Vertical Integration & Double Marginalization: Economics Examples

advertisement

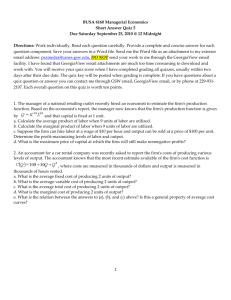

Surplus Effects of Vertical Integration With and Without Double Marginalization Examples1 What is Double Marginalization? When firms have market power, they will set price above marginal cost, which causes a welfare loss.2 This problem is accentuated when we have a firm with market power that buys an input from another firm that also has market power. The producer of the input will price above marginal cost when it sells the input to the other firm, who will then price above marginal cost again when they sell the final product that uses the input. This means the input is being market up above marginal cost twice: once by the producer of the input, and once again by the firm that uses the input to make its final product - that’s double marginalization. What is Vertical Integration? Vertical integration is when “firms that previously formed a buyer-seller relationship merge”. 3 This means that the firm that makes inputs and the firm that makes final products become one firm. Sometimes vertical integration improves social welfare by eliminating the problem of double marginalization, as is shown in example 1. This is the case if both the input and final good producing firms have monopoly power. As shown in example 2, however, this 1 Disclaimer : This handout has not been reviewed by the professor. In the case of any discrepancy between this handout and lecture material, the lecture material should be considered the correct source. Despite all efforts, typos may find their way in - please read with a wary eye. 2 Remember, total surplus is maximized when we are at marginal cost pricing. Any price above marginal cost means that a less than optimal amount of the good is being produced, which means a loss in total surplus. 3 Viscusi, W. Kip, Joseph Harrington, and John Vernon, Economics of Regulation and Antitrust (2005, MIT Press, 4th Ed.), pg. 236. Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2008 isn’t always true. Note that both examples in this handout assume a 1:1 ratio of inputs to final products. In other words, every final product sold uses exactly one input. 1 Vertical Integration with Double Marginalization - The Market for Bicycles and Bicycle Seats The Setup: There are two producers: Bikes Aplenty and Seats ’R Us. Bikes Aplenty makes bicycles, and they are the only bicycle makers in their market region. They face an inverse demand curve for bikes of PB = 450 − 4QB where QB is the quantity of bicycles sold. They have no fixed costs. Their marginal cost has two components. First, they have to buy bike seats from Seats ’R Us at a cost of PS per seat. Then, they have to assemble the bike with all the other parts, which costs $50 per unit. Seats ’R Us is the only maker of bike seats around. They have no fixed costs either, and a marginal cost of $16. There is one bike seat per bike, so the total quantity of bike seats sold is the same as the total quantity of bikes sold. The Problem, Part 1: Assuming the firms operate as independent monopolists in their respective industries, find prices and quantities in the market, the profits of each firm, and consumer surplus. The Solution, Part 1: First, let’s lay out what we know. For Bikes Aplenty, we know PB = 450 − 4QB M CB = 50 + PS For Seats ’R Us, our information is a little more limited - we only know marginal costs and that the number of bike seats sold equals the number of 2 bikes sold. M CS = 16 QS = QB = Q To solve this problem, we need the derived demand curve for bike seats. Since the only bike maker in town is Bikes Aplenty, all of the demand for seats must come from there. But how do we know how many seats they will want? To find that, we solve the profit maximization problem for Bikes Aplenty. Setting marginal revenue equal to marginal cost gives M RB = M CB 450 − 8Q = 50 + PS → 8Q = 400 − PS (1) Equation (1) looks an awful lot like a demand function - it tells us how many seats Bikes Aplenty will demand at any given price of seats PS . Since Bikes Aplenty is the only consumer of bike seats, this is the market demand function seen by Seats ’R Us. Rewriting (1) as an inverse demand function gives PS = 400 − 8Q. Since it is a linear inverse demand curve, we can get the marginal revenue curve by doubling the slope. M RS = M CS 400 − 16Q = 16 Q = 24 (2) (2) tells us the optimal quantity of bike seats produced. Since QB = QS = Q, it also tells us the optimal number of bikes produced by Bikes Aplenty. We now have the following information: M CS = 16 PS = 400 − 8(Q) = 400 − 8(24) = 208 M CB = 50 + PS = 258 PB = 450 − 4(Q) = 450 − 4(24) = 354 We’ve found the prices and the quantities in the market, now we need profits and consumer surplus. Profits ΠB = 354 ∗ 24 − 258 ∗ 24 = 2304 ΠS = 208 ∗ 24 − 16 ∗ 24 = 4608 3 Consumer Surplus 1 CS = (450 − 354)(24) = 1152 2 Total Surplus ΠB + ΠS + CS = 8064 Note that to calculate consumer surplus, we use the price of the final good (bicycles), not the price of the input (seats). The final product is all the consumer sees, so the final good quantity and price are what we want to use when calculating consumer surplus. The Problem, Part 2: Bikes Aplenty decides to buy Seats ’R Us. Find the new prices and quantities in the market, the new profits, and the new consumer surplus. The Solution, Part 2: Bikes Aplenty now owns Seats ’R Us, so their marginal costs are different. There is no longer going to be a mark up on the cost of seats, because the firm is now making seats themselves rather than buying them from another firm. That means they get seats at the marginal cost of production, which remains at $16. Solving the profit maximization problem for Bikes Aplenty gives M RB = M CB 450 − 8Q = 50 + 16 Q = 48 PB = 450 − 4(48) = 258 We don’t have to solve for PS anymore - it is fixed at $16. Profits ΠB = 258 ∗ 48 − 66 ∗ 48 = 9216 Consumer Surplus 1 CS = (450 − 258)(48) = 4608 2 4 Total Surplus ΠB + CS = 13824 Looking at parts 1 and 2, it’s clear that after the integration both total profits and consumer surplus went up (meaning total surplus has gone up). Since total surplus is maximized at marginal cost pricing, and the two firms becoming one firm got us one step closer to marginal cost pricing, this isn’t surprising. So if vertical integration eliminates double marginalization, it can improve overall surplus. We can look at the before and after graphically as well. Figure 1 shows the profits and consumer surplus before vertical integration. Consumer surplus, shaded red (or lightest grey for black & white printers), is the area under the demand curve and above the price of bikes. Profits for Bikes Aplenty are shaded green (slightly darker grey), while profits for Seats ’R Us are shaded purple (darkest grey). The sum of all three shaded areas is the total surplus. In Figure 2, it is clear that consumer surplus (still shaded red) has gone up. Profits for the single remaining firm, Bikes Aplenty, are again shaded green, and are higher than the sum of the two individual firm profits before they integrated. 2 Vertical Integration Without Double Marginalization - The Market for Computers and Processors The Setup: Processorium makes computer processors, and they’re the only company that does so. They sell processors to many different companies, all of whom then put the processors into computers and sell them under different generic names. There are enough producers in the computer market that it is perfectly competitive. The demand for computers is given by Q = 600 − PC , where PC is the price of a computer. The marginal cost of producing a processor is $100. The marginal cost of producing a computer is $50 + PP , where PP is the price of a processor. 5 450 CS Profits for Bikes Aplenty 400 Profits for Seats 'R Us 350 300 D em an d 100 50 0 20 40 fo r eats for S 150 0 8Q 045 = 8Q es 0Bik 40 for = ev. ts lR Sea na or f rgi nd Ma ma 6Q 0-1 = 40 200 De Rev. inal Marg Price Marginal Cost of Bikes = 50 + Price of Seats 250 Bi ke s = 45 0 - 4Q Marginal Cost of Seats = 16 60 80 100 120 135 Quantity Figure 1: Profits and consumer surplus under double marginalization. 450 CS Profits for Bikes Aplenty 400 350 D em ina 250 an d lR for Bi ke s Bik 200 fo r ev. Price rg Ma 300 45 0 = es - 45 150 = 4Q 08Q 100 Marginal Cost of Bikes = 50 + 16 50 0 0 20 40 60 80 100 120 135 Quantity Figure 2: Profits and consumer surplus after vertical integration. 6 The Problem, Part 1: Find the optimal quantities and prices, the profits for each firm, and consumer surplus. Solution, Part 1: We can solve this the same way we did things in example 1 . . . just remember that this time, the final product market is perfectly competitive. That means that the computer producers will have price equal to marginal cost. 600 − Q = 50 + PP → PP = 550 − Q (3) Now equation (3) is the derived inverse demand function for processors. Since Prossesorium is still a monopolist, we set their marginal revenue equal to their marginal cost 550 − 2Q = 100 Q = 225 and PP = 325 Plugging Q into the inverse demand function for computers gives PC = 375. We can now solve for profits and consumer surplus. Profits ΠC = 375 ∗ 225 − (50 + 325) ∗ 225 = 0 ΠP = 325 ∗ 225 − 100 ∗ 225 = 50625 Consumer Surplus 1 CS = (600 − 375)(225) = 25312.5 2 Total Surplus ΠC + ΠP + CS = 75937.5 The Problem, Part 2: Say Processorium buys one of the computer companies they sell to, and starts making their own computers. As a result, they stop selling processors to anyone else, which turns the formerly competitive computer market into a monopoly market controlled by Processorium. Find the change in total surplus. 7 The Solution, Part 2: As in example 1, once the firms vertically integrate we only need to worry about the profit maximization problem of one firm Processorium. Since they are the only computer company left, they profit maximize as a monopolist. M RP = M CP 600 − 2Q = 100 + 50 Q = 225 P = 375 A couple of things to note here. First, note that there is no longer a markup on processors - that makes sense, since Processorium is making everything, so there’s no point in selling themselves chips at a markup. Second, note that we have the exact same price and quantity result that we had before the merger. Since quantities and prices are the same, consumer surplus hasn’t changed. As for profits, ΠP = 375 ∗ 225 − 150 ∗ 225 = 50625 it looks like overall profits haven’t changed either. Vertical integration in this market doesn’t change total surplus at all, nor does it change surplus distribution. What’s the logic here? If the output market is perfectly competitive, then it isn’t putting any markup on its product, so the profits for all firms in the output market will be zero. The input firm does get markup above marginal cost, so they get positive profits. When the two firms vertically integrate, the former input firm now gets more revenue per unit (since before they were selling at the price of the input, now they’re selling at the price of the final good) but they incur additional costs per unit as well (since they are now paying the additional marginal cost of turning their input into a final product). Since the increase in price per unit is identical to the increase in cost per unit, the two effects will cancel each other out. This can be seen graphically as well. The marginal revenue curve for Processorium after the integration has the same slope as the marginal revenue curve before the integration. After integration, the intercept of the marginal revenue curve has shifted up by exactly the cost of assembling a computer. 8 Their marginal cost of production has shifted up by exactly that cost as well. Since the total profit for the firm is the area under the marginal revenue curve minus the area under the marginal cost curve, and both have shifted by the same amount, the area is the same and profits won’t change. The profit triangle has just been shifted up by $50 - the cost of putting the chips into computers. This is clear when looking at Figure 3. 650 Post-merger profits Pre-merger profits 500 Co Price er rg me ger r stPo -me MR Pre ium MR or ss rium ce o Pro cess Pro 400 m 300 200 pu te rM ar ke tD em an d Processorium MC Post-merger Processorium MC Pre-merger 100 0 0 100 200 300 400 500 Quantity Figure 3: Profits for Processorium pre- and post-merger. 9 650