Double Marginalization in Performance

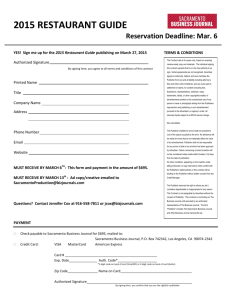

advertisement