Trade a Short Currency Position with a Forward

Financial

Trade a Short Currency Position with a Forward

•

Establishes Exchange Rate for a Specific

Future Date with No Upfront Cost

•

Most Common Speculative Currency Trade

•

One for One Risk-to-Reward Ratio

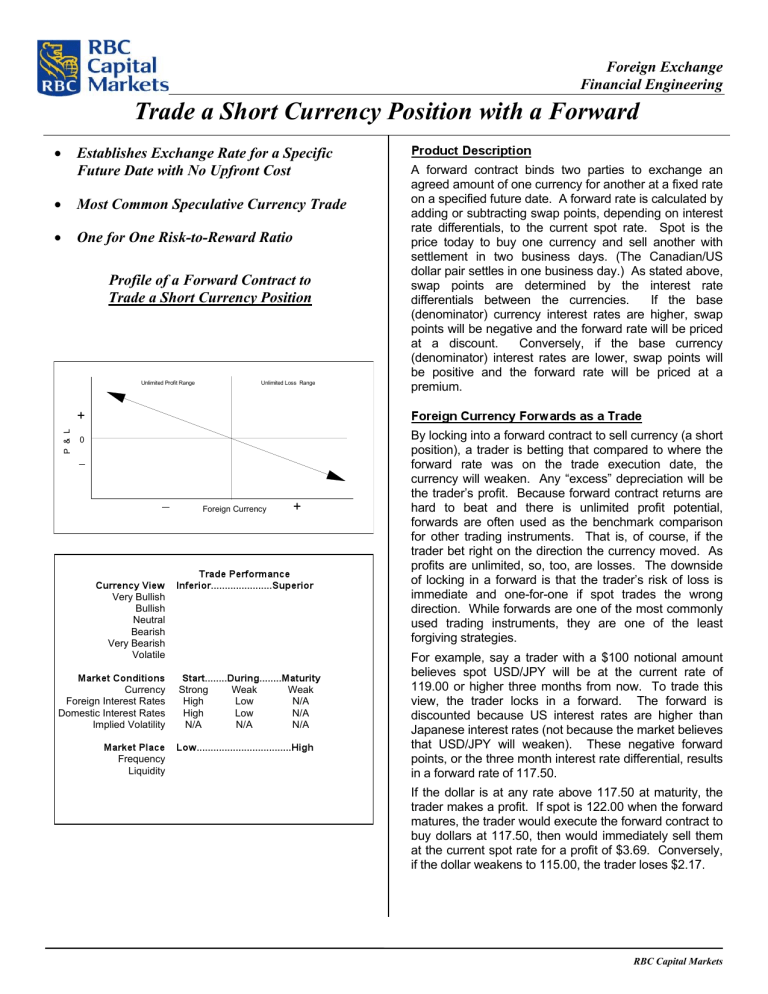

Profile of a Forward Contract to

Trade a Short Currency Position

+

0

Unlimited Profit Range

Currency Inferior......................Superior

Bullish

Bullish

Neutral

Bearish

Bearish

Volatile

Conditions Start........During........Maturity

Currency

Foreign Interest Rates High

Domestic Interest Rates High

Low

Low

N/A

N/A

Place

Frequency

Liquidity

Unlimited Loss Range

Foreign Currency

+

Product Description

A forward contract binds two parties to exchange an agreed amount of one currency for another at a fixed rate on a specified future date. A forward rate is calculated by adding or subtracting swap points, depending on interest rate differentials, to the current spot rate. Spot is the price today to buy one currency and sell another with settlement in two business days. (The Canadian/US dollar pair settles in one business day.) As stated above, swap points are determined by the interest rate differentials between the currencies. If the base

(denominator) currency interest rates are higher, swap points will be negative and the forward rate will be priced at a discount. Conversely, if the base currency

(denominator) interest rates are lower, swap points will be positive and the forward rate will be priced at a premium.

Foreign Currency Forwards as a Trade

By locking into a forward contract to sell currency (a short position), a trader is betting that compared to where the forward rate was on the trade execution date, the currency will weaken. Any “excess” depreciation will be the trader’s profit. Because forward contract returns are hard to beat and there is unlimited profit potential, forwards are often used as the benchmark comparison for other trading instruments. That is, of course, if the trader bet right on the direction the currency moved. As profits are unlimited, so, too, are losses. The downside of lo cking in a forward is that the trader’s risk of loss is immediate and one-for-one if spot trades the wrong direction. While forwards are one of the most commonly used trading instruments, they are one of the least forgiving strategies.

For example, say a trader with a $100 notional amount believes spot USD/JPY will be at the current rate of

119.00 or higher three months from now. To trade this view, the trader locks in a forward. The forward is discounted because US interest rates are higher than

Japanese interest rates (not because the market believes that USD/JPY will weaken). These negative forward points, or the three month interest rate differential, results in a forward rate of 117.50.

If the dollar is at any rate above 117.50 at maturity, the trader makes a profit. If spot is 122.00 when the forward matures, the trader would execute the forward contract to buy dollars at 117.50, then would immediately sell them at the current spot rate for a profit of $3.69. Conversely, if the dollar weakens to 115.00, the trader loses $2.17.

RBC Capital Markets