites designed for very small stores with limited seating. This

reflects a steady evolution from a mostly dine-in format 14 years ago to a 50%/50% dine-in/take-out mix

8 years ago to 2/3’s take-out currently.

RR Thermometer – July 2014

www.ChainRestaurantData.com

5

Starbucks 2Q14 Analysis

Qtr ended: 6/29/14

US Comps: +7%

Company Sales: +11%

Costs: Flat to up slightly

Sales

Fiscal 3Q comps in the US increased +7% y/y on top of +9% last year. Comp growth for the

Americas region was lower at +6% (+4% from ticket and +2% from traffic).

Strong results reflected: improved quality and variety of food offerings (food contributed +2%);

+1% in pricing; beverage innovation, including: iced teas from Teavana (Teavana Oprah Chai and

Teavana Shaken Iced Tea); Fizzio (Starbucks’ brand of preservative-free, hand crafted, cold

carbonated beverages rolled-out in ~3,000 stores in the Sun Belt region); and Frappuccino LTOs.

Menu

The brand’s investment in La Boulange and the associated rollout of new morning pastries and

products for other day parts (i.e. loaf cakes) is helping to increase the food attach rate. Food sales

are also driving margin improvement (with improvements in manufacturing costs, inventory

management and waste).

Breakfast sandwich platform delivered +40% growth in the quarter, reflecting: the nearly complete

rollout of La Boulange (with remaining stores slating to be converted by mid to late August); and

a major overhaul and upgrade of the ingredients for existing breakfast sandwiches.

New SKUs are being added to the lunch line going forward with plans to continue evolving lunch

program with a disciplined, measured approach which minimizes disruption to both store

operations and customer routines.

Hand crafted beverages are also driving afternoon & evening sales.

Evolution yogurt products (in partnership with Dannon) will be introduced in calendar 2015.

Costs for 60% of coffee needs are locked for next year (roughly flat to up slightly this year).

Marketing & Digital

Digital platforms have been instrumental in building brand loyalty and extending and deepening

customer engagement. This reflects success with cards and their associated My Starbucks Rewards

(MSR) loyalty program (8 MM+ US members). The brand is finding that “Stars” (the loyalty

program rewards currency) is highly motivating to consumers.

The core strength of its loyalty program is to fuel adoption of its mobile app (with almost 12MM

mobile app users in the U.S. and Canada). Mobile payment now accounts for 15%+ of all

transactions in U.S. company operated stores.

Forthcoming mobile order and pay initiative will allow customers to use their phones and MSR

accounts to order ahead of arriving at a store. Integration of mobile loyalty & payment and in-store

digital experiences is creating game-changing customer experiences which may translate into new

business lines.

Facilities

Drive-thrus remain a very important part of U.S. store portfolio as they continue to deliver very

strong results. They account for under 50% of company operated stores (and 50% of new stores)

and continue to drive double digit total sales growth for the 3rd consecutive year. Enhanced drivethru experience will include opportunity for face-to-face conversations, improvements in ordering

and payment and ability to keep-out rain in drive-thru lanes.

Company is very careful to maintain a strict 2:1 sales-to-investment ratio for new builds which

include new format stores & smaller footprints to address smaller markets.

RR Thermometer – July 2014

www.ChainRestaurantData.com

6

Industry Insight from Kevin Burke, Trinity Capital

Chipotle just

reported a +17%

comp for 2Q…

What is

Chipotle’s secret

sauce?

So you are saying

that it is all about

the Millennials?

What will it take

for traditional

brands to become

relevant to

Millennials? Are

there any success

stories?

Chipotle has successfully engineered its efforts toward Generation X and Generation Y

(Millennials) and most of its frequency growth is coming from Millennials. The Millennial set is

highly sensitive to what brands stand for: quality ingredients, social impact and acceptability, value

and, perhaps most importantly, “cool” factor. Restaurant chains such as Chipotle, Buffalo Wild

Wings, Taco Bell, Panera, Noodles, Café Rio, Chuy’s and a few others that have focused on this

paradigm have enjoyed recent success. Chipotle’s secret sauce is very simple: it offers fun to eat

food, healthy menu items that are made as instructed before the customer’s eyes (the way a

demanding Millennial wants it), a good atmosphere, appealing locations and good price points. If

you think about it, many of the top 25 concepts fail at applying this formula largely because of

legacy baggage. Oh yeah, and they have good music, not Muzak (Mood Media)!

Many traditional chains have completely lost the Millennials because it is generally not “cool”

(socially acceptable) to tweet/text/Facebook your buddies and ask them to meet you at brands outof-step with their generation. You get it? Things are changing rapidly with respect to: 1)

demographics, 2) consumer discretionary spending, 3) new formation of households, 4) employment

and 5) consumption. The economy today is producing winners and losers among various

demographic groups. Millennials dine out frequently and they are loyal customers. This is quietly,

but steadily shaking up the restaurant business; however, a lot of people are not talking about

it. Many “traditional” brand restaurant executives largely don't get it and are suffering predictably

consistent transaction-count losses particularly among younger demographics. Consider this: Knapp

Track casual dining transaction counts have been negative for 58 of the last 66 months. There's both

economics and consumer behavior encompassed in that trend!

In order to attract Millennials in any meaningful quantity and frequency, the traditional brands will

have to relaunch or “reset” their brands toward Millennials with respect to: restaurant image,

signage, healthy fare, advertising messages and customer base. Millennials are not going to want to

go into an old building with unhealthy food and demographically incongruent patronage (uncool

customers). These brands know who they are, but it is very difficult, expensive and time-consuming

to change your stripes and it involves the risk of alienating your existing customer base. One

example of a success story is the meteoric success of Taco Bell with its social media efforts and

dominance of the Millennial set. This was a thoughtfully orchestrated strategic move that involved

products, promotion, dayparts and social media. Taco Bell is now number two with Millennials

next to Chipotle and ahead of Starbucks!

Every day thousands of traditional restaurant brand customers retire and start to pinch pennies. This

involves reducing restaurant visits, which hurts the transaction counts of many of the traditional

restaurant brands. Let's face it, the nation's oldest restaurant chains have to find a way to replace

their retiring and/or dying customers. Some of them are not yet up to the challenge!

Trinity Capital LLC

11755 Wilshire Blvd., Suite 2450

Los Angeles, CA 90025

Main: 310-268-8330

Direct: 310-231-3100

kburke@trinitycapitalllc.com

Mr. Burke is the founder and Managing Partner of Trinity Capital. Since its inception in

2000, Trinity Capital has completed over $10 billion in mergers and acquisitions, financial

restructurings and financing transactions for restaurant companies. Clients have included

such corporations as Taco Bell, Burger King, Ready Pac, Green Earth Fuels and Yum!

Brands and such private equity firms as The Carlyle Group, Bain Capital, the Thomas H.

Lee Company and Goldman Sachs Capital Partners.

RR Thermometer – July 2014

www.ChainRestaurantData.com

7

Refranchising Helps Private and Public Valuations

Is there a relationship between public market franchisor values and private market franchisee

values? We agree with Hedgeye Risk Management's conclusion in our recent Think Piece that

this should be the case.

As we can see from the chart below, public franchisor EV/EBITDA multiples have

steadily increased relative to private franchisee EBITDA multiples since the 2008

recession - although we note that they have both increased on an absolute basis.

"Asset light" refranchising strategies have certainly helped this trend as franchisors have

traded store operating margin risk to franchisees in exchange for steady and profitable

royalty stream margins. This strategy can work well for franchisees who are looking for

as many stores to own and operate as possible. Also, we suggest that this trend helps

strengthen systems given that franchisees are often better store operators.

While higher public and private multiples reveal a win/win scenario, we suggest that

leaving store management to privately held franchisee operators means that the health of

the franchise system is more important than ever to overall brand health.

Sources: RR’s Unit Level Valuations Report & Hedgeye Risk Management

RR Thermometer – July 2014

www.ChainRestaurantData.com

8

Unit Level M&A Snapshot from National Franchise Sales

While the M&A market still enjoys relatively healthy fundamentals, demand is moderating.

July 2014

Score

(5 increasing – 1 decreasing)

Buy-side Demand

3↓

Sell-side Supply

4

Financing Availability

3↓

Valuation Multiples

4

1

2

3

4

5

Comments

High confidence in specific brand’s performance

combined with low returns on liquidity continue to

fuel interest, but not quite on pace with sell side

supply.

Sellers are taking advantage of strong multiples and

buyer’s access to new debt.

While there is a large number and variety of available

lenders, loan capacity is being constrained by

workloads. This may result in some tightening of

requirements.

Multiples remain strong in response to demand levels

and plentiful acquisition debt.

Buy-side Demand

Sell-side Supply

Financing Availability

Valuation Multiples

SPECIALIZING IN THE RESALE OF FRANCHISE BUSINESSES SINCE 1978

National Franchise Sales has become an industry leader in franchise business brokerage by successfully

assisting franchisees and franchisors in the acquisition and sales of their businesses, since 1978.

Active in over fifty brands, NFS has facilitated numerous transactions from the sale of a single unit franchise

to multi-unit sales involving over 100 units, and the sale of franchise companies. Headquartered in Newport

Beach, CA with ten offices Nationwide, NFS is staffed by over 20 industry professionals.

Alan F. Gallup

National Franchise Sales

RR Thermometer – July 2014

949.428.0483

www.ChainRestaurantData.com

9

Unit Development & Financing Activity during July 2014

M&A and financing transactions during July from RR’s Unit Development & Financing Activity

Database is outlined below. Clients can find complete database with development deals online.

Source: Restaurant Research Development & Financing Activity Database

RR Thermometer – July 2014

www.ChainRestaurantData.com

10

Stock Valuations from Hedgeye Risk Management

Healthy correction in restaurant stocks reflects rising commodity costs, extended multiples and a

persistent rotation into low P/E stocks.

July was a difficult month for restaurant stocks as the vast

majority of the industry was hampered by multiple

contraction.

Pizza is the only restaurant segment that saw multiple

expansion in the period, as Domino’s reported strong, above

consensus 2Q14 earnings.

The fine dining segment, which we flagged as a positive

outlier in June, experienced a sharp correction in July as Del

Frisco’s reported disappointing 2Q14 results.

Howard Penney

Managing Director

HEDGEYE RISK MANAGEMENT

(O) 203-562-6500

(C) 862-217-9429

(E) HPenney@hedgeye.com

RR Thermometer – July 2014

www.ChainRestaurantData.com

11

Franchise Loan Originations are Poised to Ramp-Up

According to Restaurant Research's just completed Restaurant Finance Lender Survey

(included in just released RR's Unit Level Valuations Report), loan originations are

poised to continue increasing.

We believe this has positive implications for both enterprise and real estate valuations.

Source: RR’s Unit Level Valuations Report

RR Thermometer – July 2014

www.ChainRestaurantData.com

12

The Answer to Slowing Gross New Unit Development?

Development Incentives…

Nearly half of $1B+ franchisors offer development incentives.

Source: RR's 2014 New Build Costs & Franchise Fees Report

RR Thermometer – July 2014

www.ChainRestaurantData.com

13

DelaGet’s Industry Traffic Barometer

July traffic turned positive, helping YTD results also move back into positive territory. Sit-down

discounting continues to decline, while QSR discounting remains range bound between 7% to 8%.

DelaGet transaction data for large brands is aggregated

from 4,000+ QSR and 1,700+ sit-down locations

Note: In some cases, gross sales includes sales tax

Source: DelaGet

DelaGet is a trusted partner of multi-unit restaurant operators around the world, servicing more than 10,000

restaurants and processing data associated with more than four billion order items annually. By centralizing and

consolidating the data from numerous point-of-sale, back-of-house, banks, suppliers, drive-thru timers, etc., DelaGet

leverages the data to increase operator efficiency and profitability through its above-store reporting; data integration;

loss prevention; marketing measurement and planning; payroll processing; and general ledger accounting services.

Learn more at www.DelaGet.com.

RR Thermometer – July 2014

www.ChainRestaurantData.com

14

New Product News for $1B+ Chains

New product intros picked up sharply in July for both QSR and sit-down chains.

Sandwich chains introduced the largest number of new products with a focus on burgers.

Taco Bell led the way with its low priced Grilled Breakfast Burrito line and Cantina Power

Menu additions.

Weekday discounting heated up in the pizza segment with Papa John’s new Early Week

Mania (large 2 topping pizza - $8.99 Mon. – Wed.) which will compete with Domino’s Mon.

– Thur. Carry-out Deal (large 3 topping pizza - $7.99) and Pizza Hut’s Digital Deal (large 2topping pizza - $7.99). Papa John’s continues to maintain its $1/pizza premium.

Domino's increased the price on its med. 2 topping pan pizza from $7.99 to $8.99 in July.

KFC stepped-up its value offer with the $5 Fill-ups promotion which includes a single choice

of 5 entrees, side, biscuit, cookie and drink, all for $5.

Source: Restaurant Research Menu & Promotions Database

RR Thermometer – July 2014

www.ChainRestaurantData.com

15

Marcus & Millichap’s Chain Restaurant Cap Rate Trends

July was a busy month, with transactions up +39% y/y.

Cap rates declined -5% y/y to 6.51% (just above June’s recent low) and median price per s.f.

increased +7.6% y/y, once again reflecting the ongoing strength in this asset class.

With the exception of transaction volume, YTD results show that July’s performance (while very

strong) is beginning to slightly moderate.

Source: The Nisbet Group has been specializing in the disposition and acquisition of Net-Leased properties for

the past 15 years under the expertise of Peter Nisbet, the managing partner. By focusing exclusively on the

restaurant product type, The Nisbet Group has formed an unmatched understanding of the unique challenges that

transpire during a transaction while creating solutions to overcome them. The team is recognized as a market

leader for their superior service and outstanding performance by routinely displaying their skills at analyzing

market trends, evaluating properties and resolving issues across the transaction process. This dedicated group

has closed escrow on over 300 properties; earning clients more than $500 million. The Nisbet Group’s success is

made possible through the deployment of market segmentation, innovative approaches, detail orientation, and

cultivated relationships. The group is able to deliver unmatched service to their clients year after year.

For more information please contact Hank Wolfer of The Nisbet Group at (206) 826-5730

RR Thermometer – July 2014

www.ChainRestaurantData.com

16

RR’s July Industry Data Reports (IDR) Announcement

RR just released its 2014 Unit Valuations & Franchise Finance Update Report, providing clients with

key financial benchmarking data useful in M&A and credit underwriting. A significant report finding

is that while unit level franchisee EBITDA multiples continue to increase, the pace of expansion has

slowed since December.

Unit Valuations &

Franchise Finance Update Report

RR’s Valuation Industry Data Report provides: (1) EBITDA multiple estimates (post G&A)

for 38 chains based on survey data from 6 leading appraisal firms (responsible for ~2,600 store

valuations over the last 6 months); (2) a comparison of public restaurant company and private

franchisee valuation multiples; (3) a summary of real estate cap rate trends based on data

provided by Marcus & Millichap; and (4) an update on the current state of restaurant finance

derived from a survey of leading lenders which focuses on restaurant loan origination volume,

borrower financial condition, changes to underwriting standards and interest rate outlook.

Report highlights: (1) unit level franchisee EBITDA multiples continue to increase, but the

pace of expansion has slowed since December while casual and fast casual multiples contracted;

(2) public franchisor EV/EBITDA multiples have steadily increased relative to private franchisee

EBITDA multiples since the 2008 recession; (3) cap rates for single-tenant net-leased restaurant

properties continued to decline to new lows; and (4) restaurant financing remains favorable for

franchisees due to competition among lenders, low rates and stable terms.

For more info on this report, please visit

www.ChainRestaurantData.com or contact us at

(203) 938-4703 or info@ChainRestaurantData.com

RR Thermometer – July 2014

www.ChainRestaurantData.com

17

Learn More about Client Services

www.ChainRestaurantData.com

Please Pass to Your Colleagues

Copyright: This Restaurant Research LLC document is copyrighted material. Copyright 2014 Restaurant Research® LLC. All rights reserved.

Disclosure: Restaurant Research LLC often sells report subscriptions to concepts under our coverage.

Disclaimer of Liability: Although the information in this report has been obtained from sources Restaurant Research® LLC believes to be reliable, RR does not guarantee its accuracy. The views

expressed herein are subject to change without notice and in no case can be considered as an offer or solicitation with regard to the purchase or sales of any securities. Restaurant Research’s

analyses and opinions are not a guarantee of the future performance of any company or individual franchisee. RR disclaims all liability for any misstatements or omissions that occur in the

publication of this report. In making this report available, no client, advisory, fiduciary or professional relationship is implied or established. This report is intended to provide an overview of the

restaurant industry, but cannot be used as a substitute for independent investigations and sound business judgment.

RR Thermometer – July 2014

www.ChainRestaurantData.com

18