3rd-7752 Competitive Advantage Mini Whitepaper.indd

advertisement

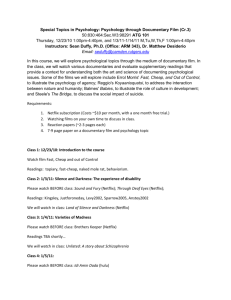

360° Perspective on Credit Union Strategic Development: Competitive Advantage “Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value.” - Michael Porter Competitive advantage is an edge that positions an organization to generate greater margin or more effectively attract and retain customers compared to its competitors. For credit unions, competitive advantage will come from leveraging meaningful points of differentiation. In the financial services marketplace, you must differentiate in a way that is unique, sustainable, and meaningful to consumers. Many organizations in other industries have successfully used differentiation as a competitive advantage. Consider the following example. For many years, Blockbuster dominated the movie rental playing field. Their stores (or those of their “me too” competitors) could be seen in practically every neighborhood. Yet today Blockbuster is a shadow of its former self, brought down in large part by the entry of a new and unconventional competitor: Netflix. Netflix differentiated itself by acting on the opportunity to shift a delivery channel paradigm and harnessing its organizational data to deliver added value to customers. On an average weekend in North America, approximately one third of all downstream internet traffic now belongs to Netflix. Its recommendation engine (built on information gleaned through customer interactions) drives 75% of its viewing. Like Netflix, credit unions compete in an industry where ease of product accessibility is critical and where consumers seek value that goes beyond pricing and fee structure. Although video rentals and financial decisions are worlds apart in terms of gravity and risk, this example still provides a valuable lesson for the credit union industry. Competitive advantage through differentiation works best in a market that offers the following circumstances: 1. Consumer needs and uses of the product are diverse. Netflix offers convenient, flexible delivery of a large, constantly evolving selection of movies to appeal to a highly diverse audience. Consumers have diverse financial needs. Conducting an indepth analysis of member engagement will provide a solid starting point for understanding what members need, how they use your products and services, and which delivery channels they prefer. Pulling a report from your core processor or MCIF can help you understand delivery channel usage among your mem- bers. The following sample data for a credit union with 40,000 members shows that branches and online banking are preferred delivery channels. Having totals that exceed the actual number of members is an indication that members are using more than one delivery channel. Comparing changes in data over time can help you understand engagement trends and identify opportunities to better meet members’ evolving needs. Delivery channel # of members % of members Branches (total) 15,000 38% Online banking 9,000 23% Mobile 4,000 10% ATM Proprietary 7,000 18% ATM Network 5,000 13% Shared branches 3,600 9% Total 43,600 111% (example based on 40,000 membership) 2. There are many ways to differentiate the products and services, and the buyer perceives these many ways as having value. By using customer data to provide targeted recommendations, Netflix adds value by offering customers selections they might not have otherwise considered. Your credit union’s frontline staff, contact center and anyone else who has direct contact with members can provide critical insights regarding members’ challenges and concerns. Understanding multiple facets of the member experience will put you on the path to defining feasible, meaningful ways in which you can add value for members. For example, one credit union was experiencing low credit card portfolio penetration despite strong cross-sell efforts and a competitive offering. Interviews with staff and an analysis of data revealed a high application rate followed by significant drop off during the 30 day period between application and issuance. Members were dissatisfied with the length of the fulfillment process, so they ended up selecting a competing product that they felt provided greater value in terms of responsiveness. Understanding the value members place on speed of fulfillment helped the credit union identify opportunities to become more competitive. 3. Few rivals are following a similar differentiation strategy. When Netflix launched its model of rental video delivery, their approach was unique and did not lend itself to easy duplication. For credit unions, it’s important to build competitive strategy on a foundation of understanding economic and financial performance position. Start with an assessment of your 5300 information and key ratios, comparing data with peers and the local economic environment. Understand what sets you apart. tify cross-sell strategies that will increase member engagement and move its loan numbers into positive territory. A comparison of 5300 data would look like this: Netflix has continued to evolve its model to keep pace with changes in technology and media consumption, producing its own content driven by the consumer data it collects. Name Credit Union A Peer Group ROA 0.15% 0.85% Loans/Shares 48.72% 67.42% Delinquency Ratio 0.20% 1.04% Charge-Off Ratio 0.39% 0.58% Efficiency Ratio 95.99% 79.37% Operating Expense Ratio 3.56% 3.09% Member Growth 19.66% 2.89% Loan Growth -7.34% 5.89% Share Growth 0.41% 5.22% Auto Loan Penetration 12.69% 16.25% Credit Card Penetration 11.49% 15.45% Mortgage Penetration 1.30% 4.39% Core Earnings Ratio 0.29% 1.10% Yield on Loans 4.74% 5.11% Yield on Investments 0.52% 1.07% Compared to peers, Credit Union A has significant member growth, a high efficiency ratio, and low delinquency and charge-off ratios. However, the credit union is lagging in loan growth and loan to share ratio. Compared to its local market competitors, Credit Union A is unique in offering basic products and services for underbanked groups. This differentiator has contributed to recent member growth, although the demographic has underperformed on loan utilization. To effectively build on this point of differentiation, Credit Union A must iden- Human capital Organizational data Competitive Advantage 4. Technological change is fast and rapid product innovation provides pathways for the pursuit of differentiation. Ongoing changes in technology continue to create opportunities for credit unions to deliver products and services to members more effectively and efficiently. To determine how they can stand out compared to other financial institutions, credit unions should begin with an analysis of which differentiators matter most to consumers and how well their existing technology delivers value to members. That will enable a credit union to identify how technology can strengthen existing differentiators or overcome existing consumer pain points. CUNA Mutual Group’s AskAuto app provides a great example of how credit unions can differentiate themselves with the help of technology. This app simplifies the auto purchase process by enabling members to learn information such as average retail cost (new or used) and EPA mileage plus save their own notes and ranking preferences, just by scanning the vehicle identification number or VIN with their smartphone. The app helps members compare vehicles and when the member is ready to purchase, they can also use the app to submit a credit union loan application. This smart use of technology adds value for members in a unique way, reinforcing a credit union’s position as a knowledgeable partner who makes members’ lives easier. A disciplined, unbiased analysis of your credit union’s current market position and member satisfaction will help you identify how to achieve competitive advantage through differentiation. Translating that understanding into a strategic vision supported by metrics-based short-term and long-term goals will enable you to create an organizational roadmap to success. Accomplishing your organization’s vision in a turbulent world requires a strategic approach to maximizing strengths and leveraging opportunities for growth. The Third Degree Business360° Process™ can help you succeed through an unbiased strategic analysis of your credit union’s competitive advantage, delivery channels, organizational data and human capital. Third Degree works with progressive credit unions at times of growth and transition to help them navigate the new realities of a more competitive marketplace. Delivery channels © Third Degree ThirdDegreeAdv.com 1-888-871-3729 @_CUSavvy @ThirdDegreeAdv