September

2014

NEWSLETTER

Dominion Global

Trends SICAV PLC

Alibaba:

Very Strong & Fairly Valued

This month we see the eagerly anticipated Alibaba IPO, which seeks to raise $21.1 billion making it the largest

in history. We take a closer look at the rise of the Chinese ecommerce giant and what to expect in the IPO.

Sharks, Thieves and Crocodiles!

As the story goes: Ali Baba was a poor man, a woodcutter, and one night in the woods he discovered

forty thieves visiting a magical cave in the forest. Concealing himself, Ali Baba overheard the secret

password that opened the cave’s otherwise impenetrable door. He waited until the thieves had gone

and approached the cave and uttered the now immortal phrase ‘Open Sesame’. The door swung open

revealing a cave filled to the roof with untold treasures. Ali Baba went on to outsmart the forty thieves

and become the richest merchant in all the land… This never happened. It is an Arabic folk tale from

One Thousand and One Nights.

The original Ali Baba fable however has much in common with the history of today’s ecommerce

superpower of the same name. They are both stories of humble beginnings and astounding

growth. Alibaba Group founded 15 years ago with just $60,000, in schoolteacher Jack Ma’s

apartment, would go on to dominate the Chinese ecommerce market and become the world’s

largest ecommerce company, with close to a quarter of a trillion dollars of goods traded across

its platforms in 20131, dwarfing the gross merchandise values (GMV) of western giants such as

Amazon ($100bln)1 and eBay ($76.5bln)1. It is also an unfinished story, for with its exposure to

structural growth in its Chinese home market and the potential for international expansion, Alibaba

may come to dominate the global markets and make good its vision to be a company that spans

three centuries, lasting 102 years.

In this article Dominion looks at the key elements of Alibaba’s success and provides some insight to

the questions: How did Alibaba conquer China? What the future holds for Alibaba? And whether it

is a good investment? In order to accomplish this we consider the company’s business model and

what makes it different from competitors, the markets it operates in (including the growth drivers) as

well as the valuation of the company in the build up to the IPO.

page 1/8

www.dominion-funds.com

September

2014

NEWSLETTER

Dominion Global

Trends SICAV PLC

How a Crocodile Conquered China

The Alibaba of today offers a dazzling number of services. Ranging from cloud computing platform Aliyun

with over 1 million customers, wholesale marketplaces (1668.com and Alibaba.com), messaging services,

a payment network (AliPay) to its vital retail online marketplaces Taobao, TMALL and Juhuasuan. The latter

combined generate 84.5% of the Company’s $8.5 billion revenue. However, it was not always this way.

China Retail Marketplaces

Taobao Marketplace

(Online shopping destination)

AliExpress

(Global consumer marketplace)

Tmall.com

Juhuasuan

(Brands and retail platform)

(Group buying marketplace)

Alibaba.com

1688.com

(Global wholesale marketplace)

(China wholesale marketplace)

Mr Jack Ma

Alipay (Payment services)*

China Smart Logistics (Logistics information system)**

Alimama (Online marketing services)

Data Platform

Alibaba Cloud Computing (Platform for internal and third-party use)

Exhibit 1: Graph outlining services offered by Alibaba Source: Company filing

When Alibaba was founded it had but one small site,

Alibaba.com, which focused on connecting small Chinese

manufacturers with overseas wholesale buyers. If it had stayed

as such it would just have been a footnote in Chinese corporate

history, another middling company perhaps. However, the

defining moment in Alibaba’s explosive growth came when

Mr Ma’s focus turned towards serving the demand of China’s

page 2/8

rapidly growing and newly affluent middle class. In 2003 he

launched Taobao - which translates as ‘search for treasure’ a consumer to consumer (C2C) marketplace similar to eBay’s

eponymous online marketplace. This change of focus proved

to be smart given that consumption is today 36.5% of China’s

$17.9 trillion GDP.

“eBay may be the shark in the

ocean but I am the crocodile in the

Yangzi. If we fight in the ocean,

we lose; but if we fight in the river,

we win”. Mr Jack Ma

Yangzi River, Crocodile

However the sector was already occupied by eBay, who through

its partnership with Eachnet controlled a market share of around

70% of the C2C landscape in China. Mr Ma famously remarked

“eBay may be the shark in the ocean but I am the crocodile in the

Yangzi. If we fight in the ocean, we lose; but if we fight in the river,

we win”. He was right: today Alibaba has a market share

of 96.5% in the C2C market and 50.1% in the business

to consumer market. How did the crocodile defeat the shark?

In the fairy tale Ali Baba defeats the 40 thieves with the help

of a slave, a healthy measure of cunning and a lot of burning oil.

Given that these are no longer considered acceptable business

practices we must look elsewhere for the key to Mr Ma’s

success, specifically the company’s business model and its

key elements: an appreciation for Chinese consumer culture,

the prioritising of trust in ecommerce, a better price and an

asset light infrastructure.

My Culture is your Culture

“Chinese consumers like busy web designs with strong colours.

Westerners prefer sparse sites like Google’s, but Chinese customers

want their websites to be noisy, with lots of links.” Zhang Yu, vice

president of marketplaces at Taobao.

Taobao is a Chinese platform. This extends beyond the nationality

of its employees or customers to the identity of its brand and its

platform design. The website design was carefully crafted in order

to provide ease of use and immediate familiarity for the Chinese

consumer. Red and Orange are the brands primary colours

symbolising festivity and prosperity. Similarly the layout of the

website is full and busy with every space filled with information

or pictures differing markedly from the more minimalistic western

approach which eBay had exported to China. This sent a clear

message; “we are Chinese and proud!” and allowed for early

differentiation from their larger foreign rivals.

Exhibit 2: Screen shot of Taobao layout. Source: Google Images

page 3/8

www.dominion-funds.com

September

2014

NEWSLETTER

Dominion Global

Trends SICAV PLC

Trust Me I Am A Website

The underlying foundation in all commerce - electronic or

otherwise - is trust. Simply put, both the buyer and seller must

believe they will not suffer from fraud. While familiarity breeds

comfort it does little to inspire trust in a user. Therefore in order

for Alibaba to create a sizable user base it had to convince

people that they provide a secure service. eBay and Amazon

originally provided this in the home markets through either

escrow payment (eBay’s PayPal) or the secure logistics chain

of Amazon’s owned distribution. Alibaba, however, had to

go further. It was, and still is, serving a population with a low

internet penetration (only 6.8% in 2003) that was far less familiar

and less trusting of the internet.

Accordingly, it is of little surprise that Alibaba has security fraud

prevention and consumer protection woven into its business

model. They offer flexibility in payments: with cash on delivery

one of the options that eliminates receivership fraud and

provides an easy bridge to ecommerce for new users. Though

the majority of payment volumes (79%) flow through AliPay, an

electronic payment platform created by Alibaba, which has the

ability to hold cash in escrow and return it to the buyer should

a dispute be resolved in the purchaser’s favour. Through these

measures Alibaba has been able to convince over 230 million

Chinese to use their site and the company records that disputed

transactions are less than 0.08% of all orders.

For a company to break into a market and take customers from

its rivals it must offer, or at least be perceived to be offering,

either a better service or price. In the case of Alibaba it offered

both across its online retail marketplaces of Taobao, and latterly

TMALL (a platform for established consumer brands) and

Juhuasuan (a group buying platform). However, the company’s

key differentiation was the tools it provided to sellers and the

price it charged for these tools.

On Alibaba’s platforms vendors create virtual storefronts, free

websites, within the Alibaba web domain using tools and a

virtual infrastructure provided by Alibaba. These pages would

then be searchable through an Alibaba indexing algorithm. This

search, explore and discover functionality allowed the company

to provide search results, suggestions and most importantly

advertising to buyers across its ecosystem, in a very similar

way that Google does for users of its search engine. In essence

Alibaba had created its own corner of the internet, a Chinese

Walled Garden.

page 4/8

The Walled Garden of the worldwide web

This system

fulfilled more than

5 billion packages

in 2013, 0.7 billion

more than the entire

UPS global

network in the

same year and

54% of all deliveries

in China over the

same year.

Exhibit 3: A Flowchart outlining Alibaba’s Market Place Offering.

Source: Company Filing

The company then offered a revolutionary pricing scheme

for its C2C business, Taobao. Traditional ecommerce models

relied on commission charged on sales. Taobao, by contrast

is completely commission free. Instead the company charges

merchants for upgrading their storefronts and advertising within

the Alibaba ecosystem and search engine. This freemium

pricing model provided a strong tailwind to merchant acquisition

which in turn drew more consumers. This led to a virtuous circle

- known as the Network Effect - as more sellers join due to the

high volume of consumers using the platform and vice versa.

These buyers now had an Alibaba account which could be

used across all their platforms, the Alibaba ecosystem, allowing

cross-selling opportunities and boosting user numbers for

commission charging platforms such as TMALL

and Juhuasuan.

The numbers speak for themselves. Through a compelling

combination of cultural awareness, a secure platform,

page 5/8

networking effects and improved pricing and services Alibaba

already has nearly one quarter of a billion buyers who are on

average each placing 49 orders a year - for a combined total

of 11.3bln per annum - with 8 million vendors.

This provides a logistical challenge as these orders need to

be fulfilled. Alibaba’s asset light business philosophy expands

into its logistics. The company owns no physical logistical

infrastructure but rather outsources to 14 chosen third party

logistics companies, termed delivery partners. Together they

employ more than 950,000 delivery personnel in over 600 cities.

Orders are processed and channelled through a joint venture

logistics platform, China Smart Logistics. This system fulfilled

more than 5 billion packages in 2013, 0.7 billion more than the

entire UPS global network in the same year and 54% of all

deliveries in China over the same year.

www.dominion-funds.com

September

2014

NEWSLETTER

Dominion Global

Trends SICAV PLC

Exhibit 4: EBITDA and EBITDA

Margin, 2014 onwards forecasts.

Source: Company Filing,

Dominion Model.

EBITDA (USD Millions)

EBITDA Margin

Scalable Business:

Growth = higher margins

Alibaba’s capital light business structure enabled the

company’s rapid growth. Indeed the only significant

investment in physical assets the company has to

make is in data centres to support web operations.

This means that as Alibaba grows it has to make very

little incremental investment to support the additional

revenue. The upside to such a scalable business model

is that as sales increase, so do margins as the company

generates operational leverage against the sunk cost of

R&D investment. The graph above illustrates the near

doubling of the post-tax operating margin.

However, the flip side of such a business model is

that a company must maintain their focus on R&D and

technical spending in order to maintain its network

and technological edge. Currently this appears to be

the case: Alibaba have 48% of its 20,884 workforce

dedicated to these tasks, either in engineering (35%)

or web operations (13%).

Growth Drivers: A Technological and

Demographic Perfect Storm

Alibaba’s growth has been nothing short of spectacular

with 72% and 52% revenue growth in 2012 and 2013

respectively, while profits have grown 157% and 88%

over the same periods. To understand how the Company

grew so fast and to glean future growth opportunities we

must also consider the structural growth drivers in the

company’s key market.

There are two elements to economic growth:

demographics and productivity. The former is

concerned with population size and make up, while the

latter with technology and workforce efficiency. Similarly

we can split Alibaba’s growth along demographic and

technological lines.

page 6/8

“The right

thing at the

wrong time

is the

wrong thing.”

Joshua Harris

Alibaba launched its first consumer focused site in 2003.

This displays either a considerable amount of foresight

or extreme good fortune, as the millennium marked the

new beginning of a Mega Trend which will change the

world - The Rise of Emerging Market Consumers. By the

end of 2003 China’s GDP per capita was $1,490, by 2013

it had more than tripled to $6,560. This meant that those

formerly on a subsistence lifestyle were moving to cities,

finding higher paying jobs, joining the middle class and

starting to spend on discretionary items. This proved a

strong structural growth tailwind for consumer focused

companies such as Alibaba.

Chinese Internet Population

700

600

500

400

300

200

Though this trend is very much still in motion, it is fair

to argue it is no longer the largest factor affecting the

growth of Alibaba. The rise of ecommerce is now the

dominant influence as more and more people come

online in China. In 2008, 298 million Chinese had access

to the internet. Today China boasts the world’s largest

online population with 618 million people online out of a

population of 1.37 billion, therefore a penetration of 45%.

By 2016 the online population of China is forecast to grow

to 790 million, an increase of 27%, driving penetration

close to 60%, still below the developed world average of

circa 85%. Currently only 49% of Chinese internet users

shop online, spending some $300 billion or 7.9% of total

Chinese consumption. However online shopping spend

is forecast to more than double by year end 2016 to

$611 billion - 11.5% of consumption - online penetration

and ecommerce adoption continues to increase as

smartphones become increasingly pervasive across the

Middle Kingdom (Alibaba already has 136 million mobile

users) and urbanisation continues.

100

If in the long-term we assume China can reach western

levels of penetration - both in internet and online

shopping - one could expect an online population of

1.16 billion people with 870 million online shoppers

spending some $1.36 trillion per annum. This implies that

the market - even with conservative spend per capita

penetration - can more than double again after 2016,

providing Alibaba with a high growth home market for

many years to come.

300

0

Shopping (USD Billions)

Online Shopping in China (UDS Billions)

900

100%

800

80%

700

600

60%

500

400

40%

200

20%

100

0%

0

EBITDA (USD Millions)

EBITDA Margin

Exhibit 5: Chinese ecommerce drivers.

Sources: CNNIC for 2008-2013, iResearch for 2014-2016

page 7/8

www.dominion-funds.com

September

2014

NEWSLETTER

Dominion Global

Trends SICAV PLC

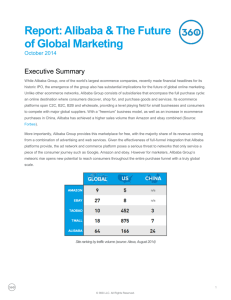

Good company does not a Good Investment Make

Renowned investor Warren Buffet once said, “It’s far better to buy a wonderful company at

a fair price than a fair company at a wonderful price.” Throughout the preceding course of

this article we have laid out the strengths and weaknesses of Alibaba and it is fair to say that

it is a strong company.

However, given that its forthcoming IPO is the most hyped of the year and has the potential

to become the largest tech IPO ever - overtaking Facebook’s IPO - it is highly unlikely that

the Crocodile of the Yangtze will list for a ‘wonderful price’. Therefore we must ascertain what

a fair price would be that could justify an investment.

Using a discounted cashflow model we calculate the company to be valued at $174.5 billion

($72.69 per share). However this method neglects any premium (or discount) that

the market may apply to the company. Given its higher margins, strong net cash fiscal

position and enviable incumbent position one could reasonably argue that Alibaba is

deserving of a premium against its peer group. This is in spite of questionable decisions

made by management in the past including the hiving off of AliPay in 2011 as a separate

non connected entity or the purchasing of half of Gaungzhou Evengrande football club.

A peer group of leading Chinese ecommerce companies, including the likes of JD.com,

Tencent and Baidu offer valuation benchmarks and suggest a valuation of around $162 billion

($67.50 per share) for Alibaba. This would be close to the top end of $66 to $68 per share

initial pricing of the company and suggests that the timing of the IPO is beneficial to selling

shareholders. If the company does price at the top end of the range then some will deem

this unattractive and will opt instead to invest in Yahoo which currently holds 24% of

Alibaba shares.

However, as the company prices, one thing is not in doubt; the Crocodile of the Yangzi River

is about to leave China and make its mark in the world.

“It’s far better to

buy a wonderful

company at a

fair price than a

fair company at a

wonderful price.”

Investor Warren Buffet

1. Source: Company Accounts

© 2014 Dominion Fund Management Limited (“DFML”). All rights reserved.

DFML is licensed by the Guernsey Financial Services Commission under the Protection of Investors (Bailiwick of Guernsey) Law 1987, as amended. DFML is a member of the

Dominion Group of companies. Registered Office: Ground Floor, Tudor House, Le Bordage, St Peter Port, Guernsey, GY1 1DB. Company no. 42592

page 8/8

GTC-ALINEWS-SEP2014

Yangzi River, China

www.dominion-funds.com