Course Syllabus for AP Macroeconomics

advertisement

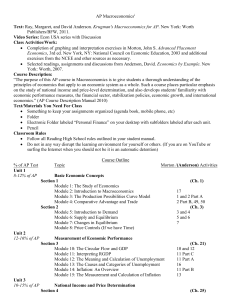

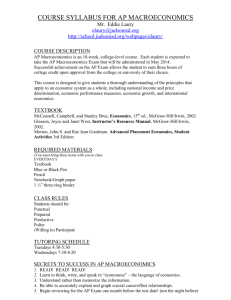

Course Syllabus for AP Macroeconomics Teacher: Mr. Weigold, Room 216 Course Description: Welcome to AP Macroeconomics! In this class we will be focusing on the many aspects of Economics. This is a year-long, college-level course that complies with College Board guidelines and is the equivalent of an introductory-level university course in Macroeconomics. The purpose of the AP Macroeconomics course is to provide students a thorough understanding of the principles of economics that apply to an economic system as a whole. Such a course places particular emphasis on the study of national income and price-level determination, and also develops students’ familiarity with economic performance measures, the financial sector, stabilization policies, economic growth, and international economics. Objectives: Students will be able to: Understand and explain the concepts, and theories pertaining to aggregate economic activity Understand and explain fiscal and monetary policy decisions and their impact on the economy Introduce students to fundamental economic concepts such as scarcity and opportunity costs Provide an overview of how the economy works, starting with a model of the circular flow of income and products that contains the four sectors: households, businesses, government, and international. It is important to identify and examine the key measures of economic performance: gross domestic product, unemployment, and inflation Introduce the concept and meaning of long-run economic growth and examine how economic growth occurs. Students will understand the role of productivity in raising real output and the standard of living, and the role of investment in human capital formation and physical capital accumulation, research and development, and technical progress in promoting economic growth Introduce the concept of how an open economy interacts with the rest of the world both through the goods market and the financial markets, and it is important to understand how a country’s transactions with the rest of the world are recorded in the balance of payments accounts Explain the utilization of resources within and across countries Effectively use macroeconomic models to measure and predict economic performance Work effectively to produce graphic products and solve problems Prepare for and successfully pass the AP Macroeconomic Exam General Expectations: 1. Students should be seated, have all the materials they need, and ready to begin class on time. 2. It is the student’s responsibility to make up assignments. The student should look on the assignment board or ask the teacher on the day they return and ask what they missed. 3. Every document that is turned in should have the date, period, and student’s name written in the appropriate places. 4. Any suspicion of copying documents/assignments done on the computer or written will result in a zero and disciplinary actions according to the school handbook. 5. Students will use the computers according to the rules stated in class/ in the school handbook and will only use approved websites and software applications. 6. Students are to treat everyone with respect as well as people’s property. 7. The student is expected to follow all classroom and school rules and respect the technology and equipment in the room. 8. Stay in your seat during class as well as quiet while others are talking. Consequences: First Offense: Warning Second Offense: Meet with me to discuss issue at hand Third Offense: Parent phone call and development of a behavior plan Fourth Offense: Disciplinary referral Required Material: Notebook, Folder, Pencil, and the following texts and websites Textbooks and other materials: Ray, Margaret & Anderson, David Krugman’s Economics for AP. New York, NY: Bedford, Freeman & Worth Publishers, 2011. Mankiw, Gregory Principles of Economics Sixth Edition with Aplia Online Supplement. Mason, OH: South-Western Cengage Learning, 2012 Anderson, David A. Economics by Example. New York, NY: Worth Publishers, 2006. Stone, Gary L. Advanced Placement Economics: Macroeconomics Student Resource Manual, 4th ed. New York, NU: Council for Economic Education, 2012. College Board released exams for AP Economics The Wall Street Journal New York Times The Economist Websites: AP Central College Board, Teachers Resource Section: www.apcenteral.collegeboard.com National Council on Economic Education: www.ncee.net Reffonomics Macroeconomics text book: www.reffonomics.com Assessment/Evaluation: Students will be assessed by different means throughout the school year. Students will receive a responsibility grade that is calculated by semester and is out of 120 points. Each day a student can earn up to 3 responsibility points. If a student receives over 120 points for a semester the points will be calculated into their total grade as bonus. Reasons why you would not get points for the day are as follows: absence, did not bring required material, are not paying attention, disrupting the class, or are not working during class. Other grades will be earned from: 1. Regular reading and writing assignments, current economics article reviews/presentations, and assigned practice/focus questions. 2. Following each unit of study outlined below, students will take a multiple-choice/free-response examination that is meant to assess their overall understanding of the material presented as well as familiarize them with the exam format of the AP Macroeconomics test administered in May. 3. Reflection Essays and free response questions 4. Short reading quizzes/projects will also be given periodically to ensure students are not falling behind on assigned readings Grading: A. School Percentages: 1. A = 100-93 % 2. B = 92-83 % 3. C = 82-73 % 4. D = 72-65% 5. F = below 65% B. Work Policy: 1. Late in-class assignments and homework will be subject to a percentage deduction each day the assignment is late. The first day the assignment will be worth 75% of its original value, 50% on the following day, 25 % the next, and after that the assignment will be worth no points. It is important that you turn your work in on time. 2. Tests and quizzes must be made up within five school days of the original date given. Students are responsible to schedule the make-up test with the teacher. 3. It is important to participate in class discussions and not disrupt the class in order to earn the maximum responsibility points. C. Tests, Quizzes, Homework and Projects: 1. All assignments will be based on a point system. Responsibility points are out of 120, with a possibility of earning 3 points per day. 2. Bell Ringers are to be completed at the beginning of class. They are to be turned in on at the end of a unit and are usually worth 5-10 points. 3. There will be tests/quizzes at the end of each chapter. The number of points per test depends upon the amount of content per each chapter. 4. There will be assigned reading and homework assignments – this class requires just as much in class time as it does outside of class time to ensure mastery of the subject. 5. There will be multiple projects assigned throughout the semester. The criteria for each project will be provided in an ample amount of time before the due date and class time will usually be provided. All papers must be completed in MLA or APA format. Since this is a business class, business attire is required for all presentations!!! Business attire will be discussed in class before first project. 6. You will have a midterm and a final in this course. These assessments will be the yearlong project broken into two sections. You will receive a rubric and breakdown of the project at the beginning of the year. You will have work days throughout the semester to work on each section of the project. Dates will be decided by the school. Course Outline: In order for students to achieve their best possible scores on the AP test, we will closely adhere to the College Board’s recommended course schedule. We will have several chapter quizzes, and exams to ensure mastery of each unit. Other assessments and projects will follow based on objectives and the time available. Percentage Goals of Exam Content Area (multiple-choice section) I. A. B. C. D. Basic Economic Concepts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8–12%) Scarcity, choice, and opportunity costs Production possibilities curve Comparative advantage, absolute advantage, specialization, and exchange Macroeconomic issues: business cycle, unemployment, inflation, growth E. Demand, supply, and market equilibrium II. Measurement of Economic Performance . . . . . . . . . . . . . . . . . . . . . . . . . . (12–16%) A. National income accounts 1. Circular flow 2. Gross domestic product 3. Components of gross domestic product 4. Real versus nominal gross domestic product B. Unemployment 1. Definition and measurement 2. Types of unemployment 3. Natural rate of unemployment C. Inflation measurement and adjustment 1. Price indices 2. Nominal and real values 3. Costs of inflation III. National Income and Price Determination . . . . . . . . . . . . . . . . . . . . . . . . . (10–15%) A. Aggregate demand 1. Determinants of aggregate demand 2. Multiplier and crowding-out effects B. Aggregate supply 1. Short-run and long-run analyses 2. Sticky versus flexible wages and prices 3. Determinants of aggregate supply C. Macroeconomic equilibrium 1. Real output and price level 2. Short and long run 3. Actual versus full-employment output 4. Economic fluctuations IV. Financial Sector . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15–20%) A. Money, banking, and financial markets 1. Definition of financial assets: money, stocks, bonds 2. Time value of money (present and future value) 3. Measures of money supply 4. Banks and creation of money 5. Money demand 6. Money market 7. Loanable funds market B. Central bank and control of the money supply 1. Tools of central bank policy 2. Quantity theory of money 3. Real versus nominal interest rates V. Inflation, Unemployment, and Stabilization Policies . . . . . . . . . . . . . . . . . (20–30%) A. Fiscal and monetary policies 1. Demand-side effects 2. Supply-side effects 3. Policy mix 4. Government deficits and debt B. Inflation and unemployment 1. Types of inflation a. Demand-pull inflation b. Cost-push inflation 2. The Phillips curve: short run versus long run 3. Role of expectations VI. Economic Growth and Productivity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5–10%) A. Investment in human capital B. Investment in physical capital C. Research and development, and technological progress D. Growth policy VII. Open Economy: International Trade and Finance . . . . . . . . . . . . . . . . . . . (10–15%) A. Balance of payments accounts 1. Balance of trade 2. Current account 3. Capital account B. Foreign exchange market 1. Demand for and supply of foreign exchange 2. Exchange rate determination 3. Currency appreciation and depreciation C. Net exports and capital flows D. Links to financial and goods markets In addition to the above, we will also focus on relevant economic current events, study 20th century economic history, and examine major contemporary economic theories. AP Exam Review (Early May) AP Exam: Thursday, May 14 2015 Post exam: Economic issues/current events Resources: 1. 2. 3. 4. The Business Ed Drive will have various files you will need. My page on the website will have resources and information. Google will play an integral role in this class with getting information and sharing files. Quizlet may be used to make study cards and review them. Questions: 1. What is Macroeconomics? How does it compare to Microeconomics? 2. What do the terms scarcity, opportunity cost, production possibility, advantage and supply and demand mean and how do they relate and affect the economy? 3. How does GDP affect the economy? Is nominal and real GDP different and how? 4. Does the business cycle repeat? How does unemployment affect the business cycle? 5. Inflation affects local markets, businesses, and people. How does it affect the global economy? 6. Aggregate Demand and Aggregate Supply are different than Supply and Demand in what ways? 7. The Federal Reserve affects the supply of money in what ways? Why do they control the money supply? 8. Explain foreign exchange markets, absolute advantage and comparative advantage in detail. How does monetary policy affect the money system? Standards: National Business Education Association set standards: Economics: I.1-4, II. 1-4, III.1-4, IV. 1-4, V. 1-4, VI. 1-4, VII. 1-4, IX. 1-4 Entrepreneurship: III. A-D, VII. A-C Personal Finance: IV. 1, V.1-4 Students: Please feel free to ask me any questions you have about the rules, the syllabus, or the class expectations that I have for you. I am here to work with you. Parents: Feel free to contact me with any remaining questions or concerns you have about your son/daughter or the class in general. I am excited to work with you this year! Mr. Weigold – Business Teacher