Cluster Analysis of the Apple Orchard Industry in Yakima, WA

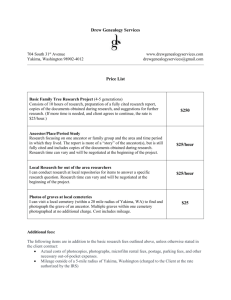

advertisement