Insights on...

W E AL T H P L AN N I N G

INCOME TAX CHARTIABLE DEDUCTION SUMMARY

Tax Savings on Charitable Gifts

THE INCOME TAX CHARITABLE DEDUCTION

The United States is one of the most charitable nations in the world, as measured by the

percentage of gross domestic product that is donated for charitable causes each year. Although tax

savings is usually not the main motivation for philanthropy, donors generally expect their

charitable gifts to result in a deduction on their taxes.

Marguerite Griffin,

National Director of

Philanthropic Services

Tim Bresnahan,

Second Vice President

Philanthropic Services

American taxpayers may be eligible for an income tax charitable deduction for donations of

cash and other assets to charitable organizations in the U.S. The amount that a donor may deduct

from his/her personal income taxes depends, in part, on what the taxpayer donated and the type of

organization that received the donation. For example, donations of cash to public charities are

generally more favorable than donations of stock for the purposes of an income tax charitable

deduction.

A donor’s income tax charitable deduction is also limited by his/her adjusted gross income

(“AGI”) in a given year. For example, if a donor contributes cash to a public charity, the donor

may only deduct up to 50% of her AGI in the year she makes the donation. If she is not able to

use all of her deduction in a given year, she may be able to “carry forward” the unused portion of

the deduction for use in subsequent years (for up to five years).

November 2013

DOUBLE TAX BENEFIT

In addition to providing a potential income tax charitable deduction, donations of certain assets,

such as appreciated marketable securities, also provide a benefit to the donor in the form of

avoiding long-term capital gains. For example, when an individual sells shares of long-term

appreciated publically-traded stock, the proceeds of the sale are subject to capital gains tax.

However, if the stock owner contributes the shares to a public charity, there would be no tax due

on the transfer to charity and the charity could sell the shares without incurring taxable long-term

capital gains.

northerntrust.com | I n s i g h t s o n W e a l t h P l a n n i n g | 1 of 3

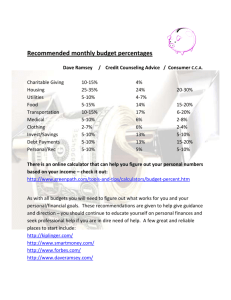

The following chart provides a helpful overview of the income tax charitable deduction:

Transfer To

AGI Limitation

Deduction Based On

Public charity

50% for cash

Fair market value

Private foundation

30% for long-term capital

gain property

30% for cash

20% for long-term capital

gain property

Charitable remainder trust

with public charity as

remainder beneficiary

Charitable remainder trust

with private foundation as

remainder beneficiary

Supporting organization

Non-qualified charitable

trust

50% for cash

30% for long-term capital

gain property

30% for cash

Fair market value for cash and

publically traded long-term

appreciated securities; tax cost for

other long-term capital gain

property, including closely held

stock and real estate

Fair market value

50% for cash

Fair market value for cash and

publically traded long-term

appreciated securities; tax cost for

other long-term capital gain

property, including closely held

stock and real estate

Fair market value

30% for long-term capital

gain property

N/A

N/A

20% for long-term capital

gain property

When determining how and when to fund charitable giving goals, it is important to consider

charitable gifts in the context of a donor’s overall wealth management plan. Working with

advisors, such as a financial planner or accountant, to select the most strategic assets for charitable

giving helps ensure the donor’s philanthropic and financial goals are aligned.

THE PEASE AMENDEMENT AND CHARITABLE CONTRIBUTIONS

The American Taxpayer Relief Act of 2012 (“ATRA”) reinstated the reduction in the amount of

itemized deductions for certain high-income taxpayers. Otherwise known as the Pease

Amendment (named after Congressman Donald Pease who sponsored the amendment in the early

1990s), total itemized deductions are now reduced by 3 percent of the amount that a taxpayer’s

adjusted gross income (AGI) exceeds a threshold amount: a threshold AGI of $300,000 for

married taxpayers who file jointly, $275,000 for heads of households and $250,000 for single

persons (indexed for inflation annually). Up to 80% of otherwise allowable deductions (charitable

contributions, mortgage interest, and state and local income and property taxes) could be

disallowed. While some commentators have predicted that the Pease Amendment would

discourage charitable giving, an analysis of the practical effects of the limitations present a

different scenario. Moreover, research has shown that from 1991 to 2009 when the Pease

northerntrust.com | I n s i g h t s o n W e a l t h P l a n n i n g | 2 of 3

Amendment was previously in effect, there was a negligible impact on the amount most charitable

taxpayers could deduct.

The extent of the loss of deductions is directly tied to AGI and, therefore, the impact for any

particular taxpayer requires individual analysis. For example, married taxpayers, Byron and

Nancy, have an AGI of $245,000. Their itemized deductions, including their charitable gifts, total

$50,000. Because Byron’s and Nancy’s income falls below the threshold amount at which the

Pease Amendment applies, they are not required to reduce their charitable or other deductions. In

other words, their charitable gifts remain fully deductible.

Essentially, the Pease Amendment is a tax on income that might otherwise escape income

taxation. The Pease deduction cap does not reduce the marginal value of tax deductions such as

charitable contributions. Even if a taxpayer recognizes a lower tax benefit from her charitable

contributions because of the Pease limitations, this should be balanced against the increased value

of her deductions given high income tax rates.

In summary, only a small number of taxpayers who make very large charitable gifts and have

very high incomes and/or no deductions other than charitable gifts could see a negative tax impact

from the reinstatement of the Pease Amendment.

FOR MORE INFORMATION

Wealth Planning Advisory Services at Northern Trust includes financial planning, family

education and governance, philanthropic advisory services, business owner consulting, tax

strategy and wealth transfer services.

If you’d like to learn more, contact a Northern Trust professional at a location near you or visit

us at northerntrust.com.

(c) 2014, Northern Trust Corporation. All rights reserved.

LEGAL, INVESTMENT AND TAX NOTICE: This information is not intended to be and should

not be treated as legal advice, investment advice or tax advice. Readers, including professionals,

should under no circumstances rely upon this information as a substitute for their own research or

for obtaining specific legal or tax advice from their own counsel.

IRS CIRCULAR 230 NOTICE: To the extent that this outline or any attachment concerns tax

matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding

penalties that may be imposed by law. For more information about this notice, see

http://www.northerntrust.com/circular230.

northerntrust.com | I n s i g h t s o n W e a l t h P l a n n i n g | 3 of 3