Case Study Analysis: Applichem - Rensselaer Polytechnic Institute

advertisement

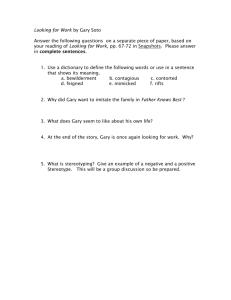

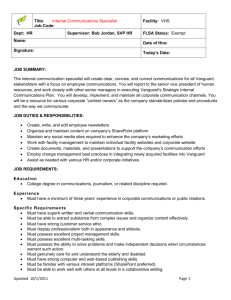

RENSSELAER POLYTECHNIC INSTITUTE Case Study Analysis: Applichem ISYE 6600: Design of Manufacturing Systems and Supply Chains Chaoqun Deng, Hongtan Sun, Prasanna Date, Wei Zou December 4, 2014 Case Study Analysis: Applichem Acknowledgement The team members had a great time working on this project! It was indeed a rewarding experience to fully understand the core concepts and models pertaining to Supply Chain Management in the lectures and then apply them to a real life scenario as a part of the course project. This experience helped us gain deeper insights into the concepts and gain a valuable exposure regarding how Supply Chain Management can be applied to a real life scenario. The project team would like to express their deepest gratitude to Professor Jennifer K. Ryan for the stimulating and insightful lectures which laid the foundation of Supply Chain Management for the team members. The understanding gained in this course is indeed going to stick for a long time. The team is very grateful to Professor Ryan for her generous and timely help for this course project. Further, the team members would like to thank Department of Industrial and Systems Engineering at Rensselaer Polytechnic Institute for offering this course and for providing us with the necessary infrastructure which enabled us to hone our skills as students and researchers. 1 Case Study Analysis: Applichem Table of Contents Serial Number Content Page Number 1. Acknowledgement 1 2. 1. Introduction 3 3. 2. Management Problems in Applichem 2.1. Organizational Problems 2.2. Obsolescence Problems 4 4 5 4. 3. Competitive Priorities and Performance Measures 3.1. Competitive Priorities 3.2. Performance Measures 7 7 8 5. 4. Network Design for Applichem 4.1. Basic Model 4.2. Variation in Exchange Rates 4.3. Variation in Demand 4.4. Not Meeting All Demand 10 11 12 13 14 6. 5. Conclusion 15 7. References 16 8. Appendix 18 2 Case Study Analysis: Applichem 1. Introduction Applichem is a company that provides customized chemicals to its customers. Once a product is made for a particular customer, Applichem modifies the product and manufactures it on a larger scale to suit the general market. Its products start off as innovative products and are converted to functional products later. Release-Ease is one of such chemical products manufactured by Applichem in six plants worldwide – Gary (USA), Canada, Mexico, Frankfurt, Venezuela and Sunchem (Japan). These plants operate 24 hours a day, 7 days a week, supply different markets all over the world and use different energy sources (steam, coal, electricity and natural gas) depending on which energy source is economical locally. Each of these plants differs from one another in terms of production efficiency. The Gary plant is the oldest, most inefficient and hasn’t improved its production processes since it began operating. The Canadian plant is wellregarded for its efficiency and quality. The Mexican plant supplies the Mexican market and has reasonably high operating costs. The Frankfurt plant has state of the art technology and produces quality products efficiently. While the Venezuelan plant hasn’t improved its production processes for twenty years, the Japanese plant is well known for its focus on product development. The external factors that affect production and distribution of Applichem are exchange rates, duties and variation in demand. The objective of this study are (1) to identify existing managerial problems in Applichem; (2) to identify the competitive priorities of Applichem and performance measures used by it to evaluate its plants; and (3) to propose an optimal network design for Applichem and conduct scenario analysis for various scenarios (for e.g. variation in demand, exchange rates etc.). This report is structured as follows: Section 2 highlights the management problems in Applichem and provides possible solution from a management perspective. Section 3 identifies competitive priorities and performance measures for Applichem. Section 4 addresses the problem of network design under different scenarios and Section 5 concludes the report with recommendations for Applichem. 3 Case Study Analysis: Applichem 2. Management Problems in Applichem The organizational problems faced by Applichem can be classified into two categories: Organizational Problems and Obsolescence Problems. Following sub-sections tackle these problems individually. 2.1. Organizational Problems Exhibit 1 shows the functional organization structure of Applichem where the employees are grouped hierarchically, managed through clear lines of authority, and report ultimately to one top person1. The benefits of a functional organization structure are that it offers a high level of specialization and expertise in a functional area which enhances efficiency and productivity2. The disadvantages of this structure include lack of teamwork and management control2. On one hand, one plant has difficulty working well with other plants due to specialization, and each plant may pursue its own interest regardless of the whole company’s interests2. On the other hand, as organizations get larger, top management needs to delegate more decision-making responsibilities/authority to each functional area. The degree of autonomy may also increase, making coordination of activities more difficult2. Applichem operates in different geographic areas all over the world. As a result, maintaining control over and managing the separate plants can be very challenging2. In Applichem, managers at one plant rarely encounter managers from other plants. As a result, plants with a low performance have little opportunities to learn from those with better performance. Thus, communication is a big problem in this hierarchical organization. It is suggested that Applichem establish a matrix structure which is more dynamic than functional management in that it is a combination of all the other structures and allows employers/executives to share information more readily across task boundaries and allows for specialization that can increase depth of knowledge in a specific sector or segment3. 1 Retrieved from http://www.businessdictionary.com/definition/functional-organization.html Retrieved from http://smallbusiness.chron.com/benefits-disadvantages-functional-organizational-structure11944.html 3 Retrieved from http://en.wikipedia.org/wiki/Organizational_structure 2 4 Case Study Analysis: Applichem 2.2. Obsolescence Problems The difficulties of keeping pace with incessant external developments can cause a firm’s innovative outputs to become increasingly unsuitable to the most current environmental demands [7]. As a result, the innovative activities of older firms may be less relevant in the light of the most current technological developments, reflecting the obsolescence of organizational know-how as firms age in rapidly changing environments [8]. The Gary plant was Applichem’s first large manufacturing facility and it hadn’t opened itself to technological innovation since its inception. Lack of technological innovation over the years led to the plant becoming obsolete and inefficient. Shifting production from Gary to Frankfurt was a decision that the top management was unwilling to take. Technological innovation was a must for Gary to keep up with other plants. However, introducing new technology to Gary would have significant implications on people, work processes, business processes and would introduce new risks into the business4. For example, it would be very difficult to encourage the aging workforce to adapt to use the new technology. Therefore, it is suggested that Gary should hire new and young workers who have different learning styles and are willing to accept and use new technology. Considering the influence of new technology on daily routines of a process operator, it is suggested that Gary formulate strict work rules and regulations for operators to ensure that work process is operated efficiently and safely. 3. Competitive Priorities and Performance Measures 3.1. Competitive Priorities Applichem’s business strategy is to provide customized services/products to meet all kinds of customer requirements and keep up with the market demand and innovation changes. Therefore the key competitive priorities of the company are: Quality: Applichem is aiming to provide high quality products and services that meet the customers’ expectations consistently. 4 Retrieved from http://iom.invensys.com/EN/pdfLibrary/ManagingObsoleteTechnologiesStrategiesandPractices.pdf 5 Case Study Analysis: Applichem Flexibility: Applichem customizes the product and service to meet different customer requirements. The engineers at Applichem have worked with customers closely to identify the problems they have encountered in the use of Release-ease, and they have developed different specifications of the chemical to better accommodate the regional demands and created products with broader applications. Release-ease is traditionally known as a functional product with consistent predictable demand; however, recently new formulations with more variety of the product are produced to meet customers’ specific requirements. Thus the supply chain efforts should focus on reducing physical costs on its main products and being responsive to different demands in different regions. 3.2. Performance Measures Table 1 summarizes the comparison of performance measures among the six plants in various aspects: i. Efficiency: To compare the production efficiency among six plants, we estimate the capacity utilization rate based on the plant capacity and actual production in 1982, the result shows that Venezuelan plant has the highest utilization rate, while Canadian plant has the lowest utilization rate of capacity. ii. Cost: Plant Sunchem has the highest cost – its raw material cost, production cost packaging, loading and shipping cost are almost twice as those for Frankfurt plant, mainly due to its high standards of manufacturing and management. iii. Product: In terms of product formulation, plant Gary is designed to produce a wide range of product while plant Frankfurt has only two. Plant Gary also has various packing types. The other plant that has various packaging is Sunchem while plant Frankfurt, Mexico and Venezuela only have one packaging available. All plants produce other chemical products. Plant Gary and Frankfurt produce more than 10 other products, while plant Sunchem and Venezuela produce one other product apart from Release-ease. The average yield on raw material, which is a key measurement of manufacturing performance, shows that plant Gary is the only one that is not performing very well in the 6 Case Study Analysis: Applichem process. It is also mentioned in the study that the quality and product specification were more closely monitored in plant Frankfurt, and plant Canada is well known for its efficiency and quality of product. The case study also lists a number of performance valuations for some of the plants: i. Product Life Span: The product life span varies in different regions. In Western Europe, customers usually use the product within a year while customers in North America may use the product as long as three years. ii. Competition: It is mentioned in the study that the competition in Western Europe is the fiercest while there’s less competition in North America and no competition in Japan. iii. Age of Plant and Production Line: Plant Gary is the oldest plant, followed by plant Canada and plant Sunchem. The Mexican plant is the newest one amongst all. Plant Sunchem was re-designed in 1969 with an update in production equipment and machines. It also added in Applichem’s first Research and Development department with product test labs and plastics engineering labs, etc. Comparatively, plant Venezuela is still producing with its old equipment in poor conditions. iv. Technology and Environmental Protection: Plant Sunchem uses the most updated technology and has waste recovery technology, while other plants don’t have special treatment for the product waste. v. Employees: Plant Sunchem and plant Canada have the most educated employees while the education levels in plant Mexico and plant Venezuela are the lowest. However, plant Mexico still outperforms plant Venezuela as its employees have a certain level of technical depth and the plant maintains improvements. 4. Network Design for Applichem With respect to Release-Ease, Applichem has six sources of supply viz. Mexico, Canada, Venezuela, Frankfurt, Gary (USA) and Sunchem (Japan); and six destinations of demand viz. Mexico, Canada, Venezuela, Western Europe, USA and Pacific and Rest of the World. The cost of production in each of the six supply regions is outlined in Appendix 2 along with data regarding import duties for each of the six demand regions. Moreover, Appendix 2 also 7 Case Study Analysis: Applichem shows the transportation costs incurred to transport hundred pounds of Release-Ease from each of the supply regions to each of the demand regions. Three variants of the basic network model are considered in this section. The basic model is explained in Section 4.1. Section 4.2 talks about network design model when the exchange rates fluctuate. Section 4.3 addresses the problem of variability in demand and section 4.4 tackles the case where Applichem doesn’t want to meet all demand. Two assumptions underline each of these models. First of all, Sunchem plant is not shut down in any model. This is because Japan is the center for Applichem’s research and development. It is vital for a firm to invest in research and development for continuous improvement. Since Sunchem is the only plant which facilitates R&D, it is in the best interest of Applichem that it doesn’t shut down. Secondly, the annual demand in North America is distributed between Mexico, Canada and USA as 10, 10 and 12 million pounds respectively. This is done to simplify calculations. 4.1. Basic Model The Basic Model addresses the idealized situation where demand, production cost, unit selling price, exchange rate and import duties are fixed. The objective in this problem is to minimize the total costs. The lowest annual cost in this model comes out to be $79,424,260. The Mexican plant and Gary plant are underutilized - the utilization being 12 million pounds and 12.7 million pounds of capacity respectively. In accordance with the first assumption, Sunchem plant is kept open but does not supply to any demand region. This model is tabulated in Appendix 3. The above model is modified to maximize profits instead of minimizing costs. Profit is calculated as the difference of revenue and costs incurred. Revenue is calculated as the selling price multiplied by the total demand. Selling price is $101 per hundred pounds of Release-Ease. The results show that Venezuelan plant needs to be shut down and Gary needs to be underutilized again (7.2 million pounds capacity utilized). Sunchem doesn’t supply to any region but is kept open only for R&D purposes. The total annual cost in this model is $81,163,510 – which is higher than the previous model. Maximum profit calculated 8 Case Study Analysis: Applichem is $8,554,790. The inconsistency in the two plans with respect to total annual cost can be attributed to the high duty and high production cost in Venezuela. However, since the duty is applied to the selling price also, the duty cancels out with the revenue when the net profit is calculated. The calculations for this model are shown in Appendix 4. 4.2. Variation in Exchange Rates As a company supplying multiple regions of the world, exchange rates could have a significant impact on Applichem’s profits. In this model, demand, price per unit, unit cost of production and unit transportation cost are assumed to be constant. The impact of variation in exchange rates is analyzed on Applichem’s profits. The input data regarding exchange rates is tabulated in Appendix 5. In the first case, exchange rates for the subsequent year (1983) are taken to be the average of exchange rates in 1977 through 1982. The capacitated plant model shows that all the five plants use their full capacity except Mexico. The Mexican plant has an excess capacity of 20.8 million pounds in this case which is approximately 94.5% of its total capacity. This is because the Mexican Peso depreciated a lot in 1982. So, if it appreciates to the average level in 1983, the unit production cost will increase in USD and other currencies significantly. The net profit in this case is $17,495,564.57, which is much higher than the previous models. These calculations are shown in Appendix 6. In the second case, the trend of exchange rates over the last three rates is linearly interpolated to estimate the exchange rate in 1983. This is the case where USD appreciates. It is seen that the capacitated model gives the best profit when the Venezuelan plant is shut down and only 7.2 million pounds of Gary’s capacity is utilized. This is a low fraction (39%) of Gary’s total capacity. This seems reasonable because when USD appreciates, it is no longer profitable to produce in USA. Hence, it is more feasible to satisfy demand in USA by importing Release-Ease. The Sunchem plant in Japan is not utilized but is operational for R&D purposes only. The net profit in this case is $11,365,371, which is lower than the previous case. The corresponding calculations are shown in Appendix 7. 9 Case Study Analysis: Applichem 4.3. Variation in Demand Although Release-Ease is a functional product, it still faces competition from Applichem’s competitors in the global market. Thus, it is possible for the demand of Release-Ease to change in 1983. First case considered in this scenario is when global demand for ReleaseEase increases by 7%. This is in consensus with the predictions made for demand in chemical industry [4]. If the demand for Release-Ease increases by 7%, the most profitable option is to close down Venezuelan plant and use 12.8 million pounds of Gary’s capacity to meet the extra demand. In this case the net profit is $8,609,592. The profit has increased from the cases in 4.1. However, the increase is not as much as expected considering the demand is increased by 7%. A possible explanation for this could be that to satisfy the current demand, all the efficient plants are utilized to their full capacity. But the high unit production cost of inefficient Gary plant cuts down the profit margin. This could be improved by increasing the efficiency of Gary. Calculations regarding this case are presented in Appendix 8. In the next case, decrease in demand is considered. It is assumed that the demand decreases by 10%. Since Release-Ease is a functional product, its demand won’t decrease drastically. In this regard, 10% decrease in demand seems to be a reasonable assumption to make. If the demand decreases by 10%, the most profitable strategy would be to close both Venezuelan and Gary plant. The maximum profit in this case comes out to be $8,459,249. Comparing to the profit in the basic model (section 4.1), the profit in this case decreases by $95,541 (1.12%). Comparing the 10% decrease in demand to 1.12% decrease in profit, it can be inferred that Gary and Venezuelan plant contribute significantly less to the company’s net profits as compared to other plants. Calculations for this case are outlined in Appendix 9. 4.4. Not Meeting All Demand Considering the results in 4.3, it might be a good idea to look at the case where Applichem doesn’t meet all demand for Release-Ease. The constraint to meet all demand is relaxed in the model. The net profit in this case turns out to be $9,003,750 – and increase of $448,960 (5.25%) as compared to the best case profit when all demand is met ($8,554,790). The 10 Case Study Analysis: Applichem market allocation indicates that 7.3 million pounds of demand in Latin America and all the demand in Pacific and Rest of the World is not met. Applichem is essentially losing a market in this case. This happens because the Frankfurt plant, which is the most efficient, doesn’t have enough capacity to fill the demand in these regions. If the total unit cost of production and transportation to each demand region is computed, it is seen that for all the other five plants except Frankfurt, Applichem is losing money when it tries to fill demand in Pacific and rest of the world. In essence, if this demand is satisfied by any one of the five other plants (Mexico, Canada, Venezuela, Gary or Sunchem), then Applichem may lose money for each pound of Release-Ease they sell in this region. On the other hand, Applichem would make money if the demand in this region is satisfied by the Frankfurt plant. However, limited capacity of Frankfurt plant doesn’t allow this. Pacific and the rest of the world is the least profitable market for Applichem. Giving up this market does increase its profits. If Applichem does not want to abandon a market, then it must increase the capacity of Frankfurt plant or decrease the unit cost of production in other plants. The calculations pertaining to this case are outlined in Appendix 10. In the next case, a scenario is analyzed where Applichem might not want to completely abandon a particular market. There may be several reasons for doing this. One of the reasons could be to keep the brand image alive and not lose old customers in these areas. So, it is assumed that that Applichem meets atleast half of the demand in the Pacific and rest of the world region. In this case, the optimal profit is calculated as $8,956,150. In this case, Applichem must give up 13.25 million pounds of demand in Latin America. The profit in this case is more than the previous case where Applichem was abandoning Pacific and rest of the world - $8,956,150 as compared to $8,554,790 respectively. The calculations for this scenario are demonstrated in Appendix 11. 5. Conclusion In this case study, the organizational and obsolescence problems that existed in Applichem were pointed out. Then, based on the company’s competitive priorities, a comparison of the performance of Applichem’s six plants was done in terms of production efficiency, 11 Case Study Analysis: Applichem manufacturing cost and product quality. Next, an optimal network design was proposed for a basic ideal case. This was then extended to incorporate variation in exchange rates and variation in demand. Further, a scenario was considered where Applichem doesn’t intend to fill all demand. Two cases were considered in this scenario – first, where Applichem completely abandons a market; and second, where Applichem meets 50% of the demand in the abandoned market of the previous case but does not meet the demand of another market fully. It was found out that both these cases generate two highest profits for Applichem. Thus, Applichem should seriously consider this option of not meeting all its demand with its existing set of plants. Further, if adequate technological innovation is introduced in its non-performing plants, Applichem can think of recapturing these lost markets in due course of time. At a time when supply chains continue to globalize and firms continue to grow, the growth of a particular firm comes at a cost to the environment [3]. In order to continue growing, Applichem should focus on sustainable growth in the years to come. Firstly, Applichem should pay attention to energy consumption, water consumption, greenhouse gas emissions and waste generation from environmental perspective [3]. Secondly, Applichem should reduce health and safety costs and labor turnover costs resulting from safer warehousing and transportation and better working conditions which can increase motivation of workers and productivity of plants [1]. Thirdly, Applichem should enhance its reputation by engaging in a sustainable behavior. Such an approach to growth makes an organization more attractive not only to its suppliers and customers [5], but also to potential employees [2], and shareholders [6]. In sum, an increased focus on sustainability will allow Applichem’s supply chain to reduce risk, become more efficient and environment-friendly, and also attract stakeholders who value those efforts [3]. 12 Case Study Analysis: Applichem References [1] Brown, K. A. (1996). Workplace safety: a call for research. Journal of operations management, 14(2), 157-171. [2] Capaldi, N. (2005). Corporate social responsibility and the bottom line. International Journal of Social Economics, 32(5), 408-423. [3] Chopra, S., & Meindl, P. (2007). Supply chain management. Strategy, planning & operation (pp. 265-275). Gabler. [4] Chemical Industry Vision 2030: A European Perspective. http://www.atkearney.com/chemicals/ideas-insights/article//asset_publisher/LCcgOeS4t85g/content/chemical-industry-vision-2030-aeuropeanperspective/10192?_101_INSTANCE_LCcgOeS4t85g_redirect=%2Fch emicals%2Fideas-insights. [5] Ellen, P. S., Webb, D. J., & Mohr, L. A. (2006). Building corporate associations: consumer attributions for corporate socially responsible programs. Journal of the Academy of Marketing Science, 34(2), 147-157. [6] Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management science, 42(8), 1199-1214. [7] Sørensen, J. B., & Stuart, T. E. (2000). Aging, obsolescence, and organizational innovation. Administrative science quarterly, 45(1), 81-112. [8] Tushman, M. L., & Anderson, P. (1986). Technological discontinuities and organizational environments. Administrative science quarterly, 439-465. 13 14 18.5 5 3.7 22 4.5 North America Pacific and Rest of World North America North America Latin America Gary Sunchem Canada Mexico Venezuela 47 Western Europe Frankfurt Market Capacity (million pounds) 4.1 17.2 2.6 4 14 38 Production (million pounds) 91% 78% 70% 80% 76% 81% Utilization Rate 87.29 75.05 68.7 91.86 60.83 53 Raw Material Cost (U.S. dollars per hundred pounds of Release-ease) 25.02 17.58 24.55 57.38 25.67 20.34 Operating Cost (U.S. dollars per hundred pounds of Releaseease) 116.34 95.01 97.35 153.8 102.93 76.69 Package, Load & Ship Cost (U.S. dollars per hundred pounds of Release-ease) 116.34 95.01 97.35 153.8 102.93 76.69 Total Cost(U.S. dollars per hundred pounds of Release-ease) 91.7 94.7 91.1 98.8 90.4 98.9 Average Yield on Raw Material (%) Good Good Good Good Not Good Good Manufacturing performance based on A.Y 1 1 NA Many 80 1 Packaging NA NA NA NA 8 2 Product Type 1 6 4 1 19 12 Other products 1. Comparison of Performance Measures Appendix Case Study Analysis: Applichem Case Study Analysis: Applichem 2. Input Data Mexico Canada Venezuela Frankfurt Gary Sunchem Production per Hundred Pounds $ 95.01 $ 97.35 $ 116.34 $ 76.69 $ 102.93 $ 153.80 Import Duty 60.00% 0.00% 50.00% 9.50% 4.50% 6.00% Supply Region Mexico Canada Venezuela Frankfurt Gary Sunchem Canada Latin America Western Europe US Pacific and Rest of the World Mexico Canada Venezuela Frankfurt Gary Sunchem Total Demand in Millions of Pounds Mexico Supply Region Demand Region Transportation Cost per per hundred pounds of Release-Ease $$ 11.00 $ 7.00 $ 10.00 $ 10.00 $ 14.00 $ 11.40 $$ 10.00 $ 11.50 $ 6.00 $ 13.00 $ 7.00 $ 9.00 $$ 12.50 $ 11.00 $ 12.50 $ 11.00 $ 11.50 $ 13.00 $$ 10.00 $ 14.20 $ 11.00 $ 6.00 $ 10.40 $ 11.20 $ $ 13.00 $ 14.00 $ 13.00 $ 14.30 $ 13.30 $ 12.50 $- 10.0 10.0 16.0 20.0 12.0 11.9 15 Capacity in Millions of Pounds Supply Region 22.0 3.7 4.5 47.0 18.5 5.0 0 37000 0 63000 0 0 100000 0 100000 0 0 0 0 0 100000 0 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand Canada Mexico Supply Region 0 27000 0 45000 88000 0 0 160000 Latin America 0 0 0 0 200000 0 0 200000 Western Europe 0 0 0 0 0 120000 0 120000 US 0 Pacific and Rest of the World 0 0 0 119000 0 0 119000 Demand Region - Shipment Quantities in Hundreds of Pounds 1 1 1 1 1 1 Open? Transportation Cost Production Cost Duty Total Cost 220000 37000 45000 470000 185000 50000 Actual Capacity 16 3,596,200.00 69,299,420.00 6,528,640.00 79,424,260.00 $ $ $ 93000 0 0 0 65000 50000 Excess Inventory $ 127000 37000 45000 470000 120000 0 Shipments Out In Hundreds of Pounds Case Study Analysis: Applichem 3. Basic Model – Minimizing Cost 37000 0 17 0 0 0 0 0 63000 0 0 0 0 100000 100000 0 Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 100000 Mexico Canada Mexico Supply Region 0 0 40000 0 0 160000 0 120000 Latin America 0 0 200000 0 0 200000 0 0 Western Europe 0 0 48000 72000 0 120000 0 0 US 0 0 119000 0 0 119000 0 Pacific and Rest of the World 0 Demand Region - Shipment Quantities in Hundreds of Pounds 45000 470000 185000 50000 37000 220000 Actual Capacity Production Cost Revenue Profit Transportation Cost 1 1 1 1 1 1 Open? 45000 0 113000 50000 0 0 Excess Capacity $ 80,699,000.00 $ 8,554,790.00 $ 67,959,410.00 $ 4,184,800.00 0 470000 72000 0 37000 220000 Shipments Out In Hundreds of Pounds Case Study Analysis: Applichem 4. Basic Model – Maximizing Profit Case Study Analysis: Applichem 5. Input Data – Exchange Rates Base Year (1982) Exchange Rate Supply Region Mexico Canada Venezuela Frankfurt (Germany) Gary (US) Sunchem (Japan) Forecasting Year Exchange Rate Annual Average Exchange Rate (Currency /$1 US) Supply Region 96.50 1.23 4.30 Mexico Canada Venezuela Frankfurt (Germany) Gary (US) Sunchem (Japan) 2.38 1.00 235.00 18 Annual Average Exchange Rate (Currency /$1 US) 26.20 1.18 4.30 2.25 1.00 219.00 0 12000 0 0 37000 0 0 88000 0 0 63000 0 0 100000 100000 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 0 Mexico Canada Supply Region 0 0 0 45000 113000 2000 0 160000 Latin America 0 0 0 0 200000 0 0 200000 Western Europe 0 0 0 0 0 120000 0 120000 US 0 Pacific and Rest of the World 0 0 0 69000 0 50000 119000 Demand Region - Shipping Quantities in Hundreds of Pounds 220000 37000 45000 470000 185000 50000 12000 37000 45000 470000 185000 50000 208000 0 0 0 0 0 Actual Shipments Excess Capacity Out Capacity 19 Production Cost Revenue Profit Transportation Cost 3,610,200.00 $ 110,272,559.35 $ 28,052,451.36 $ 78,609,907.99 $ Forecasting year cost and profit 1 1 1 1 1 1 Open? In Hundreds of Pounds Case Study Analysis: Applichem 6. Variation in Exchange Rate 0 37000 0 63000 0 0 100000 0 100000 0 0 0 0 0 100000 0 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand excess demand Canada Mexico Supply Region 0 120000 0 0 40000 0 0 160000 Latin America 0 0 0 0 200000 0 0 200000 Western Europe 0 0 0 0 48000 72000 0 120000 US 0 Pacific and Rest of the World 0 0 0 119000 0 0 119000 Demand Region - Shipment Quantities in Hundreds of Pounds 220000 37000 0 470000 185000 50000 0 0 0 0 113000 50000 20 $ 76,158,447.07 $ 11,365,317.87 $ 60,608,329.21 $ 4,184,800.00 220000 37000 0 470000 72000 0 Actual Shipments Excess Capacity Out Capacity Transportation Cost Production Cost Revenue Profit 1 1 0 1 1 1 Open? In Hundreds of Pounds Case Study Analysis: Applichem 7. Variation in Exchange Rates – USD Appreaciates 0 107000 0 0 37000 0 0 0 70000 0 0 0 0 107000 107000 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 0 Mexico Canada Supply Region 0 113000 0 0 58200 0 0 171200 Latin America 0 0 0 0 214000 0 0 214000 Western Europe 0 0 0 0 470 127930 0 128400 US 0 0 0 0 127330 0 0 127330 Pacific and Rest of the World Demand Region - Shipment Quantities in Hundreds of Pounds 220000 37000 0 470000 185000 50000 21 Production Cost Revenue Profit 0 0 0 0 57070 50000 $ 86,347,930.00 $ 8,609,392.10 $ 73,716,284.90 $ 4,022,253.00 220000 37000 0 470000 127930 0 Actual Shipments Excess Capacity Out Capacity Transportation Cost 1 1 0 1 1 1 Open? In Hundreds of Pounds Case Study Analysis: Applichem 8. Variation in Demand – Demand Increases by 7% Mexico Canada 0 37000 0 53000 0 0 90000 0 90000 0 0 0 0 0 90000 0 Supply Region Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 0 122100 0 0 21900 0 0 144000 Latin America 0 0 0 0 180000 0 0 180000 Western Europe 0 0 0 0 108000 0 0 108000 US 0 0 0 0 107100 0 0 107100 Pacific and Rest of the World Demand Region - Shipment Quantities in Hundreds of Pounds 220000 37000 0 470000 0 50000 22 Production Cost Revenue Profit 7900 0 0 0 0 50000 $ 72,629,100.00 $ 8,459,249.00 $ 59,797,871.00 $ 4,371,980.00 212100 37000 0 470000 0 0 Actual Shipments Excess Capacity Out Capacity Transportation Cost 1 1 0 1 0 1 Open? In Hundreds of Pounds Case Study Analysis: Applichem 9. Variation in Demand – Demand Decreases by 7% 0 100000 0 0 37000 0 0 0 63000 0 0 0 0 100000 100000 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 0 Mexico Canada Supply Region 73000 0 0 0 87000 0 0 87000 Latin America 0 0 0 0 200000 0 0 200000 Western Europe 0 0 0 0 120000 0 0 120000 US 119000 Pacific and Rest of the World 0 0 0 0 0 0 0 Demand Region - Shipment Quantities in Hundreds of Pounds 1 1 0 1 0 1 220000 37000 0 470000 0 50000 23 Production Cost Revenue Profit 120000 0 0 0 0 50000 $ 61,307,000.00 $ 9,003,750.00 $ 49,147,250.00 $ 3,156,000.00 100000 37000 0 470000 0 0 Actual Shipments Excess Capacity Out Capacity Transportation Cost Open? In Hundreds of Pounds Case Study Analysis: Applichem 10. Not Meeting All Demand – Losing a Market Altogether 0 100000 0 0 37000 0 0 0 63000 0 0 0 0 100000 100000 Mexico Canada Venezuela Frankfurt Gary Sunchem Total demand Excess Demand 0 Mexico Canada Supply Region 132500 0 0 0 27500 0 0 27500 Latin America 0 0 0 0 200000 0 0 200000 Western Europe 0 0 0 0 120000 0 0 120000 US 59500 Pacific and Rest of the World 0 0 0 59500 0 0 59500 Demand Region - Shipment Quantities in Hundreds of Pounds 220000 37000 0 470000 0 50000 24 Production Cost Revenue Profit 120000 0 0 0 0 50000 $ 61,307,000.00 $ 8,956,150.00 $ 49,147,250.00 $ 3,203,600.00 100000 37000 0 470000 0 0 Actual Shipments Excess Capacity Out Capacity Transportation Cost 1 1 0 1 0 1 Open? In Hundreds of Pounds Case Study Analysis: Applichem 11. Not Meeting All Demand – Not Losing Any Market Completely