Chapter 30 Money, Banking, and the Federal Reserve System

advertisement

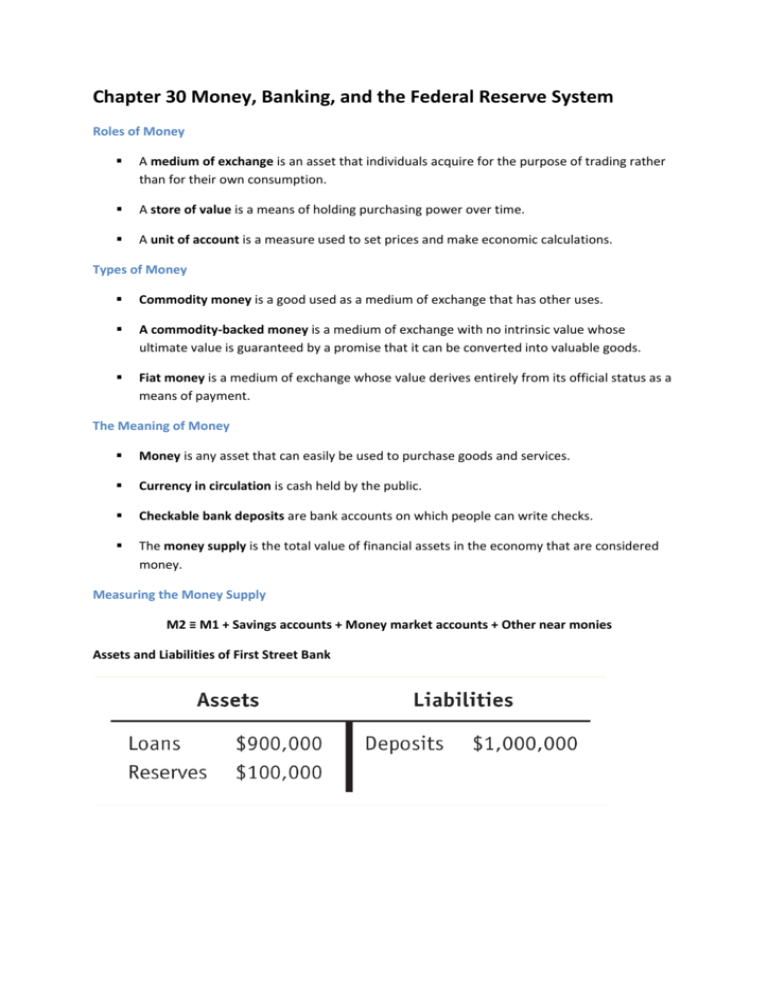

Chapter 30 Money, Banking, and the Federal Reserve System Roles of Money A medium of exchange is an asset that individuals acquire for the purpose of trading rather than for their own consumption. A store of value is a means of holding purchasing power over time. A unit of account is a measure used to set prices and make economic calculations. Types of Money Commodity money is a good used as a medium of exchange that has other uses. A commodity‐backed money is a medium of exchange with no intrinsic value whose ultimate value is guaranteed by a promise that it can be converted into valuable goods. Fiat money is a medium of exchange whose value derives entirely from its official status as a means of payment. The Meaning of Money Money is any asset that can easily be used to purchase goods and services. Currency in circulation is cash held by the public. Checkable bank deposits are bank accounts on which people can write checks. The money supply is the total value of financial assets in the economy that are considered money. Measuring the Money Supply M2 ≡ M1 + Savings accounts + Money market accounts + Other near monies Assets and Liabilities of First Street Bank The Problem of Bank Runs A bank run is a phenomenon in which many of a bank’s depositors try to withdraw their funds due to fears of a bank failure. Historically, they have often proved contagious, with a run on one bank leading to a loss of faith in other banks, causing additional bank runs. Bank Regulations Reserve Requirements ‐ rules set by the Federal Reserve that determine the minimum reserve ratio for a bank. For example, in the United States, the minimum reserve ratio for checkable bank deposits is 10%. The discount window is an arrangement in which the Federal Reserve stands ready to lend money to banks in trouble. How Banks Create Money required reserve ratio The percentage of its total deposits that a bank must keep as reserves at the Federal Reserve. Required reserve = Total deposit * required reserve ratio If Total deposit = 1000 and Required reserve ratio (RRR) = 10 %, Required reserve = 1000 * 0.1 = 100 Bank has to keep 100 at the Central bank as reserves. The Money Multiplier money multiplier ≡ 1 required reserve ratio The Federal Reserve System A central bank is an institution that oversees and regulates the banking system and controls the monetary base. The Federal Reserve is a central bank—an institution that oversees and regulates the banking system, and controls the monetary base. How the Federal Reserve Controls the Money Supply The ability of private and commercial banks to create money is limited by the volume of reserves in the system. The Fed controls the total volume of reserves. If the Fed wants to increase the supply of money, it creates more reserves, thereby freeing banks to create additional deposits by making more loans. If it wants to decrease the money supply, it reduces reserves. Three tools are available to the Fed for changing the money supply: (1) changing the required reserve ratio, (2) changing the discount rate, and (3) engaging in open market operations. Decreases in the required reserve ratio allow banks to have more deposits with the existing volume of reserves. As banks create more deposits by making loans, the supply of money (currency + deposits) increases. Changes in the required reserve ratio affect how much banks can lend from their reserves. Since changing this ratio changes the money multiplier, a small change in the required reserve ratio will have a very large impact on the money supply. For this reason the Fed rarely changes reserve requirements. open market operations The purchase and sale by the Fed of government securities in the open market; a tool used to expand or contract the amount of reserves in the system and thus the money supply. Open market operations are the most significant tools for controlling reserves. Reference A. KYI CIN THANT