Presentation to the GBC Bioscience Commitee

advertisement

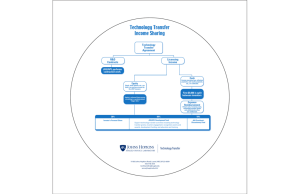

Presentation to the GBC Bioscience Commitee February 2015 Origin of Johns Hopkins Johns Hopkins, the Quaker merchant, banker and businessman, left $7 million in 1873 to create The Johns Hopkins University and The Johns Hopkins Hospital, instructing his trustees to create new models and standards for medical education and health care. • 1876: Johns Hopkins University opens • 1889: Johns Hopkins Hospital opens • 1893: School of Medicine opens Since its inception by an original innovator, Hopkins has continued to lead in discovery with exceptional people, research, and facilities People • 36 Nobel Laureates, 34 American Nobels (Lasker Award), 26 elected to National Academy of Sciences, 54 elected to Institute of Medicine, 4 Presidential Medals of Freedom • >$6.7B in revenues and largest employer in state of Maryland Research • Largest recipient of federal research funding >$2B FY2012 (#1 for 34 years in a row) Facilities • 6 hospitals, 4 suburban health care & surgery centers, 30+ outpatient centers • 100+ Core facilities • Presence or affiliation in over 40 countries Exceptional researchers produce exceptional results But we can do more with the technologies that are developed from our research JHTV’s mission is to maximize the impact of JHU’s excellence in research by facilitating the translation and commercialization of discoveries into accessible technologies, products and services for the benefit of society. Because we know that an Innovation Ecosystem is important to JHU and more broadly, to Baltimore Brings Products to the world Improves competitiveness and retention Provides additional funding sources to the University Promotes regional economic development 6 So we examined how we could do a better job in supporting innovation Innovation Committee: Implementation of the Entrepreneurial Resources Coordination of industry activities across JHU - Commercial Advisory Group FastForward Technology Licensing and Analytics Social Innovation Lab DreamIt And our Innovation Committee made these recommendations Innovation Committee Recommendations Space Services Funding Office Space Lab Space Design Studio Pre-Seed Grants Investment Fund Mentorship Corporate Partnerships Entrepreneur Training Core Facilities Today’s conversation is about our commitment to an Innovation Industry • Provides affordable, turnkey space for start up companies and venture concepts who wish to locate near JHU campuses • Provides resources to entrepreneurs that will augment their experience including networking events, access to subject matter experts, business analysis support, educational programming, and introductions to funding sources Our 2 current locations provide different offerings • • • FastForward Homewood (Stieff building) at capacity with 12 companies – all with lab FastForward East 1.0 opened in Rangos building Jan 2015 with ~ 6k s.f of co-working, office and lab space • Open seating with private lockers for 28 • 6 dedicated offices • 7 benches in shared wet lab space with adjoining offices More space for FastForward East 2.0: • 30k s.f. to open in 2016 at 1812 Ashland FastForward East: Opened January 2015 FastForward East will be a part of the Science + Technology Park • 88 acres located next to Johns Hopkins Hospital and East Baltimore Campus • 1st Building: John G. Rangos, Sr. Building • 118,182 square feet dedicated to life science building space • 22-story Graduate Student Housing Building • 21,364 square feet of laboratory facilities for the Maryland Department of Health and Mental Hygiene Public Health • Plans for a hotel and life science building FastForward East will benefit from its location near other innovative Science + Technology Park tenants We also are increasing Services to nurture our entrepreneurs and start-ups Carey Entrepreneurship Bootcamp DreamIt I-Corps program Mentors in Residence Social Innovation Lab Express License for Faculty Start ups Commercialization Academy Committee on University Policies 2014 JHU Entrepreneurship Bootcamp 70 participants from Johns Hopkins East Baltimore Schools • 47% Graduate students and residents • 42% Faculty • 11% Post docs 32 departments represented Positive (4.3 out of 5) feedback on the curriculum and the program DreamIt Health 9 companies in 2014 cycle • 5 of the 9 companies had a JHU affiliation • 4 of the 9 companies (3 JHU affiliated) have term sheets for >$500k seed round or committed revenues 2015 cycle kicked off January 2015 2015 partners: JHU, BHI/EAGB, UMB, Abell, DBED I-Corps Program for Start Up Training I-Corps Fall 2014 (JHU joined DC-node in June 2014) • 4 JHU teams accepted to upcoming Regional I-Corps (representing both SOM and WSE) • 1 JHU company accepted to the National NIH I-Corps (have to be NIH SBIR recipient); received $50k as accepted team Both programs provide real world, hands-on training on how to successfully incorporate innovations into successful products. Benefit: Helps teams make a go/no-go decision by validating their technology's market potential and identifying a solid product-market fit and building a viable business model. Mentors in Residence 6 participants for 2014, launched in August to work with students and faculty to bring deep domain expertise to help accelerate the path of our promising technologies toward market success; brought on 14 new MIRs in 2015 MIRs are encouraged to develop close ties with our inventors, entrepreneurs, and technology licensing team in order to help JHU further develop these technologies Areas of expertise include: • Personalized Medicine, Life Science Tools & Services, Oncology Development, Genomics, Computational Discovery, Software, Medical Device, Engineering, Angel/Venture Investment, General Business Social Innovation Lab (SIL) SIL has supported 33 social enterprises These enterprises have received approximately $1.5M to further their work In the fall of 2014, SIL received 40 applications, mainly from students in SPH, WSE, and SOM Express License for Faculty Start-Ups Implemented July 2014 Vetted with local law firms who advise start-ups 5 JHU start ups year to date 4 of 5 used express license Express license has required substantially less time for negotiation, reducing the time to close a deal on average from four months to less than two weeks Commercialization Academy Supports diverse science career training • Undergrads, graduate students, and post docs Supports needs of analytics group within JHTV: reviewing 450+ disclosures received annually across JHU Responsibilities include assessing market value proposition, IP position, competition, and development risk Plan to augment current group of 12 interns from across the JHU schools Funding and Corporate Deals Maryland Innovation Initiative (via TEDCO) Undergraduate Entrepreneurship Fund Recent Industry Deals Plan for pre-seed funding Plan for investment fund Maryland Innovation Initiative - a TEDCO (State of Maryland) Program 3 dedicated ‘site miners’ who serve as industry mentors to faculty with a focus on commercial relevance of the invention 52 Awards to date; average grant size ~$100k Funded projects/companies representing SOM, WSE, JHSPH, Peabody including many joint SOM/WSE collaborations 9 funded projects are now Maryland based startups Total JHU funding for PIs and companies FY 1315 ~ $5.05M Undergraduate Entrepreneurship Fund Established with $300,000 gift from Ralph O’Connor (KSAS grad) in October 2014 to support: Grants for teams of $5,000-$10,000 Resources for writing business plans Marketing, legal, and accounting information Information on filing for IP protection Connections with network / investors Seating in FastForward A web site to provide a set of translational and entrepreneurial resources Investments and Partnerships - Closed MedImmune 5 year $6.5 Million agreement signed 12/13 Focusing on 6 academic partnerships in areas of mutual interest as well as shared educational efforts Initial faculty PI’s are Felipe Andrade, Michael Betenbaugh, Peter Calabresi, Lloyd Miller, Ken Pienta, Jeff Rothstein, Bradley Undem Interest in project based support of FastForward, starting with a $50,000 commitment in support of REACH grant Roche $750,000 in funding for projects in Cancer Immunology; project proposals submitted 9/15/14 for projects in ophthalmology Investments and Partnerships - Closed Novo Nordisk Hopkins invited to participate in a competitive funding process in 2013 and received $1.45 million in funding for three investigators: • Functional study of the novel anti-diabetic adipokine, CTRP12: William Wong, Ph.D.-$500,000 Early Exploration Award for 2 years • Pluripotent Stem Cell Therapies for Diabetic Retinopathy: Elias T. Zambidis, Ph.D.-$450,000 Early Exploration Award for 2 years • A Novel Treatment Approach for Type 2 Diabetes and Obesity Related Diseases: Jonathan D. Powell, MD, PhD-$500,000 Proof of Principle Award for 2 years Investments and Partnerships - Closed Toshiba Aquilion ONE ViSION EDITION CT Scanner placed at Hopkins in July 2014 Twelve year relationship centered on testing and development of 6 CT scanners, leading to the development of the top of the line CT scanner for the cardiovascular system Testing of efficacy and efficiency of cardiovascular CT technology started at Hopkins and has led to a transformation in the practice of cardiology in the US and abroad Toshiba and Hopkins are collaborating in the area of Big Data; the first joint project focuses on novel strategies for diagnosing and treating head and neck cancers Committee on Policy Recommendations Convened initially October 2014 Formed to review recommendations of the Innovation Report and identify strategies to implement changes proposed by the committee Committee includes Provost’s office, deans, and administrators from Homewood and East Baltimore Metrics for measuring success of the Innovation Effort Where do we want to be in 3-5 years? • Impact to society as our inventions reach market • Increase number of funded start ups • Vibrant innovation ecosystem that attracts capital to translate our research to products We have a robust start-up ecosystem that can be an even larger engine of growth • Since 2000, more than 100 spinoff companies created around JHU IP • Startups have raised more than $476M in funding • 40 projects received $100k grants each for a total of $4.2 million of Maryland funding • Venture-based programs include DreamIt Health accelerator and FastForward incubator • Venture-based space in Science + Technology Park at Johns Hopkins Thank you Helen Montag hmontag@jhmi.edu Appendix What is technology transfer? Technology transfer is the process of transferring scientific findings from one organization to another for the purpose of further development and commercialization. The process typically includes: Identifying new technologies Protecting technologies through patents and copyrights Forming development and commercialization strategies such as marketing and licensing to existing private sector companies or creating new startup companies based on the technology What is Technology Transfer? Reasons for University Technology Transfer Academic and research institutions engage in technology transfer for a variety of reasons, such as: Compliance with federal regulations Recognition for discoveries made at the institution Attraction and retention of talented faculty Local economic development Attraction of corporate research support Licensing revenue to support further research and education Successful Products from University Tech Transfer JHU Inventions by faculty For proceeds from the licensing of an invention, the split is: Inventors’ Personal Share Inventors’ Research Share Inventors’ Dept Share School Share University Share First $300k 35% 15% 15% 30% 5% Over $300k 35% 15% 15% 25% 10% Survey on Technology Licensing Activities Rollout out June 2014 Faculty & Licensees • 7 of 18 responded (40%) - 85% satisfied or very satisfied overall with their experience - 100% satisfied or very satisfied with their assigned technology licensing associate Next wave now underway • Agreements: 23 invitations to licensees or faculty • ROIs: 46 invitations