New Requirements for Annual Reports on Form 10-K

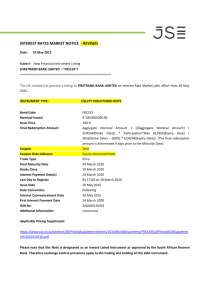

advertisement

March 11, 2003 Orrick Corporate Law Update The Corporate Law Update is distributed periodically without charge and reports on significant developments in corporate law. For more information on this and other corporate law subjects, visit our Web site at www.orrick.com. The contents of this publication are for informational purposes only and are not meant nor should be construed to be legal advice. No responsibility is New Requirements for Annual Reports on Form 10-K With the filing deadline for annual reports on Form 10-K approaching for most of you, we want to remind you of several new items that must be included in your Form 10-K due to recent rulemaking by the Securities and Exchange Commission (the “SEC”). New Cover Page Requirements: Accelerated Filer Identification and Public Float Disclosure The SEC has revised the cover page requirements for the Form 10K. Each issuer must now indicate on the cover page of the Form 10-K whether it is an accelerated filer. An “accelerated filer” is any issuer that meets all of the following conditions as of the end of its most recent fiscal year: • The aggregate market value of the issuer’s voting and nonvoting common equity held by non-affiliates of the issuer is $75 million or more (computed as of the last business day of its most recently completed second fiscal quarter); • The issuer has been subject to Exchange Act reporting requirements for a period of at least 12 calendar months; • The issuer has filed at least one previous annual report on Form 10-K; and • The issuer is not eligible to use Forms 10-KSB and 10-QSB for its annual and quarterly reports (i.e., small business issuer forms). assumed for errors made in the publishing process. If you wish to be removed from this mailing list, please reply to this message with “unsubscribe” in the subject line. ©2003, Orrick, Herrington & Sutcliffe LLP. Accelerated filers will now face accelerated filing deadlines for their Form 10-Ks and Form 10-Qs, which will be phased in over the next three fiscal years, as follows: • Form 10-Ks will be required to be filed within 75 days after the applicable fiscal year-end for fiscal years ending on or after December 15, 2003 and before December 15, 2004, and within 60 days after the applicable fiscal year-end for fiscal years ending on or after December 15, 2004; and • Form 10-Qs will be required to be filed within 40 days after the end of the fiscal quarter for fiscal years ending on or after December 15, 2004 and before December 15, 2005, and within 35 days after the end of the fiscal quarter for fiscal years ending on or after December 15, 2005. Each issuer must now also state on the cover page of the Form 10-K the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed using the price at which the issuer’s common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the issuer’s most recently completed second fiscal quarter. For most issuers, this will mean that disclosure about the issuer’s public float is required as of June 30, 2002. Website Access to Exchange Act Reports The SEC also has adopted a new rule requiring each accelerated filer to disclose in any Form 10-K filed for a fiscal year ending after December 15, 2002, whether it provides access to its Exchange Act filings through its website and encouraging all issuers to provide their website address, if they have one. Specifically, under new Item 101(e) of Regulation S-K, each accelerated filer must disclose: • Its website address, if it has one (issuers which are not accelerated filers are encouraged, but not required to disclose their website address); • Whether it makes available free of charge on or through its website, if it has one, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the SEC; • If it does not make the above filings available in this manner, the reasons it does not do so (including, where applicable, that it does not have a website); and • If it does not make the above filings available in this manner, it voluntarily will provide electronic or paper copies of its filings free of charge upon request. An issuer may choose to comply by posting Exchange Act filings directly on its website or, because the SEC now provides real-time access to filings through its EDGAR website, hyperlinking to the SEC’s EDGAR website. An issuer may also satisfy the posting requirements by hyperlinking to a third-party service if the issuer’s Exchange Act filings are made available in the appropriate time frame and access to the reports is free of charge to the user. The hyperlinks should direct the reader specifically to the issuer’s filings, not to a home page or general search page for the website. If an issuer chooses to hyperlink to a third-party service, it should make sure that it has carefully considered the reliability of the service in posting the reports and the extent and nature of any other information that may be included on that website. To address concerns about “adopting” information provided by a third-party service, issuers using a hyperlink may want to provide the website visitor with an intermediate screen stating that the visitor is leaving the issuer’s website and disclaim responsibility for the accuracy of the information provided by the third-party service. Orrick, Herrington & Sutcliffe LLP Page 2 The following is an example of the required website disclosure to be filed at the end of Item 1 in Part I of the Form 10-K: [Issuer]’s website is http://www.company.com. [Issuer] makes available free of charge, on or through its website, its annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the Securities and Exchange Commission, or SEC. Information contained on [Issuer]’s website is not part of this report. Increased Disclosure of Equity Compensation Plan Information Finally, the SEC has adopted new rules requiring increased disclosure about each issuer’s equity compensation plans, with a focus on heightened disclosure of nonshareholder-approved plans for annual reports and proxy statements, including those to be filed in 2003. Under Item 201(d) of Regulation S-K, an issuer must now disclose, in a tabular presentation as of the end of its most recently completed fiscal year, its compensation plans under which equity securities of the issuer may be issued. The tabular presentation is to include the following information: • The aggregate number of securities to be issued upon the exercise of outstanding compensatory options, warrants or rights to purchase securities (including all company plans, individual agreements and acquired plans that may have been assumed as the result of a merger); • The weighted average exercise price of such outstanding options, warrants and rights; and • The number of securities remaining available for future issuance under the issuer’s equity incentive plans. The required information must be aggregated into two groups: (i) those plans or agreements that have been approved by shareholders and (ii) those that have not. The new rules also require a narrative description of all company equity compensation plans not approved by shareholders. If that information is already included in the issuer’s financial statements, the issuer may cross-reference to the applicable portion of its financial statements. Where the information is included in a proxy statement, and a pending proxy proposal would have the effect of increasing the number of shares available for issuance under a plan, the table should include the number of securities remaining available for issuance under that plan, but should not include the number of the proposed increase. Each issuer must include the equity compensation plan disclosure table each year in its Form 10-K or 10-KSB and, additionally, in its proxy statement whenever the company is submitting a compensation plan for shareholder approval. In years that the issuer is required to make disclosures in its proxy statement, the required disclosure in the Form 10-K or 10-KSB may be satisfied by incorporating by reference to the proxy statement, but only if the proxy statement involves the election of directors and is filed not later than 120 days after the end of the issuer’s fiscal year. Orrick, Herrington & Sutcliffe LLP Page 3