Economics 401 Test 1 Wednesday 27th January 2016

advertisement

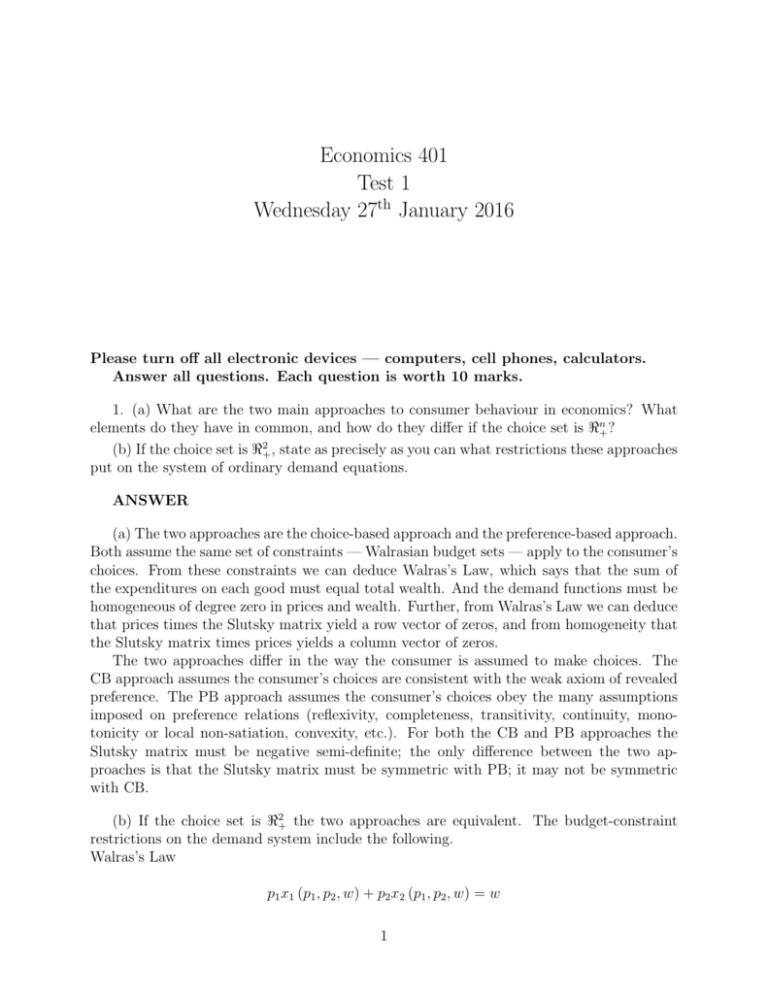

Economics 401

Test 1

Wednesday 27th January 2016

Please turn off all electronic devices — computers, cell phones, calculators.

Answer all questions. Each question is worth 10 marks.

1. (a) What are the two main approaches to consumer behaviour in economics? What

elements do they have in common, and how do they differ if the choice set is <n+ ?

(b) If the choice set is <2+ , state as precisely as you can what restrictions these approaches

put on the system of ordinary demand equations.

ANSWER

(a) The two approaches are the choice-based approach and the preference-based approach.

Both assume the same set of constraints — Walrasian budget sets — apply to the consumer’s

choices. From these constraints we can deduce Walras’s Law, which says that the sum of

the expenditures on each good must equal total wealth. And the demand functions must be

homogeneous of degree zero in prices and wealth. Further, from Walras’s Law we can deduce

that prices times the Slutsky matrix yield a row vector of zeros, and from homogeneity that

the Slutsky matrix times prices yields a column vector of zeros.

The two approaches differ in the way the consumer is assumed to make choices. The

CB approach assumes the consumer’s choices are consistent with the weak axiom of revealed

preference. The PB approach assumes the consumer’s choices obey the many assumptions

imposed on preference relations (reflexivity, completeness, transitivity, continuity, monotonicity or local non-satiation, convexity, etc.). For both the CB and PB approaches the

Slutsky matrix must be negative semi-definite; the only difference between the two approaches is that the Slutsky matrix must be symmetric with PB; it may not be symmetric

with CB.

(b) If the choice set is <2+ the two approaches are equivalent. The budget-constraint

restrictions on the demand system include the following.

Walras’s Law

p1 x1 (p1 , p2 , w) + p2 x2 (p1 , p2 , w) = w

1

Homogeneity

for all α > 0,

xj (αp1 , αp2 , αw) = xj (p1 , p2 , w) ,

j = 1, 2

Denoting the Slutsky substitution matrix by S, these identities imply

S11 S12

p1 p2

= 0 0

S21 S22

and

S11 S12

S21 S22

p1

p2

=

0

0

The last two equations imply that, with just two goods, the Slutsky matrix must be

symmetric. For all positive prices,

p1 S11 + p2 S21 = p1 S11 + p2 S12 or S21 = S12 .

Since, with budget sets in <n+ , the only possible difference between the two approaches is

the symmetry, or not, of S, and with two goods S has to be symmetric, the two approaches

are equivalent with two goods. They may differ with three or more goods.

2. Let % be the “at least as good as” preference relation defined on choice set X = <n+ .

(a) Define the strict preference relation .

(b) Define strong monotonicity, monotonicity, and local nonsatiation.

(c) Prove strong monotonicity implies monotonicity, and monotonicity implies local nonsatiation.

Make sure the way you write the strict preference relation, , looks different from the real

number strict inequality, >.

ANSWER

(a) For a, b ∈ X, a b means a % b is true and b % a is false.

(b) Definitions

P

1/2

j=n

2

, where we use the positive root.

Let X = <n+ , a ∈ X, b ∈ X: d (a, b) ≡

(a

−

b

)

j

j

j=1

Let a ∈ X: N (a) ≡ {x ∈ X : d (a, x) < , > 0}

Let y ≡ (y1 , y2 , ..., yn ) ∈ X and z ≡ (z1 , z2 , ..., zn ) ∈ X. Then y ≥ z means yj ≥ zj , j =

1, ..., n and y >> z means yj > zj , j = 1, ..., n.

‘Strong monotonicity’: suppose a ∈ X and b ∈ X and b ≥ a and b 6= a; then b a.

‘Monotonicity’: suppose a ∈ X and b ∈ X and b >> a; then b a.

‘Local non-satiation’: suppose a ∈ X: then every -neighbourhood of a, N (a) contains a

b ∈ X such that b a.

2

(c) How to structure the proofs

Suppose we have the following statements.

Statement 1: A1 ⇒ B1

and

Statement 2: A2 ⇒ B2

and we want to prove that

Statement 1 ⇒ Statement 2 .

Then start by assuming A2 is true, and argue persuasively that A2 ⇒ A1 . Since Statement

1 is assumed to be true A1 ⇒ B1 . The final step is to argue persuasively that B1 ⇒ B2 .

Proof that strong monotonicity implies monotonicity: Suppose a ∈ X and b ∈ X and b >> a,

then a ∈ X and b ∈ X and b ≥ a and b 6= a, that is, the assumptions of strong monotonicity

are met. Since we are assuming strong monotonicity is true we know its conclusion holds,

that is, b a which is what we needed to prove.

Proof that monotonicity implies local non-satiation: Every epsilon-neighbourhood of a contains some b ∈ X such that b >> a. Since we are assuming monotonicity is true we know

its conclusion holds, that is, b a which is what needed to prove.

3. Consider a price-taking consumer in a two-good world. Let w denote money wealth

and (p1 , p2 ) prices; w ≥ 0, p1 > 0, p2 > 0. Fill in the following tables as precisely as you can,

and verify the Slutsky equation for changing the price of good 2 on the demand for good 1,

for someone whose preferences are represented by:

u (x1 , x2 ) = min (ax1 , bx2 ) , a, b > 0

x1 (p1 , p2 , w)

x2 (p1 , p2 , w)

V (p1 , p2 , w)

bw/ (bp1 + ap2 ) aw/ (bp1 + ap2 ) abw/ (bp1 + ap2 )

h1 (p1 , p2 , u)

u/a

h2 (p1 , p2 , u)

u/b

Range

p1 , p2 > 0, w ≥ 0

e (p1 , p2 , u)

Range

u (p1 /a + p2 /b) p1 , p2 > 0, u ≥ 0

ANSWER

The first table follows from the observation that, with positive prices, a utility-maximizing

consumer will operate where ax1 = bx2 . This equation together with the budget constraint

give us two linear equations which can be solved for the Walrasian demand functions. Substituting these into the utility function gives the indirect utility function, V (p1 , p2 , w). The

second table follows from the observation that, with this utility function, u = ah1 = bh2 and

the definition of the expenditure function.

3

e (p1 , p2 , u) = p1 h1 (p1 , p2 , u) + p2 h2 (p1 , p2 , u) .

The Slutsky equation for changing the price of good 2 on the demand for good 1 is

∂x1

∂h1

∂x1

=

− x2

.

∂p2

∂p2

∂w

The left-hand side is

−

abw

.

(bp1 + ap2 )2

The right-hand side is

0 − x2

b

abw

=−

.

bp1 + ap2

(bp1 + ap2 )2

So this Slutsky equation holds.

4. Consider a price-taking consumer in a two-good world where prices are positive.

Denote Hicksian demands by hj (p1 , p2 , u0 ) , j = 1, 2.

(a) Define the expenditure (or cost) function e (p1 , p2 , u0 ).

(b) Prove the expenditure function must be concave in prices.

(c) Prove e (p1 , p2 , u0 ) is homogeneous of degree 1 in prices (p1 , p2 ).

ANSWER

(a)

e (p1 , p2 , u) = p1 h1 (p1 , p2 , u) + p2h2 (p1 , p2 , u) .

(b) Consider two sets of prices (p11 , p12 ) and (p21 , p22 ) and the convex combination of them

= t(p11 , p12 )+(1−t)(p21 , p22 ) for 0 ≤ t ≤ 1. Then e(p1 , p2 , u0 ) is concave in prices (p1 , p2 )

(pt1 , pt2 )

if

e(pt1 , pt2 , u0 ) ≥ te(p11 , p12 , u0 ) + (1 − t)e(p21 , p22 , u0 ).

Let (ht1 , ht2 ) be the expenditure-minimizing bundle for prices (pt1 , pt2 ) and utility level u0 .

Then

e(pt1 , pt2 , u0 ) =

=

=

≥

pt1 ht1 + pt2 ht2

(tp11 + (1 − t)p21 )ht1 + (tp12 + (1 − t)p22 )ht2

t(p11 ht1 + p12 ht2 ) + (1 − t)(p21 ht1 + p22 ht2 )

te(p11 , p12 , u0 ) + (1 − t)e(p21 , p22 , u0 ).

4

(c) The optimum for an expenditure-minimizing consumer depends on the utility function

and the ratio of prices, p1 /p2 . This means that Hicksian demands must be homogeneous of

degree 0 in prices. Thus, for all α > 0

e αp1 , αp2 , u0

=

=

=

=

αp1 h1 αp1 , αp2 , u0 + αp2 h2 αp1 , αp2 , u0

αp1 h1 p1 , p2 , u0 + αp2 h2 p1 , p2 , u0

α p1 h1 p1 , p2 , u0 + p2 h2 p1 , p2 , u0

αe (p1 , p2 , u)

This proves e (p1 , p2 , u0 ) is homogeneous of degree 1 in prices (p1 , p2 ).

5. Consider a price-taking consumer in a two-good world who purchases bundle (4, 4)

when her wealth is 12 and prices are (p1 , p2 ) = (1, 2). State as precisely as you can what

she will purchase in each of the following cases when her wealth is unchanged and prices are

(p1 , p2 ) = (2, 1):

(i) if her preferences can be represented by

1/2

u (x1 , x2 ) = ax1 + bx2 , for a > 0, b > 0;

(ii) if her preferences can be represented by

u (x1 , x2 ) = xa1 xb2 , for a > 0, b > 0;

ANSWER

(i) Since strictly increasing transformations of the utility function have no impact on

ordinary demands we can set a or b to any positive number. Here it is convenient to set

b = 2. Then using the MRS condition

MRS12 =

a

−1/2

x2

=

a

4−1/2

=

p1

1

1

= or a = .

p2

2

4

Then one can deduce:

x1 (p1 , p2 , w) x2 (p1 , p2 , w)

16p21

w

1

− 16p

p1

p2

p22

w

0

p2

w

p1

w

p1

Range

1

− 16p

≥0

p2

16p1

− p2 < 0

With w = 12 and (p1 , p2 ) = (2, 1) we are in the corner solution where x1 = 0, x2 = 12.

(ii) Again, since strictly increasing transformations of the utility function don’t alter the

ordinary demand functions, we can take the one over α + βth root of this utility to obtain

an equivalent utility function, xc1 x1−c

2 , where c = a/(a + b). And here, with Cobb-Douglas

utility, we know x1 (p1 , p2 , w) = aw/p1 . Therefore, from the data given, we can deduce that

a = 1/3. Then x1 (2, 1, 12) = 2, and x2 (2, 1, 12) = 8.

5