Deductions: In General, Medical Expenses

advertisement

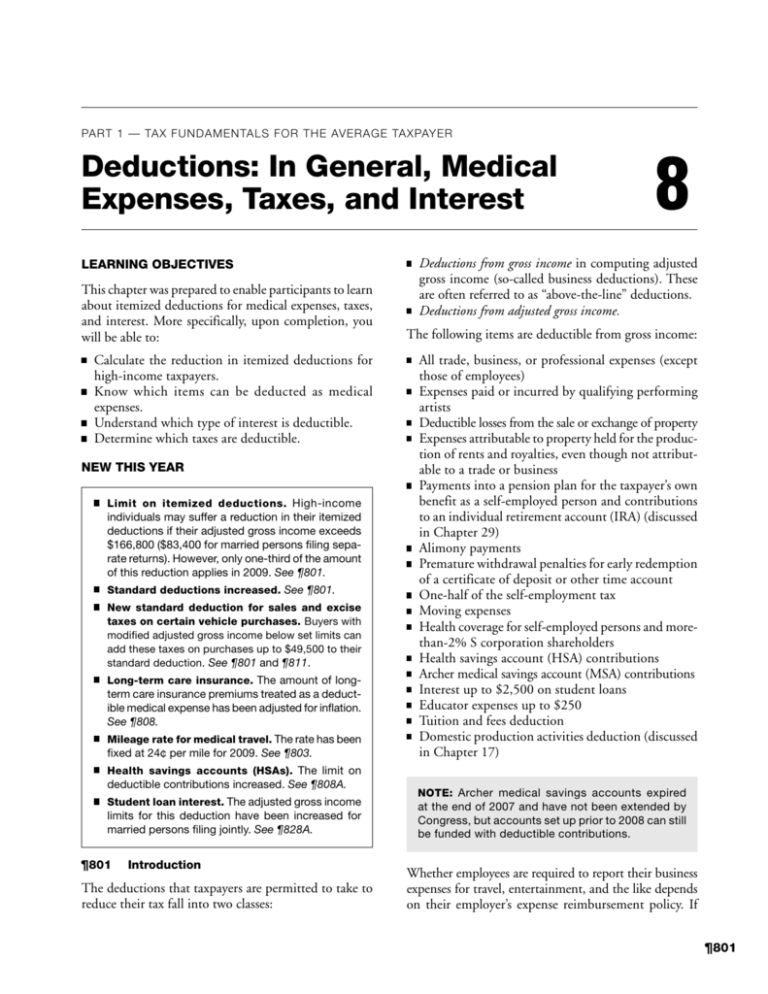

PART 1 — TAX FUNDAMENTALS FOR THE AVERAGE TAXPAYER

Deductions: In General, Medical

Expenses, Taxes, and Interest

LEARNING OBJECTIVES

This chapter was prepared to enable participants to learn

about itemized deductions for medical expenses, taxes,

and interest. More specifically, upon completion, you

will be able to:

Calculate the reduction in itemized deductions for

high-income taxpayers.

Know which items can be deducted as medical

expenses.

Understand which type of interest is deductible.

Determine which taxes are deductible.

NEW THIS YEAR

Limit on itemized deductions. High-income

individuals may suffer a reduction in their itemized

deductions if their adjusted gross income exceeds

$166,800 ($83,400 for married persons filing separate returns). However, only one-third of the amount

of this reduction applies in 2009. See ¶801.

Standard deductions increased. See ¶801.

New standard deduction for sales and excise

taxes on certain vehicle purchases. Buyers with

modified adjusted gross income below set limits can

add these taxes on purchases up to $49,500 to their

standard deduction. See ¶801 and ¶811.

Long-term care insurance. The amount of longterm care insurance premiums treated as a deductible medical expense has been adjusted for inflation.

See ¶808.

Mileage rate for medical travel. The rate has been

fixed at 24¢ per mile for 2009. See ¶803.

Health savings accounts (HSAs). The limit on

deductible contributions increased. See ¶808A.

Student loan interest. The adjusted gross income

limits for this deduction have been increased for

married persons filing jointly. See ¶828A.

¶801

Introduction

The deductions that taxpayers are permitted to take to

reduce their tax fall into two classes:

8

Deductions from gross income in computing adjusted

gross income (so-called business deductions). These

are often referred to as “above-the-line” deductions.

Deductions from adjusted gross income.

The following items are deductible from gross income:

All trade, business, or professional expenses (except

those of employees)

Expenses paid or incurred by qualifying performing

artists

Deductible losses from the sale or exchange of property

Expenses attributable to property held for the production of rents and royalties, even though not attributable to a trade or business

Payments into a pension plan for the taxpayer’s own

benefit as a self-employed person and contributions

to an individual retirement account (IRA) (discussed

in Chapter 29)

Alimony payments

Premature withdrawal penalties for early redemption

of a certificate of deposit or other time account

One-half of the self-employment tax

Moving expenses

Health coverage for self-employed persons and morethan-2% S corporation shareholders

Health savings account (HSA) contributions

Archer medical savings account (MSA) contributions

Interest up to $2,500 on student loans

Educator expenses up to $250

Tuition and fees deduction

Domestic production activities deduction (discussed

in Chapter 17)

NOTE: Archer medical savings accounts expired

at the end of 2007 and have not been extended by

Congress, but accounts set up prior to 2008 can still

be funded with deductible contributions.

Whether employees are required to report their business

expenses for travel, entertainment, and the like depends

on their employer’s expense reimbursement policy. If

¶801

82

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

an employer has an accountable plan, then employees

do not have to report their business expenses—they are

reimbursed under the plan, so there is nothing for employees to deduct. An accountable plan is one that requires

employees to substantiate expenses to the employer and

repay any excess advance or reimbursement within a reasonable time. If the employer has a nonaccountable plan

(employees are not required to substantiate expenses to

the employer or to repay excess amounts to the employer),

then the employees’ expenses will be considered unreimbursed. They can deduct these amounts subject to the

2%-of-adjusted-gross-income limit. However, statutory

employees (e.g., certain insurance agents and outside

salespersons) may deduct employee business expenses on

Schedule C and are not limited by the 2% floor.

STUDY QUESTION

1.

Which of the following deductions are taken from

gross income?

a. Student loan interest

b. Mortgage interest

c. Investment interest

EXAMPLE: Jill Gregory is entitled to file a joint return

with her husband, Howard Gregory. However, Howard

elects to file a separate return for 2009 and itemizes

his deductions. Because he itemizes, Jill is not entitled

to claim the standard deduction on her return, but she

must also itemize her deductions, if she has any.

There is an additional standard deduction amount for

taxpayers who are age 65 or older by the end of the year

and/or blind. For 2009, the additional amount is $1,400

for singles and heads-of-household, and $1,100 for

married persons filing a joint or separate return, and for

surviving spouses.

EXAMPLE: In 2009, Jerry Gilbert, a single individual,

age 55, who is blind (and does not own a home), can

claim a standard deduction of $7,100 ($5,700 + $1,400).

A married couple where one spouse is age 66 and

the other is age 64 can claim a standard deduction of

$12,500 ($11,400 + $1,100).

NOTE: Answers to Study Questions, with feedback

to both the correct and incorrect responses, are

provided in Chapter 35, beginning with ¶3508.

Real estate taxes. For 2009, there is an additional standard deduction for real property taxes. The additional

deduction is up to $500 ($1,000 on a joint return).

Items deductible from adjusted gross income include,

but are not limited to, the following:

PLANNING POINTER: The new additional standard

deduction for real property taxes can provide a benefit to seniors who have paid off their homes and do

not have enough itemized expenses to itemize their

deductions. It can also help those who purchase a

home late in the year and also lack enough deductions to itemize.

All allowable employee business expenses not deductible from gross income

Expenses attributable to income-producing activities

not constituting a trade or business (except in connection with rental or royalty-producing property)

All “personal” deductions, such as charitable contributions,

interest, taxes, medical expenses, and casualty losses

NOTE: Certain expenses are taken as miscellaneous

itemized deductions only to the extent they exceed

2% of adjusted gross income. These include, among

others, job-related education costs, expenses for the

production of income, and appraisal costs.

Individuals may elect to itemize

their deductions or to take the standard deduction, whichever is greater. The standard deduction amounts for 2009

are $11,400 on a joint return and for surviving spouses,

$8,350 for heads of households, and $5,700 for singles

and married persons filing separate returns. See ¶116.

Standard deduction.

¶801

Married taxpayers filing separate returns are ineligible

to use the standard deduction if either spouse itemizes.

See ¶116 and ¶205.

State and local sales and excise taxes on certain

vehicle purchases. These taxes on purchases up to

$49,500 can be added to the standard deduction in lieu

of claiming them as part of the itemized deduction for

state and local sales taxes. In states that do not impose

sales tax (Alaska, Delaware, Hawaii, Montana, New

Hampshire, and Oregon), the fees or taxes assessed on

the purchase of the vehicle and based on the vehicle’s

sales price or as a per unit fee can be treated as a sales

or excise tax for purposes of the additional deduction.

However, there is a modified gross income (MAGI)

limit of $125,000 for singles ($250,000 for joint filers); a partial deduction is allowed for MAGI between

$125,000 and $135,000 for singles ($250,000 to

$260,000 for joint filers).

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

Instead of claiming a loss incurred

in a federal disaster area as an itemized deduction, the

loss can be treated as an additional standard deduction

amount. Such loss in 2009 must be reduced by $500;

the 10%-of-adjusted gross income floor does not apply

to disaster losses.

83

Net disaster losses.

Special rules apply to the standard deduction for dependents. Their standard deduction is limited to the greater

of an annual amount ($950 in 2009), or $300, plus

earned income, but no more than a total of the standard

deduction for a nondependent ($5,700 in 2009).

EXAMPLE: Luke Thrasher, a 16-year-old child,

earns $1,000 from a part-time job and has unearned

income of $500. Luke’s standard deduction amount

is $1,300 (earned income of $1,000 plus $300).

Some of the items to be discussed may also qualify

as deductions if they are incurred in connection with

the taxpayer’s trade or business or other incomeproducing activity.

Overall limit on itemized deductions. Prior to 2006,

itemized deductions were reduced by 3% of the amount

by which adjusted gross income exceeded a threshold

amount. In 2006 and 2007, only two-thirds of the 3%

reduction applied. In 2008 and 2009, only one-third of

the 3% reduction will apply. In 2010, the phaseout will

no longer be in effect. The threshold amount for 2009

is $166,800 ($83,400 for married persons filing separate

returns). The reduction is limited to no more than 80%

of allowable itemized deductions. Certain deductions are

exempt from reduction: medical expenses, investment

interest, casualty and theft losses, and gambling losses

to the extent of gambling winnings.

NEW FOR 2010: Starting in 2010, the overall limitation

on itemized deductions for high-income taxpayers is

completely eliminated.

The “Itemized Deductions Worksheet” from the

instructions to Schedule A, Form 1040, can be used to

figure the reduction in itemized deductions.

MEDICAL EXPENSES (SEC. 213)

¶802

What Expenses Are Deductible?

Taxpayers itemizing their personal deductions may

include, as a deduction from adjusted gross income and

subject to certain limitations and conditions, amounts

paid for medical and dental expenses. The expenses must

have been paid in the tax year, regardless of when the

expenses were incurred.

The Internal Revenue Code defines medical expenses

as amounts paid for “the diagnosis, cure, mitigation,

treatment, prevention of disease, or for the purpose of

affecting any structure or function of the body.”

The cost of cosmetic surgery generally is not deductible. This bar does not apply to cosmetic surgery

necessary to ameliorate a deformity arising from, or

directly related to, a congenital abnormality, a personal

injury resulting from an accident, or trauma, or a

disfiguring disease.

Medical expenses also include expenditures incurred for

transportation primarily for, and essential to, medical care.

PRACTICE POINTER: This reduction does not apply

Unreimbursed long-term care services are treated as

deductible medical expenses. Long-term care services

include necessary diagnostic, preventive, therapeutic,

curing, treating, mitigating, and rehabilitative services,

and maintenance or personal care services required by a

chronically ill individual and provided under a plan of

care prescribed by a licensed health care practitioner. A

chronically ill individual is someone certified within the

prior 12 months as (1) being unable to perform at least

two activities of daily living (eating, toileting, transferring, bathing, dressing, and continence), (2) requiring

substantial supervision to protect the person due to severe

cognitive impairment, or (3) having a similar level of disability according to regulations (not yet prescribed).

for alternative minimum tax purposes. Thus, for

example, charitable contributions are deductible in full

for purposes of the alternative minimum tax without

any reduction, regardless of the amount of adjusted

gross income.

The costs of hospitalization and medical insurance

are deductible. The treatment of medical insurance

is explained in ¶808. The cost of life insurance is not

deductible. The cost of attending special schools or

EXAMPLE: John Pomeroy, a single individual, has

adjusted gross income of $316,800 and itemized

deductions of $90,000 ($20,000 of which are medical

expenses, casualty and theft losses, and investment

interest). The itemized deduction reduction (before

the 2009 phaseout) is $4,500 (3% of $150,000, which

is the amount of AGI exceeding $166,800). For 2009,

the reduction is $1,500 (one-third of $4,500).

¶802

84

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

institutions for the mentally or physically handicapped is

deductible if the resources of the institution for alleviating the handicap are the principal reason for attending

the school. Thus, amounts paid (including payments for

board and lodging) for a blind child to attend a school

where Braille is taught, or for a deaf child to attend a

school for the teaching of lipreading, are deductible.

Purchase or installation of special equipment or devices

of a medical nature or for medical purposes (e.g., ramps

or railings to accommodate a handicap) is deductible,

even though the equipment or devices acquired are of a

capital nature. However, if the equipment or installation

increases the value of the taxpayer’s home, the deduction is reduced by the amount of the increase. Thus, for

instance, the cost of central air conditioners or elevators,

installed for medical reasons, is deductible, but only to

the extent that the items do not add to the permanent

value of the house.

EXAMPLE: On his physician’s advice, Bob Lynn, a heart

patient, installs a home elevator at a cost of $2,500. A

qualified appraisal indicates that the elevator increases

the value of the home by about $1,000. Bob can take

a medical expense deduction of $1,500.

A medically dictated improvement can generate annual medical deductions. To illustrate: operating costs during the year

are $125 for electricity to operate the air conditioner and

$50 for maintenance. This $175 cost is a medical expense.

The rule is that if the improvement is a medical expense, so

are annual outlays for operation and maintenance. Furthermore, the entire amount of these yearly expenses qualifies,

even though none or only part of the original cost of the

improvement gave rise to a medical deduction.

The following items qualify as deductible medical

expenses:

Fees to doctors, osteopathic doctors, dentists, chiropractors, oculists, podiatrists, psychologists, physical therapists,

acupuncturists, and Christian Science practitioners

Hospital, nursing, and laboratory fees

X-rays and therapy treatments

Cost and maintenance of eyeglasses, hearing aids, contact lenses, artificial teeth and limbs, braces and crutches,

wheelchairs, and oxygen equipment

Seeing Eye dogs and Braille books

Orthopedic shoes

The cost of stop-smoking programs (but not overthe-counter treatments such as nicotine gum)

The cost of weight-loss programs to treat obesity

¶803

Organ donor expenses for surgery, hospital stay, lab

fees, and transportation

The following items do not qualify as itemized medical

expenses:

Over-the-counter medications

Funeral and cemetery expenses

Cost of meals and lodging received by an aged person

in an old-age home (except that portion of the cost

representing medical and nursing care)

Maternity clothing

Diaper service

Cost of caring for children while their parent is sick

or recovering from an illness

Amounts paid for the preservation of the taxpayer’s

general health, such as for health clubs, steam baths,

and vacations

Cost of a housekeeper, unless a portion of her time is

devoted to nursing services, in which case a proportionate part of the expense is deductible

Illegal operations or illegal treatment

Social activities (e.g., dancing lessons or swimming

lessons) for the general improvement of health

Cosmetic surgery that is not medically necessary

Marijuana (even if medically prescribed)

Gender reassignment surgery

¶803

Medical Transportation Expenses

If a taxpayer incurs transportation expenses primarily for

and essential to obtaining medical care, these qualify as a

medical deduction. This includes not only the patient’s

transportation expenses but also, where necessary, the

expenses incurred by accompanying persons, such as nurses

or parents of a child too young to travel alone. However,

the taxpayer should be able to prove that the trip was made

on the physician’s advice for the treatment or mitigation of

a specific disease or condition, and not merely for a change

in environment or general improvement of health. Thus, a

person suffering from a heart ailment was not allowed to

deduct the cost of traveling to Florida for the winter.

If taxpayers use their own autos for medical purposes, they

can either deduct the actual cost of gas and oil (but not

depreciation or insurance) or take a flat mileage allowance

of 24 cents per mile in 2009. Expenses incurred for tolls

and parking fees are separately deductible.

¶804

Meals and Lodging

Payment for meals and lodging furnished by a hospital

or similar institution, as a necessary incident to medical

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

care, is a medical expense if the patient’s condition is

such that the availability of medical care is the principal

reason for the patient’s presence there.

considered ordinary expenses and nondeductible,

just as food and household expenses are ordinary and

nondeductible.

Amounts paid for lodging (but not meals) while away from

home primarily for and essential to medical care provided

by a doctor in a licensed hospital, including a medical care

facility, will qualify for a medical expense deduction. The

amount is limited to $50 per night per individual. Thus,

for example, if the away-from-home lodging expenses for

a child being treated at a medical care facility qualify as

medical expenses, so too would the lodging expenses of

a parent who accompanies that child. The $50 per night

would apply separately to each of them.

EXAMPLE: Jim Gray’s adjusted gross income is

$28,000. His costs for prescription medicine and

drugs were $1,300, and his costs for other medical

expenses were $2,600. If he itemizes his personal

deductions, he can deduct medical expenses of

$1,800 on Schedule A of Form 1040 ($3,900 medical

expenses less 7.5% of adjusted gross income, or

$2,100). The “Medical and Dental Expenses” section of Schedule A prompts taxpayers to take into

account the 7.5%-of-AGI limitation.

When an individual is in a nursing or old-age home in

order to receive treatment for a mental or physical condition, the entire cost of maintenance, including meals

and lodging, is deductible. On the other hand, if an

individual is in a home primarily for custodial purposes,

only that portion of the maintenance cost attributable

to medical or nursing care is deductible.

Although the cost of transportation incurred for medical reasons is deductible, the cost of meals while away

from home for medical treatment or for the alleviation

of a specific condition is not, even if the trip was made

on a physician’s advice. If a taxpayer with a severe heart

ailment spends every winter in Florida at his doctor’s

insistence, the taxpayer’s transportation to and from

Florida is deductible. The taxpayer’s living expenses en

route or while there are not deductible.

¶805

Medicines and Drugs

Amounts paid for prescription medicines and for insulin

are included in medical expenses. Over-the-counter

drugs, vitamins, iron, and other food supplements are

not deductible, even if ordered by a doctor.

PRACTICE POINTER: Over-the-counter medications

paid through health savings accounts, flexible spending accounts, or health reimbursement accounts are

not deductible, even though they are permissible

plan distributions.

¶806

85

PITFALL: For alternative minimum tax purposes,

only medical expenses in excess of 10% of adjusted

gross income are deductible. See ¶2502.

¶807

Whose Medical Expenses Are Deductible?

In computing the medical expense deduction, a taxpayer

can include medical expenses paid for himself and his

spouse and dependents. For this purpose, a person is considered a “dependent,” even though the person’s 2009 gross

income is $3,650 or more or even though the person filed

a joint return with his spouse, provided that the person

meets the other requirements. For a dependent under a

multiple support agreement, only the person entitled to the

dependency exemption can add the dependent’s medical

costs to his own (the other contributors under a multiple

support agreement receive no tax benefit from paying

medical costs for the person claimed as the dependent). The

status must exist either when the expenses were incurred

or when they were paid.

EXAMPLE: Earl Stanton provides $5,000 a year toward

his brother Frank’s support. In addition, he pays Frank’s

dental bill of $350. Frank has 2009 gross income of

$4,900, which he spends for his own support. Although

Earl cannot claim a dependency exemption deduction

for his brother (because the brother’s gross income

exceeds $3,650), he can claim the medical expenses

paid for Frank, because he provided more than half

($5,000 + $350) of Frank’s total support.

Limitations on the Medical

Expense Deduction

In general, medical expenses are deductible only to

the extent that they exceed 7.5% of the taxpayer’s

adjusted gross income. This is because amounts up

to 7.5% of the taxpayer’s adjusted gross income are

¶807

86

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

EXAMPLE: John Adams furnished more than half

PITFALL: The fact that separate returns will yield a

the support of his married daughter, Mary, including

her medical expenses of $1,200. Mary and her husband file a joint return. For this reason, John cannot

claim an exemption for her. In computing his medical

expenses, however, John may include the $1,200

medical expenses paid for Mary.

greater medical deduction does not necessarily mean

that they will result in less tax. A joint return, because

of lower tax rates, may still produce a lower tax. Therefore, the only way one can be certain of filing the most

advantageous return in such a situation is by computing the actual tax liability both separately and jointly.

PRACTICE POINTER: A child of divorced parents who is

It should be understood that the 7.5% reduction is taken

only once on each return, regardless of the number of

individuals for whom a medical deduction is claimed.

subject to the special dependency exemption rules (¶309)

is treated as the dependent of both spouses for purposes

of the rules relating to medical expenses and medical

reimbursements. Thus, the spouse not entitled to the

exemption for a child may nevertheless claim a deduction

for medical expenses paid by him for that child.

Married couples may find it beneficial to file separate

returns in order to claim a larger medical deduction.

EXAMPLE: Sidney Green, during the year, paid the

following unreimbursed medical and dental expenses:

$1,110 for himself; $800 for his wife, Evelyn; $350 for his

child; and $1,450 for his mother (who qualifies as Sidney’s dependent). Sidney and his wife file a joint return

on which they report adjusted gross income of $45,000.

On Schedule A, Sidney can deduct $335 ($3,710 of

medical expenses minus $3,375 [7.5% of AGI]).

EXAMPLE: Assume that Sidney and Evelyn Green,

in the previous example, file separate returns instead

of a joint return. Sidney’s adjusted gross income is

$22,000, and he claims the exemption for both dependents. Evelyn’s adjusted gross income is $23,000,

and she claims only her own exemption. The medical

deduction of each will be computed as follows:

Sidney’s Return

Sidney’s, his child’s, and his

mother’s medical expenses

($1,110 + $350 + $1,450)

Less: 7.5% of AGI. . . . . . . . . . . . .

Medical Insurance Premiums

The cost of hospitalization and medical insurance

(including Medicare Part B) is deductible as a medical

expense. The cost of accident and health insurance policies

may be partly deductible. Such policies typically provide

for reimbursement not only of hospitalization, doctors’

bills, and other medical expenses but also for loss of

earnings and for loss of life, sight, or limbs. Because only

the medical expense portion of the premiums is deductible, a deduction can be claimed only if the insurance

company clearly allocates what portion of the premium

is for medical or other nonmedical benefits. If such an

allocation is made, the medical portion is deductible; if

no allocation is made by the company, no part of the

premium is deductible.

Examples of other deductible medical insurance premiums include:

Contact lens replacement insurance

Medigap (supplemental Medicare insurance)

Premiums under Medicare Part D (drug benefits)

Student health fee

PLANNING POINTER: There is a surtax on Medicare

Part B premiums in 2009, based on modified adjusted

gross income in 2007. For 2009, instead of the usual

$96.40 per month premium, it can be as high as

$308.30 per month, depending on MAGI and tax-filing

status. In view of this surtax, MAGI planning saves not

only taxes but also Medicare premium costs. Even

those who are not currently on Medicare should plan;

those who will begin in 2011 will pay premiums based

on 2009 MAGI.

$2,910

1,650

Total medical deduction

on Sidney’s return . . . . . . . . . . $1,260

Evelyn’s Return

Evelyn’s medical and

dental expenses . . . . . . . . . . . . . .

800

Less: 7.5% of AGI. . . . . . . . . . . . .

1,725

Total medical deduction

on Evelyn’s return . . . . . . . . . . .

$0

Total deduction on separate return . . . . . . . . . . . . . $1,260

Total deduction on joint return . . . . . . . . . . . . . . . .

¶808

¶808

$335

Long-term care insurance is treated as medical coverage

for purposes of deducting health insurance premiums.

However, the deductible portion in 2009 is subject to

the following limitation based on the taxpayer’s age:

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

Age Before the Close of the Tax Year

Limitation

40 or under

$ 320

41–50

600

51–60

1,190

61–70

3,180

Over 70

3,980

Health savings accounts (HSAs). Individuals who have

“high-deductible health plans” (medical insurance requiring

certain out-of-pocket payments before coverage starts) can

contribute to savings-type accounts to cover uninsured medical costs. Funds in the account can be withdrawn tax-free for

medical costs. For more details on HSAs, see ¶808A.

Small

employers and self-employed individuals can set up these

health plans, which are similar to HSAs. See ¶808B.

Archer medical savings accounts (MSAs).

NOTE: After 2007, no new Archer MSAs may be

established, but contributions to existing Archer

MSAs may continue (nonactive employees of participating employers would also be eligible for an

Archer MSA contribution). Thus, for those with existing accounts, self-employed individuals and small

businesses with high-deductible health plans can

continue to contribute to these accounts. Contributions can be made by employers or by employees.

Special deduction for self-employed individuals. Selfemployed individuals and more-than-2% S corporation

shareholders can claim their health insurance premiums as a

deduction from gross income. This deduction is not limited

by 7.5% of adjusted gross income. To claim this special

deduction, neither the taxpayer nor the taxpayer’s spouse

must be eligible to receive medical coverage from an employer.

This determination is made on a month-by-month basis.

For sole proprietors, the deduction is allowed whether

the policy is purchased in the business name or the proprietor’s own name, as long as there is sufficient income

from the business to at least equal the premium. For

more-than-2% S corporation shareholders, the abovethe-line deduction is allowed only if the corporation

purchases the policy (if the shareholders buy the policy,

they can deduct the premium only as an itemized medical

deduction subject to the 7.5%-of-AGI limit).

Certain displaced workers and retirees may qualify for a

health care tax credit of 65% of premiums. See ¶1107A.

87

STUDY QUESTION

2.

When itemizing deductions, medical expenses are

deductible to the extent that they exceed what

percentage of AGI?

a. 2.0%

b. 7.5%

c. 10%

¶808A Health Savings Accounts (HSAs)

(Sec. 223)

A health savings account (HSA) combines a highdeductible (low-cost) medical policy with a savings-type

account.

PRACTICE POINTER: Individuals covered by MSAs

can continue to fund their savings accounts. Alternatively, they can roll the funds over to HSAs; they

can continue to fund these new accounts if they meet

current eligibility requirements.

Taxpayers must be covered by a highdeductible medical insurance plan. This is defined in

2009 as follows:

Eligibility.

Coverage Type

Minimum

Deductible

Maximum

Out-of-Pocket Limitation

Individual

$1,150

$5,800

Family

$2,300

$11,600

Taxpayers cannot be covered by any other health plan,

including Medicare. However, taxpayers are eligible for

HSAs even if they have coverage for long-term care, dental care, vision care, accident insurance, disability, workers’ compensation, and disease-specific coverage (e.g.,

cancer insurance). Eligibility is determined on a monthto-month basis, on the first day of each month.

Contribution limits. Contributions for those with selfonly plans are $3,000, or $5,950 for family coverage.

Those age 55 or older by the end of the year can increase

their annual contribution limit by $1,000.

LOOKING AHEAD: In 2010, the basic annual contribution limit will be $3,050 for self-only coverage

and $6,150 for family coverage; again, these limits

can be increased by $1,000 for those 55 and older

by the end of 2010.

Contributions within the above limits made by an

employer on behalf of an employee are not taxable to

the employee. Contributions made by the taxpayer on

¶808A

88

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

his own behalf are deductible from gross income (i.e.,

they are not treated as itemized deductions).

For 2009 contributions to be

deductible, they must be made no later than April 15,

2010. The deduction for contributions to HSAs is

claimed as an adjustment to gross income on page 1

of Form 1040 (so it is deductible even if other medical

expenses are not itemized).

Claiming deductions.

PRACTICE POINTER: Contributions to HSAs can be

made via a direct deposit of a tax refund. For example,

if Ed files his 2009 income tax return in February 2010,

after which it reports a $1,000 tax refund, he can have

that refund deposited into his HSA for 2009 (or for

2010). If using the refund for a prior year contribution (e.g., 2009 in this situation), be sure the return is

filed early enough to give the IRS time to make the

transfer.

Treatment of distributions. Withdrawals from HSAs to

pay for qualified medical expenses (those expenses that

would be deductible as an itemized deduction if not reimbursed by insurance as well as over-the-counter medications) are tax-free. However, distributions cannot be used

to pay for health insurance (other than COBRA coverage,

long-term care insurance, or a Medigap policy).

Distributions for nonmedical purposes are taxed. There

is a 10% penalty unless the taxpayer is age 65 or over,

is disabled, or dies.

Transfers of HSAs incident to divorce are not treated as

a taxable event.

Funds remaining in an HSA at death can be transferred

tax-free to the surviving spouse if such person is the

designated beneficiary of the account.

¶808B Archer Medical Savings Accounts

(MSAs) (Sec. 220)

Taxpayers with Archer Medical Savings Accounts can contribute limited amounts to special savings accounts (similar

to HSAs). While 2007 was the last year in which an Archer

MSA could be established, contributions may still be made

to existing accounts after 2007.

A high-deductible health plan for purposes of Archer MSAs

is defined as follows:

¶808B

Coverage Type

Minimum/Maximum

Deductible

Maximum

Out-of-Pocket

Limitation

Individual

$2,000/$3,000

$4,000

Family

$4,000/$6,050

$7,350

Contributions for those with individual coverage are

limited to 65% of the deductible (75% of the deductible

for family coverage). As with HSAs, contributions for

2009 can be made through April 15, 2010.

Treatment of distributions. Withdrawals

from Archer

MSAs to pay qualified medical expenses are tax-free.

Distributions for nonmedical purposes are taxable and

subject to a 15% penalty unless age 65 or older or disabled (or on account of death).

¶809

Reimbursement of Medical Expenses

The total medical expense deduction for the year must be

reduced by any reimbursement received from insurance

or other sources during the year, including basic Medicare

benefits and supplementary Medicare benefits, whether

paid directly to the taxpayer or to the provider of the services. But amounts received for loss of earnings or damages

for injuries are not considered as reimbursements.

EXAMPLE: Seth Myer’s total medical expenses for

the year came to $600. His insurance company paid

him $125 for doctor bills and $700 for loss of earnings

while he was ill. His total deductible medical expenses

for the year (before the 7.5% reduction) are $475 ($600

– $125). The reimbursement for loss of earnings is disregarded for calculating the medical expense deduction.

If, as often happens, medical expenses are paid in

one year but reimbursement is not received until a

later year, the expenses are deductible in the year paid.

However, the reimbursement must be included in gross

income in the year received. Such income is reported as

“other income” on page 1 of Form 1040. If no medical expense deduction was taken in a previous year, the

reimbursement is tax-free and need not be reported.

If a reimbursement from insurance exceeds the total medical expenses, the excess reimbursement may or may not be

taxable, depending on who paid for the policy. If the taxpayer paid the premiums for the insurance policy, the excess

reimbursement is tax-free and need not be included in gross

income. If the taxpayer’s employer paid the premiums, the

excess reimbursement is taxable. If both the taxpayer and

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

the employer paid the premiums, the excess reimbursement

is taxable in the same proportion. Thus, when the employer

and the employee each pay half of the premium, one-half

of the excess reimbursement is taxable.

¶810

89

(To Be Filed with Form 1040 IN DUPLICATE)

Name ______________________________ I.D. # _________

Address ____________________________

City, State ___________________________ Year __________

Medical Expenses of a Decedent

WAIVER OF ESTATE TAX DEDUCTION

Expenses paid from a decedent’s estate for his medical care are treated as paid by the decedent in the year

incurred if they are paid within one year after the decedent’s death and are not deducted in computing his

taxable estate for federal estate tax purposes.

Pursuant to Section 213(c) of the Internal Revenue Code

of 1986, the fiduciary states that, to the best of his/her

knowledge and belief, medical expenses amounting to

$__________ claimed as a deduction on the attached return

have not been allowed as a deduction under Section 2053 of

the Code in computing the taxable estate for the purpose of

the estate tax imposed by Section 2001 of said Code.

EXAMPLE: John Smith, who filed his return on a

The fiduciary hereby waives any and all right to have the

foregoing item allowed at any time as a deduction under

Section 2053.

calendar-year basis, died on June 1, 2009, after

having incurred $8,000 in medical expenses. $5,000

of that amount was incurred during 2008, and the

balance of $3,000 was incurred in 2009. The decedent

filed his 2007 tax return on April 15, 2009. John’s

executor paid off the entire $8,000 liability in August

2009. The executor may file an amended return for

2008 claiming the $5,000 in medical expenses as

a deduction, thus securing a refund resulting from

the increase in the decedent’s 2008 deductions.

The $3,000 of expenses incurred in 2009 may be

deducted on the final return.

TAXES (SECS. 164 AND 275)

¶811

Introduction

Unlike medical expenses, which are deductible only from

adjusted gross income as an “above-the-line” deduction,

taxes may be deductible either from gross income as

an “above-the-line” deduction or from adjusted gross

income as an itemized deduction.

PRACTICE POINTER: As the estate tax exemption

Real estate taxes. For 2008 and 2009, real estate taxes

increases in the coming years, estates may no longer

be subject to estate tax, so there will be no need to

waive the right to deduct medical expenses for estate

tax purposes in order to deduct them on the decedent’s

final income tax return. For decedents still subject to

estate tax, the executor must weigh the tax savings

on the income tax return against that on the estate tax

return. Remember that there is no AGI limit on medical

expenses deducted on an estate tax return.

can be claimed as an additional standard deduction up

to $500 ($1,000 for a married persons filing jointly) by

taxpayers who do not itemize their deductions.

State and local sales and excise taxes on certain

vehicle purchases. For purchases on or after Febru-

ary 17, 2009, and before January 1, 2010, these taxes

on purchases up to $49,500 can be treated as an additional standard deduction instead of itemizing them.

See ¶801.

A copy of a waiver of the estate tax deduction follows:

Schedule A is used for claiming deductible taxes that are

not deducted elsewhere on the return.

Taxes You

Paid

(See

page A-2.)

s

a

9

t

0

f

0

a

2

r

/

D /11

8

5 State and local (check only one box):

a

Income taxes, or

. . . .

b

General sales taxes

6 Real estate taxes (see page A-5) . . .

7 New motor vehicle taxes from line 11 of

back. Skip this line if you checked box 5b

8 Other taxes. List type and amount .

.

.

.

.

5

.

6

. . . . . .

the worksheet on

. . . . . .

7

8

9 Add lines 5 through 8 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

¶811

90

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

¶812

Which Taxes Are Deductible?

Unless expressly made nondeductible (¶815), federal,

state, and local taxes incurred in the operation of a

business or charged against property used in business

are deducted from gross income together with other

business deductions on Schedule C (or Schedule F, for

farmers). If the above taxes are incurred as to operating

and maintaining property producing rents and royalties,

they may be deducted on Schedule E, Form 1040.

The same taxes are also deductible if they were paid (or

accrued) as to other income-producing activities or property, but only as a deduction from adjusted gross income,

if the itemized method is used. They are deducted on

Schedule A of Form 1040. Federal income taxes, however, are never deductible and will qualify neither as a

business expense nor as a personal deduction.

The following personal taxes are deductible from

adjusted gross income:

State and local income taxes

Foreign income taxes

claimed (¶814). For certain vehicle purchases in 2009,

state and local sales and excise taxes can also be treated

as an additional standard deduction amount (¶801) if

no itemized deduction is claimed for them. If the additional standard deduction is not claimed, the taxes can

be added to the sales tax amount found in the IRS table

or claimed separately as an itemized deduction on line

7 of Schedule A (subject to limits in ¶801).

The amount of the state and local general sales tax deduction is based on the state of residence and number of

people in the household. The deduction is taken from

an IRS table. To this amount is added any sales tax paid

on big-ticket items, such as a car, boat, or mobile home.

Those who live in more than one state during the year are

required to allocate the deduction amount in the table

according to the number of days in each state.

NOTE: The itemized deduction for state and local

sales tax expires after 2009, unless Congress

chooses to extend it.

¶814

NOTE: Instead of claiming an itemized deduction for

foreign taxes, a foreign tax credit may be allowed.

See ¶1115.

State, local, and foreign real estate and personal

property taxes

State stamp and documentary taxes (in connection

with income-producing property only)

Also deductible are employee contributions to state disability or unemployment funds in California, New Jersey,

New York, Rhode Island, and West Virginia.

The following personal taxes are deductible from gross

income (as an adjustment to gross income or as an additional standard deduction amount:

One-half of self-employment tax. See ¶801 and

¶2607

Real estate taxes up to $500 ($1,000 on a joint

return).

State and local sales and excise taxes paid on certain

vehicle purchases in 2009. See ¶801.

¶813

A common error made in preparing returns relates to

the deduction for state income taxes. The amount of

state and local taxes withheld is frequently overlooked,

or the incorrect state estimated income tax paid is used

in determining the state income tax deduction.

EXAMPLE: For 2009, a taxpayer deducts state

income taxes withheld, plus any state estimated

taxes paid in 2009, plus the additional state income

tax on 2008 income paid in 2009, plus any deficiencies for prior years paid in 2009.

If a state tax refund is received in 2009, it is excluded

to the extent that the earlier deduction did not reduce

the tax in the year in which the tax was deducted. See

¶713. It is not applied against the current year’s itemized

deductions. The refund is reported on the 2009 return

on page 1 of Form 1040 line 10.

PRACTICE POINTER: If a refund of state income tax

is reported as income on the 2009 return, it is treated

as a reduction to income for alternative minimum tax

purposes.

Sales Taxes

For 2008 and 2009, individuals are allowed to claim an

itemized deduction for state and local general sales taxes

if no itemized deduction for state and local income tax is

¶812

State and Local Income Taxes

PITFALL: A refund is not reported as income if the taxpayer did not itemize in the year the taxes were paid.

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

¶817

91

Real Estate Taxes

NOTE: Taxpayers who received a refund may receive

Form 1099-G showing the amount.

¶815

Nondeductible Taxes

State and local cigarette, tobacco, gasoline, and alcoholic

beverage taxes are not deductible. In addition, none of

the following items are deductible:

Social Security taxes paid by the employee

Federal and state estate, inheritance, and gift taxes

Motor vehicle registration fees (see ¶816)

Dog tag fees, hunting and fishing licenses, driver’s

license fees, federal excise and stamp taxes, and customs

duty, unless any of these are incurred as expenses in

carrying on a trade or business

The portion of Social Security tax paid by the employer

is deductible as a business expense. Federal unemployment insurance is paid by the employer and is, therefore, deductible by the employer. Contributions to

state unemployment insurance funds are deductible by

employers and (in states requiring employee contributions) by the employees.

¶816

Personal Property Taxes

State and local (but not foreign) personal property taxes

are deductible if they are ad valorem (i.e., based on the

value of the personal property).

EXAMPLE: Iowa imposes a motor vehicle registration tax

of 1% of value, plus 40¢ per hundredweight. A taxpayer’s

automobile is valued at $2,000 and weighs 3,500 pounds,

and he therefore pays an annual registration tax of $34

(1% of $2,000 = $20, + 35 x $.40 = $14). The $20 portion,

which is based on the value, is deductible. The balance,

which is based on the auto’s weight, is not deductible

unless incurred in connection with the taxpayer’s trade,

business, or other income-producing activities.

From the foregoing, we see that the specific deduction the

law permits for personal taxes applies only to state and local

taxes, not to federal taxes. Federal personal property taxes

are deductible only if they qualify as a business expense or

as an expense incurred in other income-producing activities.

Moreover, state and local levies are deductible only if they

are classified as a tax, not as regulatory or service fees. Thus,

charges for government services, such as water and sewers,

are not a true tax, but merely payment for services rendered.

As such, they are not deductible. (These charges, of course,

will be deductible if they qualify as business expenses.)

Taxes on a home or vacation property generally are deductible as itemized deductions. There is no dollar limit or any

restriction on the number of homes for which real estate

taxes can be deductible.

For 2009, those who do not itemize deductions can deduct

real estate taxes up to $500 ($1,000 on a joint return) as an

additional standard deduction amount. See ¶811.

If real estate is sold, the deduction

for real estate taxes must be apportioned between the buyer

and the seller, according to the number of days in the real

property tax year that each held the property. The taxes

are apportioned to the seller up to the date of sale and to

the buyer beginning with the date of sale. A settlement

statement usually reflects the apportionment. If the buyer

pays delinquent back taxes imposed upon the seller, such

payments may not be deducted by the buyer but must be

added to the cost of the property.

Sale of real estate.

PRACTICE POINTER: The closing statement for the

sale generally lists the apportionment of taxes.

¶818

Who May Deduct Taxes?

All taxes are deductible only by the person on whom they

are imposed. Thus, taxes paid by a parent on a child’s

property are deductible neither by the parent (they were

not the parent’s obligation) nor by the child (because the

child did not pay them). If taxes are paid by a tenant, as

part of the rental arrangement, for his landlord on business property, they will be deductible by the tenant, not

as a tax expense, but as additional rent (provided that the

rent is deductible). Then the tax would be deductible

by the landlord.

Tenant-stockholders in a cooperative apartment house or

home development can deduct a pro rata portion of their

carrying charges as real property taxes. See also ¶822.

¶819

Foreign Income Taxes (Sec. 901)

A taxpayer who has reportable income from foreign

sources on which income taxes to a foreign country

have been paid may claim a credit (as explained in

¶1115). Instead of claiming the foreign tax credit on

Form 1116, a taxpayer may elect to deduct the amount

of such taxes on Schedule A along with his other itemized deductions.

¶819

92

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

PRACTICE POINTER: Individuals who are subject to

the alternative minimum tax should consider claiming the foreign tax credit rather than deducting such

expenses. This is because the deduction will reduce

regular income taxes, thereby increasing alternative

minimum tax, whereas the foreign tax credit can be

used to reduce the alternative minimum tax.

INTEREST (SEC. 163)

¶820

What Interest Is Deductible?

A taxpayer may deduct interest paid (if on the cash basis)

or accrued (if on the accrual basis) on a debt, provided

that he is legally obligated to pay the debt and there is no

tax rule specifically barring the deduction. Interest paid

on another person’s debt is not deductible by the person

who paid it because that person had no legal obligation

to do so; the payment is treated as a gift to the debtor

and is not deductible in this case by either party.

EXAMPLE: Elliot Anderson’s brother Steve owned a

home. Because Steve was in financial difficulties, Elliot

made the mortgage payment. No deduction is allowed

to either Elliot or Steve. Steve did not make the payment and Elliot, who made the payment, had no legal

liability to do so.

PRACTICE POINTER: In the above example, Elliot

should make a gift to his brother. If Steve then pays

the interest, he can claim a deduction.

The same is true where a husband and wife file separate returns and one spouse pays interest on the other’s

indebtedness.

No deduction is allowed for personal interest paid during

the year (other than home mortgage interest and student

loan interest within limits described below).

Personal interest includes interest paid on car loans, credit

cards, life insurance policy loans, and other personal loans.

Interest paid to the IRS. Interest on tax deficiencies

generally is treated as nondeductible personal interest.

This includes interest on tax deficiencies related to

Schedules C, E, or F.

PITFALL: Interest on loans from 401(k) plans generally is nondeductible.

¶820

Mortgage interest on a principal residence or second

home is not subject to the personal interest limitation

where the interest on the loan is treated as “qualified

residence interest.” See ¶822.

Investment interest is deductible, subject to limitation.

The amount of investment interest that is currently

deductible cannot exceed the amount of investment

income for the year. Investment interest in excess of

investment income for any given year is carried over into

the next tax year. See ¶827.

Interest on student loans may be deductible, within

limits. See ¶827A.

Also, interest incurred to acquire an interest in a passive activity is subject to the passive loss limitation rules. See ¶709.

The character of interest—as business interest, personal

interest, investment interest, or passive activity interest—

is determined by how loan proceeds are used and not by

the type of collateral used for the loan. By “tracing” the

proceeds, the character of the interest is established. The

only exception is qualified residence interest. In that case,

interest on the loan is deductible, regardless of how the

proceeds are used. For example, interest on a home equity

loan of $50,000 is fully deductible (assuming the interest

is qualified residence interest), even though the proceeds

are used to pay for a child’s wedding, which is a personal

expense.

Individuals with outstanding personal loans can convert

nondeductible interest into deductible interest if they

consolidate those loans into a home equity loan. Not

only will the interest be deductible (assuming the home

equity loan satisfies the requirements in ¶822), but interest rates also generally are more favorable on home equity

loans than on other types of personal loans.

¶821

Where to Deduct

Interest, like taxes, may be deductible from gross income or

from adjusted gross income. If the interest paid is in connection with a taxpayer’s business, rental property, or traveling

expenses (such as interest payments on automobiles used

for business travel), it is an above-the-line deduction and,

therefore, deductible from gross income in computing

adjusted gross income. If the interest is paid in connection

with nonbusiness activities, such as investment properties

or on home loans, it is a deduction from adjusted gross

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

income—if personal deductions are itemized.

Whether the interest is a business or a nonbusiness expense

depends on the use of the money borrowed, not on the

kind of property used to secure the loan. Thus, interest

on loans used to buy merchandise is deducted from gross

income (on Schedule C), even though the loan was secured

by a mortgage on the taxpayer’s private residence.

93

PRACTICE POINTER: It is necessary for the borrower

to directly pay points to the lender. This requirement is

met where an amount is provided by the borrower (such

as a down payment, escrow deposits, earnest money

applied at closing, and funds actually paid at closing).

For purposes of this requirement, an amount charged

to the seller as points on the acquisition of a principal

residence is treated as paid directly by the borrower.

1

/

8

0

Schedule A is used for claiming interest deductible from

Interest

You Paid

(See

page A-5.)

Note.

Personal

interest is

not

deductible.

10 Home mortgage interest and points reported to you on Form 1098

11

12 Points not reported to you on Form 1098. See page A-6 for

special rules . . . . . . . . . . . . . . . .

13 Qualified mortgage insurance premiums (see page A-6) .

14 Investment interest. Attach Form 4952 if required. (See page A-6.)

15 Add lines 10 through 14 . . . . . . . . . . . . .

adjusted gross income.

¶822

10

11 Home mortgage interest not reported to you on Form 1098. If

paid to the person from whom you bought the home, see page

A-6 and show that person’s name, identifying no., and address Interest on Mortgages

[Secs. 163 and 461(g)]

Monthly mortgage payments normally consist of both interest and repayment of the loan principal. However, only the

interest portion is deductible. Banks and savings and loan

associations usually furnish a statement, either every month

or at year-end, showing the total amount of interest paid.

Home owners deducting interest on

seller-financed mortgages must report the seller’s taxpayer identification number.

Seller financing.

Points. So-called points paid to banks and savings and loan

associations, in order to obtain a mortgage for the purchase,

construction, or substantial improvement of a principal

residence, are deductible as interest in the year paid (unless

the deduction causes a material distortion of income).

The charge must have been incurred for the use of the

money, not to reimburse the lender for credit investigation,

appraisal, and other costs incurred in granting the loan.

Further, the points must not exceed the amount of points

generally charged in the area, and the charging of points

must be an established business practice in the area.

12

13

14

. .

.

.

.

.

.

.

15

As a matter of administrative practice, points paid in

connection with the purchase of a principal residence are

deductible by a taxpayer in the year paid if the following

conditions are met:

The Unified Settlement Statement (HUD-1) identifies amounts as points incurred in connection with

the indebtedness (e.g., loan origination fees, loan

discount fees, discount points, or points).

Amounts are computed as a percentage of the stated

principal loan amount.

Amounts paid conform to an established business

practice of charging points for personal residence

loans in the area, and the amount charged does not

exceed the amount generally charged in the area.

Amounts are paid in connection with the acquisition of

the taxpayer’s principal residence that secures the loan.

The amounts are paid directly by the taxpayer.

PRACTICE POINTER: Taxpayers can opt to amortize

points over the life of their home mortgage rather than

deduct them in full in the year of the payment. This option

should be used where they do not have sufficient itemized

deductions to benefit from the points write-off in the year of

payment but may be able to itemize in the coming years.

Loan origination fees paid by a buyer with regard to a

VA or FHA loan may be treated as deductible points,

but such fees paid by a seller may not.

¶822

94

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

Points paid to obtain a loan for the purchase of a principal residence are reported on Form 1098.

Generally, points paid to refinance a mortgage, regardless of

how the taxpayer arranges to pay them, are not deductible in

full in the year paid unless they are paid in connection with

the purchase or improvement of a home. This is true even

if the new mortgage is secured by the taxpayer’s principal

residence. In this case, points are deductible ratably over

the term of the mortgage. However, one appeals court has

allowed a current deduction in a refinancing of a short-term

mortgage where the refinancing was viewed as an integral

step in the overall financing of the home purchase.

Acquisition debt. This

is any debt incurred in acquiring, building, or substantially improving any qualified

residence (principal or secondary residence) of the taxpayer. The total amount of acquisition debt giving rise

to deductible residence interest is $1 million ($500,000

for married persons filing separately).

Home equity debt. This is any debt (other than acquisition

debt) secured by the principal or second home to the extent

the total debt does not exceed the home’s fair market value

reduced by its acquisition debt. This debt cannot exceed

$100,000 ($50,000 for married persons filing separately).

NOTE: The overall debt cannot exceed $1,100,000

PRACTICE POINTER: Any undeducted points can be

($550,000 for married persons filing separately).

deducted in full in the year the property is disposed

of or the mortgage is refinanced with a new lender.

Tenant-stockholders in a cooperative apartment house

can deduct their portion of interest payments on the

indebtedness of the cooperative. They can also deduct

their share of the real estate taxes on the building.

EXAMPLE: Fred Garcia owns and occupies an apartment in a cooperative project. His yearly carrying

charges amount to $2,100, of which $850 represents

his share of the interest on the building mortgage, and

$625 is his share of real estate taxes on the building.

These two items are deductible on Fred’s return as

interest and taxes, respectively.

NOTE: Certain taxpayers may be entitled to a mortgage interest credit. See ¶1115.

A cooperative housing corporation that charges

tenant-stockholders with part of the cooperative’s interest

and taxes in a manner that reasonably reflects the cost to

the cooperative of the interest and taxes allocable to each

tenant-stockholder’s dwelling unit can elect to have the

tenant-stockholder deduct the separately allocated amounts.

Prepayment penalties imposed for the privilege of prepaying a mortgage have been treated as deductible interest. In contrast, bank charges imposed on delinquent

payments that are not tied to the period of delinquency

are treated as nondeductible service charges.

Only qualified mortgage interest is deductible. In

defining qualified residence interest, a distinction is

made between acquisition indebtedness and home equity

indebtedness.

¶822

PITFALL: Interest on home equity debt used for any

purpose other than home improvements is subject

to alternative minimum tax.

Pre-October 14, 1987, debt is not subject to the $1

million limit. However, this debt reduces the $1 million

limit on new acquisition debt. Pre-October 14, 1987,

debt is debt incurred before October 14, 1987, that is

secured by a qualified residence on that date and at all

times thereafter.

If a home owner refinances a mortgage that

is acquisition debt, the treatment of the interest on the new

loan may or may not be fully deductible. If the new loan simply replaces the old loan, the new loan is treated as acquisition

debt and the interest is fully deductible as such. If the new

loan amount is greater than the outstanding balance of the

old loan, it is treated as acquisition debt only if the proceeds

are used to substantially improve the home. Otherwise, the

excess is treated as home equity debt, which is subject to the

$100,000 limit (i.e., interest on home equity debt in excess

of $100,000 is nondeductible). The treatment of points on

refinancing is discussed earlier in this section.

Refinancing.

Mortgage insurance. If a home buyer pays less than 20% of

the purchase price, lenders typically require mortgage insurance (MI). Such insurance is issued by private lenders, as well

as government agencies (Veterans Administration, Federal

Housing Administration, and Rural Housing Administration). For mortgage insurance obtained in 2007 through

2010, the premium is deductible as interest. However, there

is an income limit for this deduction. The full premium

can be deducted only if the home owner’s AGI does not

exceed $100,000. The deduction is reduced by 10% for

each $1,000 of AGI in excess of $100,000; no deduction

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

can be claimed once AGI exceeds $110,000. The AGI limit

for married persons filing separate returns is $55,000, with

a 10% reduction for each $500 of excess AGI.

NOTE: The deduction for mortgage insurance is set

to run only through 2010 unless Congress extends

this break.

STUDY QUESTIONS

3.

Which of the following taxes are not deductible

from adjusted gross income?

a. State income tax

b. Local property tax

c. Social Security taxes paid by the employee

4.

Which of the following interest payments are

deductible?

a. Interest on a tax deficiency arising from

Schedule C

b. Points paid to acquire a principal residence

c. Interest on a loan used to buy tax-exempt

securities

5.

In early 2009, Ed and Jan Brown “trade up” to

a larger home. They take out a mortgage for

$300,000. In late November, they need a new

roof and take out a home equity loan of $50,000,

$25,000 of which is used for the roof. In figuring

deductible mortgage interest, how much of the

loan amount(s) is taken into account?

a. $300,000

b. $325,000

c. $350,000

¶823

Discount on Notes and Bank Loans

When a taxpayer borrows money from a bank, the interest is usually deducted or “discounted” in advance. The

discount is deductible as interest when actually paid (or

accrued), not when the note was signed.

95

EXAMPLE: Rachel Adams borrows money from her

bank on June 20, agreeing to pay it back in 12 equal

installments, beginning July 20. She signs a note for

$1,000, but because the note is discounted in advance

at 18%, she actually receives only $820. If she uses

the cash method, the discount of $180 is considered

as being repaid in 12 equal installments of $15 each.

Thus, if Rachel pays before the end of the year all six

payments due in the current year, she can deduct $90

(6 x $15). If Rachel is on the accrual basis, she can

deduct $90 (6/12 x $180) for accrued interest, regardless of whether she made all payments.

¶824

Interest Paid to Produce Tax-Exempt

Income (Sec. 265)

If a taxpayer borrows money to buy or carry tax-exempt

securities, the interest is not deductible.

EXAMPLE: James West borrowed $10,000 at 9%

to purchase $5,000 worth of corporate stock and

$5,000 worth of municipal bonds. Only one-half of

the interest paid is deductible because the income

from municipal bonds is tax-exempt.

The disallowance of an interest deduction applies to

costs incurred to carry personal property used in a short

sale (¶1612).

¶825

Amortization of Bond Premiums

(Sec. 171)

If a taxpayer paid a premium in acquiring taxable bonds,

the taxpayer may, at his option, amortize the premiums

by deducting a pro rata portion each year over the life

of the bond.

Except in the case of bond dealers (who treat premium

amortization as a business expense), the amortization is

deductible from adjusted gross income.

If the interest on bonds is exempt from all tax, taxpayers

may not deduct the amortization, even though they must

reduce the basis of the bonds each year by a portion of

the premium.

¶826

Unstated Interest (Sec. 483)

In a sale of property with the proceeds payable in installments, a portion of the payments may be treated as

“unstated” or “imputed” interest.

An “imputed interest rate” will be treated as being

charged if less than the market rate of interest is charged.

Whether there is adequate stated interest in a debt instru¶826

96

1 0 4 0 P R E PA R AT I O N A N D P L A N N I N G G U I D E

ment issued for nonpublicly traded property is determined by reference to an appropriate “test rate.” When

adequate interest is not stated, the imputed interest rules

recharacterize part of the debt instrument’s principal

amount using a somewhat higher “imputation rate.”

The amounts of principal and interest as recharacterized

will generally determine the seller’s amount realized, the

buyer’s basis in the property, and the amount of interest

deductions and interest income for the buyer and the

seller, respectively.

For 2009, when the amount of seller financing does not

exceed $5,131,700, the minimum interest rate generally

must be 9% compounded semiannually or the applicable

federal rate (AFR). For sales over $5,131,700, the minimum interest rate is 100% of the AFR.

A special 6% rate applies in the case of intra-family

installment sales of real property valued at less than

$500,000.

¶827

Limitation on Investment Interest

[Sec. 163(d)]

The deduction for investment interest (defined below)

cannot exceed net investment income. The amount of

investment interest that cannot be deducted because

of this limit can be carried forward to the next tax year

and may be deducted to the extent that the net investment income exceeds the investment interest in that

later year.

PRACTICE POINTER: An election may be advisable

where there is no other investment income to offset

investment interest.

Investment expenses include all income-producing

expenses (other than interest expense) relating to the

investment property that are allowable deductions after

applying the 2%-of-adjusted-gross-income limit.

EXAMPLE: Jill Johnstone, a single taxpayer, has

investment income derived from interest income,

which together total $12,000. Jill’s investment

expenses (other than interest), which were directly

connected with the production of this income,

amounted to $980 after taking into account the

2%-of-adjusted-gross-income limit on miscellaneous itemized deductions. Jill also incurred

$12,500 of investment interest. Jill figures her net

investment income and the limits on the amount of

her investment interest expense deduction in the

following way:

Total investment income. . . . . . . . . . . . . . . . . . . .

$12,000

Less: Investment expenses (other than interest) .

980

PLANNING POINTER: Check for any investment

Net investment income. . . . . . . . . . . . . . . . . . . . .

$11,020

interest carryforwards from prior years that may be

added to investment interest for this year.

Less: Investment interest expense . . . . . . . . . . . .

12,500

Excess interest expense. . . . . . . . . . . . . . . . . . . .

$ (1,480)

¶828

Definitions for Investment

Interest Limitation

Investment interest generally is interest paid or accrued

on money borrowed to buy or carry property held for

investment.

Net investment income, for purposes of the limit on the

deduction for investment interest, is figured by subtracting investment expenses (other than interest expense)

from investment income.

Investment income generally includes gross income

derived from property held for investment (like interest,

annuities, and royalties). The IRS also considers interest

on tax refunds to be investment income.

¶827

Net capital gain from the disposition of investment property and dividends subject to the capital gain tax rate are

not treated as investment income. An election can be made

to include net capital gain and/or dividends as investment

income to the extent that net capital gain and/or dividends

are treated as ordinary income (the special capital gains

rates do not apply if the election is made).

This excess interest expense may be carried forward

to the following year.

The investment interest expense deduction is figured

on Form 4952.

¶828A Interest on Student Loans (Sec. 221)

Generally, interest on student loans is treated as nondeductible personal interest. However, a limited amount

of interest may be deductible as an adjustment to gross

income (whether or not the taxpayer itemizes other

deductions). The dollar limit on deductible student loan

interest is $2,500.

The deduction applies only to interest on a loan incurred

solely to pay higher education expenses (including

tuition, fees, supplies, and room and board). It does not

PA R T 1 — C H A P T E R 8 — D e d u c t i o n s : I n G e n e r a l , M e d i c a l E x p e n s e s , Ta x e s , a n d I n t e r e s t

include indebtedness to a related person. Adjustments

are made to qualified expenses for employer-provided

educational assistance, U.S. savings bond interest used

for higher education, education IRAs, and scholarships

and fellowships.

PITFALL: If a home equity loan is taken out solely

to pay higher education expenses, home mortgage

interest claimed as an itemized deduction cannot be

deducted again as student loan interest.

97

cannot claim the deduction on the student’s return.

However, where the student pays interest on the loan

after no longer qualifying as the parent’s dependent,

the student may be eligible for the deduction.

PRACTICE POINTER: It is important for families to

plan who should take out student loans: parent or

child. This decision will affect eligibility for the interest deduction on student loans.

For cancellation of student loans, see ¶716.

PRACTICE POINTER: A home owner who is eligible

for the student loan interest deduction should treat a

home equity loan used for higher education expenses

as an above-the-line deduction and forgo an itemized

deduction for interest on home equity debt. However,

if the home owner’s modified AGI precludes a student

loan interest deduction, then the interest is deductible

as interest on home equity debt.

Modified AGI limit. A full interest deduction can be

claimed only if modified AGI (essentially AGI without

regard to the foreign earned income exclusion) is below

$60,000 ($120,000 on a joint return). The interest deduction phases out once modified AGI reaches

$75,000 ($150,000 on a joint return). The deductible

interest for those within the phaseout range is figured

by using the following formulas:

Formula for Figuring the

Student Loan Interest Deduction

Singles:

Deductible amount

($2,500 maximum)

x

Modified AGI – $60,000

$15,000

Joint returns:

Deductible amount

($2,500 maximum)

x

Modified AGI – $120,000

$30,000

EXAMPLE: Sara Fisher, a single taxpayer, who just

graduated from college in 2009 while still owing student

loans, paid $2,600 of interest in 2009. Her modified AGI

is $67,500. Her interest deduction is reduced by $1,716

($2,500 interest limit multiplied by: [$70,000 modified

AGI – $60,000] ÷ $15,000). The deduction is limited to

$784 ($2,500 – $1,716 reduction).

The deduction cannot be claimed by someone who

can be claimed as a dependent on another taxpayer’s

return. So, a student who is still a parent’s dependent

STUDY QUESTIONS

6.

Student loan interest is deductible only as an itemized deduction. True or False?

7.