Managing Dining Investments with

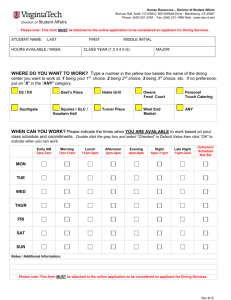

advertisement

University Dining Contracts: Managing Vendor Investments Written by: Angela Joyce, Director of Client Services The Solution Design Group, Inc. January 2014 1 Introduction Many colleges and universities contract their dining operations to one of several national vendors, including Sodexo, Chartwells and Aramark. Dining operations are complex by nature and auxiliary and business managers must be able to track varying types of data associated with each contract. Key factors such as sales by location, meal plans statistics and expenses must be carefully tracked. Other important financial measures include commissions, scholarships, catering funds, and cash versus card transactions. Because universities are seeking to maximize revenue, measuring and monitoring all types of dining revenue is a key component of managing a successful dining operation. Dining Investments Many dining contracts are long-term, often spanning ten to twenty years. A significant source of income from long-term dining contracts can be investments from the vendor. Investments are provided to a university, either directly or indirectly, and can include cash donations, new or renovated dining facilities, or purchases of dining and related equipment. Catering Funds Scholarships RevenueVision® Commissions In return for vendor investments, institutions commit to a certain contract term in order that vendors can realize long-term profits. Once an Investments investment is made, the funds are amortized, or “paid off” over a period of time. If a university terminates a contract earlier than the agreed term, it must refund the portion of the investments that have not been paid off (the unamortized amount). One example of a dining investment is a lump sum of $1,000,000 provided to a university for use in a dining hall renovation. The investment must amortize over a ten-year period on a monthly straight-line basis. After one year, 1/10 of the investment – or $100,000 – is fully amortized. A different example of a dining investment is a direct vendor purchase of new kitchen equipment of $400,000 that is to be amortized over a five-year period. The money is not directly provided to the university, but must still be amortized. In this example, the investment, monthly amortized amount, and schedule are different from the lump sum investment and must be tracked separately. Challenges of Managing Dining Investments There are specific challenges with tracking investments and associated amortizations. There are often multiple investments made over time by the dining vendor and those must be tracked individually. Each investment is a different amount, the monthly amortization is a different amount, and the amortization schedules are of different lengths and starting dates. The amortized and unamortized balances must also be maintained for each investment. Contract managers typically use spreadsheets to track the details of investment and amortization data. However, January 2014 Copyright © 2014, The Solution Design Group, Inc. 2 this manual method is time-consuming, tedious, and prone to errors. cumbersome over time. Spreadsheets can become large and Managing Dining Investments and Amortizations with RevenueVision® RevenueVision®, a cloud-based contract and revenue management solution from The Solution Design Group, Inc. (SDG) is currently being used by over a dozen universities to manage auxiliary and procurement contracts. The software allows university contract managers to track all of the important data associated with their contracts, including sales, commission and other revenue, dates, and contract provisions. As part of the deployment of RevenueVision®, several universities have configured the system to manage investment funds and corresponding amortization schedules on their dining contracts. In late 2011, The University of West Florida (UWF), located in Pensacola, deployed RevenueVision® to manage their dining, vending, bookstore and other auxiliary contracts. UWF entered into a new dining contract in June 2012. At the start of the contract, a large lump-sum investment was made by the vendor. Tracking the amortization of that investment was a priority for the UWF Auxiliary Services director. The a system was setup with a yearly amortization schedule for the life of the investment with both the monthly and annual target amounts. Then the system’s schedule feature was configured to automatically post the monthly, straight-line amortization. The process is fully automated and requires no data entry or maintenance by the UWF contract manager. Through RevenueVision® reporting, the manager can determine “target to actual” totals quickly and easily when needed. The University of Central Florida (UCF), located in Orlando, deployed RevenueVision® in November 2012 to manage over two dozen auxiliary and concession contracts. At that time, the contract manager was using spreadsheets to manage six separate dining investments. Each of these funds was a different amount and amortized on a different schedule. SDG configured RevenueVision® to track each of the six investments and through the use of the schedule feature to automatically record the monthly amortization amounts. Using RevenueVision® reports, the contract manager can quickly determine total amortized amounts for each investment by fiscal or calendar quarter, fiscal or calendar year, or overall totals from the amortization start date. The system can also report the remaining unamortized totals for those same periods. RevenueVision® Benefits Through the use of RevenueVision®, both UWF and UCF were able to eliminate lengthy and cumbersome spreadsheets and track their investment data in a centralized location. They now have an automated and accurate process in place for monitoring investments and recording amortizations. No manual intervention or data entry is needed, so staff time is saved. UWF and UCF contract managers and auxiliary staff can readily access whatever investment or amortization data that may be needed quickly and easily. Dining amortization is just one of the ways that RevenueVision® can help to improve operational efficiency and reduce financial and reputational risk. For more information about RevenueVision® or to request a demonstration, please contact: The Solution Design Group, Inc. – 407-382-1959 x 107 or at info@RevenueVision.com January 2014 Copyright © 2014, The Solution Design Group, Inc.