Swiss Monetary Policy under a Flexible Exchange

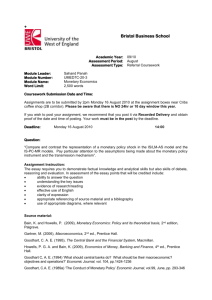

advertisement