PRODUCTIVITY SOLUTIONS FOR DISTRIBUTION, WAREHOUSING AND MANUFACTURING

mmh.com

®

September 2013

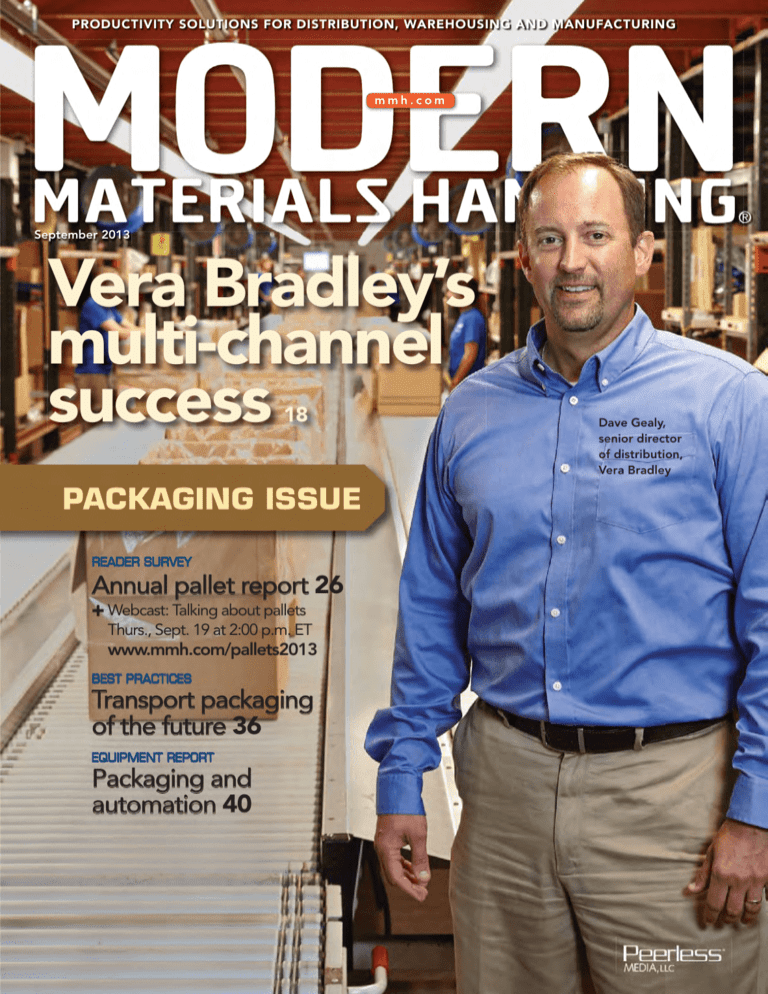

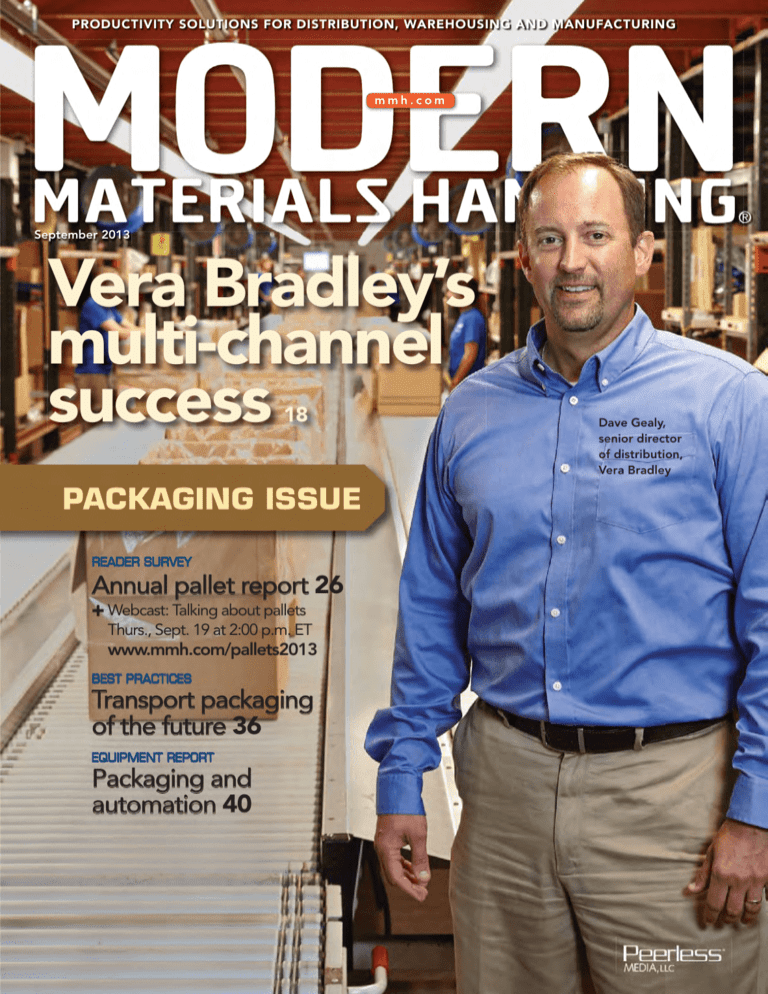

Vera Bradley’s

multi-channel

success

18

PACKAGING ISSUE

READER SURVEY

Annual pallet report 26

+ Webcast: Talking about pallets

Thurs., Sept. 19 at 2:00 p.m. ET

www.mmh.com/pallets2013

BEST PRACTICES

Transport packaging

of the future 36

EQUIPMENT REPORT

Packaging and

automation 40

Dave Gealy,

senior director

of distribution,

Vera Bradley

Improve

Operations

Order fulfillment is the most labor intensive and

highest cost function in many warehouses.

Manage these challenges with order fulfillment

technologies developed by Dematic.

Our solutions will help you develop fast,

accurate and cost-efficient fulfillment strategies

for virtually any product and order profile.

Let us show you the competitive advantage

of reduced fulfillment costs.

Learn More. Allow Dematic to

conduct a free facility audit and we’ll show

you how our new generation of order fulfillment

technologies can work for your environment

and budget.

Free Noise Cancelling Headphones*

Schedule today – visit www.dematic.com/fulfillment-audit

to request a free facility audit – we’ll visit with you to learn more about

your business, discuss technology options and leave you with noise

cancelling headphones as our personal thank you for your time.

*Qualifying conference call prior to facility visit required. Limit one headphone set per company.

www.dematic.com

usinfo@dematic.com

1.877.725.7500

UP FRONT

BREAKING NEWS YOU SHOULD KNOW

Daifuku Webb to acquire Wynright

DAIFUKU WEBB HOLDING COMPANY,

a subsidiary of Daifuku Co. Ltd., and

Wynright Corp. announced they have

reached a definitive agreement for

Daifuku Webb to acquire privately

owned Wynright. Under the agreement, Wynright will operate as a wholly

owned subsidiary of Daifuku Webb.

The acquisition is expected to be completed in the fourth quarter of 2013.

“The acquisition of Wynright will

strengthen our business in North

America and greatly improve the

services and products we offer our

customers, which is always our focus,”

said Brian Stewart, chairman, president and CEO of Daifuku Webb. “We

have worked together with Wynright

on several projects and have great

respect for their expertise in designing, manufacturing, integrating and

installing intralogistics solutions that

are helping some of the world’s largest

and fastest-growing companies.”

Wynright is headquartered in Elk

Grove Village, Ill., and has regional

offices and manufacturing locations

throughout the U.S.

North American robotics

companies set new records

for first half of 2013

MSSC partners with Houston

Community College

NORTH AMERICAN robotics

companies have set new sales

records through June of 2013,

according to new statistics

released from the Robotic

Industries Association (RIA),

the industry’s trade group.

A total of 10,854 robots valued at $679.3 million

were ordered from North American robotics companies in the first six months of 2013. Shipments to

North American customers totaled 11,308 robots

valued at $715.1 million, breaking the previous

first-half records set in 2012 by 11% in units and

10.4% in dollars.

“The advancements in robotics and machine

vision technology have allowed for new applications in materials handling, especially in picking,

packing and palletizing,” Jeff Burnstein, president

of RIA, told Modern.

THE MANUFACTURING SKILL STANDARDS COUNCIL

(MSSC) and Houston Community College (HCC) have

partnered to add the MSSC’s Certified Production

Technician (CPTAE) certification to HCC’s associate of arts

and sciences in manufacturing degree program.

“This partnership is a historically significant event for HCC and

the Houston community,” said

HCC acting chancellor Renee

Byas. “Through this partnership,

Houston’s manufacturing industries will have direct input in the kind of training they

need for their employees.”

“MSSC is delighted to work with Houston Community

College to provide industry-recognized, national certifications to meet the workforce skill needs for both

manufacturing and logistics (M&L),” said Leo Reddy, CEO

of the MSSC. “The closely integrated industries of M&L

together represent one-third of the heavily industrialized

Texas economy, well above the national average of 27%.”

ISM: July manufacturing activity at highest level since June 2011

MANUFACTURING ACTIVITY

in July continued its solid turnaround since dropping to its lowest levels since June 2009 in

May, according to the Institute

for Supply Management’s

monthly Manufacturing ISM

Report on Business.

The PMI, the index used by

the ISM to measure manufacturing activity, hit 55.4 in July,

up from June’s 50.9 and the

mmh.com

highest since 55.8 in June 2011.

New orders, which are often

referred to as the engine that

drives manufacturing, followed

a 3.1% increase in June with

a 6.4% increase in July to

58.3. The ISM said that this

increase is the highest for

the index going back to April

2011. And production, at 65,

was up 11.6% over June’s

53.4 and stands as the highest reading since May 2004.

Employment rose 5.7%

from June to an index of 54.4.

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

3

NO ELEVATORS. NO CONVEYORS. NO TRANSFERS.

.IJJ,IHKIW4VIWMHIRX34)<1EXIVMEP,ERHPMRK

My 25 years in the Material Handling industry

GSR½VQWXLEX4IVJIGX4MGO® will change the way

XLIQEVOIXETTVSEGLIWIEGLTMGOMRKSTIVEXMSRW

To hear more from Jeff about Perfect Pick go to

www.opex.com/material-handling

PERFECT PICK®

A revolutionary “One Touch”

goods-to-person picking

technology

4IVJIGX4MGO´W±SRIXSYGL²XIGLRSPSK]MWFEWIH

SREWMRKPIGSQTSRIRXXLIM&38®[LMGLLEW

access to the inventory and delivers directly to the

TMGOMRKWXEXMSRPSGEXIHEXSRISVFSXLIRHWSJXLIEMWPI

&IGEYWI[MVIPIWWM&38WSTIVEXIMRHITIRHIRXP]JVSQ

XLIVEGOMRKXLI]GERFIMRXVSHYGIHSVVIQSZIHMRE

QEXXIVSJQMRYXIWUYMGOP]EHETXMRKXLVSYKLTYX

VEXIWXSIZIVGLERKMRKFYWMRIWWHIQERHW

Exceedingly scalable in

both size and speed

Industry-leading throughput

Unmatched reliability

www.opex.com

856.727.1100

VOL. 68, NO. 9

®

PRODUCTIVITY SOLUTIONS FOR DISTRIBUTION,

WAREHOUSING AND MANUFACTURING

Dave Gealy,

senior director

of distribution,

Vera Bradley

PHOTOGRAPHY BY JEFF CASO, VERA BRADLEY

COVER STORY

SYSTEM REPORT

60 seconds with

Laszlo Horvath

18 Vera Bradley’s multi-channel success

The handbag and accessories maker’s new DC was designed to handle

store replenishment, wholesale distribution and direct-to-consumer

sales under one roof.

22 Designed for multi-channel distribution

Vera Bradley makes the most of pick-to-light and put-to-light

methodologies to optimize order fulfillment.

FEATURES

READER SURVEY

26 Talking pallets with Modern’s readers

From wood to plastic to pallet pools, our readers tell us what’s

important in pallets.

DEPARTMENTS & COLUMNS

3/ Upfront

7/ This month in Modern

14/ Lift Truck Tips: Narrow aisle

16/ Packaging Corner: Bulk containers

52/ Supplement: Warehouses/DCs

60/ Focus On: Totes and Containers

63/ Product showcase

66/ 60 seconds with...

NEWS

BEST PRACTICES

36 Transport packaging materials

of the future

Modern asked a group of packaging experts to take a peek at new

developments in secondary packaging for transport and shipping and

see which innovations might hold promise for improving the best

practices of tomorrow.

9/ Organizers prepare for largest

Pack Expo ever

10/ Report shows national 3PL revenues

more than doubled in past decade

12/ Menzies dies unexpectedly

Clarification

EQUIPMENT REPORT

In the August issue of Modern Materials

Handling, the photo on the contents page

of Jim Chamberlain should have credited

Jean-Marc Giboux/AP Images.

40 Packaging and automation:

Sealing the deal

With the growing complexity of e-commerce orders, packaging

methodologies prove as important to company missions as they are

to the speed of fulfillment.

PRODUCTIVITY SOLUTION

48 Brewery reduces labor with

floor-level palletizer

50 Custom storage containers enable

growth and optimize operations

mmh.com

Modern Materials Handling® (ISSN 0026-8038) is published monthly by

Peerless Media, LLC, a Division of EH Publishing, Inc., 111 Speen St, Suite

200, Framingham, MA 01701. Annual subscription rates for non-qualified

subscribers: USA $119, Canada $159, Other International $249. Single

copies are available for $20.00. Send all subscription inquiries to Modern

Materials Handling, 111 Speen Street, Suite 200, Framingham, MA 01701

USA. Periodicals postage paid at Framingham, MA and additional mailing offices. POSTMASTER: Send address changes to: Modern

Materials Handling, PO Box 1496 Framingham MA 01701-1496.

Reproduction of this magazine in

whole or part without written permission of the publisher is prohibited.

All rights reserved. ©2013 Peerless

Media, LLC.

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

5

Imagine the other wonders they

would have created with a Hyundai.

As one of the world’s top 25 international companies, Hyundai’s success is simple:

provide competitively priced products with a long list of standard features backed

by one of the industry’s best warranties. So no matter what job you dream up,

we have a forklift ready to move you. Learn more at hceamericas.com.

HYUNDAI FORKLIFT

Moving You Further

THIS MONTH IN

®

EDITORIAL OFFICES

MODERN

MICHAEL LEVANS

111 Speen Street, Suite 200

Framingham, MA 01701-2000

(800) 375-8015

GROUP EDITORIAL

DIRECTOR

Michael Levans

GROUP EDITORIAL DIRECTOR

mlevans@peerlessmedia.com

Bob Trebilcock

EXECUTIVE EDITOR

robert.trebilcock@myfairpoint.net

Noël P. Bodenburg

EXECUTIVE MANAGING EDITOR

npbodenburg@peerlessmedia.com

Josh Bond

ASSOCIATE EDITOR

jbond@peerlessmedia.com

Sara Pearson Specter

EDITOR AT LARGE

sara@saraspecter.com

Roberto Michel

EDITOR AT LARGE

robertomichel@cox.net

Jeff Berman

GROUP NEWS EDITOR

jberman@peerlessmedia.com

Mike Roach

CREATIVE DIRECTOR

mroach@peerlessmedia.com

Wendy DelCampo

ART DIRECTOR

wdelcampo@peerlessmedia.com

Daniel Guidera

ILLUSTRATION

daniel@danielguidera.com

Brian Ceraolo

GROUP PUBLISHER

bceraolo@peerlessmedia.com

PEERLESS MEDIA, LLC

www.peerlessmedia.com

Kenneth Moyes

PRESIDENT AND CEO

EH PUBLISHING, INC.

Brian Ceraolo

PUBLISHER AND PRESIDENT

PEERLESS MEDIA, LLC

MAGAZINE SUBSCRIPTIONS

Start, renew or update your FREE

magazine subscription at

www.mmh.com/subscribe.

Contact customer service at:

Web: www.mmh.com/subscribe

Email: mmhsubs@ehpub.com

Phone: 1-800-598-6067

Mail: Peerless Media

P.O. Box 1496

Framingham, MA 01701

For reprints and permissions, contact

The YGS Group at 800-501-9571 x100

or modernmaterials@theygsgroup.com.

ENEWSLETTER SUBSCRIPTIONS

Sign up or manage your FREE

eNewsletter subscriptions at

www.mmh.com/enewsletters.

Packaging takes center stage

T

his month in Modern, we fix the spotlight on packaging, a topic that’s now

clearly top of mind for savvy materials

handling professionals working in the evolving retail sector—and rightfully so.

The surging volume of smaller, more frequent orders that need to be filled due to

the nature of e-commerce continues to increase distribution complexity and is pushing companies to leverage highly responsive materials handling systems to meet the

demands of an ever-fickle consumer.

And while many e-tailers have reengineered their businesses around these

automated systems, they now find themselves searching for just the right packaging

solutions to not only speed up the process,

but to cut freight costs and maintain an environmentally sound position in the market.

The terrific case study that Modern

recently ran on Staples’ continued orderfulfillment transformation summed up the

state of packaging in e-commerce almost

perfectly. Its highly automated supply chain

process allows the second-largest e-tailer

to now ship millions of orders to customers

with the guarantee that any order placed

before 5 p.m. will be delivered the next day

to 98% of the U.S. population from its network of state-of-the-art fulfillment centers.

However, the Staples supply chain team

found that not even the most sophisticated

fulfillment process could solve their customers top complaint: excessive packaging.

Based on this feedback, the company created a self-imposed goal of a 20% reduction in packaging by 2020 and then set out

to find a solution.

In January 2012, the retailer launched

its “smart-size packaging program” and

deployed a system-wide rollout of a trans-

formational new technology known as “ondemand packaging.” The technology allows

Staples to automatically create a customsized carton specific for every less-than-fullcase order it ships.

Today, these types of orders—also known

as break-pack orders—account for approximately 40% of Staples’ order volume.

“It’s a remarkable change,” says contributing editor Maida Napolitano, who wrote

the article. “Staples has reduced costs,

they’ve given customers what they want,

and it’s a positive, environmental story.”

This month, associate editor Josh Bond

takes Modern readers deeper into the packaging challenge in his two-part article that

first explores the technology that is helping

companies to ensure speed and damage-free

movement within automated systems, and

then offers a snapshot of the automation that’s

improving traditional packaging processes.

“Packaging is not simply about keeping

up with throughput,” says Bond. “As the

last touch point between a merchant and

consumer, packaging speaks for the entire

organization. Changes in packaging might

improve the speed, efficiency and cost of

fulfillment, but all those gains are lost if it

negatively impacts customer satisfaction.”

And, if there’s any doubt of the importance that’s now being placed on packaging, look no further than the numbers being

reported in regards to this month’s Pack

Expo Las Vegas (Sept. 23-25).

According to PMMI, the association

that produces the show, 1,750 packaging

solutions providers (up 15% from 2011)

will occupy more than 700,000 square feet

of exhibit space. The association says this

will be the largest event since the show

opened in 1995.

Official Publication of

Member

www.peerlessmedia.com

mmh.com

Member of

Winner

Jesse H. Neal

Certificates of Merit

for Journalistic

Excellence

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

7

Follow

Modern Online

facebook.com/mmhmagazine

Twitter | @modernmhmag

Web | mmh.com

PACKAGING

Organizers prepare for largest

Pack Expo ever

SINCE EXPANDING EXHIBIT SPACE IN LATE JULY, THE SHOW

HAS ADDED ANOTHER 150 EXHIBITORS.

BY JOSH BOND, ASSOCIATE EDITOR

including:

Innovation Stage: 40 free half-hour

presentations, from engineering,

operations and cost-analysis experts

from the Alliance for Innovation

and Operational Excellence (AIOE)

and consumer insight analysts from

Mintel, among others. Central Hall,

Booths C-141, C-142 and C-143.

Center for Trends & Technology:

In this new special exhibit, learn how

technological innovations can improve

production. Central Hall, Booth 1358.

Food Safety Summit Resource

a third Innovation Stage to expand

PMMI, THE ASSOCIATION for

the on-floor educational programPackaging and Processing Technoloming, delivering even more insights to

gies, the owner and producer of

attendees looking to learn about ways

Pack Expo Las Vegas (Sept. 23-25,

to enhance sustainability, efficiency,

2013), is gearing up to host the

automation and food safety measures.

largest show since the event

The roster of educational proopened in 1995.

grams includes a number of new

As of Sept. 1, more than 1,750

and, for the first time, free events,

processing and packaging solutions

providers were set to occupy more than 700,000 net

square feet of show floor

space. The show is also on

track to play host to its largest audience of attendees.

Attendance is expected to

well exceed 26,000 manufacturing professionals from the

baking and snack, beverage,

confectionery, pharmaceutical and other industries—a

10% increase over 2011

numbers.

“Our exhibitor numbers

are already up 15%, and the

floor itself has expanded

by 12% compared to the

2011 Las Vegas show,” says

PMMI president and CEO

Charles D. Yuska.

As of Sept. 1, more than 1,750 processing and packaging solutions providers are set to

In fact, PMMI has added

occupy more than 700,000 net square feet of show floor space.

mmh.com

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

9

Center: Offering free presentations, information and one-onone consultations that address

critical food safety issues and

compliance with the Food Safety

Modernization Act. Upper South

Hall, Booth S-7332.

Reusables Learning Center:

This new program offers daily

free informative presentations by

end users and industry experts on

how they have successfully integrated reusable packaging into the

supply chain. Presentations are on

the show floor in the Reusable Packaging Pavilion. Lower South Hall,

Booth S-6458.

Education & Workforce Development Pavilion: Those looking for

education opportunities outside of the

show can meet several representatives

of colleges and universities in the Education Pavilion. Upper South Hall.

Clemson University Packaging

Emporium—Design for the Future:

Discover the impact that packaging

design has on consumer behavior as

you explore an interactive exhibit featuring Clemson’s biometric technology. Central Hall, Booth C-151.

The Amazing Packaging Race:

Teams of students from across the

country are given points as they go

hands-on with a variety of packaging

hardware and software.

PACK Solutions Challenge: Student teams are tasked with recommending a packaging solution for

a specific application. Students’ innovative solutions will be on display

after 3 p.m. on Monday, Sept. 23;

Tuesday, Sept. 24 and Wednesday,

Sept. 25 in the Education & Workforce Development Pavilion. Upper

South Hall.

3PLS

Report shows national 3PL revenues

more than doubled in past decade

A NEW REPORT SHOWS that 86%

of domestic Fortune 500 companies

use third-party logistics providers

(3PLs) for logistics and supply chain

functions, including General Motors,

Procter & Gamble, and Walmart,

who each use 50 or more 3PLs.

These are among the findings of a

report recently issued by Armstrong

& Associates, titled “Trends in 3PL/

Customer Relationships—2013.”

The report leverages Armstrong &

Associates’ proprietary database of

6,398 3PL customer relationships to

provide detailed information on the

top outsourcers to 3PLs, trends in

service demand, and 3PL market size

by vertical industry segment from

2005 through 2013.

Commenting on the report, Evan

Armstrong, president of Armstrong

& Associates, said 3PLs continue to

develop business at approximately

three times the rate of growth in the

U.S. economy.

“Even in the current slow-growth

global economy, overall U.S. 3PL

market growth was 6% in 2012 and is

forecast to be just over 4% in 2013,”

he said. “North America is benefiting from a slowly improving U.S.

economy with increasing manufacturing levels, the near-shoring of some

manufacturing to Mexico, and

newly addressable oil and gas

operations in Canada and the

U.S. At the same time, U.S.

consumers bounced back from

the great recession of 2009

and started to spend more. All

of these factors are driving a

slightly improved 3PL market.”

The average customer is

using each 3PL for just under

three different logistics services

with transportation management being the most frequent

service. Among all 3PL/

customer relationships analyzed, 18.5% are strategic, with

the 3PLs performing supply

chain management and/or

Report says that 86% of domestic Fortune

lead logistics provider ser500 companies use 3PLs for logistics and

vices. While these strategic

supply chain functions.

relationships were dominated

relationships within the retailing and

by automotive and technological industries in the past, there

industrial industries, said Armstrong.

are increasing numbers of strategic

Armstrong said the estimate of

3PL penetration of the total potential national 3PL market is 21%, up

from 10% in 2002. “Consistent with

the increased U.S. market penetration is our estimate of total U.S.

3PL revenues increasing from $65.3

billion in 2001 to $141.8 billion in

2012.” The report also quantifies

the Global Fortune 500 3PL market

at $250.2 billion, a 67% increase

since 2005.

The complete report is available

from Armstrong & Associates at:

www.3PLogistics.com.

E-Commerce Challenge:

Fast, Accurate Order Fulfillment.

Solution:

PUT-TO-LIGHT

Matthews

Fulfillment Systems

Systemsis delivers advanced material

Matthews Fulfillment

handling automation to maximize productivity, quality and

efficiency within your order fulfillment process. Our Lightning

Pick brand is the leading product suite of light-directed

technologies available.

This is why successful e-commerce operations utilize our putto-light solution for fast and accurate sortation of batch orders

into individual customer orders. Simply scan and sort by light

to gain 99.9+% accuracy levels, 40% average increases in

productivity and reduced operational costs.

Lightning Pick | A part of Matthews Fulfillment Systems

Phone: 262.250.2100 | Toll-Free: 800.827.8878

Email: info@lightningpick.com | Website: www.lightningpick.com

12

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

OBITUARY

Modern remembers

Jock Menzies

JOHN T. “JOCK” MENZIES III,

president of American Logistics Aid

Network (ALAN) passed away unexpectedly on Aug. 17 after an accident

at his Maryland home.

According to a published report, Menzies, 69, was traveling in a

private tram car on Friday when the

cable snapped and sent Menzies

falling 200 feet

down a steep

slope behind his

home in Arnold,

Md. Menzies

died as a result

of injuries susJohn T. Menzies III tained in the fall.

Menzies will

be remembered for helping to transform the logistics of disaster relief,

co-founding ALAN in 2005 after witnessing the breakdown in relief efforts

in the wake of Hurricane Katrina. The

nonprofit tapped into transportation

and logistics networks to supply water,

food and medical supplies to areas

hardest hit by natural disasters.

Among other notable achievements,

Menzies traveled to Haiti in the months

following the 2010 earthquake, where

he coordinated efforts to transport

Haitian orphans to safety. ALAN also

assisted with the delivery of critical supplies to victims of the Japanese tsunami

in 2011 and those of Superstorm Sandy

in 2012. As chairman of the Central

Maryland Red Cross in 2003, he helped

engage supply chain companies to assist in the wake of Hurricane Isabel.

Menzies brought expertise from his

30 years as chairman of The Terminal

Corporation, a logistics, warehousing

and transportation company based in

the Port of Baltimore. Menzies and his

brother bought the company from their

father and uncle in 1984. According to

the company’s Web site, the company

grew tenfold under Menzies’ guidance,

with current annual sales in excess of

$30 million. 䡺

mmh.com

YOUR

PRODUCTS

DESERVE

LESS.

LESS WAREHOUSE SPACE.

LESS EXCESS MATERIAL.

LESS WASTE. LESS COST.

LESS HASSLE.

Using the wrong packaging size with void

fill can cost you. Packsize® gives you the

ultimate flexibility to rightsize the box for

every product, on demand. Reduce

shipping costs and dimensional charges,

minimize the use of air pillows, eliminate

product damages due to package size,

decrease environmental impact, and

increase customer satisfaction.

GET PACKSIZED.

The world’s largest companies are

switching to On Demand Packaging®

packsize.com

LIFT TRUCK TIPS

Narrow aisles boost efficiency

for smaller operations

The transition to two-level picking can improve storage

and cut travel times in cramped facilities.

By Josh Bond, Associate Editor

W

hen lift truck customers think about narrow

aisle applications, the tendency is to envision

massive, hyper-efficient facilities with picking

at 400 inches, according to Bill Pfleger, president of Yale

Distribution for Yale Materials Handling Corp.

“Many people think of narrow aisle and picture these

huge facilities with tall aisles and sophisticated warehouse

management systems,” says Pfleger. “But, it’s also possible to make a lot of space very quickly by adding just

one additional layer of racking for storage or picking.”

Pfleger offers the example of a customer who traditionally used internal combustion lift trucks to stack

product on the ground. They did not have any expertise

in warehousing methodology, but they were looking at

pushing through almost twice the product the following

year compared to the current year. The solution included

a shift to narrow aisles with second-level order picking.

“It was simple enough to add a second level of racking in

the 5- to 12-foot pick zone, and the customer was able to

meet their expected growth.”

The key is to understand what’s changing and what a

customer thinks will change in terms of volume and SKU

profiles and the equipment needed to handle that, says

Pfleger. “If there are minimal changes, customers are able

to keep getting more efficient in their existing space. But

in cases of significant growth and space limitations, narrow aisle equipment can provide real benefits, including

increased efficiency and storage volume.”

In addition to storage efficiency improvement, some

small-scale narrow aisle applications can also significantly

reduce inefficient travel time. “Travel time is lost time in

the picking business,” says Pfleger. “Significant losses in

picking occur from travel time between picks and from

the last pick to wherever the finished pallet needs to be

transported.”

The transition from standard aisles to narrow aisles can

14

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

turn a few feet of width per aisle into productive space. In

very narrow aisle setups, subtle differences in the dimensions of equipment can enable a customer to even further

optimize floor space, where every inch counts. An example is a customer whose use of a slightly thinner lift truck

allowed them to add three more aisles of racks, amounting to a 2% increase in storage capacity. “That was huge

for them, because it didn’t require a dime of brick and

mortar to achieve the desired storage expansion,” adds

Pfleger.

Josh Bond is Modern’s associate editor and can be reached

at jbond@peerlessmedia.com

mmh.com

HOLIDAY RUSH

MANAGED BY STEVE.

PEAK EFFICIENCY

PROVIDED BY

VOCOLLECT.

B R O U G H T TO YO U BY VO C O LL EC T

BUSINESS OPTIMIZATION

SMART INNOVATION

OPERATIONAL FLEXIBILITY

PREMIER EXPERIENCE

MODERN MATERIALS HANDLING THOUGHT LEADERS WEBINAR

“TRANSFORMING YOUR DISTRIBUTION CENTER

OPERATION TO MEASURABLY IMPROVE

PERFORMANCE THIS HOLIDAY SEASON”

– PRESENTED BY KURT SALMON

Improving distribution center performance during the peak

holiday season is a paramount objective for virtually every

seasonal business. Preparing for the peak-season is a challenge

that continues to grow as the percentage of goods to consumer

increases in importance. This presentation will review key

components of developing a scalable and cost effective strategy to

measurably improve performance during peak seasons.

FEATURED PRESENTERS:

Steve Schaffer

Director

Kurt Salmon

Michael Levans

Group Editorial Director

Supply Chain Group, Peerless Media

SEPTEMBER 26, 2013

2:00 P.M. EST

ARE YOU READY TO MAKE

YOUR BUSINESS BETTER?

Visit www.mmh.com/vocollect5 to register.

© 2013 Vocollect. All Rights Reserved.

PACKAGING CORNER

Bulk containers deliver parts,

cost savings

Changes in bulk container size during the recession reduce

wasted trailer space and increase efficiency.

By Sara Pearson Specter, Editor at Large

M

ajor North American original equipment

manufacturers (OEMs)—including automotive, industrial machinery and appliance

makers—have long relied on reusable, plastic bulk

containers to transport components from suppliers

to assembly lines. During the recession, companies

seized the opportunity to further expand the use

of containers, says Scott Krebs, senior product category manager for BulkPak containers at Orbis.

“In addition to holding onto those assets longer, many companies took advantage of slower

production to push idle reusable containers even

deeper into their supply chains,” Krebs says.

“When they were busy, their traditional reusable

program only went to Tier 1 and Tier 2 suppliers;

during the slowdown they extended it to Tier 3

and Tier 4 suppliers.”

The advantage, says Krebs, is two-fold. In addition to eliminating more expendable packaging

and its associated costs further into the supply

chain, the companies involved have improved their

lean manufacturing and sustainability practices.

In the same vein, Krebs says that OEMs are

always looking at how parts and inventory handling

impact costs within their supply chain operations.

With most components trucked from supplier to

assembly, transportation and logistics efficiencies have

become a key area of focus because they represent up to

80% of costs, he says.

“Bulk containers used in these applications have a 45 x

48-inch footprint. When transported in a 53-foot trailer, 13

containers sit side-by-side down the length of the trailer

for 26 positions,” Krebs explains. “But that doesn’t completely maximize the volume of the trailer.”

Many OEMs have identified that wasted trailer space

as an opportunity for better efficiency, says Krebs. “Reengineering the sidewalls to a 44.5-inch footprint allows

two additional containers to fit the space in 14 side-by16

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

side positions. That lets OEMs fit more of their product

into a single truckload without requiring any changes to

line-side processes: The tops and bottoms of the containers still inter-stack, for example.”

Further, bulk container sidewalls have been redesigned

to create a shorter collapsed height for return shipping,

allowing a nine-high (instead of the previous eight) to fit a

trailer, says Krebs.

Sara Pearson Specter is an editor at large with Modern and

can be reached at sara@saraspecter.com.

mmh.com

The fastest-growing companies are making distribution their FORTE.

Warehouse Control System (WCS) Software

Driving high-performance

distribution operations

Supply chain managers must constantly

look for new ways to improve their

distribution networks to create

differentiation and stay ahead of the

Introducing next generation SCM

competition. At FORTE, our expert

innovations. The industry’s next generation

consultants engineer and implement

warehouse control system, FORTE’s Smart

Warehouse Suite™ (WCS 2.0), is a proven

innovative distribution operations

software platform for high-performance

that are flexible, scalable and, above

distribution operations. FORTE’s expert

all, profitable for many of the world’s

consulting team helps clients increase

fastest-growing companies.

operational flexibility using our costeffective technology for both integrating

automation and adding functionality.

Empowering operational decisions.

Whether examining the effectiveness of

Bridging the gap between WCS and WMS.

delivery systems or planning for future

Rather than force-fitting bloated software

DC enhancements, WCS 2.0 provides

packages into every distribution scenario,

the real-time business intelligence

FORTE’s methodology employs lean, agile

and the predictive analytics to guide

functionality to quickly extend legacy

operational improvements and strategic

systems capabilities and augment WMS

planning. This comprehensive visibility

tasks — without making WMS code changes.

to performance metrics enables proactive

Our highly configurable software alternative

issue resolution and advanced system

adapts to your most challenging requirements.

monitoring capabilities.

Download white paper

WCS 2.0 Smart Warehouse Suite™

at forte-industries.com/WCS

D I S T R I B U T I O N :

C O N S U LT I N G / E N G I N E E R I N G

|

D E S I G N / B U I L D

|

S O F T WA R E

T EC H N O LO G Y

MODERN system report

Vera Bradley’s

multi-channel

success

The handbag and accessories

maker’s new DC was designed

to handle store replenishment,

wholesale distribution and

direct-to-consumer sales

under one roof.

By Bob Trebilcock,

Executive Editor

18

S

E P T E M B E R

F

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

or years, retailers and their suppliers outsourced distribution

activities to third-party logistics (3PL) providers. The argument was that their core competency was in designing, sourcing, merchandising and selling, and not in picking, packing

and shipping.

In today’s retail market, where sales can originate from

multiple channels, that model is being turned on its head.

Brick-and-mortar retailers are selling online, Web retailers are opening retail stores and wholesale distributors are

competing in both channels. The best retailers recognize that

distribution has to be a core competency. They are bringing

distribution back in house, often serving multiple channels

under one roof.

Those were among the reasons Vera Bradley, a designer

and manufacturer of colorful quilted women’s handbags and

accessories, expanded to a 400,000-square-foot, multi-channel distribution space near its corporate headquarters in Fort

Wayne, Ind., last fall. The new facility added 200,000 square

feet and associated capacity in support of multi-channel

growth. It was designed from the outset to serve a number of

sales channels under one roof and from one reserve inventory,

including:

• wholesale distribution to specialty retailers that are Vera

Bradley’s traditional customers;

mmh.com

From left: Cindy Goheen, distribution manager,

warehouse; Ted Dienelt, distribution manager, shipping;

Jason Kiser, senior WMS specialist; Dave Gealy, senior director,

distribution; Larry Harness, inventory control manager.

PHOTOGRAPHY BY JEFF CASO, VERA BRADLEY

• wholesale distribution and value-added services for a

growing list of large, national retailers, which they refer to as

Key Accounts;

• store replenishment to Vera Bradley’s own growing chain

of retail and outlet stores; and

• a rapidly expanding direct-to-consumer Web fulfillment

business.

Working with a systems integrator (Forte, forte-industries.

com), Vera Bradley implemented a flexible system that includes

three multi-level pick modules, a best-of-breed warehouse management system (WMS) and a pick-and-pass order fulfillment

solution powered by bar code scanning, pick-to-light and put-tolight technologies.

The facility ships mixed pallets to Key Accounts, mostly

full cases to its outlet stores, split cases to specialty retailers as well as corporate stores and specially packed gift

boxes to online customers. All orders are filled from one

reserve inventory. “Orders flow through our pick-and-pass

fulfillment pipeline, regardless of where they originate,”

says Dave Gealy, senior director of distribution. “At the

same time, we created a foundation for a separate fulfillment flow for the Web should we begin to experience negative impact to service levels in the future due to multichannel growth.”

Two friends with an idea

In March of 1982, Vera Bradley’s co-founders Barbara Bradley

Baekgaard and Patricia R. Miller took note of the lack of feminine-looking luggage as they waited for a flight in the Atlanta

airport. Within weeks of arriving home, Baekgaard and Miller

created a company to market and manufacture their original

designs for stylish, cotton luggage, handbags and accessories. The company was named for Baekgaard’s mother—Vera

Bradley—a stylish woman who had once been chosen by

Elizabeth Arden to model.

It was an unlikely beginning for a women’s accessories

business. The new company was headquartered in Fort

Wayne, Ind., a city better known for heavy manufacturing

than its fashion sense. But, Vera Bradley quickly developed a

loyal following for its colorful designs.

Today, Vera Bradley has grown to more than $570 million

in annual revenue. While some product is still manufactured

in Fort Wayne, other items are also manufactured overseas.

Over the past seven years, the company has evolved from

one distribution channel into multiple channels. A Web store

for direct-to-consumer sales was launched in 2006. Internet

fulfillment was first outsourced to a 3PL in Michigan. The

next year, Vera Bradley opened its first retail store, and by the

end of fiscal year 2013, it will operate nearly 100 retail and out-

mmh.com

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

19

MODERN system report

Full cartons are stored and picked

from order pickers. These are most

commonly used to fulfill orders for

Vera Bradley’s key accounts.

let stores. In 2012, it expanded its Key

Accounts program, distributing its product to a select group of large, national

retailers and the military, many of whom

require value-added services. In all, Vera

Bradley is now distributing to more than

3,300 retail partners along with managing its growing online presence.

As recently as 2007, the company

was handling wholesale distribution

from a 40,000-square-foot facility

north of Fort Wayne while the 3PL in

Michigan handled Web fulfillment. In

the original facility, associates picked

by paper to shopping carts. However,

the growth in sales and sales channels

demanded a new distribution infrastructure, according to Gealy.

The first step was to open a

200,000-square-foot,

semi-automated

facility in February 2007, which included

20

S

E P T E M B E R

50,000 square feet of dedicated manufacturing space. The DC introduced

technology, automation and best practices. It featured high-density storage in a

very narrow aisle reserve storage area, two

pick modules with pick-to-light technology, and a WMS. E-commerce was still

being handled by the 3PL.

Within a year, Vera Bradley was

investigating ways to turn that facility

into a true multi-channel distribution

center that could support retail and

e-commerce order fulfillment. “In the

summer of 2008, we moved domestic

manufacturing to a new location across

town,” Gealy says. “Then we added a

level to our pick modules, expanded our

packing area and brought Web fulfillment in-house. It gave us the ability to

leverage our automation.”

By 2009, that facility was constrained. “We only had four dock

doors and limited staging space that

we often shared with shipping,” says

Cindy Goheen, distribution manager

for the warehouse. “That created a

bottleneck.” Despite the addition of a

third pick module plus adding levels on

existing pick modules, more space was

needed for picking, Goheen explains.

Service levels, which are the life blood

of retailing, began to degrade.

Creating a multi-channel facility

In 2010, the company did a network

study to determine whether it should

add a second distribution center. The

result indicated that Vera Bradley

would be better served by expanding

the existing DC, adding capacity and

implementing new processes for multichannel distribution rather than adding

a second DC.

In a sense, Vera Bradley’s business

model lent itself to multi-channel distribution, since a significant portion

of orders for retail distribution involve

split-case picking and mixed carton

orders, not unlike Web orders. “We

ship as many full cases as possible to

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

our outlet stores, but all of our other

channels are mostly split-case picking,”

Gealy says. The difference between the

channels is the size of the orders and in

how they are packed after picking. “We

ship mixed cartons with a number of

items to our retail stores and partners,”

he says. “Our typical Web order, on

the other hand, is gift boxed in a special way. So, we have a different profile

downstream at the packing station.”

The expanded facility builds on

the best practices Vera Bradley implemented within the first 200,000 square

feet, including very narrow aisle reserve

storage, enhancements to the WMS,

RF bar code scanning and pick-to-light

technologies. Processes are tied together

by a conveyor, sortation and associated

warehouse control system (WCS).

It features three multi-level pick

modules. Faster moving SKUs are

picked in two three-level modules. In

those, associates are directed by the

pick-to-light system.

Slower moving SKUs are picked in a

third module, where associates rely on

mobile computing and bar code scanning to receive instructions and confirm picks. In the future, the module

can be expanded to three levels.

All three modules can fulfill orders

for any sales channel. The real difference

is how the product is handled after it is

picked: Cartons for Key Accounts need

value-add attention and may be palletized and stretch-wrapped; cartons for

Vera Bradley’s stores and retail partners

are automatically weighed and taped

then sorted into trailers; Web orders are

sorted to packing stations for special gift

boxing before they are conveyed directly

into a parcel carrier trailer.

New features

The facility includes three new features

to optimize processes.

One is a put wall for direct-toconsumer orders with more than one

item. This is a wall with 18 bin locations that are enabled by lights. Each

bin represents a customer order. Totes

with SKUs for larger Web orders are

conveyed to the put wall area. When an

mmh.com

MODERN system report

The new Vera Bradley DC features a

unique light-directed put wall solution

for direct-to-consumer orders with more

than one item (top left). A separate

processing area fulfills orders for Key

Accounts (bottom right).

associate scans a UPC bar code label

from items in the tote, lights indicate

which bins will receive product from

that tote. Once all the items for an

order are put in the bin, a light on the

other side of the wall alerts a packer

that the sorting is complete and orders

are ready to be packed.

“More than 60% of our Web orders

are multi-unit orders,” says Gealy. “Using

the put wall takes the hunting and pecking for items out of the process.” The

put wall, he adds, has realized a nice

improvement in labor costs associated

with filling multi-unit orders.

Another feature is an 18,000-squarefoot mezzanine for value-added services

required by Key Accounts, such as

stuffing the bags with paper for shelf

display. The mezzanine area includes

some carton- and pallet-flow pick locations. “Before, we picked inventory that

required value-added services to a pallet truck and delivered them to processing tables,” says Gealy. Now, the product can be picked in one of the pick

modules and conveyed in and out of the

value-added processing area. Or, during

busy periods such as a core product

launch, that demand can be picked and

processed from the pick locations in

the mezzanine. “By putting the demand

there, we take that volume out of the

mmh.com

other pick modules,” Gealy says.

Finally, outbound shipping from the

Web packing stations bypasses the shipping sorter and flows directly into parcel carrier trailers. “Before the expansion, all of that volume went through

the shipping sorter,” Gealy says. “Now,

we’ve opened up capacity on the sorter

for retail and partner store growth.”

One of the keys to making these

systems work together is the integration between Vera Bradley’s WMS and

WCS. In the new configuration, the

WMS communicates with the order

management system to receive orders.

Based on priorities communicated from

distribution management, key shipping

associates determine which orders are

going to be picked, and the WMS then

determines how they will be batched

and where they will be picked from.

The WMS performs those management

functions and then sends the orders to

the WCS for execution.

“The WMS still handles conventional RF-directed picking,” explains

Jason Kiser, senior WMS specialist.

“But the WCS communicates with the

pick- and put-to-light systems, the conveyors and the sorter. Once the picks

take place, that information is communicated back to the WMS.” In that

sense, Kiser adds, the WMS “has taken

on more of a set up role for the WCS.”

By October 2012, the expansion had

gone completely live. Since then, the

bottleneck on the docks has become

a thing of the past. “We have 24 doors

and significantly more space,” says

Goheen. “We have the ability to bring

in a higher level of inbound materials

and process them more quickly.” Prior

to the renovation, Vera Bradley typically processed four to six inbound con-

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

21

MODERN system report

tainers in a 24-hour period. This past

March, the facility processed 39 containers in a 24-hour period.

Overall, the facility has seen a

decrease in distribution labor costs. “In

the two-week period after Thanksgiving,

we processed 40% more volume and

improved service levels by 60% over the

previous year,” says Gealy. “And, we did

it with very little stress.”

More importantly, he adds, the DC

has established the foundation to sup-

Designed for multi-channel

distribution

port Vera Bradley’s growth through the

foreseeable future. “We’ve been able to

address each of those pain points and

create solutions that can handle business growth for the next three to five

years,” he says.

Vera Bradley Designs

Fort Wayne, Ind.

SIZE: 400,000 square feet of distribution space

PRODUCTS: Women’s handbags and accessories, luggage

and travel items, eyewear, stationery and gifts.

Vera Bradley makes the most of pick-to-light

and put-to-light methodologies to optimize

order fulfillment.

THROUGHPUT: Each fulfillment channel is measured differently.

DIRECT-TO-CONSUMER: Averages 6,000 to 7,000 cartons

shipped per day. Peak was 27,000 cartons shipped.

V

era Bradley’s expanded distribution center was designed to

manage the company’s traditional wholesale and retail replenishment sales channels while accommodating the growth of its

Internet fulfillment. The facility brings together conveyor and sortation

technology along with both pick-to-light and put-to-light technologies.

STORE REPLENISHMENT: Averages 50,000 to 60,000 units

shipped per day for retail and specialty partners. Peak was

191,000 units shipped.

EMPLOYEES: 375 full-time and temporary associates, fluctuates seasonally

SHIFTS PER DAY/DAYS PER WEEK: 3 shifts, 5.5 days per

week (3:30 p.m. through midnight on Sunday).

Three-level pick module

4

Outbound staging

Value-added

services mezzanine

7

6

3 Narrow aisle

reserve storage

Shipping sorter

Taping lines

14

5 Slow-moving

13

Outbound

auditing

12

Put wall 11

SKU pick module

Narrow aisle 3

reserve storage

Outbound processing

and staging area

4

Receiving and staging

processing area

2

1

Receiving

7

Narrow aisle 3

reserve storage

Three-level pick

module

Single unit

e-commerce orders

8

9

Shipping

10

Parcel shipping

for e-commerce orders

22

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

mmh.com

MODERN system report

Receiving:

Product is

processes are complete, the prodreceived from two different System suppliers

ucts are conveyed to an outbound

sources.

order consolidation and staging

SYSTEMS INTEGRATOR AND WAREHOUSE CONTROL SYSTEM:

Vera Bradley receives an

area (7). There, they are palletForte Industries, forte-industries.com

advance ship notification

ized,

stretch-wrapped and staged

LIFT TRUCKS: Raymond, raymondcorp.com

(ASN) when sea containers

for

pickup

and shipping (8).

CONVEYOR: Dematic, dematic.com; Intelligrated, intelligrated.com

from off-shore manufacturPacking:

Direct-to-consumer

SORTATION: Dematic, dematic.com

orders are sorted to one of two

ers arrive in Long Beach or

WMS: Manhattan Associates, manh.com

pack-out areas. Totes picked for

Seattle. Containers travel

PICK-TO-LIGHT: Lightning Pick Technologies, lightningpick.com

single unit, e-commerce orders,

by rail to an inland port in

COMPUTING AND BAR CODE SCANNING: Motorola

which represent about 35% of

Chicago and then by truck MOBILE

Solutions, motorolasolutions.com

the direct-to-consumer orders, go

to Indiana. At the receiving

RACK: Ridg-U-Rak, ridgurak.com

docks (1), the process begins

to one area (9). Items are scanned

with a receipt against the ASN

to initiate the packing process.

in the warehouse management

They are then wrapped in tissue

onto the conveyor system, it is scanned

system (WMS). Cartons are manu- and diverted to a pick zone. Once it paper with embossed logo sticker and

ally palletized in the receiving area (2) reaches a zone, an associate scans the placed in a special shipping box along

where they are built into unit loads. license plate bar code label. Lights illu- with an invoice folio and gift card if the

The WMS creates a license plate bar minate the locations where items for consumer desires. Customers may also

code label to associate the SKU and that container are stored and indicate request a special two-piece gift box.

quantity to a pallet. Once pallets are the quantities to be picked. The asso- Once the process is complete, the carready for storage, product is inspected ciate presses the pick light to confirm ton is sealed and conveyed directly into

for quality control and pallets are staged the pick and places them in the carton. a parcel carrier trailer (10).

Multi-unit orders are conveyed to a

(2) for storage.

The container or tote is then conveyed

Domestically manufactured product to the next pick location until the order special put wall area (11). When a tote

arrives (1) at the facility on pallets. They is complete. It is then conveyed to the arrives, an associate scans the label on

the tote and begins scanning the UPC

are unloaded by lift truck, and staged next step in the process.

(2) for put away into storage.

• RF scanning for slow moving bar codes on items in the tote. When a

Storage: A lift truck operator scans SKUs: Slower moving SKUs are stored UPC bar code is scanned, the system

the license plate bar code on a staged in a one-level module (5) that includes lights up the location that will receive

pallet and is directed to a drop-off loca- carton flow and conventional deck rack the item from that tote. That process is

tion for the very narrow aisle reserve for storage. Any order with a SKU from repeated with each unit in a tote until

storage area (3). There, the pallet will this module initiates there. The picking all of the items for an order have been

be picked up by a wire-guided turret process is similar to the process in the put to a bin. At that point a light on

truck. That operator will be directed to three-level pick modules, except that the other side of the put wall will india storage location in the reserve storage orders are sent to the associate’s mobile cate that the order is ready for packing.

area. The product is now available to fill RF computer and picks are confirmed An associate will remove items from

by scanning a bar code label. Once all the bin and pack the order similar to

orders.

Picking: Vera Bradley uses two of the picks are complete, the container a single-unit order. The order is then

is either conveyed to one of the three- conveyed directly into a parcel carrier

picking processes.

• Pick-to-light for fast-moving level pick modules (4) or to the next trailer (10).

SKUs: The fastest-moving SKUs are step in the process.

Shipping: Some cartons are comstored in two three-level pick modules

Value-added processing for Key plete coming out of a pick module.

(4). Within the pick modules, product Accounts: Value-added processes are They require neither value-added

is stored in both pallet flow and carton performed in an 18,000-square-foot processing nor packing and convey

flow racks. Associates are directed by mezzanine area (6). Items requiring to a carton sealing area and then to

pick-to-light technologies and can fill value-added services can be conveyed the shipping dock. In route, the carorders from any sales channel. Orders from one of the slow- or fast-moving pick tons pass over an inline scale which

for retail partners, corporate stores and modules. Or, during busy selling sea- audits (12) the actual weight of the

Key Accounts are picked to a shipping sons, those items can be picked from a carton to the projected weight. If the

carton. Web orders are batch picked to carton-flow area located within the mez- weight is correct, the carton is taped

a tote that will be sent to a packing sta- zanine to improve the order flow in other (13) and sorted (14) to a shipping

tion. When a carton or tote is inducted picking areas. Once the value-added lane (8). 䡺

24

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

mmh.com

NOTEWORTHY

When our engineers work on a motion project with you, they share everything that’s in their

heads. Sometimes that means turning over 100 pages of notes, formulas and drawings. Other

times, it’s simply having straight forward conversations.

At the same time, Yaskawa customers share their proprietary knowledge because they can trust

us. Because we give their challenges a lot of thought. Because when they talk to us, they know

we are on their side.

Trusting the guys across the table from you with your most important product secrets.

That’s noteworthy.

YA S K A W A A M E R I C A , I N C .

DRIVES & MOTION DIVISION

1 - 8 0 0 - YA S K A W A

YA S K A W A . C O M

Follow us:

For more info:

http://Ez.com/yai527

©2013 Yaskawa America Inc.

MODERN reader survey

Pallet Report

Talking

pallets with

Modern readers

From wood to plastic to pallet pools, our

readers tell us what’s important in pallets.

R

By Bob Trebilcock,

Executive Editor

ecently, we read a case study about how CHEP and IFCO

worked with a food distributor to develop a new pallet management program. The project involved the implementation

of a dock sweep program to pick up CHEP pallets shipped

to the distributor and a new design for better performance

of the used wooden pallet shipped to the distributor’s customers. “The industry is really becoming more consultative

and service based rather than product based,” a spokesperson

from CHEP told Modern.

That change may not yet be fully reflected in the broad

market. In fact, 56% of respondents in Modern’s annual survey

of pallet users said purchase price was the most important factor in their decision to use a certain type of pallet. That was

more than any other factor. But, it is reflective of feedback we

hear from system integrators, who are beginning to understand

that a poorly built pallet can wreak havoc on their automated

systems, and consultants who are now paying attention to

how their clients’ loads perform after they come off the end of

26

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

the packaging line. In other words, pallets and the associated

transport packaging are more of a priority than ever.

That may explain why the pallet market continues to grow,

even as shippers look for alternatives to the every day wooden

pallet. Research firm Freedonia Group expects the pallet market to grow by 3.5% a year through 2017. While modest, that’s

a growth rate that is faster than the overall economy.

How then does the user community view pallets? To

answer that question and others, we surveyed subscribers

of Modern as well as a sample of recipients of our e-newsletters. We received 353 qualified responses, defined as

a reader who is employed at a location that uses pallets.

Here’s what we learned.

Purchasing decisions

A number of factors go into the decision to buy a certain type

of pallet. And, while purchase price remains the most important factor, cited by 56%, it was down from 63% of readers

mmh.com

Reader Survey Report/Webcast

ANNUAL PALLET REPORT

Thursday, Sept. 19, 2013 • 2:00 PM ET

www.mmh.com/pallets2013

What types of pallets do you use?

91%

Wood

37%

Plastic

18%

Wood composite

Cardboard/corrugated

the prior year. Cost per use was cited

by nearly 40% of respondents, suggesting not only that cost is important, but

that readers are getting more than one

trip out of their pallets.

Other leading factors include:

• 53% strength,

• 50% durability,

• 43% customer requirements,

• 40% reusability, and

• 32% availability.

Wood pallets still predominate. They

are used by 91% of readers. However, pallets manufactured from alternative materials are in the mix, with some readers also

using:

• 37% plastic pallets,

• 18% wood composite,

• 8% cardboard/corrugated, and

• 7% metal.

More importantly, there appears

to be a growing interest in alternative pallets. In its most recent report,

Freedonia noted that plastic pallets

are expected to record above average

growth. The research group also premmh.com

8%

Metal

Other

7%

3%

Source: Peerless Research Group (PRG)

Are the wood pallets you purchase new or used?

58%

60%

What has been your experience

obtaining used wood pallets?

Quality is not as good, worse

27%

Fewer pallets are available/

Used pallets are in short supply

27%

They are more expensive

16%

Pallet

pool

Other

New Used pallets,

pallets

or cores

15%

5%

Have not experienced nor

do we anticipate any issues

procuring used pallets

39%

Source: Peerless Research Group (PRG)

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

27

Reader Survey Report/Webcast

ANNUAL PALLET REPORT

Thursday, Sept. 19, 2013 • 2:00 PM ET

www.mmh.com/pallets2013

dicted that metal pallets will notch the

During the next 12 months what do you expect

biggest percentage gains of any of the

from your usage of plastic pallets

three most common pallet types (wood,

plastic, metal).

Those projections are supported by

Modern readers: 34% indicate they used

Stay the same 62%

more plastic pallets during the last 12

months, compared to 27% who reported

they were using more plastic pallets in

Decrease 5%

last year’s survey; 33% expect to increase

their usage of plastic pallets in the next

Increase 33%

12 months. Most respondents said they

are attracted to the cleanliness and longer life span of plastic pallets:

• 48% said compliance issues/cleanliAnd, why do you expect your usage of plastic pallets to increase?

ness and safety reasons;

• 45% said plastic pallets are more

Compliance issues/Cleanliness and safety reasons

48%

sustainable than wood and last longer;

More sustainable than wood/ Last longer

45%

• 40% said plastic pallets are more

Durability

40%

durable than wood;

• 25% said customers ask for plastic

Customers are asking for plastic pallets

25%

pallets; and

Greater control over our pallets

18%

• 18% said customers have greater

control over their pallets.

18%

Other

Although Freedonia Group predicts

increasing demand for metal pallets, only

Source: Peerless Research Group (PRG)

4% of respondents expect to start using

metal pallets in the next 12 months, and

only 8% expect their usage to increase in the next 12 months. bors, including Canada (80%), Mexico/South America/

Readers indicate they are exploring metal pallets because Carribean (67%), China/Asia (63%), Western Europe (50%)

they are durable, cleanable and conductive; because their and Eastern Europe (39%). Keep an eye, however, on the

customers want options besides wood and plastic; and Middle East and North Africa (33%).

because they are exploring options for reusable pallets.

International business does require a different pallet

The 48 x 40-inch is still the most commonly used size strategy for most shippers, with only 22% reporting that they

of pallet, according to 58% of readers. That was a signifi- don’t do anything differently for international and domestic

cant change from the 81% that reported using 48 x 40-inch deliveries. Some of the strategies include:

pallets last year. Still, no other size was being used by more

• 45% treat their pallets;

than 17% of respondents. Only 8.3% reported that they are

• 18% use alternative materials other than wood that don’t

shipping on a 24 x 20-inch half pallet, down from 10% in last require treatment;

year’s survey.

• 12% use wood pallets from their own pool; and

The number of respondents who are using pallets to ship

• 6% use a pallet pool for international shipments. This is

globally dipped from 57% to 55% this year, while the num- double the 3% who reported using a pallet pool for internaber that report they only ship domestically rose from 39% tional shipments in 2012.

to 42%. Only 3% ship on pallets solely to international cus- It’s still a wooden pallet market

tomers. If pallets are a leading indicator of economic activity, While plastic, presswood and metal pallets are taking some marthis slight dip coincides with the drop in exports from U.S. ket share, no alternative is as versatile and cost-effective as new,

manufacturers.

used or pooled wooden pallets.

Like last year, the leading recipients are our closest neighModern’s readers appear to take a strategic approach to

28

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

mmh.com

The Order Fulfillment Experts.

Define-Design-Implement

Higher Profitability Distribution Centers

Numina Group is an industry leading material handling

integrator with a rock solid track record consistently exceeding

project performance specifications. Our 27 years of industry

leading expertise provides clients a knowledgeable, reputable

partner for define, design and implementation of turn-key

distribution operations.

RDS™ Software is the key to accelerating performance.

Our solutions are powered by RDS™, a Powerful, Scalable,

Tier 1 WCS. Its family of application control modules provides

unsurpassed performance in pick, pack, ship, order fulfillment,

conveyor controls, and sorting applications.

Pick – Speaker Independent Voice Directed Picking with

Cartonization for Pick to Carton, Batch Pick Carts, Zone Route Pick

Powered by RDS™

Modules, and Mixed Case Pick to Pallet

Pack – LitPak

Pack Sheet Automation Prints, Folds and

Inserts Invoices and Documentation

™

Powered by RDS™

Ship – In-line Scan, Weigh, and Dimensioning with Print and

Apply Labeling to Auto Apply Packing Slips, Shipping and/or Retail

Compliance Labels

Powered by RDS™

Lean Design – Perfect Order Practices

10331 Werch Drive, Woodridge, IL 60517 630-343-2600

www.numinagroup.com

Reader Survey Report/Webcast

ANNUAL PALLET REPORT

Thursday, Sept. 19, 2013 • 2:00 PM ET

www.mmh.com/pallets2013

pallet usage—given the percentages, a typical respondent is

probably purchasing both new and used pallets, and some

are also participating in a pallet pool. In all likelihood, these

decisions are driven by the requirements of their customers.

What type of pallets are you primarily using?

Stringer 51%

Block 27%

Both equally 22%

Source: Peerless Research Group (PRG)

However, there were some slight changes in the dynamics.

The number of respondents using a pallet pool remained

constant at 17%. However, the gap between the purchase of

used and new pallets narrowed. In 2012, nearly 63% reported

that they rely on used pallets, also known as cores, while 59%

said they purchased new pallets. In 2013, 60% say they purchase used pallets, while 58% say they purchase new pallets.

Similarly, the number of readers who report they are using

more used pallets this year dropped to 42% from 46% in 2012.

The change can be explained, at least in part, to the shortage of cores that has plagued the market for several years and

showed up in Freedonia’s research.

For instance, although 39% of readers say they have not

experienced any issues in procuring used pallets, 27% report

that the quality of used pallets has deteriorated; 27% say

that fewer used pallets are available; and 15% say they have

become more expensive. Of those readers who have experienced price increases, 48% have seen a spike of 5% to 9%,

and 24% have seen a spike of from 10% to 14%.

In response to these issues, 64% of readers say they will buy

YOU PERFECT IT.

WE’LL PROTECT IT.

Buckhorn offers an unmatched selection

of reusable packaging solutions

designed to protect your products and

increase your profitability.

Our latest innovation, the BN3230 bulk

box, features a non-sequential fold

and reduced collapse height for a better

return ratio. It offers a replaceable

runner that snaps into place and

improved decoration options, saving

your company both time and money.

Visit Pack Expo Booth #6256 to be among the first to see Buckhorn’s

NEW BN3230 bulk box. Or visit buckhorninc.com for more information

on our complete line of bulk boxes.

©2013 Buckhorn / Myers Industries, Inc. #&.'*')

US: 1.800.543.4454

Canada: 1.800.461.7579

www.buckhorninc.com

BULK BOXES | HAND-HELD CONTAINERS | IBCs | PALLETS | SPECIALTY BOXES

30

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

mmh.com

The BaldorÝDodge® Quantis®

full line of modular gear drives

are engineered for flexibility

and greater torque density in a

compact housing configuration,

with horsepower capabilities from

1/4 to 75 Hp. The Quantis family

of products offers three types of

gear reducers: In-Line Helical (ILH),

Right-Angle Helical Bevel (RHB)

and Motorized Shaft Mount (MSM).

All three types of reducers are

dimensionally interchangeable

with major global competitors.

And, you can find the full line of

Baldor’s Dodge Quantis modular

gear drives at your local Motion

Industries location. Our local

sales and service specialists

are experts in application and

technical support, providing the

parts and the know-how you need

to stay up and running.

The brands you count on from

the people you trust…that’s

BaldorÝDodge and Motion

Industries.

©2013 Motion Industries, Inc.

Over 550 locations More than 5.2 million products

Industrial maintenance training courses Call. Click. Visit.

1-800-526-9328 for the location nearest you

MotionIndustries.com

Reader Survey Report/Webcast

ANNUAL PALLET REPORT

Thursday, Sept. 19, 2013 • 2:00 PM ET

www.mmh.com/pallets2013

more new pallets, and 13% say they plan to create and manage

their own pools. Just 4% say they plan to rent from a pallet pool

such as those from CHEP, PECO and iGPS.

Block or stringer

At the grocery store, the question is paper or plastic? When it

comes to wooden pallets, the question isn’t just used or new, it’s

also stringer versus block? The stringer pallet design is favored by

standard pallets such as the 48 x 40-inch GMA, the most commonly used pallet on the market. The block pallet design, favored

by plastic pallet makers as well as wooden pallet pooling organizations like CHEP and PECO, got a boost two years ago when

Costco became the first retailer to require its suppliers to ship

product on block pallets.

Beginning with last year’s survey, we began to look to see

if the Costco requirement is having an impact on the pallet

market. A few trends are beginning to appear.

First, as with the new versus used question, block or

stringer isn’t an either/or question. More than half (51%) of

How likely are you to consider participating

in a pallet retrieval/recovery system or in a

third-party pallet rental system during

the next year?

Highly likely

6%

Likely 13%

Not very likely 38%

Not at all likely 33%

Don't even know what

a pallet retrieval/recoveryy

system or third-party

pallet rental system is 11%

Source: Peerless Research Group (PRG)

How Much Can we

Reduce your Handling Costs?

That’s the question behind the reuseable

pallets we manufacture for food, beverage,

and pharmaceutical customers around the

world. Whether you need a custom or standard

solution in Radiopaque, FDA approved,

or FM approved materials,

you’ll find it at PSI

Edge

Rackable

Double Leg Ratchet

Edge

Rackable

Radiopaque ProStack® Pallet

One Piece ProGenic

Toll Free (877) 444-7225

&NBJMJOGP!QSPTUBDLDPNtMedford, NJ 08055 USA

www.prostackpallets.com

32

S

E P T E M B E R

2 0 1 3 / M O D E R N M AT E R I A L S H A N D L I N G

mmh.com

Over the past 12 months have any customers

required you to change your pallet usage?

No 86%

Yes 14%

What changes are you making/did you make?

Using more block pallets 33%

Using more stringer pallets 25%

Other 42%

Using different/special sized pallets

Heat-treated pallets for overseas shipments

Using pallet pooler

Went from plastic to wood

Improved pallet design for more strength

Source: Peerless Research Group (PRG)

mmh.com

MODERN reader survey

readers are shipping solely on stringer

pallets and 27% are shipping solely on

block pallets. Another 23% are shipping

on block and stringer pallets in equal

measure. In other words, a significant

percentage (50%) is shipping some

loads on block pallets. That is up from

47% in 2012.

Second, a relatively small percentage

of readers (14%) have been asked by customers to change their pallet usage. Of

those, 33% are using more block pallets

compared to 25% that are using more

stringer pallets.

Changes are being requested from

a variety of points in the supply chain.

According to respondents, 46% are from

the manufacturers; 36% are from the

retailer; and 26% are from the wholesalers.

As with last year, Costco appears to

be one of the few companies planning

to require its suppliers to ship solely on

block pallets.

DXWRPDWLRQVVLVFKDHIHUXVPDWUL[

M O D E R N M AT E R I A L S H A N D L I N G / S

E P T E M B E R

2013

33

MODERN reader survey

Have you evaluated or considered a

system/solution for creating or

managing your own pallet pool?

Yes 32%

No 68%

Source: Peerless Research Group (PRG)

SOME THINK

DELIVERY

ERRORS ARE

INEVITABLE.