Application for gradual retirement

advertisement

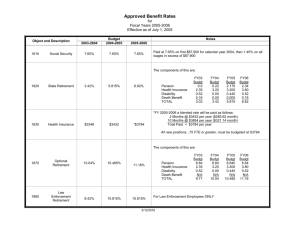

Guide to the application for gradual retirement 121A (2008-09) GENERAL INFORMATION This guide is provided for information purposes and does not supersede applicable legislation. We suggest you read it carefully as it contains the answers to most questions you may have regarding gradual retirement. The “Application for gradual retirement” (121) form is prescribed under section 150 of the Act respecting the Government and Public Employees Retirement Plan (R.S.Q., c. R-10) and its use is compulsory in applying for gradual retirement under the following plans: • Government and Public Employees Retirement Plan (RREGOP); • Pension Plan of Management Personnel (PPMP); • Retirement Plan for Senior Officials (RPSO); • Teachers Pension Plan (TPP); • Civil Service Superannuation Plan (CSSP); • Pension Plan of Certain Teachers (PPCT); • Pension Plan of Peace Officers in Correctional Services (PPPOCS); • Pension Plan for Federal Employees Transferred to Employment with the Gouvernement du Québec (PPEFQ); • Retirement Plan for Active members of the Centre hospitalier Côte-des-Neiges (RPCHCN). If you have not already retired, we invite you to send us your application at least three months prior to the expected date of your retirement to avoid an interruption in income. What gradual retirement is Gradual retirement allows you to receive a retirement pension and a salary at the same time if you are 65 or over and are: • a member in a pension plan who continues to hold a job covered by his plan; or • a pensioner who has returned to work in a job covered by his plan or by RREGOP or the PPMP. Gradual retirement can begin at the latest of the following dates: • your 65th birthday; or • the date of your return to work. The employee who is on gradual retirement does not participate in his pension plan. Gradual retirement ends on the date of end of employment with the employer with whom the agreement was signed or, at the latest, on December 30 of the year of your 69th birthday. Its impacts on your pension While on gradual retirement, the annual total of you pension and your salary1 (the salary you received or would have received if you had not received salary insurance benefits) cannot be higher than your reference salary (your annual basic salary on the day before your gradual retirement). If the total is higher, your pension will be reduced accordingly. The total is verified each year on the anniversary date of the beginning of your gradual retirement. If you have more than one employer and resign from the one with whom you have an agreement for gradual retirement, you must sign a new agreement with your other employer if you wish to continue to benefit from the provisions of gradual retirement and avoid a reduction in your pension. 1. All your salaries if you work for more than one employer concerned by our pension plans. Commission administrative des régimes de retraite et d’assurances Guide 121A (2008-09) 1 of 3 Please take notice if you are not already a pensioner Return to work provisions have been modified for pensioners of RREGOP, the TPP, the CSSP, the PPCT, the PPEFQ and the RPCHCN. When a pensioner from one of these plans returns to work in a covered job, he no longer participates in a pension plan and receives his entire pension, regardless of his age. Consequently, even if the provisions concerning the return to work of a pensioner seem more interesting than those relating to gradual retirement, you should consider all your working conditions before resigning to benefit from them. The fact that your pension would not be suspended could be insufficient to offset the loss of seniority, for example. INFORMATION ON EACH PART OF THE APPLICATION FORM As applicant, you only have to complete Parts A and B. Parts C and D must be completed by your employer(s). Part A – Identification of applicant You must enter the personal information required to identify you. Part B – Information regarding this form 1. Name of pension plan You must write the name of the plan concerned by your application. 2. Date of beginning of gradual retirement Enter here the date on which your gradual retirement will begin. That date cannot be before your 65th birthday, if you have returned to work before that age, nor before the date of your return to work if it is later than your 65th birthday. 3. Status of applicant on the day before the beginning of gradual retirement If you participate in your plan on the day before gradual retirement begins, this application constitutes a formal application for a retirement pension. In that case, you must provide the information requested in Part B so that we can process your application for a pension. If you are a pensioner of your pension plan, you do not have to provide the information requested in points 4, 5 and 6, since we already have it. 4. Surviving spouse’s pension The basic option is a surviving spouse’s pension* of 50% of your retirement pension, except for the RPSO and the CSSP where it is 60%. However, if you are a member of RREGOP, the PPMP or the PPPOCS, you can choose a surviving spouse’s pension of 60% of your retirement pension. If you choose that option, your pension will be permanently reduced by 2%. Your choice becomes irrevocable with the first pension payment. If you have not checked any box, CARRA will conclude that you do not have a spouse or that you do not wish to increase the surviving spouse’s pension. * Usually, the word spouse means the person who is married or in a civil union with you. If you are not married or civilly united, it is the person of the opposite sex or the same sex represented as your spouse and who had been living in a conjugal relationship with you for a period of one or three years. Commission administrative des régimes de retraite et d’assurances Guide 121A (2008-09) 2 of 3 5. Other current applications If you have another application under consideration at CARRA, please indicate which in this section so that we can take that into account when processing of your application for gradual retirement. 6. Documents to enclose with the application • If you live outside Québec, an original copy of your birth certificate is required for the processing of your application. If you were born in Québec, the certificate must be delivered by the Directeur de l’état civil if it was issued after December 31, 1993. If you were born outside Québec, it must be issued by the competent authority. This document will be returned to you as soon as possible. • If you want additional tax exemptions to the basic exemptions, you must provide CARRA with a filled out “Source deduction return” TP-1015.3 (Québec) and a “Personal tax credits return” TD1E (Canada Revenue Agency). • For your pension benefits to be deposited directly to your bank account, please enclose a CANCELLED blank personal cheque with your application. 7. Multiple jobs If you have more than one employer, indicate the names of those with whom you have a gradual retirement agreement. They must be employers concerned by our pension plans. Your salaries from all your employers will be taken into account for the calculation of the pension amount to which you will be entitled while on gradual retirement. 8. Signature of applicant Your application will be returned if you do not sign it. Failure to provide the information requested on this form can prevent the processing of your application. Under the Act respecting Access to documents held by public bodies and the Protection of personal information (R.S.Q., c. A-2.1), the information it contains will be disclosed only to authorized agents. The Act allows the applicant to examine his personal information and ask for corrections. Part C – Employer information with respect to participation in the plan Every employer you had in the last two years must complete this part of the form if, the day before the beginning of your gradual retirement, you are: - a member or - a pensioner under age 65 who is back to work for an employer covered by a pension plan that is administered by CARRA who participates in that plan. It is not necessary to have this part completed if, on that date, you are a pensioner who is back to work for an employer covered by a pension plan administered by CARRA who does not participate in that plan. Part D – Employer information concerning the gradual retirement agreement This part must be completed by the employer with whom you have a gradual retirement agreement. However, he does not have to provide the information requested in points 1 and 2 if he is the same employer as in Part C. Commission administrative des régimes de retraite et d’assurances Guide 121A (2008-09) 3 of 3 121A Application for gradual retirement (2008-09) Click to erase all the form. Part A – Identification of applicant Last name Numéro d’assurance sociale First name Date of birth Sex year month day Language of correspondence M F French English Telephone (home) Area code Last name as it appears on the birth certificate (if it is different) Extension Telephone (work) Area code Address (number, street, apartment, P.O. Box, rural route) Postal code Province City or town Part B – Information regarding this form 1. Name of pension plan: year month day 2. Date of beginning of gradual retirement: 3. Status of applicant the day before the beginning of gradual retirement I participate in my pension plan. In this case, please answer question 4 and following. I am a pensioner. In this case, go directly to question 7. 4. Surviving spouse’s pension If you participate in RREGOP, the PPMP or the PPPOCS, check the option you choose: Upon my death, I want my spouse to receive a pension equal to 50% of my pension. Upon my death, I want my spouse to receive a pension equal to 60% of my pension. In this case, I understand that my pension will be permanently reduced by 2%. 5. Other current applications • Do you have a phased departure agreement with your employer? Yes No - Have you applied for a statement of benefits? Yes No - Have you applied for payment of the value of benefits accrued under your pension plan? Yes No • Is an earlier application for a retirement pension being reexamined by CARRA? Yes No • Is an application for buy-back currently being processed? Yes No year If so, enter the date of the beginning of the period covered by the agreement: month day • Partition of the family patrimony: If so, enter: the date of the application for buy-back: year the years concerned by the application: month day Commission administrative des régimes de retraite et d’assurances 121A (2008-09) 1 of 4 Numéro d'assurance sociale Partie B – Information regarding this form (cont.) 6. Documents to enclosed with the application Original copy of your birth certificate (if you are living outside Québec) TP-1015.3 and TD1 forms (for additional tax exemptions) Personalized cheque specimens (for direct deposit) 7. Multiple jobs If you have more than one employer, indicate the names of those with whom you do not have a gradual retirement agreement: Area code Name : Telephone : Name : Telephone : Area code Area code Name : Telephone : 8. Signature of applicant If I participate in the pension plan, I am aware that this application for a retirement pension will become irrevocable when my first pension payment is deposited in my account or when I cash my first cheque. I hereby attest that the information I provided in Parts A and B is complete and accurate. Signature Date year month day Part C – Employer information with respect to participation in the plan 1. Employer Employer number Name of employer Address (number, street, P.O. Box, rural route) Department number Telephone Area code Province City or town Postal code 2. Identification of applicant Last name First name Employee number Social insurance number 3. Administrative information Employee’s title or occupation: year days year days Number of paid days* during the last two years: * Paid days include: - days of actual work; days of absence with pay (ex.: vacations, sick leave, legal holidays, maternity leave, etc.); days during which the employee is eligible for salary insurance benefits; contributory days of absence without pay. If the employee is not a permanent full-time or part-time employee, is he on a list that guarantees him priority of hiring or employment? Yes Date of end of employment: year month day AND Date of last paid day: year month day No Commission administrative des régimes de retraite et d’assurances 121A (2008-09) 2 of 4 Numéro d'assurance sociale Part C – Employer information with respect to participation in the plan (cont.) Other information that might be useful for the processing of this application: 4. Financial information (for the last two years of employment) Please refer to the Guide de la déclaration annuelle de l’employeur to complete this section. Year Plan Salary – maternity leave Year Contributory salary Contributions Days of absence – Date of beginning Date of end* maternity leave (month - day) (month - day) Plan Salary – maternity leave Days - 1 year of service Non-contributory Unpaid days of salary (after 35 years) absence Exempted salary Non-contributory disability days Status ** Part time – % of time Basic annual salary Please note that the section entitled “Financial information” Days - 1 year of Contributory salary Non-contributory Unpaid days of Part time – % has been Contributions replaced bysalary the(after 35 years) absence service of time “Déclaration annuelle anticipée transitoire” (203) form. Days of absence – Date of beginning Date of end* Exempted salary Non-contributory Status ** Basic annual maternity leave (month day) (month day) disability days salary Since form 203 must be completed by your employer, it is in French only. Last name and first name of the person in charge of the employer’s annual report Telephone Area code Extension * Enter date of end of employment ** Leave this section blank, except in the following cases for which you must enter percentage in “Part time - % of time” box. Teacher on early retirement (school boards only) =6 Employee on sabbatical leave with deferred pay =7 Employee laid off with proportional salary =8 5. Signature of employer’s authorized representative I hereby certify that the information provided in Part C of this form is complete and accurate. Last name and first name of authorized representative Telephone Area code Extension Fax Area code Commission administrative des régimes de retraite et d’assurances Date year month day Signature 121A (2008-09) 3 of 4 Numéro d'assurance sociale Part D – Employer information concerning the gradual retirement agreement 1. Identification of employer Employer number Name of employer Address (number, street, P.O. Box, rural route) Department number Telephone Area code Province City or town Postal code 2. Identification of applicant Last name First name Employee number year month day year month day Social insurance number 3. Date of beginning of gradual retirement: 4. Expected date of end of gradual retirement: 5. Salary you expect to pay during the first year of gradual retirement (regular salary): $ 6. Signature of employer’s authorized representative I hereby attest that the information provided in Part D of this form is complete and accurate. Last name and first name of authorized representative Telephone Area code Extension Fax Area code Date year month day Signature In this form, the masculine is taken to include the feminine. Client services: Please return this form to: 418 643-4881 (Québec City area) 1 800 463-5533 (toll free) Commission administrative des régimes de retraite et d’assurances 475, rue Saint-Amable Québec (Québec) G1R 5X3 You have completed the form. Commission administrative des régimes de retraite et d’assurances 121A (2008-09) 4 of 4