Case for Change - Redesign Ethan Allen

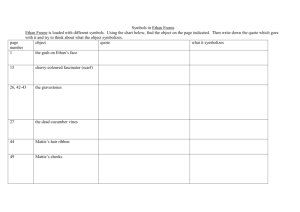

advertisement