Dow Jones U.S. Total Stock Market Index

Fact Sheet

Stated Objective

To represent all U.S. equity issues with readily available prices.

Key Features

—

To be included in the index, a security must be the primary equity issue of a U.S. company. Excluded are bulletin-board issues, because

in general they do not have consistently readily available prices.

—

Two versions of the index are maintained, one weighted by full market capitalization and the other weighted by float-adjusted market

capitalization.

—

The Dow Jones U.S. Total Stock Market Index was first calculated on January 1, 1987.

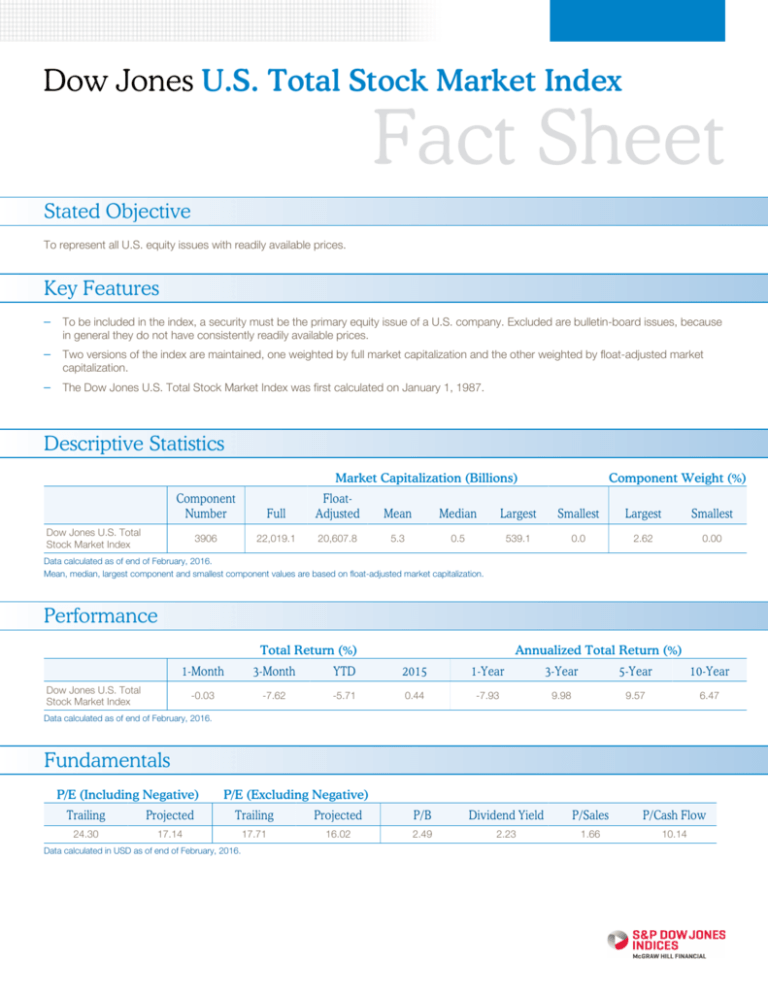

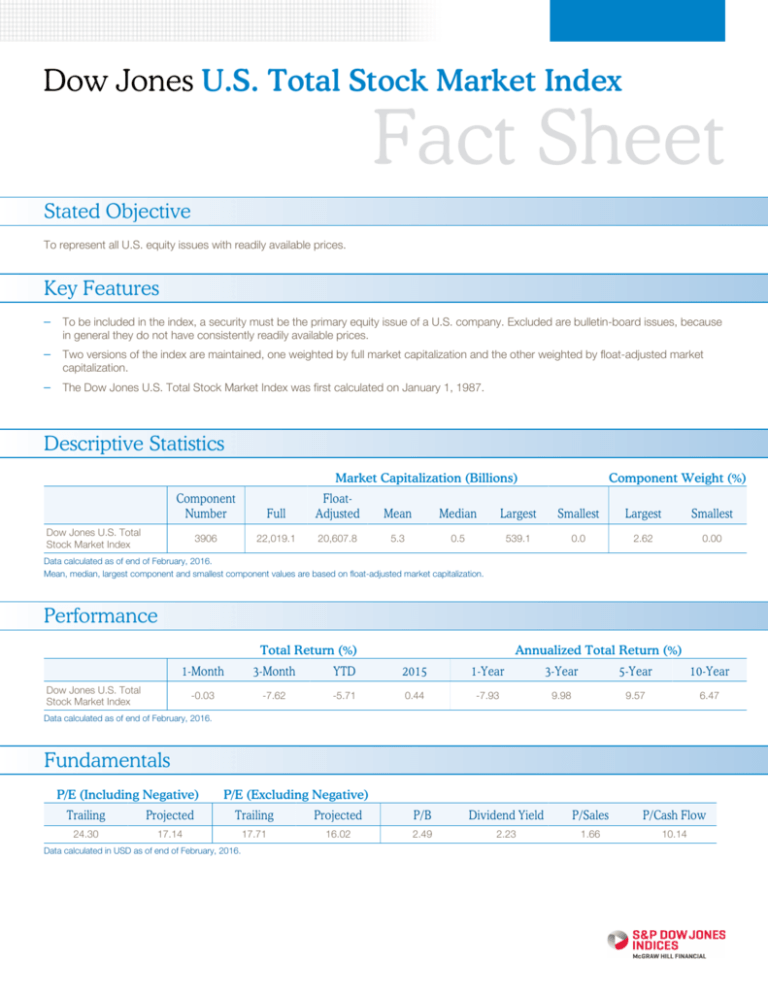

Descriptive Statistics

Market Capitalization (Billions)

Component Weight (%)

Component

Number

Full

FloatAdjusted

Mean

Median

Largest

Smallest

Largest

Smallest

3906

22,019.1

20,607.8

5.3

0.5

539.1

0.0

2.62

0.00

Dow Jones U.S. Total

Stock Market Index

Data calculated as of end of February, 2016.

Mean, median, largest component and smallest component values are based on float-adjusted market capitalization.

Performance

Total Return (%)

Annualized Total Return (%)

1-Month

3-Month

YTD

2015

1-Year

3-Year

5-Year

10-Year

-0.03

-7.62

-5.71

0.44

-7.93

9.98

9.57

6.47

Dow Jones U.S. Total

Stock Market Index

Data calculated as of end of February, 2016.

Fundamentals

P/E (Including Negative)

P/E (Excluding Negative)

Trailing

Projected

Trailing

Projected

P/B

Dividend Yield

P/Sales

P/Cash Flow

24.30

17.14

17.71

16.02

2.49

2.23

1.66

10.14

Data calculated in USD as of end of February, 2016.

Dow Jones U.S. Total Stock Market Index

Fact Sheet

Symbols

Index Name

Suggested

Symbol

Bloomberg

Bridge

Reuters

Thomson

Telekurs

DJ U.S. TSM Index - Total

Return

DWCFT

DWCFT

US&DWCFT

.DWCFT

.DICFT

DWCFT

DJ U.S. TSM Index - Price

Return

DWCF

DWCF

US&DWCF

.DWCF

.DIWCF

.DIWCF

Sector Allocation

Financials

18.50%

Technology

16.34%

Consumer Services

14.20%

Health Care

13.49%

Industrials

12.57%

Consumer Goods

10.60%

Oil & Gas

5.97%

Utilities

3.43%

Telecommunications

2.48%

Basic Materials

2.43%

Data calculated in USD as of end of February, 2016.

Sectors are based on the ten industries defined by the proprietary

classification system as described at www.djindexes.com

Top Components

Company

Country

ISIN/Ticker

Industry

Supersector

Float

Factor

Adjusted

Weight (%)

Apple Inc.

United States

AAPL

Technology

Technology

1.00

2.62%

Microsoft Corp

United States

MSFT

Technology

Technology

1.00

1.97%

Exxon Mobil Corp

United States

XOM

Oil & Gas

Oil & Gas

1.00

1.62%

Johnson & Johnson

United States

JNJ

Health Care

Health Care

1.00

1.41%

1.00

1.33%

General Electric Co

United States

GE

Industrials

Industrial Goods &

Services

Berkshire Hathaway B

United States

BRK.B

Financials

Insurance

0.76

1.22%

Facebook Inc A

United States

FB

Technology

Technology

1.00

1.18%

AT&T Inc

United States

T

Telecommunications

Telecommunications

1.00

1.10%

Procter & Gamble

United States

PG

Consumer Goods

Personal &

Household Goods

1.00

1.06%

Wells Fargo & Co

United States

WFC

Financials

Banks

0.91

1.06%

Copyright © 2016 by S&P Dow Jones Indices LLC, a subsidiary of The McGraw-Hill Companies, Inc., and/or its affiliates.

Dow Jones U.S. Total Stock Market Index

Fact Sheet

Quick Facts

Component Number

Variable

Weighting

Full and float-adjusted market capitalization

Review Frequency

Monthly, after the close of trading on the third Friday of the month

Base Value/Base Date

Price Return: 2434.95 as of January 1, 1987; Total Return: 5.67 as of January 1, 1987

Calculation Frequency

Every 15 seconds during U.S. trading hours

Dividend Treatment

Price return and total return versions are available. The total return version of the index is calculated with gross

dividends reinvested.

Estimated Back-Tested

History Availability

Full market and float-adjusted market cap history available from January 1, 1987.

Launch Date

January 1, 1987

For more information on the Dow Jones U.S. Total Stock Market Index,

email index_services@spdji.com

or call Americas +1.212.438.2046 | Asia +86.10.6569.2770 | EMEA : +44.20.7176.8888

Learn more at http://www.djindexes.com.

Dow Jones U.S. Total Stock Market Index

Fact Sheet

All information as of end of February, 2016

Source: S&P Dow Jones Indices LLC.

The launch date of the Dow Jones U.S. Total Stock Market Index was January 1, 1987.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are

based on the same methodology that was in effect when the index was officially launched. Past performance is not a guarantee of future results. Please see the Performance

Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-tested performance.

© S&P Dow Jones Indices LLC, a part of McGraw Hill Financial 2016. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without

the written permission of S&P Dow Jones Indices. Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a part of McGraw Hill

Financial, Inc. Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). S&P Dow Jones Indices LLC, Dow Jones, S&P and their respective

affiliates (“S&P Dow Jones Indices”) make no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector

that it purports to represent and S&P Dow Jones Indices shall have no liability for any errors, omissions, or interruptions of any index or the data included therein. Past performance

of an index is not an indication of future results. This document does not constitute an offer of any services. All information provided by S&P Dow Jones Indices is general in nature

and not tailored to the needs of any person, entity or group of persons. It is not possible to invest directly in an index. S&P Dow Jones Indices may receive compensation in

connection with licensing its indices to third parties. Exposure to an asset class represented by an index is available through investable instruments offered by third parties that are

based on that index. S&P Dow Jones Indices does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that seeks to provide an

investment return based on the performance of any Index. S&P Dow Jones Indices LLC is not an investment advisor, and S&P Dow Jones Indices makes no representation

regarding the advisability of investing in any such investment fund or other investment vehicle. For more information on any of our indices please visit www.spdji.com .

Ed 03-03-16, FACT-211-166-022916